- Covid-19: How business is coping with the outbreak. (What We’re Tracking Today)

- Covid-19: The CBE’s response. (What We’re Tracking Today)

- Covid-19: New details on the govt’s EGP 100 bn fiscal support package. (What We’re Tracking Today)

- Covid-19: Courts postpone cases, ISPs giving us more data, Azhar says communal prayers could be shut down if needed. (What We’re Tracking Today)

- EGX30 tumbles 9.3% in worst showing since 2012. (Speed Round)

- The Fed just deployed its biggest bazooka yet to support financial markets. (What We’re Tracking Today)

- Gov’t proposes new top rate of personal income tax. (Speed Round)

- Foreign direct investment up 16% in 2Q2019-2020 -GAFI. (Speed Round)

- The Market Yesterday

Monday, 16 March 2020

Businesses allow remote work as Egypt reports 126 covid-19 cases

TL;DR

What We’re Tracking Today

It’s another big news day, and there’s more in store after the EGX plunged 9.3% yesterday (it’s worst one-day selloff since 2012), more companies moved to remote work, and the government announced its covid-19 case list has grown again.

That said: There’s never been a better day to keep calm and carry on: This is going to sound weird coming from a bunch of news junkies like us, but we’re encouraging you to read Enterprise and then disconnect as much as possible from the news until tonight or tomorrow morning. Many (perhaps even most) of you have been through “force majeure” events before: Think back to 2011, 2012, 2013, 2016 for starters. The same things that got you through those events will get you through covid-19: A calm sense of purpose. Look after your people. Open lines of communication with your suppliers and bankers. And reassure your customers and investors. Do not fall down the rabbit holes of Facebook, Twitter and WhatsApp.

Egypt has now reported a total of 126 covid-19 cases and there were no new deaths yesterday after another 16 people tested positive, according to the Health Ministry. The new cases involve eight Egyptians and eight foreigners, the ministry said, adding that 26 people have now recovered from the illness. There are now two confirmed cases in Alexandria, according to Al Masry Al Youm.

Our report on covid-19 in Egypt (this section, below) has four components this morning:

- How businesses are coping with the crisis, including work-from-home procedures;

- The Central Bank of Egypt’s response to the crisis;

- New details of the country’s EGP 100 bn fiscal package + how regulators are coping;

- The virus’ impact on society at large.

*** HOW BUSINESS IS COPING: While bankers still head to offices and branches, most businesses with whom we spoke are working from home or planning a shift: We surveyed senior executives from both EGX-listed companies and multinationals operating in Egypt (and compiled statements from others) to get a sense of where the private sector is heading amid the covid-19 outbreak:

- Ten of the 17 companies we surveyed are actively drawing up new work from home policies or procedures;

- Seven have already introduced some form of remote work policy or schedule.

Who we surveyed: The execs we spoke to or heard from operate in the FMCG, telecoms, real estate, finance, law, and ride-hailing industries.

Some companies already had worked remotely in the past, making it easier for them to make a switch. Nestlé and Unilever, for example, had allowed office-based employees to work remotely for at least one day a week before the outbreak. Unilever yesterday told office-based employees to work remotely until further notice, while employees at Nestlé were told to take home their work laptops in case a company-wide policy is put in place, execs we spoke to yesterday said. Nestlé is also allowing parents who need to stay at home with their children to do so following the nationwide decision to shut down schools.

In finance, EFG Hermes will begin implementing a rotating schedule for employees to work from remotely or from the office to limit the number of people at its offices at any given time. Roughly half of the firm’s employees would work remotely at any time and then rotate every two weeks. The firm has also taken steps to limit in-person meetings and imposed a moratorium on travel.

Law firms are somewhat mixed in their policies. Matouk Bassiouny & Hennawy has allowed employees to work from home or from the office at their personal discretion, while Youssef & Partners has also moved to a rotational schedule. Al Tamimi & Co is currently preparing employees and their internal processes for a shift to remote work, and expect to officially make the switch within days.

Ride-hailing company Uber has, meanwhile, temporarily closed down driver support centers worldwide “to encourage social distancing,” according to an official statement (pdf). Those centers, known as Greenlight Hubs, handle inquiries from drivers, and can be contacted through the application.

CIB, Procter & Gamble, and Al Ismaelia Real Estate Investment are taking precautions. Employees still regularly show up, but numbers are being limited whenever possible. There are also precautionary measures and attempts to control the infection (i.e. drills to practice social distancing, limiting in-person meetings, etc), employees we spoke to said.

The remaining execs we got in touch with, which include real estate developers and telecommunication providers, and food producers, seem to be flexible and are working on plans to allow those whose jobs can be done remotely to do so. Three said they expect to have remote-working policies for some employees in place by Thursday.

Three execs (one with hundreds of retail staff and two with production lines) told us yesterday they’re actively reviewing safety procedures for production and front-line staff.

Meanwhile, supply chain diversification is the order of the day: Edita chief Hani Berzi told Hapi Journal that the company has started looking for new suppliers to avoid production interruptions. “So far, productivity has not been impacted, but as the global hedging continues, more effects will appear,” he said, suggesting Edita has no plans to cut back on production for the time being.

These companies are being responsible, and if you’ll forgive us the editorializing, all of us have a duty of care to our staff and customers that demands we look at risk mitigation steps across the board.

JOIN US FOR A WEBINAR ON HOW TO WORK REMOTELY. Enterprise has been produced remotely for the past week and has always had half of its staff working from home at any given time. The staff at Inktank, our parent company, follow suit today. This coming Thursday, 19 March at 2pm CLT, we’ll be hosting a call for Enterprise readers to discuss the strategies and technologies you can use to go remote. We have lines for up to 100 readers to either dial in or log in from their computer (the latter will allow you to see our screen). Use this link to sign up.

*** THE CBE’S RESPONSE: The Central Bank of Egypt (CBE) has directed banks to relax credit limits for companies, remove ATM and point-of-sale transaction fees and commissions, and raise daily limits on card transactions, according to a directive obtained by Enterprise (pdf). The move is meant to make it easier for businesses to access working capital and pay employee wages, to finance essential food and commodity imports, as well as to ensure consumers have access to the credit they need in uncertain times.

The CBE has also directed banks to delay instalment payments for SMEs on a zero fee basis and to work arrangements with foreign banks to ensure trade finance services are not interrupted. They were also told to monitor and study business sectors most likely to be affected by the outbreak and lay out a plan to support them.

The CBE told banks to continue business as usual, while taking precautionary measures to limit the spread of the virus. Bank executives are encouraged to limit face-to-face meetings and increase the digital exchange of documents, keep early detection kits on their premises, and routinely disinfect offices and branches, among other measures.

*** EGP 100 BN FISCAL PACKAGE + REGULATORS: The Finance Ministry unveiled yesterday further details of an EGP 100 bn funding package to help fight the spread of covid-19 infections in Egypt and fund treatment. Finance Minister Mohamed Maait said at a presser yesterday the funding will be made available through emergency liquidity made available in the current fiscal year’s budget. The funding includes a EGP 187.6 mn tranche immediately disbursed to the Health Ministry, of which EGP 153.5 mn will be allocated for medical supplies and preventative measures and EGP 34.1 mn in bonuses to healthcare workers handling testing and infections according to a ministry statement. Further details are expected to trickle in over the coming days as the situation evolves on the ground.

Draft FY2020-2021 budget ready in one week -Maait: The Finance Ministry will finalize the state budget for the upcoming fiscal year over the next week, minister Mohamed Maait said in a press conference yesterday. The budget was reviewed by President Abdel Fattah El Sisi on Saturday. We have more on its provisions and more remarks from Maait during the presser in this morning’s Speed Round, below.

EGX-listed companies will have access to an e-voting system for their general assemblies within 10 days, courtesy of Misr for Central Clearing, Depository and Registry (MCDR). The clearinghouse is working on a system to facilitate virtual meetings as part of efforts to practice social distancing to curb the spread of covid-19, reports the local press.

The FRA has rolled out online services to limit visits to HQ: Non-banking financial service providers under the Financial Regulatory Authority (FRA) can access the regulator’s services through online portals and via email, according to a statement. The FRA is encouraging the digital submission of service request forms and financial statements in a bid to curb the spread of the covid-19.

It looks like the three-year moratorium on a capital gains tax for EGX transactions will be extended. The cabinet economic group will meet this afternoon to decide whether to implement the deferred 10% capital gains tax on EGX trades. The domestic press yesterday cited unnamed government officials as saying that there’s a consensus among policymakers that the measure should be delayed again given current market conditions. An announcement on the tax could come as early as this week, Maait told Hapi Journal. The measure was shelved for three years in 2017 in favor of a provisional stamp tax. The three-year period will come to an end in May.

*** THE SOCIAL IMPACT OF COVID-19 IN EGYPT- Courts postpone all pending cases for two weeks: The Justice Ministry has decided to postpone all cases that were scheduled in the coming two weeks, according to an official statement cited by Masrawy. Administrative work at courts will continue without interruption.

All internet subscribers will get an extra 20% added to their monthly download quota after Communications Ministry Amr Talaat held meetings with the country’s top internet service providers, the cabinet said in a statement. The agreement, which will see the government stump up an estimated EGP 200 mn, will also allow students to access the education and higher education ministries’ websites for free.

Al Azhar issues fatwa permitting gov’t to suspend communal prayers: While mosques remain open for daily and Friday prayers, Al Azhar announced yesterday that it is permissible for the government to shut them down entirely if required. The religious authority also urged senior citizens, who are disproportionately impacted by the virus, to pray at home.

The Endowment Ministry has joined the Education Ministry’s two-week shutdown, closing shrines and suspending Islamic educational and cultural centers for the period, according to AMAY. Endowment Minister Mohamed Mokhtar Gomaa also appeared on the airwaves to urge Egyptians to avoid gathering at funeral ceremonies.

The Coptic Orthodox Church has also suspended public activities: The church will continue to hold masses but will only allow limited numbers of worshippers to attend several smaller services each day, it said in a statement.

The Supply Ministry says that stocks of staple goods are sufficient for the coming months, with enough wheat for 3.6 months, rice for 4.6 months, and sugar for 7.3 months, as well as enough soybean and sunflower oil to last until August, according to a statement picked up by Reuters.

*** GLOBAL RESPONSE- In a historic move, the Fed goes all in to protect the US economy from covid-19: The US Federal Reserve slashed its benchmark interest rate by 100 bps to 0.0-0.25% and pledged to restart its crisis-era bond-buying program with USD 700 bn in fresh asset purchases in an effort to insulate financial markets from the economic fallout of covid-19. “The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the US. Global financial conditions have also been significantly affected,” the Fed’s Open Market Committee said in a statement. “The Federal Reserve is prepared to use its full range of tools.”

Hours earlier, Treasury Secretary Steve Mnuchin announced he would ask Congress to reinstate powers used to prop up the economy during the 2008 financial crisis, the New York Times reported. Speaking yesterday, Mnuchin said he would request repealing regulations imposed by the 2010 Dodd-Frank Act, legislation that curbed the Fed’s ability to lend to individual companies, requiring the central bank to extend credit only through facilities that help the financial system as a whole.

Cue more market panic: At the time of dispatch US equity futures had plunged to ‘limit down’ levels — the 5% threshold that cuts off trading to reduce panic among traders — meaning that we don’t quite know how far markets will fall later today. In Asia almost all stock markets were in the red albeit not the drastic extent that we saw last week. “They had no choice, but it won’t be enough in the grand scheme of things,” said Jeff Mills, chief investment officer of Bryn Mawr Trust, speaking of the Fed’s measures. “We need large fiscal programs, which, based on the recent communication from the treasury secretary, it seems clear we will be getting.”

It’s maybe not surprising, given that we’re now almost certainly headed for a global recession, according to former IMF economists: The global economy has entered recession due to the combination of covid-19 and the increasingly drastic measures governments are taking to prevent it spreading, four former IMF economists have said. “A global recession seems baked in a cake at this point with odds over 90%,” Harvard University economics professor Kenneth Rogoff said. Olivier Blanchard, senior fellow at the Peterson Institute, said there is “no question in my mind that [global] growth will be negative” in the first half of 2020. Activity in the second half will depend on when the outbreak peaks, he said, adding that this period will probably see negative growth as well. The Financial Times has more.

In other global covid-19 news:

- Three European countries record their worst days yet for covid-19 deaths. Italy reported 368 deaths yesterday to bring its total to 1,809, while Spain reported 97 deaths for a total of 288, and France 29 deaths to reach a total of 120. The UK also suffered its worst day for covid-19 deaths on Sunday, recording 14 new fatalities to bring its total to 35, the BBC reports.

- The UK’s covid-19 outbreak could last until the spring of 2021 and infect 80% of the population, according to a secret document sent to National Health Service officials seen by the Guardian. The government’s chief medical adviser, Chris Whitty, had previously described that outcome as a worst-case scenario, yet the PHE report states that four fifths of the population “are expected” to contract the virus.

Finablr looking at emergency steps to solve liquidity squeeze as shares nosedive: London-listed Emirati payments company Finablr is assessing its liquidity and cash flow positions with an independent financial advisor after its shares plummeted 80% on Thursday, according to Bloomberg. The company is suffering a “liquidity squeeze at both group and operation business level,” and has been hit by its ties to NMC Health, travel restrictions imposed by the covid-19 outbreak, and a downgrade of Travelex’s bonds, the company said in a statement. Its share price has punged 97% since it went public last May, and its market cap has tumbled to GBP 31.5 mn, from GBP 1.5 bn in December. NMC Health, whose founder is also the founder of Finablr, is facing allegations of financial wrongdoing since last year, prompting Finablr to begin its own investigation to clear its name.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We dive into how schools — both private and public — are moving towards e-learning to keep their students on track following the government’s decision to shut down schools nationwide to curb the spread of covid-19.

Enterprise+: Last Night’s Talk Shows

Covid-19 continued to dominate the airwaves last night: Al Hayah Al Youm’s Lobna Assal spoke by phone with Finance Minister Mohamed Maait to discuss the presidential decree to allocate EGP 100 bn for measures to prevent the spread of the covid-19 virus. He said the state was prepared with reserves for such exceptional circumstances, and confirmed that EGP 188 mn had been allocated to the Health Ministry (watch, runtime: 16:53). Min Masr’s Amr Khalil (watch, runtime: 5:03) also covered the news.

The latest covid-19 figures: Al Kahera Alaan's Lamees El Hadidi spoke by phone with Health Ministry spokesman Khaled Megahed who confirmed that 126 people had now tested positive for the covid-19 virus in Egypt. Sixteen new cases were reported, he said, adding that they are all cases of community spread — people who’ve come into contact with existing patients in the country — with the exception of one Egyptian who had just returned from Italy. He added that 34 cases have recovered, 26 of which tested negative twice within a 48-hour period and have therefore been discharged from quarantine (watch, runtime: 8:38), Min Masr’s Reham Ibrahim had the same report (watch, runtime: 1:15).

Strategic goods supplies: El Hadidi spoke by phone with Supply Minister Ali El Moselhy who said that strategic supplies of essential goods were available for the coming months, including wheat, sugar, rice and fresh and frozen meats and poultry, and warned against panic buying. They noted that rumors circulating on social media of a curfew being imposed in any governorate starting Tuesday were false (watch, runtime: 13:13), (watch, runtime: 2:19).

Internet data packages beefed up by 20%: El Hadidi spoke by phone with Communications Minister Amr Talaat who confirmed that all landline internet data packages will be given an additional 20% capacity for free to accommodate remote learning needs for students who’re facing a two-week suspension from onsite learning at schools and higher learning institutions

(watch, runtime: 8:31). El Hekaya’s Amr Adib (watch, runtime: 1:30), (watch, runtime: 5:20), and Al Hayah Al Youm’s Lobna Assal (watch, runtime: 5:46) also had the same report.

Remote learning on track: El Hadidi also spoke by phone with Higher Education Minister Khaled Abd El Ghaffar who said that online lectures were proceeding without any setbacks, from basic powerpoint presentations to video conferences across a host of e-learning platforms. He added that the ministry would use the next two weeks to disinfect the higher learning institutions currently closed to the public (watch, runtime: 8:34), Min Masr’s Amr Khalil also had the story (watch, runtime: 7:30).

Sudan to mediate GERD talks: Adib also covered President Abdel Fattah El Sisi’s meeting with the leader of Sudan’s Sovereign Council, General Mohamed Hamdan Daglo, in which they agreed that Sudan will play a leading role in mediating the Grand Ethiopian Renaissance Dam negotiations (watch, runtime: 2:42). Assal (watch, runtime: 1:17), and El Hosary (watch, runtime: 5:38) had the same report.

Speed Round

Speed Round is presented in association with

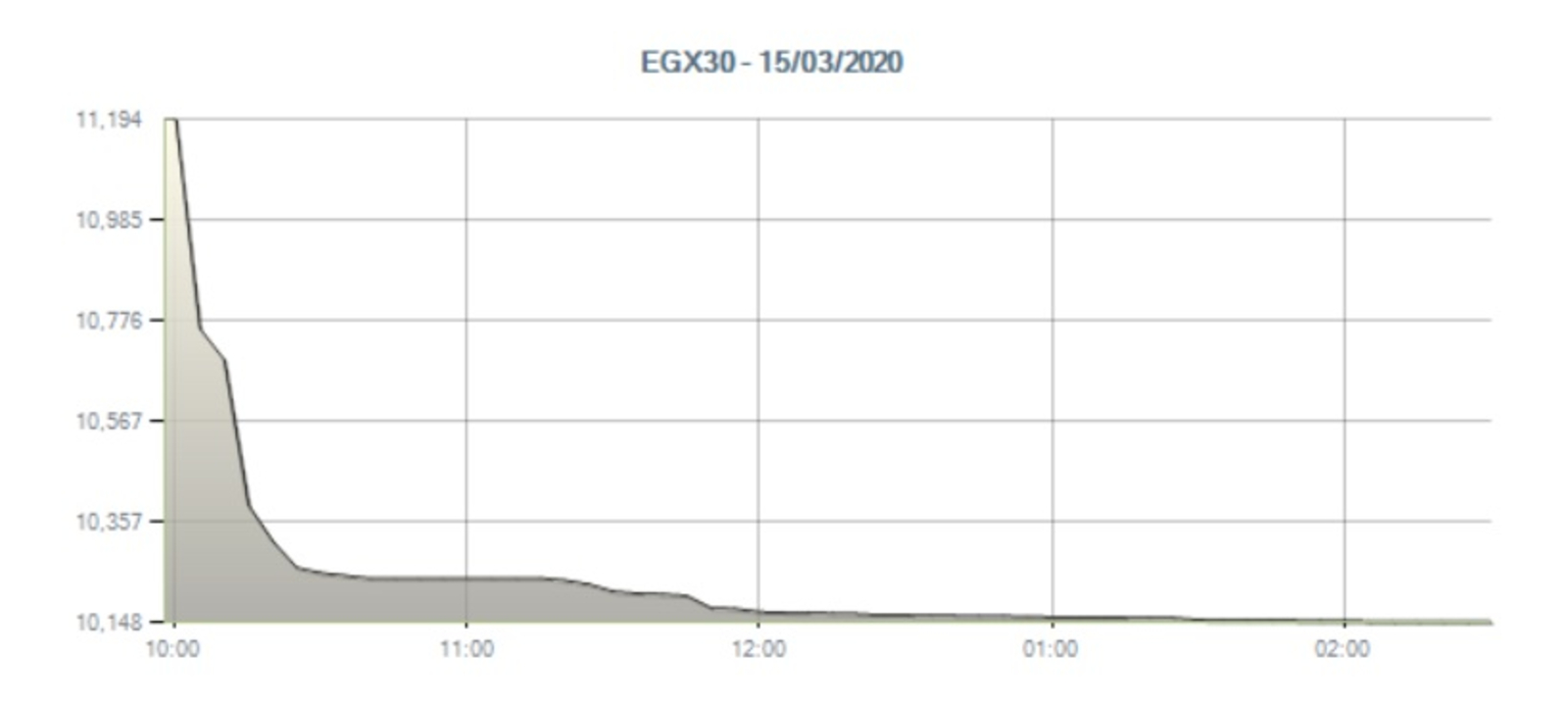

EGX30 tumbles 9.3% in worst showing since 2012: The EGX30 caught up yesterday with last week’s turbulence across global financial markets, closing down 9.3% in what was its sharpest one-day decline since November 2012. Index heavyweight CIB closed down 9.9%. The bourse suspended trading for half an hour after the wider EGX100 index fell more than 5%, triggering circuit breakers for the second time this month. The EGX30 is now down a bit more than 27% for 2020.

The heavy selloff came after the EGX was closed on Thursday, a day on which global markets plunged, with US and European markets recording their biggest single-day drops since 1987 after US President Donald Trump’s decision to suspend air travel between the US and Europe. It also followed the government’s rollout over the weekend several measures to contain the covid-19 outbreak. After banning large gatherings and urging citizens to practice social distancing last week, cabinet decided on Saturday to close schools and universities nationwide for two weeks.

Markets across the region took a beating yesterday. Boursa Kuwait (which was also closed on Thursday) closed down 6.5%, while Dubai’s main index fell 3.4%, the Abu Dhabi Exchange ended the day down 1.9%, while Bahrain’s bourse was 1.5% in the red and Saudi’s Tadawul fell 1.1%. Oman, Qatar, and Israel were the only regional markets to close in the green.

The regional sell-off came despite Egypt, the UAE and Saudi Arabia unveiling a combined USD 47 bn in stimulus packages over the past few days, including a EGP 100 bn response package from Egypt. The efficiency of these packages on easing pressure on businesses “largely depends on the depth and persistence of the coronavirus spread, as well as banks’ appetite to deploy this liquidity into credit growth,” a financial industry analyst told the business information service.

The CBE sold less than half of the EGP 24 bn in bonds put up for auction yesterday as investors continued to demand higher yields. Investors bought just EGP 11.81 bn of the total amount offered, which was spread between three auctions of six-month, one-year and seven-year bonds. Particularly notable was the six-month issuance, which saw the CBE sell just EGP 111 mn of the EGP 10 bn on offer after investors requested a 15.3% yield — a full 100 bps higher than the rate accepted by the central bank. It also failed to find buyers for its EGP 3.5 bn seven-year offering, selling EGP 1.2 bn at a yield of 14.6% rather than the 15.3% requested by investors. The CBE did manage to offload all of the EGP 10.5 bn one-year issuance at a yield of 14.7%, marginally below the 14.9% requested by investors.

EGP WATCH: The EGP dropped three piasters against the greenback yesterday from last week to 15.69. The currency has eased gradually from its peak of 15.49 on 23 February.

Gov’t proposes new top rate of personal income tax: Individual taxpayers earning more than EGP 400k per year will face a new, 25% tax bracket the top end of their income under amendments to the tax code being proposed by the Finance Ministry, according to a document seen by El Watan. The tax hike is part of a package of changes that will also introduce new income tax brackets, raising the number of bands to seven from five, and lowering rates for several existing bands. As it stands, the proposal would reportedly be:

- Those earning between EGP 15-30k would be taxed 2.5%;

- Those earning between EGP 30-45k would be taxed 10%;

- Those earning between EGP 45-60k would be taxed 15%;

- Those earning between EGP 60-200k would be taxed 20%;

- Those earning between EGP 200k-400k would be taxed 22.5%; and

- Those earning more than EGP 400k would be taxed at 25%.

The ministry has also outlined the specifics of new raises for public sector employees to take effect in July: All government employees will receive raises between EGP 150 to EGP 375 on top of their annual increments in the next fiscal year, Finance Minister Mohamed Maait said at a press conference, according to a ministry statement. Confirming President Abdel Fattah El Sisi’s directive at the weekend, Maait said that those covered by the Civil Service Act will receive a raise amounting to 7% of the gross wage while others will receive a bump of 12% of their basic salary (up from 10% in FY2019-2020). The sum total of financial incentives will be EGP 31 bn for the fiscal year, Maait said.

FDI rises by 16% in 2Q2019-2020, says GAFI: Net foreign direct investment (FDI) into Egypt increased by 16% y-o-y during 2Q2019-2020, head of the General Authority For Investment and Freezones (GAFI) Mohamed Abdel Wahab said during a cabinet meeting yesterday. Although Abdel Wahab did not provide an exact figure, the increase would mean that Egypt received more than USD 3.2 bn in FDI during the quarter, given that it attracted USD 2.77 bn in the equivalent period last year.

There seems to be a mix-up with these figures though: Abdel Wahab said yesterday that the increase was driven by companies investing USD 2.2 bn during the quarter, up from USD 1.4 bn a year earlier. But this USD 800 mn increase doesn’t seem to square with the official figures (which show Egypt attracted USD 2.77 bn in 2Q2018-2019) and his claim of a 16% rise in quarterly FDI, which would only allow for around USD 400 mn in additional investment.

An increase in non-oil investments led FDI to jump 66% in the first quarter, rising to USD 2.35 bn from USD 1.41 bn in 1Q2018-2019.

LEGISLATION WATCH- Tawfik surveys house representatives’ opinion on new Public Enterprises Act: Public Enterprises Minister Hisham Tawfik met last week with lawmakers in the House of Representatives to survey their opinions on the amendments to the Public Enterprises Act, which were passed by the cabinet last month and will soon enter the House for discussion, Al Mal reported. The 26-article bill would effectively remove state-owned companies from the legislation if they list 25% stake on the EGX and bring them within the scope of the Companies Act, thus giving general assemblies more power to increase governance, oversee company boards and remove them if they deliver bad poor results.

The Social Solidarity Ministry has announced a EGP 100 mn relief package for those affected by the severe weather over the weekend, dubbed the “Dragon storm.” NGOs contributing to the initiative include the Good Life foundation, the Viva Egypt Fund and the Zakat and Charity House, among others. The ministry estimates that 7,750 families have been impacted. Twenty-one people were killed in the downpours on Thursday and Friday, which caused widespread power outages, travel disruption and infrastructural damage.

EARNINGS WATCH- Cleopatra Hospitals Group reported a 16% dip in net profit in 2019 to EGP 265.4 mn from EGP 315.2 mn a year earlier, according to the company’s earnings statements (pdf). Revenues rose 23% y-o-y to EGP 1.8 bn, up from EGP 1.45 bn the previous year. In 4Q2019, CHG generated profits of EGP 95.4 mn, up 6% y-o-y. CEO Ahmed Ezzeldin said the company had produced “excellent operational and financial results” during a year that saw it add four new facilities including Queens and El Katib hospitals in addition to conducting expansions at Al Shorouk and Nile Badrawi Hospitals.

Looking forward: “We enter 2020 with renewed confidence that the solid fundamentals that underpin the Egyptian economy and the foundations we laid over the course of the 12 months, have us placed in an ideal position to continue generating sustainable value for stakeholders,” Ezzeldin said. “I am particularly excited about the rollout of the first phase of our Beni Suef hospital, the group’s first facility outside Greater Cairo which we expect to complete during the last quarter of 2020.”

Egypt in the News

It’s a surprisingly quiet morning for Egypt in the international press.

Diplomacy + Foreign Trade

Sudan to mediate GERD dispute: Sudan will step in and act as the mediator for an agreement between Egypt and Ethiopia over the Grand Ethiopian Renaissance Dam (GERD), the Associated Press reported the deputy head of the country’s governing council as saying yesterday. General Mohamed Hamdan Dagalo said the Sudanese government will work to “reach an agreement” in the long running dispute following two days’ of talks with President Abdel Fattah El Sisi in Cairo. Tensions have risen between the two states in past weeks after Ethiopia walked out of US-backed talks at the end of February, saying that it needed more time to consider the draft agreement and later accusing the US of being biased in favor of Cairo.

Private schools are mobilizing to shift learning online amid countrywide covid-19 closure: Egypt’s private schools are rolling out e-learning systems to resume classes online after Saturday’s decision to close all schools and universities for two weeks in a bid to slow the spread of the virus that causes covid-19.

What are they deploying? The tools include suites of products from Microsoft and Google, their own learning management systems, and specially created videos. Many schools have been preparing for at least three weeks, representatives of El Alsson, the American International School of Egypt (AIS) and Schutz American School told Enterprise. Distance learning measures will be fully implemented today or tomorrow for a number of schools, including AIS and schools owned by Cairo for Investment and Real Estate Development (CIRA), while GEMS is ready to implement its e-learning program for its international schools today and for its national schools in a week, according to GEMS CEO Ahmed Wahby.

For many private schools, this means adapting and deploying resources already in use. El Alsson’s e-learning system is centered around Google Classroom, which the school already uses to assign tasks, communicate with students, and track their responses. All teachers and students are already familiar with the system, which makes the transition process smoother, says El Alsson Executive Director Karim Rogers. Use of Google Classroom is often complemented by Zoom, a video-conferencing platform that allows teachers to interact directly with students in situations where visual cues are particularly important. Microsoft learning tools are also among the suite of resources currently being augmented to be used at greater scale, says CIRA CEO Mohamed El Kalla. And online resources, including guided reading program Raz-Kids and education differentiation platform Freckle, are great examples of adaptive learning software that AIS is currently using, says AIS Director Kapono Ciotti. At a global level, Scholastic, Zoom, Cambridge and other learning platforms are opening up to help schools move online as smoothly as possible, notes El Kalla.

Schools are also creating their own new tools. AIS has been creating online lessons in video format as its main way of delivering education to its primary school students, who are not yet ready to work through Google Classroom, says Ciotti. It’s been very positive for teachers to learn how to do this process together, he said, and an interesting chance to accelerate hybrid learning, which is likely to be the future for many schools, even without these closures. CIRA, meanwhile, is employing its own learning management system to communicate with students and teachers and to deliver e-learning. GEMS is using its own platform for remote learning (a virtual learning environment) to post lectures and homework assignments and to communicate with parents and students. The parts of the curriculum posted there won’t be live at the beginning, says Wahby, but the live version may be implemented in the future depending on community readiness.

But just how effective is e-learning? AIS measures two main things to assess whether learning is really taking place: Students need to first demonstrate their mastery of a topic and then defend their understanding of it, says Ciotti. These are important indicators of authentic learning, and are often most effectively measured through video or audio submissions, either live or recorded. The process helps assure teachers that learning is taking place, and also encourages students to reflect on their learning, which he likens to a mini masters or doctoral defense.

The message? It’s not business as usual, but it’s as close as we can manage. Many schools have been preparing for this measure and have the infrastructure and the technical capabilities to put it into place, says Schutz’s Assistant Head of School Massimo Laterza. And with school closures in effect in Hong Kong since early February, AIS and other schools have learned from the experience of schools in Asia and prepare, says AIS chief Tammam Abu Shakra.

And lessons learned from previous crises are being put into action. Teaching staff who experienced school closures and disruptions during the bird flu and swine flu outbreaks are able to reassure and inform new teachers, putting forward a strong case for quick action while helping to create a sense of normalcy around online learning and reduce panic, says Rogers. Creating a sense of calm is especially important for students with SATs and GCSEs coming up, who do need that extra interaction, he adds.

It’s not just the private sector that’s moving to e-learning in a bid to stay on top of the curriculum — the Education Ministry is also rolling out an online remote teaching plan for students enrolled in government schools. Students between grades three and eight will be delivered lessons in all subject areas through the ministry’s website, while high school students will be able to rely on the Egyptian Knowledge Bank — a virtual library — for their lessons. The ministry will also stream video lessons across all grade levels. Students have also been directed to use Designmate, an interactive visual teaching resource accessible through the Egyptian Knowledge Bank, that provides animated videos to explain learning material.

Considering some students in government schools may not have internet access, the ministry will also prepare and distribute removable media, including CDs, with the same content.

Right now, the biggest challenge is in the behavior shift. Today’s students are already tech-literate, so schools can scale up existing models and take rapid action to train teachers and students in preparation for online learning. But e-learning systems will never be a perfect substitute for school — an environment in which students grow emotionally, socially, and psychologically. These are aspects of the learning experience that just can’t easily by replicated online, says Laterza. Schools are mindful of this, stressed everyone who spoke to Enterprise, and they are all taking steps to make sure that students are supported during an unsettling time. Children need the certainty provided by a routine, Ciotti, so it is important to create a structured timetable, as well as ensuring continuity of curriculum and delivering an appropriate workload — especially considering that the students aren’t used to working this way.

Parents have a vital role to play — and extra responsibility on their shoulders. While CIRA is sending a suggested schedule for its students to follow, it’s up to parents to create a structure for their children and keep them engaged and physically active during the quarantine period, says El Kalla. This is an absolutely crucial part of ensuring that the steps being taken by schools have their intended impact. For younger children especially, the onus is on the parents to make sure their children are punctual for their online classes and complete their assignments on time. This does place an additional burden on parents, many of whom are also juggling work and other pressures, says Rogers. Some are trying to mitigate these pressures by pooling their human resources, gathering small groups of roughly six children to study together while the parents take it in turns to supervise.

The rapidly-changing situation is challenging, but schools are trying to roll with the punches. Preparations are being made for longer closures, with a skeleton staff currently in place at El Alsson, working on changing lesson plans from in-person to virtual lessons, says Rogers. This should enable the school to respond quickly in the event that closures extend beyond the initial two week period. Whether externally marked exams such as the international baccalaureate and IGCSE will be able to go ahead remains uncertain, but Abu Shakra stresses that it’s the responsibility of schools to make sure their students are prepared in any case.

On a positive note, these changes will likely transform learning in the long-term. Measures taken during this crisis period may catalyze or accelerate a change to global educational systems. “AIS is hoping that this will be a chance for our teachers to grow as educational professionals and kind of lean into the 21st century in ways we haven’t had to before,” says Ciotti. The measures we are seeing now may represent the future of educational models, says Laterza. Perhaps students will learn online two or three days per week and come to school on the other days to play sport, give a presentation or perform a chemistry lab experiment that you can’t do at home, he speculates. “In my completely personal opinion as an educator, I think that the school closures around the world are going to force us to explore new ways of teaching and delivering. And I think this will change the landscape of teaching.”

Your top education stories of the week:

- Schools and universities in Egypt have been ordered to close for two weeks starting Sunday after Ittihadiya announced emergency measures designed to help prevent the spread of the covid-19 virus.

- The Education Ministry had previously suspended extracurricular activities such as physical education, music and computer science programs as part of the ban on large gatherings.

- Education Minister Tarek Shawky also announced the closure of group tutoring centers alongside schools and universities, over corona concerns.

- Higher education has also gone online: University lectures will be uploaded to YouTube and the Higher Education Ministry encouraged online learning during the temporary university shutdown.

- The Higher Education Ministry is considering extending academic semesters in light of university closures.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.7 | Sell 15.8

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Sunday): 10,148 (-9.3%)

Turnover: EGP 942 mn (57% above the 90-day average)

EGX 30 year-to-date: -27.3%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 9.3%. CIB, the index’s heaviest constituent, ended down 9.9%. Yesterday’s worst performing stocks were Ezz Steel down 13.0%, AMOC down 12.8% and Porto Group down 12.4%. The market turnover was EGP 942 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -439.7 mn

Regional: Net short | EGP -1.3 mn

Domestic: Net long | EGP +441.0 mn

Retail: 29.8% of total trades | 27.8% of buyers | 31.9% of sellers

Institutions: 70.2% of total trades | 72.2% of buyers | 68.1% of sellers

WTI: USD 31.73 (+0.73%)

Brent: USD 33.85 (+1.90%)

Natural Gas: (Nymex, futures prices) USD 1.87 MMBtu, (+1.52%, April 2020 contract)

Gold: USD 1,516.70 / troy ounce (-4.63%)

TASI: 6,287 (-1.10%) (YTD: -25.05%)

ADX: 3,849 (-1.86%) (YTD: -24.16%)

DFM: 1,963 (-3.39%) (YTD: -28.99%)

KSE Premier Market: 4,904 (-6.51%)

QE: 8,310 (+0.98%) (YTD: -20.28%)

MSM: 3,748 (+0.39%) (YTD: -5.85%)

BB: 1,414 (-1.52%) (YTD: -12.15%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.