- Brokers on seven African exchanges, including EGX, could be covering each others’ markets within the next year. (Speed Round)

- Al Ahly Capital fully acquires Pharos Securities. (Speed Round)

- BdC's IPO is moving along with Grant Thornton reportedly tapped for a fair value assessment. (Speed Round)

- Egyptian, Saudi investors will invest EGP 1.6 bn to launch phase one of Al Fanar University in Alexandria. (Speed Round)

- ExxonMobil acquires more than 1.7 mn acres for offshore exploration in Egypt. (Speed Round)

- The hedge fund industry had a rough 2019, but the robots came out on top. (What We’re Tracking Today)

- What impact would a central bank cryptocurrency have on our global banking system? (Worth Reading)

- Wherein we engage in some navel gazing about Enterprise’s 2019. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 31 December 2019

Happy New Year, everyone

TL;DR

What We’re Tracking Today

It’s officially the last day of the year (and, depending on how you squint, the decade) that refused to go silently into the night.

Holiday season is (almost) in full swing: The EGX will ring in the new year with a day off tomorrow, 1 January. Banks will also be closed tomorrow and back to work on Thursday, 2 January.

Christmas cheer for the private sector: The private sector will also get a day off in observance of Christmas on Tuesday, 7 January, Manpower Minister Mohamed Saafan confirmed in a statement.

And we are stoked about our much-needed time off. Enterprise is taking its traditional publication holiday from Wednesday, 1 January until Wednesday, 8 January.

News triggers on which to keep your eye in the first few days of the new year:

- Foreign reserves figures for December will be released on or around Sunday, 5 January.

- The purchasing managers’ index for Egypt and the UAE is due out on Monday, 6 January at 6:15am CLT.

- Inflation figures for December are out on Thursday, 9 January.

- The Central Bank of Egypt’s monetary policy committee will review key interest rates on Thursday, 16 January.

Turkey’s forays into our neck of the woods will be the subject of a high-level meeting in Cairo between senior officials from Egypt, Greece, Cyprus, and France on 4 or 5 January, Greek Foreign Minister Nicos Dendias was cited by Cyprus Mail as saying. The meeting comes as the four countries grapple with Turkey’s exploration and expanded naval presence in the Eastern Mediterranean basin — and as Ankara continues to threaten to send troops into Libya to back opponents of Egypt ally Khalifa Haftar.

The Central Bank of Egypt (CBE) will offer USD 800 mn in one-year USD-denominated t-bills on Monday, 6 January, according to CBE data. The last local USD issuance was on 10 December, which saw the CBE selling USD 1 bn in 1-year USD t-bills carrying an average yield of 3.589%.

Making global headlines this morning: Carlos Ghosn, the embattled former chief of Nissan-Renault facing a politically charged trial in Japan, has done a runner and landed overnight in Lebanon. Ghosn holds Lebanese citizenship thanks to his parents and spent a good chunk of his childhood there. It’s still unclear how he managed to get out of Japan despite being on bail and facing trial. Lebanon does not extradite its citizens, so it’s unlikely Ghosn can be sent back to Tokyo. The story is topping the financial press this morning: Financial Times | Wall Street Journal | Reuters | Bloomberg.

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

The financial loser of 2019: hedge funds. The industry looks set to record more funds closing than launching for the fifth year in a row, bringing to more than 4k the number of funds liquidated in the last half-decade, Bloomberg reports, citing data from Hedge Fund Research. Though still worth over USD 3 tn, the hedge fund industry is struggling as clients buck high fees and low yields, leading investors to pull USD 81.5 bn between the beginning of the year and the end of November — over double what was pulled in the whole of 2018.

The financial winner of 2019: The [redacted] robots. The past decade has seen a spike in index-tracking funds, with a sixfold growth in ETFs since late 2009 to see them stand collectively at almost USD 6 tn, the Financial Times reports. And although much of the shift towards passive investing has been driven by equities, bonds haven’t fared badly either: Each group took in over USD 200 bn in 2019 alone. One ETF that’s not doing so great: The first-of-its-kind ETF for pot, which fell 4.8% yesterday to its lowest trading price since it was launched in April 2017, capping a 43% drop this year, according to Bloomberg.

Meanwhile, sovereign and corporate bond issuances saw a surge in MENA, with Gulf borrowers raising a record amount of over USD 100 bn in bond placements this year. Egypt tapped international bond markets, as did Saudi Arabia and Oman, Bloomberg notes. Saudi Aramco and Qatar were the biggest issuers of bond placements, driving bond sales in the GCC as a whole to rise 28% in the course of the year. Syndicated loans, by contrast, saw a 39% drop, as state projects throughout the region were delayed, demand for loans reduced, and both sovereigns and companies sold notes in USD and EUR.

And mergers and acquisitions had their fourth-best year on record, their value soaring to USD 3.8 tn as of 27 December, just 4% short of last year’s figure, according to the Wall Street Journal. Twice the number of companies as last year engaged in megamergers worth over USD 25 bn, and the US saw the total value of its M&A go up 12% from last year, to USD 1.8 tn. However, while the size of global M&A is up, the number of transactions decreased by 1.6%, much of which was driven by uncertainty over Brexit and the US-China trade war. This affected Europe in particular, which witnessed a 30% reduction in total M&A value.

Moving into 2020, emerging market equities are likely to continue underperforming relative to developed market equities, says Christopher Jeffery, head of rates and inflation strategy at LGIM, in an interview with Bloomberg (watch, runtime: 04:04). EM credit spreads tightened in 2019, in line with corporate credit spreads in the US and Europe, he points out.

Bonds are a different story. There’s been a 50 bps pickup for investing in investment-grade EM sovereign bonds versus investment-grade USD corporate bonds, which makes them highly attractive. And when it comes to local debt, you can’t even compare the positive real interest rates of 2-3% offered by large chunks of the EM Index with the negative interest rates on lots of developed market bonds. Diversified exposure to South Africa, Brazil, Mexico, and Turkey on the local side is particularly appealing, Jeffery says.

EM currencies should offer good long-term valuation metrics, with LGIM expecting high real interest rates to provide support, and there being little chance of risk from monetary policy tightening in the US or Europe.

What’s going to hit sentiment on EM in 2020? The US-China trade conflict, China’s growth prospects and the Fed’s interest rate path, Jeffrey says.

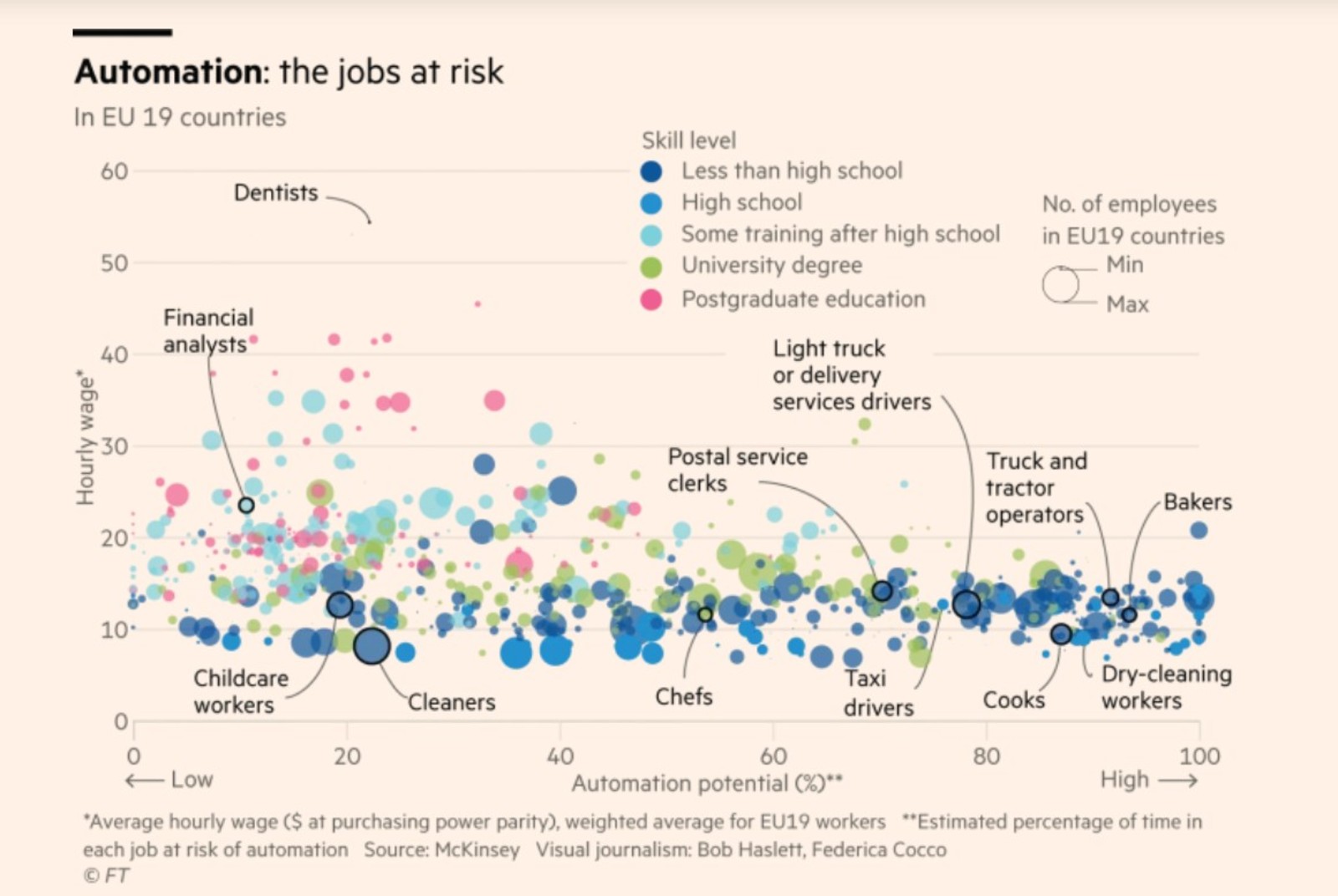

What’s going to lead the conversation in the next decade? Robots, mostly. Ten charts published by the Financial Times in the last year show the issues likely to dominate the global narrative in the coming decade. Chief among the concerns for workers is the risk posed by automation, which is highest for those in low-skilled and low-paying jobs, but exists in some capacity for everyone, analysis shows. It raises the question of whether governments and the private sector are doing enough to prepare employees for disruptions to their careers and livelihoods. Other core issues include rising sea levels, the US-China trade war, the rise in surveillance technology, the space race, Brexit and global immunization coverage.

When it comes to the global energy market, keep your eye on non-OPEC oil production, Chinese oil imports, and the political response to climate change to get an idea of where it’s heading, writes Nick Butler in the Financial Times. As US oil production keeps rising, Brazil, Norway, and Guyana (and possibly Iran) are all on course to add to global supplies next year, further impeding OPEC’s already limited ability to manage the market. Meanwhile, any economic slowdown in China would make a fall in oil prices much more likely. Add to this the political need to mitigate climate change and respond to global calls (albeit inconsistent ones) for mass divestment from the hydrocarbon industry, which will largely be shaped by whether US President Donald Trump gets re-elected.

Decentralized finance (“DeFi”) could be the financial world’s next big thing, the Financial Times reports. A new movement of projects aiming to build an interlinked financial system denominated in cryptocurrencies, DeFi offers lending and derivatives products globally available peer-to-peer, instead of through traditional financial institutions. Advocates cite high yields, with interest rates tied to supply and demand, and rapid growth led by a flourishing of new initiatives, as reasons for their optimism. But others question the economic sustainability of the model, and whether DeFi’s experimental nature and lack of regulation makes it ill-prepared for widespread adoption.

We hit 100k unique monthly active readers in 2019. About half of you read us on email and half on our website.

You are CEOs and MDs, founders and marketing managers, C-suite execs and portfolio managers, brokers and bankers — and more than a handful of students. Thank you, every single one of you, for starting your day with us each weekday.

About 59% of you prefer to read the English edition, and about 41% prefer the Arabic. And a surprising number of you read both.

More than 3/4 of you have read us by 10am CLT each day, with bumps in the early morning on the East Coast of the US, on the drive home in Cairo, and in the middle of the evening here in Omm El Donia.

You read about equally on mobile and desktop. As a group, you prefer iPhone to Android and you are most likely to read us on either Gmail or Outlook.

Statistically, about half of you first read us on your smartphone or tablet, then switch over to a computer to dig deeper or share a story with a friend or colleague.

On any given day, a bit over half of you are based in Egypt, and Cairo is the biggest center of gravity for our readership. That’s followed by Dubai, London, Riyadh, and New York on most days.

We published 245 issues this year including the morning edition and our monthly Your Wealth.

That’s about 4.1 mn words about business, finance, the economy, and policy this year when you count the English and Arabic editions.

We launched a podcast (Making It) and our first vertical (Blackboard) this fall and have lots more in store for 2020.

Blackboard is our first industry vertical — a deep dive into the news, analysis, and raw data (plus context) on the business of education in Egypt, from pre-K through the highest reaches of higher ed. We’ve covered everything from the Education Ministry’s decision to cap foreign ownership of schools at 20% to how light touch regulation has helped attract international universities to open branch campuses in Egypt.

Making It is our podcast on how to build a great business in Egypt. It’s on hiatus until the new year, so maybe you want to take the time to get caught up on season one, where guests so far have included:

- Jalal Abugazaleh, founder of Gourmet Egypt

- Karim El Sahy and Abeer El Sisi from high-profile AI startup Elves

- Karim Awad, group CEO of EFG Hermes

- Fatma Ghali, Managing Director of Azza Fahmy

- Hazem Moussa, co-founder and CEO of Sarwa Capital

Episodes are available on our website | Apple Podcast | Google Podcast.

Enterprise is written and edited by: Abdullah G., Aly El-T., Ghada A., Hasaballah K., Hussein A., Lucy M., Mariam I., Mohamed E., Sayed A., Yasmine M., Yasmine S., Ahmed A., Hisham A., Matt H., Salma El-S., and Patrick F.

Enterprise exists digitally and looks good thanks to: Tarek M.A., Alaa Y., M. Bahaa, M. Saqr, A. Attia, M. Essam, and Jan G. from the dev creative teams at Inktank.

Enterprise is kept solvent by: Fady S., M. Attia and Ahmed H.

Enterprise wouldn’t be Enterprise without: Moustafa B., Karim N. and Hadia M.

Enterprise’s official mascots are: The resident 12-year-old and Luna.

Enterprise would not exist five years down the road without the generous support of: CIB, Sodic, Pharos, Somabay, CIRA, EFG Hermes and the United States Agency for International Development.

And most of all, we wouldn’t still stay awake all night / crawl out of bed before dawn were it not for you, our readers. Thank you, all, for reading, for your comments and criticism, witticisms and suggestions. You’re the reason we do this, friends, and you make our day, every day, when you write or call.

Enterprise+: Last Night’s Talk Shows

Our roundup of last night’s talk shows will be back when we return from our annual publication holiday on Wednesday, 8 January.

Speed Round

Speed Round is presented in association with

The African Securities Exchanges Association (ASEA) has begun working on a project to link seven stock exchanges in Africa by 1Q2021, ASEA President and Casablanca Stock Exchange boss Karim Hajji said, according to Bloomberg. This project will allow brokers in Cairo, Casablanca, Abidjan, Johannesburg, Nairobi, Lagos, and Port Louis to place orders on each other’s exchanges. It has received funding of close to USD 1 mn from the African Development Bank, says Hajji. We previously noted that the EGX has already completed all necessary preparations to join the project.

An IFC-funded privatization tie-in: The International Finance Corporation (IFC) is funding a study to look into the feasibility of privatization through stake sales in state-owned companies on African exchanges, Hajji says. State listings could accelerate the development of the continent’s capital markets, raise funds for governments, and give investors broader participation in national projects, he adds. Hajji didn’t get into much detail about the specifics of this IFC-funded study, but we can only hope at this point that the study ends up helping or guiding our very own privatization program, which has been in limbo and only saw a single company — Eastern Tobacco — sell a stake last March.

The timing couldn’t be better for Egypt’s stock market: News of the linkage project picking up steam came only a day after EGX boss Mohamed Farid said on Sunday that the bourse is essentially headhunting companies to list on the EGX as equities are struggling with low trading volumes and a dearth of IPOs. Farid’s comments imply that the linkage project is a welcome prospect for its potential to create pan-African equity indices that could reduce the overall risk to investors.

REGULATION WATCH- ُEGX to publish aggregated financials of stockbrokers on its website: Separately, the EGX has built a new program to improve its collection of data on the brokerages and securities intermediaries on its membership list, according to a news release. Brokerages were asked to send recent financial statements that were aggregated on the system and published on the EGX’s website. The move will allow the exchange access to quicker and more efficient data analytics that it can use to mitigate market risks.

M&A WATCH- Ahly Capital to fully acquire Pharos Securities: National Bank of Egypt-owned Al Ahly Capital has signed a final agreement with Pharos Holding to acquire 100% of its brokerage arm, Pharos Securities, NBE said in a statement carried by Al Mal. The acquisition is reportedly worth EGP 120 mn, according to the local press. The agreement is still pending approval from the Financial Regulatory Authority; signoff could come this week. Pharos Securities’ current CEO, Essam Abdel Hafiz, will retain his position, while Al Ahly Capital Managing Director Karim Saada has been tapped as non-executive chairman of Pharos Securities.

The agreement comes as Pharos begins a pivot to focus on non-banking financial services, with financial inclusion expected to "play a very important part of the equation," Elwy Taymour tells Enterprise. The company is looking to “significantly grow” its micro-financing business either alone or alongside partners, and is also eyeing other lines of business. “We believe that the non-bank financial services pie in Egypt will continue to grow quite substantially going forward when it comes to these lines of business as financial inclusion takes hold in the country and more and more people become banked,” Taymour said.

Background: Talks between Pharos and Prime Holdings on the sale of Pharos’ investment banking and brokerage divisions broke down back in August 2019.

Advisors: PwC acted as financial advisor for Al Ahly Capital on the transaction, while KPMG was tax advisor. Our friends at ALC Alieldean, Weshahi & Partners acted as legal counsel for Al Ahly Capital, and Al Tamimi & Company was legal counsel for Pharos.

PRIVATIZATION WATCH- Banque du Caire reporetdly hires Grant Thornton for fair value assessment ahead of 2020 IPO: State-owned Banque du Caire (BdC) has tapped Grant Thornton Financial Advisors to conduct the fair value assessment for the bank's upcoming EGX debut, according to the local press. The study will be ready by the end of February, after which the Financial Regulatory Authority and the government committee overseeing the state privatization program will be required to sign off on the IPO.

Where things stand with the IPO: The government is expected to kick off next month a roadshow for the sale of BdC. The plan, so far, would see the bank sell as much as 49% on the EGX in 1Q2020, Chairman Tarek Fayed said earlier this month. The bank, along with payments platform e-Finance, is first in line to IPO under the state privatization program.

*** Tell us what you think will happen in 2020 and maybe we’ll send you an Enterprise mug and our very own coffee, sourced from our friends at 30 North. Every year we ask you, our readers, to weigh in on what you expect for the year ahead: Are you investing? Do you plan to hire new staff in 2020? How do you think the EGP will perform? What’s your take on interest rates? Tell us, and we’ll share the results with the entire community in early January to help you shape your view of the year. The survey is quick, we promise.

LEGISLATION WATCH- SMEs Act up for final vote in March 2020: The House of Representatives’ SMEs committee is expected to wrap up its discussion of the proposed SMEs Act sometime in March 2020, committee deputy chair Hala Abou El Saad said. The SMEs Act would provide a legal framework to regulate SMEs and encourage their much-needed integration into the formal economy. It received preliminary committee approval last month, but still needs to get a final committee signoff before being tabled for a final general assembly vote. The committee has postponed discussions of incentives SMEs would receive under the framework and of the draft’s proposed tax treatment of SMEs to 12 January, Abou El Saad says. Those discussions will need the Finance Ministry on board.

The bill would provide plenty of carrots for SMEs to go legit: The incentives are expected to cover tech-based and AI startups, as well as small and medium factories that use locally sourced materials and regularly scale up their in-house technology. Livestock and agriculture projects and those that work in renewable energy or emerging tech will also be considered, Abou El Saad said. Incentives can come in the form of utility bill discounts or waivers, state-funded vocational training, or subsidized land allocations. The Finance Ministry said in September that the act would exempt SMEs from paying stamp tax, land registration fees, and fees to register contracts to set up companies, among other things. The overall incentive package could cost the government EGP 1.5-2 bn each year.

INVESTMENT WATCH- A group of Egyptian and Saudi investors will be investing EGP 1.6 bn to launch the first phase of the planned Al Fanar University in Alexandria, Al Mal reports, citing unnamed sources with knowledge of the matter. The university, which has appointed Professionals for Investment Banking as its financial advisor, received approval in 2017 from the Supreme Council of Universities to be established. The university is now waiting on presidential approval, which it expects to come through in 1Q2020. Al Fanar will include seven main faculties, including engineering, technology, pharmacy, dentistry, physical therapy, mass communication, and arts and design, a statement from the university website reads. These will later be expanded to include a faculty of medicine, in addition to an affiliated university hospital in West Alexandria, the sources added.

US oil giant ExxonMobil has acquired more than 1.7 mn acres for offshore exploration in Egypt, the company said yesterday. The awards include the 1.2 mn North Marakia Offshore block near the north coast, and 543k acres in the North East El Amriya Offshore block in the Nile Delta. Exxon will operate and hold 100% interest in both blocks, where operations are expected to start in 2020.

Background: Last February, ExxonMobil earned the green light to conduct exploration activities for the first time in Egypt as part of the two oil and gas exploration bid rounds launched by the EGPC and EGAS last year. Exxon was also awarded gas concessions in the bid round.

MOVES- Maridive decouples chairman, MD positions, taps CEO as acting MD: Maridive & Oil Services’ board of directors has temporarily tapped CEO Emad Fawzy to act as the company’s managing director until 31 March, it said in a statement to the EGX (pdf). The company has decided to split the positions of chairman and managing director, which were previously held by Tarek Nadim.

The company has also appointed Roy Donaldson as COO for a one-year term.

El Sewedy makes it to New African’s list of the 100 Most Influential Africans of 2019: Ahmed El Sewedy, president and CEO of Elsewedy Electric, was recognized in the New African magazine’s end-of-year roundup (paywall) of private and public sector figures behind major achievements throughout the year, according to Zawya. El Sewedy has been recognized for transforming the family business formerly known as Arab Cables into the integrated energy solutions giant it is now, with 25 production facilities in 9 countries.

Also on the list: Merck Foundation CEO Rasha Kelej. Kelej has been recognized for her achievements in African charitable work, and launching the “More Than a Mother” campaign targeting infertile women through access to information, education, and health services, according to PR News Wire.

To exactly nobody’s surprise, Mo Salah makes the list: Egyptian footballer Mohamed Salah makes an appearance on the list for his football achievements and his influence online and offline.

Image of the Day

Film critic Samir Farid’s never-before-seen images of Egyptian cinema: Akkasah, the center for photography at NYU Abu Dhabi, has released more than 600 never-before-seen photographs from Egyptian movies dating from the 1950s to the 1990s.The above image is from the 1974 movie, Wedding Night Widow, featuring Nagwa Fouad and Bader El Den Gamgome. The photographs and negatives were taken on set of the films and were later donated by Samir Farid, a prominent Egyptian writer, scholar, and leading film critic. Akkasah’s digital archive aims to provide a platform where photographs can be preserved with many historic and contemporary collections available to audiences online, according to The National.

Egypt in the News

Leading the conversation on Egypt today: Prominent human rights lawyer Gamal Eid was allegedly attacked on Sunday in the second assault against him since October. A group of armed men reportedly beat, threatened and threw paint on him, Human Rights Watch reports. The story is receiving coverage in international media, with CNN quoting him as saying that he has since filed a complaint with the Prosecutor General. The BBC also has the story.

Other headlines to skim:

- Should Arab countries follow Egypt’s non-aggression model with Israel? Although the US is urging other Arab countries to sign non-aggression pacts with Israel similar to Egypt’s, the peace between Cairo and Jerusalem is a “cold” one and public opinion across the Arab world would likely make such pacts ineffective, writes Israel Kasnett in Israel Hayom.

- An Ancient Egyptian mummy named Hermione is not getting enough visitors where she has been displayed in Girton College, Cambridge for the past century, even though she might have been the first woman professor of all time, according to the BBC.

Worth Reading

What impact would a central bank cryptocurrency have on our global banking system? China’s upcoming issuance of a central bank-backed cryptocurrency, which could happen in 2020, has the potential to profoundly disrupt the banking sector — with global impact, writes Andy Mukherjee in a Bloomberg opinion piece. The digital RMB, which China has reportedly been developing for five years, is expected to be a private blockchain supplied by the People’s Bank of China via the banking system, partially replacing physical money. Blockchain’s distributed ledgers will effectively render correspondent banks redundant, Mukherjee argues, opening up new possibilities for rapid and cheap cross-border payment, especially for businesses that currently move some USD 124 tn across borders annually.

With central banks in the driving seat, digital currencies could become a substitute for bank reserves, as well as physical cash. This process is likely to be fueled by a stagnating global economy, driven by negative interest rates, as official digital currencies would allow central banks to offer monetary easing in an efficient way. And as companies, including Facebook, plough ahead with research into developing mega-cryptocurrencies, central banks all over the world are being spurred to look more seriously at what it would mean to set up their own digital currencies. This is in spite of some major risks, which range from sidelining commercial banks — a key funding source of the real economy — to reducing a state’s ability to use currency as a tool in foreign policy negotiations, and cybersecurity issues.

Reminder: Egypt is among the countries said to be considering a central bank cryptocurrency. The Central Bank of Egypt is mulling over the introduction of its own cryptocurrency, as a way of making the banking sector more efficient and to avoid being left behind by new tech developments. The CBE had previously slammed crypto on more than one occasion, citing high risks, but began warming up to the idea after Sweden’s central bank governor made the case for why central banks should investigate state-issued e-currencies.

Worth Watching

The next time you go to a restaurant here in Egypt, check for ostrich meat on the menu: Ostrich breeding to provide restaurants and shops with meat has become common in Cairo’s outskirts, ostrich farm owner Yousef Adly tells the Associated Press (watch, runtime: 03:56) Once referred to as “the meal of the kings,” one kilo of ostrich meat ranges between EGP 200-225. As more farmers import ostriches to breed for their meat, eggs, and feathers, the supply of the once-rare meat is increasing and therefore decreasing the price of the delicacy in Egypt.

Diplomacy + Foreign Trade

El Sisi, Shoukry keep up drive to galvanize support on Libya: President Abdel Fattah El Sisi held a phone call on Sunday with French President Emmanuel Macron to discuss the situation in Libya and potential cooperation between Cairo and Paris to reach a political solution in Tripoli, according to an Ittihadiya statement. Foreign Minister Sameh Shoukry, meanwhile, held a similar conversation in which the two expressed their refusal of a military intervention in Libya, which would be detrimental to the political process, .

Turkey, still seemingly unfazed, could send fighters to Libya: Turkish President Recep Tayyip Erdogan has asked Ankara’s parliament for a one-year mandate to deploy Turkish in Libya, according to Bloomberg. Erdogan’s motion would grant him a carte blanche on the limit, extent, amount, and timing of deployment. Meanwhile, four Turkish sources told Reuters that allied Syrian fighters might be deployed to Libya to support Fayed Al-Serraj’s Government of National Accord (GNA). The unnamed sources said Turkey has not yet sent any Syrian fighters, despite reports from the Syrian Observatory for Human Rights claiming that 300 Syrian fighters had been transferred to Libya while dozens are being trained in Turkish camps.

Energy

Nuclear Power Plants Authority contracts Worley to consult on construction of El Dabaa nuclear power plant

The Nuclear Power Plants Authority has contracted Australian energy firm Worley to consult on the construction of the Dabaa nuclear power plant, the company said in a statement (pdf). Worley, which has worked with the NPPA since 2009, will offer technical support in engineering and design review, as well as project management, training, and quality assurance. The contract, the value of which was not disclosed, will run until the end of 2030.

Basic Materials + Commodities

Egyptian Administrative Court keeps steel import tariffs

The Administrative Court has decided to refer to commissioners a lawsuit against the Trade Ministry’s decision to impose import tariffs on steel rebar and iron billets, according to Al Mal. The commissioners will prepare a report on the matter, which the court will look into on 1 February. In the meantime, the import duties of 25% on steel rebar and 16% on iron billets, which the ministry has imposed for three years and will be gradually tapered over that time before being lifted entirely in April 2022.

Tourism

Egypt signs MoU with Saudi investor to renovate Shepheard Hotel

Egypt has signed an MoU with an unnamed Saudi investor to renovate the Shepheard Hotel, Public Enterprises Minister Hisham Tawfik said, according to a cabinet statement. The final contract, which will be signed within a month, will see the Saudi investor finance the renovation of the historic hotel and will get a cut of revenues once it is operational again, Tawfik told Hapi Journal. The expected cost of the renovation was not disclosed.

Telecoms + ICT

Mobile subscribers in Egypt inch up slightly in September

The number of mobile subscribers in Egypt reached 94.9 mn in September, up slightly from 94.76 mn in August and up 0.33% y-o-y from 94.59 mn in September 2018, according to a CIT Ministry report (pdf). The number of ADSL subscribers rose 14.63% y-o-y and 1.38% m-o-m to 7.12 mn. Mobile internet users also rose to 38.17 mn in September, rising 14.5% y-o-y.

Egyptian startup Dayra lands USD 15k grant from Y Combinator

Egyptian fintech app Dayra was one of several startups to land a USD 15k grant from Y Combinator’s Startup School, becoming the first MENA-based startup to earn the grant, Menabytes reported. Dayra allows users to send money to anyone in Egypt with a phone number at a low cost and high speed, the startup claims. Y Combinator, a US-based seed accelerator, launched Startup School in 2017 as a not-for-charge eight-week online course to give entrepreneurs and would-be entrepreneurs access to the startup community as well as weekly group sessions by industry leaders, according to the company’s website. This year, 10k startups completed the program.

Automotive + Transportation

Passenger car sales decline by 4% y-o-y in November

Passenger car sales were down in November for the ninth consecutive month, declining 4% y-o-y to 12,321 vehicles, according to an Automotive Information Council (AMIC) report (pdf). However, bus and truck sales increased 34.1% and 36.5% y-o-y, respectively, during the month. Total market volume in Egypt increased by 5.12% in November from last year while total vehicles sales dropped 3.4% y-o-y in the first 11 months of 2019 to 161.1k vehicles, AMIC added.

On Your Way Out

This year gave way to quite a few happenings in Egypt’s arts and culture scene: Amr Diab making it to Times Square earlier this year is just one of many additions on Egypt Today’s list of Egypt’s cultural and artistic milestones of the year., alongside Egyptian-American stars Rami Malek and Ramy Youssef snagging nominations for the Golden Globe awards. Also on the list: Egyptologist Zahi Hawass earning the Golden Medal of the Carrick Foundation and Nicolas Mouawad being applauded by UNAIDS MENA for his activism against HIV.

Madbouly, El Anany sued over moving sphinxes out of Luxor: Rep. Haitham El Hariri, Egyptologist Monica Hanna, and lawyer Tarek El Awady filed a lawsuit before the Administrative Court against Prime Minister Mostafa Madbouly and Tourism and Antiquities Minister Khaled El Anany over a plan to move four sphinxes from Luxor’s Karnak Temple to Cairo's Tahrir Square as part of its renovation, according to Masrawy. The trio warned that moving the sphinxes would damage the features of the archaeological site where they were initially found.

The Market Yesterday

EGP / USD CBE market average: Buy 15.98 | Sell 16.08

EGP / USD at CIB: Buy 15.98 | Sell 16.08

EGP / USD at NBE: Buy 15.99 | Sell 16.09

EGX30 (Monday): 13,937 (+0.9%)

Turnover: EGP 440 mn (36% below the 90-day average)

EGX 30 year-to-date: +6.9%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.9%. CIB, the index’s heaviest constituent, ended up 1.0%. EGX30’s top performing constituents were Cleopatra Hospital up 3.6%, Eastern Co up 2.7%, and Emaar Misr up 2.5%. Yesterday’s worst performing stocks were Palm Hills down 2.3%, Egypian Resorts down 2.0% and Egyptian Iron and Steel down 1.3%. The market turnover was EGP 440 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +45.9 mn

Regional: Net Short | EGP -37.1 mn

Domestic: Net Short | EGP -8..7 mn

Retail: 44.7% of total trades | 44.3% of buyers | 45.1% of sellers

Institutions: 55.1% of total trades | 55.4% of buyers | 54.9% of sellers

WTI: USD 61.63 (-0.08%)

Brent: USD 68.44 (+0.41%)

Natural Gas (Nymex, futures prices) USD 2.19 MMBtu (+0.27%, February 2020 contract)

Gold: USD 1,524.70 / troy ounce (+0.40%)

TASI: 8,345.01 (-0.80%) (YTD: +6.62%)

ADX: 5,091.62 (+0.38%) (YTD: +3.59%)

DFM: 2,769.94 (-0.24%) (YTD: +9.49%)

KSE Premier Market: 6,976.12 (+0.51%)

QE: 10,450.00 (+0.30%) (YTD: +1.47%)

MSM: 3,954.13 (+1.63%) (YTD: -8.55%)

BB: 1,608.29 (+0.08%) (YTD: +20.27%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: Indian automotive delegation to visit Egypt.

January 2020: 1,000 artifacts to be displayed when Hurghada Museum opens.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

4 or 5 January 2020 (Saturday or Sunday): Meeting between Egypt, Greece, Cyprus and France due to take place, Cairo.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

6 January (Monday): Egypt’s Emirates NBD PMI for December released.

7 January 2020 (Tuesday): Coptic Christmas, national holiday.

9-12 January 2020 (Thursday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

9-10 January 2020 (Thursday-Friday): Egypt, Ethiopia and Sudan will hold talks in Addis Ababa on GERD.

13 January 2020 (Monday): Egypt, Sudan, and Ethiopia move to Washington, DC, for a fourth (and final?) round of negotiations on GERD.

16 January 2020 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February 2020: The Arab-African International Forum, Jeddah, Saudi Arabia

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February 2020 (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

12 April 2020 (Sunday): Easter Sunday

20 April 2020 (Monday): Sham El Nessim, national holiday.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

25 April 2020 (Saturday): Sinai Liberation Day, national holiday.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June 2020 (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

6 October 2020 (Tuesday): Armed Forces Day, national holiday.

29 October 2020 (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.