What we’re tracking on 31 December 2019

It’s officially the last day of the year (and, depending on how you squint, the decade) that refused to go silently into the night.

Holiday season is (almost) in full swing: The EGX will ring in the new year with a day off tomorrow, 1 January. Banks will also be closed tomorrow and back to work on Thursday, 2 January.

Christmas cheer for the private sector: The private sector will also get a day off in observance of Christmas on Tuesday, 7 January, Manpower Minister Mohamed Saafan confirmed in a statement.

And we are stoked about our much-needed time off. Enterprise is taking its traditional publication holiday from Wednesday, 1 January until Wednesday, 8 January.

News triggers on which to keep your eye in the first few days of the new year:

- Foreign reserves figures for December will be released on or around Sunday, 5 January.

- The purchasing managers’ index for Egypt and the UAE is due out on Monday, 6 January at 6:15am CLT.

- Inflation figures for December are out on Thursday, 9 January.

- The Central Bank of Egypt’s monetary policy committee will review key interest rates on Thursday, 16 January.

Turkey’s forays into our neck of the woods will be the subject of a high-level meeting in Cairo between senior officials from Egypt, Greece, Cyprus, and France on 4 or 5 January, Greek Foreign Minister Nicos Dendias was cited by Cyprus Mail as saying. The meeting comes as the four countries grapple with Turkey’s exploration and expanded naval presence in the Eastern Mediterranean basin — and as Ankara continues to threaten to send troops into Libya to back opponents of Egypt ally Khalifa Haftar.

The Central Bank of Egypt (CBE) will offer USD 800 mn in one-year USD-denominated t-bills on Monday, 6 January, according to CBE data. The last local USD issuance was on 10 December, which saw the CBE selling USD 1 bn in 1-year USD t-bills carrying an average yield of 3.589%.

Making global headlines this morning: Carlos Ghosn, the embattled former chief of Nissan-Renault facing a politically charged trial in Japan, has done a runner and landed overnight in Lebanon. Ghosn holds Lebanese citizenship thanks to his parents and spent a good chunk of his childhood there. It’s still unclear how he managed to get out of Japan despite being on bail and facing trial. Lebanon does not extradite its citizens, so it’s unlikely Ghosn can be sent back to Tokyo. The story is topping the financial press this morning: Financial Times | Wall Street Journal | Reuters | Bloomberg.

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

The financial loser of 2019: hedge funds. The industry looks set to record more funds closing than launching for the fifth year in a row, bringing to more than 4k the number of funds liquidated in the last half-decade, Bloomberg reports, citing data from Hedge Fund Research. Though still worth over USD 3 tn, the hedge fund industry is struggling as clients buck high fees and low yields, leading investors to pull USD 81.5 bn between the beginning of the year and the end of November — over double what was pulled in the whole of 2018.

The financial winner of 2019: The [redacted] robots. The past decade has seen a spike in index-tracking funds, with a sixfold growth in ETFs since late 2009 to see them stand collectively at almost USD 6 tn, the Financial Times reports. And although much of the shift towards passive investing has been driven by equities, bonds haven’t fared badly either: Each group took in over USD 200 bn in 2019 alone. One ETF that’s not doing so great: The first-of-its-kind ETF for pot, which fell 4.8% yesterday to its lowest trading price since it was launched in April 2017, capping a 43% drop this year, according to Bloomberg.

Meanwhile, sovereign and corporate bond issuances saw a surge in MENA, with Gulf borrowers raising a record amount of over USD 100 bn in bond placements this year. Egypt tapped international bond markets, as did Saudi Arabia and Oman, Bloomberg notes. Saudi Aramco and Qatar were the biggest issuers of bond placements, driving bond sales in the GCC as a whole to rise 28% in the course of the year. Syndicated loans, by contrast, saw a 39% drop, as state projects throughout the region were delayed, demand for loans reduced, and both sovereigns and companies sold notes in USD and EUR.

And mergers and acquisitions had their fourth-best year on record, their value soaring to USD 3.8 tn as of 27 December, just 4% short of last year’s figure, according to the Wall Street Journal. Twice the number of companies as last year engaged in megamergers worth over USD 25 bn, and the US saw the total value of its M&A go up 12% from last year, to USD 1.8 tn. However, while the size of global M&A is up, the number of transactions decreased by 1.6%, much of which was driven by uncertainty over Brexit and the US-China trade war. This affected Europe in particular, which witnessed a 30% reduction in total M&A value.

Moving into 2020, emerging market equities are likely to continue underperforming relative to developed market equities, says Christopher Jeffery, head of rates and inflation strategy at LGIM, in an interview with Bloomberg (watch, runtime: 04:04). EM credit spreads tightened in 2019, in line with corporate credit spreads in the US and Europe, he points out.

Bonds are a different story. There’s been a 50 bps pickup for investing in investment-grade EM sovereign bonds versus investment-grade USD corporate bonds, which makes them highly attractive. And when it comes to local debt, you can’t even compare the positive real interest rates of 2-3% offered by large chunks of the EM Index with the negative interest rates on lots of developed market bonds. Diversified exposure to South Africa, Brazil, Mexico, and Turkey on the local side is particularly appealing, Jeffery says.

EM currencies should offer good long-term valuation metrics, with LGIM expecting high real interest rates to provide support, and there being little chance of risk from monetary policy tightening in the US or Europe.

What’s going to hit sentiment on EM in 2020? The US-China trade conflict, China’s growth prospects and the Fed’s interest rate path, Jeffrey says.

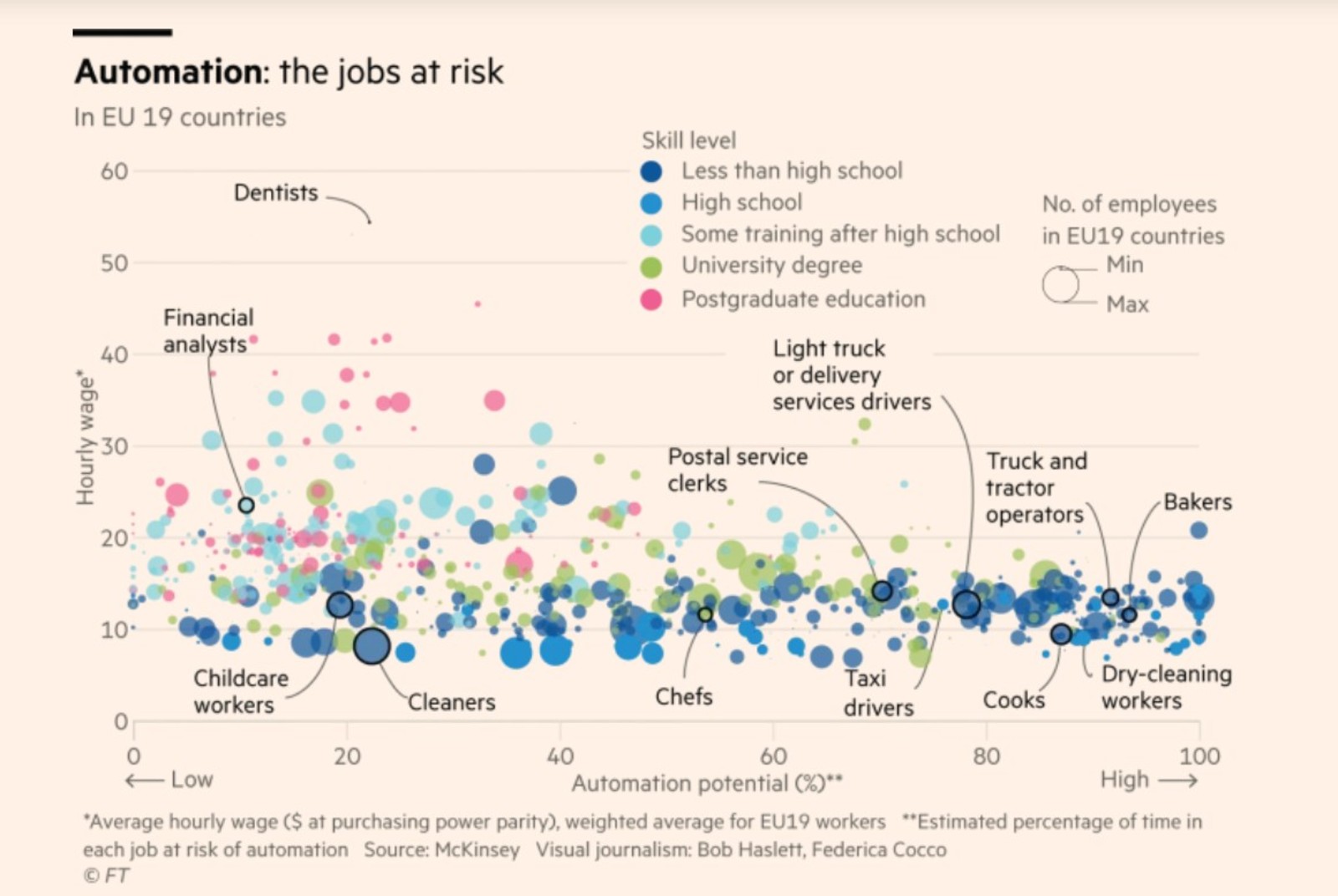

What’s going to lead the conversation in the next decade? Robots, mostly. Ten charts published by the Financial Times in the last year show the issues likely to dominate the global narrative in the coming decade. Chief among the concerns for workers is the risk posed by automation, which is highest for those in low-skilled and low-paying jobs, but exists in some capacity for everyone, analysis shows. It raises the question of whether governments and the private sector are doing enough to prepare employees for disruptions to their careers and livelihoods. Other core issues include rising sea levels, the US-China trade war, the rise in surveillance technology, the space race, Brexit and global immunization coverage.

When it comes to the global energy market, keep your eye on non-OPEC oil production, Chinese oil imports, and the political response to climate change to get an idea of where it’s heading, writes Nick Butler in the Financial Times. As US oil production keeps rising, Brazil, Norway, and Guyana (and possibly Iran) are all on course to add to global supplies next year, further impeding OPEC’s already limited ability to manage the market. Meanwhile, any economic slowdown in China would make a fall in oil prices much more likely. Add to this the political need to mitigate climate change and respond to global calls (albeit inconsistent ones) for mass divestment from the hydrocarbon industry, which will largely be shaped by whether US President Donald Trump gets re-elected.

Decentralized finance (“DeFi”) could be the financial world’s next big thing, the Financial Times reports. A new movement of projects aiming to build an interlinked financial system denominated in cryptocurrencies, DeFi offers lending and derivatives products globally available peer-to-peer, instead of through traditional financial institutions. Advocates cite high yields, with interest rates tied to supply and demand, and rapid growth led by a flourishing of new initiatives, as reasons for their optimism. But others question the economic sustainability of the model, and whether DeFi’s experimental nature and lack of regulation makes it ill-prepared for widespread adoption.

We hit 100k unique monthly active readers in 2019. About half of you read us on email and half on our website.

You are CEOs and MDs, founders and marketing managers, C-suite execs and portfolio managers, brokers and bankers — and more than a handful of students. Thank you, every single one of you, for starting your day with us each weekday.

About 59% of you prefer to read the English edition, and about 41% prefer the Arabic. And a surprising number of you read both.

More than 3/4 of you have read us by 10am CLT each day, with bumps in the early morning on the East Coast of the US, on the drive home in Cairo, and in the middle of the evening here in Omm El Donia.

You read about equally on mobile and desktop. As a group, you prefer iPhone to Android and you are most likely to read us on either Gmail or Outlook.

Statistically, about half of you first read us on your smartphone or tablet, then switch over to a computer to dig deeper or share a story with a friend or colleague.

On any given day, a bit over half of you are based in Egypt, and Cairo is the biggest center of gravity for our readership. That’s followed by Dubai, London, Riyadh, and New York on most days.

We published 245 issues this year including the morning edition and our monthly Your Wealth.

That’s about 4.1 mn words about business, finance, the economy, and policy this year when you count the English and Arabic editions.

We launched a podcast (Making It) and our first vertical (Blackboard) this fall and have lots more in store for 2020.

Blackboard is our first industry vertical — a deep dive into the news, analysis, and raw data (plus context) on the business of education in Egypt, from pre-K through the highest reaches of higher ed. We’ve covered everything from the Education Ministry’s decision to cap foreign ownership of schools at 20% to how light touch regulation has helped attract international universities to open branch campuses in Egypt.

Making It is our podcast on how to build a great business in Egypt. It’s on hiatus until the new year, so maybe you want to take the time to get caught up on season one, where guests so far have included:

- Jalal Abugazaleh, founder of Gourmet Egypt

- Karim El Sahy and Abeer El Sisi from high-profile AI startup Elves

- Karim Awad, group CEO of EFG Hermes

- Fatma Ghali, Managing Director of Azza Fahmy

- Hazem Moussa, co-founder and CEO of Sarwa Capital

Episodes are available on our website | Apple Podcast | Google Podcast.

Enterprise is written and edited by: Abdullah G., Aly El-T., Ghada A., Hasaballah K., Hussein A., Lucy M., Mariam I., Mohamed E., Sayed A., Yasmine M., Yasmine S., Ahmed A., Hisham A., Matt H., Salma El-S., and Patrick F.

Enterprise exists digitally and looks good thanks to: Tarek M.A., Alaa Y., M. Bahaa, M. Saqr, A. Attia, M. Essam, and Jan G. from the dev creative teams at Inktank.

Enterprise is kept solvent by: Fady S., M. Attia and Ahmed H.

Enterprise wouldn’t be Enterprise without: Moustafa B., Karim N. and Hadia M.

Enterprise’s official mascots are: The resident 12-year-old and Luna.

Enterprise would not exist five years down the road without the generous support of: CIB, Sodic, Pharos, Somabay, CIRA, EFG Hermes and the United States Agency for International Development.

And most of all, we wouldn’t still stay awake all night / crawl out of bed before dawn were it not for you, our readers. Thank you, all, for reading, for your comments and criticism, witticisms and suggestions. You’re the reason we do this, friends, and you make our day, every day, when you write or call.