- Could military-owned companies one day list on the EGX or sell stakes to private companies? (Speed Round)

- Aramco’s IPO could begin today after MbS accepts lower valuation. (Speed Round)

- Egypt’s petchem industry could see its gas bill cut. (Speed Round)

- Kellogg to invest EGP 3.6 bn in Egypt. (Speed Round)

- Ekuity acquires 30% stake in AluNile from Ezdehar Egypt Mid-Cap Fund. (Speed Round)

- Emerald Real Estate Investment to list on EGX. (Speed Round)

- Tui to relaunch Sharm El Sheikh holiday packages next week. (Speed Round)

- Gov’t issues executive regulations for Public Contracts Act. (Speed Round)

- The Market Yesterday

Sunday, 3 November 2019

Will military companies one day list on the EGX or sell shares to the private sector?

TL;DR

What We’re Tracking Today

Happy November, ladies and gentlemen. Hard to believe that the first 10 months of the year are now behind us — we hope that you’re all surviving budget season. The countdown to new year’s is about to begin…

Privatization is the theme of the day here at home and regionally, as we wait for the official announcement today of the Aramco IPO and its timeline. After Saudi Arabia’s Crown Prince Mohamed bin Salman reportedly greenlit the transaction, we look at the details and what this could mean for Egypt’s own stake sale program in this morning’s Speed Round below.

In parallel, Egypt is sending messages that it is open for business: Perhaps the biggest surprise on the privatization front came from President Abdel Fattah El Sisi, who announced that companies owned by the Armed Forces should sell shares to private investors. At the same time, the nation’s new sovereign wealth fund has recently made clear that it welcomes co-investment from the private sector. We have the highlights in this morning’s Speed Round, below.

Look for GERD talks to be a fixture in the headlines this week. Ethiopia confirmed on Thursday it has accepted Trump administration’s invitation for talks over the Grand Ethiopian Renaissance Dam on Wednesday, 6 November, according to a spokesperson for the Ethiopian Foreign Ministry. Egypt accepted the offer last week. Ethiopia had repeatedly mediation by third parties, and it remains a touchy topic: The statement out of Addis made sure to underline that the meetings would not involve direct negotiations, but discussions only.

Egypt, Greece and Cyprus to hold three-way defense meeting in Athens on Tuesday, according to the Cyprus Mail. The next day will see the three ministers flying to Crete to watch part of the trilateral “Medusa 9” military drill that starts today and wraps up on 8 November.

Expect an announcement by the Housing Ministry at the Real Estate Debate 2019 conference today. The one-day event takes place at the Cairo Marriott Hotel. More info here (pdf).

Other key dates on which to keep your eye out:

- Monday, 4 November is reserves day, with the CBE expecting to announce its foreign reserves position as of the end of October;

- Tuesday, 5 November is PMI day, with October’s reading of the IHS / Markit Purchasing Managers’ Index expected to come out;

- Sunday, 10 November is inflation day, with the CBE and state statistics agency CAPMAS releasing figures for headline and core inflation;

- Thursday, 14 November is interest rate day, when the CBE’s Monetary Policy Committee meets to seat interest rates. The committee has cut rates at its last two meetings.

*** EDITOR’S NOTE- We’re delighted to welcome Soma Bay to the Enterprise family this morning as our Red Sea holiday destination partner. With a championship golf course, dive center, kite house (can you say, “300 days of wind a year”?), a spa for those so inclined, and stunning white sandy beaches, Soma Bay is a self-contained resort paradise — and the first Red Sea destination we visited nearly 20 years ago. Soma Bay is an easy four-hour flight from central Europe (and an even easier flight for a long weekend from Cairo), accessed from Hurghada International Airport, from which it is just a 45-minute drive south.

Discover Soma Bay (or book a hotel room) through their website to learn more about our favourite Red Sea holiday destination.

Soma Bay joins our friends at Pharos, SODIC and CIB as an anchor partner. Collectively, their generous financial support helps ensure your morning read remains available to you each weekday at 6am without charge. We hope you will join us in thanking them all.

Capital inflows in emerging markets fell to USD 22.5 bn in October from USD 37.7 bn in September, according to the Institute of International Finance (IIF). Competitive yields on EM bonds drove almost all of these inflows into debt-based-assets, totalling USD 21.3 bn. The fall comes despite renewed easing by the US Federal Reserve, which the IIF notes in the past has helped to support EM currencies. But years of hot money encouraged by low interest rates in developed countries has dampened the knock-on effects of loose monetary policy on EMs, it suggests.

Warren Buffett is sitting on a huge pile of cash: Berkshire Hathaway’s cash pile reached a record USD 128 bn in 3Q as Buffett continued his dry spell in finding major acquisitions. Profits at the hedge fund rose by a record USD 7.8 bn, a 14% increase from 3Q2018. Bill Smead, chief executive of Smead Capital Management, suggested that the investor could be hoarding cash in case he or Charlie Munger, his number two, were hospitalized or in the event of a severe market downturn. Berkshire’s cash pile rose USD 6 bn during the quarter from USD 122 bn. The Financial Times has more.

El Sherbiny, Abdel Gawad win CIB squash tournaments by the Pyramids: The CIB PSA Women’s World Championship and CIB Egyptian Squash Open Men’s Platinum wrapped up on Friday at the Giza Pyramids, with Nour El Sherbini capturing the women’s title and Karim Abdel Gawad crowned the men’s champion. El Sherbini took the USD 61k prize after she beat World No.1 Raneem El Welily 3-1, Karim Abdel Gawad got the better of World No.1 Ali Farag in straight sets, winning USD 25k. PSA has the lowdown on the matches.

Sports Ministry wants to keep the trophies flowing: Sports Minister Ashraf Sobhy used the occasion to announce a new state-sponsored program to nurture young talent.

Which brings us to the age-old question: What is the secret of our squash dominance? The New York Timesis the latest to explore how our women rose to become the dominant force. “That is the mn-USD question. No one really knows,” El Welily told the Gray Lady. Author of ‘The Talent Code’ Daniel Coyle offers one explanation: “Proximity to greatness.” Egypt has only 400 courts and less than 10k players, and the finest are clustered in 10 clubs and two cities: Cairo and Alexandria. This tight-knit squash community made it commonplace for rookies to train alongside world title-holders, and made the sport the second most prestigious in the country (after football, of course).

Reuters also took note that Egypt is the global squash champ, pointing out that the women’s prize pool at the CIB Women’s World Championship was worth more this year than the one on offer at the men’s world championship in Qatar thanks to the generosity of our friends at CIB, which has led the funding drive for squash that has helped turn Egypt into a global powerhouse.

The first phase of a US-China trade agreement is close: Deutsche Welle reports that Washington and Beijing are “nearer to completing trade negotiations” after a phone call on Friday. Trump and Jinping were supposed to putting pen to paper at this month’s Asia-Pacific Economic Cooperation summit in Chile, but are having to reorganize after the Chilean president pulled the plug on the event amid mass demonstrations. The news comes after the WTO gave Beijing additional ammunition if things turn sour, having given China the green light to apply USD 3.6 bn of retaliatory tariffs on US goods after it ruled that US anti-dumping duties had impeded Chinese exporters, Reuters reports.

Among the international headlines worth knowing this morning:

- Banks in Lebanon have effectively imposed capital controls. Bloomberg takes pains to write that the central bank hasn’t stepped in, but nevertheless the country’s four major banks have stopped all overseas transfers unless the account holder can show a critical need for funds. Banks re-opened on Friday after a two-week shutdown amid ongoing protests.

- Sudan will undertake structural economic reforms and obtain debt relief from creditors under a “roadmap” signed with the World Bank, the IMF and the African Development Bank to rescue its ailing economy, according to Reuters Africa.

- Daesh has confirmed the death of its leader, Abu Bakr Al Baghdadi, and named a successor, the Wall Street Journal says.

PSA- What’s good for your heart is also good for your brain. Whether you’re just getting started in life, comfortably in midlife or well into retirement, cardio isn’t just good for your heart — it’s good for your brain. Resistance training may be all the rage today (and great fun to boot), but studies claim the benefits of good old fashioned have specific protective effects against the ravages of Alzheimer’s and dementia. And some of those benefits persist in your 70s and beyond even if you were only active in middle age, but stop working out.

Better still: Cardio could make you better at your day job. Look no further than this 14-year-old classic: The aristocracy of cardio in Men’s Health, for the lowdown on why CEOs at the top of their game run / spin / cycle / swim. The science has only gotten more conclusive in the decade and a half since — and the good folks at the New York Times (including the inimitable Gretchen Reynolds) are documenting it day in and day out.

Enterprise+: Last Night’s Talk Shows

Transportation was topic du jour on the airwaves last night: In amongst the blanket coverage of a ministerial railway meeting and a marathon 32-minute interview on electric cars courtesy of Lobna Assal, El Hekaya’s Amr Adib picked up a fairly unusual parliamentary request from President Abdel Fattah El Sisi and we got the latest on last week’s “train ticket incident.”

But first: President tells House to up its criticism of the government: El Sisi has called on MPs to start more actively grilling government officials in public hearings, El Hekaya’s Amr Adib said (watch, runtime: 3:39). “Officials who are questioned should not take this personally … we’re working within a national context,” El Sisi said at the inauguration of state-owned El Nasr For Intermediate Chemicals’ new factory. Adib spoke to Deputy House Speaker Soliman Wahdan and asked him for the rundown on the different levels of questioning (questions, early day motions and interpellations) (watch, runtime: 12:29). Wahdan said an elected representative is authorized to use the highest level of questioning — an interpellation — provided they have evidence to back their claims and permission from the speaker and his two deputies.

Plans to manufacture electric cars domestically: Al Hayah Al Youm’s Lobna Assal dedicated a lengthy segment to an interview with the Military Production Ministry’s undersecretary, Mohamed Sherine, to discuss plans to manufacture electric vehicles domestically (watch, runtime: 31: 59). Sherine told Assal the ministry had decided to focus on making “cars for the future” rather than build capabilities in manufacturing traditional ones. Two key agreements were signed with China’s Foton Motor earlier this year: One to purchase 50 public buses to operate in urban areas, and another on the sidelines of El Sisi’s participation in China’s Belt and Road Forum to manufacture 2000 buses in Egypt, starting with 450 buses in 2020, Sherine said.

El Sisi, Madbouly, El Said, El Wazir sit down to review transport projects: President Abdel Fattah El Sisi was briefed on the progress of projects to reform Egypt’s railway and metro in a meeting with Prime Minister Moustafa Madbouly, Planning Minister Hala El Said, and Transport Minister Kamel El Wazir. El Sisi and high-level officials also met with top executives from US-based Progress Rail Locomotives, which is supplying Egypt with 50 new locomotives and repairing 50 old ones. The meetings were widely noted by talk show hosts, including Assal (watch, runtime: 2:25), Hona Al Asema’s Reham Ibrahim (watch runtime 1:17 and runtime: 1:14), and Masaa DMC’s Eman El Hossary (watch, runtime: 2:36).

Prosecutor’s office latest statement on the “train ticket incident”: A train conductor who forced last Monday two street vendors to jump from a moving train, resulting in the death of one of them, will face charges, Adib reports (watch, runtime: 7:22). The story is making international headlines, as we note in Egypt in the News, below.

Speed Round

Speed Round is presented in association with

PRIVATIZATION WATCH- Could military-owned companies be set to list on the EGX or sell stakes to the private sector? President Abdel Fattah El Sisi has raised for the first time the idea of including military companies in his administration’s stake sale program. Egypt’s people should be able to buy shares in military-owned and operated companies, El Sisi said, speaking at the opening of two chemical plants in the Nasr for Intermediate Chemicals complex in Abu Rawash on Thursday. The statement is receiving widespread coverage in both the local and international press.

The army is not competing with the private sector, El Sisi said: The president stressed that the army doesn’t undertake projects at the expense of the private sector and noted that the military and civilian businesses are actively working together on a series of strategic initiatives.

Background: El Sisi’s remarks appeared designed to address claims the military is crowding-out the private sector as its involvement in the economy deepens, a topic he has addressed on several occasions. Last year, for example, El Sisi said the military’s economic activity constitutes only 2-3% of Egypt’s GDP, according to Ahram Online. Growing state involvement in the economy has been of significant interest to the international press. Reuters led a year-long investigation into the issue last year, and the Wall Street Journal later looked into the topic. The IMF has since spoken on the need for the state to reduce its involvement in the economy.

Don’t expect fewer mega-projects: El Sisi said Egypt would continue with projects designed to boost economic growth, saying that critics could “get lost” if they didn’t like it.

El Sisi touts plans for SWF as gov’t promotes fund to private investors: The president also spoke on Thursday about Egypt’s plans for its sovereign wealth fund, which is set to start operating soon. The fund will be an embodiment of the economic power of the state, he added. His statements comes as Orascom Development Egypt and Al Ismaelia For Real Estate Investment appear to have both expressed interest in investing in or alongside the SWF, according to remarks by Planning Minister Hala El Said picked up by Al Mal. She also highlighted proposals from international and Arab investors to partner with the fund, which will get its strategy and full structure within two months. El Said had met last week with UAE businessman Khalaf Al Habtoor of Al Habtoor Group to discuss the fund. The SWF’s newly appointed CEO Ayman Soliman also began drumming up investor interest for the fund during the Egypt Can conference.

Partnership with other SWFs in the offing as well: Prime Minister Mostafa Madbouly also said that the Egyptian government is expanding the participation of the private sector in its development and will also work on partnerships with other global sovereign wealth funds, direct investment funds, and private sector companies.

El Said noted that the government intends to raise the capital of the SWF and contributed new assets at a meeting scheduled for this week, according to Al Mal. El Said noted that assets worth EGP 50 bn will be contributed to the fund, including a number of parcels of land. The current issued capital of the fund is now EGP 5 bn, while its authorized capital is EGP 200 bn.

IPO WATCH- Aramco’s IPO is moving forward as MbS appears to accept valuation of less than USD 2 tn: Saudi Crown Prince Mohammed bin Salmangave on Friday the go-ahead for Aramco’s long-awaited IPO and an official announcement is expected as early as today, sources familiar with the matter told Bloomberg. The decision to move ahead signals a willingness by MbS to lose his valuation to USD 1.6-1.8 tn from USD 2 tn — a price that was largely rejected by international investors.

Saudi money will now be instrumental in pushing the share sale through: Aramco’s bankers will be relying on contributions from Saudi’s wealthiest families, and local asset managers (including those that look after government funds) have also been asked to buy heavily. Domestic banks, meanwhile, have been told to offer generous loans so that retail investors can buy Aramco shares.

Extra effort is being put into making Aramco’s stock more attractive: Aramco has announced its intention to pay USD 75 bn in dividends next year, which would give investors a yield of 3.75% if the company achieves a USD 2 tn valuation. And a guarantee is being made that the dividend won’t fall until after 2024, irrespective of oil prices. If the company has to reduce the total dividend to less than USD 75 bn, it will cut back on government payouts, it has said.

Aramco’s top brass are getting smaller compensation packages to help the company through. Some 17 top Aramco management and board members took away USD 30 mn last year — about half of what ExxonMobil and Chevron offered their top brass, according to Bloomberg, which it says reflects how the Saudi business community sees the IPO.

Aramco could be listed on the Tadawul before the end of the year. We reported last week that Al Arabiya had announced the expected timeline of the IPO:

- Sunday, 3 November: Saudi Arabia’s Capital Markets Authority is set to announce the start of the IPO process.

- Sunday, 17 November: The share price on offer will be announced.

- Wednesday, 4 December: Subscription to the offering will begin.

- Wednesday, 11 December: First day of trading.

Size of the offering: If Saudi gets a USD 2 tn valuation, it would hope to bring in USD 20 bn from the sale of 1% of Aramco on the Tadawul in December. It has also planned another 1% offering in 2020, sources told Reuters last month. The sales will be the jumping off point to a public sale of around 5% of Aramco at some later date.

Advisors: JPMorgan Chase, Morgan Stanley, Bank of America Merrill Lynch, Goldman Sachs Group, Credit Suisse Group, Citigroup, HSBC, Saudi Arabia’s National Commercial Bank, and Saudi Arabia’s Samba Financial Group, were all given the mandate for the IPO. Our friends at EFG Hermes are doing joint bookrunner duties.

Do, what does this mean for the government’s stake sale program here in Egypt? Banks advising on our state privatization program have urged the government to factor the Aramco IPO into their plans, Public Enterprise Minister Hisham Tawfick said in an interview. “Aramco is the biggest IPO in the world and we should take it into consideration when deciding the timing of our offerings. This is the message we got from the investment banks,” he said. Whether this means bringing sales forward to before the reported date of Aramco’s offering or pushing them further back is unclear, he tells Bloomberg, but authorities are due to meet advisors “soon” to discuss the timing. He confirmed that Abu Qir Fertilizers and Alexandria Container & Cargo Handling would be the next in line for a share sale.

… and while we’re still on privatization, state-owned Heliopolis Housing and Development (HHD) announced that bidding on acquiring a 10% stake with management rights was still officially open, according to a bourse statement (PDF). The company noted it will still receive bids even after approving the draft contract, which is expected to take place on 23 November. A total of three companies managed to meet the initial deadline of 14 October.

Nat gas price cuts for the petrochem industry may be on the way: The Madbouly government is considering introducing a new pricing scheme that would lower the price of natural gas sold to petrochemical factories below USD 7/mmBtu, a government source told the press. The mechanism would be linked to global natural gas prices, and its details will be made public soon, the source said.

This comes almost a month after the cabinet decided to lower gas prices for cement, metallurgy, and ceramics manufacturers, heeding the call of lobbyists who have been pushing for this for years. The cement industry will now pay USD 6/mmBtu, while metallurgy and ceramics firms pay USD 5.5/mmBtu. The government also set up a committee to review the prices every six months.

The petrochemicals industry is claiming it is owed EGP 5.4 bn in overdue export subsidies by the Export Subsidy Fund, according to the press. Companies will be able to write off the overdue amounts against their taxes as an alternative to cash payments. They would also be allowed to apply for industrial land at a discount through the government’s new online land allocation portal, as well as receive discounts on their obligations to the electricity, oil, and investment ministries and claim redeemable IOUs from the Finance Ministry.

This comes as the government targets a 10.7% growth rate for the industrial sector by 2022, up from 6.3% currently, Prime Minister Moustafa Madbouly said at a press conference yesterday. A recently-launched electronic platform for industrial land allocation is one example of government efforts to achieve its target, Madbouly said.

INVESTMENT WATCH- Kellogg Company announces EGP 3.6 bn in new Investments in Egypt: Cereal and snack maker Kellogg Company earmarked EGP 3.6 bn for investment in Egypt “towards it’s next chapter,” the firm said in a statement (pdf). The statement, which was made during the celebrations of its five-year anniversary since coming to Egypt, provided no detail on the nature or timeline for the investments. A statement from the Madbouly Cabinet said only the investment would fund expansion.

Egypt a key EM player for Kellogg: The company’s sales volumes in emerging markets rose almost 80% in 2017 compared to the previous five years, with the acquisition of Egypt’s Bisco Misr and Mass Food significantly contributing to this growth, said CEO Steven Cahillane. Kellogg has also launched EGP 180 mn noodles factory on a joint venture with Tolaram Group. The company first entered the Egyptian market in 2015 by acquiring Bisco Misr and then Mass Food, the maker of Temmy’s cereal and NutriFit brands. Kellogg says it has invested some EGP 7.2 bn in Egypt to date.

M&A WATCH- Ekuity acquires 30% stake in AluNile from Ezdehar Egypt Mid-Cap Fund: Kuwaiti investment holding company (Ekuity) has acquired a 30% stake in Egypt’s Nile Aluminum and Metals Company (AluNile), from the Ezdehar Egypt Mid-Cap Fund, the companies announced in a joint statement this morning (pdf). “Ekuity is on the continuous lookout for quality investment opportunities in the Egyptian market, and that the decision to invest in AluNile came after a thorough due diligence as well as several rounds of negotiations by Ekuity’s acquisition team,” said Ekuity CEO Adnan Al Sager.

Growth plans: He anticipates scaling AluNile — which designs, makes and installs integrated aluminum and glass systems — through growing its product and services portfolio, geographical expansion, and a future public listing. Ezdehar managing director Emad Barsoum said Ekuity’s investment would enhance AluNile’s capabilities as it started to undertake more major projects in the coming period. The transaction’s size was not disclosed.

Advisors: Ekuity was advised by Al Tamimi & Co, Loyens & Loeff, and PwC, while Ezdehar Management was advised by Van Campen Liem.

Context: Ekuity, which is owned by the Kuwait Investment Authority, has indicated it plans to invest USD 100 mn in Egypt in the coming three years. Its targets are quality, high-growth businesses and it is open to investing in partnership with institutional and strategic investors, Al Sager said. The Ezdehar Egypt Mid-Cap Fund is the first fund of private equity outfit Ezdehar Management, which invests in high-growth businesses in Egypt.

IPO WATCH- Odin Investments seeks to IPO subsidiary on EGX: Real estate investment firm Emerald is seeking approval from the Financial Regulatory Authority (FRA) to offer an undisclosed stake on the Egyptian Exchange (EGX), the company's major shareholder Odin Investments (which holds a 16% indirect stake in the company) said in a bourse disclosure (PDF). The statement noted that a fair value report has been submitted. No other detail on the expected size or timing of the listing was mentioned.

Who is Odin? Formerly known as The Egyptians Abroad Investment and Development, Odin Investments has recently obtained a license from the FRA to set up and manage investment funds and said it was planning to launch a logistics sector focused fund. The company operates investment banking, private equity, asset management, and venture capital departments under a regulation that enabled banks and several types of non-banking financial service firms to set up any type of investment fund apart from real estate independently or with local, regional, or international partners.

Tui to resume selling Sharm El Sheikh holiday packages next week, to allow travel from February 2020: Tui, the UK’s biggest holiday firm, plans to resume selling holiday packages to Sharm El Sheikh, which will be available within three months, the Independent reports. Tui flights and holidays are set to go back on sale on 7 November, which will allow customers to travel starting from February 2020. Initial flights will depart from Gatwick, Manchester and Birmingham. We had recently reported that the company intended to resume flights next summer.

This comes just days after UK lifts its four-year ban on flights to Sharm El Sheikh: Tui UK’s director of product and destination experience called Sharm El Sheikh a “hugely popular destination.” The news comes just ten days after the UK lifted its four-year ban on flights to Sharm El Sheikh, introduced after the downing of a Russian airliner in 2015. Some half a mn British holidaymakers travelled to resorts in Sinai in 2014, but operators have reportedly faced difficulties in fully capitalizing on the high demand for flights, thanks to the timing of the Foreign Office announcement. Tui has also faced challenges in restoring links because of the continued grounding of the Boeing 737 Max, following two fatal crashes.

REGULATION WATCH- Gov’t issues executive regulation for Public Contracts Act: The government has issued the executive regulations of the Public Contracts Act, according to a Finance Ministry statement on Friday. The statement was very light on details, but reiterated previous statements that the regs would set up an e-procurement system for the government. It would also mandate that the government solicit the participation of SMEs in national projects through the SMEs Development Authority to stimulate their contribution in national projects. The regulations lengthen the payment period for tender participants, and cap the required insurance to bid on the project at 1.5% of the estimated value of the project.

The statement does not address concerns that the new act would allow the government to expand the use of no-bid contracts except to say that the regs would fight “monopolies” and “concentration of economic power.” The Madbouly Cabinet had signed off on recommendations from a government committee allowing the government to use no-bid contracts for unspecified projects. While the recommendations still require that direct order agreements comply with the Public Contracts Act (previously known as Auctions and Tenders Act), the decision had gotten flak from the foreign press, which claimed the move would open the door for corruption.

Foreign holdings of Egyptian treasuries rose slightly to USD 15.29 bn at the end of September compared to USD 15.06 bn at the end of September 2018, according to the CBE’s monthly statistical bulletin (pdf).

Pharos Securities announced the launch of its trading app Pharoslive. The app, available on desktop, Play Store and the App Store offers the firm’s clients real-time e-trading services and real time follow-up on transactions, enabling customers to make investment decisions faster and easier. The app provides clients with a comprehensive package of information specifically designed to suit individual investment needs through manageable tools and widgets, drag and drop features, and easy navigation between different screens layout. The move is part of Pharos' efforts to strengthen its role in the financial services arena and to fulfill its role in the market as a comprehensive investment bank offering a full range of solutions and services that meet the requirements of its clients, Chairman and CEO Elwy Taymour said in a statement (pdf).

Image of the Day

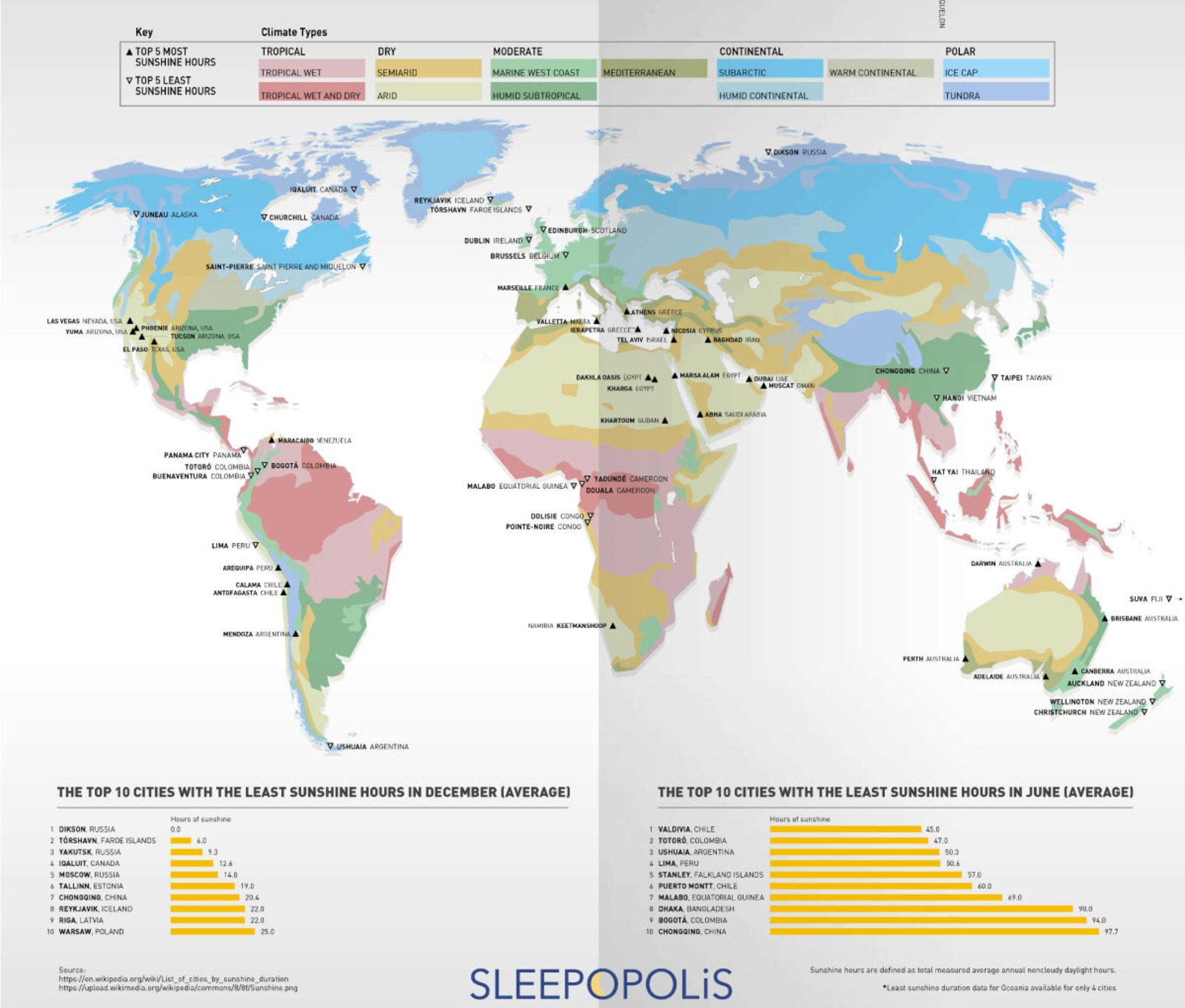

The sun tan lotion industry should think of moving here: Apparently Wikipedia has ranked three Egyptian cities as being among the 10 cities with the highest average annual sunshine hours in the world. While Wikipedia isn’t really scientific, anyone who was here these past summers can attest that it's more than anecdotal evidence. Either way, we’re thankful at the amazing infographic by the good people at Sleepopolis. Marsa Alam is the second sunniest city in the world, followed by Dakhla Oasis in third place, and Kharga at ninth. The sunniest city on Earth is Yuma, Arizona in the US, but even that city receives a meager amount of rain while Dakhla receives practically zero precipitation each year.

Egypt in the News

No single story is dominating the conversation on Egypt this morning. Here are a selection of articles worth your time:

- International human rights organizations are raising concerns over the arrest of Esraa Abdel Fattah, a journalist and human rights activist, according to Deutsche Welle.

- Train ticket conductor to face trial: A train conductor who is accused of forcing two youth out of a moving train for not purchasing tickets will be sent to trial, reports the Associated Press. One of the young men died in the incident.

- The Tutankhamun exhibit (which made it to London) has brought mns to his home country on its world tour, according to The Guardian

Energy

Toyota-Orascom alliance begins trial run on 250 MW Ras Gharib wind farm

A consortium comprised of Orascom Construction (OC), Engie, and Toyota Tsusho Corporation began trial runs on its 250 MW wind farm in Ras Ghareb, sources in the New and Renewable Energy Authority (NREA) told the local press. The sources said that testing began two weeks ago, with full commercial operation expected to begin before the end of the year. The consortium had announced it was on track to complete the 250 MW wind farm by October, two months ahead of the 24-month construction schedule. Phase one of the build-own-operate project is expected to cost USD 312 mn, while phase two is estimated to be around USD 700 mn. The consortium inked the agreements for the project in July of last year.

Infrastructure

Egypt greenlights establishment of SCZone Utilities

Prime Minister Moustafa Madbouly authorized the Suez Canal Economic Zone (SCZone) to participate in establishing a joint stock company named Economic Zone Utilities Company to manage the construction, operation and maintenance of various utilities projects for developers and investors at the SCZone, according to Egypt Today. Elsewedy Electric signed a partnership agreement with the SCZone to set up the Economic Zone Utilities Company back in May. Elsewedy owns a 49% stake in the venture, which will have EGP 1 bn in capital.

Tourism

Marsa Alam receives first flight from Milan

Marsa Alam International Airport received yesterday the first EasyJet flight from Milan,reports Akhbar El Youm. The low-cost airliner recently launched weekly flights to the Red sea resort town from European cities Milan, Venice, Berlin, and Naples. The airport also received the first Austrian Airlines-operated flight yesterday, according to Masrawy. The Lufthansa subsidiary flight was carrying 170 passengers departing from Vienna.

US tourist dies in boat fire in Marsa Alam

A US tourist died in Marsa Alam on Friday after the tourist boat she was on caught on fire, according to Al Masry Al Youm. The tourist was an employee of the US Embassy in Tanzania. The other 29 passengers survived the fire without injuries.

Automotive + Transportation

France’s AFD considers EUR 190 mn loan for Tanta-Damietta railway upgrade

The Transport Ministry is in talks with the French Development Agency for a EUR 190 mn loan to finance upgrades to the Tanta-Mansoura-Damietta railway line, a source told Al Shorouk. The government is planning to issue a global tender early next year, the source said. We noted last week that the European Investment Bank was also considering extending a EUR 90 mn loan for the project. The project involves double-tracking a 65-km stretch of the 118 km line and installing an automated signaling system. The government is planning to spend EGP 56 bn in the next five years to upgrade signaling systems across the country, EGP 17 bn of which will be acquired from foreign lenders.

Banking + Finance

Ebtikar to set up two consumer finance arms by year end

Ebtikar for Financial Investment is planning to set up two consumer finance arms by the end of the year, the company’s CEO Ayman El Dessouky said. One of the companies will specialize in car purchases, and both will be majority-owned by Ebtikar — which is a joint venture between B Investments and MM Group. Dessouky said that both companies will be up and running at the beginning of 2020. Private equity firm Tanmeya Capital Ventures (TCV) and Acquire for Investments, as well as other individual investors, will also purchase shares in the companies.

Other Business News of Note

McKinsey urges gov’t to merge 26 state entities

McKinsey Consultants have urged the government to merge 26 state entities as part of its ongoing administrative reform, the local press reports. McKinsey, hired by the government to produce a report on public sector reform, did not recommend that ministeries be eliminated but emphasized the need to reduce and simplify the state structures by merging a number of entities, the details of which have not been made public. The Planning Ministry has handed the report to cabinet for review.

Egypt Politics + Economics

Deadline for illegally obtained land settlement expires

The committee tasked with confiscating state-owned land that was allegedly acquired illegally has begun the next phase of its land repossession program, according to an official statement. The committee recommended that officials begin on Saturday clearing people from land who have not applied to retain it. Moreover, the committee also recommended coordinating with the General Authority For Reconstruction Projects & Agricultural Development to prioritize land that the state needs to build new infrastructure projects. An ultimatum by the committee was given to land holders to pay for inspection fees and legitimize their status by 14 June 2018, before being extended to 31 October 2019. Anyone who fails to comply by the deadline will have effectively defaulted on their right to contest the land, giving the state legal authority to reclaim it.

On Your Way Out

Katy Perry is living it up in Egypt. The US popstar flew over 64 of her friends and her fiance, Orlando Bloom, to celebrate her 35th birthday by the pyramids and on the Nile, according to the Daily Mail.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.20

EGP / USD at CIB: Buy 16.07 | Sell 16.17

EGP / USD at NBE: Buy 16.09 | Sell 16.19

EGX30 (Thursday): 14,558 (+0.6%)

Turnover: EGP 957 mn (33% above the 90-day average)

EGX 30 year-to-date: +11.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.6%. CIB, the index’s heaviest constituent, ended up 0.6%. EGX30’s top performing constituents were Sidi Kerir Petrochemicals up 5.8%, Egyptian Resorts up 3.0%, and AMOC up 2.8%. Thursday’s worst performing stocks were Heliopolis Housing down 1.2%, Madinet Nasr Housing down 1.1% and Orascom Construction down 1.0%. The market turnover was EGP 957 mn, and local investors were the sole net sellers.

Foreigners: Net long | EGP +14.4 mn

Regional: Net long | EGP +1.7 mn

Domestic: Net short | EGP -16.1 mn

Retail: 63.0% of total trades | 61.2% of buyers | 64.8% of sellers

Institutions: 37.0% of total trades | 38.8% of buyers | 35.2% of sellers

WTI: USD 56.20 (+3.70%)

Brent: USD 61.69 (+3.5%)

Natural Gas (Nymex, futures prices) USD 2.71 MMBtu, (+3.10%, December 2019 contract)

Gold: USD 1,511.40 / troy ounce (-0.2%)

TASI: 7,744 (-0.6%) (YTD: -1.10%)

ADX: 5,107 (-1.3%) (YTD: -3.9%)

DFM: 2,746 (-0.3%) (YTD: +8.6%)

KSE Premier Market: 6,211 (-0.3%)

QE: 10,188 (-0.9%) (YTD: -1.1%)

MSM: 3,999 (-0.3%) (YTD: -7.5%)

BB: 1,523 (+0.1%) (YTD: +13.9%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

3 November (Sunday): Real Estate Debate 2019 Conference – Catalysts for Growth in 2020, Cairo Marriott Hotel.

4 November (Sunday): Saudi Arabia’s Capital Markets Authority is set to announce the start of the IPO process (expected).

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

4 November (Monday): Narrative PR Summit, Hilton Heliopolis, Cairo.

4-6 November (Monday-Wednesday): Egypt’s Chamber of Tourism Establishments will participate in the UK’s World Travel Market (WTM) event in London.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-9 November (Friday-Saturday): Startups Without Borders Summit, The American University in Cairo Downtown, Tahrir, Egypt

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17 November (Sunday): The share price for the Aramco IPO will be announced (expected).

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

23 November (Saturday): HHD extraordinary general assembly to approve the 10% stake + management request for proposal

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.