- Economic growth to slow slightly to 5.5% in FY2019-2020 -poll of economists. (Speed Round)

- Is the CBE about to cut reserve requirements in a bid to spur lending? (Speed Round)

- CIRA to invest EGP 110 mn in New Mansoura, Assuit projects. (Speed Round)

- Regulators give Adeptio more time on MTO for minority shareholders of Americana Egypt. (Speed Round)

- Russia-Africa summit: UAE could invest in the RIZ, but no breakthrough on Russian flights to Sharm. (Speed Round)

- Attijariwafa receives preliminary approval for insurance license. (Speed Round)

- We have the second most active fintech startup hub in MENA by investment volume, but the ticket sizes are small. (Speed Round)

- Cabinet signs off on Egypt’s waste-to-energy tariff. (Speed Round)

- My Morning Routine: Amr Shawki, director at CVentures.

- The Market Yesterday

Thursday, 24 October 2019

Is the CBE about to cut reserve requirements to spur corporate borrowing?

TL;DR

What We’re Tracking Today

The first Russia-Africa summit wraps up in Sochi today. The opening day saw lots of talk but little in the way of action. Discussions were had on trade and investment, the Russian Industrial Zone and the resumption of Russian flights to Sharm (no breakthrough there — we have more on President El Sisi’s meeting with Putin in this morning’s Speed Round, below).

So, will El Sisi and Abiy Ahmed meet today? Heading into the summit we weren’t quite sure what the schedule was for the president’s anticipated meeting with Ethiopian Prime Minister Abiy Ahmed. Tension on that front ratcheted up earlier this week when Ahmed said that Ethiopia could mobilize “mns” in the event of war with Egypt. It’s unsurprising, then, that there was nothing but radio silence on the GERD front.

Also still an open question: Will Ethiopia accept Washington’s offer to mediate the dispute? Egypt suggested yesterday that it would accept the invitation to talks with Ethiopia and Sudan in the US capital, but there’s been radio silence on the Ethiopian front.

A couple of quick event-related notes:

Cairo Water Week wraps up today, as does the Intelligent Cities Exhibition & Conference at the Hilton Heliopolis.

The IMF and AUC will be holding a discussion on the World Economic Outlook on Tuesday, 29 October from 1-3pm at Moataz Al Alfi Hall on AUC’s New Cairo campus. The talk, headlined “World Economic Outlook: Global manufacturing downturn, rising trade barriers” will be presented by Gian Maria Milesi-Ferretti, deputy director at the IMF’s research department.

Capitalizing on low borrowing costs, Saudi eyes USD 2.5 bn sukuk issuance: Saudi Arabia is planning a USD 2.5 bn sukuk (sharia-compliant bonds) issuance as the kingdom looks to capitalize on borrowing costs hitting their lowest level in four years, according to Bloomberg. The 10-year notes will be priced somewhere between 145 and 150 bps over the benchmark mid swap rate, a source familiar with the matter tells the news information service. The issuance should be enough to cover Saudi’s funding requirements to plug its budget deficit.

Other international stories worth knowing about:

- Lebanon faces “cash crisis”: Protests in Lebanon have forced banks to close for the past six days, raising concerns over a potential bank run when they eventually open, CNBC says.

- US to lift sanctions on Turkey: President Donald Trump announced yesterday that the US will lift sanctions on Turkey “unless something happens that we’re not happy with,” as a ceasefire between Turkey and Kurdish militia in northern Syria continued to hold. As Russian troops rolled into Syria yesterday, Trump declared that the US should “let someone else fight over this long blood-stained sand” and said that troops will now exit the country (forgetting to mention that the US is evidently still willing to fight over Syria’s oil fields).

- Trump’s Ukraine envoy spills the beans on Biden investigation quid pro quo: The Donald tried to condition USD 391 mn in US aid to Ukraine on the government launching an investigation into the activities of former VP Joe Biden and his son Hunter, US diplomat William B. Taylor Jr. told impeachment investigators on Tuesday, the New York Times reports.

PSA- The National Meteorological Authority is forecasting the rain to continue in Cairo, the Delta and the North Coast through Friday. Our favourite weather app is calling for cloudy conditions and a high of 26°C through Saturday, with a chance of showers today, a chance of rain on Friday, and showers again for Saturday. Nineteen people have died over the past two days as a result of the heavy rains that lashed Cairo and the Nile Delta, Ahram Gate reported.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi visit to Sochi to attend the Russia-Africa Summit dominated the airwaves for the second consecutive night.

El Sisi’s summit opening remarks as the chair of the African Union were aired on Al Hayah Al Youm(watch, runtime: 2:35). The president invited Russian companies to up their investment on the continent and urged African countries to cooperate on cross-border transportation and communications links. The vice president of the Egyptian Council on African Affairs,Salah Halima, told show host Khaled Abu Bakr that the maiden summit is of “special importance” because of its potential to pave the way for a comprehensive Russian-African partnership (watch, runtime: 4:38).

El Sisi and Ethiopian Prime Minister Abiy Ahmed are yet to hold their highly anticipated meeting, Abu Bakr noted. Ahmed on Tuesday raised the prospect of military action if the ongoing dispute over the Grand Ethiopian Renaissance Dam (GERD) continues to deteriorate.

El Sisi also held talks yesterday with his Vladimir Putin. We recap the meeting and more in this morning’s Speed Round, below.

Doubt cast on Russia as potential GERD mediator: As we wait to see what Russia is able to achieve on the GERD front, Russian expert Amr El Deeb told Abu Bakr that we shouldn’t expect too much. Why? Russia simply doesn’t have the influence over Ethiopia to force it to the table, making it more likely that it will be the US that will flex its diplomatic muscles and carve out an agreement (watch, runtime: 2:59). Egypt on Tuesday accepted an invitation from Washington that would bring together the foreign ministers of Egypt, Ethiopia and Sudan in an effort to end the dispute. We have more on this in this morning’s Egypt in the News.

Economic reform program hasn’t been great for the poverty rate, social solidarity minister admits: Austerity measures undertaken as part of the IMF-backed economic reform program were always going to push people into poverty, particularly after the 2007-2008 financial crisis and the revolution, Social Solidarity Minister Ghada Waly told Masaa DMC’s Ramy Radwan (watch, runtime: 3:25). Capmas figures revealed in July that the poverty rate increased to 32.5% in FY 2017-2018 from 27.8% in 2015. However, efforts to strengthen the social safety net spared the country from a full-scale poverty crisis, she said: “This increase could have been two times as bad if it weren’t social welfare programs.”

Sherif Amer goes undercover as taxi driver: Yahduth Fi Misr’s Sherif Amer posed as a white cab driver yesterday to gauge people’s reactions and traffic (or lack thereof) on Cairo’s streets after heavy rainfall swept over the capital on Tuesday evening. Amer took a sewer expert on a ride to explain the drain process (watch, runtime: 2:08). He also drove around during the morning rush hours: here (watch, runtime: 4:13) and here (watch, runtime: 2:55).

Speed Round

Speed Round is presented in association with

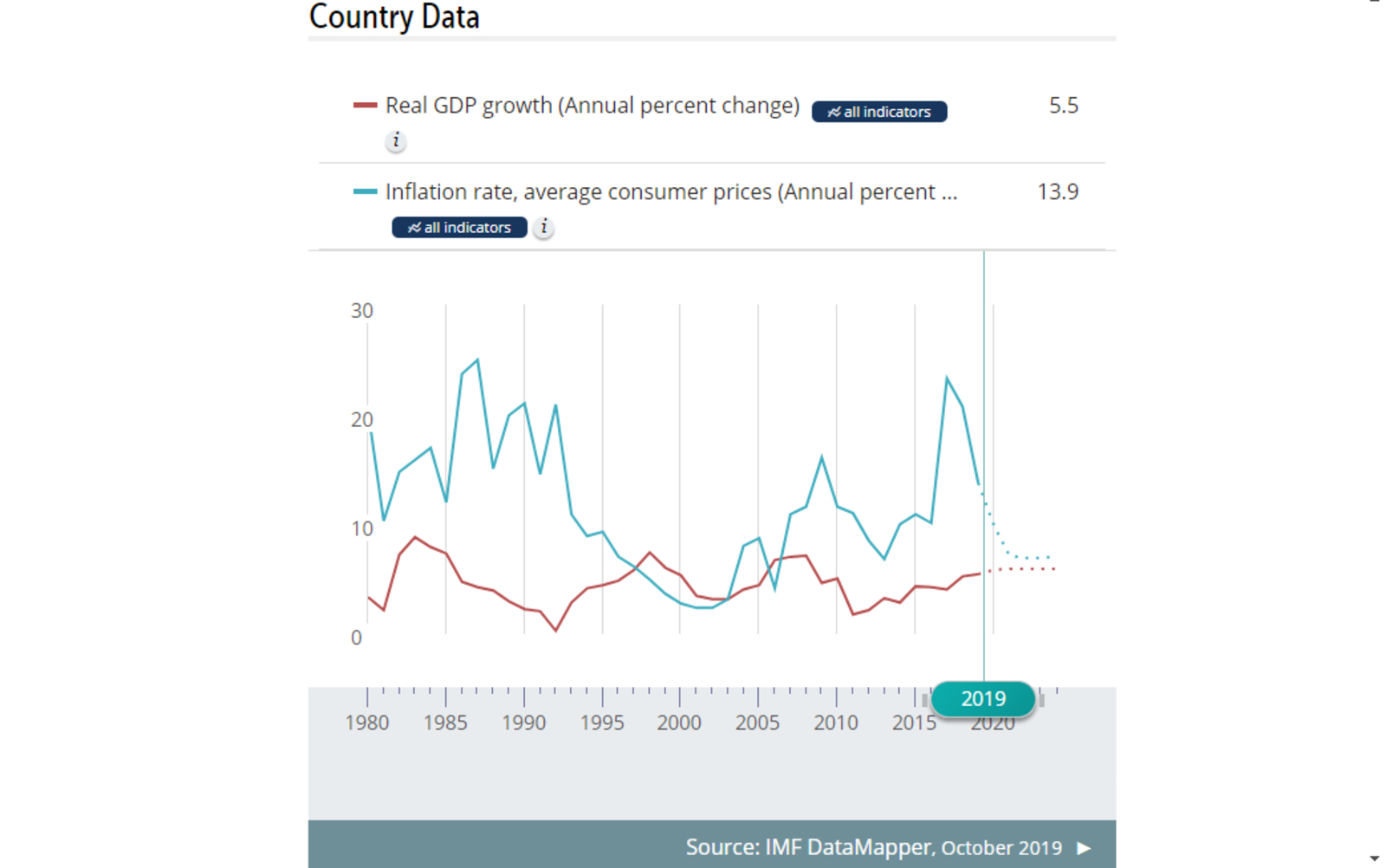

Egypt’s economic growth to slow slightly to 5.5% in FY2019-2020 -poll: Egypt’s economic growth will slow to 5.5% in the current FY2019-2020 fiscal year, down from 5.6% last year and below the government’s target of 6% growth in FY2019-2020 and overall target range of 6-7%, according to a Reuters poll of economists. The poll confirms economists’ July projections for the current fiscal year, but the respondents downgraded their expectations for FY2020-2021 to 5.7% from 5.8%. Reuters notes that Egypt’s non-oil private sector has expanded only six months since beginning the IMF-backed economic reform program in November 2016. The IHS / Markit Purchasing Managers’ Index showed the sector contracted for the second consecutive month in September.

Inflation is seen slowing to 10.2% in FY2019-2020 and to 9.2% in FY2020-2021 from 33% in July 2017, the analysts said. “We expect prices to continue to decelerate in October 2019 before rising to high single digits by the end of the calendar year 2019 as they come off a lower base from the previous year,” said Jacques Verreynne, an economist at NKC African Economics. Headline inflation cooled in September for the fourth consecutive month to 4.3%, its lowest recording in nearly seven years.

As inflation continues on a downward trajectory, analysts expect more rate cuts before the year is out, which could unlock corporate borrowing for capex. “As of now, capex growth indications still remain muted,” Allen Sandeep, head of research at Naeem Brokerage told the newswire. “Assuming interest rates are cut by another 300 basis points, the hope for 2020 and 2021 is that pent-up demand finally kicks in.” Sandeep noted that retail lending growth has crossed 20% and could rise to more than 30% next year, signaling a return to health for the private non-oil economy.

Is the CBE about to begin an “orchestrated unfolding” of liquidity to boost credit growth, private investment? CI Capital and Sigma Capital think so. The Central Bank of Egypt (CBE) could kick off a liquidity cycle over the remainder of the year and into 1Q2020 by scaling back its requirements for commercial banks’ reserve ratios, allowing banks to increase money supply in the market, Sigma Capital and CI Capital said in two separate research notes this week. The CBE had hiked its reserve requirement Ratio (RRR) for bank deposits to 14% in 4Q2017, which Sigma says pushed down Egypt’s money supply by EGP 400 bn. Now that inflationary pressures have largely been contained, Sigma says the CBE is likely to move RRR in the opposite direction to support economic growth and expects the ratio to be reduced to 10% — essentially making it possible for banks to loan out a higher percentage of the deposits they take in.

How much liquidity should we expect this policy direction to unlock? If RRR is cut down to 10% as Sigma anticipates, banks would unlock EGP 70 bn currently held in their reserves, and direct that money to increase liquidity in the sector. CI Capital, on the other hand, expects the CBE to allow for the release of EGP 220-250 bn of the EGP 650 bn currently tied in its corridor-linked deposits in 1Q2020. Over the course of the next two years, the CBE could release EGP 590 bn into the market, CI says.

The question: Will companies have appetite to invest in anything other than capex replacement when the money is more available and interest rates finally hit a reasonable level?

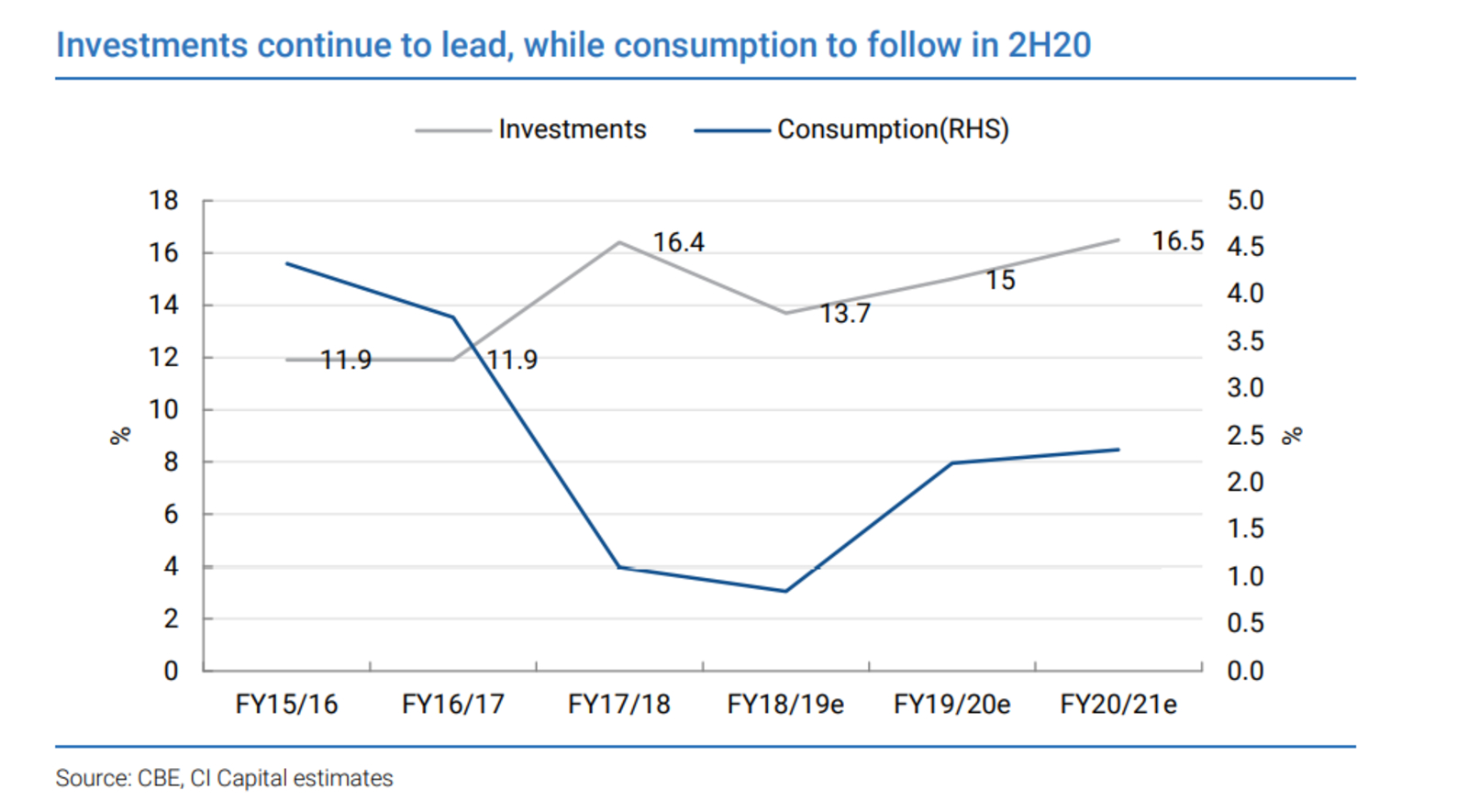

Increased liquidity will spur credit growth, investment, and economic growth: Since the CBE began its monetary easing cycle in 1Q2018, “activity has been broadly muted, as liquidity remains tight,” CI Capital says. As liquidity was tight, the 550 bps rate cuts the CBE has enacted have yet to take full effect on the economy. By increasing money supply in tandem with reduced interest rates, credit growth and private sector lending for investments are all expected to rise, thereby kicking off the economic growth cycle.

More liquidity and lower interest rates should see inflation-adjusted credit growth at north of 12% in 2020, compared to -6.6% on average over the past three years, CI Capital says, suggesting that the acceleration of investment will be supported later on by a recovery in consumption levels.

Don’t expect an influx of liquidity to put significant downward pressure on the EGP, even as demand for the currency will ease slightly on the back of increased supply, the CI team argues. The investment bank expects the EGP to depreciate 5-8% during the current fiscal year and projects an average FX rate of EGP 17.11 to the greenback in FY2020-2021.

The liquidity release will likely be complemented by more rate cuts next year, but don’t expect another cut in November, CI Capital says. The economists expect the CBE’s Monetary Policy Committee to keep rates on hold when it meets next month, and suggest that a 250-300 bps rate cut is in the cards over the course of 2020. Sigma’s view seems to support the suggestion that the CBE will hold off on rate cuts for a little while, as the research house expects the main monetary policy tool that will be in play is RRR.

INVESTMENT WATCH- CIRA plans to invest EGP 110 mn in New Mansoura, Assiut projects: Leading private sector education provider Cairo for Real Estate and Investment (CIRA) will invest EGP 110 mn this fiscal year in two projects in New Mansoura and Assiut, CEO Mohamed El Kalla told Al Mal. The New Urban Communities Authority had agreed to allocate CIRA 81 feddans in west Assiut to establish a private university in partnership with an international university. CIRA had also closed an EGP-denominated EUR 25 mn agreement with the European Bank for Reconstruction and Development (EBRD) to finance the university. In New Mansoura, CIRA has begun construction of an integrated school at a cost of EGP 60 mn financed through the company's own resources, the proceeds of its listing on the EGX, and some of the real estate assets it holds.

El Sisi ratifies CIRA’s new Badr University faculties: President Abdel Fattah El Sisi ratified a decision to allow Cairo for Investment and Real Estate Development (CIRA) to add seven new colleges to their flagship higher Badr University, according to a decree published in the Official Gazette yesterday. The private sector education outfit completed the construction of the new faculties and was waiting for a presidential decree to begin operations.

M&A WATCH- FRA grants Adeptio extension to submit offer to minority shareholders of Americana Egypt: The Financial Regulatory Authority (FRA) given Adeptio AD Investments a 15-day grace period to submit a mandatory tender offer (MTO) to buy out minority shareholders in the Egyptian International Tourism Projects Company (Americana), according to a statement (pdf). Adeptio had requested a 30-day extension on the initial deadline, which was set for Monday, 21 October, on the grounds that it has yet to complete its fair share evaluation on Americana.

Background: Adeptio acquired 67% in Kuwait Food Company (Americana) in June 2016 following a two-year process, giving it indirect ownership of the majority of Americana Egypt. The FRA then ordered Adeptio to submit an MTO to buy the remaining shares in Americana Egypt earlier this year, but Adeptio had argued that its indirect ownership in the company is less than 90% of its total capital and therefore does not require an MTO submission. Adeptio submitted an appeal against the order, which the FRA promptly rejected. The company then filed a suit with an economic court challenging the FRA’s rejection, but the court also dismissed the appeal.

Attijariwafa gets green light for insurance arm: Attijariwafa Bank has received preliminary approval from the Financial Regulatory Authority for a license to set up an insurance arm, according to a local press report. The company is the first to submit a license request since the authority finalized on 13 October a draft of the proposed Insurance Act and sent it over to cabinet for approval. The proposed law would, if passed by the House of Representatives, raise the minimum requirement for the issued and paid-in capital of life and property insurance companies by 150% to EGP 150 mn, among other changes. Morocco’s Attijariwafa completed in 2017 its takeover of Barclays’ Egyptian operations. Background on the acquisition here.

STARTUP WATCH- Egypt is the second most active FinTech startup hub in MENA, but still receives little funding: Egypt’s share of 51 disclosed fintech startup funding agreements closed in the MENA region in the first nine months of the year grew to 27%, or about 13 agreements, from only 13% in the entire 2018, the latest MENA FinTech Venture Report by Magnitt shows. Despite this lively fintech scene, the value of funding received by Egyptian startups accounted for a disproportionate 7% of the MENA total for the segment. We trailed behind both Bahrain and Lebanon, which accounted for 9% fundraising on a lower volume of transactions.

The report suggests this discrepancy may be explained by differences in government involvement. The Central Bank of Egypt newly-launched EGP 1 bn (USD 57 mn) fund was dwarfed by three Emirati government-sponsored funds whose combined value is USD 1.2 bn. The CBE’s fund, a two-year program for fintech startups in partnership with the IIF, is also smaller than Bahrain’s USD 100 mn Al Waha Fund of Funds. We took note earlier this year of the potential of the booming sector to bring more Egyptians into the formal economy and drive financial inclusion.

Regionally, funding to fintech entrepreneurs fell 30% y-o-y to USD 26 mn during 9M2019 despite the highest number of transactions than in any previous 12-month period — largely because investors are getting out and raising funds at an earlier stage, Magnitt suggests. Some 89% of the investments recorded ins the first nine months of this year were made in early-stage startups, compared to 86% in the 12 months of 2018 and 62% in 2017. The UAE led in both volume and value, maintaining a leading position in at 47% and 69%, respectively.

In other startup news: ITIDA and RiseUp are hosting Africa’s first pitch competition for gaming and app development startups, “African App Launchpad Cup,” in December, according to a press release (pdf). The competition will offer a total of USD 60k in grants to the top competitors. Applications for the pitch event are open until 18 November.

CABINET WATCH- Gov’t signs off on waste-to-energy tariff: The Madbouly Cabinet approved yesterday setting the feed-in tariff (FiT) rate for waste-to-energy (WtE) projects at 140 piasters per kWh, according to an official statement. The tariff will be payable in EGP and will remain in place for 25 years. Under the tariff decision, the governorate in which a WtE project is set up will pay 103 piasters per kWh, while the remaining 37 piasters will be paid by sanitation organizations falling under the Environment Ministry’s jurisdiction. We’ve been waiting for the government to set the official WtE rate for over two years, since the days when Sherif Ismail was prime minister. The government has been mulling several frameworks for the tariff, including setting the rate on a case-by-case basis according to investors’ offers, and creating a three-tier system for different energy sources.

The ministers also signed off on legalizing a total of 64 churches and their affiliated buildings across the country, bringing the total number of churches whose status has been legalized to 1,235.

MOVES- Abdallah Al Nuqrashi has left his position as regional head of Majid Al Futtaim and will become the CEO of Capital Group Properties next month, according to an unconfirmed report in the local press.

MOVES- Amgad Hassanein has resigned from his position as Capital Properties Group’s chief projects officer, a source told the local press.

Emiratis want to get involved with the RIZ, Putin tells El Sisi: The UAE has expressed interest in investing in the Russian Industrial Zone (RIZ), Russian President Vladimir Putin said during his meeting with President Abdel Fattah El Sisi on the sidelines of the Russia-Africa Summit in Sochi, according to Tass news agency. “I recently visited our common friends in the United Arab Emirates. They are very interested in this joint project of ours and will also think about how they could fit into our joint development plans in the production sector,” Putin was quoted as saying.

Background: The RIZ is expected to attract as much as USD 7 bn in investments, its backers say. Moscow has recently committed up to USD 190 mn to develop the zone’s infrastructure. The first 500k sqm phase of the 5.25 mn sqm area will be handed over to investors for development by the end of the year, Suez Canal Economic Zone (SCEZ) Chairman Ashraf Zaki said on the airwaves earlier this month. It is expected to produce USD 3.6 bn worth of products by 2026.

Still no breakthrough on Russian flights to Sharm: Just a day after the United Kingdom said it would allow the resumption of direct flights to Sharm El Sheikh, El Sisi raised the same issue with Putin, according to an Ittihadiya statement. The Russian Foreign Ministry’s MENA director, Mikhail Bogdanov, told Sputnik that he hopes to see the issue resolved soon, a message the Russian side has repeated more than once in recent years.

Other news from Sochi:

- El Sisi calls on int’l financiers to get serious about Africa: El Sisi called on international and regional lenders to finance more investments and trade in Africa to support the African Union’s (AU) Agenda 2063 in the summit’s opening speech and during a working lunch with the heads of the AU’s eight certified Regional Economic Communities.

- First batch of Russian railcars coming in December: Russian rail equipment manufacturer Transmashholding is set to deliver the first batch of railcars to Egypt in December, a month earlier than previously expected, El Sisi said, according to Mubasher. This comes under a EGP 22 bn contract that will see Transmashholding supply a total of 1,300 cars,

Egypt in the News

Egypt’s row with Ethiopia over the Grand Ethiopian Renaissance Dam is getting plenty of ink in the foreign press. Reuters and Bloomberg both noted yesterday that the Egyptian Foreign Ministry accepted the US’ invitation to meet in Washington alongside the Ethiopian and Sudanese foreign ministers. Importantly, Ethiopia has not yet said whether it will attend the talks, which would effectively kill the US’ mediation efforts before they’ve even begun. Other outlets focused on Ethiopian Prime Minister Abiy Ahmed’s hints that Addis Ababa is prepared for a military confrontation over the dispute (AFP | Asharq Al Awsat | Sputnik | Africa Times | Stratfor).

Mohamed Ali has been busily chatting with the international press: Mohamed Ali sat down for a 30 minute interview with BBC Arabic in which he rehashed his allegations of corruption and call for people to take to the streets. As we noted in yesterday’s talk show coverage, the Egyptian media are not best pleased: The anti-Beeb campaign continued yesterday, with Ahram Gate accusing the British broadcaster of trying to sow chaos in the country and Youm7 editor Dandrawy Elhawary making generous use of the exclamation mark to attribute “brazen crimes” to the broadcaster. It didn’t stop there though: Ali also gave an interview to the New York Times and the Guardian in what has the hallmarks of a concerted public relations campaign.

Worth Watching

Say what you will about Egyptians, but nobody can deny we’re innovative problem-solvers. Case in point: When faced with a street that was flooded after Tuesday’s heavy rainfall, an enterprising citizen ran a ferry service — using a front-end loader (watch, runtime: 0:59).

Diplomacy + Foreign Trade

Egypt has banned the import of cattle from Sudan after an outbreak of Rift Valley fever in eastern Sudan announced by the World Organization for Animal Health, the local press reports. Rift Valley fever is a virus that affects both animals and humans that can cause significant economic harm if allowed to spread. Sudan’s Health Minister said this week that authorities have detected 135 cases in areas near the Red Sea and north Darfur.

Vet Syndicate claims foul play on Halal meat certificate decision: The Egyptian Veterinarians Syndicate’s Food Safety Committee has submitted a formal request to the prosecutor-general and Administrative Control Authority to investigate the Agriculture Ministry’s decision to limit the acceptance of halal meat certificates from Latin America exclusively to the Egyptian Islamic Company (IS EG), according to the local press. The committee is alleging corruption after the decision effectively granted IS EG a monopoly and resulted in the company hiking its fees 300%. The ministry’s decision has caused diplomatic tension with Brazil, one of our major meat exporters who would be forced to export less Brazilian beef. Brazilian beef exporters have also been lobbying to scrap the halal meat certificate decision.

Energy

EETC signs EGP 656 mn in contracts with ELMACO, El Sewedy to supply transformers

The Egyptian Electricity Transmission Company (EETC) has signed two contracts with Elsewedy Electric and El Nasr Transformers and Electrical Products (ELMACO) to supply, and supervise the installation and testing of several power transformers worth a combined of EGP 656 mn, Al Mal reported. Elsewedy will supply 51 transformers and ELMACO will supply 50.

Basic Materials + Commodities

Sukari gold mine production falls 17% y-o-y in 3Q2019

Production at Centamin’s Sukari gold mine fell 17% y-o-y in 3Q2019 to 98,045 oz of gold, the company said in its quarterly report (pdf). The company produced 332,141 oz between January and September this year, and is maintaining its 490k oz target for this year.

Manufacturing

Angel Yeast inaugurates the first yeast extract factory in Beni Suef

China’s Angel Yeast has inaugurated its yeast extract factory in Beni Suef, according to Food Navigator. The plant is expected to produce 12k tonnes of yeast per year. The European Bank for Reconstruction and Development (EBRD) had extended a USD 52 mn loan to the global yeast manufacturer to build the factory and increase its production of dry yeast at its first plant in Egypt.

China’s Hebei Iron and Steel plans Ain Sokhna iron factory

China’s Hebei Iron and Steel Group is looking to set up an iron factory in Ain Sokhna, the company said during a recent visit to the Suez Canal Economic Zone.

Health + Education

CHG sets up EGP 30 mn hospital management company for El Katib Hospital

Cleopatra Hospitals Group’s (CHG) board of directors approved setting up a EGP 30 mn hospital management and operations company to manage its El Katib Hospital, according to a bourse disclosure (pdf). CHG will hold 99% of the new company, according to the statement. CHG had added El Katib Hospital in Dokki to its platform back in March.

Real Estate + Housing

CBE extends EGP 235 mn in mortgage financing

The Central Bank of Egypt (CBE) has extended an additional EGP 235 mn to mortgage companies to provide subsidized loans for middle-income homebuyers., Mortgage Finance Fund Chairwoman May Abdel Hamid told Masrawy reporters. The CBE recently renewed its mortgage financing program that originally ran from 2014 until January this year, and said it will provide EGP 50 bn to the fund.

More protest-related detainees released

Authorities have released an undisclosed number of people detained in the wake of anti-government protests that took place last month, Ahram Online reports. Among those released are detainees who were not involved in the protests, and children, women and elderly men who protested but were not connected to groups attempting to agitate against the government, the prosecutor-general said in a statement. Authorities have sporadically released people in groups after arresting more than 2.3k after the demonstrations on 20 September.

My Morning Routine

Amr Shawki, director at CVentures: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Amr Shawki, a director at CVentures, Egypt’s first corporate venture capital firm focused primarily on fintech.

My name is Amr Shawki, I’m 35 years’ old, and I’m the son of an engineer and a statistician. My wife, Sara El Masry, and I have two children: Rouqaya, who’s 8, and Zeinedin, who’s 11. I’m from Maadi but have plans to move to the Fifth Settlement in the near future.

I’ve been working at CIB for almost 14 years — and now that I reflect on it, it’s crazy how quickly time flies. Since graduating from college, I’ve been fortunate enough to have an inspiring career across several business lines at CIB. To be part of an environment that fosters learning, innovation, and empowerment is something I value greatly.

I recently joined CVentures, a wholly-owned subsidiary of CIB, as a director responsible for portfolio management. My colleagues and I spend a considerable amount of time speaking to smart and progressive founders with ambitious dreams, from all over the world. We explore and challenge new ideas and business models, exchange thoughts with cross-border investors, CIB stakeholders and other members of our partner network, including but not limited to subject matter experts and innovation executives. Though our primary aim is to invest in companies creating meaningful change in financial services, we are also interested in other tech and tech-enabled value-creating businesses.

My line of work requires a lot of critical and strategic thinking — being bold and imaginative is a must. Most of what we invest in is a shared vision of the future. Engaging with next-generation entrepreneurs is what consumes our time and energy. We’re looking for the possible Collisons and Tenevs of the future (though we’re happy settling for a little less).

I wake up as early as 6:30 am, have my morning coffee, jump in the shower, get dressed, and we’re all out the door by 7:30 am. I drop Rouqaya and Zein off at school, which is my favorite part of the day. I usually plan to make it to the gym for early morning workouts but have consistently failed to do so for the past 10 years.

I’m often the first to arrive in the office, and that’s when I have time to myself. I read the news — Enterprise, BBC, and Bloomberg — and just when I think I have the office all to myself, my colleagues start charging in.

We’re currently a four-person team, running a CIB subsidiary with enough energy to light up Cairo. We all share the same passion for startups. Every week, we dedicate time to discussing our pipeline, organizing work schedules, and optimizing our pipeline selection (essentially engaging in deep analysis, evaluation, research and assessment). Additionally, we spend a considerable amount of time negotiating and structuring investment transactions with investment partners and target company founders.

My workdays are usually long — we work late hours. I often make a one-hour stop at the gym for weightlifting and cardio after work, and then pick up my kids from their after-school activities or pay my parents a visit, where I’m usually greeted with delicious home-cooked meals. I sometimes play soccer and squash. Generally, I end the day by reading, which provides me with some time to relax and reflect.

The last book I read was “Poor Economics,” by new Nobel Prize laureates Abhijit Banerjee and Esther Duflo. It’s a real eye-opener, discussing the fundamentals of behavioral economics — one of my favorite topics. It specifically examines the philosophy of poor people’s economic decisions, as well as evaluating how this impacts social security programs usually spearheaded by governments.

Joker, the recently-released Todd Phillips film, is a masterpiece. I spent 10 minutes in silence after it ended, taking time to digest its depiction of a troubled individual living under such emotionally challenging conditions. I found the message quite impactful, especially its portrayal of a deeply distressing experience that often goes unnoticed by society.

CVentures implements a concentrated investment strategy, primarily focused on companies creating meaningful change in financial services. We invest in founders with deep market insights, defensible IP, major partnerships and strongly expansive markets. We provide smart, patient, and strategic capital to transformative businesses with high performance cultures. Additionally, when possible, it’s important that these companies complement CIB’s innovation agenda and demonstrate synergies to other portfolio companies.

Unjustifiable investment rounds are creating unnecessary distortions in startup valuations. The industry is likely to change for the better once more VCs are deeply engaged with founders, and limited partners demand responsible investing. Additionally, I’d like to see more digital-friendly regulations, ultimately enabling entrepreneurs to innovate with fewer restrictions (which gives room for more imaginative thinking), provided the system is well-governed, of course. A balanced approach is key. I’d also like to see more collaboration among key ecosystem stakeholders.

Our team is the reason for our success, thus far. I’m fortunate to be surrounded by competent, highly-driven professionals, interested in making a real change in financial services. We’re a founder-centric organization. We believe that the best investments are those made in mature management teams with experience in solving the problems they’re addressing. Additionally, our direct relationship with a leading financial services platform with cross-border ambitions gives us access — and on a case-by-case basis, the chance — to use a wide variety of resources and mechanisms designed to support portfolio companies and their respective teams, ultimately increasing the value for all stakeholders (CVentures included).

Believe it or not, arriving at investment decisions is the easy part of our job. Helping portfolio companies and their respective management teams execute their vision is where the real work comes in. The challenge is rolling up our sleeves, navigating markets and helping founders to build is something most people (of those I’ve spoken to) don’t pay a lot of attention to.

Other than reading (which I do quite extensively), I usually spend my free time with family and friends, playing sports, pursuing activities and other hobbies. I like nature, and enjoy spending time with my dog. I also enjoy card games. I’m a big fan of F1, and Ferrari is my preferred team. I’m also a big football fan, an Ahlawy, Manchester United-awy and Mo Salah-awy. I listen to lots of music, with classic rock being my favorite genre.

Staying organized is all about setting the right priorities in life. This is what sets the tone for everything, because organization then becomes based on the value and order that one assigns to each task. With practice, one learns how to allocate the right amount of time to each activity, making it easier to then integrate this into a daily routine.

There’s a Winston Churchill quote that I find to be deeply inspiring: "Success is not final. Failure is not fatal. It is the courage to continue that counts.” Though Churchill was a politician, the sentiment is relevant to business. I believe that any company that fails to continue executing, and stops striving to achieve greatness, is mediocre. Our mindset, as thought and business leaders, should always be geared towards aspiring to become better.

The Market Yesterday

EGP / USD CBE market average: Buy 16.12 | Sell 16.24

EGP / USD at CIB: Buy 16.12 | Sell 16.22

EGP / USD at NBE: Buy 16.14 | Sell 16.24

EGX30 (Wednesday): 14,127 (-0.5%)

Turnover: EGP 434 mn (38% below the 90-day average)

EGX 30 year-to-date: +8.4%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.5%. CIB, the index’s heaviest constituent, ended down 0.3%. EGX30’s top performing constituents were Eastern Co up 1.8%, Ibnsina Pharma up 1.3%, and Cleopatra Hospitals up 0.8%. Yesterday’s worst performing stocks were Egypt Iron & Steel down 3.8%, Qalaa Holding down 3.3% and Ezz Steel down 3.3%. The market turnover was EGP 434 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -9.4 mn

Regional: Net long | EGP +4.2 mn

Domestic: Net long | EGP +5.2 mn

Retail: 65.8% of total trades | 63.3% of buyers | 68.3% of sellers

Institutions: 34.2% of total trades | 36.7% of buyers | 31.7% of sellers

WTI: USD 55.75 (-0.4%)

Brent: USD 61.17 (2.5%)

Natural Gas (Nymex, futures prices) USD 2.29 MMBtu, (November 2019 contract)

Gold: USD 1,495.00/ troy ounce (-0.10%)

TASI: 7,887 (+0.2%) (YTD: +0.8%)

ADX: 5,151 (+0.3%) (YTD: +4.8%)

DFM: 2,780 (+0.3%) (YTD: +9.9%)

KSE Premier Market: 6,282 (-0.2%)

QE: 10,354 (-0.2%) (YTD: +0.5%)

MSM: 3,996 (-0.3%) (YTD: -7.6%)

BB: 1,525 (-0.0%) (YTD: +14.1%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt.

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

20-24 October (Sunday-Thursday) The 2nd Annual Cairo Water Week Conference, Al-Manara International Conference Center, New Cairo, Cairo, Egypt

20-24 October (Sunday-Thursday): German-Arab Chamber of Industry and Commerce’s ROI Week with ROI Institute, JW Marriott Hotel, New Cairo

21-25 October (Monday-Friday): Radiocommunication Assembly 2019, Sharm El Sheikh, Egypt

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

22 October (Tuesday): 20th Century Middle Eastern Art annual auction: Sotheby’s Gallery, London

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23-24 October (Wednesday-Thursday): Russian-African Summit, Sochi City, Russia.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October (Monday): B2B conference for German companies organized by the German-Arab Chamber of Industry and Commerce and the Bavarian Ministry of Economic Affairs, Regional Development and Energy, InterContinental Semiramis, Cairo.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

28 October- 22 November: World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review key interest rates.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

3 November (Sunday): Real Estate Debate 2019 Conference – Catalysts for Growth in 2020, Cairo Marriott Hotel.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

4-6 November (Monday-Wednesday): Egypt’s Chamber of Tourism Establishments will participate in the UK’s World Travel Market (WTM) event in London.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo. US trade delegation visits Cairo to discuss investments in health, energy and information technology as part of the gathering.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.