- BdC could IPO before the end of the year. (Speed Round)

- Egyptian economy “resilient” but further reform needed: IIF. (Speed Round)

- Let’s not panic about our external debt just yet. (Speed Round)

- Emaar Misr faces lawsuit over Marassi land plot. (Speed Round)

- Tomorrow is the big day. (What We’re Tracking Today)

- Gov’t eyes USD 2.5 bn loan for monorail project. (Speed Round)

- Salah speaks on the Amr Warda situation. (Egypt in the News)

- The Market Yesterday

Wednesday, 21 August 2019

Will Banque du Caire IPO this year?

TL;DR

What We’re Tracking Today

The Eid news slowdown is showing no signs of letting up…

Tomorrow is interest rate day: The Central Bank of Egypt’s Monetary Policy Committee will announce its interest rate decision tomorrow. Three-quarters of economists surveyed by Enterprise this week see the central bank easing (with most anticipating a 100 bps cut). A Reuters poll yesterday showed that 10 out of 13 economists expect the bank to ease: seven see a 100 bps cut, three expect a more aggressive 150 bps cut, while three think it will leave rates on hold. The MPC last cut interest rates in February, when the overnight deposit and lending rates were reduced by 100 bps to 15.75% and 16.75%, respectively.

How will a cut affect the EGX? Shuaa Securities’ sees a 79% chance that the EGX is positive one month after the meeting if the CBE cuts rates.

The private sector needs at least a 300 bps cut to resume capex borrowing, says Monette Doss, banking analyst at HC Securities’ equity research department, citing bank surveys. Our poll of nine companies across several industries earlier this year found that businesses are waiting for interest rates to fall within pre-float levels of 10-13% before ramping up capex borrowing. HC Securities sees this happening before the end of next year, with 100–200 bps worth of cuts coming in 2H19 and another 200-300 bps in 2020. This would fully reverse the 700 bps of rate hikes enacted since 2016.

Investors are hoping the US can avoid a recession now that the yield curve is steepening, but “history indicates that the reprieve may be brief, before a more sustained, severe flip occurs,” Reuters says. US Federal Reserve officials are gathering at Jackson Hole this week and could cause the yield curve to invert once again if Fed boss Jay Powell indicates that the central bank is not “fully on board for an all-out rate-cutting mode, which would drive short-term rates higher.”

All this talk of the inverted yield curve has apparently caused a spike in Google searches on what exactly the term means, according to the newswire. Are you among those who need a crash course? We’ve got you covered.

Meanwhile, rebounding US stocks are pushing the VIX lower: Derivatives traders are expecting less market volatility as major indices in the US, including the Dow Jones, have begun recouping losses from last week’s declines, according to the Wall Street Journal. The expectations have driven the volatility index (VIX) lower. “Leveraged funds like hedge funds recently increased bearish wagers on futures linked to the VIX to the highest level since September … A bearish bet on the VIX is akin to a bullish one on stocks, since the volatility gauge and S&P 500 tend to move in opposite directions. Investors can tap futures to make directional bets or hedge other parts of their portfolios,” the piece explains.

EM equities rebound on easing hopes: EM stocks rose for a third consecutive day yesterday as expectations for accelerated easing in developed economies grew, Reuters reports. The MSCI EM Equities Index inched 0.2% higher following movements in global equities. Mark Haefele, CEO at UBS Global Wealth Management, said that the effects of renewed stimulus would make the EM carry trade more attractive for investors. “The combination of muted growth and low yields creates a conducive environment for carry strategies,” he wrote in a note.

Lazard, Moelis to advise on Aramco IPO: Saudi Aramco has chosen investment banks Lazard and Moelis & Co. to advise on what is expected to be the world’s largest ever IPO, sources told Bloomberg. The banks have already started work on the listing, and will help to select the underwriters, identify suitable markets, and ensure that the company is valued in line with expectations. The IPO was originally scheduled to take place last year but the company put it on hold prioritizing instead its purchase of Saudi chemicals giant Sabic. Aramco now intends to list as early as 2020, although sources say plans could yet be delayed.

Are shorter working hours the key to bringing more women into banking? European banking and asset management organizations, including the Association for Financial Markets in Europe (AFME) and the UK’s Investment Association, are discussing a proposal to reduce stock market trading hours in a bid to attract more women to the sector, the Financial Times reports. The idea is that cutting down on standard trading hours would make the industry, which is notoriously male-dominated, a more appealing option for parents and simultaneously promote better mental health for all employees.

Sudan civilian-army coalition disbands military council: Sudan’s civilian coalition and the army have disbanded the military council and established a joint ruling body that will govern the country until elections are held in 2022, the Associated Press reports. The 11-member Sovereign Council is comprised of six civilians and five generals, and will be led for the first 21 months by General Abdel Fattah Burhan. The two sides signed the final power-sharing agreement last week, which paves the way for the creation of a new legislative assembly and a cabinet appointed by the opposition.

Facebook ads are apparently about to get less annoying (and hopefully less creepy): The social media company is launching a new tool that lets users put a cap on what information can be gathered about them from other websites and apps, the AP notes. The tool will let users delete past browsing history from Facebook and prevent the website from keeping track of future activities.

Enterprise+: Last Night’s Talk Shows

Social media tax coming soon: The Finance Ministry will soon announce a VAT on e-commerce platforms and social media ads, Al Hayah Al Youm’s Lobna Assal had the story (watch, runtime: 05:41).

Egyptian banks’ international assets climbed to a record USD 19 bn in July, up from USD 16 bn in June, Assal cited CBE data as showing (watch, runtime: 01:53). The increase is apparently thanks to increased remittances as well as Suez Canal, tourism and export revenues.

The state’s 100k greenhouse project is still getting love on the air with Hona Al Asema’s Lama Gebreil pointing out that it will benefit some 20 mn citizens in Minya and Beni Suef (watch, runtime: 01:34).

PM monitors SME support: Prime Minister Moustafa Madbouly met with SME authority boss Nevine Gamea yesterday to discuss the latest efforts to support the sector, Masaa DMC’s Ramy Radwan noted (watch, runtime: 06:37). The authority has spent EGP 2.8 bn to support over 100 projects that provided 147k jobs in addition to grants amounting to EGP 35 mn. The authority is also increasing its funding for the non-banking sector to EGP 150 mn from EGP 75 mn.

Speed Round

Speed Round is presented in association with

IPO WATCH- BdC could go public before the end of the year: State-owned Banque du Caire will go ahead with its anticipated initial public offering by the end of 2019 or early 2020, Chairman Tarek Fayed told reporters yesterday, according to Reuters’ Arabic service. There remain a few hurdles left to clear before the IPO can go ahead as the company finalizes plans with other stakeholders, he said. BdC is planning to sell 30-40% of its shares through a capital increase and selling a stake owned by the government, he added. The stake sale could see the bank raise between USD 300-400 mn.

Fayed recently said that he expects the bank pull the trigger later this year as part of the second wave of the state privatization program, which consists only of IPOs. Fayed told us in an interview earlier this year that BdC is “internally ready” for the IPO and is awaiting a decision by stakeholders and regulators.

ACCH, Abu Qir, then BdC (or e-Finance): Fayed’s comments came a day after Public Enterprise Minister Hisham Tawfik said three state-owned companies will sell shares this year, two of which completed over 97% of the sale preparations. Those two companies are known to be Alexandria Container and Cargo Handling (ACCH) and Abu Qir Fertilizers, which are already listed and are expected to proceed with additional stake sales. The third company could either be BdC or the state-owned e-payments platform e-Finance, we noted on Sunday.

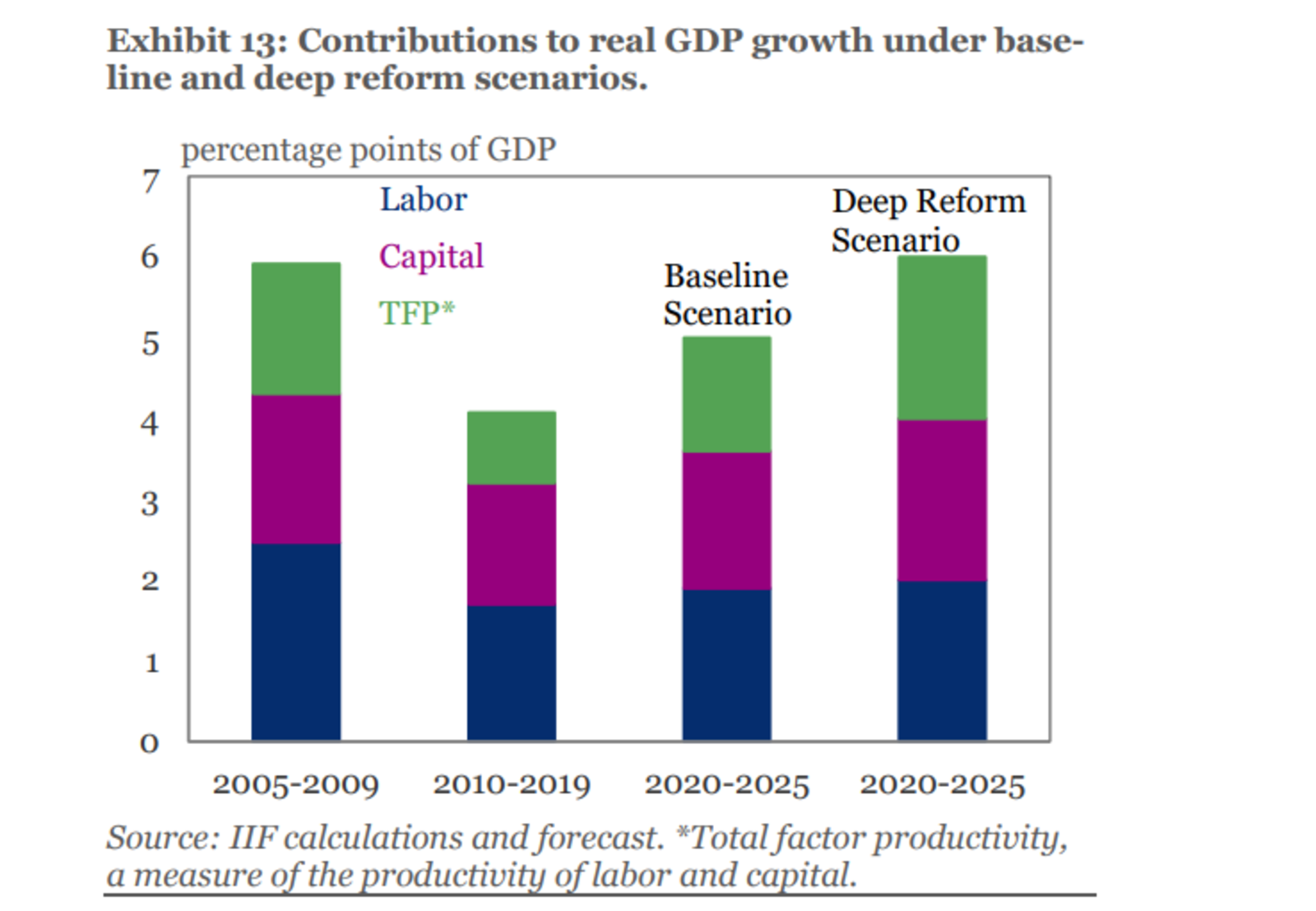

The Egyptian economy has proven resilient, but further reform is needed to sustain growth- IIF: Egypt is in a strong and “resilient” position three years after the start of the IMF-backed reform program, but there are still structural challenges to overcome to sustain economic growth, the Institute of International Finance (IIF) said in a report published on Monday. Macroeconomic stability has been underpinned by strong economic growth, which is expected at around 5% beyond the near term, and a healthy banking sector which has seen increasing capitalization and a decrease in non-performing loans. With headline and core inflation falling, the IIF joins the growing chorus of economists predicting an imminent easing of monetary policy.

Narrowing deficits, steady reserves, and subsidy reductions are all good signs: Fiscal consolidation has seen the deficit narrow to 8.2% of GDP, and this is expected to continue falling to 7.2% in FY2019-2020. The primary surplus, meanwhile, is also expected to increase from 1.7% to 2.5% of GDP. Spending on fuel and electricity subsidies is expected to fall to 1% of GDP in the current fiscal year, and targets to completely eliminate them by FY2020-2021 is achievable due to the continued slump in global oil prices, the report says. The current account deficit is expected to narrow to 2.5% of GDP and exports are likely to increase by 7% this fiscal year. Capital inflows, however, are forecast to continue a trend of decline, having fallen to USD 16 bn in FY2018-2019 from USD 27 bn in FY 2017-2018, but with narrowing deficits and a “comfortable” level of reserves, Egypt is well-positioned to withstand global volatility, the report says.

But we need more FDI and private sector growth: While “considerable progress” has been made on a structural level, and legislation has improved the investment climate and the ease of starting new ventures, the report says that the government must work to encourage private sector growth and non-oil FDI to maintain growth of 5-6%. It recommends that the state reduce its role in the economy, reform public procurement, and create more space for private sector initiatives.

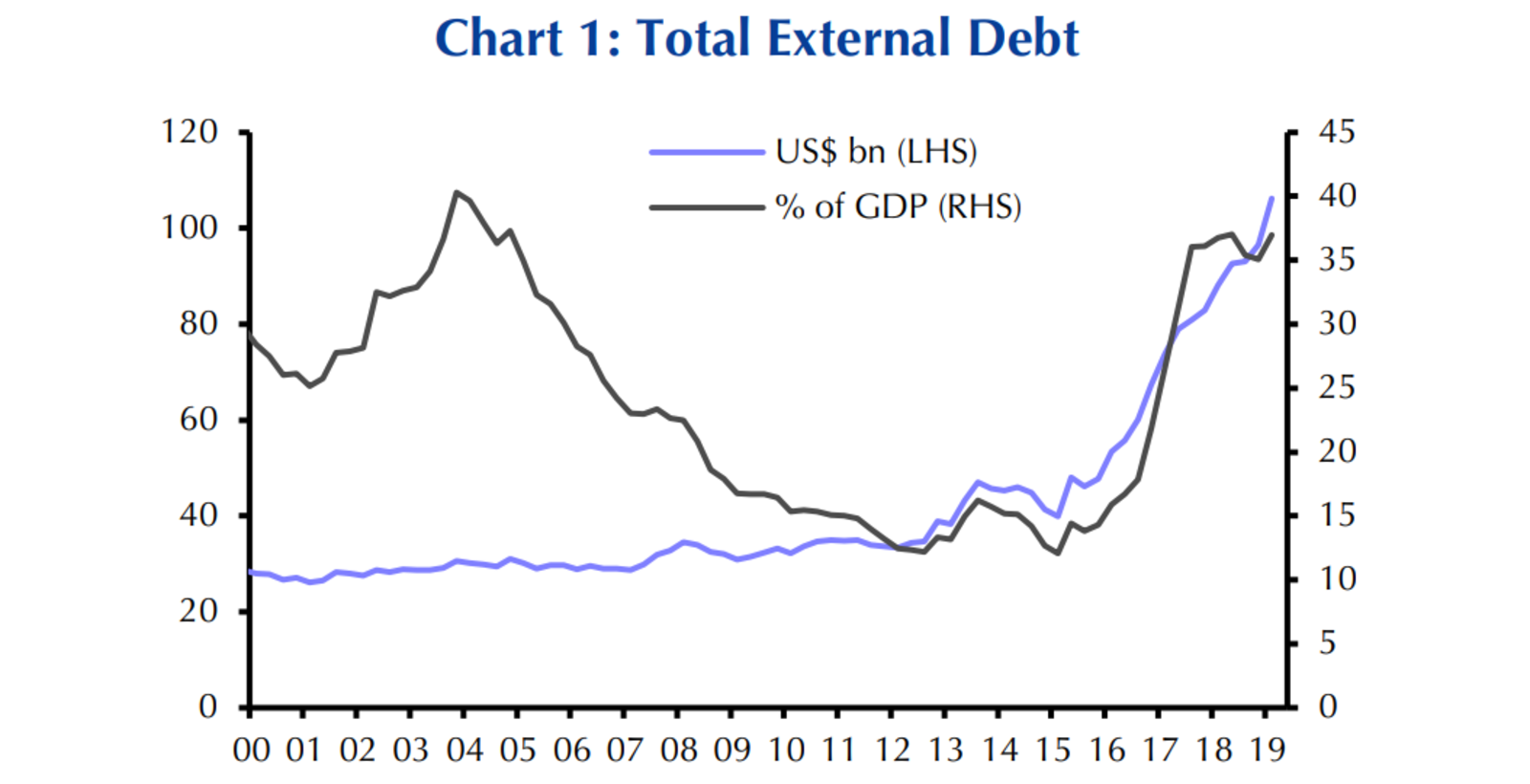

The “sharp rise” in Egypt’s external debt since 2015 could be cause for alarm but “the risks are currently manageable,” Capital Economics says in a research note. There are obvious downside risks to external debt, including “roll-over risks — if risk appetite deteriorates, it can become much more difficult to access new financing from abroad to roll over maturing debts,” Capital Economics says. FX-denominated debt (which accounts for the majority of Egypt’s debt) can become particularly problematic if the currency depreciates. However, the research house says that the central bank’s efforts to shore up the country’s FX reserves mean that it can now cover external financing needs for the next year. Egypt’s foreign reserves inched up to USD 44.91 bn at the end of July.

Fair EGP value, narrowing current account deficit also keep debt risks contained: The EGP’s recent appreciation has made the currency “relatively fairly valued,” remaining 15% lower than its pre-devaluation value, Capital Economics says, adding that a large drop in currency value that would drive up debt service costs in EGP terms is currently a low risk. The research house also points to the country’s current account deficit narrowing to around 1% of GDP, which lends further credence to the low risk of a significant adjustment in the FX rate. “The upshot is that, unless external borrowing is ramped up much further, Egypt’s external debt shouldn’t pose a significant risk,” the note says.

DISPUTE WATCH- Emaar Misr sued over Marassi land plot: Businessman Waheed Raafat has filed a legal case against Emaar Misr claiming to own 400 feddans of the land plot on which real estate developer Emaar Misr has built its Marassi compound in Sahel, Reuters reports. The first court hearing for the case has been scheduled for 2 September, according to Raafat’s lawyer. Emaar said in a statement to the bourse (pdf) that Raafat’s legal challenge over the status of the land is “baseless,” maintaining it purchased the land from the government through an auction. The company also said the land plot has been legally registered, a process that involved reviewing any claims to the land.

Gov’t eyes USD 2.5 bn loan for monorail project: The government is seeking a USD 2.5 bn loan to finance the monorail project linking Cairo to 6 October and the new administrative capital, Khalid Hamza, deputy head of the European Bank of Reconstruction and Development’s (EBRD) Egypt office, told Al Mal. Egypt is seeking USD 1 bn from the Europan Investment Bank, USD 900 mn from an unnamed UK bank, and USD 600 mn from EBRD, sources told the newspaper. A consortium of Bombardier Transportation, Orascom Construction and Arab Contractors signed earlier this month a USD 4.5 bn contract with the National Authority for Tunnels to design, build, supply and operate the lines.

EARNINGS WATCH- ODE doubles y-o-y profit to EGP 205 mn in 2Q2019: Orascom Development Egypt (ODE) doubled its net profits in 2Q2019 to EGP 205.2 mn, up from EGP 101.5 mn in the same period last year, according to an EGX earnings statement (pdf). Revenues for the quarter climbed 50.9% to EGP 1.32 bn, up from EGP 873.9 in 1Q2018. Net profit also grew by 113.3% to EGP 393.8 million in 1H2019. “We are very pleased to see that ODE is continuing its solid stance and continues to be on track to achieve 2019 targets,” said CEO Khaled Bichara. Looking forward, ODE is expecting higher demand for its hotels in 2H2019, following the inauguration of two Thomas Cook hotels in El Gouna and the lifting of German travel restrictions on Taba.

Cement producer Arabian Cement Company reported a net profit after tax of EGP 19.4 mn in 2Q2019, down from EGP 50.8 mn during the same period last year, according to the company’s consolidated financial statements (pdf). Sales revenues for the quarter reached EGP 772.3 mn, up from EGP 727.5 mn in 2Q2018.

MOVES- Abdel Aziz Sherif met with Trade Minister Amr Nassar to discuss becoming the new head of the Export Development Authority following Khaled Youssef’s resignation earlier this week, a Trade Ministry source told Youm7. Sherif should take up the position in early September.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Egypt in the News

Mo Salah “sets the record straight” on Warda controversy: Mohamed Salah sat down for an interview with CNN to “set the record straight” on his role in the Amr Warda controversy and his position on women’s rights in the region. Salah didn’t really back down from his position, saying that his defense of Warda was “misunderstood”, and that anyone guilty of intimidating women needs “treatment and rehabilitation.” The National and NBC affiliate WTVA have both picked up the story.

UN shelves Cairo anti-torture conference: The UN has put on a hold an anti-torture conference scheduled to take in place in Cairo on 4-5 September following criticism from human rights organizations, the Guardian reports. Rupert Colville, spokesperson for the UN high commissioner for human rights, said that there was a “growing unease” among some NGOs over the decision to hold the event in Egypt. Local and international human rights groups have criticized the choice of location, with one Egyptian activist describing the situation as “Kafkaesque.” Reuters also picked up the story.

A British family is suing travel company Thomas Cook after getting food poisoning at Hurghada’s Steigenberger Aqua Magic Hotel last year, the Daily Mail reports. This follows the death of a British couple who stayed in the same hotel at roughly the same time, which was linked to e-coli.

Diplomacy + Foreign Trade

Egypt’s exports from Qualifying Industrial Zones (QIZ) increased 6.7% y-o-y to USD 472 mn in 1H2019, according to the local press. An unnamed source at the QIZ unit at the Trade Ministry said textiles and readymade garments made up 97% of the exports, while food and glass products comprised the rest. Participants in the QIZ agreement, which Egypt signed with Israel and the US in 2004, enjoy access to the US market without tariffs provided they meet a minimum required amount of Israeli content.

Energy

EGPC to launch new oil and gas exploration tender by the end of the year

State-owned Egyptian General Petroleum Corporation (EGPC) plans to launch a new oil and gas exploration tender by the end of the year, Oil Ministry sources told the local press. The tender is expected to include eight to 12 concession blocks in the Western Desert, the Gulf of Suez, and the Eastern Desert.

North Delta Co. to establish four new power control centers by 2022

North Delta Electricity Distribution Company is planning to establish four new power transmission control centers by 2022 at a cost of more than EGP 3 bn, sources from the Electricity Ministry said, according to Al Mal. The state-affiliated company will arrange loans from local banks to finance the construction of a center in Damietta and two in Mansoura by the end of 2022. A third center will be inaugurated later in Kafr El Sheikh.

Wintershall DEA to begin natgas production at Raven field next month

Wintershall DEA will begin natural gas production from its Raven field in September, unnamed sources told Amwal Al Ghad. The field is expected to produce up to 900 mcf/d of natural gas, and between 20k to 25k bbl/d of condensates.

Korea National Oil Corporation to step up investment in Egypt

Korea National Oil Corporation is looking to increase its investment in Egypt and raise crude production from 12k barrels per day currently, the Oil Ministry announced in a statement (pdf). CEO Su Yeong Yang said during a meeting with Oil Minister Tarek El Molla on Tuesday that the company is interested in bidding for new exploration concessions soon to be put forward by the ministry. El Molla also discussed yesterday renovation plans of the Qena-Safaga-Abu Tartour railway line with Transport Minister Kamel El Wazir, the local press reported.

Gov’t to announce waste-to-energy tariff in coming days

The government will announce within days a new tariff of 140 piasters per kWh that it will use to purchase energy produced from waste, sources told the local press. The Electricity Ministry will pay 103 piasters per kWh and the Environment Ministry will pay the remaining 37 piasters. The tariff will remain in place for two years.

Infrastructure

ACCH to finish deepening Dekheila deck in two years

Alexandria Containers & Cargo Handling is planning to complete the second phase of deepening a deck at the Dekheila Port in Alexandria in two years’ time, Chairman and Managing Director Mamdouh Draz told the local press.

Manufacturing

EKH to add 700k sheet production line to Sprea Misr

Egypt Kuwait Holding (EKH) plans to add a new production line to its subsidiary, Sprea Misr, towards the end of 2019, according to government sources. The new line will have a capacity of 700k sheets.

AOI, Adtran sign agreement to supply fiber products to Egypt

The Arab Organization for Industrialisation (AOI) has signed an agreement with communications product provider Adtran to manufacture fiber products for Egypt and the region, Telecom Paper reports. The agreement is intended to help meet the increasing demand for gigabit broadband.

Banking + Finance

Al Marasem eyes Banque Misr to become lead arranger for EGP 2 bn Islamic loan

Real estate player Al Marasem International is in talks with Banque Misr to have it act as the lead arranger for a EGP 1.5-2 bn Islamic loan to fund its work in the new administrative capital, banking sources said, according to Al Mal. The state-owned bank approached a number of other local banks including Al Baraka Bank and Export Development Bank Of Egypt to arrange a revolving Sharia-compliant credit facility. Al Marasem is one of the contractors hired by the New Urban Communities Authority to build the R5 residential area in the new capital.

Inertia, BdC sign EGP 575 loan agreement for construction work

Inertia signed yesterday a five-year EGP 575 mn loan agreement with Banque du Caire, according to Reuters’ Arabic service. The money will be used to finance construction work at Inertia’s flagship project Jefaira North Coast, as well as other projects over the next two years. The company will have one year to repay the debt following the end of the loan period.

Other Business News of Note

ElSewedy Electric signs EGP 308 mn transmission line contract with Canal Sugar

ElSewedy Electric for Trading and Distribution signed a EGP 308 mn contract to build a transmission line and internal network for Canal Sugar, the company said in a bourse filing (pdf).

Egypt Politics + Economics

Supreme Media Council secgen arrested on bribery charges

The Administrative Control Authority (ACA) has arrested Supreme Media Council Secretary General Ahmed Selim on charges of bribery, Ahram Online reports. The ACA has reportedly been investigating accusations against Selim for over a month as part of a wider anti-corruption campaign. The operation has ensnared the former head of the Egyptian Customs Authority, the head of the state Food Industries Holding Company, and several Supply Ministry officials.

Sports

Emergency Fifa committee to manage EFA until elections

An emergency Fifa committee will take over the management of the Egyptian Football Association (EFA) until elections are held, Fifa said in a statement yesterday. Four men and one woman have been appointed to the committee, which will oversee the day-to-day management of the association and organize elections. Former EFA president Hany Abou Rida and other board members resigned and sacked the national team’s coaching staff following the round of 16 loss to South Africa in the African Cup of Nations last month.

Egypt dominates judo in 2019 African Games

Egypt has claimed four gold medals in judo at the 2019 African Games, which is running from 19-31 August in Morocco, Nigerian outlet the Nation Online reports. Egypt’s Ramadan Darwish landed gold in the men’s 100 kg, Ali Abdelmouati in the 73 kg, Abdelrahman Mohamed in the 81 kg, and Ali Hazem in the 90 kg categories.

On Your Way Out

YouGov survey names Google most popular brand in Egypt: Google has unseated Facebook to assume first place in this year’s YouGov BrandIndex’s annual brand health rankings for Egypt. WhatsApp and YouTube both improved their position compared to last year, coming in at numbers two and three. The annual BrandIndex survey looks at customer opinion about brands across 29 countries, measuring the “overall brand health” of 350 brands based on perceptions of quality, value, reputation, and customer satisfaction.

What do our elected representatives do during their summer recess? Worry about energy drinks. House Rep Faiqa Fahim has called for a ban on the import of energy drinks and a campaign to raise awareness of their negative impact on health, Egypt Today reports. She claims that the consumption of energy drinks is particularly high among students and athletes, and that regular consumption can lead to addiction.

The Market Yesterday

EGP / USD CBE market average: Buy 16.53 | Sell 16.66

EGP / USD at CIB: Buy 16.54 | Sell 16.64

EGP / USD at NBE: Buy 16.52 | Sell 16.62

EGX30 (Tuesday): 14,428 (+0.9%)

Turnover: EGP 1.1 bn (87% above the 90-day average)

EGX 30 year-to-date: +10.7%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.9%. CIB, the index’s heaviest constituent, ended up 0.1%. EGX30’s top performing constituents were Egyptian Resorts up 8.4%, AMOC up 6.1%, and Ezz Steel up 4.3%. Yesterday’s worst performing stocks were EFG Hermes down 0.2%, and Egypt Kuwait Holding down 0.2%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -20.0 mn

Regional: Net short | EGP -122.5 mn

Domestic: Net long | EGP +142.5 mn

Retail: 56.9% of total trades | 58.9% of buyers | 54.8% of sellers

Institutions: 43.1% of total trades | 41.1% of buyers | 45.2% of sellers

WTI: USD 56.34 (+0.23%)

Brent: USD 60.17 (+0.23%)

Natural Gas (Nymex, futures prices) USD 2.22 MMBtu, (-0.09%, September 2019 contract)

Gold: USD 1,514.50 / troy ounce (-0.08%)

TASI: 8,598.75 (+0.28%) (YTD: +9.75%)

ADX: 5,068.81 (+0.82%) (YTD: +3.13%)

DFM: 2,788.99 (-0.06%) (YTD: +10.25%)

KSE Premier Market: 6,642.55 (+0.55%)

QE: 9,894.94 (+0.91%) (YTD: -3.92%)

MSM: 3,889.57 (+0.54%) (YTD: -10.04%)

BB: 1,534.69 (+0.35%) (YTD: +14.76%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

24 August (Saturday): The Supreme Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets. The was postponed from 17 August.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

1 September (Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule into the stock manipulation case, in which Gamal and Alaa Mubarak are involved in along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.