- NI Capital to launch bookrunner tender for HHD secondary offering next month. (Speed Round)

- Egypt’s economy to grow at a 6.8% annual rate over next decade: Harvard. (Speed Round

- GTH board approves Veon’s offer to acquire USD 2.3 bn assets. (Speed Round)

- All eyes on Jackson Hole. (What We’re Tracking Today)

- Investors could hold the key to saving the planet. (Worth Reading)

- Tech IPOs aren’t what they used to be. (What We’re Tracking Today)

- Explaining the yield curve. (Worth Watching)

- Egyptian handball team triumph over Germany to win U19 world title. (Speed Round)

- The Market Yesterday

Monday, 19 August 2019

We’re the handball champions of the world.

TL;DR

What We’re Tracking Today

The central bank’s Monetary Policy Committee (MPC) is set to meet this Thursday, 22 August to review key interest rates. Our poll on Sunday showed three-quarters of economists predicting that the central bank will cut rates for the first time since February.

Another case for a rate cut: Beltone’s Alia Mamdouh, who was absent from our Sunday poll, expects inflation to remain within the CBE’s target of 9% (+/-3%) for the remainder of the year, giving the MPC room for a 100 bps cut on Thursday. “We believe no further fuel price hikes will take place when prices are reviewed in September due to a strengthening EGP and falling global crude prices,” Mamdouh said, adding that the US Federal Reserve’s recent cut will also give the CBE more room to ease rates. She also downplayed the risk of outflows from Egyptian debt, suggesting that the strong EGP and higher real interest rates will continue to make treasuries attractive post-rate cut.

And Goldman is also predicting a 100 bps cut, according to Bloomberg.

President Abdel Fattah El Sisi will be in France next week to attend the G7 Summit, which will run from Sunday to Tuesday in Biarritz.

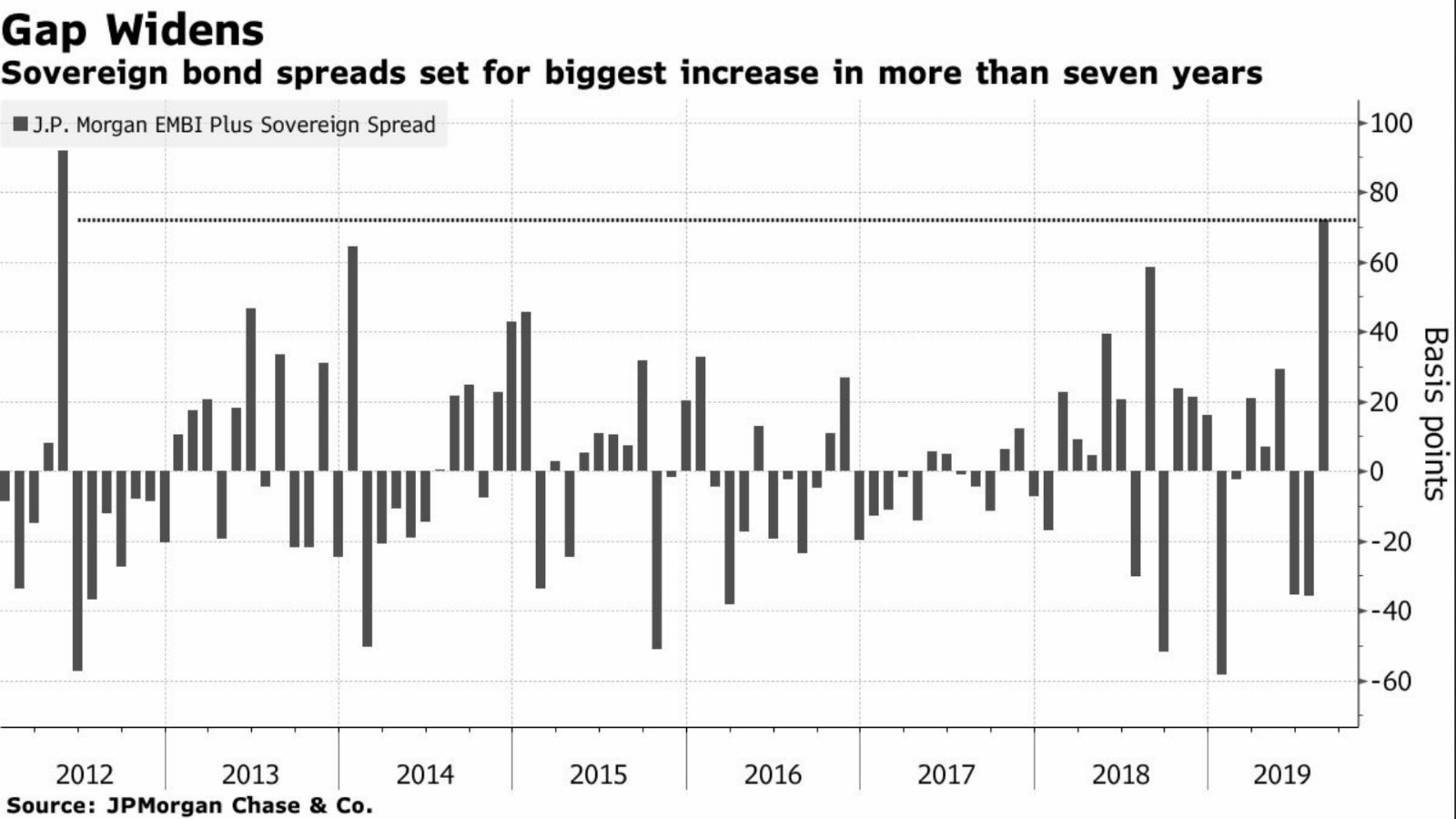

All eyes on Jackson Hole: Federal Reserve officials will gather in Jackson Hole later this week for the annual economic symposium — and marker watchers will be hanging on Chairman Jay Powell’s every word as he speaks for the first time since the bond market last week showed warning signs of a recession. His words will be closely scrutinized for indicators of whether the recent market volatility will persuade the Fed to embark on a full-scale easing cycle, and even restart its crisis-era bond-buying program. Powell’s captioning of last month’s 25 bps cut as a “mid-cycle adjustment” marked the start of a volatile August in the financial markets as hopes for a more aggressive easing cycle faded.

Economists think Powell will keep his cards close to his chest: Powell is likely to remain tight-lipped on the direction of US interest rate policy, economists tell MarketWatch.

That could be a risky strategy though: A failure to provide concrete signals will disappoint the markets and runs the risk of reigniting volatility, James Bianco, president of Bianco Research, told CNBC. “We could see another plunge in rates. We could see further movement down in yields and the yield curve and more volatility and problems in the markets. He should move aggressively,” he said.

Any sign of easing could help EMs claw back losses: “Policy action, including from the Fed, and natural cyclical forces should eventually help activity to recover,” an emailed note from Morgan Stanley analysts seen by Bloomberg said. “EM risk assets tend to overshoot and undershoot fair value, with particularly large downside moves in the May-to-October time frame,” they said, adding that lower valuations and more time would be needed before inflows pick up.

Kudlow appears on Trump TV to quash economic fears: “I don’t see a recession at all,” Trump’s top economic official Larry Kudlow told Fox News yesterday (watch, runtime: 12:32), citing strong retail and unemployment figures. It’s probably worth bearing in mind, though, that this is Larry Kudlow: the guy who wrote “there’s no recession coming” six months before the biggest economic catastrophe this side of the Great Depression.

Tech IPOs are no longer as appealing and profitable as an investment prospect as they once were, the Wall Street Journal says. “Unlike during the dot-com era, when very young companies went public, many of today’s IPOs have been making losses for years. With age comes slowing growth.” These companies are also “more aggressively priced than their predecessors.” Part of the issue here is the delay in contemporary tech companies going to market versus in previous years, because they have access to VC funding and other private market sources, and shareholders tend to favor mergers or acquisitions to an IPO.

Softbank Group is lending some USD 20 bn to employees so they can buy stakes in its second giant venture-capital Vision Fund. The step is highly unusual and potentially risky, especially given the state of the global startup economy. With Softbank also contributing USD 38 bn to the fund itself, it could cumulatively make up more than half the money raised, the WSJ reports.

Suicide bomber targets wedding party in Kabul; At least 63 people died and 182 others were injured after a suicide bomber targeted a wedding party in Kabul on Saturday, BBC reports. The local branch of Daesh later claimed responsibility for the deadliest attack in the Afghan capital this year, which targeted an area with a significant Shia Hazara community. Afghan president Ashraf Ghani condemned the “inhumane attack” in a statement on social media, while the Taliban, which is currently in peace talks with the US, called the bombing “forbidden and unjustifiable.”

Egypt’s Foreign Ministry condemned the attack in a statement, offering condolences and solidarity to the victims’ families and to the country.

Iran tanker spat: Gibraltar has turned down a request by the US to detain an Iranian oil tanker seized by the UK in July, the BBC reports. Authorities said that they would not grant the request because US sanctions against Iran are not applicable in the EU. Gibraltar lifted the detention order on the Grace-1 vessel on Friday following negotiations with the UK, and allowed it to leave yesterday. UK authorities detained the tanker on 4 July over suspicions that it was transporting oil to Syria in breach of international sanctions.

Argentina’s economy minister Nicolas Dujovne handed in his resignation yesterday amid an economic crisis caused by President Mauricio Macri’s shock loss in a primary election last week, the BBC reports. The Argentinian peso lost a fifth of its value against the USD and the country’s main stock market crashed 48% in a single day, after the election increased the likelihood that the pro-market Macri will lose October’s presidential vote.

Is the European Union next in Trump’s sights? The Donald railed against EU trade policy at a rally in New Hampshire last Thursday, telling the crowd: “The European Union is worse than China, just smaller. It treats us horribly: barriers, tariffs, taxes, Bloomberg reports.

Here we were thinking this was a joke: It turns out Trump actually wants to buy Greenland. Trump told reporters yesterday that Greenland would be a “strategically interesting” purchase for the US and that White House officials “are looking at it,” according to the Washington Post (watch, runtime: 1:06). Greenlanders may have to wait a while for the privilege of becoming the 51st state of America though, after Trump said the issue “is not number one on the burner.”

Enterprise+: Last Night’s Talk Shows

Our handball triumph was the topic du jour on the airwaves last night. News that Egypt brought home the 2019 Men’s Youth Handball World Championship dominated coverage. We have the story in the Sports section, below.

Al Hayah Al Youm’s Lobna Assal reported the win, and took note of President Abdel Fattah El Sisi’s congratulations to the team (watch, runtime: 9:43). El Hekaya’s Amr Adib, meanwhile, said that we should all be paying more attention to the sport (watch, runtime: 1:27).

Cotton crops from Fayoum, Beni Suef farmers under new auction mechanism: The government has started experimenting with a new public auctions mechanism in Fayoum and Beni Suef to sell local short staple cotton to bidding companies in the coming harvest season, Hona Al Asema’s Reham Ibrahim reported (watch, runtime: 1:02). The auction mechanism, which we noted last month, could be standardized as of the 2020-2021 harvest season.

El Sisi directs cabinet to clear Cairo of gov’t buildings: The president ordered the Madbouly Cabinet to clear Cairo of all government administrative buildings by 2020, Masaa DMC’s Eman El Hosary said (watch, runtime: 0:34). Many government offices are currently being moved to the new administrative capital. “This will allow Cairo to assume its historical role as a cultural, touristic, and heritage center,” according to a statement read by El Hossary.

Speed Round

Speed Round is presented in association with

IPO WATCH- NI Capital to launch bookrunner tender for HHD secondary offering next month: State-owned investment bank NI Capital is planning to issue a tender in September to choose the bookrunner for state-owned real estate developer Heliopolis Housing and Development’s (HHD) planned secondary offering on the EGX, HHD’s Managing Director of Financial Affairs Sahar El-Damaty told the local press. The company plans to sell up to 25% of its shares in the offering, 10% of which will be allocated to a private equity investor or an alliance of a private equity investor and a property developer.

Background: We previously reported that the company called an extraordinary general assembly meeting on 26 August to vote on handing its management to a private sector partner as part of the share sale process. Real estate developers will be invited to bid to manage its portfolio of assets and land following the general assembly meeting. The successful company will purchase 10% of the company, a share currently estimated at EGP 1.1 bn.

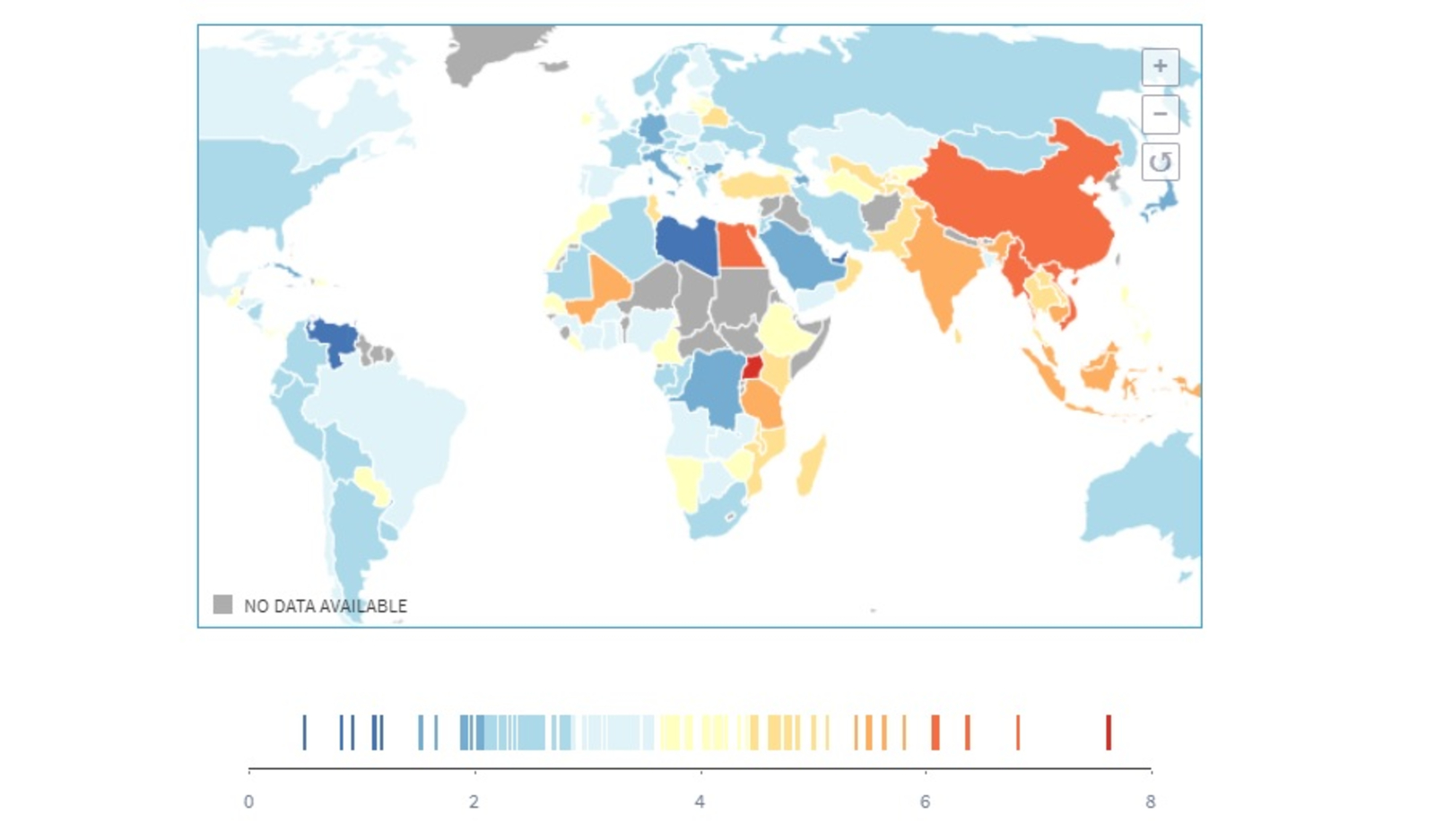

Egypt’s economy is forecast to grow at a 6.8% clip per year over the next 10 years, placing it among the top of the list of the fastest-growing economies until 2027, according to the Harvard Center for International Development’s 2027 Growth Projections. Also expected to hit annual growth rates of at least 6% are Myanmar, Uganda, China, and Vietnam. Harvard’s projections are based on a measure of ‘economic complexity,’ which accounts for the diverse and sophisticated production involved in each country’s exports.

The only unifying factor in the fastest growers? Specialized knowhow: “What unites Uganda, Egypt, China, Vietnam, and Tanzania as the fastest-growing countries in the projection is not that they uniformly share the same education level, geographic region, religion, or any measure of institutional quality. Rather, each country has a more sophisticated range of specialized knowhow than expected or its income that will drive diversification and growth,” researcher Timothy Cheston writes.

Egypt ranks 68th on the Economic Complexity Index. Egypt has moved up two places in the Economic Complexity Index due to export diversification increasing complexity of the country’s economy. Harvard projects that Egypt will continue along the same trajectory in the years to come as it further diversifies production.

GTH board approves Veon’s offer to acquire USD 2.3 bn assets: Global Telecom Holding’s (GTH) board of directors has approved Veon’s offer to acquire all of GTH’s operating assets for USD 2.3 bn, GTH said in a bourse filing (pdf). Veon will acquire the company’s stakes in Jazz, Bangalink, Djezzy (including MedCable), and Mobilink Bank for PKR 313.3 bn, BDT 24.9 bn, DZD 70.2 bn, and PKR 14.7 bn respectively. The board also postponed the shareholders’ meeting to discuss the transaction to 9 September instead of 27 August.

Background: The Financial Regulatory Authority approved in June Veon’s mandatory tender offer (MTO) to acquire 1.99 bn shares in GTH, equivalent to a 42.3% stake in the company. The MTO closed earlier this month, leaving Veon with around 98% of GTH’s total outstanding equity. Plans for the MTO were a long time in the making, having suffered delays due to a long-running tax dispute between GTH and the government. The dispute was finally resolved in June, and the FRA subsequently approved the MTO at EGP 5.08 per share (down from EGP 5.30 per share previously).

Champions of the world:Egypt’s handball team were crowned champions of the 2019 Men’s Youth Handball World Championship after beating Germany 32:28 in the final yesterday, according to the International Handball Federation. The Pharaohs dominated the first half of the game, but Germany staged a second half comeback bringing them at one point within three goals of catching Egypt. Egypt is the first non-European and African team to win the title. Youngster Hassan Walid Ahmed was the tournament’s top scorer, and the team topped both lists of most attempts and most goals scored.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Egypt in the News

This morning in the foreign press: AFP reports that Egypt helped China to detain Uighurs after the two countries signed a security memorandum focused on "combating terrorism.” The news agency interviewed several Uigurs who claimed to have been detained during a three-day crackdown in 2017 which came three weeks after the signing of the agreement. China has received widespread criticism for its treatment of Uighur Muslims, who are reportedly being detained in internment camps by the government.

Other headlines that should be on your radar:

- An Egyptian Uber driver will likely be deported to Egypt after being found guilty of assault in the US, the Associated Press reports.

- Google’s “more active” role in Egypt is drawing concern from rights activists, who say the expansion and planned reopening of its Cairo office will subject the company to pressure to provide access to personal data, according to the Intercept.

- Before the Revolution, a “bruising” two-hander play by Ahmed El Attar, “dives into the long lead-up to 2011 in an attempt to determine what causes mass revolt,” says the Guardian in a short review.

Worth Reading

Some of the world’s biggest investors could be the key to saving the planet from irreparable harm — not because they’re tree-hugging earth lovers, but because their investments could lose significant value or be wiped out altogether if the environment is damaged beyond repair, Tom Espiner writes for the BBC. “‘The economic and financial risks associated with climate change are very real,’ says Steve Waygood, chief responsible officer at Aviva Investors. ‘We only have the next five to 10 years to [cope] with the risks associated with climate change and make sure they don’t become real.”

A group of 360 investors with over USD 34 tn in assets under management have come together to form Climate Action 100+, a group that works to “put pressure on companies to do the right thing” when it comes to the environment. The group targets significant emitters of greenhouse gases and companies with large carbon footprints, such as BP, Shell, and coal producer Glencore. And since they’re shareholders, Espiner points out, they can exert considerable pressure, but that’s not to say they’ve found success with every attempt. Several large companies, such as ExxonMobil, are all but refusing to cooperate, and even those who do meet the group halfway are still not putting the brakes on their harmful activities altogether.

Worth Watching

There has been a lot of chatter about the inverted yield curve lately: The inverted yield curve is an infamous predictor of US recessions, having occurred before every downturn since 1950 (apart from one). And last week the alarm began to ring again, setting off fevered speculation in the financial press about whether the US economy is about to sink into a recession. For those of you who don’t know what an inverted yield curve is and why you should care about it, the Economist’s Wall Street correspondent Alice Fulwood is on hand to explain (watch, runtime: 4:15).

Put in the simplest possible terms: The yield curve is a graph which measures the returns investors receive from government bonds with different maturities. The x-axis measures time, and the y-axis the interest rate (or yield) received on each bond. It is typically upward-sloping, indicating that bonds with longer maturities have a higher interest rates. This is because investors would, under normal circumstances, demand higher returns for locking up their cash for longer periods of time. If prevailing economic expectations take a turn for the worse, the interest rates on longer-term bonds can fall below those on short-term bonds, causing the curve to become downwards sloping. This is what economists refer to when they say “a yield curve has inverted.”

Health + Education

Cira says government approved adding 7 new schools to its Badr University

The government has granted permission to leading private sector education provider Cairo for Investment & Real Estate Development (CIRA) to add seven new colleges to Badr University, including medicine, biotechnology, law, politics and international relations, according to a bourse filing (pdf). Construction of the new schools was completed and the company is waiting for a presidential decree to begin operations.

Automotive + Transportation

Raya discusses EV licensing regs with Egypt’s traffic authorities

Raya Auto is in talks with traffic authorities to clarify licensing regulations for electric motorcycles, CFO of parent company Raya Holdings Hossam Hussein tells Al Mal. The company is investing EGP 300 mn in the production of EVs, having recently inaugurated a second production line at its 6 October production facility. Raya’s EGP 100 mn light vehicle line has begun production, but sales are currently on hold due to the lack of a legal framework for licensing the vehicles, Hussein said.

El Nasr Auto to enter EV partnership with Chinese auto manufacturer

The Public Enterprises Ministry has reached an agreement with an unnamed Chinese automotive company to set up an electric vehicles factory in partnership with state-owned El Nasr Automotive, minister Hisham Tawfik said. The company is one of the largest in China, and is due to send a delegation to Egypt soon to sign the partnership MoU, Tawfik added. We noted last month that the Trade and Industry Ministry is also in talks with China’s Dongfeng, which is considering manufacturing electric cars in Egypt.

Banking + Finance

HC targets concluding its first private equity transaction this year

HC Securities & Investment is looking to close its first private equity transaction worth between EGP 500 mn and 1 bn this year, Chairman Hussein Choucri told Hapi Journal. HC is targeting several similar transactions in which regional and international investors acquire stakes of up to 30% in companies. HC is also working on eight M&A transactions worth USD 25-75 mn each.

Sports

Egyptian football giants Al Ahly sack head coach after Egypt Cup elimination

Egyptian Premier League title holders Al Ahly have sacked their Uruguayan coach Martin Lasarte yesterday after suffering a 1-0 loss to Pyramids FC in the Egypt Cup round of 16, reports Ahram Online. Lasarte failed to meet the board’s expectations, despite helping the team secure their fourth consecutive league title last season. The club has appointed Lasarte’s assistant Mohamd Youssef to coach the team until a successor is appointed.

On Your Way Out

Tahrir Square is getting a facelift: Prime Minister Moustafa Madbouly has ordered his government to develop and renovate Tahrir Square as part of plans to maintain historical Cairo as a major tourist attraction, according to a Cabinet statement. The facelift will apparently entaily adding an obelisk to the square. It has yet to be determined how long the process will take. In other news pertaining to the renovation of historical sites, the Antiquities Ministry expects to complete the restoration of the Baron Empire Palace in Heliopolis and inaugurate the renovated site this year, according to a ministry statement. The Baron facelift has sparked controversy and mockery on social media after pictures showed it is possibly being “distorted” rather than renovated, says Arab News.

The Market Yesterday

EGP / USD CBE market average: Buy 16.53 | Sell 16.65

EGP / USD at CIB: Buy 16.53 | Sell 16.63

EGP / USD at NBE: Buy 16.52 | Sell 16.62

EGX30 (Sunday): 14,400 (+0.7%)

Turnover: EGP 507 mn (13% below the 90-day average)

EGX 30 year-to-date: +10.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.7%. CIB, the index’s heaviest constituent, ended up 0.7%. EGX30’s top performing constituents were Sidi Kerir Petrochemicals up 5.2%, Ezz Steel up 3.5%, and Heliopolis Housing up 3.0%. Yesterday’s worst performing stocks were Egyptian Resorts down 1.2%, Orascom Construction down 1.0% and Emaar Misr down 0.9%. The market turnover was EGP 507 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -49.9 mn

Regional: Net Long | EGP +21.0 mn

Domestic: Net Long | EGP +28.9 mn

Retail: 74.4% of total trades | 74.4% of buyers | 74.4% of sellers

Institutions: 25.6% of total trades | 25.6% of buyers | 25.6% of sellers

WTI: USD 54.95 (+0.15%)

Brent: USD 58.71 (0.12%)

Natural Gas (Nymex, futures prices) USD 2.17 MMBtu, (-1.50%, September 2019 contract)

Gold: USD 1,521.30/ troy ounce (-0.15%)

TASI: 8,527.41 (-0.27%) (YTD: +8.95%)

ADX: 5,039.13 (-0.31%) (YTD: +2.52%)

DFM: 2,797.00 (+0.04%) (YTD: +10.56%)

KSE Premier Market: 6,572.30 (-1.69%)

QE: 9,782.25 (+1.67%) (YTD: -5.02%)

MSM: 3,862.47 (+0.02%) (YTD: -10.67%)

BB: 1,530.43 (-0.31%) (YTD: +14.45%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

24 August (Saturday): The Supreme Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets. The was postponed from 17 August.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

1 September (Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule into the stock manipulation case, in which Gamal and Alaa Mubarak are involved in along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.