- It’s official — Actis takes over the management of APEF IV and AAF III funds from Abraaj. (Speed Round)

- Egypt bucks the trend as EM debt climbs to new record highs. (Speed Round)

- Sarwa just got the first sukuk issuer license in the country. (Speed Round)

- The ripple effect of the fuel subsidy cuts is starting to touch food. (Speed Round)

- Saudi German Hospitals Group could invest as much as EGP 50 bn over the next 15 years. (Speed Round)

- The second phase of the Investment Ministry’s investment map is here. (Speed Round)

- How Egypt’s currency float compares to Nigeria’s. (What We’re Tracking Today)

- Egypt needs to invest an additional USD 30 bn into its electrical grid by 2023, Apicorp says. (Speed Round)

- The Market Yesterday

Tuesday, 16 July 2019

Actis takes over the management of Abraaj’s APEF IV and AAF III funds

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to the busiest hump day we’ve seen in a long time.

The biggest story of the day is private equity giant Actis’ takeover of two funds formerly managed by Abraaj. The takeover, which is the culmination of a year of negotiations, is one of the final chapters in the Abraaj meltdown saga. We have chapter and verse in this morning’s Speed Round, below.

The House of Representatives is officially on summer recess, and we’re not entirely sure that our elected representatives are as happy as we are. House Speaker Ali Abdel Aal officially adjourned parliament’s fourth legislative session yesterday, according to Al Shorouk. Surprising exactly no one, the rush to the holidays saw a number of laws passed by the House yesterday. We have a comprehensive rundown in this morning’s Speed Round.

US Secretary of Energy Rick Perry is due to visit Egypt later this month, we heard through the grapevine.

We have our Afcon 2019 finalists: Algeria’s Riyad Mahrez scored a last minute freekick to send his team through to the championship final with a 2-1 win against Nigeria. Senegal also beat Tunisia 1-0 after defender Dylan Bronn scored an extraordinary own goal in extra time. You can watch highlights from both matches here and here. The final will be played at the Cairo International Stadium on Friday, 19 July.

In other news from the confederation, CAF boss Ahmad Ahmad could be in hot water as FIFA begins probing allegations of graft, including reportedly receiving false expense claim payments, says the BBC.

Another day, another vindication of Egypt’s currency devaluation. Today it’s Bloomberg charting our rising fortunes, in contrast with Nigeria’s decision to keep a tight hold on the naira in the face of a USD squeeze. Not only does our June 9.4% inflation rate contrast with Nigeria’s 11.2%, but our economy grew almost three times as quickly in 2018, and is predicted to be the fastest growing MENA economy this year. Increasing investment and high-performing assets indicate investor confidence, with Egyptian stocks up 12% year-to-date, while Lagos’ main equity index is down 8.6%. And stress on the EGP continues to fall as pressure grows on the naira, according to Citigroup’s Early Warning Signal Indexes.

China growth hits 27-year low despite strong industrial data: Chinese economic output dipped to 6.2% in the second quarter, the lowest level in 27 years, CNBC reports. The data was in line with the results of a poll of economists conducted by Reuters last week, which predicted that higher US tariffs on Chinese exports would further curtail economic growth. Industrial output and retail sales growth both outperformed expectations though, growing 6.3% y-o-y and 9.8% y-o-y respectively.

Falling growth in China puts EM rate cuts in the spotlight: Expectations for a US rate cut this month and yesterday’s weaker Chinese growth data are increasing the need for further easing in emerging markets, Bloomberg writes. Anticipation is now growing that central banks in Indonesia, Ukraine, South Africa, and even South Korea may move to cut rates when they meet later this week. Turkey is also looking like it’s heading towards a rate cut, if recent hints by newly-appointed central bank governor Murat Uysal are anything to go by.

PSA- The entire nation is facing a two-day heat wave today and tomorrow, with the temperature in Cairo set to hit 42°C tomorrow, according to the Egyptian Meteorological Authority.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s sit-down with AmCham Executive Vice President Myron Brilliant to talk US-Egypt cooperation earned some airtime with Al Hayah Al Youm’s Khaled Abu Bakr (watch, runtime: 9:16). We have the story in Diplomacy + Foreign Trade, below.

Gov’t studying deliberate deflation? Prime Minister Moustafa Madbouly discussed during a meeting yesterday with the ministers of supply, trade and industry, and finance allowing prices to fall on the back of the strengthening of the EGP against the USD, Masaa DMC’s Ramy Radwan reported (watch, runtime: 1:13). Radwan phoned Federation of Egyptian Chambers of Commerce boss Ahmed Wakeel, who said the government will oversupply the market “until prices balance out” (watch, runtime: 6:48).

On a lighter note, Dahab getting some love in a recent Forbes contributor article for being “a secret paradise for adventure travelers” from the world over was the topic of discussion on Masaa DMC (watch, runtime: 4:08).

Speed Round

Speed Round is presented in association with

It’s official — Actis takes over management of APEF IV and AAF III funds from Abraaj: Emerging markets private equity giant Actis has officially taken over the management of the Abraaj Private Equity Fund IV (APEF IV) and Abraaj Africa fund III (AAF III) in a landmark transaction for PE in the region, the firm announced in a statement yesterday. Following a year of negotiations and “a process that was extremely complex with multiple stakeholders,” Actis will now take over the two funds — with assets worth a combined USD 2.6 bn — from the now defunct PE firm Abraaj. It was reported earlier this month that Actis had received approval from the Financial Regulatory Authority for the fund’s Egypt-related assets. Reuters and the Wall Street Journal also have the story.

What does this mean for the regional PE landscape? The transaction includes investments in 14 portfolio companies across the two funds, and brings Actis’ assets under management to USD 12 bn. “This Abraaj transaction further bolsters Actis’ footprint in the growth markets and follows the addition and integration of Standard Chartered’s Principal Finance Real Estate business in Asia in 2018,” it said. “Actis’s takeover sees the firm add new investment professionals in its Nairobi, Johannesburg and Lagos offices, as well as adding a new office in Dubai,” according to the Wall Street Journal. APEF IV’s USD 1.6 bn portfolio includes Cleopatra Hospital Group, Nahda University in Egypt, and restaurants chain Kudu in Saudi Arabia. It also includes GCC-based oil company Viking Oil. AAF III’s USD 990 mn portfolio includes Java House in Kenya, Libstar in South Africa, and Nigerian chemicals company Indorama.

What it took to get here: Bloomberg reported that Actis received the support of 75% of limited partners in the funds, allowing it to take over the APEF IV and the AAF III. Actis had reportedly made an offer last September to acquire “the bulk” of Abraaj’s EM funds.

Meanwhile, Ahmed Badreldin’s RMBV takes over ANAF II from Abraaj: The announcement comes as Dutch fund manager RMBV terminated its relationship with Abraaj Investment Management Limited (AIML), and taken over management of the Abraaj North Africa Fund (ANAF II). The fund has assets under management of USD 600 mn, investing primarily in healthcare and education in Egypt, Algeria and Tunisia. RMBV’s management team includes Cleopatra Hospitals Non-Executive Chairman and former head of MENA at Abraaj Group Ahmed Badreldin.

The Cleopatra connection: APEF IV (currently being managed by Actis) and ANAF II (currently managed by RMBV) both hold an indirect stake in private sector healthcare giant Cleopatra Hospital Group (CHG) through Care Healthcare, which as of last week, holds a 37.9% stake in CHG. APEF IV has a 42.5% indirect interest in Care Healthcare, while ANAF II has a 30% indirect interest in Care, Badreldin tells Enterprise. Three of ANAF II’s investors — the European Bank for Reconstruction and Development (EBRD), German Investment Corporation (DEG), and PROPARCO — together hold a combined 27.5% indirect stake in Care separate from the fund.

What brought us here: The takeover is one of the final acts following the implosion of Abraaj, the one-time darling of the emerging markets private equity world. Abraaj filed for liquidation last year after investors accused the firm of mismanaging a USD 1 bn healthcare fund. Executives Mustafa Abdel-Wadood and Arif Naqvi were arrested in April and released on bail the following month. Abdel-Wadood pled guilty to racketeering and fraud charges earlier this month and will be appearing as a prosecution witness in Naqvi’s trial. US PE firm Colony Capital took over Abraaj’s Latin American operations earlier this year, while Franklin Templeton Investments held talks to acquire Abraaj’s Turkey operations.

Egypt bucks the trend as emerging-market debt climbs to new record highs: Egypt’s debt-to-GDP ratio fell y-o-y in 1Q2019 as overall debt in emerging markets surged to new record highs, according to a report by the Institute of International Finance (IIF). Corporate, household and public sector debt all fell during the first three months of the year, while money owed by the financial sector remained unchanged.

EM debt rose by another USD 200 bn in 1Q2019 y-o-y to a record USD 69.1 tn. Cheap borrowing costs pushed the ratio of public, corporate and household debt-to-GDP in emerging markets to 216%. “The persistent economy-wide increase in EM borrowing continues to feed into higher contingent liabilities for many sovereigns,” the report says.

High reliance on short-term debt could become a problem: Around USD 3 tn of EM bonds and syndicated loans reach maturity between now and the end of 2020, leaving emerging markets exposed to a sharp reversal in global risk appetite.

“More blip than trend”: The latest figures suggest that last year’s slowdown in EM debt growth was merely a flash in the pan. “Helped by the substantial easing in financial conditions, borrowers took on debt in 1Q2019 at the fastest pace in over a year,” the report notes.

Globally, the story is the same: Global debt jumped by USD 3 tn to hit USD 246.5 tn — or 320% of GDP — in the same period. Levels of global debt are now just USD 2 tn away from the USD 248 tn record set in 1Q2018.

Expect more of the same to come: With the world’s key central banks poised to cut interest rates, debt accumulation is likely to accelerate over the coming years. “Broad-based central bank easing could well prompt more debt buildup across the board, undermining deleveraging and reigniting concern about long-term headwinds to global growth,” the report says.

NI Capital invites investment banks to advise on Sidpec share sale: State investment bank NI Capital has invited top investment banks to bid on the role of adviser for the sale of 30% of Sidi Kerir Petrochemicals (Sidpec), government sources tell Al Mal. The sources noted that banks that were invited were those whose brokerage arms were in the top five of the brokerage league tables, which we can safely assume will include the likes EFG Hermes, CI Capital, and Beltone Financial. NI Capital had already lined up the advisers for Alexandria Containers and Cargo Handling Company (ACCH) and Abu Qir Fertilizers — the other companies that will see stake sales as part of the state privatization program. EFG Hermes and Citi are advising on the stake sale of ACCH, while Abu Qir is being advised by Renaissance Capital and CI Capital. Share sales are not expected to take place before September, Public Enterprises Minister Hisham Tawfik told us.

Competition to advise on e-Finance IPO heats up: In other news on the state privatization program, government e-payments firm e-Finance is currently deciding on bids from EFG Hermes, CI Capital, Pharos Holdings, Beltone, and Renaissance Capital for the mandate to advise on its IPO, the local press reports. A decision on the mandate will be taken during the next meeting of the government committee managing the state privatization, sources said without revealing when the meeting will take place. e-Finance has reportedly chosen Baker Tilly Wag to conduct the fair value report. Reports in the local press had noted that the government is planning to sell 10-15% of e-Finance in an IPO during 4Q2019.

Sarwa just got Egypt’s first sukuk issuer license: Consumer- and structured-finance player Sarwa Capital has been granted the country’s first sukuk issuer license by the Financial Regulatory Authority (FRA), the company said in a statement to the bourse (pdf). Sarwa now has the green light to issue the sharia-compliant bonds through its sukuk arm, Sarwa Sukuk Company. Sarwa had applied for the license back in January.

Background: The FRA issued regulations governing sukuk in April. The regulations stipulate that the bond issuances be approved by a religious committee and issued through an independent body that monitors issuances. It also said issuances must be worth at least EGP 50 mn. Two unnamed companies partially owned by the government had expressed their interest last month in issuing sukuk bonds to finance new projects this year, with one of the companies saying it will carry out the issuance through Sarwa Capital.

The impact of higher fuel prices is beginning to touch food. Exhibit A: The Supply Ministry is studying raising the profit margin of subsidized bread bakeries to offset rising costs incurred by the latest fuel subsidy cuts, Al Mal cited an anonymous source as saying. The government could increase bakers’ profit margin per sack of flour, which is enough to produce about 1,250 loaves, to between EGP 240-260 from EGP 220. Increasing the profit margin would entail lowering the price of the subsidized flour provided to bakers. The bakers believe a fair profit margin is EGP 280 per sack. Supply Minister Ali El Moselhy is set to meet with members of the bakers’ division at Egypt’s chambers of commerce within days to decide on the increase.

Bread will still be sold to citizens at the same price of EGP 0.05 per loaf, so the additional cost burden will be shouldered by the government. It is unclear how much the move would raise the state’s subsidy bill, but the same move last year had led the ministry to pay an additional EGP 5 bn a year on subsidized bread production.

Exhibit B: Sugar beet crops could drop by between 33-50% to 300k-400k feddans in 2020 on the back of the fuel price hikes and challenging market conditions, Agriculture Ministry sources told the newspaper. Sugar beet prices have stagnated at EGP 650 per tonne for the second year in a row, and higher fuel prices will increase the financial pressure on farmers. Sugar beet plantation season begins in August and runs through November before the harvest season in February. Companies last week refused a request by the ministry to raise the crop’s price by EGP 150 per tonne, a move that the government hoped would encourage farmers to plant the crop.

INVESTMENT WATCH- Saudi German Hospital to invest tens of bns in Egypt as part of 15-year plan: The Saudi German Hospitals Group (SGH) is looking to invest EGP 40-50 bn in Egypt within the next 15 years to expand its business in the country, Vice Chairman Makarem Batterjee said. In the near future, the group is planning to inaugurate a second hospital in Cairo and add an outpatient clinics building in its existing facility in Heliopolis. The group is also expecting to inaugurate the first phase of its Batterjee Medical City on the outskirts of Alexandria in two years. The three-phase project will come at an initial investment cost of up to EGP 10 bn.

Separately, the group’s hospital joined international doctors collaboration Mayo Clinic Care Network, becoming the “the first hospital in Africa [to do so],” according to a press release (pdf).

INVESTMENT WATCH- Qalaa to invest EGP 400 mn in portfolio company Dina Farms: Qalaa Holdings is planning to invest upwards of EGP 400 mn within three years in its dairy and fresh milk operation Dina Farms, Chairman Ahmed Heikal said at a press conference, according to Reuters’ Arabic service. Qalaa will add some 3k feddans to Dina’s farmlands, increase its headcount of cattle, and augment the milk production of its dairy farms. “The funds are already available,” Heikal said, adding that his company could borrow EGP 50-100 mn to finance the investment if need be.

Investment Minister Sahar Nasr unveiled the second phase of her ministry’s investment map yesterday, compiling an interactive directory of 2,000 new projects up for grabs across the country, according to a Cabinet statement. The projects include different types and sizes, including freezones, tech-dedicated, manufacturing complexes, national megaprojects, and SMEs. The megaprojects on the plan’s priority list are the new capital, the Suez Canal Economic Zone, New Alamein, New Galala City, the president’s 1.5 mn feddan initiative, and the Grand Egyptian Museum. The ministry had launched the first phase of the map with 1,270 projects last year.

The updated version of the map also offers new virtual services, including a virtual library containing digital texts of all investment-related legislation, said Malek Fawaz, the minister’s advisor for promoting investment. Prospective investors can also create online profiles which will allow for personalized pitches based on stated preferences, and the ability to compare between prospects, download brochures, and submit suggestions to further develop the map.

LEGISLATION WATCH- The House of Representatives’ general assembly officially passed the amended NGOs Act yesterday, which will now replace the contentious original version that was issued in 2017, according to Masrawy. The new law grants NGOs and other civil society organizations a grace period of one year to comply with the law, after which violators will be subject to several penalties including having their operating licenses revoked. Prison sentences imposed on violators have been scrapped from the new law and replaced with monetary fines. You can read our full recap of the amended legislation here.

Civil society is still not happy: Ten local and international rights groups issued a statement last week slamming the new law as “a re-marketing of the repressive law that contains a hostile attitude towards civil society groups,” Reuters reports. The groups say that the changes made to the law are not enough, and should be accompanied by a “revamping” of other laws that restrict civil society.

The House also granted its final approval to the Social Security and Pensions Act, which will see 21% of public and private sector workers’ salaries going towards a newly-established pension fund, Ahram Gate reports. The percentage taken out of employee salaries will increase 1% once every seven year until it hits 26%. The law will also require the fund to provide quarterly and annual financial reports to the presidency, cabinet, and parliament for transparency purposes. You can check out the full text of the law, courtesy of Masrawy.

Amendments to the Economics Courts Act were also approved yesterday in a final vote in the House general assembly. The amendments widen the scope of the nation’s economic courts to cover new business and finance activity and expand the courts’ jurisdiction to cover more cases, including those pertaining to new non-banking financial services, money laundering, and bankruptcy. The changes will also allow for cases to be filed electronically and certain procedures to be completed online.

Also passed yesterday: A law regulating shops in public spaces (including restaurants) and amendments to the law governing the Bar Association.

What the House didn’t get around to passing: The commercial rent law has been shipped back to the House Housing Committee for renewed discussion after it stirred controversy within Parliament, according to Masrawy. The bill, which would see commercial tenants who signed long-term leases before 1996 pay significantly higher rents, will be revisited in the next legislative session, which begins in October.

LEGISLATION WATCH- EDA’s mandate expands under new pharma legislation: The Health Ministry will transfer regulatory powers over the pharma market to the Egyptian Drug Authority (EDA) under legislation passed by the House last week, the local press reported. The EDA will now be in charge of registering new products, maintaining production standards, and setting customs rates on imported products. The Prime Minister must issue the executive regulations of the legislation within six months of its announcement in the official gazette. Here’s a breakdown of the legislation:

- The National Organization for Drug & Control Research and the Drug Planning and Policies Fund will be dissolved, with the EDA receiving the budgets and responsibilities of both organizations. Some employees will be transferred to the EDA while others will be moved to other public sector entities;

- EDA employees will be allowed to enter facilities to supervise and inspect them if approved by the justice minister;

- The EDA will be able to set up companies by itself or in partnership with existing companies. It will be part-funded via returns on its investments and sales, and will be exempt from paying preliminary or final insurance fees on purchases;

- The Egyptian Authority for the Unified Procurement of Medical Supply and Technology will be in charge of making available medical products and appliances for all government entities.

Egypt needs to invest USD 30 bn into electrical grid by 2023 -Apicorp: Egypt needs to invest an additional USD 20 bn in power generation and USD 10 bn in transmission and distribution (T&D)to increase capacity to 63 GW by 2023, the Arab Petroleum Investments Corporation (Apicorp) says in its newly-released MENA Power Investment Outlook report (pdf). Increasing urbanization, population growth and higher levels of cooling requirements will continue to place greater stress on Egypt’s electricity needs, despite significant investments over previous years leading to a current electricity surplus.

Egypt isn’t short on investments in its electrical grid: Investment in current projects stands at USD 24 bn, with that figure rising to USD 59 bn when accounting for projects that are still in the pipeline. In fact, the current electricity surplus has pushed the Egyptian Electricity Holding Company (EEHC) to postpone an agreement with the UAE’s Al Nowais to build a USD 4 bn “clean coal” power station in Oyoun Mousa, Electricity Ministry sources told the local press. Egypt’s power reserves currently stand at 20 GW per day and are expected to increase to 22 GW by the end of 2019 due to new renewable energy projects in the Gulf of Suez and Benban, the sources said.

The growth of medium-term demand is expected to accelerate, but will slow over the long term as the lifting of electricity subsidies hits household wallets and company balance sheets. Apicorp estimates that demand will grow at a compound annual rate of 5.1% by 2023, having risen by 4.6% between 2015 and 2017.

The MENA region needs USD 209 bn of investment in power to generate 88 GW by 2023, the report says.Apicorp has cut these projections by a fifth since last year’s outlook due to lower medium-term growth forecasts, falling population growth rates and higher electricity prices.

Investments in the MENA energy sector could reach USD 1 tn, with the power sector comprising a 36% market share, driven by growing demand for electricity and renewable energy. Egypt, Saudi Arabia and the UAE alone account for half the expected investments in the power sector. In the case of both Egypt and Saudi Arabia, the majority of planned or existing power generation projects are focused on gas-fired capacity. Renewable energy is expected to account for 34% of total power investments, although technical and regulatory issues are expected to keep many countries below their renewable generation targets.

Sector reforms are essential for increased private sector involvement: With the total share of regional government investments in the sector at 78%, the report calls for greater private sector involvement in both power generation and distribution, using traditional business models including the Single-Buyer Model.

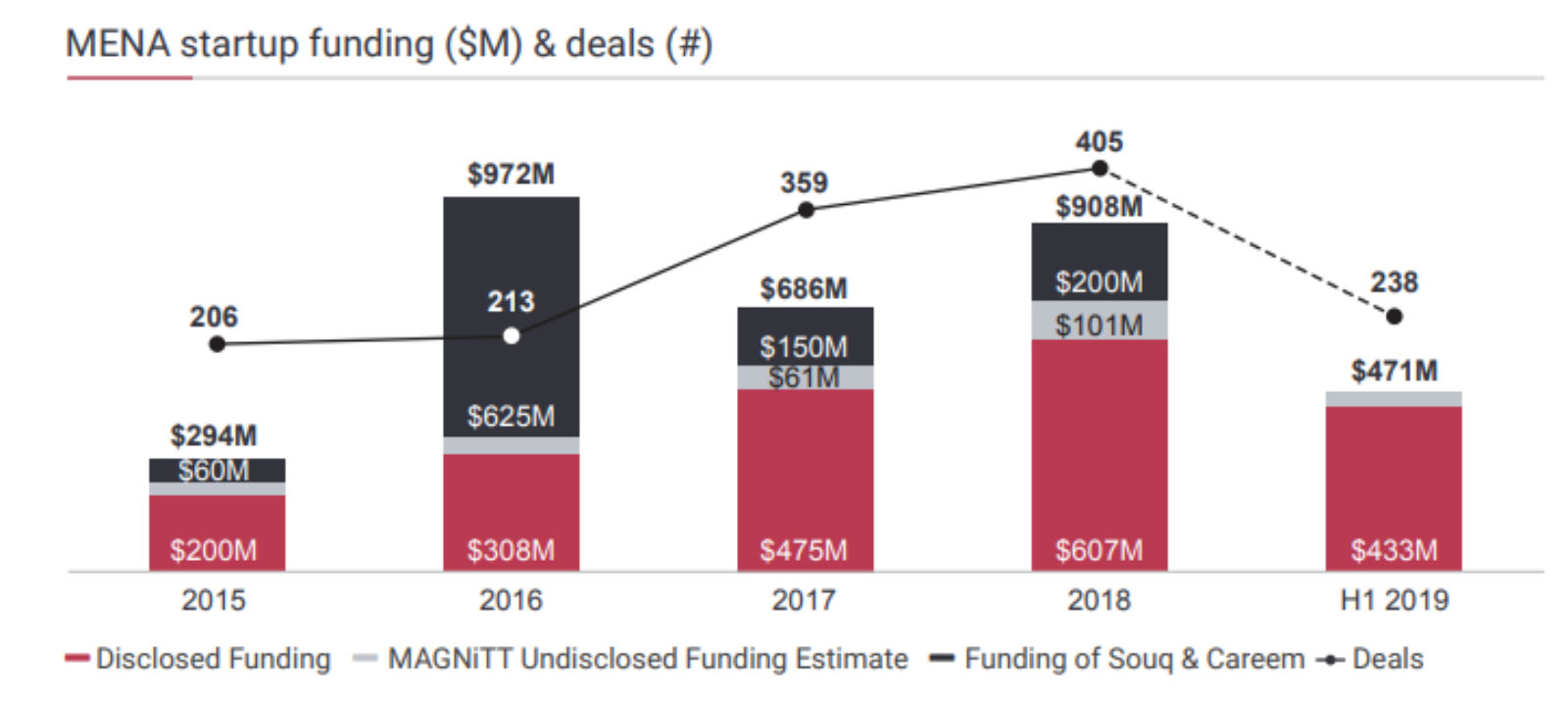

MENA startups have raised USD 471 mn during the first half of the year, surging 66% y-o-y, according to Magnitt’s MENA Venture Investment Report 1H2019 update. A record of 238 funding agreements were inked, up 28% from 1H2018. The top two funding rounds were UAE-based Emerging Markets Property Group (EMPG) and Yellow Door Energy, which attracted USD 100 mn in series D and USD 65 mn in series A funding, respectively. You can check out the summary (pdf) or the full report (paywall)

Egypt’s SWVL raised the third-largest sum during the period with its USD 42 mn series C round. The landmark USD 3.1 bn Uber-Careem merger was also a highlight during the first half of the year, making Careem the region’s “first unicorn exit” since the USD 580 mn Amazon acquisition of Souq in 2017.

Egypt came in as the region’s second largest funding recipient, accounting for 21% of the number of agreements signed. The UAE retained the top position at 26%, and Lebanon and Saudi Arabia came in third and fourth, at 13% and 11%, respectively. “In relative terms, Egypt, Saudi Arabia and Jordan have witnessed the greatest funding growth, while Lebanon and Kuwait have witnessed the biggest decline,” Magnitt founder Philip Bahoshy said in a live webinar yesterday, according to Zawya.

Fintech remained the most attractive industry, after overtaking e-commerce as the most active in the 2018 Magnitt coverage. The industry accounted for 17% of the total agreements, up 9% y-o-y and ahead of e-commerce, which covered 12%.

EARNINGS WATCH- Maridive & Oil Services has reported a consolidated net loss of USD 3.77 mn in 1Q2019, compared to a USD 7 mn profit during the same period the previous year, according to the company’s financial statement (pdf). ٌRevenues fell 27% to USD 39.1 mn during the quarter, down from USD 54.8 mn the year before.

MOVES- First Abu Dhabi Bank (FAB) has appointed Moataz Khalil (LinkedIn) as the CEO, replacing Ahmed Ismail, who has been made the country manager for Egypt at Arab Bank, Al Mal reports. Khalil is currently the managing director and head of corporate and investment banking.

Image of the Day

‘Photographs of Films’ series turns well-known films into art: Photographer Jason Shulman captures beautiful images by making an ultra-long exposure of films as they play all the way through. From this picture of the 1951 Alice in Wonderland to ‘moody monochrome’ Dr. Strangelove, Shulman’s images depict the feel of each film in a single image, by recording its ‘visual DNA’. You can see the full series here.

Egypt in the News

Despite being a busy news day at home, it’s all quiet on the foreign press front for Egypt this morning.

Worth Watching

A deep dive into ancient Nubia: The ancient royal burial site of Nuri holds the secrets of many Nubian pharaohs, but with rising water levels impeding entry to the tombs, exploring them requires the skills of underwater archaeologists like Pearce Paul Creasman. This BBC video (watch, runtime: 01:47) follows him diving into the tombs to reveal remnants of long-buried history.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi discussed yesterday tripartite cooperation between the US, Egypt, and the remainder of Africa with a focus on the digital, healthcare, and energy sectors with AmCham Executive Vice President Myron Brilliant, according to an Ittihadiya statement. Brilliant also talked boosting economic and trade cooperation with Foreign Minister Sameh Shoukry.

Telecoms + ICT

Gov’t offers 250 feddan to the private sector in Egypt’s planned Knowledge City

The CIT Ministry is offering 250 feddans to private investors in the new capital’s knowledge city, which is planned to house headquarters of tech majors operating in Egypt, reports Youm7. The city is set to be built on 301 feddans, with initial investments valued at EGP 6 bn, we noted last year.

Banking + Finance

Raya’s microfinance arm Aman in negotiations eyes EGP 500 mn in loans from five banks

Raya Holding’s microfinance subsidiary Aman is seeking to borrow EGP 500 mn from CIB, Suez Canal Bank, Attijariwafa Bank, Blom Bank Egypt, and United Bank, Chief Financial Officer Ayman Bassiouny told Mubasher. The company hopes to borrow EGP 100 mn from each bank, having already obtained EGP 500 mn in loans from seven banks in 1H2019. Aman said last week that it was seeking to borrow a further EGP 500 mn this year to finance SMEs.

Ostoul obtains primary dealer license from FRA for EGP-denominated securities

Ostoul Securities Brokerage has obtained a license from the Financial Regulatory Authority to begin in August operating as a primary dealer for EGP-denominated government debt investors, CEO Mohamed Lotfy tells Al Mal. The move to obtain the license is part of the firm’s expansion plan, which will see it apply for a short selling license and begin trading in futures.

Other Business News of Note

Egypt’s administrative court turns down gov’t appeal to bring back iron tariffs

The administrative court has turned down the Trade Ministry’s appeal to bring back the 15% import duty on iron billets, which it lodged after twenty-one iron factories won a case at the court reversing the ministry’s decision to impose the duties, according to Al Mal. The companies halted operations last week in response to the appeal, saying they would not resume production until the court rules on the appeal.

Egypt Politics + Economics

Eight terrorists detained in Kuwait returned to Egypt

Kuwait has handed over to Egypt eight detainees that it claims have links to the Ikhwan, according to state news agency KUNA, Reuters reports. Kuwait’s interior ministry stated that the detainees had fled Egypt after receiving prison sentences of up to 15 years, and that they had been returned based on the terms of bilateral agreements.

Authorities release Egyptian transgender activist El-Kashef

Authorities have released transgender woman and rights activist Malak El-Kashef, who was arrested in March on charges of “belonging to a terror group,” reports Al Shorouk. El-Kashef was allegedly arrested after calling for protests in the wake of the Ramses train crash, the Egyptian Commission for Rights and Freedoms said at the time.

On Your Way Out

Yes, lunar mining may become a thing (but it’s fraught with complications). The latest step in the space race has governments and companies all over the world bickering about how best to exploit the moon for minerals and fuel sources. Nobody can seem to agree on whether to allow for private ownership of lunar resources, fairly distribute them or prohibit commercial exploitation altogether. It’s unchartered territory in more ways than one, and what happens next is anyone’s guess. The Wall Street Journal has more.

The Market Yesterday

EGP / USD CBE market average: Buy 16.54 | Sell 16.66

EGP / USD at CIB: Buy 16.54 | Sell 16.64

EGP / USD at NBE: Buy 16.56 | Sell 16.66

EGX30 (Monday): 13,628 (-0.3%)

Turnover: EGP 703 mn (9% above the 90-day average)

EGX 30 year-to-date: +4.5%

THE MARKET ON MONDAY: The EGX30 ended Sunday’s session down 0.3%. CIB, the index heaviest constituent ended down 1.1%. EGX30’s top performing constituents were SODIC up 2.5%, Heliopolis Housing up 2.5%, Orascom Development up 2.4%. Yesterday’s worst performing stocks were Juhayna down 2.7% and Telecom Egypt down 2.4%. The market turnover was EGP 703 mn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -15.0 mn

Regional: Net Short | EGP -60.8 mn

Domestic: Net Long | EGP +75.8 mn

Retail: 40.3% of total trades | 37.6% of buyers | 43.0% of sellers

Institutions: 59.7% of total trades | 62.4% of buyers | 57.0% of sellers

WTI: USD 59.45 (-0.22%)

Brent: USD 66.35 (-0.20%)

Natural Gas (Nymex, futures prices) USD 2.40 MMBtu, (-0.42%, Aug 2019 contract)

Gold: USD 1,416.10 / troy ounce (+0.18%)

TASI: 9,044.21 (+0.32%) (YTD: +15.56%)

ADX: 5,041.95 (-0.28%) (YTD: 2.58%)

DFM: 2,715.70 (+0.40%) (YTD: +7.35%)

KSE Premier Market: 6,724.25 (-0.75%)

QE: 10,595.55 (-0.04%) (YTD: +2.88%)

MSM: 3,785.57 (-0.22%) (YTD: -12.45%)

BB: 1,533.97 (-0.20%) (YTD: +14.71%)

Calendar

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

14-18 July (Sunday-Thursday): The government is expected to announce the details of the new export subsidies framework.

17 July (Wednesday): Harvard Business School alumni reception and admissions presentation, Falak Startups-The Greek Campus, Cairo.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

25 July (Thursday): US Secretary of Energy visiting Cairo.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.