- Is the Oil Ministry bringing the fuel pricing mechanism on 95-octane into effect this month? (Speed Round)

- The EGX30 dipped 4.3% in 2Q2019. (Speed Round)

- Israel’s export of gas into Egypt are reportedly delayed due to a hang up in regulatory clearances. (Speed Round)

- The trade war isn’t affecting emerging markets as much as you thought. (The Macro Picture)

- Global stocks are recovering on expectations of progress on a US-China trade agreement. (What We’re Tracking Today)

- US companies took the lead in global M&As during 2Q2019. (What We’re Tracking Today)

- Companies can now advertise on tuk-tuks and motorcycles in ride-hailing app Halan’s fleet. (Speed Round)

- Mo Salah was definitely meant to play football, not basketball. (Worth Watching)

- The Market Yesterday

Tuesday, 2 July 2019

Is the price of 95-octane fuel changing this month?

TL;DR

What We’re Tracking Today

The question of the day is whether we should expect new 95-octane fuel price changes this month. All signs seem to indicate the answer is “yes,” particularly as the local press is on high alert for any clues. We have the full rundown in this morning’s Speed Round, below.

The EGX didn’t have a great second quarter. The EGX is back today from a four-day weekend. Last week, the bourse issued a report stating that the EGX30 fell 4.3% in 2Q2019, with analysts we spoke with telling us that the Global Telecom Holdings dispute and a turbulent global market as a result of the US-China trade war contributed to the decline. We have more in this morning’s Speed Round below.

It’s interest rate day next week: The CBE’s Monetary Policy Committee will meet to review interest rates on Thursday, 11 July. The MPC left key rates on hold at the last meeting in May and the expectation is that it is likely to do the same again this month — especially considering the fuel and electricity subsidy cuts.

Watch for these news triggers in the coming days:

- PMI: The purchasing managers’ index for Egypt, Saudi Arabia, and the UAE will be released tomorrow.

- Foreign reserves: The CBE is due to release Egypt’s net foreign reserve figures for June this week.

- Inflation: Monthly inflation figures are due out next week.

Alain Pilloux, vice president of banking at the EBRD, began a four-day visit to Egypt yesterday with a meeting with Prime Minister Moustafa Madbouly. Piloux suggested that the EBRD might fund Egypt’s monorail project. We have more in this morning’s Diplomacy + Foreign Trade, below.

It’s your last chance to register for AmCham’s monthly luncheon with Electricity Minister Mohamed Shaker, taking place today.

The planned resumption of US-China trade talks is doing good by global stocks as investors are banking on improved global economic growth, Reuters reports. The S&P 500, Dow Jones Industrial Average, Nasdaq Composite, and MSCI’s broadest global index all rose yesterday, and the USD rose around 0.4%, driving gold prices down 1.5%. “‘Any step toward a trade resolution — and it doesn’t have to be a lot of progress — just a step, is viewed very positively by markets,’ said Scott Brown, chief economist at Raymond James in St. Petersburg, Florida. ‘And investors at this point are trying to focus on the positive in hopes that there will be some trade resolution down the line.’”

Restarting negotiations is piling pressure on the US Federal Reserve to move ahead with its first rate cut in a decade to help strengthen the US economy and put The Donald in a stronger position in the trade talks, according to the newswire. Fed Chairman Jerome Powell said last week that slowing economic growth made it more likely that a rate cut would come to fruition in the next few months, but cautioned against knee-jerk policy responses to current conditions.

A slump in global manufacturing is a signal that easing tensions could not happen soon enough. The impact of the trade standoff on the global economy can be seen in a series of bleak manufacturing index releases from JP Morgan and IHS Markit, which showed manufacturing slumping across the world, according to the Financial Times. Key Asian markets, including South Korea, China, and Japan, as well as most eurozone countries have reported falling output, which some analysts are concerned could start a domino effect of job cuts and a downturn in the services sector.

US companies took the lead in the global M&A market in 2Q2019, as corporates took advantage of gains in the equity and debt markets to hammer out several mega agreements, according to Reuters. Major agreements in the US included a USD 121 bn merger between United Technologies’ aerospace division and Raytheon, AbbVie’s USD 63 bn acquisition of Allergan, and Occidental Petroleum’s USD 38 bn purchase of Anadarko.

But European and Asian M&As plunge: The mega agreements were not enough to prop up global M&A volumes, which fell 27% y-o-y in 2Q, Refinitiv data shows.The value of European M&As plummeted 54% to USD 152 bn in 2Q2019 while Asian companies fell 49% to USD 132 bn. In comparison, US M&As dipped only 3% over the quarter. Hernan Cristerna, global M&A co-head at JPMorgan Chase, said that European firms “risk losing their competitive edge” if they continue to fall behind their US rivals.

Riyadh and Moscow give their blessings to an oil supply cut extension: The alliance between OPEC and non-OPEC oil producers is set to extend oil supply cuts until March 2020 at the two-day OPEC+ meeting which began yesterday in Vienna, Bloomberg reports. Concern is reportedly growing among exporters that supply growth will soon outstrip weakening demand. Plans to extend the cuts were discussed by Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman during last weekend’s G20 summit. The cuts removed 1.2 mn b/d from the market at the tail-end of 2018 in a bid to arrest the slump in oil prices.

In global miscellany this morning:

- Iran has intentionally breached its 2015 nuclear agreement by exceeding the agreed-upon limit on its stockpile of enriched uranium as tensions between Tehran and Washington continue to grow, according to the Wall Street Journal.

- Beijing’s new airport is a sneak peek into the future: China has just completed the futuristic looking c.USD 12 bn Beijing Daxing International Airport, the capital’s second.

PSA- The General Administration for Passports, Immigration and Citizenship has been moved from the bureaucratic nightmare that is the Mogamma to a new location in El Abbasiya, Egypt Independent reports. The seven-story building is more advanced and equipped with digital queuing and electronic visa systems.

Enterprise+: Last Night’s Talk Shows

Government-sponsored healthcare was on the talking heads’ minds as Egypt’s new universal healthcare system officially debuted in Port Said yesterday.

The launch is a model for Africa, says the World Bank’s Sherif Hamdy: Al Hayah Al Youm’s Lobna Assal highlighted comments by the World Bank’s private sector specialist Sherif Hamdy about launching the scheme, which he said could serve as “a model for African neighbors” (watch, runtime: 2:18).

Madbouly highlights key features of the healthcare scheme: Hona Al Asema’s Lama Gebril, meanwhile, took note of Prime Minister Moustafa Madbouly saying that Port Said will be the first to benefit from the universal scheme through 11 general and specialized hospitals and healthcare units. Madbouly also reiterated that less financially secure citizens will be fully exempt from subscription fees (watch, runtime: 3:03).

Gebril also took note of the presidential initiative for the early detection of breast cancer, which kicked off yesterday with the screening of some 8 mn women. Women aged 18 and older in nine governorates will benefit from the first phase of the program, which will cover Alexandria, Port Said, Matrouh, Qalyubia, Beheira, Assiut, Fayoum, South Sinai, and Damietta. All services under the program will be offered at no charge (watch, runtime: 9:18).

Speed Round

Speed Round is presented in association with

Is Egypt’s fuel pricing mechanism coming into effect this month? Speculation is rife in the local press that the Oil Ministry might begin moving prices on 95-octane fuel this month under the automatic fuel pricing mechanism, after it kept the price of 95-octane unchanged at EGP 7.75 per liter in April. The government has also launched a video campaign on the benefits of lifting fuel subsidies, according to Masrawy, which seems to be a definite sign that the price changes are coming.

A quick refresher on the pricing mechanism: The new mechanism — whose enforcement was mandated by the IMF as a condition for the disbursement of the fifth tranche of its USD 12 bn facility to Egypt — will allow the price of 95-octane to fluctuate by as much as 10% in line with movements in the international markets, the government had said at the time. The Finance Ministry has said previously that any USD 1/bbl increase in international oil prices would lead to a EGP 2.3 bn increase in fuel subsidy costs. The prices undergo a periodic review by a government committee.

The bigger question is how the government plans to pull the trigger on wider fuel subsidy cuts this year. With July being fuel subsidy cuts month, it is yet unclear how the government plans to move on cutting subsidies for the other fuel grades. Government officials who spoke to Bloomberg late last year said that the plan to extend the new mechanism to other grades would be announced in June, with an eye to implementing it in September. It is also unclear whether we would see this apply across all grades and other fuel sources (including liquid gas and diesel) at once or gradually.

Electricity prices are also rising by 15% on average, as the government makes further cuts to the subsidy budget. Check out the full price breakdown here.

What we do know is the overall budgeted size of the subsidy cuts this year. The FY 2019-2020 state budget, which was ratified over the weekend by President Abdel Fattah El Sisi, will see large fuel subsidies fall to EGP 52.96 bn, from EGP 89.75 bn last fiscal year.

The EGX30 fell 4.3% y-o-y in 2Q2019, the Egyptian Bourse said in its quarterly report (pdf). Total market capitalization came in at EGP 756.1 bn at the end of the period, falling 7.4% y-o-y during the quarter. The total trade volume for the quarter was EGP 50.8 bn, down from EGP 91.9 bn in 2Q2018 and from EGP 82.6 bn in 1Q2019.

Banks are leading the pack: Banking stocks rose 5.3% during the quarter, making them the biggest winners, followed by telecoms (which rose 1.5%) and healthcare and pharma stocks (up 0.9%). The biggest losers were construction material stocks, which fell a whopping 27.2%.

GTH dispute had a hand in this drop: “The prolonged dispute with Global Telecom Holding (GTH) has impacted sentiment and trust among investors and caused trading volumes to fall,” Sherif Shebl, vice president of GCC sales at Pharos Holding, told Enterprise. Veon subsidiary Global Telecom Holding (GTH) ended its long, drawn-out tax dispute with the government last week, signing a USD 136 mn settlement agreement. Shebl added that the performance of state companies was not good during the quarter, with some reporting losses, coupled with a slowdown in the real estate sector, whose shares fell 8.8% y-o-y in 2Q2019.

Global headwinds, monetary policy had an impact as well: CBE monetary policy and global economic headwinds also hit the market during the quarter, Shuaa said in a report last week (pdf). The CBE’s decision to hold off on rate cuts in May, the appreciation of the EGP against the greenback, and a pickup in flows to Saudi Arabia and Argentina reduced inflows into Egyptian equities. Trade friction between the US and China and political tensions in the Arabian Gulf also had an impact on investors’ sentiment, Shuaa said.

What does this mean for the state privatization program? When looking at the results, it is perhaps unsurprising that there has not been a move in the state privatization program since Eastern Tobacco sold a 4.5% stake back in early March. Public Enterprises Minister Hisham Tawfik said companies selected to IPO under the program could begin listing as early as September, but noted that investment banks advising on the program would still need to determine when market conditions would be right for companies looking to pull the trigger on an additional share sale. With the GTH dispute settled, things are looking like they are moving forward, however. Advisers on the share sale by state-owned Alexandria Containers and Cargo Handling Company (ACCH) have concluded roadshows in Dubai and London, while preparations are underway to kickstart the bookbuilding process of a 30% stake sale in Sidi Kerir Petrochemicals (Sidpec).

Golden ticket for those seeking cheaper valuations: Based on 2019 price-to-earnings ratio projections, Egypt is the sixth-cheapest among global markets in terms of valuations and is the third regionally behind Oman and Dubai, Shuaa says. Based on current market prices and earnings estimates for 2019, EGX30 is trading at a PtE of 9.6x, or 26% less than the MSCI EM index’s 13.0x, and is 15% below its 6-year historical average of 11.4x. “The heat on local equities, however, opens the door for global or regional investors who are looking to buy the dips,” Shuaa said.

T-bond yields hit new 14-month lows: Yields on T-bonds fell to their lowest levels since May 2018 in a bond auction last week as banks snapped up 3- and 7-year government bonds, CBE data (pdf) showed. Yields on 3-year bonds fell to 15.987% from 16.022%, while yields on 7-year notes fell to 15.943% from 16.016%. A later auction saw yields on 5-year bonds fall to 15.97% from 16.005%, and those on 10-year notes to 15.969% from 15.988%.

Are carry traders seeing an interest rate cut coming at the end of the year? Apparently not. Most expect interest rates to stay the same or be reduced by no more than 100 bps, government officials tell Al Mal, adding that investors are locking in the current yields. Investors have netted themselves a 23% return on EGP-denominated bonds this year — five times the emerging market average, helping Egypt maintain its position as one of the world’s best carry trades of the year.

INVESTMENT WATCH- Government-owned carrier Telecom Egypt (TE) is planning to invest EGP 17 bn through 2020, Reuters reports. The company is accelerating efforts to develop its infrastructure and improve its networks by 2020, two years earlier than initially planned. The company said last month that it was planning to build four or five data centers in the coming two years in the new administrative capital, Alexandria, Smart Village, and Suez. It is also upgrading its existing data centers and is expecting to host Nokia’s Internet Of Things platform by the end of the year to serve Egypt and the region. TE is also working to meet the requirements to host Microsoft’s cloud network.

Israeli gas exports to Egypt delayed on regulatory hangups? The operators of Israel’s largest gas fields, branded as the Tamar Gas Consortium, have postponed commercial sales of Leviathan gas field-produced natural gas to Egypt to the end of the year, Delek Drilling said in an Israeli bourse filing picked up by Egypt’s local press and Israel’s Algemeiner Journal. Delek, a member of the consortium, blamed an unexpected surge in domestic demand, but anonymous sources told Israeli newspapers that the real culprit is a hold up in obtaining approvals from Israel’s Energy Ministry.

Israel’s competition watchdog also needs to sign off on an agreement related to the pipeline which will be used to transport the gas, the sources said. The consortium, however, expects Israeli Energy Minister Yuoval Shneitz to step in and support clearance. It is unclear whether the agreement pending approval is the USD 518 mn sale of a 39% stake in Ashkelon-Arish pipeline operator Eastern Mediterranean Gas (EMG) to Delek, Noble, and Egypt’s East Gas late September. The pipeline was used in the pre-2011 revolution era to transport gas into Israel, but is now being made ready to flow in the opposite direction. Delek said in yesterday’s statements that tests on switching the flow direction were successful.

Background: Delek and its US-based partner Noble Energy partnered together last year with other Israeli energy companies to form the Tamar Gas Consortium. The consortium then signed a USD 15 bn agreement to supply Alaa Arafa-led Dolphinus Holding with gas from each of the Leviathan and Tamar gas fields. Commercial sales of the gas should have begun by the end of June, according to a target Delek announced last month.

M&A WATCH- GC Equity Partners III fund looking to compete for 100% stake in Arab Dairy: UAE-based Gulf Capital’s GC Equity Partners III fund has asked to conduct due diligence ahead of a potential bid for 100% of Arab Dairy, sources familiar with the matter told Hapi Journal. The fund will be up against Netherlands-based FrieslandCampina, which was given the green light earlier this month to do due diligence to submit a competing bid to acquire the Egyptian cheese maker. Arab Dairy is 70% owned by Pioneers Holding.

STARTUP WATCH- Cairo-based tuk-tuk and motorcycle ride-hailing startup Halan has launched Halan Ads, allowing companies to advertise on its fleet, according to Menabytes. Adverts will be displayed on wraps attached to tuk-tuks and small billboards will be mounted to motorcycles. “We feel that mobile advertisements are very underdeveloped in Egypt and can be more effective than traditional outdoor billboards,” said co-founder and CCO Mohamed Aboulnaga. At least three companies have already expressed their intention to advertise with Halan, which reached the 10 mn ride and delivery milestone in April. “We are looking at developing a 360-degree channel of advertising, branding, and engagement for brands and consumers,” Aboulnaga added.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

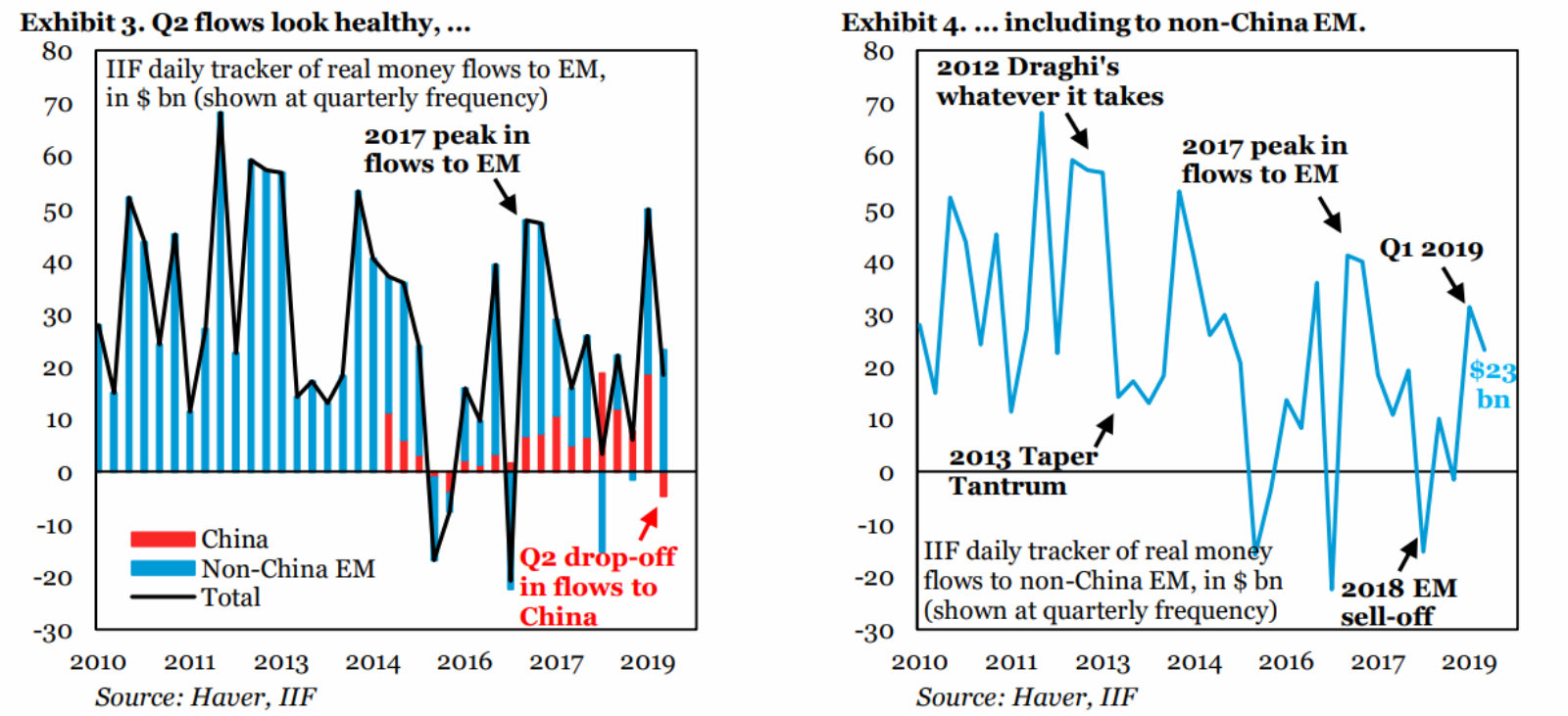

The trade war isn’t affecting emerging markets as much as you thought: Ever since Donald Trump made the first move in the ongoing US-China trade duel last year, financial commentators have ruminated on how emerging markets are about to experience a slow-mo economic calamity. But they appear to have jumped the gun. New data from the Institute of International Finance (IIF) shows that emerging markets have perhaps fared a little better than the experts first thought. Inflows to non-China emerging markets came to around USD 23 bn in 2Q2019, according to the IIF’s capital flow tracker published last week. This marks a 25% fall from the USD 31 bn that made its way into non-China EMs in the first quarter.

“This is still a very healthy pace,” IIF chief economist Robin Brooks writes in the report, but cautions that the current overhang in EM assets will present an obstacle to new inflows. To be sure, the current ‘Trade Tantrum’ predicament pales in comparison to last year’s EM Zombie Apocalypse. You only need to glance at the above graph to see how far away non-China EMs are from a repeat of the 2013 or 2018 experiences.

This is still a significant drop-off though: Make no mistake, an USD 8 bn quarterly fall shouldn’t just be dismissed as a non-event. And while the IIF might call these figures “remarkably robust,” it remains crucial for emerging markets that the US and China come to some sort of truce as soon as possible.

Image of the Day

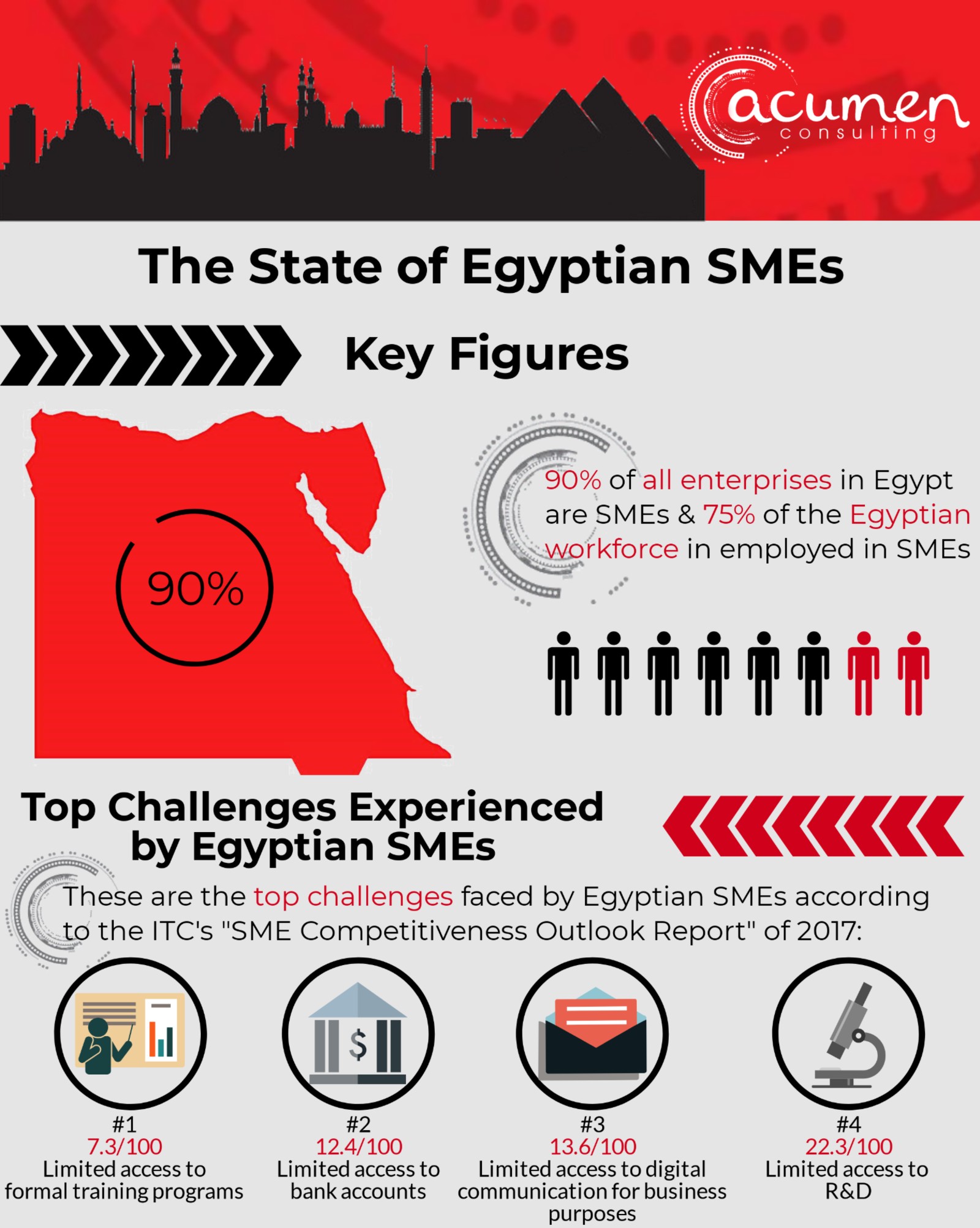

The state of Egypt’s SMEs (there are even more than you thought): Regular Enterprise readers will know we love a good infographic, and this one from our friends at Acumen Consulting offers some interesting information about Egypt’s SME sector from the ITC and FEP Capital. A few noteworthy stats:

- The vast majority (90%) of all enterprises in Egypt are micro businesses and SMEs, employing 75% of the Egyptian workforce;

- Just 7.3/100 people have access to formal training programs and 12.4/100 have bank accounts;

- We have USD 380 mn of unrealized export potential in processed cheese.

Egypt in the News

It’s a blessedly slow morning for Egypt in the foreign press, which offers just a few headlines worth a quick skim:

- Daeshbags deported: Costa Rica will deport two Egyptian Daesh suspects to Egypt after being arrested in Nicaragua last week, AFP reports.

- A new Great Game? Competition for eastern Mediterranean natural gas is giving rise to a new web of alliances and conflicts akin to the 19th century ‘Great Game’ between the UK and Russia, Geoffrey Aronson writes for The Arab Weekly.

- No way back for the Ikhwan: The Muslim Brotherhood is beset by factionalism and disagreement, preventing them from reasserting themselves as a social and political force, writes Mohamed Taha in The Conversation.

- Mo Salah’s defense of Amr Warda has put him on “unfamiliar” grounds with disgruntled fans in Egypt, writes the National’s Hamza Hendawi.

On The Front Pages

The screening of 8 mn women as part of a presidential health care initiative topped the front page of Al Akhbar, one of the country’s three state-run dailies. Both Al Ahram and Al Gomhuria’s websites were still down this morning.

Worth Watching

Irrefutable proof that Mo Salah is meant to be a football player: If Mo Salah ever decides to leave football behind, let’s just say he’s not exactly going to find great success as a basketball player. Exhibit A: This video of him trying to take one successful shot, and picking up the ball with his football moves when he (expectedly) misses, interspersed with reaction clips from Egyptian films for extra comic relief (watch, runtime: 0:53).

Diplomacy + Foreign Trade

EBRD’s Pilloux indicates future cooperation on Egyptian infrastructure projects: The European Bank of Reconstruction & Development’s (EBRD) VP for banking, Alain Pilloux, indicated that the bank could provide finance for a number of Egyptian infrastructure projects in a meeting with Prime Minister Moustafa Madbouly yesterday, according to a cabinet statement. Pilloux said the bank is interested in getting involved with the government’s monorail project, and new oil and electricity infrastructure.

FinMin to finalize USD 500 mn World Bank cash subsidy support loan by the end of the month: The Finance Ministry is set to wrap up the procedures of obtaining a USD 500 mn loan offered by the World Bank last year to support the Takaful and Karama cash subsidy programs by the end of the month, Deputy Social Solidarity Minister Nevine El Kabbag said, according to Al Mal. The ministry will receive 10% of the loan to set up projects for families enrolled in said social welfare programs. The remaining proceeds will be used for yet-to-be-decided projects.

Energy

Molla discusses joint project with Schlumberger in Egypt with company top execs

Oil Minister Tarek El Molla discussed his ministry’s joint projects with Schlumberger in the Western Desert, Gulf of Suez, and the Red Sea with northern Middle East President Maen Razouqi and Egypt and East Mediteranean Managing Director Karim Badawi yesterday, according to a Cabinet statement. Schlumberger is planning to partner with the government on more projects in the coming period as Egypt is a “priority country” in the region, Razouqi said.

Basic Materials + Commodities

Agriculture Ministry, Gogreen mull livestock project in Western Desert

The Agriculture Ministry and Gogreen for Agricultural Investment and Development are studying a livestock project that would produce 50k head of cattle in five years in Al Moghra in the Western Desert, Amwal Al Ghad reports.

ITDA, Carrefour sign agreement to set up four distribution centers in Egypt

The Supply Ministry’s Internal Trade Development Authority (ITDA) and Majid Al Futtaim Retail have signed an agreement to set up four logistics and distribution centers at undisclosed locations, company COO Herve Majidier said, according to Al Mal. His company signed a cooperation protocol with an arm of Elsewedy Electric) to begin construction work on the first two centers, he told reporters yesterday.

Tourism

EgyptAir, Flynas ink interline traffic agreement

EgyptAir has inked an interline traffic agreement with Saudi budget carrier Flynas to offer passengers a wider range of travel destinations, Flynas said in a statement. EgyptAir customers will now be able to travel to a number of destinations in Saudi Arabia, while Flynas passengers can now fly to a host of new cities in North African and European countries.

Banking + Finance

NBG agrees to issue EUR 41.7 mn loan for Elsewedy Electric

The National Bank of Greece has agreed to issue a EUR 41.7 mn loan for Elsewedy Electric, it said in a press release. The long-term facility will be used to partially finance Elsewedy’s acquisition of four Greek renewable energy companies.

Other Business News of Note

Environ Adapt, Ministry of Environment sign protocol to make Dawar official waste management system for seven governorates

Environ Adapt has signed a protocol with the Environment Ministry that will make its Dawar mobile application the official waste monitoring and management system for seven governorates, it announced in a statement (pdf). Dawar uses GPS technology to enable local residents to send photos of street waste to authorized collection companies, each with a location and timestamp included. Its beta version was launched in October 2018.

Egypt Politics + Economics

Egypt’s customs exchange rate remains unchanged

The Finance Ministry has left the discounted customs exchange rate for essential imports unchanged at EGP 16 for July, Masrawy reported. The ministry set the rate for non-essential imports at EGP 16.77.

Egypt aims to pay employees electronically through new state-backed debit card

Around 4.5 mn civil servants could receive their salaries through the state-backed “Meeza” debit cards starting August, Finance Ministry spokesman Mohamed Ibrahim said, according to Al Shorouk. Around 270k citizens have already been issued Meeza cards while the ministry has distributed some 18k PoS machines to government entities. The government had made it mandatory for government payments over EGP 500 to be paid electronically starting 1 May.

On Your Way Out

Actor Ezzat Abou Aouf died on Monday morning, aged 71, after undergoing several years of treatment for heart and liver problems, Al Masry Al Youm reports. He was a prolific performer, appearing in 100 film, TV, and theater productions throughout his career, as well as developing soundtracks and serving as the director for the Cairo International Film Festival for seven years. Some of his best-known performances include “Birds of the Dark” and “The Embassy in the Building,” in which he starred with Adel Imam, and starring as musician Mohammad Abdul Wahab in “Halim,” a biopic about Abdul Halim Hafez. Abou Aouf was beloved by fans and respected by peers, and tributes have poured in since news of his death first emerged.

The Market Yesterday

EGP / USD CBE market average: Buy 16.65 | Sell 16.75

EGP / USD at CIB: Buy 16.64 | Sell 16.74

EGP / USD at NBE: Buy 16.65 | Sell 16.75

WTI: USD 58.86 (-0.39%)

Brent: USD 65.06 (+0.49%)

Natural Gas (Nymex, futures prices) USD 2.27 MMBtu, (-0.09%, Aug 2019 contract)

Gold: USD 1,390.90 / troy ounce (+0.12%)

TASI: 8,852.69 (+0.35%) (YTD: +13.11%)

ADX: 4,978.56 (-0.03%) (YTD: +1.29%)

DFM: 2,673.68 (+0.57%) (YTD: +5.69%)

KSE Premier Market: 6,391.55 (+0.23%)

QE: 10,560.13 (+1.00%) (YTD: +2.54%)

MSM: 3,876.04 (-0.23%) (YTD: -10.08%)

BB: 1,475.62 (+0.31%) (YTD: +10.35%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

1-2 July (Monday-Tuesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

2 July (Tuesday): AmCham monthly luncheon, with Electricity Minister Mohamed Shaker.

7 July (Wednesday): The FRA will hear an appeal filed by Adeptio AD Investments, the lead shareholder of Egyptian International Tourism Projects Company’s (Americana Egypt), against an order to submit an MTO for Americana

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.