- How low do interest rates have to go before Big Business borrows to fund capex? Here’s what you had to say. (Speed Round)

- An 11% stake in Heliopolis Housing is up for grabs — with management rights. (Speed Round)

- Arqaam is Egypt’s first licensed short seller. (Speed Round)

- It’s going to be a bidding war for Emisal. (Speed Round)

- GB Lease completes EGP 767 mn securitized bond issuance. (Speed Round)

- FEI gives seven thumbs up to Mineral Resources Act amendments. (Speed Round)

- Emerging-market enthusiasts are getting a reality check. (What We’re Tracking Today)

- My Morning Routine: Rana Badawy, chief actuary at AXA Egypt.

- The Market Yesterday

Thursday, 13 June 2019

How low do interest rates have to go before Big Business borrows to fund capex? Here’s what you had to say.

TL;DR

What We’re Tracking Today

Monday’s inflation figures are still receiving attention as we prepare to slide into the weekend. Shuaa’s Asset Management Portfolio Manager Aarthi Chandrasekaran tells Bloomberg TV that the spike in annual headline inflation to 14.1% in May will not have come as a surprise to the central bank, adding that the figures will accelerate further in the coming months due to the planned cuts to fuel and electricity subsidies.

Do we have to wait until inflation falls to 10% for further monetary easing? Chandrasekaran predicts that the central bank will hold off on further rate cuts over the next two months. We can expect easing to resume when inflation falls to around 10%, she says.

How far do interest rates have to fall before businesses go on a capex spending binge? That’s the question we posed to nine of Egypt’s leading companies in the food, healthcare, construction, automotive, and financial sectors. Find out what they told us in this morning’s Speed Round below.

It looks like we’ll have to wait at least another week before we have the final FY2019-2020 budget: The House of Representatives’ general assembly is off next week and will reconvene the following week to tie up any loose ends and vote on the budget, which is expected to be the last item on the agenda before representatives depart for the three-month summer recess (we can’t help but feel that we’re in the wrong line of work). Look for plenty of committee-level news next week.

Among the events you may want to mark on your calendars before you head off for your own summer breaks:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada this month from 19-20 June;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs from 18-21 June;

- Middle East and Africa Rail Show will take place at the Egypt International Exhibition Center, Nasr City on 16-18 June;

- Seamless North Africa will be held at the Nile Ritz-Carlton on 17-18 June;

- Cairo Technology Week will run next week at the Hilton Heliopolis on 17-19 June.

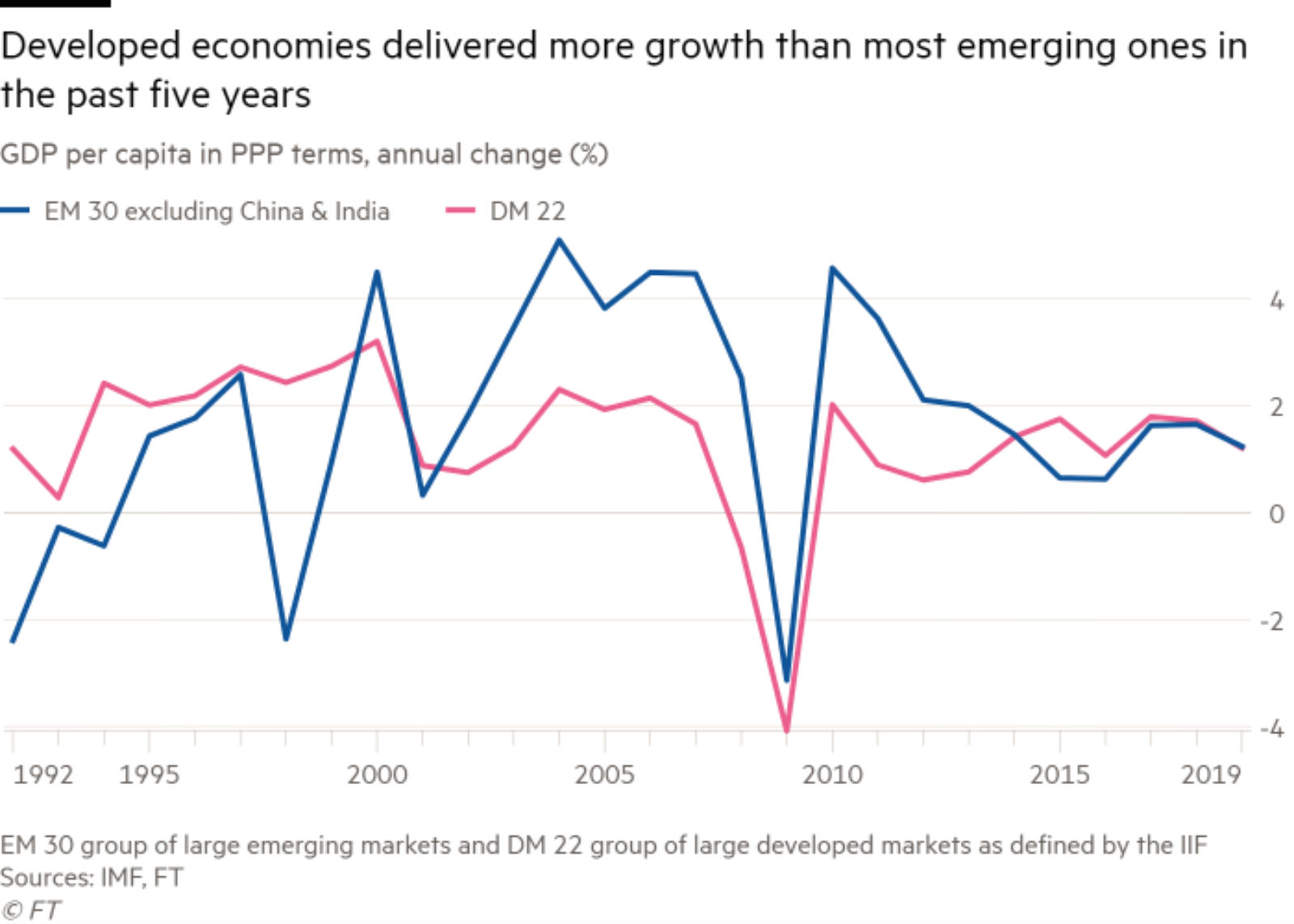

A reality check for EM enthusiasts? EM growth this century has been dominated by China and India, and the last five years have actually seen more growth in developed markets than in most emerging economies, the FT suggests. An analysis of IMF data by the salmon-colored paper appears to undermine the fundamental EM investment proposition (that they are the source of growth premium and high returns) while the US-China trade war may have exposed a pressing need for a new EM growth model.

SIGN OF THE TIMES- Global FDI flows contracted for the third consecutive year in 2018, falling to their lowest levels since the 2008 financial crisis, according to a UN report. We’ll be breaking this down for the macro junkies in Sunday’s issue, but until then the FT has you covered.

It’s not like we needed another reminder, but IMF chief Christine Lagarde and European Central Bank President Mario Draghi are warning that the protectionist trend is posing a threat to the global economy. (CNBC)

Thousands of protesters have amassed in Hong Kong as they demand the government drop bill that would allow extradition to mainland China. Protest organizers said that over 1 mn people took to the streets on Sunday, although official estimates are around 240,000. Protests turned into open clashes with police, who fired tear gas and rubber bullets, Tuesday night and during the day yesterday. Workers and small business owners joined a strike yesterday in opposition to the extradition bill. Officials shut “government offices in the city’s financial district for the rest of the week” today after the protests. The BBC has good coverage here and here.

The Hang Seng fell 2% yesterday as the protests added to the growing list of problems (read: the US-China trade war, a weakening yuan, a spike in the interbank rate) weighing down the Asian market. (Bloomberg)

In miscellany this morning:

Luc Besson was only three centuries out: Melbourne will be the first city outside the US to test the flying taxi-esque UberAir service, which will see “electric vertical take-off” vehicles travelling between “skyports”. Uber plans to commercially launch the futuristic transportation service in 2023. The Guardian has more.

*** Parents, read this: If you’re over the age of 25, your habits are set. You’re either a jerk who makes life miserable for the rest of us forced to share an airline with you. Or you’re one of those forced to suffer through the ill manners and boorish behaviour of the jerks with whom we sahre a metal cylinder in order that we may be hurtled across the earth. Enter the inimitable Tom Nichols, author of The Death of Expertise (which we’ve previously noted): His Six rules everyone should follow when flying must be taught to our children.

With Airbus and Boeing set to make trans-Atlantic flying infinitely worse than it already is, the least those of us who have spawned can do is ensure the next generation is composed of better-behaved air travelers than us.

Enterprise+: Last Night’s Talk Shows

The anti-corruption forum and a construction conference stole the limelight on the nation’s airwaves last night.

Take that, corruption: The two-day African Anti-Corruption Forum (AAFC), which kicked off yesterday, got some airtime on Al Hayah Al Youm’s Lobna Assal (watch, runtime: 2:28). Assal noted President Abdel Fattah El Sisi calls for increased African legislative and judicial cooperation to combat corruption.

The upcoming Builders of Egypt conference, which is set to kick off on 16 June, received some love from Masaa DMC’s Ramy Radwan, who said the event will introduce Egyptian construction companies to investment prospects in Africa (watch, runtime: 2:24).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- The Enterprise business interest rate survey: How far will interest rates have to fall before big business starts borrowing to finance capex? Inflation rose unexpectedly in May, and turmoil in global markets makes it imperative Egypt remain attractive to the carry trade. Together, those factors mean sky-high interest rates are going to be here a while longer. Analysts with whom we spoke last month predicted that the next rate cut was unlikely before 4Q2019, and that consensus held this week.

The issue here is that businesses are borrowing, but only short-term money to finance working capital. They’re not taking out larger, long-term loans to finance new production capacity or innovation — that type of borrowing fell off a cliff when the central bank jacked interest rates to the heavens after the float of the Egyptian pound.

Why? The central bank’s overnight deposit and lending rates have remained unchanged at 15.75% and 16.75% since February. Those are expensive rates at which to borrow — meaning, in very basic terms, that your expansion has to generate much higher returns for it to be worthwhile — instead of just tossing your money in the bank and scooping up the interest.

And it’s actually a lot more expensive than that to borrow: The average interest rate charged by banks to corporates for facilities backing capital expenditure (capex) is on the order of 20%. Think about it: Credit-card interest rate levels to finance your business’ growth.

So we ask: How low do rates have to go before businesses start borrowing again not to finance the day-to-day, but to build something new.

Key highlights: We polled execs at nine companies in the food, healthcare, automotive, construction and financial sectors. Here are the key takeaways:

- Interest rates need fall to 10-13% range (ie: pre-EGP float levels) for capex spending to pick up;

- Some companies need to see a pick-up in consumer demand before increasing spending;

- For others, the trigger is about getting their utilization rates up;

- Companies borrowing in USD have had an easier time financing additional capex — the borrowing cost is just so much lower;

- Most are ready to invest when rates drop.

All nine companies we spoke with want to see a lower interest rate environment and further monetary easing. Overall, the companies would like to see interest rates fall into the 10-13% band Healthcare companies would like to see a 200 bps cut this year, with a long-term interest rates reaching 13%. Auto companies meanwhile are eyeing interest rates in the range of 11-13%, and food industry companies would prefer rates to fall slightly lower to 10-12%. Investment conglomerate Egyptian Kuwait Holding (EKH) would like to see them in the 11-12% range to encourage investment.

Food and auto — they want to grow, but can’t justify the cost as it stands: The food and auto companies with whom we spoke need to borrow for expansion, but struggle to justify borrowing in the current high interest rate environment. “The current high rates eat from earnings and are a financial burden on business. They don't only impact future business, but current operations as well,” says GB Auto Associate Vice President for Investor Relations Andre Valavanis, adding, “All our capex plans are currently shelved because of the high cost of debt.”

The food sector is particularly hamstrung by high interest rates: Dairyfoods player Juhayna has significantly reduced its capex spend since the currency float, having frozen its spending in 2017. Snackfood producer Edita, meanwhile, saw its capex outlay fall to EGP 105.2 mn in 2018 from EGP 361.8 mn in 2015. “Our capex cycle before the float reached about EGP 1 bn at one point in time,” said Ahmed Saad, head of investor relations at Juhayna. “Following the currency float in 2016 it was at a minimum of EGP 200-250 mn annually, mainly for maintenance.” There’s been a modest rebound since out of necessity, he says: “It now stands at approximately EGP 400-450 mn.”

Lower interest rates will also boost consumer demand: For auto and food companies, a lower interest rate environment is also about spurring consumer spending. “Beyond capex,lower rates should also stimulate the economy in terms of consumer demand,” said Edita Investor Relations and Business Development Senior Director Menna Shams El Din. Adds GB Auto’s Valavanis: “It won’t only be about capex, it will bring down prices [in the automotive industry], which leads to more demand and more investment in expansions whether in sales or manufacturing.”

But high rates haven’t deterred health and pharma companies: As defensive stocks whose businesses are far less impacted by economic downturns than automotive or real estate companies, many Egyptian healthcare and pharma companies have continued to borrow to fund capex spending in the current high interest rate environment. Think about it: When your salary doesn’t go as far because of a high inflation environment, you’re still going to buy heart meds and pay school tuition — but you’re not as likely to buy your dream car.

Against that backdrop: Ibnsina Pharma saw capex more than quadruple to EGP 478.9 mn in 2018 from EGP 111.3 mn in 2016. Cleopatra Hospitals raised its spending rise to EGP 148.6 mn in 2018 from EGP 117 mn in 2017. Ibn Sina also benefited from extra liquidity after its highly successful IPO in 2017.

Where you stood before the float also matters: Companies that had borrowed prior to or around the time of the float of the EGP back in 2016 (yes, it’s been more than 2.5 years…) locked-in favorable interest rates. “Fortunately, we had invested over the past years and built our fifth factory. We have already reduced our EGP debt exposure in light of its high cost,” said Edita’s Shams El Din. “We are currently working on USD financing for our Morocco investments and to add some more production lines,” she added.

Companies with USD revenue streams have had fewer worries about the cost of borrowing. “Investments with USD revenue streams are operating on USD debt, while projects whose revenues are in EGP are executed over multiple phases to reduce the cost,” said EKH’s Investor Relations Director Haitham Abdel Moneim. “We are planning to invest around USD 180 mn in 2019, including USD 110 mn at our natural gas operations, where revenues are covered in USD. It is the same case for electricity projects in which we plan to invest USD 25 mn with a 60:40 debt-to-equity ratio,” he added.

Some are still waiting for utilization rates recover and even get close to the red line before borrowing again: “Our current focus is to do the necessary capex to maintain equipment and secure our market position,” said Juhayna’s Saad. “We are also focused on utilizing current capacities before investing in adding new ones,” he added. “In 2020, when we expect to see higher utilization rates, we would have a clear picture of the best expansion routes.”

Where would our poll-takers deploy new financing if interest rates were to come down?

- Abou Ghaly Motors: “[Low interest rates] will allow us to expand investments, speed up expansions and increase profits,” said Tamer Kotb, the company’s commercial director, said. “It will allow us to expand by increasing branches and expand the car hiring business by buying more cars — and we’ll be able to generate new demand then by lowering rental prices.”

- GB Auto: “Once rates are reasonable, we want to spend between EGP 400-500 mn on service centers, not to mention other expansions and investments that will open up in this new environment,” Valavanis said.

- EKH: “If [for example] we get the sense that there is a direction for easing, we could speed up our investment in the new EGP 2 bn medium-density fiberboard factory,” said Abdel Moneim.

- Juhayna: “Cutting rates will allow us to think broader than our current pipelines and look at different investment openings for growth and It will allow us more financial flexibility,” Saad told us.

- Ibnsina: It’s more about the short term in a cash-intensive business that’s already built out its infrastructure: “If rates fall substantially, this will allow us to use bank facilities to fund cash purchases from suppliers and get cash discounts,” the company’s investor relations manager, Mohamed Shawky, said. “This should improve our margins and will give us financial flexibility.”

M&A WATCH- Gov’t to offer 11% stake in Heliopolis Housing — with management rights: The Public Enterprises Ministry and the Holding Company for Construction and Development have given principal approval to hand the management of Heliopolis Housing & Development (HHD) to a private investor, Heliopolis Housing said in a bourse filing (pdf). The company will offer 22% of its equity in a share sale, half of which will be sold to the investor. The plan still needs the approval of the company’s general assembly. No further details were given on the transaction or whether any investors had expressed interest.

Background: HHD was dropped from the lineup of companies in the first wave of the state privatization program in April. Public Enterprises Minister Hisham Tawfik said in May that while the sale of an additional stake on the EGX in 4Q2019 remains a possibility, the option to develop the company in partnership with a strategic investor is also on the table.

Arqaam gets Egypt’s first short selling license from FRA: Arqaam Securities Brokerage has officially become the first brokerage firm allowed to short sell after receiving a license from the Financial Regulatory Authority (FRA), the regulator said in a statement (pdf).

What’s a short? Let’s pretend that you believe that shares of Company X are overvalued. Shorting allows you to profit on this belief. At the simplest level, it works like this:

- Step 1: Borrow a load of company X’s shares (likely from someone who wants to hold them long-term);

- Step 2: Sell them immediately back to the market;

- Step 3: Pray the price goes down (and mount an activist campaign if you have to…);

- Step 4: Buy them back on the open market and return them to their rightful owner to “close out your position”;

- Step 5: Pocket the difference (presuming, of course, the price went down).

Background: Under FRA regulations, you can only short 20% of a company’s freefloat shares while any one shareholder won’t be able to lend more than 5% of a company’s shares. The regulations also cap the total percentage of any company’s shares that can be used to create a short position. Folks looking to open a short position will need to put down 50% of the value of the securities borrowed, and brokerages will be required to park that sum in fixed-income assets while the position is open. We have an EGX-approved list of short sell-able stocks here.

M&A WATCH- Bidders have until the end of this month to submit tender offers for Emisal: The National Bank of Egypt is giving would-be bidders until the end of the month to make offers for Emisal Salts, company sources told the local press. Earlier this week, a consortium made up of Kuwait’s Al Madar Finance and Investment and the Saudi-Egyptian Industrial Investment (SEII) said it was looking to acquire Emisal, potentially triggering a bidding war with Egypt Kuwait Holding, which had made an approach back in February. NBE is leading the sale process on behalf of other state-owned shareholders.

GB Lease has completed a EGP 767 mn securitized bond issuance to improve its short-term liquidity position, according to a press release (pdf). The offering included three tranches: a EGP 203 mn 13-month bond with a variable yield of 40 bps, a EGP 353 mn 3-year bond with a 90 bps yield and a EGP 211 mn 5-year bond yielding 145 bps. The tranches received ratings of AA+, AA, and A respectively. “I am very pleased that GB Lease’s second securitized offering received a strong rating from international agencies that reflects a high quality portfolio of receivables,” Managing Director Sherif Sabry said.

LEGISLATION WATCH- Leaked draft law would grant autonomy to the FRA: The full draft of a proposed law to grant the Financial Regulatory Authority (FRA) operational autonomy from the government has been published by Al Mal. The bill, if passed, would give the authority status as a separate legal entity with its own balance sheet. The authority’s head would be appointed by the president and would effectively have cabinet rank. The bill is currently being discussed by the House of Representatives and would need to be passed by the general assembly before El Sisi signs it into law.

Background: The Madbouly Cabinet approved the bill in February, paving the way for the authority to gain technical, financial, and administrative autonomy. Among the details released at the time was that it would require the authority to submit an annual report on its activities and the performance of the non-banking financial services industry to the president, prime minister, and House speaker. It would also outline the structure of the authority and the procedures for appointing its head and board members. The regulator was established in 2009 as an independent entity but is still subject to oversight from the cabinet.

FEI says it likes proposed amendments to the Mineral Resources Act — with one caveat: The mines and quarries division of the Federation of Egyptian Industries (FEI) has voiced approval for the main provisions of the Mineral Resources Act amendments, local press reported. The business association appears satisfied with the amendments governing licensing, the regulatory framework, and punitive measures when it presented its suggestions to the House’s industry committee this week.

Their primary gripe appears to be the royalties. Under the draft currently being discussed in the House, companies will have to pay a minimum royalty of 5% of annual production, with a 20% cap being set. The FEI would like to see the royalties be brought down to within the 3-10% range. Instead of paying governorates 6% of the mine’s production in “rent,” the FEI is suggesting that revenues from royalties be split between the Egyptian Mineral Resources Administration (EMRA) and the governorate. They also would like concession rights to be limited to six years, with the license being revoked if the concession has not been developed within two years.

Trade deficit shrinks 7.8% y-o-y in 1Q2019 -Reuters: Egypt’s trade deficit has shrunk by 7.8% y-o-y in 1Q2019 to USD 10.57 bn, according to calculations made by Reuters Arabic based on data from CAPMAS. The narrowing of the deficit was caused by a 5.5% y-o-y fall in imports to USD 17.96 bn, which offset a 1.9% y-o-y decline in exports to USD 7.39 bn.

MOVES- Lufthansa Group has appointed Silke Wobken as its senior director for sales based in Cairo, covering North Africa, the Near East and Turkey, the German airline said yesterday in a statement (pdf). She succeeds Frank Van den Steen, who returns to Lufthansa’s headquarters in Frankfurt. Wobken is currently the airline’s director of sales for northern Germany.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Egypt in the News

Leading the conversation about Egypt in the foreign press this morning: The Associated Press reports that a court has handed out jail terms to 296 people on terror charges. The majority (264) were given sentences ranging between three and 15 years, while 32 were sentenced to life after plotting to assassinate the president. Asharq Al Awsat also picked up the story.

Other headlines worth a moment of your time:

- A road accident in Helwan: A multi-vehicle accident in Helwan yesterday resulted in 14 fatalities and 10 injuries, according to the AP.

- Egypt’s self-appointed morality cop has a new target: Samir Sabry, the lawyer who has made a name for himself going after Egypt’s most high-profile sinners, is turning his attention to Egypt’s community of wealthy Syrians, The National reports.

On The Front Pages

President Abdel Fattah El Sisi’s statements during the African Anti-Corruption Forum, which kicked off yesterday in Sharm El Sheikh, topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria). The two-day event will wrap up later today.

Worth Watching

Red Bull has sold the world (way) more energy drinks than it needs. But there’s much more to the company’s story than meets the eye, as this Bloomberg video explains (watch, runtime: 5:54). The company’s mysterious founder, Austrian entrepreneur Dietrich Mateschitz, made sure that its tagline (Red Bull gives you wings) communicated a very specific message. It promises to make your life more adventurous, more thrill-seeking. And it reinforces this through wild, big-budget marketing campaigns (such as Felix Baumgartner’s record skydive), the ownership of sports teams, and the creation of globally-recognized extreme sports competitions.

Diplomacy + Foreign Trade

El Sisi discuss terrorism, regional affairs with World Jewish Congress boss: President Abdel Fattah El Sisi discussed the Middle Eastern peace process and US-Egypt relations with World Jewish Congress President Ronald Lauder in Cairo on Tuesday, according to an Ittihadiya. The story was picked up by Israel National News.

Energy

Siemens Gamesa frontrunner to build Lekela’s 250 MW wind energy plant in Ras Ghareb

Siemens Gamesa is the frontrunner in a tender to build Lekela’s 250 MW wind energy plant in Ras Ghareb, sources close to the matter told the local press. Siemens Gamesa’s offer is better than offers submitted by Germany’s Senvion and Denmark’s Vestas, the sources said, adding that contracts are expected to be signed within the next two months. Lekela is expected to reach financial close for the project in August for Siemens to begin construction next year, the sources said. Siemens Gamesa is expected to partner up with either Elsewedy Electric or Orascom Construction to build the project. Three European banks have agreed to lend Lekla USD 245 mn for the project, which will be built under the build-own-operate (BOO) framework.

Total mulls expanding exploration in Mediterranean and Red Seas

French energy giant Total is considering bidding for new oil and gas exploration concessions in Egypt’s Mediterranean and Red Sea territories, chairman and CEO Patrick Pouyanne told Oil Minister Tarek El Molla in a meeting yesterday, Al Shorouk reports. The company is also looking at increasing investments in expanding fuel stations and fuel transportation.

Infrastructure

Denmark’s A.P. Møller Capital eyes investing in Egypt’s 10th of Ramadan dry port

Denmark-based A.P. Møller Capital, the investment arm of Maersk, is eyeing investing in the 10th of Ramdan dry port and will launch studies in July, according to a Transport Ministry statement. This came following a meeting between minister Kamel El Wazir and Denmark’s ambassador to Egypt Tomas Anker Christensen. The two discussed cooperation in the logistics sector.

My Morning Routine

My Morning Routine looks each week at how a successful member of the business community starts their day — and then throws in a couple of random questions just for fun. Speaking to us this week is Rana Badawy (LinkedIn), chief actuary at AXA Egypt, the local arm of the global insurance company.

My name is Rana Badawy, and I’m the chief actuary at AXA Egypt. AXA is a French multinational insurance firm which entered the Egyptian market in 2015, focusing on the non-life insurance and health markets. After two years, it acquired one of the largest life insurers in the market. We cater to both corporations and the retail sector in Egypt.

You might ask what on earth the job of chief actuary entails, and a common response is to talk about financial models, projections and probabilities — AUC provides a great overview on this. But that doesn’t really capture my role. In essence, I get to lead a team of incredibly gifted individuals who dive into data and bring meaning to numbers. It’s our job to provide incisive business intelligence and insights that enable management to act quickly and serve our customers better. And it involves a lot of creativity about how to visualize data and make complex issues understandable to everyone.

I would describe myself as the product of many influences and experiences. I was educated at German and American institutions and, while this was testing at times, I feel that experiencing two different educational philosophies helped develop both sides of my brain. But I’m Egyptian at my core: born, bred and intending to stay in Om El Donya. I’m very active and, as a former national volleyball player, I get agitated if I don’t break a sweat every couple of days.

I have a highly entrepreneurial and extremely supportive family. My parents have always tried to use their businesses to benefit society and their family. My brother Yehia is a co-founder of the region’s first fully licensed digital currency exchange. So I think entrepreneurship runs in my blood and at some stage I will follow in their footsteps and go it on my own (but not for a while yet).

I’m an early riser, waking up without an alarm between 4 and 5am. Usually I find at least one of my parents already up, so we get some quality time together before the rush of the day. These golden hours of the morning are my zen time. Creative solutions and new ideas pop into my head and I make sure to write them all down. I catch up on the news (Enterprise, Al Mal, BBC, Guardian, Bloomberg) and have a quick look at my calendar to start mentally preparing for the day. I have a light breakfast and then head to my workout at 7am, in time to be at work at 9am.

I’ve just completed two half marathons, and am now training to complete my first 70.3-mile triathlon.

Being surrounded by business owners, I love watching and reading anything about entrepreneurship. So I’ve enjoyed listening to the podcast How I Built This and watching Shark Tank. I recently read the book Nudge, which gives valuable insights about human psychology and how people are influenced by their environment. It pushes you to think about how to reach people to bring about positive changes in their behavior.

My taste is eclectic when I’m reading purely for enjoyment. It’s important to me to read in Arabic because I’m very proud of my Egyptian heritage, and reading old Arabic literature helps remain connected to the language. So I like to read novels by Yusuf El Sibai and Naguib Mahfouz. At the same time, I enjoy contemporary writers including Roald Dahl, Elif Shafak, and Khaled Hosseini. I read in German whenever possible and recently finished reading the novel Perfume in its original language.

AXA aims to be a “one stop shop,” helping our partners — individuals and businesses — to achieve their long term financial goals by providing quality advice. Insurance companies exist to protect people and to pay claims when needed. We want to have a social impact, and I take pride in the fact that we help people get access to quality medical care — or that we help make sure the recently bereaved don’t fall into poverty. Supporting people suffering through unfortunate events is the core of our business.

I see two areas where the insurance industry will grow substantially in the near future. Increased financial inclusion will hopefully provide a safety net and more accessibility for people who do not currently have any coverage. So microfinance and microinsurance initiatives, as well as the Universal Healthcare Act, will materially increase insurance penetration and people’s appreciation of its value. Meanwhile, technological developments and an improved understanding of data should allow insurers to make it easier for customers to get coverage. I see real appetite in the industry to simplify processes and reduce a lot of the mystery around insurance. The ability to analyze and better understand customer behavior through data will be a game changer.

I do a lot of volunteer work in my spare time, as does my family. My mum works in education, and she has dedicated her life to developing the next generation of thinkers and doers. Her family has an orphanage in Upper Egypt, and my dad has a foundation in the Delta, so it runs in my blood to volunteer for social causes. I am a passionate environmentalist — I’m passionate about a very important initiative called Save Egypt’s Water.

I’m also driven by a desire to explore and learn new things. In the past couple of years I’ve learned parachuting, diving, skiing, kite-surfing, in-line skating, interior design, and beadmaking. History, culture, industries and businesses are built around so many different things, so you never know when you can connect the dots in an unconventional way and carry ideas over to apply them to your own situation. For example, Dyson was inspired by looking at the way airplanes work when he invented his bladeless fan (which he called the Air Multiplier).

I have two main ways of staying organized: Firstly, I try to start every day with a clear and focused vision of what I want to get done. Secondly, I use the Pomodoro Technique, where you break your time into chunks of intense, focused work, punctuated by breaks in between.

The best piece of business advice I’ve ever been given came from my mentor, who shaped the early years of my career in a significant way. It’s simple: If you take care of your people, they will take care of the business.

The Market Yesterday

EGP / USD CBE market average: Buy 16.69 | Sell 16.79

EGP / USD at CIB: Buy 16.67 | Sell 16.77

EGP / USD at NBE: Buy 16.71 | Sell 16.81

EGX30 (Wednesday): 14,158 (-0.3%)

Turnover: EGP 680 mn (12% below the 90-day average)

EGX 30 year-to-date: +8.6%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.3%. CIB, the index heaviest constituent ended up 0.3%. EGX30’s top performing constituents were Madinet Nasr Housing up 3.1%, Heliopolis Housing up 3.1%, and Qalaa Holdings up 1.1%. Yesterday’s worst performing stocks were GB Auto down 3.0%, Orascom Development down 2.4% and Eastern Co down 2.3%. The market turnover was EGP 680 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -52.1 mn

Regional: Net Long | EGP +3.7 mn

Domestic: Net Long | EGP +48.4 mn

Retail: 49.2% of total trades | 52.6% of buyers | 45.8% of sellers

Institutions: 50.8% of total trades | 47.4% of buyers | 54.2% of sellers

WTI: USD 51.13 (-0.02%)

Brent: USD 59.97 (-3.72%)

Natural Gas (Nymex, futures prices) USD 2.38 MMBtu, (-0.21%, Jul 2019 contract)

Gold: USD 1,337.50 / troy ounce (+0.05%)

TASI: 9,084.75 (+1.06%) (YTD: +16.07%)

ADX: 4,990.86 (+0.50%) (YTD: +1.54%)

DFM: 2,663.55 (-0.44%) (YTD: +5.29%)

KSE Premier Market: 6,455.50 (-0.63%)

QE: 10,621.76 (+0.35%) (YTD: +3.13%)

MSM: 3,962.20 (-0.51%) (YTD: -8.36%)

BB: 1,451.00 (+0.06%) (YTD: +8.51%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

12-13 June (Wednesday-Thursday): The African Anti-Corruption Forum (AACF), Sharm El Sheikh

15 June (Saturday): An administrative court will look into an appeal by steel manufacturers to cancel the recently-imposed duties on imported steel rebars and pellets.

Mid-June: A delegation of Egyptian businessmen will head to Estonia and Latvia to explore investment prospects in the two eastern European nations.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-21 June (Tuesday-Friday): President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

18 June (Tuesday): IDC CIO Summit, Marriott Hotel Zamalek, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, GrEEk Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.