- FinMin looks set to set new medium-term economic targets as global headwinds build. (Speed Round)

- Egypt will be a highly resilient “hidden gem” as EM face global challenges -Bloomberg. (Speed Round)

- CBE to reintroduce subsidized funding for middle-income mortgages. (Speed Round)

- Egypt just got its first licensed SME-focused lender. (Speed Round)

- Customs exchange rate left unchanged for June despite strengthening EGP. (Speed Round)

- EgyptAir is about to introduce wifi on some international routes. (Speed Round)

- Cairo’s Liver-fuul cart in the headlines as Salah leads Liverpool to Champions league title. (Image of the Day)

- We’re heading into a five-day holiday weekend. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 2 June 2019

Finance Ministry to set new macro targets as global headwinds build

TL;DR

What We’re Tracking Today

It’s shaping up to be a five-day holiday weekend after cabinet announced over the weekend that Tuesday through Thursday will be off for the civil service in observance of Eid El Fitr. There have been no announcements yet from the Central Bank of Egypt or the EGX, but government holiday = CBE holiday = banks closed and, as a result, capital markets are on holiday.

Enterprise will be off Tuesday through Thursday. We wish all of you a blessed and relaxing Eid with family, friends and … coffee. Lots and lots of coffee.

The EGP gained 0.3% on the greenback last week, closing on Thursday at a sell price of 16.83, according to the CBE, against 16.88 at the end of the previous week.

Data points due out this week and next:

- Foreign reserves: The CBE should announce this week Egypt’s net foreign reserves as at the end of May.

- Inflation: Monthly inflation figures are due out next week. Annual headline inflation cooled unexpectedly in April to 13% from 14.2% in March.

- PMI: The purchasing managers’ index for Egypt, Saudi Arabia, and the UAE is due out on Monday, 10 June at 6:15am CLT.

Tariff Man’s latest: Fresh from upping the stakes in his trade war with China, US President Donald Trump threatened on Friday to slap a 5% tariff on all Mexican goods on 10 June unless the Mexican government put a stop to illegal migration.

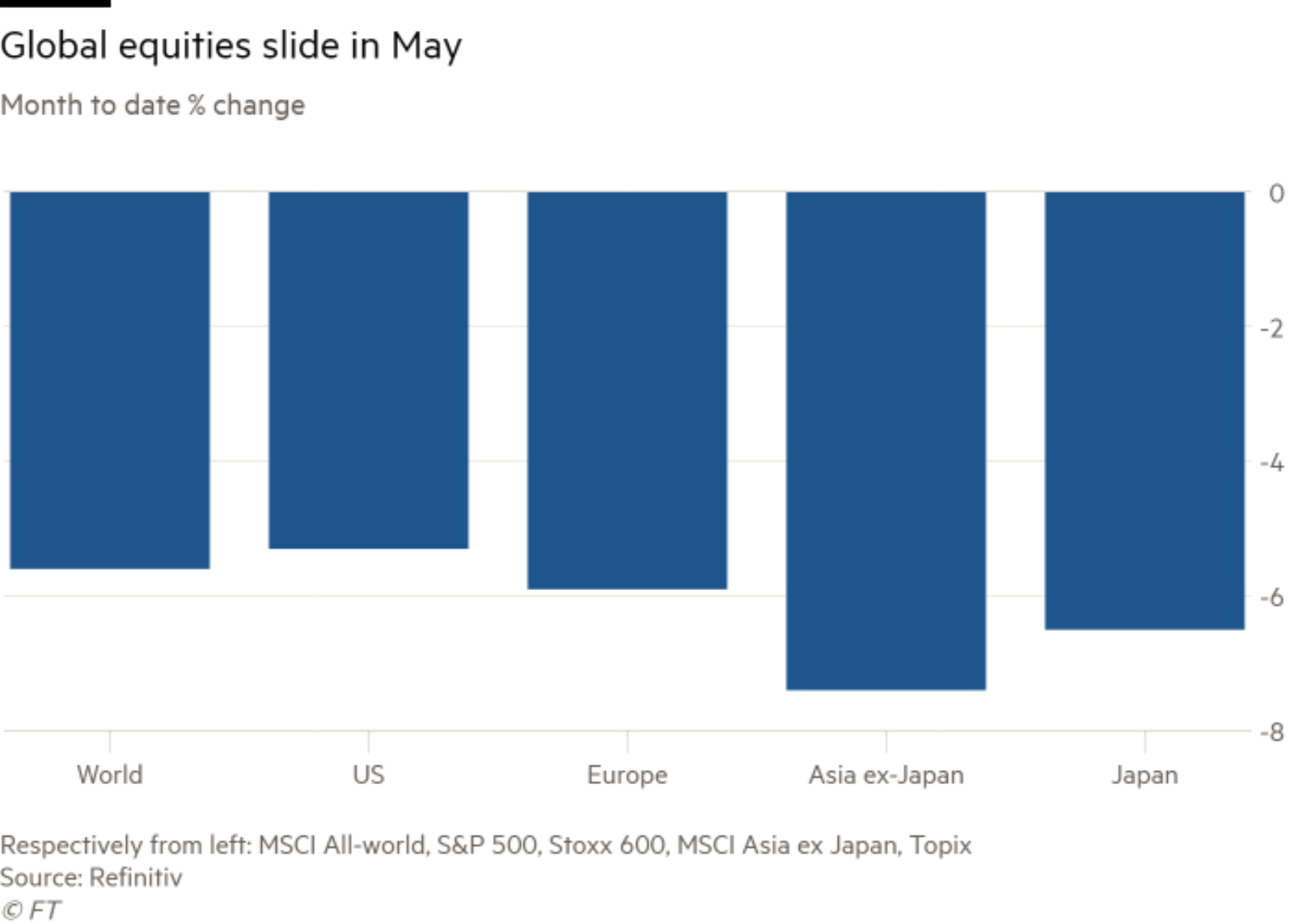

Global markets aren’t taking it very well… US markets closed last week in the red (with the S&P down 6% for May), as did European and Asian shares. Oil plunged, too, with Brent down nearly 4% on Friday. Investors continued piling into the relative safety of bonds, and the inverted yield curve is widening: The spread between 3-month and 10-year US bonds — traditionally an early predictor of a recession — widened to 21 basis points for the first time since 2007. See wall-to-wall coverage in the global business press: Bloomberg | FT | WSJ Reuters.

…And economists think the Mexico sanctions are a horrible idea: “The massive supply chain disruptions, significantly tighter financial conditions and depressed private sector confidence would amplify the direct tariff shock and increase the odds of a US downturn,” Gregory Daco, chief US economist at Oxford Economics, told the FT.

All of this could prompt the US Federal Reserve to cut interest rates if, as some expect, the trade wars cause the US economy to sputter — JPMorgan’s chief US economist is now calling rate cuts in September and December, though the FT’s Michael Mackenzie counters that the Fed is unlikely to cut “unless inflation falls below its 2% target rate or consumption and investment take a serious hit.”

Canary in the coal mine? Watch what happens with FedEx. China announced on Friday that it will draw up a list of “unreliable” foreign companies that could be banned from the country for harming domestic businesses and consumers. FedEx looks to be first on the chopping block, with Chinese officials announcing an investigation into the company’s “wrongful delivery of packages,” Bloomberg reports.

Is Turkey beginning to emerge from its recession? Yes, but it isn’t enough to undo last year’s damage and the recovery may not be permanent, according to the Financial Times. Propelled by government spending, Turkey’s GDP grew 1.3% during 1Q2019, but the economy remains 2.6% smaller than it was a year ago due to the effects of the recession. “Although the economy has grown at a high rate, we think that this was largely driven by the increase in fiscal spending and a loosening in credit conditions,” Goldman Sachs analysts said in a note to clients. The analysts expect another downturn and see the Turkish economy contracting again in 2Q and 3Q2019.

What We’re Tracking Today, the Ramadan edition:

The Boston Celtics’ Jaylen Brown joined a pickup game Cairo American College and the US sports press went a little bit bananas, saying the 2016 NBA draft’s third pick used the game as a “convenient excuse to show off his moves” as he “flashed an absolutely filthy crossover” on the CAC kid tapped to guard him before draining a jumper. Yahoo Sports and Boston CBS affiliate WBZ have the story. Watch what appears to be the original video here (runtime: 0:24).

Goodbye, iTunes? Kinda. Apple is expected to launch three new apps that individually provide what iTunes currently provides on one platform: Music, TV, and podcasts, according to Bloomberg in a t-up piece for WWDC — effectively the start of Apple’s product year. The shift away from iTunes comes in tandem with the company’s move to make its products more independent — it will introduce new iPad software that will help sell the product as a feasible alternative to laptops, as well as Apple Watch software that reduces its dependence on the iPhone.

True iSheep will want to tune in here tomorrow at around 7pm CLT to livestream WWDC. 9to5 Mac has more, as does the Financial Times with its Five things to watch at WWDC.

True nerds can follow WWDC by Sundell for daily coverage of the gathering including “articles, videos, podcasts, and interviews, covering all things WWDC — from recommendations on what session videos to watch, to in-depth looks at new APIs, to interviews with people from all over the Apple developer community.” Hometown bonus: The site is co-sponsored by Egypt’s very own Instabug.

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- Laptops are getting weird and wonderful again — it’s all about dual-screens and foldable devices, the Verge writes.

- ESG hypocrisy: How is it okay for a fund that claims to be driven by ESG principles to invest in a company that provides systems to dentention camps and enables “mass surveillance of a Muslim ethnic minority group” in China? (Financial Times)

- It can be hard to follow a legendary act. Here are thoughts on how you can pull it off. Tim Cook managed it — we don’t need to name his company for you to identify him, do we? But John Flannery? That’s another story. Check out Strategy + Business and read Succeeding the long-serving legend in the corner office and How new leaders can step out of the shadow of a legendary CEO.

BBM shut down on Friday. That is all.

Consumerism we love, part 1: Ikea UAE’s ad campaign titled Real life series, wherein Publicis Spain recreates iconic rooms from Stranger Things, Friends and The Simpsons using Ikea furniture. PetaPixel has the summary, while AdAge drills deep for the ad geeks out there.

Consumerism we love, part 2: Nike and Stranger Things seem set to launch a sneaker and clothing collaboration.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

So, when do we eat? Maghrib is at 6:52pm CLT today in Cairo. You’ll have until 3:10am tomorrow morning to caffeinate / finish your sohour.

Enterprise+: Last Night’s Talk Shows

We’re on the last few days of the talking heads’ annual Ramadan hiatus. Check back here for our usual rundown of last night’s talk shows after Eid break.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- FinMin to set new medium-term economic targets as global macro headwinds build: The Finance Ministry is on track to specify “more realistic” medium-term targets for Egypt’s key macro indicators in light of a challenging outlook for global growth and volatility in emerging markets, according to official documents seen by Enterprise.

It’s a tough pill to swallow, but acknowledging the headwinds reflects maturity on the part of policymakers. Among the highlights:

GDP growth: The ministry could revise downward its forecasts for GDP growth for FY2020-2021 to 6.5%, down from an initially forecasted 7.2%. GDP growth is expected to reach 7% in FY2021-2022, according to the amended targets. The ministry had previously also cut its expectations for GDP growth in the current fiscal year to 5.6% from 5.8%, and the upcoming fiscal year to 6% from an initial 6.5%.

Interest rates and oil prices: The ministry is working with the assumption that interest rates will remain high at 15.5% in FY2019-2020, after initially expecting the Central Bank of Egypt to cut rates to an average of 10.7%. The ministry now sees rates averaging 11.5% in FY2020-2021 and 10% in FY2021-2022. It is also budgeting for oil at USD 68 per barrel in FY2020-2021.

Inflation: The ministry expects inflation to cool to an average of 10.5% in FY2019-2020 (up from an earlier projection of 9.7%) and to continue declining over the following two years to 9.1% in FY2020-2021 (previous forecast: 7.1%) and 8% in FY2021-2022.

Budget deficit: Egypt’s budget deficit is now expected to narrow to 6.2% of GDP in FY2020-2021 and 4.8% in FY2021-2022, according to the ministry’s revised projections. Initial forecasts had set a budget deficit target of 5% for FY2020-2021. The budget deficit is expected to hit 7.2% of GDP in the next fiscal year, the Finance Ministry said in its draft state budget.

Public debt is expected to reach 84.8% of GDP in FY2020-2021, up from a previous forecast of 80%. The ministry is looking to further narrow debt levels to 79.4% by FY2021-2022.

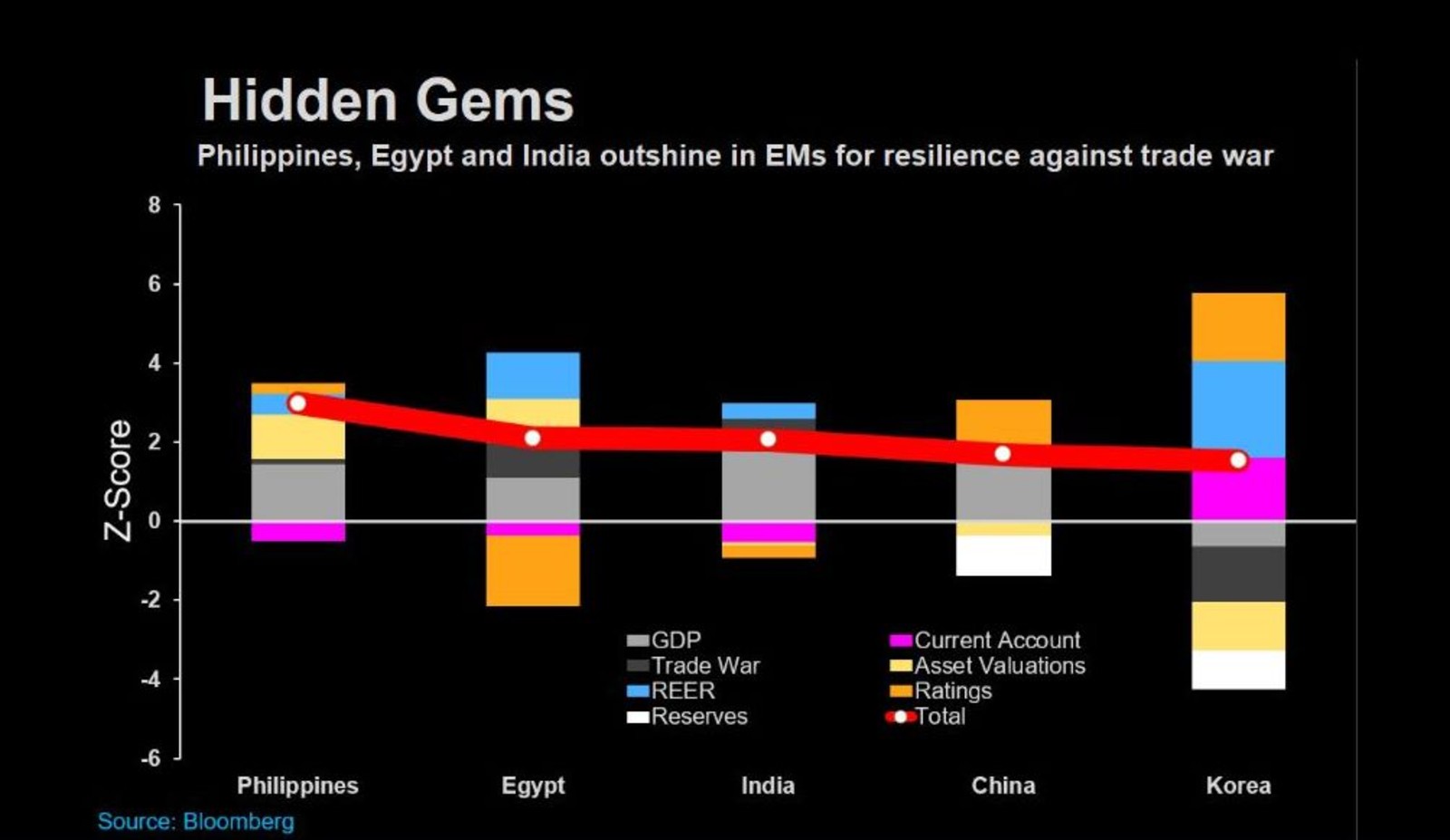

Egypt is a highly resilient “hidden gem” among EMs -Bloomberg. Egypt, the Philippines, and India are sitting at the top of a Bloomberg ranking of the most resilient emerging markets amid the instability prompted by the US-China trade war. The study ranks 21 developing economies on factors including domestic demand and exposure to China or the US. Recent EM sell-offs have left assets in both Egypt and the Philippines relatively undervalued, insulating them from the shocks to which Mexico, for example, is vulnerable as a result of the trade war.

Egypt’s budget deficit fell to 5.3% of GDP in 9M2018-2019, compared to 6.2% in the same period the previous year, the Finance Ministry said in its April monthly bulletin (pdf). The primary surplus came at 0.7% of GDP during the first nine months of the fiscal year. The numbers came on the back of revenues growing 20.3% y-o-y to EGP 598.7 bn, outpacing the 14% growth in expenditures to EGP 879 bn. Tax revenues increased 16.2% y-o-y to EGP 468.4 bn, of which VAT contributed EGP 247.5 bn. The government is targeting GDP growth of 5.6% for the current fiscal year.

Background: Projections for GDP growth in FY2018-19 from HSBC, the European Bank for Reconstruction and Development, Capital Economics, Fitch Group’s BMI Research, and economists polled by Reuters have ranged between 3.8% and 5.5%.

The Central Bank of Egypt (CBE) announced on Thursday it will provide EGP 50 bn to reintroduce subsidized mortgages for middle-income homeowners, according to a statement (pdf). A committee with members from the central bank, local banks, and real estate developers will be formed to discuss the specifics of the financing. The mortgage financing program is meant to support the real estate sector to expand projects that “will have an economic impact in employment, GDP, and the economy,” the statement says.

Background: Earlier in April, the central bank has agreed to a proposal from the Federation of Egyptian Industries’ Real Estate Development Chamber to reintroduce lower interest rates for would-be middle-income homebuyers. The initiative will offer preferential interest rates of 10.5% to prospective homeowners starting from July, the chamber’s chairman Tarek Shoukry said at the time. A similar program originally ran from 2014 until January this year and offered middle-income homeowners long-term loans at a 5-7% rate of interest.

Egypt just got its first licensed SME-focused lender: UK-based development finance institution CDC Group has been granted a license from the Central Bank of Egypt (CBE) to act as a “tier two” lender in Egypt, according to a statement. CDC will offer as much as USD 200 mn to Egyptian banks, the lender said. “CDC is currently in discussions with a number of Egyptian banks with a view to providing funding that will support their loan book expansion, bringing new products to their MSME (micro, small & medium sized businesses) and export-orientated customers.” According to the statement, CDC has been investing in Egypt since 2003, having provided some USD 115 mn to 20 companies in the country. The lender has also provided financing for the Benban solar power park.

Background: CBE Governor Tarek Amer had announced back in February that the CBE was mulling issuing licenses for tier two lenders. The announcement came days after the IMF released a research paper on bringing SMEs into the formal banking system in the Middle East and Central Asia.

Customs exchange rate left unchanged despite strengthening EGP: The Finance Ministry left the discounted customs exchange rate for essential imports unchanged at EGP 16 for June despite the recent uptick of the EGP against the USD, according to a Customs Authority circular (pdf). An anonymous government official told Youm7 last week that the rate could be cut to EGP 15 on 1 June as the EGP hit fresh two-year highs against the greenback.

Money supply growth continues slowing in April: The pace of M2 money supply growth continued to slow in April, falling slightly to 11.33% y-o-y from 11.39% in March, Reuters reported. The M2 gauge stood at EGP 3.76 tn at the end of April, up from EGP 3.72 tn a month earlier. M2 growth has consistently slowed over the past year, having fallen from 21.36% growth in April 2018. M2 measures liquid assets such as cash, savings deposits and money market securities.

EFG Hermes topped the EGX’s brokerage league table for May with a market share of 26.0%, according to figures released by the EGX (pdf). CI Capital came in second with 14.7%, followed by Pharos (4.3%), Pioneers (3.8%) and Arqaam (3.7%).

EgyptAir will begin providing in-flight connectivity on its Boeing 787-900 Dreamliner aircraft in cooperation with Panasonic Avionics’s unit Aeromobile, the national air carrier said in a statement. The B787-900 fleet with in-flight mobile connectivity will serve destinations including Europe, America, and Asia during 2019.

Meanwhile: If you’re travelling to the Land of the Free, prepare to hand over all your info. US visa applicants will need to hand over their social media handles, phone numbers and email addresses going back five years, the BBC says. Anyone who provides false social media information will face “serious immigration consequences,” an official told The Hill.

El Sisi attends Mecca summit as Qatar takes a step in from the cold: President Abdel Fattah El Sisi affirmed Egypt’s commitment to protecting Saudi Arabia and the UAE from “terrorist threats” during an emergency Arab League summit in Mecca at the weekend, but stopped short of calling for action against Iran. Saudi Arabia called the meeting in response to attacks on Saudi and Emirati oil facilities last month, which Riyadh and Washington blame on Iran. El Sisi condemned the Houthi attack on Saudi Arabia’s oil facilities and called for a “comprehensive strategic approach” to dealing with the crises in Libya, Syria and Yemen, but made no mention of Iran. “Explicit acts of terrorism require a clear position from all the international community to condemn it first, and then to work by all means to deter the perpetrators,” El Sisi said referring to the Houthis. You can read the president’s speech in-full here.

Saudi Arabia calls on Arab leaders to take firm action against Iran: Governments should use “all means to stop the Iranian regime from interfering in the internal affairs of other countries,” King Salman said during the summit.

Is Qatar coming in from the cold? Qatari PM Abdullah bin Nasser bin Khalifa Al Thani shook hands with King Salman and Crown Prince Mohamed bin Salman at the summit, described by one observer as a “huge step forward” to thawing the relations between the two countries. The Kremlinology continues here.

El Sisi also attended the Organization for Islamic Cooperation summit yesterday: El Sisi urged OIC members to do more to combat the spread of terrorism and solve the ongoing crises in Libya, Yemen and Syria. The president also announced that Egypt will host the OIC’s 2020 Ministerial Conference on Women. Read El Sisi’s OIC speech in-full here.

The president met with several leaders on the sidelines of the OIC summit, including King Salman, Lebanese PM Saad Hariri, Pakistani PM Imran Khan, and President of Gambia Adama Barrow.

** LUNA WANTS YOU: She conducts the final interview in our hiring process as we look for smart, talented, journalists with an interest in business, finance and the economy to join our team.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Pan-African trade pact is in effect, but key structural challenges threaten to undermine its efficacy: The African Continental Tade Agreement (AfCFTA) finally came into force on 30 May amid high hopes, but one of its architects is warning that it is a “very weak agreement that needs a lot of work” and could take three years before it is implemented properly, the Financial Times says. AfCFTA will create one of the world’s largest trade areas and aims to boost intra-regional trade, eliminating 90% of tariffs and allowing goods and services to move freely on the continent. The agreement also promises to increase intra-African trade by 52.3% and bring more FDI — which currently stands at less than a tenth of what goes into Asia — by offering would-be investors access to economies of scale and making export processes easier.

The issue is rooted in how Africa’s infrastructure was set up to serve trade outside the continent (thanks, colonialism). As it currently stands, African markets are better connected to the EU, China, and the US than they are to each other, meaning intra-regional trade in Africa is well below its trade with almost all regional blocs. While these echoes of colonialism can be undone, doubts have been cast on the political will among governments to forgo customs revenue and actually make crucial logistical changes. Harmonizing Africa’s economies under one agreement is also complicated by their different levels of development, with over 50% of the continent’s cumulative GDP contributed by Egypt, Nigeria and South Africa, while only 1% comes from the six sovereign island nations.

Egypt is poised to be one of the winners of AfCFTA: Along with other countries with large manufacturing bases, including South Africa and Kenya, Egypt is set to be a net beneficiary of the agreement. The garments industry is one example of where we may see immediate results, with Egypt being able to import raw materials from within Africa, rather than Turkey or Asia, thus reducing costs. Likewise, Egyptian cotton is likely to be in higher demand from other African countries, due to rules of origin stipulating that a product will have to be manufactured using mostly African inputs, up to a certain level.

Image of the Day

A Liverpool-themed fuul cart in Ain Shams is taking puns to a whole new level: The cart’s name is “Liver-fuul,” its logo features a fuul qedra (pot) instead of the team’s liver bird, and its slogan is a cleverly crafted “you’ll never eat alone,” says France’s AFP. The cart, which operates from 11pm to 3am for suhoor, launched at the start of Ramadan by co-founders Mohamed Ahmed and Mohamed El Sayed.

Egypt in the News

Human rights continues to dominate the conversation on Egypt in the global press following week’s publication of a 134-page report accusing security forces of misconduct in North Sinai. Human Rights Watch is claiming that the domestic press has threatened its employees, the Associated Press reports, while the Washington Post is out with an editorial about the report.

Other headlines worth a moment of your time:

- Former New Yorker Cairo correspondent Peter Hessler’s book The Buried: An Archaeology of the Egyptian Revolution is “an eclectic, beautifully written narrative that weaves a portrait of contemporary life in Egypt together with the complex strands of its pharaonic past,” Rachel Newcomb writes in a review for The Washington Post.

- The New York Times’ Teo Bugbee reviews hit Egyptian film Yomeddine, which he describes as an “empathetic” debut from director A.B. Shawky that applies an unusual subject.

- Convenient whipping boy: Netflix is considering a boycott of Georgia over a draconian abortion bill, but “maintains unwavering partnerships with countries like Egypt, where abortions are illegal, and China, where Muslims are being held in internment camps,” Fox News whines.

- The strengthening of the EGP is suspicious, Mohamed Hammad writes for The Arab Weekly, suggesting that the authorities are supporting the currency ahead of the removal of fuel and electricity subsidies in July.

On The Front Pages

President Abdel Fattah El Sisi’s attendance at the Organization for Islamic Cooperation (OIC) summit in Mecca topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria). We recap the story in full in Speed Round, above.

Worth Watching

Is trying to protect our online privacy a lost cause? These days, trying to protect yourself against internet trackers is like playing a game of whac-a-mole, an episode of the WSJ’s Personal Technology suggests (watch, runtime: 4:27). “Knock out one way for advertisers to track you, and they quickly find another way to do it,” Joanna Stern tells us. This is all coming despite Google and Facebook launching new initiatives in the past few weeks to guarantee internet privacy. Well we could at least try. Here are a handful of things to do:

- Use a privacy-focused browser (like Firefox) or download the Privacy Badger extension if you use Chrome

- Turn off Google’s Location History Tool on your computer and/or phone. On Facebook, kill everything under ad settings

- Make sure to turn off your Advertising ID in your iPhone or Android privacy settings

- Turn off Location Tracking on apps that don’t need your location.

Basic Materials + Commodities

First case of Fall Armyworm in Egypt threatens crops, vegetable exports

Egypt has reported its first case of Fall Armyworm (FAW), which can cause significant damage to crops, the Agriculture Ministry announced in a statement on Thursday. The case was reportedly detected in a maize field in a village in Kom Ombo, Aswan. The Agricultural Pesticide Committee (APC) is asking farmers to take precautions and use certain insecticides to try to prevent an infestation. It is possible that its presence in Egypt’s crops may affect export restrictions on Egyptian vegetables, the head of the Farmers’ Syndicate has said.

Manufacturing

Military Production Ministry signs air filters MoU with Micro-Mesh

The Military Production Ministry signed on Thursday an MoU with UK-based hydraulic and air filter manufacturer Micro-Mesh to cooperate in the production of air filters for gas turbine power plants, the ministry said in a statement.

Health + Education

Abdel Ghaffar discusses smart tech in Egypt’s universities with Huawei Egypt CEO

Higher Education Minister Khaled Abdel Ghaffar discussed developing smart, integrated facilities in Egyptian universities with Huawei Egypt CEO Vincent Sun, according to a ministry statement. The ministry is close to finalizing a plan to establish a university specialized in communications, tech and artificial intelligence, Abdel Ghaffar told Sun.

Tourism

Oman Air launches flights to Alexandria, Air Serbia to Cairo

Oman Air began operating a direct air route from Muscat to Alexandria on Friday, Al Mal reports. No details were provided on the frequency of the flights. Meanwhile, Air Serbia is set to launch a direct flight from Belgrade to Cairo this week, which will be its only African destination, MENA reports.

MoU to increase tourism signed between Egypt and Bulgaria

Tourism Rania Al-Mashat signed an MoU with her Bulgarian counterpart Nikolina Angelkova on Thursday to increase cooperation on tourism initiatives between the two countries, Ahram Online reports. Angelkova will visit Egypt again with a delegation from the Bulgarian tourism sector in October.

Banking + Finance

Fawry to launch in UAE this summer

Fawry has signed an agreement with Dubai Islamic Bank to launch a trial run in the UAE this summer, CEO Mohamed Okasha said. The e-payment platform will partner with the Emirati bank, and start with the rollout of bill payment and banker's acceptance services.

Misr Italia in talks with unnamed Egyptian banks for EGP 1.5 bn loan

Real estate developer Misr Italia is in talks with unnamed local banks to arrange EGP 1.5 bn in financing for its projects, CEO Mohamed El Assal said. Of the proceeds, EGP 550 mn will help fund the company’s Cairo Business Park in New Cairo. The remainder will be directed to other commercial and service projects.

Sports

Salah leads Liverpool to victory in the Champions League final

Liverpool were crowned Champions League winners for the sixth time as Mohamed Salah and Divock Origi stepped up to secure a 2-0 win against Tottenham in Madrid last night, BBC Sport reports. Salah converted a penalty in the second minute and substitute Origi gave the team a late goal to net Liverpool its first European trophy since 2005. The Evening Standard has a feature of Salah’s journey from a youth player in Nagrig to Champions League winner. Keep making us proud, Mo.

On Your Way Out

The Egyptian radio celebrated on Friday its 85th anniversary, according to Egypt today. “Hona El Kahera” (This is Cairo) was how it all started. A Quran recitation by Sheikh Mohamed Refaat, followed by a concert by the iconic Umm Kulthum were the first to broadcast on national radio.

The Market Yesterday

EGP / USD CBE market average: Buy 16.73 | Sell 16.83

EGP / USD at CIB: Buy 16.70 | Sell 16.80

EGP / USD at NBE: Buy 16.75 | Sell 16.85

EGX30 (Thursday): 13,771 (-1.5%)

Turnover: EGP 444 mn (43% below the 90-day average)

EGX 30 year-to-date: +5.6%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 1.5%. CIB, the index heaviest constituent ended up 0.04%. EGX30’s top performing constituents were Cairo Investment & Real Estate Development (CIRA) up 1.2%, Orascom Development Egypt up 0.6%, and CIB. Thursday’s worst performing stocks were Global Telecom down 5.1%, Madinet Nasr Housing down 4.6% and AMOC down 4.3%. The market turnover was EGP 444 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -31.6 mn

Regional: Net Long | EGP +2.9 mn

Domestic: Net Long | EGP +28.7 mn

Retail: 49.0% of total trades | 51.7% of buyers | 46.3% of sellers

Institutions: 51.0% of total trades | 48.3% of buyers | 53.7% of sellers

WTI: USD 53.50 (-5.46%)

Brent: USD 61.99 (-5.11%)

Natural Gas (Nymex, futures prices) USD 2.45 MMBtu, (-3.65%, Jul 2019 contract)

Gold: USD 1,311.10 / troy ounce (+1.45%)

TASI: 8,516.48 (+1.22%) (YTD: +8.81%)

ADX: 5,003.59 (+2.82%) (YTD: +1.80%)

DFM: 2,620.33 (+0.79%) (YTD: +3.58%)

KSE Premier Market: 6,242.24 (+0.59%)

QE: 10,273.01 (+3.43%) (YTD: -0.25%)

MSM: 3,934.15 (-0.18%) (YTD: -9.01%)

BB: 1,433.52 (+0.24%) (YTD: +7.20%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

3-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

4-5 June (Tuesday-Wednesday): Eid El Fitr (TBC).

10 June (Monday): Egypt’s Emirates NBD PMI for May released.

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.