- Is the Electricity Ministry on a privatization drive? (Speed Round)

- EGAS is planning a fresh WestMed gas exploration tender for next year. (Speed Round)

- We’re one step closer to a new Insurance Act. (Speed Round)

- House committee wants to loosen the state’s purse strings with up to EGP 20 bn in extra spending. (Speed Round)

- Egyptian fintech startup Vapulus launches new zero-fee online payment portal. (Speed Round)

- Boutique banks are grabbing a slice of the M&A pie. (Worth Watching)

- A double Fed rate-cut this year is looking more likely. (What We’re Tracking)

- My Morning Routine: Mohamed El Taher, CEO of Al Ismaelia for Real Estate Development

- The Market Yesterday

Thursday, 30 May 2019

Privatization drive at the Electricity Ministry?

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to the last day of the week — and final Thursday of Ramadan. We’re all getting a little antsy in anticipation of the long Eid El Fitr weekend, which could start on Tuesday or Wednesday, depending on how hopeful you are.

In the meantime, a few things we’ll be keeping our eyes on over the next several days:

- Foreign reserves: The CBE should announce Egypt’s net foreign reserves for the end of May next week.

- Inflation: Monthly inflation figures will be released during the second week of the month. Annual headline inflation cooled unexpectedly in April to 13% from 14.2% in March.

- PMI: The purchasing managers’ index for Egypt, Saudi Arabia, and the UAE is due out on Monday, 10 June at 6:15am CLT.

Across the pond, the news cycle is driven by US special counsel Robert Mueller’s resignation while giving his first public comments about his two-year investigation into potential Russian interference in the 2016 US elections. Mueller reiterated that his investigation neither fully exonerated US President Donald Trump nor confirmed he was involved in criminally conspiring with the Russians. More importantly, however, he stressed that it was never within his power to charge the president with any crimes, essentially placing that responsibility squarely in Congress’ lap.

Still playing catch-up with the whole story? The Wall Street Journal and Reuters have the facts. The Washington Post also has a nice annotation of Mueller’s comments to provide context and explanations on key parts.

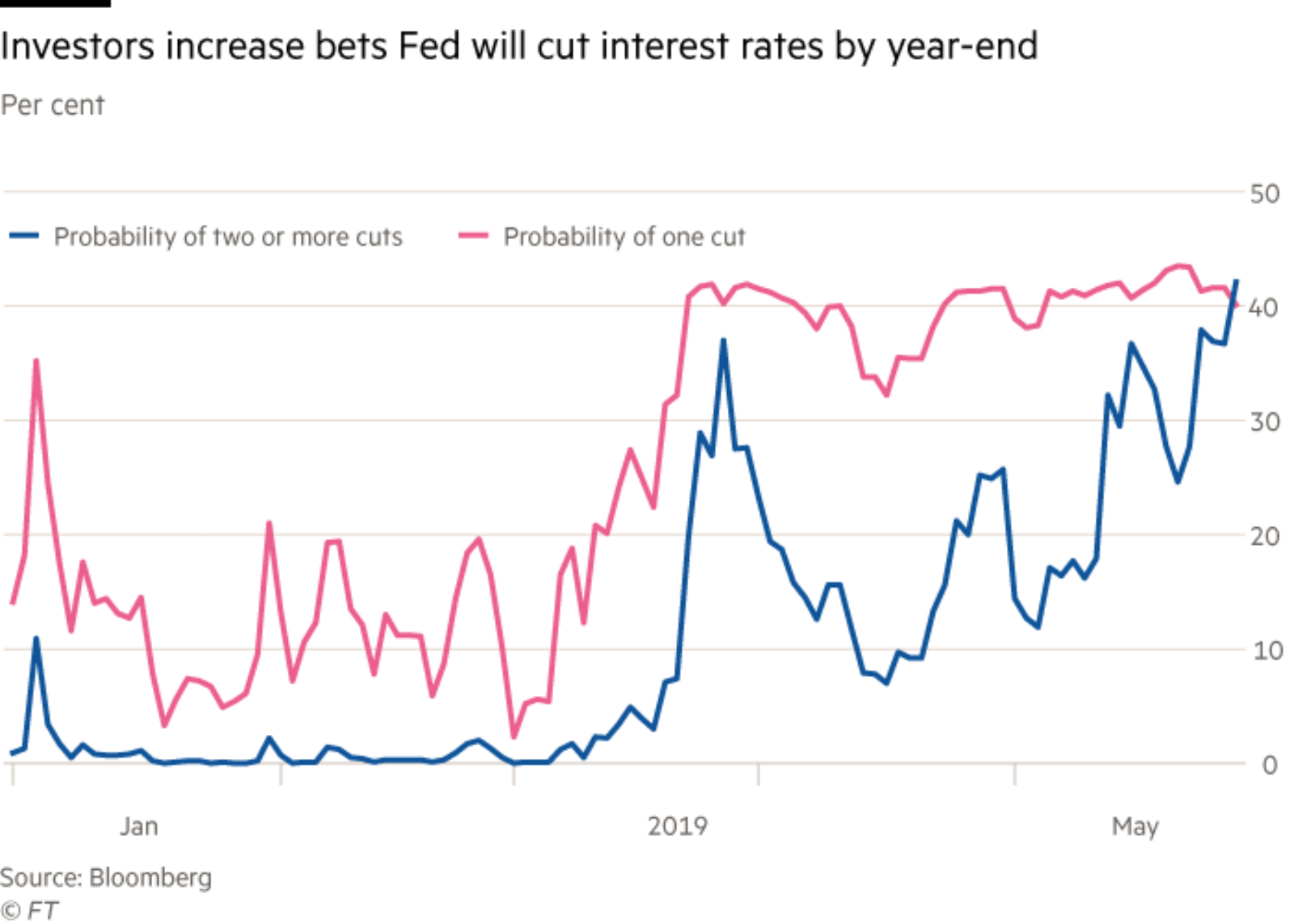

The odds of a double Fed rate-cut in 2019 are back on the rise: Federal funds futures — contracts that gauge the market’s expectation of an interest rate change — have risen sharply this week, as concerns over an economic slowdown grow, the FT says. The probability that the US Federal Reserve will make two cuts before the end of the year rose above 40% yesterday, beating expectations for a single cut for the first time. Bond investors also seem to see the rates coming down, the New York Times notes, pointing to the inverted yield curve as being the source of much doom and gloom.

This is the last thing traders need: The financial press was full of speculation yesterday over whether China might resort to one of its nuclear options and ban rare earth exports to the US. China exports 80% of the planet’s rare earth minerals, which are vital for production in the energy, defense, automobiles and electronics sectors. Chinese media have been enthusiastically talking up the idea, which if enforced would spell trouble for companies working in key economic sectors. At least the miners are happy. (Bloomberg | FT | CNBC | Business Insider)

The winner of the Clumsiest Neologism of the Week award goes to: Agripreneur. We don’t mean to mock the next generation of African farmers, who according to The New York Times are doing great work promoting agriculture as a forward-thinking sector. But seriously, agripreneurs?

What We’re Tracking Today, the Ramadan edition:

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- Teaching your kids about money in the i-Era: The Wall Street Journal runs through the apps parents can use to educate kids about money, manage their chores and monitor their spending.

- Single mothers in the US are increasingly joining the labor force, in large part due to policies like paid leave and minimum wage increases that ensure their employment and parenting obligations are easier to balance, according to the Gray Lady.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

So, when do we eat? Maghrib is at 6:50pm CLT today in Cairo. You’ll have until 3:11am tomorrow morning to caffeinate / finish your sohour.

WEATHER- It’s going to be, ahem, warm today and tomorrow: Look for a high of 41ºC and a low of 22ºC on both days.

Enterprise+: Last Night’s Talk Shows

We know you’ve missed them: The talking heads will be back on our screens after Eid El Fitr break — and so will our daily roundup of their shows.

Speed Round

Speed Round is presented in association with

Is the Electricity Ministry on a privatization drive? The Egyptian Electricity Holding Company (EEHC) could sell stakes in its electricity production and distribution subsidiaries to the private sector under an asset management program, former Egyptera head Hafez Salmawy said. The program, which Salmawy says is already in place, seeks to overhaul the electricity sector to promote market competition and increase efficiency. The private sector is by law allowed to purchase up to 49% of any of EEHC’s subsidiaries.

Exhibit A: His statement came days after Electricity Minister Mohamed Shaker revealed that Blackstone Group’s Zarou and Malaysian company Edra Power Holdings had expressed interest in acquiring the three Siemens-built combined-cycle power plants inaugurated in July. The move could see the companies take on the responsibility of meeting debt repayments for the EUR 6 bn facilities, 85% of which was financed by foreign lenders.

EGAS plans fresh WestMed gas exploration tender: The Egyptian Natural Gas Holding Company (EGAS) plans to put some 11 natural gas exploration blocks in the western Mediterranean up for auction by 1Q2020, a source from the company told Al Shorouk. EGAS has finalized studies and seismic scans, and is waiting for the Oil Ministry to make a final decision on the timeline and the number of concessions on offer.

The great gas rush of 2019: The ministry in February handed five gas exploration concessions in the Mediterranean and Nile Delta to Shell, Eni, BP, DEA and Petronas in the largest bid round in the state gas company’s history. A month later, the South Valley Egyptian Petroleum Holding Company (Ganope) launched a tender for 10 oil and gas exploration blocks off Egypt’s Red Sea coast. It remains unclear when the ministry will announce the winning companies.

LEGISLATION WATCH- Regulator wraps up Insurance Act consultations: The Financial Regulatory Authority (FRA) has wrapped up several rounds of consultations on the new Insurance Act, FRA head Mohamed Omran said, according to a statement (pdf). There was no mention of the outcome of the sessions, which saw participation from industry stakeholders including representatives from the Insurance Federation of Egypt (IFE) and the Egyptian Healthcare Management Society. We reported last week that the FRA is set to review the draft act before the Eid El Fitr break.

Discussions likely touched on high capital requirements: If passed, the proposed legislation would raise the required issued and paid-in capital of life and property insurance providers by 150% and the minimum legal requirement for reinsurers by 733%. The IFE has made clear that it views the new thresholds as unnecessarily high and is urging the government to reduce them. The industry group also reportedly opposed the bill’s higher licensing and incorporation fees, as well as the doubling of mandatory policy payouts to EGP 80k for car insurance.

Other elements of the draft: According to details leaked in January, the act will also:

- Make the FRA the primary regulator of the insurance sector;

- Double the ceiling for life insurance payouts to EGP 80k;

- Introduce mandatory coverage for public gatherings and venues;

- Raise the ceiling of life insurance payouts;

- Require individuals with liability-prone professions to obtain liability insurance.

BUDGET WATCH- House committee loosens state purse strings with EGP 7.3 bn of additional allocations in FY2019-2020 state budget: The House of Representatives’ Planning and Budgeting Committee has allocated an additional EGP 7.3 bn across a number of sectors in FY2019-2020, committee sources said. The Health Ministry will receive an extra EGP 2 bn for health treatment programs, the education sector will receive EGP 1.2 bn, and the Agriculture Ministry will get an additional EGP 2.5 bn.

The committee is expecting to approve north of EGP 20 bn in extra spending allowances by the time the horse-trading over the draft budget comes to an end. The committee, which began the discussions earlier this month, is expecting to receive reports from several other parliamentary committees this week, and begin discussing them following the Eid El Fitr break. Committee-level approval is required for the draft to make it to the general assembly for a final vote, ahead of being ratified by President Abdel Fattah El Sisi. The new fiscal year begins on 1 July.

STARTUP WATCH- Egyptian social video analytics platform Mintrics is looking to raise USD 500k in an investment round, with which it plans to set up a sales office in the US, growth hacker Adel Heikal tells Ventureburn. Hawaii-based accelerator Blue Startups is among the investors participating in the funding round, which is likely to conclude within two months, Heikal added. This follows an announcement from Mintrics earlier this week that it was the first startup from the MENA region to be accepted into Blue Startups’ 11th accelerator program, where it will receive funding of up to USD 350k.

What is Mintrics? The platform uses machine-learning algorithms to help video publishers understand how their content is performing and how it could be improved. It allows creators to assess their competition and spot industry trends, enabling them to increase their viewership and engagement. Launched in 2016, and with a team of 10 in offices in Cairo and Dubai, Mintrics now has 18 clients, including Discovery Networks, YouTube and the Dubai Future Foundation. Dubai-based private equity firm Numu Capital invested an undisclosed amount in the company in 2017.

STARTUP WATCH- Vapulus launches the world’s first zero-fee online payment portal: Egyptian fintech startup Vapulus has launched the commercial operations of the world’s first zero-fee online payment portal, according to an emailed statement (pdf). More than 450 MENA companies and e-commerce platforms have used the platform since the pilot was launched almost a year ago. The company is planning to compete regionally for the next three years before starting a drive into global markets. The new zero-fee payments represent a shift from the traditional fee-based business model, which CEO Abdelrahman Elsharawy predicts will become obsolete in the future.

CABINET WATCH- Cabinet approves USD 200 mn World Bank SMEs loan: The Madbouly Cabinet approved in yesterday’s meeting the USD 200 mn loan from the World Bank to support SMEs and entrepreneurs signed earlier this month, according to a statement. Both sides agreed on the loan during the IMF and World Bank Spring Meetings in April. Its proceeds include USD 145 mn earmarked for loans to small businesses and USD 50 mn for angel and venture capital funds.

Other decisions taken at the meeting:

- Approving a draft law to establish an authority to protect lakes and fisheries;

- Amending maritime activity regulations to require licensed shippers to present EGP 5k-worth of insurance or bank guarantees to port authorities;

- Shutting down the National Council for Drug Control and Treatment in a move to create a single state-led body responsible for curbing addiction.

Abraaj founder Arif Naqvi freed from prison after paying USD 19 mn conditional bail: Private equity firm Abraaj founder Arif Naqvi was released from prison in the UK on Tuesday evening, after his record GBP 15 mn (USD 19 mn) bail payment was paid, Bloomberg reports. Naqvi will now effectively be under house arrest in his London home, surrendering his travel documents and wearing an electronic tag. Naqvi maintains that he is innocent of charges that include inflating the value of Abraaj’s holdings and stealing hundreds of mns of USD — claims he terms “ludicrous.” Former Abraaj managing partners Sev Vettivetpillai and Mustafa Abdel-Wadood are facing similar charges. Abraaj was widely seen as a standard-bearer for EM private equity before it collapsed last year amid concerns about the misuse of funds.

EARNINGS WATCH- Sinai Cement reported a net loss of EGP 78.3 mn in 1Q2019, down 7% y-o-y from EGP 84.3 mn in 1Q2018, the company said in its earnings release (pdf). Revenues for the quarter grew 38% y-o-y to EGP 201.1 mn from EGP 148 mn in 2018.

CORRECTION- We incorrectly said in yesterday’s issue that British Trade Secretary Liam Fox met on Tuesday with President Abdel Fattah El Sisi. The two did not meet during Fox’s visit. The story has been corrected on our website.

** LUNA WANTS YOU: She conducts the final interview in our hiring process as we look for smart, talented, journalists with an interest in business, finance and the economy to join our team.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

The day Einstein changed our understanding of the universe: On 29 May, 1919, a total solar eclipse proved correct Einstein’s theory of general relativity, a cornerstone of modern science. Two teams — in Sobral, Brazil, and on Príncipe Island, off the western coast of Africa — took the chance afforded by the eclipse to measure the deflection of starlight by the sun’s gravitational field, collecting data that proved Einstein’s theory. A hundred years later, scientists around the world are celebrating the impact of these theories on our understanding of the universe. The New York Times has more.

Want to see a total solar eclipse? There’s one coming up on 2 July, lasting four minutes and 33 seconds. The caveat: You’ll need to head a few thousand kms south-west as it will only be visible in the South Pacific, Chile and Argentina, according to The Independent.

Egypt in the News

Coverage of Egypt in the foreign press is currently dominated by two stories: The extradition of special forces officer-turned-terrorist Hisham El Ashmawy from Libya, and the detention of Al Jazeera reporter Mahmoud Hussein. Coverage of the latter is mostly confined to wire pickups from the Associated Press and AFP.

On The Front Pages

Mixed bag of nuts on state-run newspapers this morning: Egypt’s state-owned newspapers are not in lockstep with their front page stories this morning, with the top headlines ranging from Al Ahly potentially withdrawing from the Egyptian premier league (Al Ahram) to President Abdel Fattah El Sisi handing out awards to Quran reciters (Al Akhbar) to several upcoming summits in Saudi Arabia (Al Gomhuria).

Worth Watching

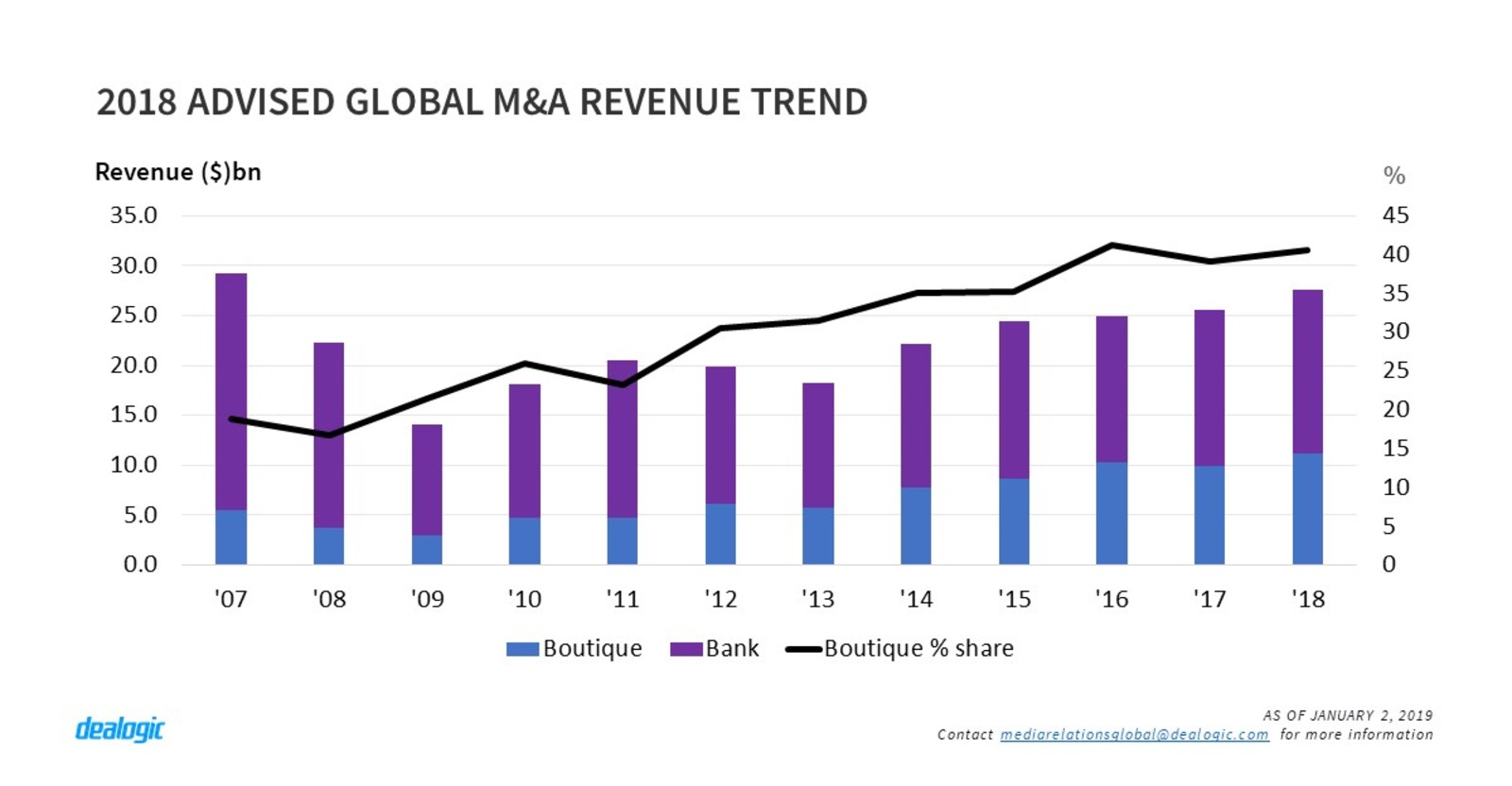

Boutique banks grab a slice of the M&A pie: The rise of “boutique” banks, many of which have been founded by former big-bank employees nostalgic for the old ways of banking after post-financial crisis regulatory reform, has substantially changed the M&A landscape over the last 10 years, says this FT video (watch, runtime: 01:59). In the early 2000s, the top five mega banks took home about 50% of M&A fees, while boutiques accounted for just 15%. Their share of the M&A pie has risen dramatically since then, now accounting for some 30-35% of the market.

Energy

Eni completes Zohr natgas treatment facility

Italy’s Eni has completed the Zohr field’s final natural gas treatment plant, bringing the overall capacity of the USD 5 bn facility to 3.2 bcf/d, according to an industry source. Zohr is currently producing 2.3 bcf/d, and this is set to increase to nearly 3 bcf/d in July of this year. Egypt is looking to emerge as the region’s premier energy hub by increasing its liquefied natural gas (LNG) exports.

Manufacturing

AOI to work with Germany’s Gutmann to produce modern aluminum systems

The Arab Organization for Industrialization signed yesterday an agreement with Germany’s Gutmann that will see the AOI and Guttman’s MENA branch cooperate to manufacture modern aluminum systems in Egypt to meet local demand, according to a Cabinet statement.

Real Estate + Housing

Tabarak Holding to invest EGP 1 bn in two projects in New Sphinx

Tabarak Holding is planning to invest EGP 1 bn this year in two projects in New Sphinx with a total area of 859 feddans, the local press reported. The two projects are planned to be mixed-use and residential.

Tourism

Egypt, Bulgaria to sign tourism cooperation MoU during Bulgaria forum

Egypt and Bulgaria are set to sign an MoU to boost cooperation in cultural, heritage, and coastal tourism during the two-day Investing in Tourism Sustainability Conference, according to Youm7. Tourism Minister Rania Al Mashat flew to Bulgaria to attend the conference, which will kick off later today.

Aqaba-Egypt direct flights to start June 3, EgyptAir to resume Abidjan flights

Direct flights will be launched between Jordan’s Aqaba and Cairo and Sharm El Sheikh starting 3 June, the local press reports. Meanwhile, national flag carrier EgyptAir will resume direct flights to Abidjan, Côte d’Ivoire starting 20 June, with two flights per week, Ahram Online cited CEO Ahmed Adel as saying. The decision comes in light of the 2019 Africa Cup of Nations kicking off in coming weeks.

Telecoms + ICT

Egypt and China to cooperate in AI field

The CIT Ministry met with a Chinese delegation this week for talks on cooperating in developing Egypt’s AI sector, according to a ministry statement. Egypt is seeking assistance in organizing graduate IT trainings, among other things.

Telecom Egypt to launch online TV, mobile wallet services

State-owned Telecom Egypt’s mobile network operator WE is launching an online TV streaming service and mobile wallet within weeks, CEO Adel Hamed told Youm7. WE Mobile Wallet will be set up in collaboration with Banque Misr amid efforts to support financial inclusion and digitalization, Hamed says.

Banking + Finance

Univert obtains EGX committee approval to begin delisting

Univert Food Industries has obtained approval from the EGX listing committee to begin procedures to voluntarily delist its shares, according to a release. The company will take itself private once it purchases shares of affected shareholders at a fair value and obtains final approval from the committee. The company’s majority shareholder, Mohammed Ahmad Basamh, was seeking approval last year from the Financial Regulatory Authority to submit a mandatory offer for 100% of the company’s shares.

Qalaa Holdings completes final funding round for ERC

Qalaa Holdings has completed the final USD 120 mn funding round for its Egyptian Refining Company (ERC), including a capital increase of USD 70 mn and loans at a combined total of USD 50 mn, Al Mal reported. The funding will be used to restructure its debts, Chairman Ahmed Heikal said. The project, which has drawn a total of USD 4.4 bn in investments, is 99.6% complete and is expected to come online within the coming months.

Sports

CAF sets up special committee for Africa Cup security

!_StoryTags_ CAF, Africa Cup of Nations, security

A special committee has been established to manage security concerns at the Africa Cup of Nations in Egypt, which is set to kick off next month, CAF President Ahmad Ahmad said, according to Reuters. The concerns come after an explosion near the Grand Egyptian Museum injured at least 12 people less than two weeks ago.

My Morning Routine

My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Mohamed El Taher, CEO of Al Ismaelia for Real Estate Development, the first real estate company in Egypt to focus on acquiring and renovating heritage buildings in Downtown Cairo.

I’m Mohamed El Taher and I’m the CEO of Al Ismaelia for Real Estate Development. We specialize in renovating old heritage buildings in the Downtown Cairo area. I initially graduated as an electrical power engineer, but after a brief period working for Unilever, I went on to get my MBA in finance. I then shifted my career to real estate investment and finance. It’s been 14 years since I made this shift, and not a single day passes without me being glad of it.

Al Ismaelia is a small organization, and our setup is almost like a startup, with about 15 people in the team. We work very closely together to get things done. This is especially important because doing real estate development in Downtown is really like entering unmarked territory with no manual. We face a lot of challenges, ranging from issues with tenants, to unexpected surprises in the structure and design of the buildings, to procuring approvals and licenses from the government. But it’s a very dynamic field. We’re also very interested in the arts, the cultural and startup scenes, and we work hard to support them. Usually my day includes a couple of meetings with people from the startup community who want to rent space Downtown. Working with organizations to see how we can bring people back to Downtown is also a big part of what we do, so we plan and hold events, including art and photography shows, workshops, and discussions.

I’m really not a morning person; I’m at my peak at night. I wake up at 7:30am and usually reach the office by 9:30am, so I take most of my meetings early in the morning. But when I have time for myself, I leave the most important strategic documents — the ones that require focus — to the later part of the day. I prefer to work on those from 3pm until about 8pm, rather than in the morning. So I can’t claim to wake up at 5am. In the past I tried to change this, but it was really a struggle, so I realized I just needed to capitalize on what I have. I focus better at night, and as long as my mind is clear, that’s more important than what time of day it is. I enjoy having a quiet setup to work in, because I always have a lot of ideas running in my head and can be easily distracted. So I give myself this quiet time, where I don’t answer emails or phone calls, and I can be very productive.

It is essential to me to have time in the day for my family. I like to hear a bit about their day, and make sure they have my attention and feel my presence for at least a small period of time every day. No matter what else happens, this is very important.

I also love reading and listening to audiobooks. I have a book-collecting addiction, and read as much as I can, as well as listening to audiobooks during my commute. Malcolm Gladwell is a brilliant writer, and I’ve read and re-read all of his books — he’s changed how I look at things. The first non-fiction book I ever read was The Seven Habits of Highly Effective People, which created a real paradigm shift in my life. Stephen Covey’s idea of “slow is fast and fast is slow” is one I always return to when I’m trying to align my team on an idea, or create a unified spirit between us as we work to achieve something. It helps me to be patient with the process.

Al Ismaelia for Real Estate Investment started in 2008. Our chairman, Karim Shafei, was behind the idea. He had a vision for renovating buildings in Downtown and partnered with our board members, who had similar ambitions. They wanted to focus on the Ismaelia zone in Downtown, so everything grew from there. There was a slowdown during the revolution, because no one, including the investors, knew what would happen — especially Downtown. Between 2011 and 2014, we made some acquisitions that were important, but not large. But as things started to stabilize in 2015, we were back on track and started to grow rapidly. I joined in 2016, and since then we have been very focused on how to transform buildings into livable, functioning spaces. In 2018, our new project, La Viennoise, really captured the attention of the media and won two prizes, which we were delighted about. We’re very proud of what we’ve achieved.

Al Ismaelia isn’t a day-to-day real estate developer, with huge pieces of land in urban areas. In a sense, we are always looking back in time to our beloved Downtown Cairo, and we are very specialized. Our current inventory is 80,000 sqm, which is quite niche. We know that, to make a difference to our company and the area we work in, we have to be selective in terms of what we offer as assets in our space. Our niche means we’ve had to turn down some lucrative prospects in order to partner with organizations that we’re aligned with. We’re trying to change the fabric of Downtown Cairo, to ensure that there’s a mix of people represented. Our vision is to have fuul sandwich carts next to upmarket buildings and residents — like the downtown area of any major city.

We are allocating a budget of EGP 150 mn for acquisitions for the next couple of years, as part of our strategic goals. It isn’t always easy to acquire the buildings we want, as there can be a lot of complexity in terms of ownership, but we’re very active right now in looking for new buildings. We also have a EGP 150 mn loan from the EBRD that is going towards renovation. So we’re focusing on the rest of our portfolio projects: the old French Council, Radio Cinema, and Cafe Riche. We have five or six buildings that we’re currently working on. The next building we’re launching is Radio Cinema, which will be finished in August this year.

Strategically, we always target heritage buildings in the Downtown area. This is really our business model, and it works. We look for buildings near our current properties, and as Downtown has 1500 buildings, we can’t target all of them. But in principle, we’re open to working on any heritage buildings in the area. Every building has an interesting story, in terms of its ownership, commercial set-up, how it was built, and how it has transformed.

At the beginning, people didn’t understand what we were trying to do. They thought we had a nice idea that would fail, and some even thought we were an NGO. We tried to be very clear: We’re a business, and we’re here to make money, but we have a different approach. It took some time but now we’re making news and headlines, and people are starting to see our vision. We’re making money out of old buildings. We’ve proven that it can happen. What’s great is that it’s good for everyone: The country, the people, our shareholders. It’s the perfect equation.

At an industry level, everyone is speaking now about Egypt’s real estate sector slowing down. A huge amount of inventories have been dumped in the market, and the emergence of many new, small real estate developers who are young in the business has also contributed to the slowdown. I think that by the end of 2019 or 1Q2020, the newcomers will face a tough stress test, and whoever survives will be hugely successful. We will also find big names facing issues in their operations. Because there isn’t the same absorption rate as in previous years, people feel the market is slowing down. Having said that, there’s always genuine demand in Egypt. With 100 mn people, getting married, having children, some making money during the bad times, and some selling because they’re moving, there will always be movement and demand in real estate.

What’s happening in the Gulf area at the moment is interesting, because it may bring more attention to the Egyptian market. We don’t have Dubai’s framework for doing business, but we’re stable and resilient, so you might see a shift in capital, towards doing business in Egypt. Some of that will be felt in real estate.

One maxim I try to live by actually comes from Brad Pitt in the film World War Z: “Whoever moves survives.” It takes courage to move forward, no matter what is happening. Sometimes you need to fight the market; you can’t just wait until the bad times pass. You always need to make sure you’re prepared, but when you settle into your comfort zone things usually don’t turn out well.

The Market Yesterday

EGP / USD CBE market average: Buy 16.76 | Sell 16.88

EGP / USD at CIB: Buy 16.76 | Sell 16.86

EGP / USD at NBE: Buy 16.80 | Sell 16.90

EGX30 (Wednesday): 13,974 (-0.4%)

Turnover: EGP 637 mn (19% below the 90-day average)

EGX 30 year-to-date: +7.2%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.4%. CIB, the index heaviest constituent ended up 0.5%. EGX30’s top performing constituents were Orascom Investment Holding up 1.5%, and Egyptian Iron & Steel up 0.9%, and Madinet Nasr Housing up 0.7%. Yesterday’s worst performing stocks were Cairo Investment & Real Estate Development down 3.9%, Kima down 2.8% and GB Auto down 2.5%. The market turnover was EGP 637 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -104.3 mn

Regional: Net Long | EGP +85.8 mn

Domestic: Net Long | EGP +18.4 mn

Retail: 45.5% of total trades | 47.3% of buyers | 43.7% of sellers

Institutions: 54.5% of total trades | 52.7% of buyers | 56.3% of sellers

WTI: USD 59.23 (+0.71%)

Brent: USD 69.45 (-0.94%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, (+1.98%, June 2019 contract)

Gold: USD 1,284.30 / troy ounce (-0.16%)

TASI: 8,413.88 (-1.60%) (YTD: +7.50%)

ADX: 4,866.18 (+1.56%) (YTD: -0.99%)

DFM: 2,599.70 (-0.28%) (YTD: +2.77%)

KSE Premier Market: 6,205.36 (+0.84%)

QE: 9,931.94 (+0.36%) (YTD: -3.56%)

MSM: 3,941.21 (+0.57%) (YTD: -8.85%)

BB: 1,430.14 (+0.18%) (YTD: +6.95%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

3-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

4-5 June (Tuesday-Wednesday): Eid El Fitr (TBC).

10 June (Monday): Egypt’s Emirates NBD PMI for May released.

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.