- The House is planning to make the 0.25% healthcare tithe tax-deductible. (Speed Round)

- Banque du Caire could IPO in 1Q2020. (Speed Round)

- The E-Payments Act has cleared the House. (Speed Round)

- Emerging markets have to hope the US economy stays where it is. (The Macro Picture)

- Real estate developers aren’t happy about the prospect of jail time. (Speed Round)

- Natgas authority won’t get to pocket the fines it hands out. (Speed Round)

- President El Sisi OK’s USD 1 bn World Bank loan. (Speed Round)

- Coffee with Mohamed Abou Ghaly, CEO of Abou Ghaly Motors

- The Market Yesterday

Tuesday, 12 March 2019

The House will consider making healthcare tithe tax-deductible

TL;DR

What We’re Tracking Today

It’s a slow news morning, ladies and gentlemen, as we slide into the final days of the week.

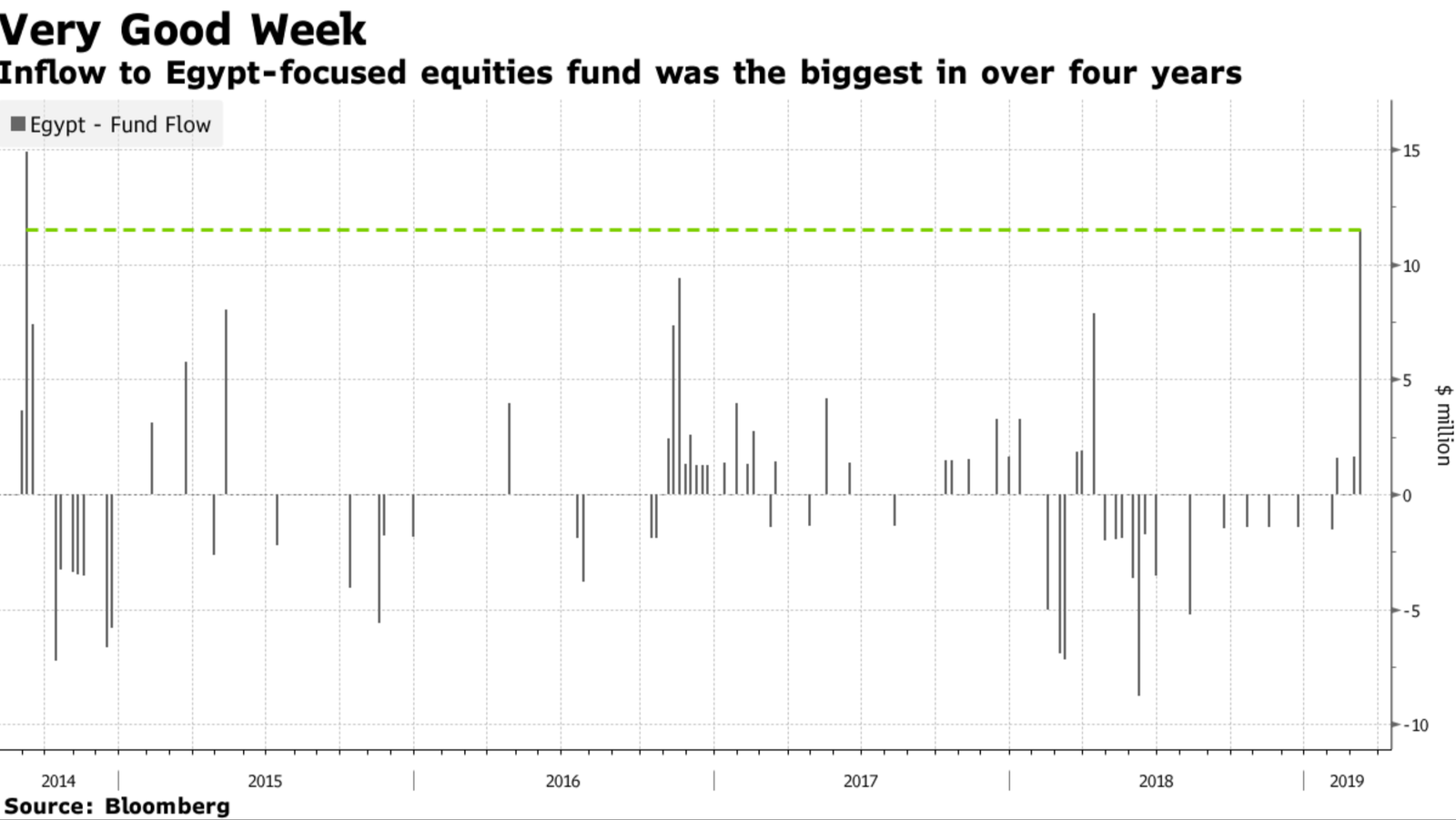

Better investor appetite saw an Egypt-focused exchange-traded fund get highest inflows since 2014: The VanEck Vectors Egypt Index ETF recorded inflows of USD 11.5 mn in the week ending 8 March, the highest on a weekly basis since September 2014, Bloomberg reports. The US-based fund’s assets under management rose to its highest level since August, reaching USD 52 mn. “After the stellar week for the VanEck fund, Egypt ranked first on a list compiled by Bloomberg that tracks ETF flows to different countries globally.” (You can lean more about ETFs in general here.)

Algerian President Abdelaziz Bouteflika will not seek a fifth term in office. The ailing, 82-year-old president’s hand appears to have been forced after generally peaceful protests expanded to include a strike in the country’s critical (and sprawling) state-owned petroleum sector. Elections originally scheduled for 18 April have been postponed as Bouteflika “signalled his intention to preside over a transition that would include a national conference to debate political and economic reforms, draft a new constitution and set the date of a presidential election before the end of the year. The constitution would be submitted to a popular referendum.” Ring any bells? There’s plenty more on Reuters, the FT, Washington Post and New York Times.

The Donald has put forward a record USD 4.75 tn budget for the 2020 financial year. The plans would see spending increases in defense and national security and bring the axe down on environmental spending and foreign aid. Also up for cuts: Earmarks to support health, education and transportation. Notably, the budget would increase government spending on small businesses by 17%. The NYT has more.

The document hints that US military aid to Egypt would remain intact, stating that it “fully supports the US diplomatic and security partnership in Egypt.” The US earmarks about USD 1.3 bn in military aid for Egypt each year. The US earmarked about USD 1.381 bn in aid (military and economic) to Egypt for FY2019, down from USD 1.419 bn the year before.

Trump’s budget is not likely to pass though: The WSJ reminds us that Congress has ultimate authority over drafting and amending the federal fiscal budget. And with the response from House Democrats being far from welcoming, the budget may well result in another government shutdown later this year. For a bit of light reading, we’ve attached the budget here for your reading pleasure.

The world’s largest oil and gas giants now seek diversified portfolios, combining projects that pay back quickly with larger, more traditional projects, allowing them to be more responsive to price fluctuations, Bloomberg reports. The approach has allowed them to emerge stronger from the late-2014 fall in energy prices and regain profitability.

Good news for Egypt as well: While investments had already been made in natural gas before the price fall, its value since then has only increased, with one BP executive now calling it “the fastest growing hydrocarbon” and “the future.”

In miscellany worth knowing this morning:

Turkey has fallen into recession for the first time in a decade, with official data released on Monday recording a 3% y-o-y slump at the end of 4Q2018. Full-year GDP growth was down to 2.6% in 2018 from 7.4% in 2017. A “collapse” in the lira following last summer’s tension between Ankara and Washington and the subsequent raising of interest rates to 24% triggered the crisis, according to the Financial Times and Bloomberg.

The position of Egypt-backed Libyan military commander Gen. Khalifa Haftar has been strengthened by a successful recent offensive in the south-west, the Guardian reports. Haftar now controls two-thirds of the country, including most border crossings and key oil installations, and is more able to dictate the terms of a peace settlement to his rival Fayez al-Sarraj.

Apple is expected to announce a subscription-based streaming TV service at a press event on 25 March, the Verge reports. Reuters also has the story.

Enterprise+: Last Night’s Talk Shows

Topping the airwaves last night: After being sworn in yesterday, newly-appointed Transport Minister Kamel El Wazir sat with President Abdel Fattah El Sisi to discuss plans for the nation’s railways (watch, runtime: 01:29), (watch, runtime: 02:16), and (watch, runtime: 01:12).

Unemployment is down to 8.9% and GDP growth was at 5.4% in the first half of FY 2018-19, according to official data (watch, runtime: 01:22) and (watch, runtime: 08:06). Meanwhile, the country has seen 1,133 new projects launch with investment of USD 17 bn in the same period (watch, runtime: 03:29).

Inflows to the VanEck Vectors Egypt Index ETF made the airwaves last night(watch, runtime: 00:54) as the talking heads picked up the Bloomberg report we note above.

An industrial complex in Aswan is creating jobs for local residents, El Hekaya’s Amr Adib said in a spotlight on the national project (watch, runtime: 03:41).

Speed Round

Speed Round is presented in association with

LEGISLATION WATCH- House looking to make 0.25% healthcare tithe tax-deductible: The House of Representatives is set to discuss within the next few days amendments proposed by Rep. Mohamed El Sewedy that would make tax-deductible the 0.25% tithe on revenues that companies are required to pay to finance the new national healthcare system, according to local media reports. The bill would also, if passed, add a clause to the Income Tax Act reflecting this change. The House planning, budgeting and health committees are expected to meet soon to review the proposed amendments, according to unnamed parliamentary sources.

Reminder — the tithe is 0.25%, not 0.0025%: The Finance Ministry confirmed to Enterprise earlier this year that the taxman will take EGP 2.5 out of every EGP 1,000 in sales revenues. The tax rate that originally ran in the Official Gazette was incorrect, and the ministry has since issued a correction.

Background: The state’s EGP 600 bn health insurance plan mandated under the Universal Healthcare Act will be rolled out incrementally throughout Egypt over the course of 11-13 years, but the Finance Ministry is expected to start collecting special taxes (including the 0.25% tithe) designed to fund the scheme during the current fiscal years. As it stands, all companies are to pay the 0.25% flat tax on revenues this year except under certain circumstances and in some sectors, a senior government source told Enterprise in January, and as it stands the 0.25% levy does not count as an expense that would reduce a company’s pre-tax profit. The Finance Ministry will set a tax formula for outliers on a case-by-case basis. Among those eligible for some relief for the tax are companies making losses, joint venture projects, and services or commissions in which both a client and service providers make shared revenues from the same project or activity.

EXCLUSIVE- The IPO of state-owned Banque du Caire (BdC) could take place in 1Q2020, a senior government official told us. Officials are discussing whether to push the transaction to the start of next year as the bank wraps up settlements and paperwork that make it difficult to carry out a stake sale at the same time, our source said without providing further details. CEO Tarek Fayed had said in December he expected the IPO could take place in 2019, but flagged that final timing would be subject to market conditions. A senior bank official told is last August that BdC would float up to 30% of its shares in the IPO, which comes as part of the state privatization program.

Proceeds from the privatization of state companies will be divided between the state treasury, shareholders, and debt repayment, our source tells us. The debts include dues owed to state utility companies for water, electricity, and gas, as well as to the National Investment Bank. A committee comprised of the finance and public enterprises ministers, and the minister in charge of each company’s industry, will figure out the use of proceeds from each transaction.

Background: Public Enterprises Minister Hisham Tawfik told us earlier this month that the next wave of offerings will be new listings. The ministry plans to IPO four or five state companies at a rate of about one per month starting September. The government is also expected to announce an updated list of the companies on the roster, Tawfik said, after the state kick-started the program last week with the sale of an additional 4.5% stake in Eastern Company.

LEGISLATION WATCH- The House of Representatives’ general assembly approved the E-Payments Act yesterday, Al Shorouk reports. The law drafted by the CBE makes it mandatory for government and private sector entities to make all payments to subsidiaries, suppliers, and contractors electronically. The bill also demands electronic payment for big-ticket items such as taxes and customs payments, as well as subscriptions to IPOs, investment funds, and share purchases. Violators will pay a penalty equivalent to 2-10% of the total payment, or up to EGP 1 mn.

What does this mean for business? We’ll know more in the coming months as the government works out the executive regulations to the act.

Background: The bill is part of the government’s plan to gradually transition towards a cashless, paperless economy. The cabinet had announced last year its intention to make all government transactions electronic by the start of this year, and the Finance Ministry announced last month it will make electronic payment of government fees for amounts exceeding EGP 500 mandatory by early May.

And speaking of the move to a cashless society: The move toward (electronic) cash payment of welfare benefits appears to be gathering steam. A widely picked-up piece by state-run news agency MENA quotes Supply Minister Ali El Moselhy as saying that people benefiting from his ministry’s bread subsidy program could soon be paid cash instead. El Moselhy noted that the strategy would not save the government money, but would allow it to better target the subsidy to those who need it most. The proposal would see bread produced under the subsidy program sold at market prices.

INVESTMENT WATCH- Dutch development bank FMO announced yesterday it has invested EUR 1 mn in Dopay, a digital payroll and payments platform through which companies can pay their unbanked employees’ salaries, according to an emailed statement. Egypt is Dopay’s first operating market. “Through this investment, FMO supports dopay to scale up their payments and banking services in Egypt, thereby improving financial inclusion and creating more decent workplaces,” the statement reads. The convertible note was provided by the FMO-managed Massif fund, which invests in low-income countries.

LEGISLATION WATCH- Developers object to jail terms in draft real estate development law: Real estate developers have voiced objections to a bill the House of Representatives is drafting that could see developers who miss delivery deadlines face fines and prison time, Al Mal reports. Tarek Shoukry, head of the Federation of Egyptian Industries’ real estate development division, said missed deadlines are sometimes the result of unanticipated factors, including rising costs, that force developers to revise construction timelines. Hussein Sabbour, chairman of Al Ahly for Real Estate Development, also called for the bill to be withdrawn until the Housing Ministry completes drafting its own legislation.

Background: The parliament has been working out a new law that would regulate the real estate industry by clamping down on wildcat developers, creating a state-sponsored federation for developers, and set up a fund to hedge against sector-related risks.

LEGISLATION WATCH- Natgas authority won’t be able to hand out fines and then benefit from the proceeds: The House of Representatives amended yesterday the Natural Gas Act to make the state’s coffers the primary beneficiary of fines for those who violate the act, according to local press pickups of a story in state news agency MENA. The act, signed into law in 2017, had originally made the Natural Gas Regulatory Authority responsible for collecting fines outline in the act. The decision came after officials decided there might be a conflict of interest in the authority both handing out fines and then collecting them to fund its own operations.

Background: The Natural Gas Act deregulates the industry by allowing the private sector to trade gas through existing infrastructure. The law established the Natural Gas Regulatory Authority as the regulator for the industry, giving it a say in pricing, mandating it with regulating the system, giving it the power to both make policy and hand out licenses, and tapping it to promote investment in the sector. The authority regulates both public and private sector players.

President Abdel Fattah El Sisi has ratified a USD 1 bn loan from the World Bank to support the next phase of his administration’s economic reform program, according to a piece in state news agency MENA picked up by Al Mal. The facility is earmarked to support development of Egypt’s private sector and encourage entrepreneurship and SME development. The House of Representatives in January signed off on the facility, which came with its own set of conditions, similar to those of the IMF’s USD 12 bn extended fund facility: improve the business climate, support SMEs and entrepreneurship, curb energy subsidies, and come up with a strategy for debt control.

Transport Minister Kamel El Wazir was sworn in before President Abdel Fattah El Sisi yesterday, according to an Ittihadiya statement. The president announced El Wazir’s appointment on Sunday, and the House of Representatives greenlit the announcement on the same day. The new cabinet member, an army Lieutenant General, replaces Hisham Arafat, who resigned in the aftermath of the Ramses train disaster last month.

MOVES- Isobar MENA has announced that CEO Karim Khalifa will step down on 30 April 2019. He will be replaced by Ziad Ghorayeb, who was made the company’s regional managing director on 1 March. Karim entered the company after Dentsu Aegis Network acquired Digital Republic back in May 2016. Ziad has 17 years experience in the digital marketing industry, and was most recently head of product at Initiative MENA.

MOVES- The Public Enterprises Ministry has appointed army Staff Major General Salah El Din Helmy as chairman of the Holding Company for Maritime and Land Transport, according to a statement (pdf). The ministry also brought in Emad El Din Moustafa, a senior accountant, as the chairman of the Chemical Industries Holding Company, Minister Hisham Tawfik announced separately, according to Youm7.

CORRECTION- Contrary to a report in the domestic press that we noted in yesterday’s edition, Royal Ceramica is not pursuing an EUR 12 mn investment in Morocco. Royal Ceramica CEO Hossam El Sallab reached out yesterday to let us know that the company is not investing in manufacturing facilities “in Morocco or any other markets for the time being. However, we are working by the hour to increase our exports to Africa as part of our plan to export 8 mn sqm to Africa over five years, especially to Morocco and West Africa.” El Sallab says the export drive is being made easier by Egypt’s preferential trade agreements with African countries. The original story has been removed from our website.

Coffee with Enterprise

Mohamed Abou Ghaly learned the business in Detroit, the birthplace of the automotive industry, before joining Abou Ghaly Motors in 1994. As CEO, he has since led the business (founded by his father Maher Abou Ghaly in 1980) to become a self-styled provider of mobility solutions. While continuing to distribute brands that include Jeep, Chrysler, Subaru, KTM motorcycles and Petronas lubricants, Abou Ghaly is also the sole franchisee of Sixt Rent-a-Car and runs the London Cab service. The offering beyond car sales comes as the industry pivots toward a business model that includes financing (long a staple of western markets) and transportation services. In the latest edition of our Coffee with Enterprise series, we sat down with Abou Ghaly for a chat about the outlook for the industry in 2019 and beyond.

The key takeaways:

- Consumer demand is strong and appetite for European cars has increased since the elimination of EU tariffs in January.

- The auto market is expected to grow by 20-25% at least this year.

- The ideal interest rate to spur consumer growth is between 7.5-8%.

- Government should focus more on growing feeder industries than on manufacturing.

- Kia’s decision to invest EGP 4.2 bn into Egypt in the coming five years and Mercedes-Benz coming resumption of domestic assembly are both very positive steps.

- Abou Ghaly Motors will invest some EGP 250-300 mn in growth this year.

- Electric vehicles are coming to Egypt, it’s only a question of when. The future of autonomous vehicles is harder to predict.

Enterprise: The perception among consumers is that cars in Egypt are, in absolute terms, substantially more expensive than they would be if bought in the US or Saudi Arabia, for example — anywhere from 30-70% more expensive. Is this sentiment fair or accurate?

Mohamed Abou Ghaly: It’s accurate, yes, because even after the European Union custom tariffs were taken off, there are still taxes, development fees and other charges that have been put on to essentially cap the inflow of vehicles until the market here has adapted. But still, the situation is much better than it was before, and most customers appreciate this. The reality is often quite different to what is portrayed in the media. You see this with the “Let it Rust” campaign. Is it affecting our sales? Not really. On the ground, people are still buying cars on a daily basis. The pace is definitely slower, but there is still demand and customers are still getting their needs met.

E: Can you walk us through the price of a car brought in completely built up (CBU) from the European Union pre- and post- the phase-out of customs?

MAG: It’s quite straightforward. It’s the price of CIF (costs, insurance and freight), with — for EU manufactured cars — zero customs, but still you have development fees and VAT. Our customs are based on engine size. So a 1000 CC engine had a customs rate of 40% but a 2000 CC engine had a rate of 135%. They all pay different development fees and schedule tax but the same VAT. So now the elimination of tariffs for EU vehicles has of course made a huge difference. There were customs ranging from 62.20% to 278.87% that are now no longer applicable. I think before long, the Americans and Asians will also push for trade agreements.

E: What are the tax / customs advantages now enjoyed by EU assembled vehicles, Turkish vehicles, and Moroccan vehicles compared with all other vehicles?

MAG: Moroccan vehicles fall under the Agadir Agreement, which was signed by Morocco with Egypt, Tunisia, and Jordan. Morocco happens to manufacture cars with certain components that allow the cars to be deemed Moroccan-made. So under this agreement, there have been zero customs on cars coming from Morocco, and I think this has been the case for 10 years.

In the case of EU-assembled vehicles, the tariffs have also been decreasing for at least 10 years, because the agreement with the EU came into force in 2004 (and has been applied in Egypt since 2009). There was a delay for a couple of years so when a reduction of 30% was applied suddenly, it felt more significant. But the decrease over the past 10 years had been 70%, so the impact wasn’t actually that dramatic. Again, the media was very selective in the story it chose to tell.

When it comes to Turkey, there is the Egypt-Turkey Free Trade Agreement, which was also delayed by one year. So currently, Turkish products are still subject to tariffs at 10%, but by January 2020 they will be zero as well. Egyptians don’t rush to buy Turkish vehicles but if the price is attractive, they might consider it.

E: Has the industry felt the impact of customs tariffs on EU vehicles falling to zero?

MAG: It takes between four and five months for the cars to arrive from the EU, so if I make an order in January, I won’t see it on the ground before May or June. Within the first half of this year, the impact will be clear, and the demographics of the market will change, I believe, in the second half of the year. In the run-up to 1 January, nothing was certain. People are looking at European cars more than they were previously, but you will really see the figures in the second half of 2019. It’s reasonable to anticipate that growth in European car sales will lead the market this year. Before that, it was Koreans car sales.

E: What is your outlook on the automotive industry for 2019?

MAG: The market will grow this year by 20-25% at least. The challenge to all of us is to be well-prepared to capture this expansion, or else you risk losing your market share and presence. You need to look to a host of different factors, such the method of selling, consumer thinking and the logic behind purchasing, the buying experience, and even the different people who affect the decision to buy. For Abou Ghaly Motors, we know that we need to expand our physical location and online presence in order to embrace this growth.

Growth will depend on rise in GDP per capita: Obviously, as GDP per capita growth will impact consumer purchasing power. If the GDP per capita grows by USD 600-1000, the car market will grow by more than 25% this year. The purchasing power of the lower middle class in particular will increase, in correlation with GDP growth, which is set to rise to 5.8% this year.

Tap or click here to continue reading our sit-down with Mohamed Abou Ghaly.

The Macro Picture

Emerging markets banking on a ‘Goldilocks’ US economy: The good times will keep on rolling for emerging markets as long as the US economy remains in a ‘Goldilocks’ state, former Mideast hand Robin Wigglesworth writes in the Financial Times. A ‘Goldilocks economy’ refers to an economy that is neither booming or slowing down, but growing sustainably supported by low inflation. Both a US slowdown and an economic boom (precipitating further interest rate rises) would be negative for EM inflows. Continued investment therefore requires that the US economy walk a fine line between growth and decline, Wigglesworth says.

Investor exuberance: Ecuador’s recent bond sale is a sign of investors’ current bullish attitude towards emerging markets. Ecuador, the country that routinely defaults on its debts and only in 2015 repaid its first bond in-full and on time, surprised analysts after it successfully auctioned USD 1 bn worth of 10-year bonds to international investors. Yes, the bonds carried an interest rate of 10.75% — the highest bond yield since 2011. But the fact that appetite for highly risky assets exists indicates an exuberant approach to emerging markets on the part of investors.

But selectiveness is a virtue when it comes to EM investments: Investors should ignore the bulls and the bears and make calculated, selective EM investment choices, Mohamed El Erian, markets sage and chief economic adviser at Allianz, writes in the FT. “The best approach to EM assets is to be selective, including taking advantage of higher yields on shorter-dated bonds and loans in some of the weaker non-investment grade names that have the reserves to repay debt coming due soon,” he writes.

Egypt in the News

There was more gas-related banter in the foreign press yesterday: Egypt’s new gas fortunes could help boost our geopolitical standing by allowing us “to strengthen economic ties with Israel and Jordan while becoming an indispensable partner to Europe,” Clifford Krauss and Declan Walsh write for the New York Times. Recent agreements have “the potential to stabilize Egypt’s precarious, debt laden finances and help clean up its polluted air,” but both internal and external risks remain. While cooperation with our regional neighbors is increasing, Krauss and Walsh do not rule out the possibility that tensions could be stoked if, for example, Israel constructs its proposed undersea gas pipeline to Europe, which would undermine Egypt’s standing. They also caution the government against “squandering” the gas wealth if it fails to push ahead with subsidy cuts.

Other headlines worth knowing about:

- The Sharm El Sheikh highway barrier currently under construction earned some more digital ink, with Al-Monitor’s Rasha Mohamed wondering whether it is meant to isolate Sinai’s bedouins.

- Alexandria’s Greek community turned out on Friday to celebrate the memory of Despoina Achladioti, an iconic figure who was known as the ”Lady of Ro” and who died in 1982, according to the Greek Reporter.

- Reports that three troops and 46 Islamist terrorists were killed in Sinai has been picked up by the Associated Press, though no context has been provided.

On The Front Pages

President Abdel Fattah El Sisi’s meeting with newly-appointed Transport Minister Kamel El Wazir to discuss efforts to develop railway infrastructure topped the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Watching

Self-correcting metropolises by 2050? Researchers are attempting to create cities that can heal themselves in the same way living organisms do by 2050, according to FT Rethink (watch, runtime: 2:33). A breakthrough by a microbiologist at Delft University and expert on self-healing bio-concrete, Hendrik Jonkers, has unveiled a special type of bacteria able to lay dormant when mixed with concrete, but is brought to life by water. So “if cracks appear, they excrete calcites, better known as limestone, which fixes the damage.” Although this seems like tech from the distant future, the materials and tools have already made it to the global commercial market — the value of which is expected to grow about thirty-fold to some USD 4 bn from USD 120 mn by 2025.

Diplomacy + Foreign Trade

The Japanese business delegation currently in town met Investment and International Cooperation Minister Sahar Nasr yesterday, the ministry said in a statement. The delegation took a tour of the new investors services center in the new administrative capital. Members of the delegation said they are interested in increasing their investments in Egypt, but did not provide specifics. The delegation met with Trade and Industry Minister Amr Nassar on Sunday. The ministry signed an MoU with the Japan Bank for International Cooperation to support investment and development projects until 2022, according to a separate statement from the ministry.

Energy

Lekela, NREA sign land agreement for USD 325 mn, 250 MW Suez wind farm

Actis-backed Lekela Power has signed a land usufruct agreement with the New and Renewable Energy Authority (NREA) for its USD 325 mn, 250 MW wind farm in the Gulf of Suez, according to a cabinet statement. Lekela will pay the NREA 2% of the power produced annually for its right to use the land, NREA Chairman Mohamed El Khayat said. The Egyptian Electricity Transmission Company will purchase the remaining amount at an unannounced tariff both sides agreed on when they signed the power purchase agreement last month.

House signs off on construction of Cyprus-Egypt gas pipeline

The House of Representatives signed off yesterday on the construction of a gas pipeline between Cyprus and Egypt, state agency MENA reported. The pipeline will allow natural gas from the Aphrodite gas field to be transported to Egypt’s liquefaction facilities at Idku and Damietta, and re-exported as liquefied natural gas. The agreement was signed in September last year.

Infrastructure

SCA looks to partner with Samsung or Daewoo on new shipyard in East Port Said

The Suez Canal Authority (SCA) is looking to partner up with either of Samsung Heavy Industries or Daewoo Shipbuilding & Marine Engineering Company to build a new shipyard in East Port Said Port, SCA’s shipbuilding advisor Sayed Abou El Fetouh said, according to Al Mal. News came after SCA boss Mohab Mamish visited the South Korea-based companies’ headquarters last month to explore cooperation avenues. The Suez Canal Economic Zone (SCEZ) aims to attract USD 55 bn in investments by 2024, Mamish also said.

Basic Materials + Commodities

Egypt looks to diversify wheat imports

The government is looking to diversify its sources of wheat imports through “more realistic” specifications in tenders, Supply Minister Ali El Moselhy told Reuters’ Arabic service. El Moselhy’s statement comes a week after an official said state grain buyer GASC had rejected a Romanian wheat shipment over a “quality issue,” which El Moselhy later confirmed to Reuters.

Manufacturing

Al Ahram in talks with investors, banks over EGP 2 bn paper factory

Al Ahram newspaper is currently in talks with banks and investors from the US and China to become partners in building a planned EGP 2 bn paper factory in Rosetta, Chairman Abdel Mohsen Salama said. The factory is planned to have four production lines, including one for newspapers.

Tourism

Hotel revenues grow 30% y-o-y in January 2019: Colliers International

Hotels saw an average of 30% growth in revenue during January of this year compared to January of 2018in Cairo, Alexandria, Hurghada and Sharm El Sheikh according to a report from Colliers International picked up by the local press. This beat Colliers’ expectations that hotels would see revenue growths of only 13%.

Automotive + Transportation

House agrees EUR 350 mn loan from EIB to develop Metro Line 1

The House of Representatives has agreed a EUR 350 mn loan from the European Investment Bank (EIB) to finance the development of Cairo Metro Line 1, Al Mal reported. The EIB signed the agreement for the loan with the Investment Ministry in December.

Banking + Finance

CIB shareholders approve EGP 1/share 2018 dividend

Leading private sector bank CIB’s shareholders approved a dividend payout of EGP 1 per share, the lender said in a bourse filing (pdf). The dividend will be distributed on 28 March.

Other Business News of Note

IDA to tender 4 mn sqm of land in Sadat and Borg El Arab by September

The Industrial Development Authority (IDA) is planning to tender 4 mn sqm of land for industrial investors in Sadat and Borg El Arab cities in August or September, sources from the authority say, according to Al Mal. The land, 2 mn sqm in each city split into smaller plots of 2-4k sqm, will come at a price of no more than EGP 700 per sqm, the sources estimate. The tender was expected to launch in March, but was delayed amid now-resolved conflicts between the IDA and the New Urban Communities Authority.

National Security

Egyptian security forces kill 46 terrorists in northern Sinai

Security forces have killed 46 terrorists in recent gun battles in northern Sinai, the Armed Forces announced in a statement on Monday.

On Your Way Out

Money laundering for dummies: If you’re the kind of person to dip your toes into the world of illicit narcotics trafficking, chances are at some point you’ll need to find a way to clean up all that dirty money. Bloomberg has you covered. Thankfully you have a lot of options available to you: shell companies, mirror trades and a process known as ‘smurfing’ — the separation of large quantities of money into smaller amounts that can be deposited in banks in different locations.

The Market Yesterday

EGP / USD CBE market average: Buy 17.39 | Sell 17.49

EGP / USD at CIB: Buy 17.38 | Sell 17.48

EGP / USD at NBE: Buy 17.38 | Sell 17.48

EGX30 (Monday): 15,098 +0.8%

Turnover: EGP 1.4 bn (51% above the 90-day average)

EGX 30 year-to-date: +15.8%

THE MARKET ON MONDAY: The EGX30 ended yesterday’s session up 0.8%. CIB, the index heaviest constituent ended up 0.2%. EGX30’s top performing constituents were Heliopolis Housing up 5.1%, Arab Cotton Ginning up 3.6%, and Eastern Company up 2.6%. Yesterday’s worst performing stocks were Telecom Egypt down 1.1%, Arabia Investments down 1.0% and Kima down 0.6%. The market turnover was EGP 1.4 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -16.1 mn

Regional: Net Short | EGP -15.4 mn

Domestic: Net Long | EGP +31.5 mn

Retail: 46.7% of total trades | 45.9% of buyers | 47.5% of sellers

Institutions: 53.3% of total trades | 54.1% of buyers | 52.5% of sellers

WTI: USD 56.91 (+0.21%)

Brent: USD 66.58 (+1.28%)

Natural Gas (Nymex, futures prices) USD 2.78 MMBtu, (+0.43%, Apr 2019 contract)

Gold: USD 1,293.60 / troy ounce (+0.19%)

TASI: 8,426.29 (-0.47%) (YTD: +7.66%)

ADX: 4,870.40 (-0.03%) (YTD: -0.91%)

DFM: 2,591.89 (+0.53%) (YTD: +2.46%)

KSE Premier Market: 5,582.67 (+0.1%)

QE: 9,744.22 (-0.25%) (YTD: -5.39%)

MSM: 4,085.44 (-0.12%) (YTD: -5.51%)

BB: 1,406.34 (+0.04%) (YTD: +5.17%)

Calendar

10-12 March: A delegation of 50 Japanese business companies is expected to visit Egypt.

11-13 March (Monday-Wednesday): International Conference on Material Science & Engineering Recent Advances and Challenges, Sofitel El Gezirah, Cairo, Egypt.

14-16 March (Thursday-Saturday): Metal & Steel, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): WINDOOREX, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): Egypt Projects, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): FabEx Middle East, Egypt International Exhibition Center, Nasr City, Cairo.

March (date TBD): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

15 March (Friday): Arab World Social Innovation Forum, American University in Cairo, Cairo, Egypt.

16-18 March (Saturday-Monday): Automation Technology Expo, Cairo International Convention Center, Nasr City, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18-19 March (Monday-Tuesday): Coaltrans, Four Seasons Nile Plaza, Garden City, Cairo, Egypt.

19-20 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

20-22 March (Wednesday-Friday): Egypt International Green Building Conference, Egypt International Exhibition Center, Nasr City, Cairo.

20-22 March (Wednesday-Friday): Watrex, Egypt International Exhibition Center, Nasr City, Cairo.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.