- Inflation unexpectedly surges in February. Will CBE postpone rate cuts? (Speed Round)

- The scramble to drill for oil and gas in the Red Sea just got underway. (Speed Round)

- Heliopolis Housing planning to offer a 32.25% stake on the EGX by mid-2019. (Speed Round)

- Snackfood player Edita plans to invest EGP 450 mn this year. (Speed Round)

- Qalaa’s ERC just made petrol. (Speed Round)

- Engineering Authority’s Kamel El Wazir named new transport minister. (Speed Round)

- Egypt to receive USD 700 mn in funding from the AfDB. (Sped Round)

- For the second time in five months, a Boeing 737 Max has crashed, killing 157 people. (What We’re Tracking Today)

- The Market Yesterday — Pharos View: Despite unsupportive inflation numbers, rate cut still possible

Monday, 11 March 2019

Inflation unexpectedly rises to 14.4% in February.

TL;DR

What We’re Tracking Today

Medhat Khalil’s take-private bid for Raya Holding kicks off today: A mandatory tender offer for nearly 37% of Raya Holdings by company chairman Medhat Khalil will begin today, the EGX says in a statement. A company majority-owned by Khalil, El Pharonia Real Estate Investment, is making the offer at EGP 5.53 per share, a slight premium to the EGP 5.35 at which it last closed. The FRA had ordered Khalil last year to submit an MTO for Raya or sell down his stake, arguing that he and related parties controlled a combined 42% of the outfit, a level of control that triggers an MTO under securities regulations.

Our friends at AmCham are putting on a one-day entrepreneurship event today in collaboration with the AUC School of Business, Mindsalike Network, the Entrepreneurs’ Organization and Endeavor Egypt.

A Japanese business delegation is in town today and tomorrow to talk investment, the domestic press reports. The delegation will meet with government officials and business owners.

The CIB-sponsored 2019-2020 PSA Women’s World Championship will take place in front of the Great Pyramid of Giza, PSA World Tour announced on Wednesday. The tournament, deemed “the most prestigious squash tournament of the season,” will bring 64 of the best female squash players in the world together to compete for the title between 23 October and 1 November. The world championship was last held in front of the Pyramids in 2006. “The Pyramids at Giza have become synonymous with squash over the past two decades and have provided the sport with some of the most iconic sporting images of all time,” PSA Chief Executive Alex Gough said.

China has ordered its airlines to ground all Boeing 737 Max aircraft after 157 people were killed in an Ethiopian Airlines crash yesterday. It is the second time in five months that a Boeing 737 Max has crashed: 189 people were killed when a Lion Air flight went down in Indonesia in October. The 737 Max is “the latest version of Boeing's workhorse narrowbody jet that first entered service in 2017,” Reuters reports.

Are you due to board a 737 Max this week? You’ll want to start by reading this piece in the New York Times, which looks at how “the rarity of two planes of the same model going down in such a short time span has urgently caught the attention of pilots, passengers, engineers and industry analysts.” Also worth reading: A similar piece from CNBC.

Six Egyptians died in the crash, which took place just minutes after the flight departed Addis Ababa for Nairobi. Among the dead, which included an accountant, a law student, aid officials and a noted professor, were 32 Kenyans, 18 Canadians, nine Ethiopians and eight each from Italy, China and the United States, according to the Associated Press.

Is the Fed getting cold feet? In the clearest sign yet that the US Federal Reserve will again hold off on raising interest rates when it meets next week, Chairman Jerome Powell has said that the central bank sees no need to continue tightening. Instead, the Fed has “adopted a patient, wait-and-see approach to considering any alteration in the stance of policy,” he said. The WSJ has more.

In miscellany worth knowing about this morning:

- Protest in Algeria becomes a strike in the oil fields: Algerian President Abdelaziz Bouteflika is back in town after seeking medical treatment abroad. Protests against his plan to seek another term in office expanded yesterday to include a strike by workers at the country’s “massive state oil and gas companies,” the WSJ, FT and Bloomberg report.

- The Donald will not meet Xi Jinping on 27-28 March as the US and China look to hash out a trade truce before the two leaders meet, the Financial Times and Bloomberg report.

- Democratic presidential challenger Elizabeth Warren wants to break up Apple, too, she told the Verge, saying the company’s control over its app store puts it in the same category as Google, Facebook and Amazon.

- Would-be Democratic presidential candidates Joe Biden and Bernie Sanders topped a poll of likely Iowa caucus-goers, according to Reuters.

Speaking of the Verge: Vlad Savov got to hold the Huawei Mate X foldable phone in his very own hand — one of the few to have done so.

PSA- A quick reminder that time changed in much of North America yesterday. New York and Toronto are now CLT -6. There is no change to daylight saving time in Egypt.

Enterprise+: Last Night’s Talk Shows

The appointment of Gen. Kamel El Wazir as new Transport Minister led the airwaves last night (watch, runtime: 02:21), (watch, runtime: 04:33) (watch, runtime: 03:08) and (watch, runtime: 06:33). We have more in this morning’s Speed Round, below.

The launch of the first oil and gas exploration tender in the Red Sea also earned some airtime last night (watch, runtime: 04:48). We have everything you need to know about this in our Speed Round, below.

President Abdel Fattah El Sisi stressed the importance of Egypt’s economic reform program to improving public services and quality of life for all citizens in a speech marking the Armed Forces’ observance of Martyrs' Day (watch, runtime: 02:04).

Speed Round

Speed Round is presented in association with

Inflation unexpectedly surges in February: Annual headline urban inflation accelerated to 14.4% in February compared to 12.7% in January, the central bank said in a statement (pdf). Month-on-month, inflation rose to 1.7% in February compared to 0.6% in January. Annual core inflation, which excludes volatile items such as food and fuel, shot up to 9.2% compared to 8.6% in January. Vegetables were the biggest contributors to rising prices, advancing some 39.4%, according to CAPMAS figures. Other major contributors were meat and chicken, household utilities and transportation.

Does this mean the central bank will pull back from rate cuts? The Central Bank of Egypt, which sees inflation falling to 9% (±3%) by the fourth quarter of this year, cut its key interest rates by 100 bps last month, citing lower inflation as one of the reasons behind its decision. The surge in February inflation has some analysts suggesting further cuts could be delayed. “We think the reading might dim the chances for another rate cut when the Egyptian central bank meets later this month,” Mohamed Abu Basha, head of macro analysis at EFG Hermes said in an emailed note. Allen Sandeep, head of research at Naeem Brokerage, said in a note that the higher than expected inflation “should put the brakes on monetary easing for now”.

Others are still optimistic: Radwa El Swaify, head of research at Pharos Holding, told Reuters she expects inflation to reach 13.5-14.5% between now and September as vegetable prices remain the primary challenge. That said, she sees inflation coming under control and another 100 bps rate cut this month as likely — subsidy cuts expected in June mean this month’s meeting is the last opportunity to cut rates until September. (Pharos’ full research note is this morning’s Pharos View, below.) Shuaa Capital’s Esraa Ahmed said the surge in inflation makes another cut more difficult, but noted inflation is being fueled primarily by volatile items such as vegetables and this “should not hinder a possible rate cut if the overall scene is conducive to monetary easing.”

The central bank will next look at interest rates on 28 March.

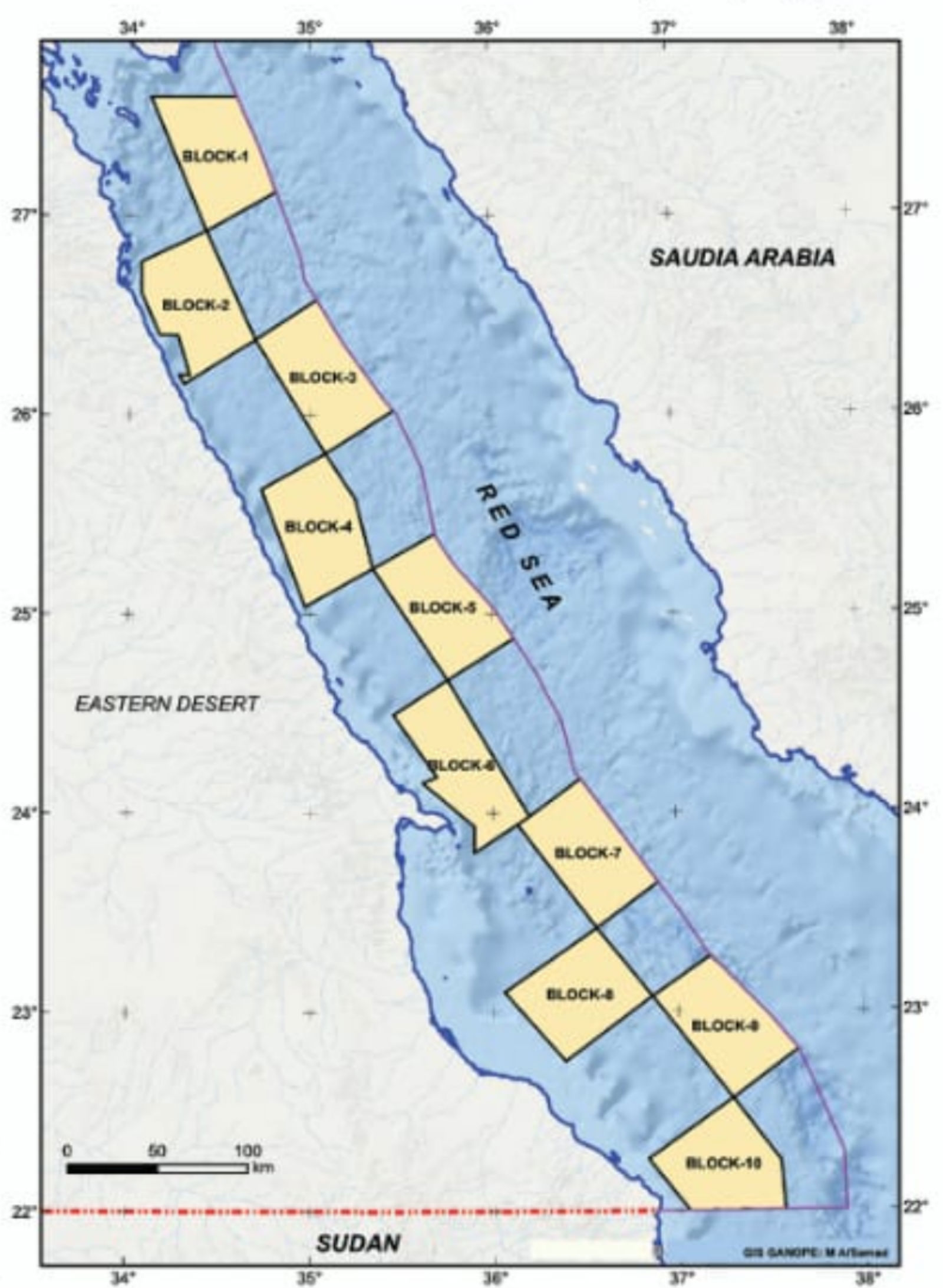

The scramble to drill for oil and gas in the Red Sea just got underway: The South Valley Egyptian Petroleum Holding Company (Ganope) has launched a tender for 10 oil and gas exploration blocks off the Red Sea coast under a new production sharing contract, according to a company statement (pdf). There is detailed information (pdf) on the bid round available on Ganope’s website. The launch of the tender came following the completion of seismic scans in the area by Schlumberger, Norway’s TGS and three other oil companies. Schlumberger’s data suggests there is a high probability of natural gas discoveries, noting that the seafloor resembles the gas-rich terrain of neighboring Saudi Arabia.

Just in time: The tender was expected back in December but was delayed just long enough to take place under new production sharing contracts, which took effect this quarter. The new friendlier terms would see companies bear the cost of exploration and production in return for a share of the output, which will vary from one concession to another based on the cost of investment. They also allow companies to sell their share of production to any entity of their choosing, as opposed to the current system, which gives them only one-third of output and allows the government to buy the producer’s entire share at predetermined prices.

This is clearly not the time for a company to pursue LNG imports: On the natural gas front,private sector companies seeking to import LNG for the local market have put their plans on hold now that Egypt is exporting surplus gas, according to a domestic press report citing an oil ministry official. The Natural Gas Regulatory Authority, which issued 18 licenses for gas import and distribution last week, has not handed a single import license to a private sector company. The ministry has signalled it is willing to extend preliminary import approvals for companies including BB Energy, Fleet Energy, and Qalaa Holdings’ TAQA Arabia.

IPO WATCH- Heliopolis Housing planning to offer a 32.25% stake on the EGX by mid-2019: Heliopolis Company for Housing and Development (HHD) is planning to offer a 32.25% stake on the EGX by mid-2019, Sahar Al Damati, HDD’s managing director for financial affairs, told Zawya. Public Enterprises Minister Hisham Tawfik said last week that HHD was among a list of companies planning secondary offerings before Ramadan. However, Al Damati’s comments suggest that the move could instead take place in May or June. The size of the stake on offer is “waiting for the company’s board of directors approval, which is expected to be announced [in the] next few days,” she said. Heliopolis Housing was originally expected to sell a stake before the end of 2018, but the move was delayed amid the turmoil in emerging markets.

Heliopolis will sell off part of its land portfolio at an auction in the coming two months to finance its investment plans, Al Damati said. “The company decided to sell its 1,980 sqm land plot behind the Sheraton, as well as a 100 acre land plot in Heliopark City in New Cairo, and a 190 acre land plot in New Heliopolis City to implement HHD’s investment plan, along with conducting a financial restructuring of the company and considering a capital increase,” she said.

INVESTMENT WATCH- Edita plans to invest EGP 450 mn in 2019: Edita is planning to invest EGP 450 mn on its expansion in Morocco and in adding new production lines in its Egypt facilities, the company said in a bourse filing. The company, Egypt’s largest maker of snack foods by market share with brands including Todo and Molto, offered no further details of its plans.

Eastern Sugar Company has lined up bridge financing of EGP 1.2 bn and a further USD 100 mn for its El Minya factory, the company said in a statement (pdf). The syndicated facility was provided by the National Bank of Egypt, QNB Al Ahli, Bank of Alexandria, Industrial Development Bank, The United Bank of Egypt and Suez Canal Bank. The company is currently working on another loan agreement for USD 700 mn.

Advisors: Al Ahli Capital and Zaki Hashem & Partners served as financial and legal advisers respectively to El Canal Sugar, while Helmy Hamza & Partners advised the banks.

M&A WATCH- Americana’s minority shareholders ask FRA to compel MTO bid by Alabbar: Minority shareholders of Egyptian International Tourism Projects Company (Americana Egypt) are demanding that the Financial Regulatory Authority (FRA) take legal action to compel a company led by Emirati business figure Mohamed Alabbar to make a mandatory tender offer for the Americana Egypt’s shares, Al Mal reports. Alabbar controls Adeptio AD Investment, the largest shareholder in Americana. Adeptio had said it will challenge before an administrative court the FRA’s rejection of its appeal against the MTO. Adeptio argues that its indirect ownership of Americana Egypt is less than 90% of its total capital and therefore does not require an MTO submission.

ERC just made petrol: Qalaa Holding’s USD 4.3 bn Egyptian Refining Company facility successfully concluded trial operations of its unit producing 98-octane fuel and is set to finish all trial operations by the end of 2Q2019, Qalaa Holdings said in a bourse filing. Qalaa recently announced that it had made its first diesel at the USD 4.3 bn facility. The first product came in at 1.5 parts of sulfur per mn (ppm) — well ahead of the 10 ppm sulfur required to qualify as Euro V diesel, the cleanest-burning diesel in the world. ERC will cut Egypt’s present-day sulfur emissions by about a third and reduce Cairo’s carbon footprint at the same time. The facility is due to enter full commercial operations by the third quarter of this year. You can tap or click here to take a tour of ERC in this video produced by Qalaa, including some very cool drone footage (runtime: 6:52).

Saudis to launch Egypt-Saudi interconnection tender in June: The Saudi government will issue in June a new tender for its power transmission lines that will be part of the now USD 2.5 bn Egypt-Saudi interconnection project, sources told the local press. The project, which had been put on hold, was initially estimated to cost USD 1.6 bn, but the kingdom had to revisit its plans for the lines to avoid conflict with its USD 500 bn Neom city mega project. This caused the cost estimates to shoot upward to USD 2.5 bn, and necessitated a new tender.

Egypt, meanwhile, has completed its power line tenders and is waiting on the new route to begin construction, the sources noted. Authorities from both sides agreed to finalize preparations in December and begin construction by no later than 1Q2020. Alstom, ABB, and Siemens have all applied for Egypt’s tender, but the results are yet to be made public.

MOVES- Engineering Authority’s Kamel El Wazir named new transport minister: President Abdel Fattah El Sisi tapped the current head of the Armed Forces Engineering Authority, Kamel El Wazir, to serve as the nation’s new transport minister, replacing Hisham Arafat, who stepped down after a deadly train crash at Cairo’s main train station. El Sisi made the announcement during the Armed Forces’ observance of Martyrs' Day, according to Ahram Online.

Takes office today: The House of Representatives approved El Wazir’s appointment in a session on Sunday, and he is due to take the constitutional oath before the president today, the domestic press reported. The authority’s chief of staff, Ehab El Far, will reportedly take on El Wazir’s former position. El Sisi’s appointment of a new minister comes in the aftermath of the Ramses train disaster last month.

The foreign press widely covered the announcement, with pickups from the Associated Press, The National, China’s Xinhua and France’s AFP. Wire pickups are all noting that the Armed Forces are being brought in to run a civilian portfolio.

Egypt to receive USD 700 mn in funding from the AfDB: Egypt is to receive loans totalling USD 700 mn from theAfrican Development Bank (AfDB), the bank’s VP Khaled Sherif told Al Masry Al Youm. The bank will provide a USD 500 mn facility earmarked for electricity projects over two equal installments in June and January, as well as a separate USD 200 mn facility to finance railway upgrades in November. Bank officials told Enterprise last week that the pan-African lender plans to lend Egypt USD 1.2 bn in 2019 and 2020.

MOVES- Uber Egypt has named Ahmad Hammouda as the company’s new general manager for Egypt, according to Menabytes. Hammouda joined Uber in 2017 and has worked as an operations executive during his tenure at the company. He fills the position left by Abdellatif Waked, who became the general manager for Uber MENA five months ago.

EXCLUSIVE- US-based AgTech start-up Bon Harvest is raising a seed round of USD 1.5 mn to launch a blockchain-based inventory system in the US in April 2019 and Egypt in 2020, according to an emailed statement from the company’s Egyptian-American CEO, Teymour el Derini. The two-year-old business aims to use blockchain technology to build an inventory system that will create a market for “ugly” fruit and veg, aiming to reduce food waste at the farm level and make it easier for smaller suppliers to compete in the marketplace.

Bon Harvest plans to begin working with Egyptian farmers and food industry leaders by 2020. It is looking to work with the government to introduce blockchain-based inventories into the country’s agriculture sector, which it believes will help reduce food price volatility, increase revenues and cut back on waste.

How will it work exactly? First, the blockchain-based inventory system will facilitate communication and make possible smart contract payment between farmers and buyers. Secondly, the Bon Harvest Exchange, an anonymous digital market reader (aggregating local prices) will match food supply with demand, reducing food waste of perishable produce and maximizing profits for farmers. Finally, the network will itself serve as a platform, strengthening the connection between farmers and the communities they supply.

CORRECTION- We wrote that Egypt’s crude oil production averaged 1.8 bbl/d in February. We were wrong: Combined oil and gas production last month reached a record 1.8 mn barrels of oil equivalent (boe/d). H/t Tamer N.

Image of the Day

If this is the future of the high-end auto industry, it’s sleek and almost impossibly expensive. Making its debut at the Geneva Motor Show was Hispano Suiza’s USD 1.7 mn Carmen (anove): a 1,005-horsepower electric car which does zero-to-60-mph in under three seconds and packs a maximum 503 bhp. The Carmen represents the 115-year-old Spanish company’s first foray into the field of electric cars, Bloomberg tells us.

Meanwhile, Bugatti’s ‘La Voiture Noire’ (below) doesn’t give a [redacted] about fuel efficiency: With six tailpipes and a 16-cylinder engine, the Batmobile knock-off has reportedly been sold for EUR 16.7 mn, making it the most expensive car of all time.

Egypt in the News

Human rights are still dominating coverage of Egypt in the international press, with Reuters and the Washington Post still Malaysia’s deportation of six Egyptians, which we noted yesterday.

Other headlines worth noting in brief include:

- Egyptian workers hoping to find employment in the Gulf are getting squeezed out as GCC countries nationalize their jobs, leaving the Division of Recruitment Companies at the Cairo Chamber of Commerce scrambling for alternatives, according Al Monitor.

- Egypt has been slowly regaining its appetite for stories about the monarchy, says The National.

- Egypt and Hamas’ improving relationship is raising eyebrows, as Hamas chief Ismail Haniyeh concludes a 24-day trip in Egypt, reports The National.

On The Front Pages

President Abdel Fattah El Sisi’s speech at the Armed Forces celebration of Martyrs' Day topped the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar). At the event, the president reaffirmed the state’s commitment to fighting terrorism and paid respect to the families of martyrs.

Diplomacy + Foreign Trade

French President Emmanuel Macron has invited President Abdel Fattah El-Sisi to attend this year’s G7 summit, which will be held in Biarritz, France, on 25-27 August, according to an Ittihadiya statement. The two presidents reportedly held a phone call where they discussed bilateral cooperation between France and Egypt, including maintaining close cultural ties and working together on regional issues such as the situation in Libya.

Japan is considering establishing an industrial zone in the Suez Canal area, the Industry and Trade Ministry said in a statement (pdf). Industry Minister Amr Nassar met a delegation of Japanese companies and investors and discussed ways and opportunities for increasing Japanese investments in Egypt.

A cohort of Egyptian human rights advocates presented yesterday a report to the United Nations Human Rights Council (UNHRC) highlighting the “blatant discrimination” against women in Qatar, reports Ahram Online. The report referred to an article stipulated in the Qatari Nationality Law which denies citizenship to the children of Qatari women married to non-Qataris, among other provisions enabling discriminatory practices.

Automotive + Transportation

El Sisi announces the extension of Egypt’s railways to Sudan and Africa

President Abdelfattah El Sisi announced plans to extend it’s railway lines to Sudan and Africa during his address at the Armed Forces educational seminar yesterday, reports the local press.

Banking + Finance

Catalyst acquires Nilex adviser Delta Financial

Catalyst Partners has acquired Delta Financial Investments and laid out a plan to restructure the company, according to a press release (pdf). Delta is licensed by the Financial Regulatory Authority to offer non-banking financial services, manage portfolio and mutual funds, and advise on Nilex IPOs.

Banque Misr agrees to give Vodafone Egypt EGP 4.5 bn in credit facilities

Banque Misr has agreed to give Vodafone Egypt EGP 4.5 bn in credit facilities that will be used to fund the company’s capital and operating expenses, a bank official told Masrawy. The UK’s Vodafone is the majority shareholder in Vodafone Egypt while Telecom Egypt owns 45% of the company.

Elsewedy Electric BoD signs off on USD 150 mn Afreximbank credit facility

The board of directors of Elsewedy Electric has approved signing a USD 150 mn loan agreement with the African Export–Import Bank, according to an EGX disclosure (pdf).

Other Business News of Note

Madbouly Cabinet maps out priority areas in Egypt in need of development

The Madbouly Cabinet mapped out last week priority areas in Upper Egypt most in need of the Upper Egypt Development Authority’s attention, according to a statement. Topping the list of priority areas was the region between Halayeb and Shalateen, and Lake Nasser and the area between the Quseer and Safaga axis and the Kharga and Dakhla oases. The rest include Luxor, northern Aswan, Fayoum, Beni Suef and El Wadi El Gedid among others.

On Your Way Out

Meet Mansa Musa, the richest person in history: The story of Mansa Musa, the 14th century African ruler estimated to have been the richest man who ever lived, reads like a fairytale. But this may be because, as this piece by Naima Mohamud for the BBC notes, “the history of the medieval period is still largely seen only as Western history.” Musa’s kingdom of Mali stretched for 2,000 miles and the king’s empire reportedly accounted for almost half the gold of the Old World. So when Musa embarked on an epic pilgrimage to Mecca, he traveled through the desert accompanied by 60,000 men in gold brocade and Persian silk and a hundred camels weighed down with the precious metal.

One of his most notable stops was in Cairo, where he handed out so much gold that its value throughout the region decreased dramatically for 10 years, reportedly leading to some USD 1.5 bn of cumulative economic losses.

Have a look at the list of the wealthiest men of all time for a reminder of how skewed the Eurocentric view of history is: Not only does Musa top the list with his “incomprehensible” wealth, but right up there beside him are Zhao Xu, 11th century ruler of China, and Akbar I, 16th century ruler of India. The wealth of both is termed “incalculable.”

The Market Yesterday

EGP / USD CBE market average: Buy 17.39 | Sell 17.49

EGP / USD at CIB: Buy 17.38 | Sell 17.48

EGP / USD at NBE: Buy 17.38 | Sell 17.48

EGX30 (Sunday): 14,981 (+0.5%)

Turnover: EGP 608 mn (34% below the 90-day average)

EGX 30 year-to-date: +14.9%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.5%. CIB, the index heaviest constituent ended up 0.7%. EGX30’s top performing constituents were Elsewedy Electric up 3.2%, Arabia Investments up 3.0%, and Arab Cotton Ginning up 2.3%. Yesterday’s worst performing stocks were Global Telecom down 1.3%, SODIC down 0.7% and Pioneers down 0.7%. The market turnover was EGP 608 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -7.2 mn

Regional: Net Long | EGP +33.4 mn

Domestic: Net Short | EGP -26.3 mn

Retail: 60.5% of total trades | 61.1% of buyers | 60.0% of sellers

Institutions: 39.5% of total trades | 38.9% of buyers | 40.0% of sellers

PHAROS VIEW

Despite unsupportive inflation numbers, rate cut still possible: Inflation in February was higher than anticipated, rising to 13.9% y-o-y for total Egypt (urban and rural), against an expectation of 12.2%. M-o-m inflation grew to 1.8%, higher than a projected 0.4%. Despite the spike in inflation, Pharos still sees another 1% cut in rates on 28 March, as this would be the only window for the CBE to make the cut before September (to guard against subsidy cuts). Pharos sees the cuts as necessary for implementing the government’s debt control strategy, so it is unlikely for the CBE to pass up the March window. The investment bank also sees Egypt’s debt as attractive to foreign investors even with a 1% cut in interest rates. You can catch the full report here (pdf).

***

WTI: USD 56.07 (-1.04%)

Brent: USD 65.74 (-0.84%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (-0.03%, Apr 2019 contract)

Gold: USD 1,299.30 / troy ounce (+1.03%)

TASI: 8,465.75 (-0.16%) (YTD: +8.16%)

ADX: 4,872.08 (-0.86%) (YTD: -0.87%)

DFM: 2,578.14 (-0.63%) (YTD: +1.91%)

KSE Premier Market: 5,576.91 (-0.37%)

QE: 9,769.04 (-0.12%) (YTD: -5.15%)

MSM: 4,090.20 (-0.55%) (YTD: -5.40%)

BB: 1,405.84 (-0.22%) (YTD: +5.13%)

Calendar

10-12 March: A delegation of 50 Japanese business companies is expected to visit Egypt.

11-13 March (Monday-Wednesday): International Conference on Material Science & Engineering Recent Advances and Challenges, Sofitel El Gezirah, Cairo, Egypt.

14-16 March (Thursday-Saturday): Metal & Steel, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): WINDOOREX, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): Egypt Projects, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): FabEx Middle East, Egypt International Exhibition Center, Nasr City, Cairo.

March (date TBD): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

15 March (Friday): Arab World Social Innovation Forum, American University in Cairo, Cairo, Egypt.

16-18 March (Saturday-Monday): Automation Technology Expo, Cairo International Convention Center, Nasr City, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18-19 March (Monday-Tuesday): Coaltrans, Four Seasons Nile Plaza, Garden City, Cairo, Egypt.

19-20 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

20-22 March (Wednesday-Friday): Egypt International Green Building Conference, Egypt International Exhibition Center, Nasr City, Cairo.

20-22 March (Wednesday-Friday): Watrex, Egypt International Exhibition Center, Nasr City, Cairo.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.