- Inflation drops in December, falling within CBE’s year-end targets. (Speed Round)

- Purchasing managers’ index rises in December to four-month high, remains in contraction range. (Speed Round)

- Net FDI and non-oil exports down, remittances flat as current account deficit largely unchanged in 1QFY18-19. (Speed Round)

- Mercedes-Benz could soon resume the assembly of passenger cars in Egypt, official tells El Sisi. (Speed Round)

- Apicorp to invest USD 1 bn in five countries, including Egypt, in 2019. (Speed Round)

- Seven law firms bidding to act as legal advisors in Egypt’s upcoming eurobond issuance. (Speed Round)

- In landmark Cairo speech, US SecState Mike Pompeo touts America as “a force for good” in the Middle East. (Speed Round)

- New antitrust act this week. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 13 January 2019

Inflation is down — but so are FDI and non-oil imports

TL;DR

What We’re Tracking Today

You want to pack this morning with nasty weather in mind. Depending on who you want to believe, we’re looking at a cold (high of 16°C) and intermittently windy day that could bring with it a sand storm and / or rain.

The 2019 investor conference season gets underway this morning for blue-chip Egyptian companies. CI Capital’s MENA investor conference runs today through Wednesday in Cairo and then 22-23 January in New York.

We are likely to get a new antitrust act this week. MPs could vote as early as today on the proposed text of a bill that would give the Egyptian Competition Authority (ECA) expanded power to regulate commerce. The recently activist ECA has sought a mandate to review all M&A transactions worth north of EGP 100 mn and has of late issued public warnings to companies including Uber, Careem and Apple over what it claims could be anti-competitive practices. Cabinet signed off on the bill last week. A vote scheduled for early December was scrubbed when the House general assembly failed to reach quorum.

President Abdel Fattah El Sisi is in Jordan today for talks with King Abdullah, according to an Ittihadiya statement cited by Youm7.

Global markets snapped a five-day winning streak on Friday ahead of US earnings season, which gets underway this week. A wave of profit warnings, job cuts, worries about the Chinese economy and global trade tensions could all be weighing on sentiment, Bloomberg suggests.

Two big producers have just called USD 60 as the bottom for oil, Bloomberg reports. Oman’s oil minister sees oil trading at USD 60-70 / bbl this year, while Eni boss Claudio Descalzi sees crude at USD 60-62. Egypt recently walked away from a fuel hedging plan as oil was trading significantly below the USD 67 / bbl it had used to set its budget for the current state fiscal year. Crude has risen just over 20% from its low in December.

World Bank boss Jim Yong Kim is ditching the presidency of the global institution to take a gig with a private equity firm. Kim is stepping down three years ahead of schedule to take a job with Global Infrastructure Partners, a New York-based PE fund that has a particular interest in renewable energy and which sold a majority stake in Gatwick airport to Vinci las month. See more in the FT, WSJ, Bloomberg and the Economist. Kim steps down on 1 February.

Are we really going to see Ivanka Trump running the World Bank? The institution is traditionally led by an American, and the FT reports that names being bandied about in DC as potential replacements include former UN ambassador Nikki Haley, top treasury official David Malpass, USAID boss Mark Green and, yes, Trump.

Investment bankers won’t be getting much out of Slack: Slack is planning to go public via a direct listing, the Wall Street Journal reports, saying the workplace chat app (which powers thousands of companies around the world, including Enterprise) will follow Spotify in “bypassing a traditional IPO.”

Sound smart: “In a direct listing, a company bypasses the traditional underwriting process, which involves lining up investors ahead of time and selling shares at a set price, and instead lets the open market play a greater role in setting the price. No money is raised for the company. … For companies that can forgo the cash, the benefits include sidestepping hefty underwriting fees and avoiding lockups that prevent insiders from selling shares for a set period.”

In miscellany worth knowing about this morning:

- From the department of the obvious: Emerging markets can’t escape the Fed’s balance sheet unwind. (Financial Times)

- Big hedge funds that have invested in both tech and people are shining as smaller players come off their worst performance in years. (Financial Times)

- Jeff Bezos is getting a divorce after 25 years of marriage.The Amazon founder and CEO is the richest man in the world, setting off all of the expected hand-wringing about prenups, influence on Amazon going forward and the potential for the world’s biggest divorce settlement. (Wall Street Journal | New York Times)

- Saudi Arabia says it will sink USD 10 bn into a refinery in Pakistan, following up on some USD 6 bn it had pledged last year in an assistance package that included help to finance crude imports. (Reuters)

Must-read for tech-heads: The big hangup: Why the future is not just your phone, in the Wall Street Journal.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag of nuts on the airwaves on another evening devoid of any noteworthy business or econ-related discussions.

US Secretary of State Mike Pompeo’s speech in Cairo on Thursday was a reflection of the Trump administration’s “clear and straightforward” policies, Al Shorouk’s editor-in-chief Emad El Din Hussein said on Hona Al Asema (watch, runtime: 02:35). We have the full story on Pompeo’s trip to Egypt in Speed Round, below.

President Abdel Fattah El Sisi plans to hold regular meetings with Egypt’s governors to follow up on each governorate’s issues and projects, Ittihadiya spokesman Bassam Rady told Masaa DMC’s Eman El Hosary (watch, runtime 01:55).

African Cup preparations: Youth and Sports Ministry spokesman Mohamed Fawzy updated viewers on Egypt’s preparations to host the 2019 African Cup of Nations this summer. Prime Minister Moustafa Madbouly has apparently taken the preparations as a chance to encourage investing in the country’s sports facilities (watch, runtime 01:35).

Al Azhar University’s curriculum allegedly includes several books that support extremist thought, undermine the concept of moderate Islam, and attack the Egyptian state, Rep. Ghada Agamy said on Hona Al Asema (watch, runtime: 03:43).

Speed Round

Inflation drops in December, falling within CBE’s year-end targets: Annual headline inflation dropped to 12.0% in December, down from 15.7% the previous month, according to a statement from the central bank (pdf). Monthly headline inflation also dropped to -3.2%, down from -0.8% in November. Annual core inflation, meanwhile, which doesn’t include volatile goods such as food, rose to 8.3% in December from 7.9% “due to an unfavorable base effect,” the CBE said, despite month-on-month inflation in fruit and vegetable prices falling 19.5%. The CBE had previously said it expects inflation to come in at c.13% in 4Q2018 before dropping to the single digits over the course of this year “after the temporary effect of fiscal supply shock dissipates.”

The drop in inflation could bode well for interest rates: “With headline inflation now 5.25 percentage points below the 17.25 percent benchmark — and assuming that underlying factors such as oil prices remain under control — the central bank may cut interest rates by 100 basis points at its March 28 meeting,” Naeem Holding said, according to Bloomberg. CI Capital’s Hany Farahat agrees the CBE could cut rates during 1H2019, but other analysts say it is “too early to tell” whether declining inflation will lead the CBE to resume its monetary easing cycle, Reuters adds.

No impact from hike in FX rate for customs on non-essential imports: The government’s recent decision to scrap the discounted customs exchange rate for non-essential imports had been expected to send inflation up by as much as 1 ppt, but has yet to register on inflation. That suggests the next few months may see “an interim upside,” Naeem says.

Still, we haven’t seen the end of inflation: The government is about to test letting gasoline prices float +/- 10% in tandem with global oil prices. It will pilot the pricing mechanism with 95 octane fuel (which constitutes a tiny fraction of the total market) as early as 2Q2019 and could then extend the test to other grades when it next cuts energy subsidies for its 2019-20 budget cycle.

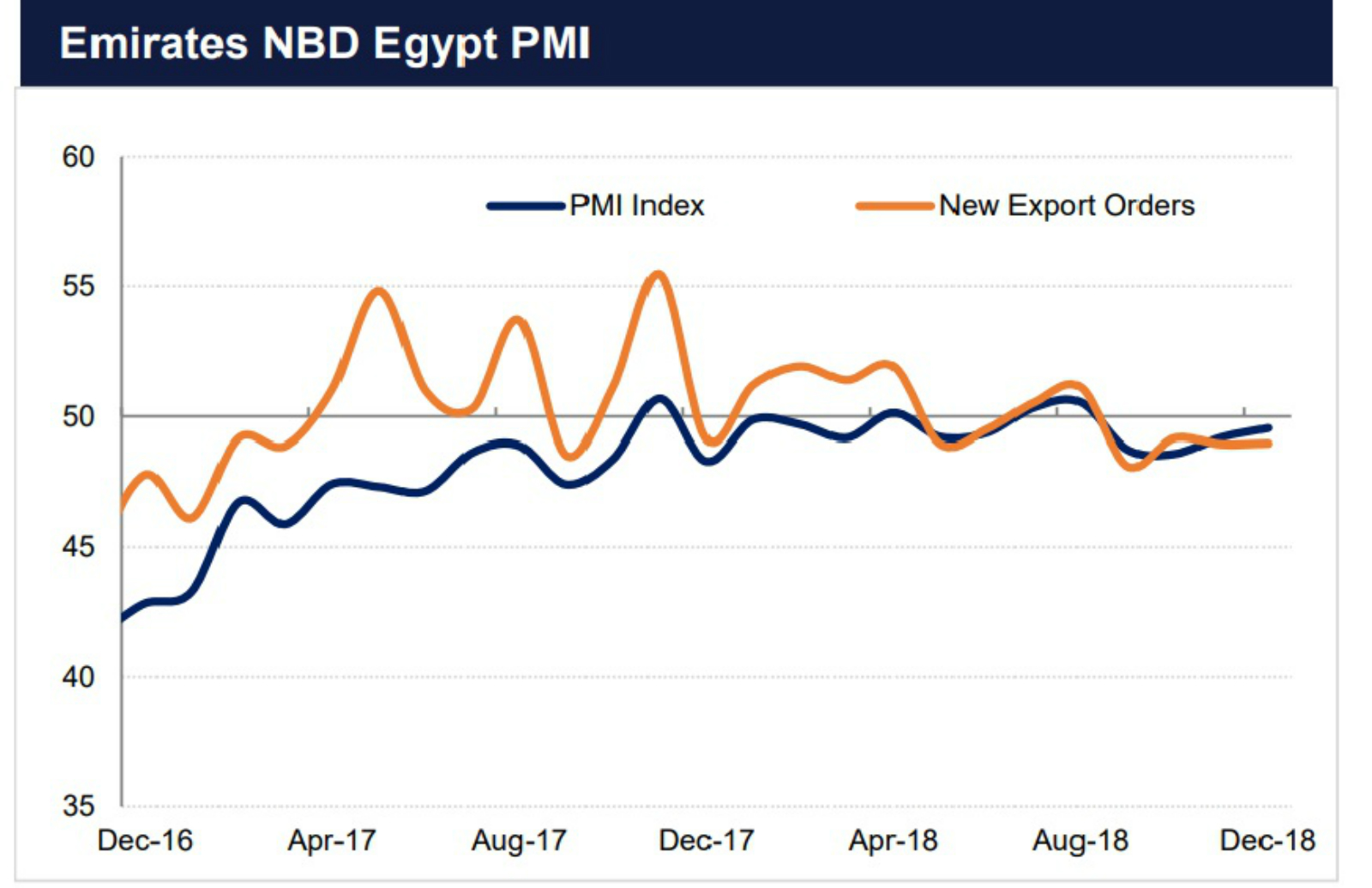

Purchasing managers’ index rises in December to four-month high, remains in contraction range: Non-oil business activity in Egypt contracted for the fourth consecutive month in December, but at a slower pace than the previous two months, according to the Markit / Emirates NBD purchasing managers’ index (pdf). The PMI rose to 49.6 in December from 49.2 in November and 48.6 in October, missing the 50 expansion mark by a narrower margin during the last month of 2018. The reading also remains the highest in four months — and there remains reason for optimism that 2019 will “see something of a recovery” for the private sector.

New orders in December rose to their highest level, “boding well for future output levels” despite output dropping to 48.8 from 49.2 a month earlier. “There was also an increase in firms’ purchasing activity from 51.2 in November to 52.0 [in December], the highest reading since May, as respondents cited increased business requirements.”

Confidence in future output also increased, albeit by a small margin in December to 60.3, from 60.3. “This has fallen from the 80.5 seen in January, but is likely a reflection on the improvements already seen in the economy rather than any negative sentiment.” The market is generally optimistic about the 12 months ahead, with “the bulk of firms [expecting] the volume of output to be the same or higher.”

Egypt’s current account deficit narrowed marginally to USD 1.751 bn in 1QFY18-19, down from USD 1.754 bn during the same period last year, according to a CBE report (pdf). The balance of payments recorded a surplus of USD 248.1 mn, down from USD 5.1 bn in 1QFY17-18, while the trade deficit rose to USD 9.9 bn from USD 8.91 bn a year ago.

Net foreign direct investment dropped to USD 1.1 bn in 1Q2017-18, down from USD 1.84 bn during the same period last year. Investment in oil and real estate accounted for the lion’s share of FDI. Portfolio investment generated net outflows of USD 3.2 bn, down from USD 7.5 bn a year ago.

Merchandise exports grew 16.2% to USD 6.8 bn, thanks to a 57.6% rise in oil exports to USD 2.8 bn, bolstered by higher volumes and higher global crude prices. Non-oil exports dropped 2% y-o-y to USD 4, down from USD 4.1, mainly as a result of lower exports of semi-finished goods, particularly gold. Imports climbed 13% to USD 16.68 bn.

Remittances also grew marginally to USD 5.91 bn, up from USD 5.82 bn a year earlier. According to Reuters, the CBE seems to have revised its remittances figure for last year, which it previously said had reached USD 5.97 bn during the comparable quarter. Travel receipts recorded a surplus of USD 3.2 bn, up from USD 2.0 bn, while revenues from the Suez Canal grew by 4.3% y-o-y to USD 1.44 bn.

Mercedes-Benz could soon resume the assembly of passenger cars in Egypt after a years-long hiatus, production chain boss Markus Schaefer told Prime Minister Moustafa Madbouly, according to a Cabinet statement. The meeting came after Schaefer met President Abdel Fattah El Sisi in December. The luxury car maker shut down its assembly line in mid-2015 amid FX shortages and as completely built-up cars (CBUs) were made cheaper in light of falling tariffs on EU cars, which hit zero earlier this month. Efforts to bring the company back as part of a 100-200k sqm dedicated auto manufacturing area in the Suez Canal Economic Zone have been ongoing. The company “agreed in principle” in 2017 to resume assembly.

INVESTMENT WATCH- Apicorp to invest USD 1 bn in five countries, including Egypt, in 2019: Egypt is one of five countries in which the Arab Petroleum Investments Corporation (Apicorp) plans to invest a total of USD 1 bn this year, CEO Ahmed Ali Attiga said, according to Bloomberg. Apicorp is also looking to Iraq, Libya, Morocco, and the US. “Borrowings by energy producers in the six-nation Gulf Cooperation Council plunged 24 percent last year as oil prices hit a four-year high,” pushing the company to look outside the Gulf to expand its portfolio. Apicorp is also looking at assets relate to “the transformation of the energy sector in this region: renewables, energy efficiency, technology, and anything related to it,” Attiga said.

Egypt is in talks with Spanish-Italian JV Union Fenosa Gas (UGS) in a bid to have the European outfit drop its arbitration claim over gas supply interruptions at the Damietta liquefaction plant, an industry source tells the domestic press. The World Bank’s International Centre for Settlement of Investment Disputes ordered in September that Egypt pay USD 2 bn to UGS in the case, which UGS filed after the state cut off flows to its Damietta liquefaction plant. UGS owns 80% of the facility, while state-owned EGPC and EGAS together own the remaining 20%. According to the sources, the Oil Ministry is looking to hammer out an agreement that would see Egypt gradually relaunch operations at the Damietta facility and compensate UGS for its losses through EGAS’ profits from the facility’s operations. Naturgy and Eni are in “advanced talks” over the relaunch of operations, Eni CFO Massimo Mondazzi said back in October.

IPO WATCH- Beltone wasn’t invited to bid for a piece of Abu Qir stake sale: State-owned investment bank NI Capital has excluded Beltone Financial from a tender it issued last month that will see it hire a manger for the sale of an additional stake in Abu Qir Fertilizers and Chemicals Industries on the EGX, sources close to the matter tell Al Shorouk. According to the sources, NI Capital approached several other investment banks, including EFG Hermes, CI Capital, Arqaam Capital, HC Securities, Pharos Holdings, and HSBC. Beltone was eliminated from the list due to allegations of misconduct during its handling of the Sarwa Capital IPO last year leveled against it by the Financial Regulatory Authority (FRA). The sources did not disclose when NI Capital expects to tap a manager or follow through with the sale, which comes as part of the state’s privatization program.

What’s the status on the privatization program, anyway? The committee overseeing the sell-down of state assets via stake sales and IPOs is scheduled to hold a meeting this month to look into how market conditions developed since the first phase of the program was put on ice last October amid the emerging markets selloff. A senior government official had told us that the program could resume as early as 1Q2019 or as late as the start of the new fiscal year in July, based on market conditions.

EXCLUSIVE- Seven law firms bidding to act as legal advisors in Egypt’s upcoming eurobond issuance: Seven local and international law firms, including Shalakany Law Office, Zulficar & Partners, Zaki Hashem & Partners, White & Case, and Baker McKenzie, have submitted bids to the Finance Ministry to act as legal advisors in Egypt’s upcoming eurobond issuance, a senior government official tells Enterprise. The government plans to select three or four domestic firms to act as legal counsel, in addition to one international firm, and expects to close the bidding window by next week, our source says. The government had given the Finance Ministry the green light last week to move ahead with the tenders for the issuance’s lead managers and legal advisors. The selection process for all advisors should be complete within two months, as the ministry is looking to take the issuance to market during the first half of March.

Background: Egypt is preparing to issue USD 4-7 bn worth of yen-, yuan-, USD-, and EUR-denominated bonds in 1Q2019, we reported last month. The treasury has also been waiting on global markets to stabilize before moving ahead with the issuances, government sources had previously told us. A government source told us last month that the ministry is looking for an Asian firm to join the final lineup of bookrunners, since the government’s planned issuances will largely be concentrated in Asian markets. HSBC, Citigroup, JPMorgan Chase & Co, Morgan Stanley, and National Bank of Abu Dhabi have led past issuances. Finance Minister Mohamed Maait had also said that the Madbouly government will release details on its 1Q2019 international bond issuances sometime this month.

In landmark Cairo speech, US SecState Mike Pompeo touts America as “a force for good” in the Middle East: America is committed to its “traditional role as a force for good” in the Middle East under US President Donald Trump after years of being “absent too much,” US Secretary of State Mike Pompeo said in a speech at the American University in Cairo on Thursday (watch, runtime: 25:17). The speech came as part of a Mideast tour in which Pompeo aimed to “[reassure] America’s partners that withdrawing troops from Syria does not mean Washington is abandoning the region,” the AP notes. The speech has been widely controversial, with some in the US accusing Pompeo of “misreading history and camouflaging Trump’s own desire to reduce U.S. commitments in the region,” Reuters says.

Pompeo says Egypt is “strategic partner,” praises advancement of religious freedoms: Earning much less digital ink was Pompeo’s praise for Egypt’s anti-terror efforts in Sinai and his assertion that Egypt and the US have a strategic partnership. “As we seek an even stronger partnership with Egypt, we encourage President Sisi to unleash the creative energy of Egypt’s people, unfetter the economy, and promote [an] … open exchange of ideas. The progress made to date can continue.” Pompeo also lauded the advancement of religious freedom in Egypt, which on he stressed during a separate visit to the recently inaugurated cathedral in the new administrative capital.

Pompeo’s speech also took not-so-veiled shots at former US President Barack Obama, the New York Times writes, “painting a picture of a Middle East cast into chaos” by The Donald’s predecessor — a region that can “only be rescued by crushing Iran.” The speech is being cast as an answer to Obama’s landmark speech at Cairo University a decade ago.

El Sisi, Shoukry meet Pompeo to talk security, cooperation: Pompeo met with President Abdel Fattah El Sisi on Thursday to discuss terrorism and security, among other topics, Ittihadiya said in a statement. Foreign Minister Sameh Shoukry had a separate sit-down Pompeo during which the two agreed to set up 2+2 meetings between the US and Egypt, the Foreign Ministry said.

Watch the Shoukry-Pompeo presser after their meeting (watch, runtime: 16:52) or read the full transcript of their statements, courtesy the State Department.

Egyptian and US defense officials also inked on Friday an agreement to step up military cooperation ahead of Pompeo’s visit, according to a statement from the US embassy in Cairo. The agreement “opens a new chapter in cooperation,” assistant Defense Minister Mohamed El Keshky said.

Pompeo’s speech led the conversation on Egypt in the foreign press over the weekend, prompting an avalanche of coverage, including from the Financial Times’ Heba Saleh, the Economist, the Wall Street Journal, Bloomberg, and the Times of Israel.

LEGISLATION WATCH- Foreign NGOs will be consulted on a revised NGOs Act: The Social Solidarity Ministry plans to invite foreign NGOs operating in Egypt to join a third round of consultations on potential amendments to the controversial NGOs Act, Social minister Ghada Wali said, according to Al Ahram. Local civil society and other organizations participated in two earlier rounds of talks in recent weeks.

National council to regulate NGOs seen as bureaucratic, unnecessary: Local civil society reps have suggested the amendments scrap the notion of setting up a national regulator for NGOs, said Talaat Abdel-Qawi, head of a national association for NGOs. Groups also recommended lowering licensing fees for NGOs, the elimination of a 60-day waiting period for forming a new group, and the scrapping of prison terms for violations of the act.

Background: President Abdel Fattah El Sisi said in November that a committee would review the contentious NGOs Act, which passed the House of Representatives in November 2016 and was signed into law in May 2017. The current act gives the state the power to decide who can set up an NGO and for what purpose and sets restrictions on donations, among other provisions seen as choking the work of the groups. The Supreme Constitutional Court last year struck down as unconstitutional a clause that gave the social solidarity minister the power to disband the boards of NGOs.

MOVES- Maj. Gen. Tarek El Zaher will join the board of directors of state-owned landline monopoly Telecom Egypt as a representative of the government, the company said in a regulatory filing (pdf). El Zaher succeeds Maj. Gen. Ashraf Farid.

MOVES- Sony Mobile Egypt country head Sherif Salem (LinkedIn) stepped down in December, the former executive tells Al Mal. Salem had held the post since early last year and was formerly head of regional sales for the Lenovo-owned Motorola Mobility.

CORRECTION- The EGX30 closed Wednesday’s session down 0.3% — not up 2.5%, as we incorrectly noted in Thursday’s The Market Yesterday section. We flipped the Wednesday figure (-0.3%) with the YTD figure (+2.5%). The figures have since been corrected on our website.

Up Next

French President Emmanuel Macron will be in town in the coming weeks, France’s ambassador in Cairo, Stéphane Romatet said last week, according to Al Ahram. We had previously reported that security cooperation (including the situation in Libya) as well as economic ties will feature high on the agenda.

Image of the Day

A Reuters image gallery capturing scenes of pick-up football games between Egyptian boys in graveyards and on streets was published by the National yesterday. “Just because their pitch may consist of a dusty field or wasteland doesn't mean their passion for the beautiful game is dimmed,” said the National, in reference to the shots. The newspaper goes on to mention Egypt’s recent grab of hosting rights for the 2019 African Cup of Nations and Mohamed Salah’s African Footballer of the Year award.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning: Interior Ministry forces killed six suspected terrorists in a raid on their hideout between Sohag and Assiut, according to a government statement. The story has received attention from the Associated Press, Anadolu Agency, and AFP.

Also getting plenty of coverage: US Secretary of State Mike Pompeo’s “Cairo speech” at AUC, which we cover extensively in Speed Round, above.

Egypt and Israel are far from normalization despite the “close” military cooperation between the two countries, Zvi Bar’el writes for Haaretz (paywall). President Abdel Fattah El Sisi confirmed in a 60 Minutes interview broadcasted last week that Cairo and Tel Aviv have been cooperating in Egypt’s anti-terror campaign in Sinai, and Israeli Prime Minister Benjamin Netanyahu has lobbied the US Congress to prevent military aid cuts to Egypt, Bar’el says. However, there remains “an abyss … between the military cooperation and normalization,” but the perks Israel has to gain from full normalization are “negligible compared to the military cooperation.”

Football is also getting attention from the international media: The Egyptian Football Federation (EFA) is building a new headquarters and will house the national football squad in the same complex, FIFA, football’s global governing body, says in a feature on its website. FIFA is giving the Egyptian association some USD 2.25 mn to help fund the construction. News came as the association’s boss, Gianni Infantino, said he is confident Egypt will manage to deliver a “great African Cup of Nations,” despite having little time to prepare. “Egypt is five months away from hosting Africa's largest continental football tournament … which is expected to revive the football sector in the country and strongly push the ailing tourism sector,” Xinhua adds.

Other headlines worth a skim this morning:

- The inauguration of a Coptic cathedral in the new administrative capital is a step forward, but Egypt has lots of do on the minority rights front, Marlo Safi writes in an opinion piece for the Wall Street Journal.

- The inauguration of a mosque and church on the same day served to show “Egypt is to be a country where Christians and Muslims can co-exist,” Darrell Bock writes for Dallas News.

- Ramy Essam, famous for his Arab Spring song “Irhal,” has been stripped of his Egyptian passport according to an interview with PRI.

- The Egypt-Israel border fence has served its purpose — but our situation is much different than Trump’s, who used the fence as a model for his US-Mexico wall, Yaakov Lappin writes for the Jewish National Syndicate.

On The Front Pages

President Abdel Fattah El Sisi’s call to establish a complex to house all government bodies in El Wadi El Gedeed is top news this morning in state-owned Al Ahram and Al Akhbar. Al Gomhuria alone takes note of El Sisi’s scheduled trip to Amman, Jordan today. The Education Ministry administering practice exams under the reformed thanaweya amma system also earned some ink in Al Ahram and Al Gomhuria.

Diplomacy + Foreign Trade

Egypt will reportedly fully reopen the Rafah border crossing, Hamas announced after an Egyptian security delegation met with senior Hamas officials on Thursday, according to Al Arabiya. The Palestinian Authority had pulled its staff from the crossing last week, leading Egypt to close it completely before eventually allowing limited passage.

Basic Materials + Commodities

Egypt’s GASC purchases 415k tonnes after receiving wheat offers

State grain buyer GASC purchased 415,000 tonnes of Russian wheat in two international tenders on Wednesday, according to Al Shorouk. The shipments are due for delivery between 28-29 February and 1-10 March, according to the GASC tender offer. Russian suppliers’ “clean sweep” in the GASC tender pushed wheat futures trading on Paris’ Euronext and the Chicago exchange to drop, reflecting the “dampened hopes for EU and US exports,” according to Reuters.

Egypt’s GASC announces second rice tender of 2018-2019 for 20k tonnes

GASC has issued Egypt’s second international rice tender for 20,000 tonnes of medium on short grained white rice, according to GASC’s website. The bidding window closes on 27 January. Egypt bought last month 130k tonnes of rice in its largest import to date from one Chinese supplier and four other countries.

Health + Education

CIRA’s private university in west Assiut to cost EGP 2.45 bn

Cairo Investment and Real Estate Development’s (CIRA) planned private university in west Assiut is expected to cost a total of EGP 2.45 bn, according to Al Mal. The first EGP 500-800 mn phase of the university will be financed through both equity and debt. The New Urban Communities Authority (NUCA) had recently granted CIRA an 81 feddan plot in west Assiut to develop its private university. Construction of the project is expected to take 10 year and land is conditional on CIRA partnering up with an international university.

Telecoms + ICT

TMG signs digital partnership agreement with Huawei Technologies

Talaat Moustafa Group (TMG) has inked a partnership agreement with Huawei Technologies to provide the technology to develop TMG projects into smart cities, according to Al Mal. The agreement entails implementing AI systems and North Africa’s first facial recognition system for increased security.

Egypt loses mobile subscribers in October, penetration rate falls to 102.48%

The number of mobile service subscribers in Egypt declined 5.52% y-o-y in October 2018 to record 94.31 mn, down from 99.82 mn in October 2017, according to an ICT Ministry report (pdf). This brought Egypt’s mobile phone penetration rate to 102.48% by the end of October, down 7.89% y-o-y. The number of ADSL subscribers, meanwhile, increased 25% y-o-y, to stand at 6.31 mn in October 2018, up from 5.05 mn in October 2017. Mobile internet users rose 8.45% y-o-y to record 35.99 mn in October 2018. Federation of Egyptian Industries’ ICT division head Hamdy El Leithy attributed the decline in mobile phone penetration rate to MNOs passing on to customers the cost of higher taxes in the sector (watch, runtime 04:33)

Banking + Finance

National Bank of Egypt will begin issuing “Meeza” debit cards today

The National Bank of Egypt will begin issuing “Meeza” debit cards as of today, Retail CEO Alaa Farouk tells Masrawy. The card — which the Finance Ministry first announced in September as part of the government’s new e-payments drive — would make state benefits available electronically to pensioners, civil servants, and subsidy recipients. Banque Misr had begun issuing the cards as of the beginning of January.

Banking consortium to lend Al Nasr Coke USD 100 mn for coke-oven battery

A local banking consortium led by the Bank of Alexandria is arranging a USD 100 mn loan for Al Nasr for Coke and Chemicals, company head Medhat Nafei told Al Mal. Al Nasr, a subsidiary of the Chemical Industries Holding Company, will use the loan to finance the establishment of a coke-oven battery. Building the battery will take around two and a half years. Al Nasr had signed in October an agreement with a Ukrainian company to supply and install the equipment and supervise the battery.

NBE looks to arrange EGP 2.4 bn syndicated loan for EGPC

The National Bank of Egypt is in talks with local banks to arrange a EGP 2.4 bn syndicated loan for the Egyptian General Petroleum Company (EGPC), banking sources told Al Shorouk. The loan, which includes a USD-denominated tranche, will be used to develop the EGPC’s oil wells.

EBRD preliminarily agrees to lend EUR 400 mn to Egypt’s Damietta Port Authority

The European Bank for Reconstruction and Development (EBRD) has agreed in principle to lend EUR 400 mn to the Damietta Port Authority to finance the construction of a second container terminal at the port, banking sources told Al Shorouk. The authority was set last year to sign a EUR 305 mn loan agreement with the European Investment Bank for the same project. It remains unclear whether talks with the EIB have broken down.

Egypt Politics + Economics

Egypt deports one of two Germans for link to Daesh group in Sinai

Authorities deported Egyptian-born German Mahmoud Abdel Aziz over suspected links to Daesh and plans to join an offshoot group, state news agency MENA reported, according to Ahram Online. A second German national, Issa El Sabagh, was also arrested last week at Luxor International airport over the same charges and is expected to be deported as well. His father has denied his intentions to join the group. The two men were believed to have been missing since December. Xinhua, Al Arabiya and Turkey’s Anadolu Agency also had the story.

Egypt court acquits Ikhwan top brass from murder charges

The Giza Criminal Court acquitted on Thursday Ikhwan leader Mohamed Badie — along with deputies El Beltagy and Essam El Erian, and several others — of “gathering with the intention of murder and sabotage” in a case dating back to 2013, state news agency MENA reported, according to Middle East Eye. Badie still faces a number of sentences, including the death penalty and three life sentences, for his involvement in jailbreak and as well as espionage.

Sports

Salah named Liverpool’s Player of the Month for December

Mohamed Salah was crowned the Standard Chartered Player of the Month for December, an award reserved for Liverpool’s top monthly asset. This came after he was named Africa’s top footballer for the second consecutive year, handed a special accolade from the Emirati royal family, and made Liverpool’s goal of the month scorer — all in the span of just one week, says Al Mal.

On Your Way Out

Two Egyptian animal rights groups saved a rare Egyptian wild wolf from being trafficked through Facebook, according Ahram Online. The group purchased the animal for EGP 1,000 and released him back into the wild at Fayoum’s Wadi El Rayan.

The Market Yesterday

EGP / USD CBE market average: Buy 17.87 | Sell 17.96

EGP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.79 | Sell 17.89

EGX30 (Thursday): 13,367 (0.0%)

Turnover: EGP 1.0 bn (25% above the 90-day average)

EGX 30 year-to-date: +2.5%

THE MARKET ON THURSDAY: The EGX30 ended Thursday's session flat at 0.0%. CIB, the index heaviest constituent ended down 0.5%. EGX30’s top performing constituents were Juhayna up 4.3%, Telecom Egypt up 3.3%, and Egypt Kuwait Holding up 1.8%. Thursday’s worst performing stocks were Global Telecom down 2.1%, Porto Group down 2.0% and Madinet Nasr Housing down 1.9% . The market turnover was EGP 1.0 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -45.1 mn

Regional: Net Short | EGP -39.9 mn

Domestic: Net Long | EGP +85.0 mn

Retail: 51.3% of total trades | 49.8% of buyers | 52.8% of sellers

Institutions: 48.7% of total trades | 50.2% of buyers | 47.2% of sellers

WTI: USD 51.59 (-1.90%)

Brent: USD 60.48 (-1.95%)

Natural Gas (Nymex, futures prices) USD 3.10 MMBtu, (+4.38%, Feb 2019 contract)

Gold: USD 1,289.50 / troy ounce (+0.16%)

TASI: 8,210.16 (+0.78%) (YTD: +4.90%)

ADX: 4,962.37 (+0.18%) (YTD: +0.96%)

DFM: 2,545.65 (+0.23%) (YTD: +0.63%)

KSE Premier Market: 5,453.33 (+1.23%)

QE: 10,658.22 (+1.17%) (YTD: +3.49%)

MSM: 4,310.56 (0.0%) (YTD: -0.30%)

BB: 1,341.72 (+0.26%) (YTD: +0.33%)

Calendar

10-13 January (Thursday-Sunday): International Property Show (IPS), Egypt International Exhibition Center.

13-16 January (Sunday-Wednesday): CI Capital’s third annual MENA Investor Conference, Four Seasons Nile Plaza, Cairo, Egypt.

17 January (Thursday): Talent in the Digital Era, Galleria40, Cairo, Egypt.

19 January (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January (Sunday): Cairo Court of Urgent Matters to hear an amendment to the constitutional to extend the presidential term limits.

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-23 January (Tuesday-Wednesday): CI Capital’s third annual MENA Investor Conference, The Plaza, New York City, USA.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

3 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

7 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

10-12 February (Sunday-Tuesday): Third African Forum: “Building on Science, Technology and Innovation to Boost Private Sector and Socio-Economic Transformation in Africa”, Venue TBD, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.