- Egypt is the fastest growing startup market and second biggest in MENA, says MAGNiTT’s 2018 Mena report. (Speed Round)

- World Bank sees Egypt growth accelerating 0.2% faster this year. (Speed Round)

- IFC aims to invest USD 5 bn in Egypt over the next 5 years. (Speed Round)

- FinMin completes drafting “more realistic” comprehensive debt control strategy, raises public debt targets. (Speed Round)

- Manfoods to invest EGP 250 mn in Egypt in 2019. (Speed Round)

- The Madbouly Cabinet approved yesterday proposed amendments to the Competition Act (or Antitrust Act). (Speed Round)

- Is the Electricity Ministry looking to ditch the feed-in tariff program in favor of IPP framework? (Speed Round)

- What Cairo can learn from Dar Es Salaam’s transportation systems. (Worth Reading)

- The Market Yesterday

Thursday, 10 January 2019

We are the fastest growing startup market in MENA

TL;DR

What We’re Tracking Today

Can we begin by first saying how happy we are it is Thursday. We feel we still need one more weekend before the post-New Year’s break yawning dissipates.

US Secretary of State Mike Pompeo arrived to Cairo last night. The word is out that Pompeo would use the visit to deliver an address that would repudiate former US President Barack Obama’s speech on the country’s Middle East policy. “Pompeo intends to assert the Trump message that Iran is to be countered at all costs, while assuring that the United States remains deeply committed to the region despite the America First rhetoric emanating from the White House,” according to Reuters.

Meanwhile, French President Emmanuel Macron will be in town in the coming weeks, France’s ambassador in Cairo, Stéphane Romatet said yesterday, according to Al Ahram. We had also previously reported that security cooperation (including the situation in Libya) as well as economic ties will feature high on the agenda.

FRA issues explainer on cumulative voting in GA meetings, BoD elections: The Financial Regulatory Authority (FRA) issued yesterday an explainer outlining the framework for using cumulative voting during companies’ board elections and general assembly meetings. The cumulative voting system, which allows shareholders to vote proportionately to the number of shares they hold, is meant to strengthen minority shareholders’ influence on the selection of board members, according to a FRA statement.

The Social Solidarity Ministry should be presenting a draft of the new Social Welfare Act to the House of Representatives sometime in the next few days, according to previous statements by Minister Ghada Wali on Sunday, according to Al Mal. The bill, if passed, would require the government to provide families eliminated from the Takaful or Karama social welfare programs with jobs.

Strangest story of the day: Egypt’s embassy in Australia was among those targeted by an Australian man who sent strange parcels. Australian police said they had arrested a 48-year-old man for sending as many as 38 suspicious packages to diplomatic embassies and consulates across the country, according to Reuters.

Emerging markets bond issuance season has begun: It seems that the quickest way to a media-weary EM investor’s heart is through yields. Saudi Arabia and Turkey took advantage of the rebound witnessed since the New Year to go to the bond market with massive issuances. Saudi Arabia made a USD 7.5 bn offering in two tranches, while Turkey took to selling USD 2 bn in USD-denominated bonds, according to Bloomberg. Both governments offered premium yields on their 10-year debts. The newspaper notes that the political missteps of both countries in 2018 had been a major contributor to emerging markets selloff last year.

Should Egypt get on board the station: Both countries and the Philippines are among a string of EMs — including Egypt — that will look to capitalize on the current favorable climate. Egypt has yet to decide to the timing of its eurobond issuance, with senior government officials telling Enterprise that the timing of the issuance will be determined with investment banks that would be selected to manage the issuance. The Finance Ministry has received the green light from Cabinet to move ahead with issuing a tender for investment banks and law firms to act as joint lead managers and legal advisors, officials told us.

This comes as more indications come in that the US Federal Reserve will be looking to slow down rate hikes moving forward. Minutes from the Fed’s 18-19 December meeting, where it raised interest rates a quarter point to a range of 2.25-2.5%, appears to indicate that not only is the Fed seeing that it can "afford to be patient about further policy firming,” but that it is factoring in global considerations. The minutes noted that the low-inflationary backdrop means the Fed "Concerns over escalating trade tensions, global growth prospects, and the sustainability of corporate earnings growth were among the factors that appeared to contribute to a significant drop in U.S. equity prices," the minutes said. Suggestions of a slowdown in the rate cut were the primary reason behind the rebound in EM assets.

Cue the naysayers: New York-based fund manager Steve Eisman, who made mns by predicting the housing market collapse first, sees the market for triple B-rated bonds crashing soon, the Financial Times reports. With their outstanding issuance jumping to USD 2.7 tn from USD 750 bn at the end of 2007, Eisman says the bonds will likely be sold at huge discounts.

Season 5 of the Abraaj liquidation — Abraaj strikes USD 10 mn debt-for-equity transaction with Nigeria’s C&I Leasing: Beleaguered MENA PE firm Abraaj has struck up an agreement with Nigeria’s C&I Leasing to acquire a 70% stake in order to avoid paying a USD 10 mn loan agreement, according to Bloomberg. “Abraaj knows that pulling out USD 10 mn will be detrimental to the growth of the business, so rather than cash out, they decided to convert,” C&I Chief Executive Officer Andrew Otike-Odibi said. C&I is planning a rights issue or an IPO that may dilute the former giant’s stake to about 30%, he said.

Depressing story of the day: the chances for getting a stroke in one’s lifetime is now 25%, according to 2016 data from the Institute for Health Metrics and Evaluation picked up by Bloomberg. The study showed that the lifetime stroke risk for 25-year-olds ranged from 8-39%. The lesson: “it is clear that younger adults need to think about long-term health risks,” said Dr. Gregory Roth, a professor at the institute at the University of Washington and senior author of the study.

Other headlines worth noting in brief:

- Saudi Arabia has published the first audit of Aramco in 40 years as it tries to renew interest in an Aramco IPO, according to Bloomberg. The audit, conducted by Dallas-based consultant DeGolyer & MacNaughton, showed that reserves totalled 268.5 bn barrels.

- The UK’s House of Commons agreed to an amendment that would limit the government's ability to change the tax law should a no-agreement Brexit take shape, according to the FT.

- Sudan’s President Omar Al Bashir rejected calls for him to step down on Wednesday as protests against his rule, which saw around 40 killed, continued for the third straight week, according to the Washington Post.

- MacKenzie Bezos could become the richest woman in the world by virtue of divorcing Amazon founder Jeff Bezos. An even split could see her get USD 69 bn, according to Bloomberg. Thoughts of Eddie Murphy’s Raw standup (NSFW) on getting half comes to mind (watch, runtime: 5:58).

Enterprise+: Last Night’s Talk Shows

It was an economics-focused night on the airwaves last night. While not one particular issue dominated the discussion on the airwaves, we are thankful that Hona El Asema and Yahduth fi Masr was around to add color to recent econ news.

The Standard Chartered report in focus: Al Hayah Al Youm discussed a Standard Chartered report that saw Egypt becoming one of the world’s top 10 economies by 2030 (watch, runtime: 02:36). The show featured an interview with Ain Shams Economics Professor Dr. Yomn El Hamaky who said Egypt needs to focus on effectively using its various resources to achieve economic growth(watch, runtime: 04:01).

Not everyone is buying that zero customs is lowering prices on EU cars. Prices of European cars will increase next monthas there is an expectation that the EUR strengthens relative to the USD, auto expert Nur Darwish tells Ten TV’s El Rai El Am (watch, runtime: 36:37). In an extended discussion, he also noted that auto dealerships have had to contend with an 8% limit on cars sold, suggesting that any price drops would be for a short period of time.

Background: European cars with 1600cc engines have reportedly gone down between EGP 10,000 to EGP 50,000, while prices of 1600cc cars decreased 3-8% while prices of cars with engines of 2000cc or more were down by 15-20%. Auto assemblers have long argued that customs on EU cars falling to zero would translate to a sustained drop in car prices. They have been pushing for the automotive directive to provide a sustained buffer against EU and regionally-made cars by developing a domestic manufacturing industry.

Egypt settled the first phase of its late-tax collection campaign, gathering a total of EGP 6.3 bn, Tax Authority boss Abdel Azim Hussein told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 04:28). The authority waived EGP 6.2 bn from a total EGP 12.5 bn it initially saught to collect in phase one. Taxpayers have until February 10 to benefit from a 50% exemption.

You can watch your favorite sport shows again. Qatar’s beIN Sports has resumed its broadcast in Egypt, after one day of disruption, having worked out an agreement with service provider Cable Network Egypt (CNE), Masaa DMC ‘s Osama Kamal said (watch, runtime: 02:40). The company abruptly announced on Monday that it was “unable” to continue carrying out its services with CNE.

Speed Round

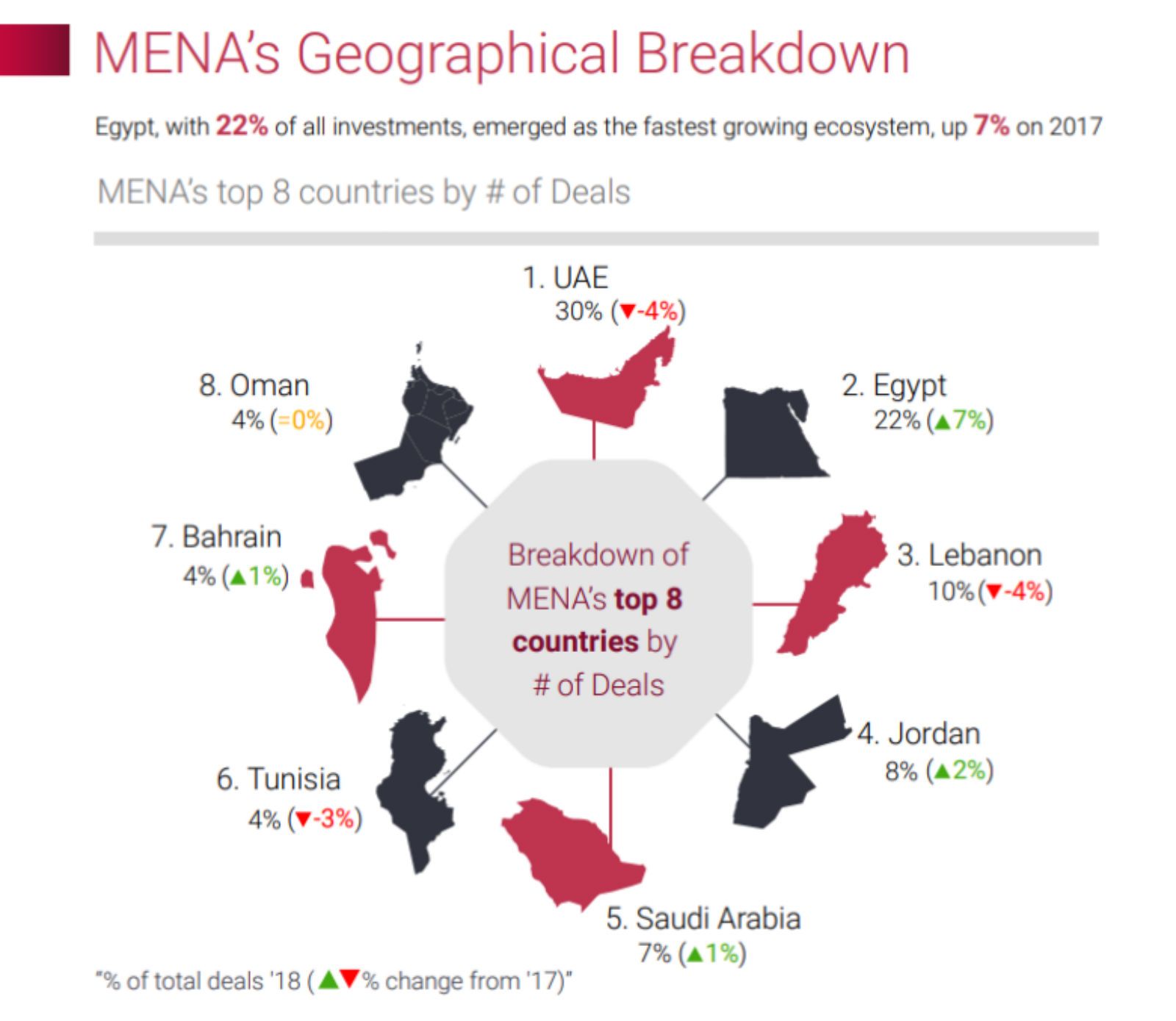

Is Egypt the fastest growing startup market in MENA? Egypt is the fastest growing startup ecosystem and the second largest after the UAE, according to start-up platform MAGNiTT’s 2018 Mena Venture Investment Report — summary (pdf) and full report (paywall). Egypt’s share of total number of seed funding agreements grew by 7% y-o-y to USD 196.5 mn, representing 22% of all MENA closes in 2018. We came in second to the UAE, who retained the top position with a 30% share and 70% of total funding proceeds. “Egypt is seeing a second wave of entrepreneurs and investors that are more mature and experienced. The population is also starting to embrace technology for everyday activities,” Algebra Ventures Managing Partner Ziad Mokhtar said. Egypt was followed by Lebanon (with a market share of 10%), Jordan (8%) and Saudi Arabia (7%).

MENA startups raise USD 893 mn in 2018 seed funding: MENA startups attracted some USD 893 mn in seed funding in 2018, up 31% from the previous year, according to the report. A total of 366 funding agreements were inked, up 3% from 2017. The agreements included 14% of which were inked in series A rounds, 3% in series B and 2% in series C and higher. More than 155 different institutions took part — 30% of which were from outside the region and 47% first-ever MENA investors. Our friends at Flat6Labs were among MENA’s most active investors.

Ride-hailing app Careem and real estate website Property Finder led the pack. The former attracted USD 200 mn in series F funding in October while the latter USD 120 mn in its November ‘growth’ round. Saudi-based online store Wadi.com also attracted a record USD 30 mn in series B investments for Majid Al Futtaim Group. Other notable recipients include mass transit app Swvl, which MAGNiTT estimated raised more than USD 20 mn in a recent series B round.

Fintech overtook e-commerce as the most active industry, accounting for 12% of the total agreements while the latter came in second at 11%. Notable fintech recipients included UAE-based insurance technology company Aqeed.com, which attracted USD 18 mn, and robo-advisors Wahed Invest, which secured USD 8 mn, in series A rounds. Delivery and transport (8%), IT solutions (8%), food and beverages (7%) and education (6%) were next in line as top industries.

World Bank sees Egypt growth accelerating 0.2% faster this year: The World Bank sees Egypt’s economic growth accelerating 0.2% faster in 2019 than originally anticipated in 2018, according to its Global Economic Prospects 2019: Darkening Skies report, which it released yesterday. Nonetheless, the World Bank maintained its forecast for Egypt’s economic growth this year at 5.7%. The WBG sees growth accelerating to 5.9% and 6.0% in 2020 and 2021, respectively, buoyed by strengthening activity in the tourism and natural gas sectors coupled with policy reforms, fiscal adjustments, and the easing of the country’s unemployment rate.

GDP estimates differ, but plenty on analysts see stellar growth coming Egypt’s way: Egypt should see strong economic growth this fiscal year, FocusEconomics says. “This fiscal year, economic growth should be robust thanks to higher government investment spending, rising natural gas production and an improving regulatory environment,” the firm said on Wednesday. It pointed to fiscal imbalances as a challenge though, predicting GDP to grow 5.2% this fiscal year and 5.3% in FY 2019-20.

EM growth expected to stall in 2019: Growth in emerging markets and developing economies (EDMEs) “is expected to stall at 4.2 percent in 2019, markedly below previous expectations. The forecast reflects the lingering effects of recent financial market pressure in some large economies … Growth is projected to plateau at 4.6 percent toward the end of the forecast horizon.” The report also puts global growth in 2018 at 3% and is forecasting 2.9% for this year.

You can read the full report here (pdf) or check out the Middle East and North Africa chapter here (pdf).

The story received some attention on the airwaves, with Yahduth fi Masr’s Sherif Amercovering the report (watch, runtime: 03:34).

INVESTMENT WATCH- Meanwhile, the World Bank’s International Finance Corporation (IFC) aims to invest USD 5 bn in Egypt over the next 5 years, at an average rate of USD 1 bn per annum, IFC MENA Regional Director Mouayed Makhlouf said, according to Al Mal. The investments are expected to target the private sector, infrastructure development, and SMEs. The IFC’s recent investments in Egypt include a EGP 1.2 bn commitment to e-commerce infrastructure in September 2018, as well as a USD 1 mn investment in Vezeeta in December 2018.

EXCLUSIVE- FinMin completes drafting “more realistic” comprehensive debt control strategy, raises public debt targets: The Finance Ministry has completed drafting a comprehensive debt control strategy spanning the next four years, in which it targets bringing down Egypt’s public debt to 80-85% of GDP by the end of FY2021-22, a senior government official tells Enterprise. The strategy — which has been in the making for the past six months — has been “significantly amended” to be more realistic and set a more comprehensive vision for how to achieve the targets it sets out, according to our source. Among the details the strategy now includes is the planned inclusion of the informal economy into the formal economy, which is expected to eventually raise GDP growth by more than 10%. The ministry has referred the strategy to Cabinet for review and approval, and will officially unveil details once it receives Cabinet sign-off.

The strategy caps Egypt’s eurobond issuances at USD 22 bn until the end of FY2021-22. Egypt would be allowed to take to market USD 12 bn of USD-denominated eurobonds and another USD 10 bn-worth of bonds in currencies other than USD. A shift to longer-tenor debt is also a key component of the strategy, which hopes to reduce Egypt’s annual debt servicing bill to 20% of GDP. Long-term debt should account for around 52% of Egypt’s borrowing by June 2022, our source says. The Finance Ministry has received approval from the Madbouly Cabinet to launch an international tender for advisers on its upcoming eurobond issuance.

Background: The ministry had presented an initial draft of the FY2019-20 state budget to President Abdel Fattah El Sisi last week, in which it set a revised debt target for the country. State budget guidelines for that fiscal year, released in November, had set a public debt target of 79.3% of GDP by FY2021-22, and senior officials speaking to Enterprise had been even more optimistic, setting the target at 72-75% of GDP by FY2021-22.

What could help the situation is int’l finance institutions cutting down on FX–denominated loans: Development finance institutions such as the EBRD are handing out loans to companies in emerging markets in local currencies, rather than in USD or EUR, according to the FT. Leaning away from FX-denominated loans helps to mitigate the effect of “painful currency swings” borrowers are exposed to. “The practical implication of this is the obvious social gain, ie more projects and funding and ultimately value creation since this protects the local economies from FX fluctuations and risk,” says Philippos Kassimatis, partner at hedging strategy specialist Maven Global.

The ministry is also hoping to nudge Egypt’s GDP growth to 8% by the end of the strategy’s implementation, and has included proposed measures to stimulate the economy and encourage local industry, among others.

INVESTMENT WATCH- Manfoods to invest EGP 250 mn in Egypt in 2019: Manfoods, which holds the franchise for McDonald’s, is planning to invest EGP 250 mn in Egypt this year to finance its expansion plans in the country, Manfoods Egypt General Manager Alaa Fathy tells Al Mal. The company is planning to set up 13 new McDonald’s branches as part of these expansions, according to Fathy. Manfoods had said in 2017 that it intends to invest EGP 650 mn until 2020 to expand its activities in the country. The company already invested EGP 170 mn of that amount last year.

Potential bidders for Edison’s Egypt assets line up ahead of expected close this month: France’s EDF is looking to sell Edison exploration and production assets in Egypt and Italyin a private auction where bidders are expected to offer up to USD 2 bn, sources close to the matter told Bloomberg. Neptune Energy, Warburg Pincus’s Apex International Energy and DEA Deutsche Erdoel AG could be potential bidders in the auction whose deadline is sometime this month, the unnamed sources said. The move comes amid plans by the French company to pull away from the fluctuating oil and gas market and focus instead on the nuclear and renewable energy market.

Background: Edison appears to not be be pulling out of Egypt completely saying last month it was not giving up oil and gas exploration rights in Egypt’s northeastern Hapi and Theqa concessions. The company had also said it would launch a USD 200 mn development program at two offshore concessions in the Nile Delta, expecting production by 1Q2021.

Nassef Sawiris sells USD 68 mn of shares in LafargeHolcim: Nassef Sawiris sold off USD 67.5 mn-worth of shares he holds in the world’s largest, Switzerland-based cement producer LafargeHolcim, the company issued a statement confirming reports, according to Reuters’ Arabic service. Sawiris held 16.58 mn shares in the company, and is a major shareholder — with a 2.73% stake, before the sale.

CABINET WATCH- The Madbouly Cabinet approved yesterday proposed amendments to the Competition Act (or Antitrust Act) that are meant to increase regulation against monopolistic practices and help protect competition in Egypt, according to a statement. The amendments would ban collusion in any form between competitors in any industry — including coordinating on whether or not to enter auctions and tenders, or production strategies — if said collusion is meant to effect a change in market prices and stability. The amendments would also grant the Egyptian Competition Authority (ECA) with the jurisdiction to investigate and gather evidence on suspected incidents of anti-competitive practices.

Did the ECA just get its New Year’s wish? While the details are lacking, this is looking like the key piece of legislation the ECA has been looking to push through to get sweeping new powers. The ECA had been attempting to have sign off powers on M&As worth more than EGP 100 mn. Recently, the ECA has been on a campaign against high profile cases it deemed to violate the Competition Act. These include issuing warnings to Uber and Careem over talks of a merger, and slapping Apple with a warning over the distribution of its products in Egypt.

The Council of Ministers also signed off yesterday on:

- Amendments to the country’s penal code imposing fines and prison time on civil servants found guilty of transgressing on land or buildings;

- A EUR 350 mn loan agreement from the European Investment Bank to finance the development of Cairo Metro Line 1;

- A loan agreement with Italy to support Egypt’s private sector growth;

- A bundle of decisions from the Cabinet’s investment dispute resolution committee.

Is the Electricity Ministry looking to ditch the feed-in tariff program in favor of IPP framework? The Egyptian Electricity Transmission Company (EETC) is reportedly looking to end its reliance on power purchased from the private sector under the feed-in tariff (FiT) program, unnamed Electricity Ministry sources said. The move is meant to open up space for the private sector to produce and sell power under an independent power producer (IPP) framework, which allows private companies to directly sell power to consumers while paying the state a fee to use the national grid for transmission. The EETC is not looking to back down from its pre-existing commitments to power purchases under the FiT framework, including from the Hamrawein and Al Nowais coal plants, the sources stressed.

Background: The Egyptian Electricity Utility and Consumer Protection Agency (Egyptera) had been holding high-level meetings last year to discuss the pricing scheme for power produced and sold under the IPP framework. Sources at the time said the plan is to implement a flexible system that will allow suppliers to negotiate prices with consumers, charging them more or less than the state for power based on a contractual agreement between them. Energy group Empower reportedly became the first company to receive an IPP license to sell electricity from waste in June.

Banque Misr has begun issuing “Meeza” debit cards as of the beginning of this month, an unnamed source from the bank tells Al Mal. The card — which the Finance Ministry first announced in September as part of the government’s new e-payments drive — would make state benefits available electronically to pensioners, civil servants, and subsidy recipients. All government payments, including fines, are set to be settled electronically as of this year under the amended Government Accounting Act.

Egypt ranked 127 out of 170 on the Economist Intelligence Unit’s 2018 Democracy Index, which saw the average global score remain largely stable at 5.48, despite there being changes in specific regions and indices. According to the report, 2018 saw a general global improvement in political participation, but the Middle East and Africa is the only region to buck the trend: “Here the Arab Spring revolt in the early 2010s has had far-reaching repercussions, with the reassertion of power by authoritarian or hybrid regimes in all but one (Tunisia) of the countries affected.” Egypt’s overall score remained unchanged at 3.36, and its score in each of the five indices was also stable. You can view the full report here (pdf).

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

Supply Minister Ali El Moselhy will present his ministry’s food security strategy to the Madbouly Cabinet “soon,” the minister said at a press conference on Sunday, according to a local source. The new strategy will track the country’s commodity production and consumption rates to able crop production forecasts and better anticipate shortages. The ministry expects the new strategy to reduce the country’s EGP 50 bn wheat subsidy bill by 10-15%, according to El Moselhy.

Egypt, Sudan begin trial runs on electricity grid connection project in two weeks: Egypt and Sudan will begin trial runs for the first phase of a USD 60-70 mn electricity interconnection project in two weeks at a capacity of 100 MW, local news reported. A government source said 95% of the project has been completed.

A government committee mandated with defining Egypt’s informal economy is set to meet for the first time this month. The committee’s work comes in light of the Madbouly government’s bid to convince the World Bank and the IMF to agree to include the informal economy in calculations of Egypt’s GDP.

Egypt in the News

Topping coverage of Egypt in the foreign press is the return of a stolen ancient Egyptian artefact that was found at a London auction. The reclaimed part of a King Amenhotep I cartouche was stolen from the open museum of Luxor’s Karnak temple. CNN, CTV news and Xinhua also have the story.

Human rights was again part of the conversation after a Cairo Criminal Court handed down a 15-year sentence and EGP 6 mn fine to political activist Ahmed Douma for his involvement rioting and assaulting security personnel in 2011. The sentence can be appealed within 60 days, Reuters notes. The story has been widely covered in the foreign press, with Turkey’s Anadolu Agency and the Associated Press among those taking note.

Meanwhile, Egyptian authorities have confirmed detaining 23-year-old Egyptian-German student Mahmoud Abdel Aziz, Germany’s Foreign Ministry stated, according to Deutsche Welle (DW). Aziz and 18-year-old Isa El Sabbagh, also an Egyptian-German student, went missing while visiting Egypt last month. Aziz, who is enrolled in an Islamic studies program in Saudi Arabia and was on holiday to visit his grandparents in Egypt with his brother Malik, was detained upon arrival at Cairo International Airport for as of yet undisclosed reasons. The whereabouts of El Sabbagh, meanwhile, have yet to be revealed.

On The Front Pages

Econ and business news permiated the front pages of the country’s three main state-owned dailies (Al Ahram | Al Akhbar | Al Gomhuria). Al Ahram and Al Akhbar highlighted the Standard Chartered report that said Egypt would be among the world’s top 10 economies by 2030 that we noted above. Meanwhile, Al Gomhuria focused on power projects the country is currently working on amid efforts to revamp the sector. The newspaper also congratulated Egyptians for the AFCON hosting win from earlier this week.

Worth Reading

What Cairo can learn from Dar Es Salaam’s transportation systems. Dar es Salaam, the de facto capital of Tanzania, is revisiting public transportation solutions since its population began growing by half a mn people every year, reports the Guardian. With this growth, it matches Cairo in transportation system headaches, and whose solutions could be used to inform policies here.

Constructing an underground system is not always the answer: Instead of constructing a metro, which can be expensive and plagued by delays, Dar es Salaam opted for a revamped bus system. Whereas the main arterial routes into the capital used to be served by informal buses, the new Dart system created dedicated bus lanes in the middle of the road to reduce stoppage. Ticketing is handled at stations, and journey time from the periphery to the terminus has been more than halved to 45 minutes, from 2 hours.

That’s not to say the system is perfect, but the choice of a well-planned bus system over a metro network means that the infrastructure investment is directly tied to developing the local economy. “With a metro, an international firm will often just parachute in its own system,” says Chris Kost, Africa director of the Institute for Transportation and Development Policy. “Bus rapid transit allows existing stakeholders to get involved.”

Diplomacy + Foreign Trade

Egypt, EBRD sign EUR 148 mn loan for Kitchener Drain project: Irrigation Minister Mohamed Abdel Atti and the European Bank for Reconstruction and Development’s (EBRD) Egypt Deputy Director Katrina Hansen have signed the final contract for the EBRD’s EUR 148 mn loan to finance the Kitchener Drain project, according to Al Mal.

Basic Materials + Commodities

Centamin produced 472.4k oz of gold from Sukari in 2018

Centamin announced that its 2018 full-year production from the Sukari gold mine was 472.4k ounces, marking a 13% y-o-y decrease, according to a company statement. The company had initially held a target of 580k ounces in 2018 but adjusted the figure following operational challenges it faced during 1H2018, such as lower grades being delivered. “We look forward to 2019, where the focus remains on ensuring delivery of grade and as such gold production from Sukari, supported by tight cost control across all areas of the organisation and returns for our shareholders,” CEO Andrew Pardey commented.

Telecoms + ICT

NTRA to contract int’l company to run QoS tests in 1Q2019

The National Telecommunications Regulatory Authority (NTRA) is in the final stages of contracting an unnamed international company to conduct quality of service (QoS) tests on Egypt’s mobile network services in 1Q2019, CIT Minister Amr Talaat told Youm7. The quality of services has recently seen a marked decline, leading to a 4.84% y-o-y drop in September 2018.

Automotive + Transportation

Sahar Nasr discusses with Uber’s SVP investment plans in Egypt

Investment Minister Sahar Nasr met with Uber’s Senior VP and Chief Legal Officer Tony West yesterday to discuss the details of the ride-hailing company’s planned investments and expansions in Egypt, according to a ministry statement (pdf). Uber had committed to investing USD 100 mn over five years following the launch of Uber Bus.

Other Business News of Note

ODH enters agreement with Chairman Samih Sawiris for stake purchase in ASA

Orascom Development Holding (ODH) has entered an agreement to purchase an additional 1% and one share of Andermatt Swiss Alps (ASA) from ODH Chairman Samih Sawiris at a total price of CHF 3.2 mn, according to a company press release. The transaction, which is conditional on Sawiris forgiving CHF 150 mn in debt owed to him by ASA, would make ODH the majority shareholder in ASA by a margin of one share.

On Your Way Out

Astronomers intercept radio frequencies 1.5 bn light years away: A telescope in Canada has reportedly picked up 13 bursts of radio waves, or FRBs, from a source in outer space 1.5 bn light years away, BBC reports. FRBs are short flashes of bright radio frequencies appearing to originate from deep space. Theories on what caused them to appear include a neutron star with a powerful magnetic field, two stars merging, and — among a small number of observers — alien spaceships.

The Market Yesterday

EGP / USD CBE market average: Buy 17.87 | Sell 17.96

EGP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.79 | Sell 17.89

EGX30 (Wednesday): 13,366 (-0.3%)

Turnover: EGP 1,035 mn (30% above the 90-day average)

EGX 30 year-to-date: +2.5%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.3%. CIB, the index heaviest constituent ended down 1.4%. EGX30’s top performing constituents were Telecom Egypt up 4.0%, TMG Holding up 3.1%, and Pioneers Holding up 2.4%. Yesterday’s worst performing stocks were Global Telecom down 2.8%, Eastern Co. down 1.7% and CIB down 1.4%. The market turnover was EGP 1,035 mn, and local investors were the sole net sellers.

Foreigners: Net Short | EGP -15.5 mn

Regional: Net Short | EGP -66.8 mn

Domestic: Net Long | EGP +82.3 mn

Retail: 62.4% of total trades | 63.7% of buyers | 61.1% of sellers

Institutions: 37.6% of total trades | 36.3% of buyers | 38.9% of sellers

WTI: USD 52.16 (+4.78%)

Brent: USD 61.31 (+4.41%)

Natural Gas (Nymex, futures prices) USD 2.99 MMBtu, +0.78%, Feb 2019 contract)

Gold: USD 1,294.70/ troy ounce (+0.68%)

TASI: 8,146.68 (+1.11%) (YTD: +4.09%)

ADX: 4,953.25 (+0.53%) (YTD: +0.78%)

DFM: 2,539.75 (+0.44%) (YTD: +0.40%)

KSE Premier Market: 5,386.95 (-0.25%)

QE: 10,535.13 (+0.73%) (YTD: +2.29%)

MSM: 4,310.76 (0.00%) (YTD: -0.30%)

BB: 1,338.27 (+0.45%) (YTD: +0.08%)

Calendar

10-13 January (Thursday-Sunday): International Property Show (IPS), Egypt International Exhibition Center.

17 January (Thursday): Talent in the Digital Era, Galleria40, Cairo, Egypt.

19 January (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January (Sunday): Cairo Court of Urgent Matters to hear an amendment to the constitutional to extend the presidential term limits.

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

3 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

7 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

10-12 February (Sunday-Tuesday): Third African Forum: “Building on Science, Technology and Innovation to Boost Private Sector and Socio-Economic Transformation in Africa”, Venue TBD, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.