- AWB arrests spark steepest one-day sell-off on EGX since January 2017. (Speed Round)

- New consumer protection act creates advertising watchdog, puts car, e-commerce and real estate sectors under spotlight. (Speed Round)

- Insurance will be mandatory for everything under the sun as part of draft Insurance Act now being finalized. (Speed Round)

- Is the Finance Ministry about to compete with the likes of Fawry as it studies national e-payments system? (Speed Round)

- EXCLUSIVE- Matouk Bassiouny wins mandate on Eastern sale. (Speed Round)

- EFG eyes entry into new EM, sees growth in non-banking financial services -Awad. (Speed Round)

- Opinion writers, unhappy Egypt is “losing” at int’l arbitration, simply miss the point. (On Deadline)

- TE Data blocking Slack? (What We’re Tracking Today)

- 19 Egyptians make Forbes Middle East’s list of influential women. (Speed Round)

- The Market Yesterday

Monday, 17 September 2018

Biggest EGX selloff since Jan ‘17

TL;DR

What We’re Tracking Today

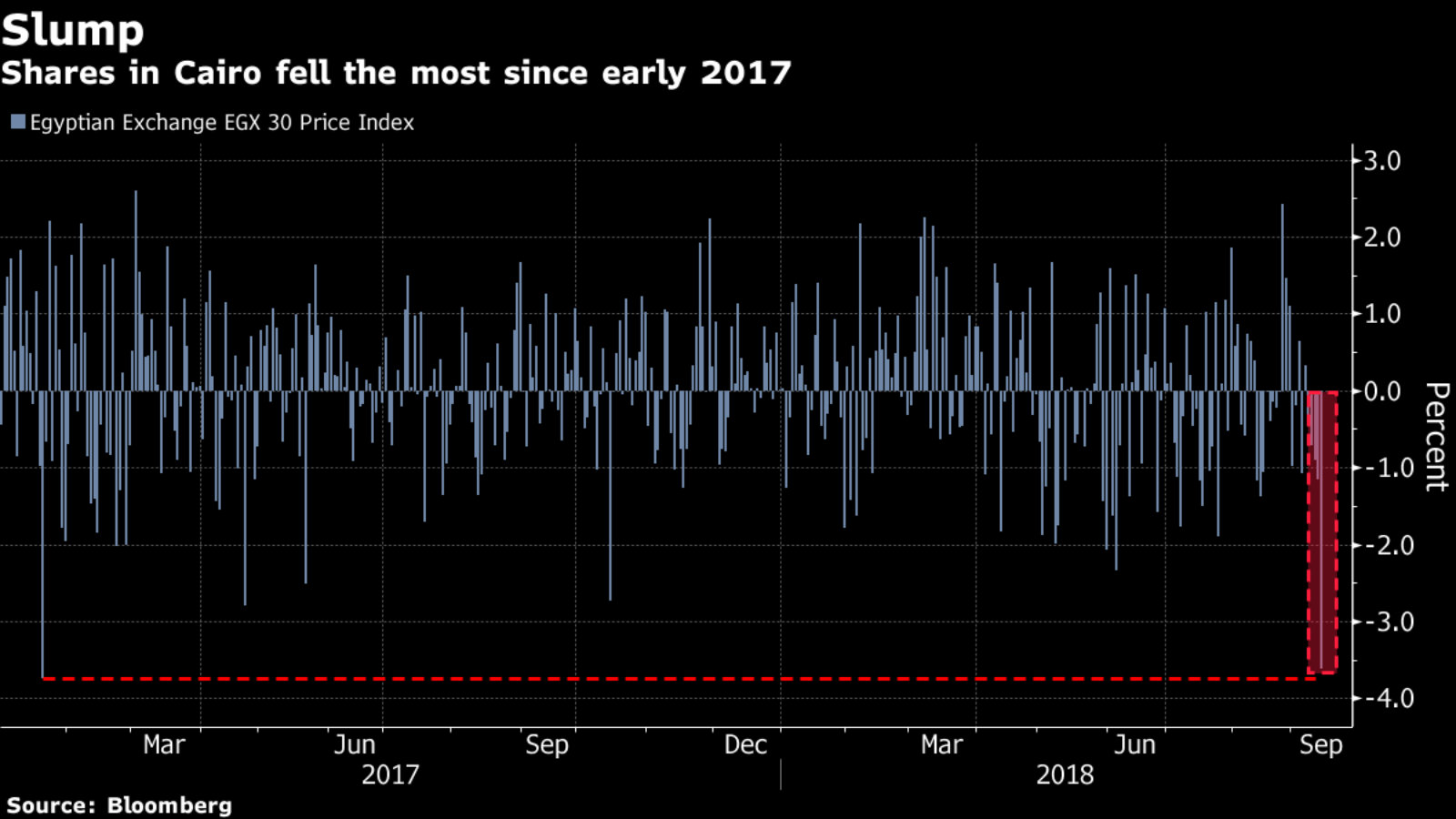

The EGX30 posted its biggest one-day loss in more than a year and a half yesterday as the market reacted to the arrest of principals accused in the so-called Al Watan Bank case, which dates back to immediately after the events of January 2011. The sell-off was overdone and on thin volumes, but underscores that the sell-off comes at a delicate time for market sentiment. We have more in today’s Speed Round, below.

Drivers of heavy trucks who turned onto the Cairo Ring Road yesterday were warned that a ban on daytime driving there will carry fines of up to EGP 3,000, Al Shorouk reported. Drivers also risk losing their licenses. A daytime ban on heavy trucks carrying more than four tonnes of cargo kicked off on Saturday.

Two questions that will help shape sentiment on emerging markets this week: Can oil stay in the USD 80 neighborhood? And is the USD, down 1.7% in the last four weeks against its major global peers, going to continue slipping? The Financial Times looks at the over / under on both questions.

Could Netflix make history at the Emmys tonight? The 70th annual Primetime Emmy Awards take place overnight tonight, with Netflix looking to set a milestone in the number of wins this year. Netflix is already the content factory with the most nominations at a whopping 112 — and is likely to win the most awards, Reuters says. The move will be a milestone for the company, which only beban making its own shows five years ago, as it would unseat reigning network HBO. The latter is fielding some tough competition though, particularly in the best drama category, with Game of Thrones and Westworld (the most-nominated dramas) coming up against Netflix’s Stranger Things and the Crown. Hulu is also in the running with acclaimed Handmaid’s Tale. Vox has the full list of nominees here.

One thing on Netflix that isn’t impressing us: The Israeli-produced biopic of alleged spy Ashraf Marwan. The Angel, which came out over the weekend, gets low marks on everything from acting to plot development and writing. It gets a flat zero for authenticity, as the heavy Israeli and Moroccan accents on Egyptian characters really drown out any historical feel. You’d think with 100 mn people and Egypt being one of the cinematic capitals of the world, there wouldn’t be a shortage of Egyptian actors who could play-out their own history. Cairo also looks an awful lot like downtown Rabat, if you ask us.

Spoiler Alert: As Israel’s very poor answer to Ra’fat El Haggan, we’re not counting on historical accuracy. But when we got to the part at which the grand strategy of the ‘73 war was depicted as having been developed by Marwan, we couldn’t help but simply end the movie wishing we had made the decision an hour earlier.

**#8 PSA- TE Data appears to be blocking Slack, the popular business productivity app that incorporates text-based chat and file sharing features. For four years now, we’ve used those features to speak with each other in the dead of night as we produce Enterprise. We’ve had access issues for days now, and so have other companies. Our yearlong subscription is now essentially worthless to all of our remote staff, and it seems we’re going to be forced to deploy a rival product today at both Enterprise and our parent company. Why is TE Data, an internet service provider, blocking Slack? Because, we’re told, Slack provides voice calling features, which might eat into the mother company’s revenues.

The TE Data Customer Service Baboon, who hasn’t made an appearance in Enterprise since 2015, is pleased. The stock market is a dumpster fire right now. Nobody knows what the Emerging Markets Zombie Apocalypse means for anything from this autumn’s IPO window to our ability to retain hot money — or the state’s management of its debt position. High interest rates are going to delay the return of corporate borrowing — but will need to stay high to keep the hot money here. Court cases that should have been settled nearly a decade ago are still lingering on. But protect a few pennies of an antiquated revenue stream? You betcha.

As our blood pressure returns to somewhat less stratospheric heights, we recommend the following reading for your morning commute:

- The new head of the San Francisco Fed is a high-school dropout who toiled in a donut shop and at a Target before going back to school and becoming a noted labour economist. (New York Times)

- A push to execute clerics who weren’t on board with the Qatar Smackdown is allegedly rattling the Saudi power structure. (Wall Street Journal)

- The UAE is going to let (comfortably well-off) folks retire there and obtain long-term residence visas. (Bloomberg)

- The guys who built Salesforce has bought Time magazine, the latest in trend of tech moguls buying up media companies (cf: Bezos, Jeff, and the Washington Post). (Reuters)

- We’re not alone in thinking the Apple Watch 4 stole the show at the company’s fall event last week. (New York Times)

- Volkswagen is going to stop making the Beetle next year with a limited run “Final Edition” that puts an end to Der Führer’s favourite vehicle. (Road and Track)

The Egyptian women’s squash team brought home Egypt’s fourth world championship trophy after yesterday’s victory over England, according to the tournament’s official website. The WSF World Team Squash Championships takes place every other year. Egypt won the men’s title five times and the women’s four times.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi signing the Consumer Protection Act into law dominated the economic discussion on the airwaves last night. Also guiding the business conversation was the impact on yesterday’s trading of the arrest of Alaa and Gamal Mubarak, Hassan Heikal and Yasser El Mallawany. We have full coverage of both topics in today’s Speed Round, below.

Also on the econ front, the Supply Ministry addressed the many half-hearted campaigns calling for boycotts of fruit and veggies in protest of rising prices. Assistant Supply Minister Ibrahim Ashmawy explained why inflation is a feature of Egyptian life post the float of the EGP (watch, runtime: 8:48). Earlier in the evening, Ashmawy sat down with Al Hayah fi Masr’s Kamal Mady to talk about a range of topics including the ration card system (watch, runtime: 31:02).

As back to school season gets in full swing, Education Minister Tarek Shawky gave a presser yesterday on the new education reform strategy. He then made the rounds on the airwaves where he spoke to El Hekaya’s Amr Adib on the move away from rote memorization (watch, runtime: 2:47). Al Hayah fi Masr talked about vocational training after Prime Minister Mostafa Madbouly visited the Asmarat housing project (watch, runtime: 7:58).

Strangest story of the night: State Forensic Authority head Hisham Abdel Hamid resigned, citing a “unhealthy work environment.” Justice Minister Hussam Abdel Rahim appointed Soad Abdel Ghafar as his replacement. Legal minds called in to Masaa DMC to discuss the strange resignation (watch, runtime: 5:30). We, and others, still can’t tell if Abdel Hamid means unhygienic or just hostile work environment. We hope you have fully stocked your zombie bunkers. This is how it starts.

The Egyptian Football Association (EFA) is planning to introduce instant replay when refereeing Egypt Premier League games, according to an EFA statement. The VAR system, was first used in the FIFA 2018 World Cup to review head referee decisions. Amr Adib discussed the move with football commentator Ahmed “Mido” Hossam (watch, runtime: 2:18).

LAMEES WATCH- Still no sign. We have dispatched the Enterprise Special Rescue Forces.

Speed Round

**#1 Arrests in Al-Watany Bank insider trading case trigger EGX selloff: The EGX30 dropped to its lowest level since January 2017 yesterday following the arrest of Gamal and Alaa Mubarak on charges of stock market manipulation, Filipe Pacheco and Tamim Elyan write for Bloomberg. The benchmark EGX30 was down 3.6% at yesterday’s closing bell as EFG Hermes shares dropped 8.6% on news that former co-CEOs Yasser El Mallawany and Hassan Heikal were also ordered arrested. Qalaa Holdings was down 6% after the company said (pdf) a staff member had been detained in connection with the case.

EFG and Qalaa shares are being punished unfairly… This case dates back to 2012 — no new facts have been presented in court. Current EFG Hermes management has nothing to do with the case (and, we’d argue, even an adverse verdict for Heikal and El Mallawany has been priced-in for years). And the Qalaa staffer arrested has (a) also been embroiled in the case since it began and (b) been dragged into it for reasons having nothing to do with his current employer.

…Then again, so is everyone else: It was a sea of red at the closing bell yesterday, with index heavyweight CIB down 2.1%, Eastern off 6.1%, and MNHD down 8.4% and Palm Hills sinking 5.6% in a broad selloff from which few issuers escaped unscathed.

Sentiment on the arrests was exacerbated by a wider emerging market sell-off. Stock markets in Saudi Arabia, Qatar, the UAE, and Bahrain were all down yesterday. “Investors are in a selling mood and the volumes are low — any negative news is merely an excuse for a fall,” said Naeem Brokerage CEO Tarek Abaza in remarks to Bloomberg.

Background: The arrests came on Saturday on charges of insider trade in the sale of Al Watany Bank of Egypt to the National Bank of Kuwait. The accused were remanded to custody despite report from a court-appointed panel of experts recommending that most charges against the defendants be dropped. The report found that the transaction was largely compliant with capital market regulations.

The story received prominent coverage on Hona Al Asema last night, where former Al Awael Portfolio Management Chairman Wael Enaba said that he expects the EGX to dip at the beginning of today’s trading but to gradually start picking up toward the end of the day (watch, runtime: 4:14). A

**#2 LEGISLATION WATCH- New consumer protection act creates advertising watchdog, puts car, e-commerce and real estate sectors under spotlight: President Abdel Fattah El Sisi signed into law amendments to the Consumer Protection Act, the amended text of which was published on Sunday in the Official Gazette. The act, easily the least business-friendly of the Sisi administration’s economic reform package, sets a legal framework and mechanism by which the government could institute price controls. The law also gives the Consumer Protection Authority (CPA) the right to censor ads, and regulate markets including e-commerce, real estate and auto sales. The law also requires manufacturers to recall products that break within a year of a consumer making a purchase. You can check our primer on the law here.

Stickers is beaming: CPA head Rady “Stickers” Abdel Moaty is beaming from the victory, calling in to Hona Al Asema to hail law as a step forward for consumer safety. He delighted in his new role as advertising tsar and delivered his first warning that the law would punish ads he considers misleading (watch, runtime: 6:02).

Rep. Medhat El Sherif tried to give the impression that business had a say in the law by pointing to meetings held with various business associations. He noted other features of law, including that the CPA will be an independent body under the supervision of the Madbouly Cabinet and not the Supply Ministry (watch, runtime: 5:12).

**#3 LEGISLATION WATCH- Insurance will be mandatory for everything under the sun as part of draft Insurance Act now being finalized: The Financial Regulatory Authority is expected to complete a draft of the new Insurance Act and submit it to the board for approval before the end of this month, FRA deputy head Reda Abdel Moaty tells Al Mal in an interview. The bill — which is now just a few “final touches” away from completion — will then be put up for “national dialogue” in October and amended to reflect the views of various industry stakeholders. A final draft will then be presented to the Madbouly Cabinet in December, according to Abdel Moaty.

Background: The FRA had announced earlier this year that it was drafting a new Insurance Act that would make it the primary regulator for the sector, governing everything from the establishment and licensing of insurance companies, to setting best practices and industry standards, and regulating transactions, contracts, and policies.

Compulsory insurance for SMEs is expected to be a key component of the new act, which is also expected to regulate insurance for freelance and seasonal jobs. It is also expected to make insurance cover mandatory for public gatherings and venues (such as malls and concerts).

**#4 Is the Finance Ministry about to compete with the likes of Fawry? The Finance Ministry is planning to launch a new national electronic payments system that could see it roll out ATMs and point-of-sale (PoS) terminals at which people will be able to pay bills and fees for government services, sources close to the matter tell Al Mal. Banks including the National Bank of Egypt and Banque Misr have already agreed to supply the PoS terminals to support the ministry’s plans, as the government move to make e-payments mandatory as of January 2019 and continues to push policies for financial inclusion and a transitionto the cashless economy.

A national debit card? The new system will also see state-controlled banks issue debit cards for the unbanked portion of the population for a nominal fee that will likely range from EGP 10-15, the sources add. This comes as Deputy ICT Minister Khaled El Attar tells the newspaper that the ministry is in talks with the central bank about the possible roll-out of a new national card system that would allow citizens to pay for state services, receive social welfare and pension payments, as well as receive their healthcare benefits. The Finance Ministry had issued a statement on Saturday saying that all government payments, including fines, would be settled electronically as of next year under the amended Government Accounting Act.

REGULATION WATCH- New EGX trading regs to come into effect on Thursday: The Financial Regulatory Authority approved changes yesterday to trading regulations that will round securities trading under EGP 2 per share to the thousandth decimal point, according to a bourse statement (pdf). Under the new regulations, which come into effect on Thursday, these shares will be placed on a special list that will be reviewed weekly to monitor the daily fluctuations in their prices. Also yesterday, the FRA approved changes that will set the opening price for exchange-traded index funds based on their net asset value rather than the previous session’s closing price. The regulator also signed off on amendments that shorten the time it takes to get approvals for specialized activities, such as margin trading, to come into effect.

Background: The FRA passed a number of regulatory changes recently to bring listing and trading regulations in line with the new Companies Act and its executive regulations. Among those were provisions that establish a weighted voting system that allows shareholders to vote on board members and also ask the board questions ahead of general assembly meetings.

FinMin renews agreement with Lawyers Syndicate on VAT: The Finance Ministry renewed an agreement on Sunday with the Lawyers Syndicate that sets the value-added tax rates for their services. The agreement sets a flat VAT on each service or type of court proceeding undertaken by a firm. Representing clients or filing a motion in a district court (whether in civil or criminal suit) will taxed at EGP 20. VAT for proceedings in the Court of First Instance will be EGP 40 and EGP 60 for Court of Appeals proceedings. Lawsuits filed in the courts of cassation, administrative, constitutional, and international arbitration will have a VAT of EGP 200, Finance Minister Mohamed Maait said in a statement (pdf). The agreement will see the Justice Ministry issue receipts to lawyers and will send those receipts to the Tax Authority, said Justice Minister Hussam Abdel Rahim, who also signed the agreement. The agreement was initially signed in April 2017 and expired in April 2018. The Syndicate had been opposed to the initial agreement and vowed earlier this month to negotiate better terms.

Perhaps the rest of us should have hired lawyers to negotiate with the Tax Authority on our collective behalf when it was formulating the VAT?

**#5 EXCLUSIVE- Matouk Bassiouny wins mandate on Eastern sale: Law firm Matouk Bassiouny has been chosen to act as legal counsel on the 4.5% stake sale of Eastern Company, a Finance Ministry source told Enterprise. The news has yet to be made official. EFG Hermes was tapped earlier this month as banker for the transaction, which will pilot the privatization program. A final date has yet to be set for the sale, which is widely expected to be executed in October.

Abu Qir to be the third company in the program: Abu Qir Fertilizers will be the third company state-owned company to stake on the EGX after Eastern Company and the Alexandria Mineral Oils Company (AMOC), the source added. Abu Qir will sell shares in November. Investment banks are now bidding for the mandate.

**#6 EFG eyes entry into new EM, sees growth in non-banking financial services: EFG Hermes is looking to enter one or two new emerging markets in the next two years as part of a plan to expand its footprint, Group CEO Karim Awad tells Al Mal in an interview. The firm is already active in some 11 countries and expects to launch operations in Nigeria soon, he said, noting that EFG’s geographic presence in the region allows it access to 95% of markets on the MSCI EM index.

The company also sees a lot of potential for growth in NBFS, Awad said. The segment is expected to generate half of the company’s total revenues in five years’ time. EFG Hermes pioneered the expansion into non-bank financial services with the launch a couple of years back of its successful leasing startup. It also acquired leading private-sector microfinance outfit Tanmeyah and launched valU (pdf), a consumer finance startup, in December 2017. New forays into NBFS are in the pipeline, Awad said.

You can also expect EFG to continue making prop investments in education and energy in the coming period, Awad suggested. Preliminary talks are on to launch a new education-focused fund in Egypt, he said, adding only that the idea has already generated a lot of interest. Awad also pointed to EFG’s recent acquisition of four schools from the Talaat Moustafa Group in a EGP 1 bn transaction through its joint venture with GEMS Education. Awad said Vortex, the firm’s European renewable energy platform, sees substantial new opportunities in the market.

EFG Hermes’ Egyptian pipeline includes the initial public offering of private education outfit CIRA. Another unspecified transaction should close by the end of the year, Awad said, noting that his firm has closed 12 transactions so far in 2018.

**#9 19 Egyptians make Forbes Middle East’s list of influential women: Nineteen Egyptian women were on the Forbes Middle East list of the most influential women in the Middle East, including Integrated Diagnostics Holdings CEO Hend El Sherbini; Zulficar and Partners Founding Partner Mona Zulficar; Noha El Ghazaly, managing director and head of investment banking at Pharos; MZ Investments and Maridive’s Shahira Zeid, Commercial Bank of Kuwait CEO Elham Mahfouz; and Soha El Turky, CFO at Banque du Caire. You can check out the full list here.

CBE Sub-Governor Lobna Helal was ranked third in the magazine’s top 10 women heading government departments in the Middle East.

Up Next

Finance Minister Mohamed Maait will be at AmCham tomorrow for a lunch. The minister will speak about “Egypt’s financial reform agenda.” Members and their guests can register here.

The E-Commerce Summit in Egypt takes place on Wednesday, 26 September.

The central bank meets on Thursday, 27 September to review interest rates.

The Egyptian-Sudanese ministerial committee will meet at the end of this month ahead of a presidential summit set to be held in Khartoum in October.

The Egypt-Romania business council will meet in Bucharest from 7-11 October, according to Al Mal.

Egypt in the News

No one story this morning is driving the conversation about Egypt in the international press, but the Guardian’s editorial board launched a broadside attack on Egypt’s democracy that will get attention. The editors are writing to condemn the death sentences handed down to over 70 people in a mass trial stemming from the Rabaa Adawiya clashes of 2013.

Other headlines worth noting in brief include:

- DW appeared to confirm that Yousry Fouda was fired on [REDACTED] harassment allegations, according to the AP. Reports had emerged that the former Al Jazeera and ON TV broadcast journalist had been accused of harassment.

- Egyptians and Israelis are still living in an “uneasy peace” four decades after they signed the Camp David Accords, Mona Salem and Aziz El Massassi write for AFP.

- Security forces arrested six Ikhwan members planning attacks against state institutions, Al Bawaba reports.

On Deadline

**#7 Opinion writers, unhappy Egypt is “losing” at int’l arbitration, simply miss the point: Since the USD 2 bn ruling handed down by the International Centre for Settlement of Investment Disputes in favor of Union Fenosa, opinion writers have expressed frustration at this “losing streak.” Ziad Bahaa El Din is urging in Al Shorouk the government to review all its oil and gas contracts to avoid losing future arbitration hearings. Mohamed Saleh concurs in AMAY, urging the government to seek the expertise of legal minds. AMAY’s Newton is complaining about the size of the loses, which he claims have reached EGP 38 bn, while AMAY’s Mohamed Abu Al Ghar is suggesting that the officials who have signed the contracts to be corrupt.

All four miss the point: None of them explain to their readers why we failed to meet our natural gas export obligations (it’s called “force [redacted] majeure” for a reason, people) —and none get the point that settling outstanding disputes is key to Egypt’s aim of emerging as the eastern Med’s premier energy hub.

Worth Reading

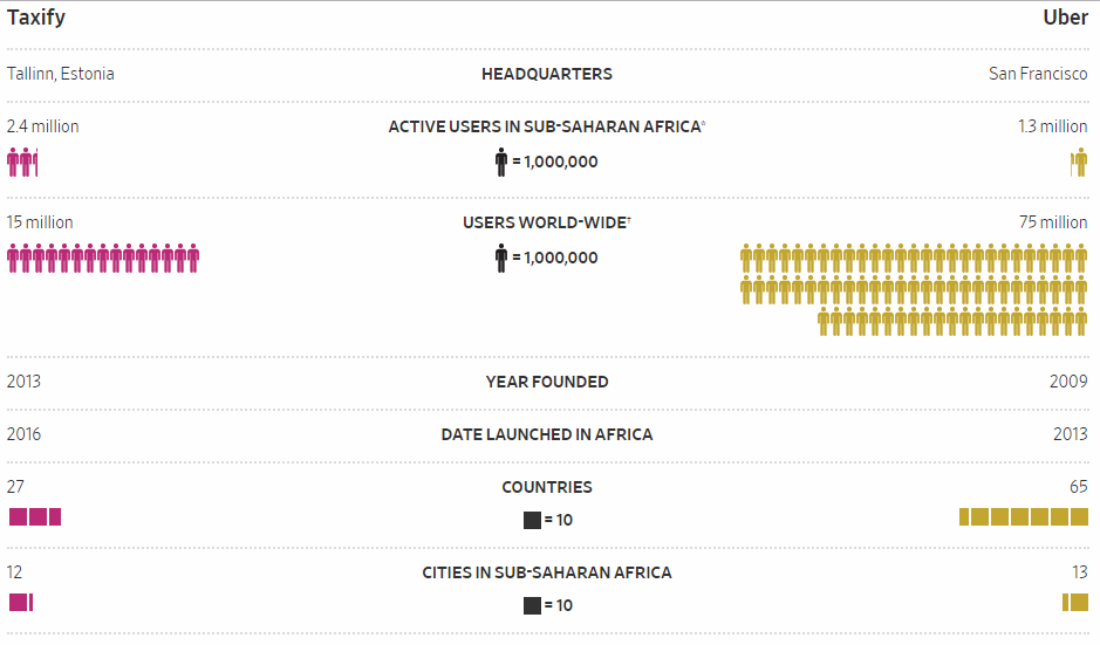

Why Taxify is beating Uber in Africa: It appears that ride-hailing giant Uber is being one upped by a smaller, Estonia-based competitor named Taxify, writes Alexandra Wexler for the Wall Street Journal. In just five years since its launch, Taxify has managed to take more active users (measured by the number of people who’ve used the app in the past month) in Africa than Uber. Taxify has 2.4 mn active users in Uganda, South Africa, Nigeria, Tanzania, Kenya and Ghana. Uber, which operates in these six countries in addition to Egypt and Morocco, is breaking 1.3 mn users.

In the emerging markets ride-hailing scene, nimbler is better: Taxify founder Markus Villig attributes this growth to the company’s ability to adapt quicker and faster to the needs of emerging markets. In Uganda, Taxify got a leg up on Uber by offering motorbike-hailing first. It took Uber two years to launch its motorbike service there. Taxify has also beat out Uber in offering mobile payments, which is very popular there. With low banking penetration, high unemployment, and poor access to vehicles, services such as these are more attractive.

Furthermore, Taxify takes 15% of a driver’s fare, while Uber charges 25%. “That makes a big difference in a country like Uganda where per-capita gross domestic product was just USD 604 last year.”

The trend is visible not just in Africa: Taxify’s success over Uber in Africa follows a familiar trend where the latter has been losing ground to smaller, and nimbler competition. Uber gave up territory to a number of smaller competitors in Asia in exchange for shares in them, including China’s Didi Chuxing Technology and Malaysia’s Grab.

Local player to watch: Halan, which targets the motorcycle and tuktuk market and was said earlier this year to be closing in on a USD 2 mn pre-Series ‘A’ round.

Worth Watching

Does a sin tax actually work? Or do consumers just work around it? Taxes imposed on popular vices including sugar, tobacco and alcohol apparently result in an overall drop in sales of the taxed items that may point to lower consumption levels, according to The Economist. In the US for example, a 1% increase in prices led to a 0.5% drop in sales. That said, however, while Berkeley witnessed a 10% drop in the sales of sugary drinks back when it imposed a high tax on them in 2015, people in Denmark were buying high-tax butter from neighboring countries to avoid paying the hefty duty (watch, runtime: 1.27).

Diplomacy + Foreign Trade

Egypt and the European Investment Bank (EIB) signed two agreements for grants worth EUR 32 mn (EGP 662 mn) to support sewage treatment projects in Kafr el Sheikh, according to an Investment Ministry statement. The agreements will allow EIB to help implement infrastructure projects throughout 79 villages. EIB had previously said that it intends to sign funding agreements with Egypt worth a combined EUR 589 mn before the end of the year, including a EUR 214 mn loan for the Kafr El Sheikh Kitchener drainage project and another EUR 375 mn to support the country’s private sector.

In other diplomacy news:

- A number of Indian companies signed MoUs with Egyptian partners last week that should see them cooperate on projects in IT, pharma, and renewable energy.

- A Moroccan trade delegation will be in Egypt next monthto discuss ways to step up Egyptian exports to West Africa through Rabat.

- Foreign Minister Sameh Shoukry talked power interconnection with his Greek and Cypriot counterparts ahead of a planned summit set to take place soon.

- Shoukry also met with Eritrean President Isaias Afwerkiin Asmara on Thursday to discuss bilateral relations and cooperation and D-8 Organization for Economic Cooperation Secretary General Dato Ku Jaafar Ku Shaari

- European Council President Donald Tusk and Austria’s Chancellor Sebastian Kurz held talks with President Abdel Fattah El Sisi yesterday during an official visit to Egypt. Illegal migration was at the top of the agenda.

Basic Materials + Commodities

Gov’t targets 1 mn tonnes of rice purchases to satisfy demand

The Supply Ministry is looking to purchase at least 1 mn tonnes from local farmers this harvest season, reports Al Mal. The government had announced earlier that it will pay local farmers EGP 4400-4700 for different strains, a lower-than-market price that is discouraging farmers.

Health + Education

Education Ministry gives itself right to supervise US high school diploma curriculum

Education Minister Tarek Shawky signed a directive on Sunday which would give the ministry the right to supervise the curriculum for obtaining a US high school diploma in Egypt, according to a ministry statement picked up by Ahram Online. The move would allow the ministry to organize the curriculums and exams for these degrees through a number of accreditation agencies, including the Middle States of Colleges and School Commissions on Elementary and Secondary Schools and AdvancED. The directive, which would give the ministry more regulatory control over obtaining foreign degrees, follows a similar directive signed in June for UK diplomas.

El Sisi inaugurates Japanese schools this week

President Abdel Fattah El Sisi will be inaugurating a number of Japanese schools this week, Education Minister Tarek Shawky said. El Sisi was scheduled to launch the schools yesterday. Shawky announced last week that the government plans to have 34 Japanese schools operational by the start of this academic year.

Services under the Universal Healthcare Act will be rolled out next May

The services under the country’s new health insurance scheme will begin rolling out in May, Health Minister Hala Zayed said. A trial run of the services in the newly upgraded and built public hospitals will begin then, she noted. Some 200 doctors have been hired and trained for the roll out of phase one of the Universal Healthcare Act.

Tourism

Archaeologists find new sphinx statue in Kom Ombo

Archaeologists discovered a ptolemaic-era sphinx statue at the Kom Ombo temple in Upper Egypt, according to the Antiquities Ministry. Two statues of King Ptolemy V were found in the same location two months ago.

Telecoms + ICT

TE completes acquisition of MENA cables

Telecom Egypt (TE) announced today that it has officially completed the acquisition of MENA Cables from Orascom Telecom Media and Technology in a USD 90 mn transaction, of which USD 40 mn represented the cost of the cable.

Banking + Finance

Banque du Caire signs MoU with Uzbek national bank to boost trade and exports

Banque du Caire has signed a cooperation agreement with the National Bank of Uzbekistan aimed at boosting trade ties and stepping up Egyptian exports to a dozen Eurasian counties, Al Shorouk reported. The agreement allows for direct transactions between the two banks, making it easier for exporters to do business.

Egypt Politics + Economics

Abu Zaid, Youssef vye to head up Support Egypt

Support Egypt Coalition members Rep. Taher Abu Zeid and Rep. Mohamed Youssef appear to be throwing their hats in the election to head up the House of Representatives’ largest political bloc, party insiders tell Al Shorouk. The move follows the surprise announcement by current leader Mohamed Elsewedy that he will not seek another term as coalition head.

On Your Way Out

Egyptian music acts are touring the US as part of Center Stage, a cultural exchange program launched by the US Department of State, according to Egypt Today. Dina El Wedidi, Yousra El Hawary and the Karkade band will tour the United States for one month as part of the program.

Egyptian actor Mohamed Karim stars opposite Nicolas Cage

Egyptian actor Mohamed Karim stars opposite Nicolas Cage in his upcoming movie “A Score to Settle,” Egypt Independent reports. The two are said to have filmed many action scene togethers and Karim claims to have performed all his stunts on his own. The film is now in post-production.

12 people were injured when a train derailed at the Shebin El Koum station in Menoufiya yesterday, Health Ministry spokesman Khaled Megahed said, Ahram Online reports. The National Railway Authority formed a committee to investigate the cause of the accident, according to Al Shorouk. Egypt is working on a broader overhaul of the country’s rail system to prevent these types of accidents from occurring.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.96

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 14,756 (-3.6 %)

Turnover: EGP 634 mn (20% below the 90-day average)

EGX 30 year-to-date: -1.8%

THE MARKET ON SUNDAY: The EGX30 index ended Sunday’s session down 3.6%. CIB, the index heaviest constituent ended down 2.1%. Yesterday’s worst performing stocks were EFG Hermes down 8.6%, Madinet Nasr Housing down 8.4%, and Egyptian Iron and Steel down 8.1%. The market turnover was EGP 634 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -13.4 mn

Regional: Net Long | EGP +19.6 mn

Domestic: Net Short | EGP -6.2 mn

Retail: 70.0% of total trades | 69.1% of buyers | 70.8% of sellers

Institutions: 30.0% of total trades | 30.9% of buyers | 29.2% of sellers

Foreign: 12.6% of total | 11.5% of buyers | 13.6% of sellers

Regional: 8.0% of total | 9.6% of buyers | 6.5% of sellers

Domestic: 79.4% of total | 78.9% of buyers | 79.9% of sellers

WTI: USD 68.99 (+0.58%)

Brent: USD 78.09 (-0.12%)

Natural Gas (Nymex, futures prices) USD 2.77 MMBtu, (-1.77%, Oct 2018)

Gold: USD 1,201.10/ troy ounce (-0.59%)

TASI: 7,469.81 (-1.59%) (YTD: +3.37%)

ADX: 4,965.74 (+0.63%) (YTD: +12.90%)

DFM: 2,774.09 (-1.27%) (YTD: -17.68%)

KSE Premier Market: 5,347.35 (-0.03%)

QE: 9,942.03 (-0.80%) (YTD: +16.64%)

MSM: 4,563.20 (+0.10%) (YTD: -10.51%)

BB: 1,341.21 (-0.28%) (YTD: +0.71%)

Calendar

16 September (Sunday): Creative Industry Summit 2018, Four Seasons Nile Plaza, Cairo.

17-19 September (Monday-Wednesday): INTERCEM Cairo to Cape Town cement industry conference, Dusit-Thani LakeView, Cairo.

18-21 September (Tuesday-Friday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Cairo, Egypt.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

23-24 September (Sunday-Monday): Arab Security Conference on cyber security, Nile-Ritz Carlton, Cairo.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

06 October (Saturday): Armed Forces Day, national holiday.

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday- Wednesday) World Travel Market London exhibition, London, England, UK.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.