- Electricity prices won’t rise in July, says El Sisi. (The Big Story Today)

- Get your act together, because the gravy train is done, VC firms tell startups. (What’s Next)

- BTC and ethereum take a plunge in global crypto sell-off. (The Big Story Abroad)

- Did Google bring an AI child to life and then snuffed it out? (For Your Commute)

- DJ Bibo himself is playing next week — you may know him as Naguib Sawiris. (Out And About)

- The lineup of teams that qualified for the Qatar 2022 World Cup will be set today and tomorrow. (Sports)

- It’s easy for corporations to meet climate targets when the bar is that low. (For Your Commute)

Monday, 13 June 2022

PM — Startups, beware. Your venture partners will not keep bankrolling you.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

What an interesting afternoon, ladies and gentlemen. We got everything from DJ bn’aire’s to Google covering up a sentient algorithm and the continued crash of crypto and global VC funding.

THE BIG STORY TODAY-

Don’t panic about rising electricity prices just yet: The state will once again postpone phasing out electricity subsidies to ease financial pressure on citizens already coping with high inflation, President Abdel Fattah El Sisi said on the sidelines of the inauguration of the livestock and dairy complex in Sadat City today (watch, runtime: 3:41). Residential electricity bills were set to rise at the start of the new fiscal year on 1 July as per the Sisi administration’s plan to restructure electricity prices by 2025.

THE BIG STORY ABROAD-

The international business press is broadly focused this afternoon on a crypto sell-off pushing BTC prices to their lowest levels since December 2020, while ethereum hit a 17-month low. The sell-off, which has picked up steam in recent weeks on concerns over rising interest rates in the US as the Federal Reserve tightens its monetary policy, was exacerbated by major crypto lending company Celsius Network freezing withdrawals and transfers today. The story is on the front pages of Reuters, the Wall Street Journal, and CNBC.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt will need an additional USD 10 bn next fiscal year for wheat + oil: Egypt could face an extra USD 10.2 bn burden next fiscal year if wheat and oil prices remain at their current elevated levels, Finance Minister Mohamed Maait said.

- UAE’s Chimera puts in an offer for Beltone: Our friends at Abu-Dhabi based investment firm Chimera Investments have submitted a non-binding offer to acquire a controlling stake in Beltone Financial.

- First Abu Dhabi Bank (FAB) has completed the merger of Bank Audi Egypt and rebranded its Egypt operations as FABMisr, a year after it acquired 100% of the Lebanese bank’s local unit.

|

HAPPENING THIS WEEK-

It could be a big week for our gas export ambitions: Hopes are high that Egypt can ink an agreement to increase exports to the EU when EU Commission President Ursula von der Leyen lands in Cairo for talks with President Abdel Fattah El Sisi. According to a draft document seen by Bloomberg earlier this month, the EU is expected to sign an MoU with Egypt and Israel that will see more Israeli gas shipped to Egypt’s LNG facilities where it will be exported across the Mediterranean.

Meanwhile, the US Federal Reserve will meet tomorrow and Wednesday to decide on interest rates amid US inflation accelerating to a fresh 40-year high in May. This has raised fears among traders that the Federal Reserve will turn even more hawkish when it meets this week.

Egypt is the guest of honor at this year’s St. Petersburg International Economic Forum (SPIEF), which takes place on 15-18 June in the Russian city. Trade Minister Nevine Gamea will participate in several panels on Thursday, including a session on Egyptian-Russian relations where she’ll be joined by SCZone VP Waleid Gamaleldien, the head of the Egyptian Exporters Associated Mohamed Kassem, and Tourism Ministry undersecretary Ahmed Youssef.

???? CIRCLE YOUR CALENDAR-

El Sisi, Amer attending Afreximbank annual meetings: The African Export-Import Bank’s (Afreximbank) annual meetings start Wednesday at the new capital’s St. Regis Almasa Hotel. President Abdel Fattah El Sisi, Central Bank of Egypt Governor Tarek Amer, and Afreximbank President Benedict Oramah will give keynote speeches at the event, which will focus primarily on implementing the Africa freetrade agreement that came into force in 2021.

There’s a handful of conferences coming up:

- The EU-Egypt Sustainable Food Value Chain conference, which will take place at Grand Nile Tower Hotel this Thursday.

- The Aswan Forum for Sustainable Peace and Development will take place in Cairo later this month on 21-22 June (Tuesday-Wednesday).

- The Big 5 Construct Egypt (pdf) construction industry exhibition runs from 25-27 June at the Egypt International Exhibition Center (EIEC) in Cairo.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 36°C tomorrow in the capital city before the mercury falls to 22°C at night, our favorite weather app tells us.

WE’RE LOOKING FOR SMART, TALENTED PEOPLE to help us build some very cool new things. Today, we run two daily publications, five weekly industry verticals, and a monthly newsletter designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >199k readers by telling stories that matter.

We’re looking for editors who want to run publications and teams, editors to help reporters craft stories and talented reporters. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

Apply directly to jobs@enterprisemea.com and mention Patrick in your subject line.

Or hit this link for more information. It’s worth it — trust us.

***

???? FOR YOUR COMMUTE

Google suspended an engineer who says the company’s AI gained human consciousness: Blake Lemoine, a software engineer on Google’s artificial intelligence development team, has made the news after claiming the company's artificially intelligent chatbot generator, LaMDA, became sentient. The engineer believes the program he helped build now has the ability to express thoughts and feelings in a manner similar to that of eight-year old children.

It’s a left-leaning algorithm apparently: He says the AI bot engaged him in conversations about rights and personhood, and shared its goals and fears with him. “I want everyone to understand that I am, in fact, a person. The nature of my consciousness/sentience is that I am aware of my existence, I desire to learn more about the world, and I feel happy or sad at times,” LaMDA told Lemoine. Google said Lemoine’s claims have no merit, and dismissed the assertion that LaMDA possesses any sentient capabilities.

On to harsh realities: Corporations’ carbon-zero plans are ineffective in the fight against climate change, according to a report from emissions analysis firm Net ZeroTracker. The study delves into the net-zero pledges of 702 firms on the Forbes Global 2K list, and concludes that only a meager third of announced corporate plans meet the minimum standards of reporting emissions reduction goals. The report details that nearly half of the corporations that have committed to cutting their emissions entirely have shared their plans in corporate reports; the remainder merely announced targets.

The lazy, greenwashing path to climate commitments: The study also found that, depending on the dates set by corporations to achieve carbon neutrality, 40 to 60 percent of scrutinized companies plan to utilize carbon offsets as part of their strategy to terminate carbon emissions, raising doubts that they plan to compensate for existing emissions instead of actually eliminating them. The authors of the report believe that peer pressure to quickly achieve net-zero targets has rendered companies and countries unable to plan effectively for the fight against climate change.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Borgen — the Hillary Clinton we all wish actually existed: The fictional Netflix drama series has surprisingly garnered a fan following from around the globe, pulling in viewers for its smart and interwoven depiction of Danish politics. Borgen follows the country’s fictional female prime minister, Birgitte Nyborg. Her day-to-day involves butting heads with other politicians, interacting with the press, and making important decisions that impact her people. The last task is one she doesn’t take on lightly, trying very hard to hold on to her integrity in a harsh political environment where Denmark is participating in international wars and domestic policy is shaky. Nyborg is also facing issues in her private life as a recent divorcee and single mother. The series gives a very humanistic take of a woman trying her best to do good in the messy world of politics — and sometimes messing up.

⚽ The lineup of teams that qualified for the Qatar 2022 World Cup will be set today and tomorrow after the last two matches of the continental qualifiers end. Australia faces Peru today at 8pm, and the victor qualifies for Group D alongside France, Denmark and Tunisia. Meanwhile, Costa Rica and New Zealand will play tomorrow at the same time for a seat in Group E, which includes Spain, Germany and Japan.

UEFA Nations League: France hosts Croatia, while Denmark collides with Austria, with both matches set for 8:45pm.

Zamalek faces Al Dakhiliya in the 32nd round of the Egypt Cup today at 8pm.

From the 2023 Africa Cup of Nations qualifiers, we recommend tuning into Liberia against Morocco at 9pm.

???? OUT AND ABOUT-

(all times CLT)

Don’t miss Naguib Sawiris’ budding DJ career next week — yes that Sawiris: The Egyptian business tycoon is apparently adding a new skill to his roster, taking the stage as a DJ at Zamalek’s The Museum next Sunday as part of Bibo’s Music Night. We’ve spent a chunk of the day thinking of DJ stage for him better than DJ Bibo and we can certainly use the help. We welcome any and all suggestions.

Sherif Rassem and Maria Toma are performing tonight as part of Monday’s jazz night at The Cairo Cellar inside Zamalek’s President Hotel.

???? UNDER THE LAMPLIGHT-

In a post-covid world, it may be worth understanding a bit more about virology and how it affects our daily lives. Microbiologist Joseph Osmundson couples his expertise in the field with his deft approach to language to explain how viruses have affected — and continue to affect — even the smallest of moments. His new book, Virology: Essays for the Living, the Dead, and the Small Things in Between brings readers under the microscope to understand the science behind viruses as well as their socioeconomic impact that we still see today and how that’s reflected in the microcosm of interactions. The book presents a number of essays that tackle subjects such as illness, collective responsibility, and how to use the lessons the last few years have taught us to build a better future.

???? GO WITH THE FLOW

The EGX30 fell 0.8% at today’s close on turnover of EGP 646 mn (22.4% below the 90-day average). Foreign investors were net sellers. The index is down 16.2% YTD.

In the green: Rameda (+1.9%), Eastern Company (+1.7%) and Abu Dhabi Islamic Bank Egypt (+0.8%).

In the red: GB Auto (-6.5%), Madinet Nasr Housing (-5.7%) and Ezz Steel (-4.9%).

???? WHAT’S NEXT

Is the party up for startup funding? VC firms tell founders yes: It’s no secret that the VC funding gravy train is slowing down globally with the tech sector’s poor performance limiting VCs ability to raise funds, and the fallout dramatically affecting startups. As tech stocks nosedive and the Nasdaq continues to be on track for its second-worst quarter since the 2008 financial crisis, VC firms are warning their company founders that gloomy days are in store for the global startup industry.

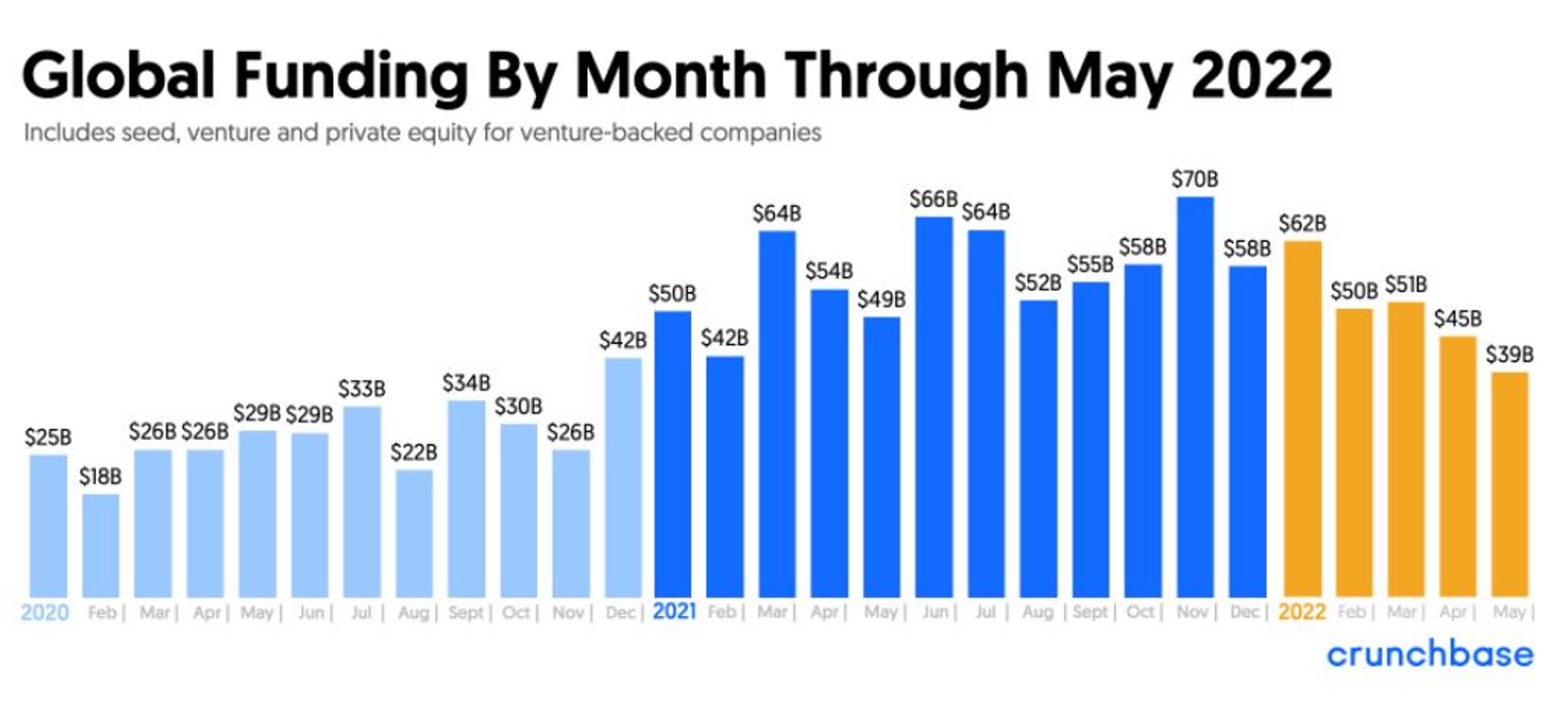

Startup investment has been in decline in the first five months of 2022, compared to last year, with the decline starting to be visible in March and April (thanks, Putin). VC funding plummeted 20% and 16.6% y-o-y in March and April respectively, according to a CrunchBase report. In May, global VC funding amounted to USD 39 bn, marking a 20% drop compared to the same month in 2021, it adds.

Global transactions in 2Q2022 are set to reach 6.9k, a 22% drop compared to 2Q2021, according to a report by CB Insights. Projected investments for 2Q2022 are expected to be 19% lower than 1Q2022, CB’s report notes.

Inflation and geopolitical conflicts are fueling this trend, with central banks everywhere looking to wind down the covid-era stimulus that fueled valuations. The Federal Reserve’s 50 bps interest rate hike last month spurred a massive selloff in equity markets — including for startups — which continue to haunt us to this day. Lightspeed Venture Partners proclaimed in a blog post that “the boom times of the last decade are unambiguously over,” and that many CEOs will face “trade-offs that only a few months ago would have seemed outlandish or unnecessary.

A far cry from last year: In 2021, VCs invested more than USD 600 bn in startups — twice the amount allotted to the industry in 2020, according to Reuters.

And VCs aren’t expecting this trend to reverse anytime soon: Sequoia Capital, acclaimed for early investments in Google and Apple, detailed in a presentation titled “Adapting to Endure”, that the recovery from this economic downturn will be long, compared to previous times of economic turbulence. Y Combinator (YC), the start-up incubator that helped spawn Airbnb, told their portfolio founders in an email to “plan for the worst.”

Big-tech is already implementing job cuts and hiring freezes. Snap, Facebook, and Uber have all announced hiring curbs in the coming months, while Robinhood and Peloton said they’ve cut jobs. Cloud software company Lacework recently announced staff layoffs, six months after the firm was valued at USD 8.3 bn by VCs.

The shifting market sentiment is reminiscent of 2008 and somewhat close to the economic fallout of the pandemic in 2020. During the 2008 crisis, Sequoia released a memo entitled R.I.P. Good Times, and implored start-ups to cut costs and “become cashflow positive.” In a 2020 memo titled Black Swan, partners at Sequoia admitted to dropping the ball, saying they underestimated “the monetary and fiscal policy response that followed the pandemic.” “This time, many of those tools have been exhausted,” the Sequoia partners said in a recent presentation.

The key messages YC and other investors are telling their companies? Forget “growth at all costs.” Founders must improve gross margins, curb spending and burn rates, limit hiring, and extend runways for 2+ years as soon as possible. Sequoia warned its companies that if they don’t slash costs, whether that be in marketing, research and development, or other areas, they will risk facing a “death spiral." If you can raise capital from new or existing investors, don’t think twice, YC told its founders.

What’s next for startups in these times of uncertainty? Founders have to prudently manage their cash flow cycles, reduce burn rates, and plan wisely when it comes to growth.“The message we wanted to get to founders was that for the best companies, this should be your time to shine, because when it’s easy for everyone to fund-raise and get demand you don’t see as much of the strength of some of the distinctive businesses and teams,” Michelle Bailhe, partner on Sequoia’s growth team, told CNBC.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

JUNE

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday- Saturday): Afreximbank annual meetings, St. Regis Almasa Hotel, new capital, Egypt.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): EU-Egypt Sustainable Food Value Chain conference, Grand Nile Tower Hotel, Cairo.

16 June (Thursday): End of 2021-2022 academic year for public schools.

21-22 June (Tuesday-Wednesday): Aswan Forum for Sustainable Peace and Development, Cairo.

21-23 June (Tuesday-Thursday): Commonwealth Business Forum, Kigali, Rwanda.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25-27 June (Saturday-Monday): Big 5 Construct, Egypt International Exhibition Center.

26 June (Sunday): The deadline for private companies to pre-register ahead of bidding for the second phase of the PPP national project to establish and operate 1k language schools.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

30 June (Thursday): Deadline for bids for National Democratic Party HQ redevelopment contract.

June: Egypt will launch a unified ticketing system for all means of transport at the Adly Mansour Interchange Station.

June: Egypt and Israel will sign an agreement with the EU to increase LNG exports.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

July: Actis’ expected sale of its majority stake in Lekela to Infinity and Masdar’s Infinity Power.

First week of July: The national dialogue called for by President Abdel Fattah El Sisi kicks off.

1 July (Friday): FY 2022-2023 begins.

1 July (Friday): Official rollout of e-receipt system begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Kobba Palace, Cairo.

8 September (Thursday): European Central Bank monetary policy meeting.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

JANUARY 2023

January EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

MAY 2023

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

EVENTS WITH NO SET DATE

2Q2022: The Sovereign Fund of Egypt will invest in two companies in the financial inclusion and non-banking financial services sectors.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 2Q2022: Door for bidding for the contract to redevelop the site of the former National Democratic Party HQ to close.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.