- IFC snaps up 5% of IDH. (The Big Story Today)

- Swvl makes its Nasdaq debut. (Happening Now)

- Cheaper financing is the key to closing the global gap in renewable energy production. (Climate)

- The most distant star seen through Hubble. (For Your Commute)

- Volcano bonds for crypto enthusiasts in El Salvador. (For Your Commute)

- Windfall follows three people stuck in one place for 36 hours: What could go wrong? (On the Tube Tonight)

- Sojo is every meat + sausage fan’s answer for iftar and sohour. (Eat This Tonight)

- WHAT’S NEXT- Understanding and utilizing data is key to future success. (Under the Lamplight)

Thursday, 31 March 2022

PM — Ramadan Kareem, everyone

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen — it’s finally the weekend, and while Thursdays are always cause for celebration, we can’t help but agonize over the fact that our next workday will be sans caffeine as we enter Ramadan (presumably as of Saturday).

We continue to publish EnterpriseAM at 6am CLT Sunday-Thursday and EnteprisePM at 3:30pm Sunday-Thursday during the holy month. You can also look forward to our popular Your Wealth edition tomorrow morning. The theme (predictably enough) is Ramadan.

The EGX announced (pdf) yesterday shortened hours that will be in place for the holy month. The opening bell will be at 10am and last trades will take place at 1:30pm.

Banks are also keeping shorter hours for the month, with employees due in from 9am-2pm, while customers will have access to services from 9:30am-1:30pm, the central bank has said (pdf).

Before we dive into the day’s top headlines, NBE confirmed it purchased 6% stake in Fawry: The National Bank of Egypt (NBE) bought over 102.5 mn shares in the fintech company — exactly 6% — in a EGP 1 bn block transaction executed by Al Ahly Pharos Securities Brokerage, Fawry announced in an EGX disclosure (pdf) today. This brings NBE’s stake in the fintech darling to 12.54%, following Banque Misr in buying a chunk of Fawry, likely setting up the sale of the government-controlled stake to Abu Dhabi’s ADQ. The Abu Dhabi wealth fund will reportedly purchase an undisclosed stake in the company as part of a USD 2 bn investment agreed earlier this month.

THE BIG STORY TODAY-

IFC grabs 5% stake in consumer healthcare giant IDH: The International Finance Corporation (IFC) and investment management fund IFC MENA Fund have together acquired a 5% stake in Integrated Diagnostics Holdings (IDH), according to a disclosure (pdf) to the LSE. The stake purchase is part of “a larger overall engagement” between the IDH and IFC, which began back in May 2021 to back IDH’s dual listing on the EGX and LSE.

HAPPENING NOW-

SWVL ticker hits the Nasdaq: Homegrown mass transit app Swvl made its debut on the Nasdaq just minutes before we hit “send” on this afternoon’s edition. The Egypt-born, UAE-based company began trading on the Nasdaq via a merger with its SPAC, Queen’s Gambit Growth Capital, with shares debuting at USD 10 apiece.

^^We’ll have more on these stories and others in Sunday’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Saudi Arabia pledges USD 15 bn to support Egypt through Ukraine crisis: Saudi Arabia deposited USD 5 bn with the Central Bank of Egypt, as our Gulf neighbors move to help shore up our finances amid global fallout from Russia’s war in Ukraine. In parallel, the Saudi sovereign wealth fund is looking to invest USD 10 bn in Egypt’s healthcare, education, agriculture and financial services sectors.

- Brownie points from IMF’s Georgieva: IMF head Kristalina Georgieva praised Egypt’s swift response to “head off the balance of payment shock and impact of rising food prices” caused by Russia’s war in Ukraine, and said the IMF will “support a program that helps to buttress reserves, protect the vulnerable, and strengthen private sector-led growth.”

- Offers roll in for the management of EV charging station company: Fourteen firms are vying to manage the state’s planned EV charging firm, including our friends at renewable energy giant Infinity have submitted an offer, along with a consortium of MB Engineering EV charging subsidiary Sha7en and an unnamed French company, as well as Saudi’s AlSharif Group.

THE BIG STORY ABROAD

Russia and Ukraine could resume peace talks tomorrow, following up on the last round of negotiations held in Istanbul this week, a top Ukrainian official said today, according to Bloomberg. The anticipated talks come as Ukrainian President Volodymyr Zelensky accused Russia of trying to “provoke a global food crisis” by targeting Ukrainian farms in its attacks, while NATO said Russia is regrouping to launch fresh attacks, not withdrawing.

|

???? CIRCLE YOUR CALENDAR-

It’s a new month tomorrow. The key news triggers to keep your eye on:

- PMI: Purchasing managers’ index figures for March for Egypt, Saudi Arabia, the UAE, and Qatar will be released on Tuesday, 5 April.

- Foreign reserves: March’s foreign reserves figures will be announced during the first week of the month.

- Inflation: Inflation figures for February are expected on Sunday, 10 April.

Companies have a little less than two weeks to file their first quarterly ESG compliance report: Listed firms and non-bank financial services companies need to submit their first quarterly ESG report by 10 April, the FRA said (pdf) on Sunday. The regulator is making it mandatory for corporates to publicly disclose their performance on key environmental, social and governance (ESG) metrics each year when they submit their annual financial statements, starting 2023. Reach out to Moustafa Taalab at InkankIR, our parent company, if you need some help.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- We’re getting ready to pack up our winter clothes until next year: Expect the mercury to rise to 34-36°C during the weekend as we head into a week-long heatwaves ahead of Ramadan, our favorite weather app indicates. At night, temperatures will fall to 16-20°C.

We know mood isn’t just one thing. But it’s everything. Set the mood this Ramadan, and every occasion, with our new seasonal selection range, or mix and match from our products to create your own gift box for your loved ones. Visit abuauf.com and set the mood today … and everyday.

???? FOR YOUR COMMUTE

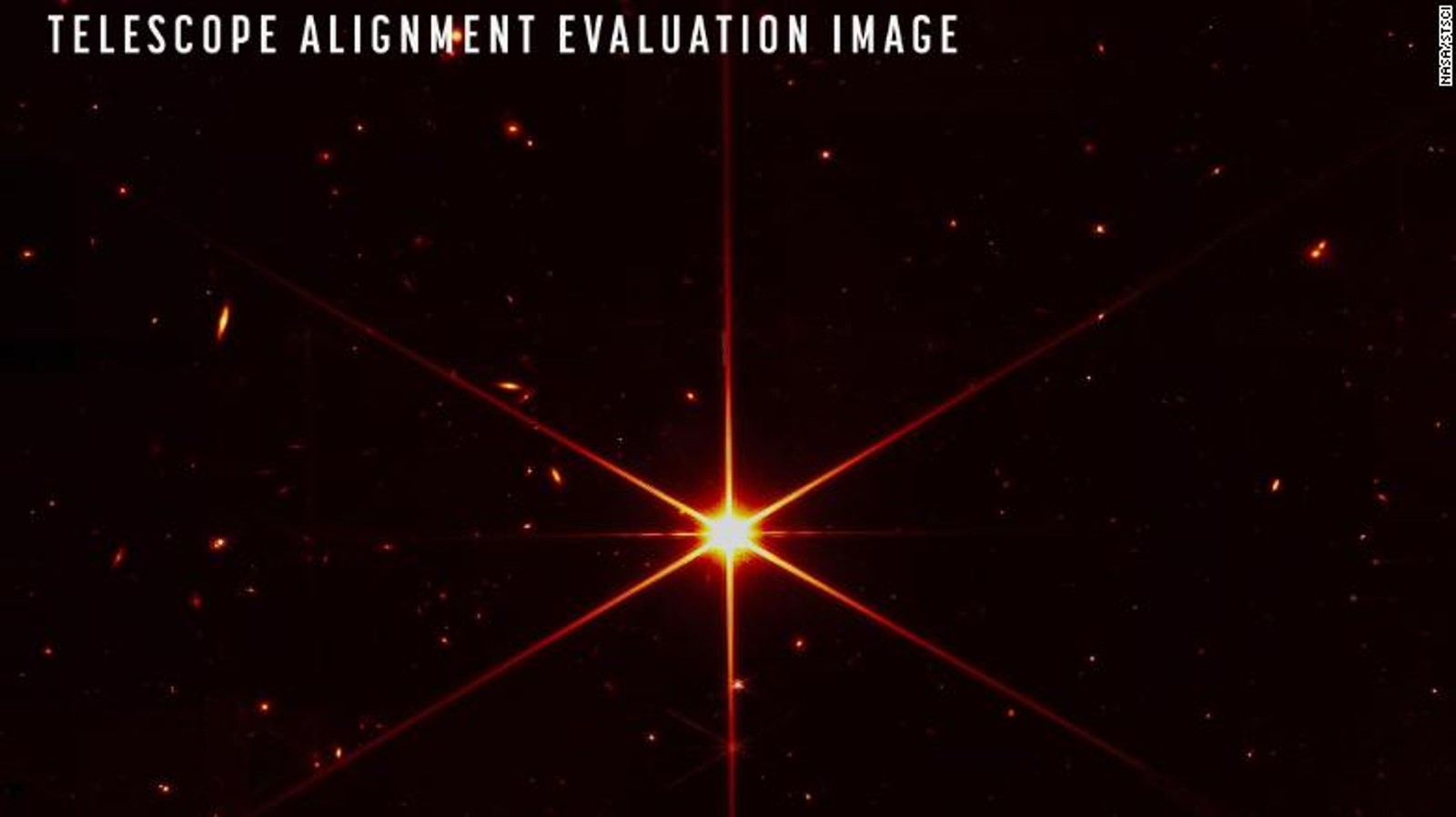

Astronomers have spotted what is believed to be the most distant star ever seen through the Hubble space telescope, according to the Associated Press. Earendel, which means rising light, is believed to be among the first generation of stars born after The Big Bang. The image of the star picked up by Hubble is believed to be from 12.9 bn years ago, breaking the previous record of 9 bn years. With the Big Bang believed to have taken place 13.8 bn years ago, this makes it one of the oldest stars we’ve seen. Astronomers expect to observe even more distant stars and galaxies with the newly launched (and pretty expensive) James Webb Space Telescope, which could “provide us with another piece of this cosmic puzzle that is the evolution of our universe,” National Science Foundation’s NOIRlab’s Vinicius Placco said.

El Salvador is targeting crypto enthusiasts for its USD 1 bn worth of so-called “volcano bonds,” after big bond investors turned their noses up at the offer, the Financial Times reports. Crypto exchange Bitfinex — which will host the issuance — told the FT it’s expecting interest from investors holding huge sums of BTC to help cover the bonds. Half of the proceeds are set to go to crypto investments, while the other half will fund El Salvador’s planned volcano-powered “BTC city,” where the digital coins would be mined using geothermal energy. Traditional investors are doubtful of the plan, arguing that it could make it harder for the country to access traditional debt markets and affect its relationship with global lender the IMF.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Three people given no names stuck in one place for 36 hours — what could go wrong? Windfall, a thriller on Netflix, tells the story of an average Joe (Nobody) who breaks into a vacation home owned by an arrogant b’naire (CEO) and his wife (just named Wife). After a brief stint of living the life of a tech b’naire in the empty house as he’s robbing it, Nobody (played by Jason Segel) gets caught by CEO (Jesse Plemons) and Wife (Lily Collins) at the last minute. Nobody doesn’t want to hurt CEO or Wife, but doesn’t want them to turn him in either — and so begins a process of negotiation as the character-driven thriller tracks their hopes for survival and success, while uncovering secrets within the trio.

⚽ We sadly have no football games to keep us occupied this evening — but they’ll make a comeback over the weekend, starting with Zamalek’s last game in the CAF Champions League group stage tomorrow at 6pm against Angola's Sagrada Esperança. The Egyptian club’s exit from the tournament is a foregone conclusion after it ranked third in its group.

Moving to the UK, Liverpool kicks off matchweek 31 on Saturday against Watford at 2:30pm tomorrow, marking the return of European leagues and the end of the international break.

We’re also watching six other games in the English Premier League on Saturday, with five of them with a 4pm kickoff: Manchester City v Burnley, Chelsea v Brentford, Brighton v Norwich City, Leeds v Southampton, and Wolves v Aston Villa. We’ll be catching our breath for half an hour before the game between Manchester United and Leicester City kicks off at 6:30pm.

La Liga will also be making a return on Saturday, with leading Real Madrid v Celta Vigo at 6:30pm, and other games: Getafe v Mallorca at 2pm, Levante v Villarreal at 4:15pm, and Atletico Madrid v Alaves at 9pm.

???? EAT THIS TONIGHT-

Sojo has great additions to both your iftar and sohour tables (if you like to go meats-heavy): Sausage and meat fans will hit the jackpot with Sojo, which offers a selection of homemade sausages that you can order to be delivered. The menu includes mini air dried chorizo sausages, Indian masala sausages, Thai sausages, German bratwurst sausages, loukaniko Greek sausages, Moroccan merguez sausages, and of course, oriental sausages. They also have a selection of sujuk and makanek, as well as different types of kofta: halaby, azmirily, and khashkhash. For the uninitiated: Every picture on Instagram comes with a description of the item and what it’s best served with.

???? OUT AND ABOUT-

(all times CLT)

Egyptian reggae band Meshwar will be performing tonight at 7:30pm at El Sawy Culturewheel to mark their 11th anniversary.

In the mood for some laughs? Downtown’s Rawabet is bringing Squadra stand-up comedy, which brings seven rising comedians together at 8pm.

We’re all in for the tunes of El Set, but how would that be with the iconic Oum Kalthoum as a puppet? Get ready for all of that at El Sakia Puppet Theater tonight 6pm as Oum Kalthoum is brought to life with performances of Seret El Hob and Daret El Ayam.

Another impulse night is landing tonight at Cairo Jazz Club 610 at 8pm with producers: Fur Coat, Jonas Saalbach & Ashmawy. Cairo Jazz is also holding a Cabaret night at their Agouza branch at 9pm.

We’re on a shopping spree ahead of Ramadan, and we’re all too excited for Bazarna holding their Ramadan Pop-Up Market tomorrow at New Cairo’s Downtown from 11am to 11pm.

Jordanian underground band Autostrad are performing at Zamalek Theater at 7pm tomorrow to wrap up Zamalek’s Music Week.

???? UNDER THE LAMPLIGHT-

WHAT’S NEXT- Understanding and utilizing data is key to future success: Our readers know that in this increasingly data-centric world, being able to include data and analytics is essential to get a point across. Persuading with Data by Miro Kazakoff acts as a guide to data visualization, strategic communication, and delivery best practices to ensure that you enter your next meeting ready to talk and break down the numbers. The book acknowledges that data isn’t always the most interesting thing to look at — and that’s why it starts by explaining how our brains make sense of graphs and how to design effective graphs and slides that support your ideas. It then moves on to how to organize those ideas into a compelling presentation and how to deliver and defend data to an audience. Persuading with Data is an accessible book for everyone from students to CEOs, with a ton of examples from different businesses and sectors.

???? GO WITH THE FLOW

EARNINGS WATCH-

Orascom Investment Holding saw a bottom line of EGP 564.0 mn in FY2021 compared to losses of EGP 103.22 mn in FY2020, according to the company’s financials (pdf). Revenues rose 495.2% y-o-y to EGP 27.92 mn in 2021.

Domty’s bottom line fell 54% y-o-y to EGP 72.4 mn in 2021, according to the company’s financials (pdf). This came despite a 12% y-o-y increase in sales to EGP 3.4 bn as costs increased during the year.

Arabia Investments Holding’s bottom line increased 7.6% y-o-y to EGP 102.81 mn in 2021, according to the company’s financials (pdf). Operating revenues rose 5.0% y-o-y to EGP 1.69 bn in 2021.

MARKET ROUNDUP-

The EGX30 fell 0.01% at today’s close on turnover of EGP 1.22 bn (20.4% above the 90-day average). Local investors were net Sellers. The index is down 6% YTD.

In the green: Orascom Construction (+5.0%), Qalaa Holding (+4.9%) and GB Auto (+3.6%).

In the red: EKH (-4.4%), AMOC (-4.4%) and Medinet Nasr Housing (-2.7%).

???? CLIMATE

We have an inequality issue with global renewable energy generation. Cheap financing might help fix it. Renewable energy production is unevenly distributed around the world. Places like the US, China, Japan, Germany and the UK are home to about two thirds of the globe’s solar panels and wind turbines despite containing less than half the world’s population, according to data from Bloomberg and Global Solar Atlas. Last year these same five economic powerhouses were responsible for bringing online some 40% in additional global solar capacity and 45% more wind power — and it’s not because of an abundance of sunshine or wind.

Renewable technologies have become relatively affordable and borrowing costs in developed markets has made it even easier: A combination of low interest rates and supportive government policy has helped stimulate increased adoption of renewable energy sources in developed countries. For rich countries with low interest rates, renewable energy facilities are much cheaper to build out than a fossil fuel based equivalent, even if you’re barely getting any sun. Add a little policy incentive — feed-in tariffs to drive solar adoption (like we’ve done here), for example — and it makes perfect sense how fast renewables have been growing in these countries.

The situation in emerging economies is quite the opposite: Across much of the developing world, renewable tech remains expensive thanks to higher interest rates pushing up the costs of energy transition. According to the International Energy Agency, interest payments on the upfront costs of installing solar and wind facilities can account for up to half of the price it needs to be sold at to be economically viable.

Even more frustrating is the fact that these are places strategically positioned to be generating a lot of renewable energy: Indonesia currently has some 484k sqm of land viable for solar panel installation that could generate 18% more than what the entire world consumed in 2019. Instead, renewables contributed to a measly 0.07% of its domestic electricity generation in 2021.

And this same dynamic is unfolding closer to home: Egypt and the US have about the same average wind speeds but the energy the US captures from wind power is about four times as much as what Egypt generated in 2020 — equivalent to only around 1.6% of our energy mix.

At the root of the problem still remains the question of financing: Thailand for example is one country that has fallen behind its solar production capabilities largely due to the high cost of financing. If borrowing costs in Thailand were the same as they are in Germany (around 39% cheaper) the country could add 60% more power from new wind projects, according to Bloomberg projections. The same is true for India, which could produce an estimated 40% more renewable power this year if it enjoyed the same interest rates as Germany.

That’s expected to be a core theme at this year’s COP27: International Cooperation Minister Rania Al Mashat has said that the climate conference, scheduled to be held in Sharm El Sheikh this November, is a chance to emphasize that emerging markets need financial support to meet climate commitments and to bring innovative financing such as concessional lending. Al Mashat touched on how a general lack of resources continues to hold back certain countries from rolling out green projects.

The widening gap in renewable energy development will need to be filled with the help of richer countries and financing institutions: Although the past decade has seen steps in the right direction, with a majority of new capacity installations made in developing countries between 2017 and 2019, rich countries still had around four times more capacity per capita (at 880 watts per capita) than developing countries in 2019. And worryingly, 2019 witnessed a slowdown in both renewable installation growth and EM-focused clean-energy funds, which declined by 8% to less than USD 150 bn in 2020. For the world to get on track to reach net-zero emissions by 2050, that figure will need to be more than USD 1 tn by the end of the decade.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

15 February-15 June (Tuesday-Wednesday): ITIDA’s Technology Innovation and Entrepreneurship Center is organizing the first Metaverse Hackathon.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: Contracts for last two phases of Egypt’s USD 4.5 bn high-speed rail line to be signed.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

2022: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

March: The new multi-purpose station at Dekheila Port and the revamped Ain Sokhna Port will start operating.

March: General Authority for Land and Dry Ports to issue the condition booklets for the operations of the Tenth of Ramadan dry port.

Mid-March: Bidding for the construction of Anchorage Investments’ petrochemical complex in the Suez Canal Economic Zone starts.

14 March-30 June: The “Escape to Egypt” exhibition at the Coptic Museum, in celebration of its 112th anniversary.

24 March-1 April: Ahlan Ramadan Supermarket Expo, Cairo International Convention Center.

30 March (Wednesday): The Angola-Egypt Investment Roundtable discussion (pdf), the Hilton Cairo Heliopolis Hotel.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

31 March (Thursday): OPEC+ meets to review a modest oil supply rise.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

10 April (Sunday): Deadline for listed companies and NBFIs to submit quarterly ESG report.

11 April (Monday): The deadline to submit bids for Chelsea FC.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

21 April (Thursday): EGX-listed Taaleem will hold an extraordinary general assembly to discuss the mechanism to build and own nonprofit and private universities.

22-24 April (Friday-Sunday): World Bank-IMF Spring Meetings, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

30 April (Saturday): Deadline to apply to the Tatweer Misr Innovation Competition.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

1 May (Sunday): Suez Canal Authority raises tolls for different vessels.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

Early July: Polish President to visit Egypt.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.