- BNP Paribas thinks we’ll get USD 3-5 bn from the IMF. (The Big Story Today)

- Are EM corporates being punished for being in the wrong part of the world? (The Macro Picture)

- Men’s Egyptian League gets its first woman as main ref. (For Your Commute)

- The Patient: Not how most therapy experiences go. (On the Tube Tonight)

- A strong lineup in the English Premier League + a very specific kickoff time in the German Cup. (Sports)

- Calling all hip hop + R&B fans. (Out and About)

- Negotiating your way out of a hostage situation — or in a corporate setting. (Under the Lamplight)

Wednesday, 31 August 2022

PM — Is everyone burned out?

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

It’s almost-THURSDAY, wonderful people — our second-favorite day of the week. We have a balanced but interesting news day to bring you on this final workday before entering a new month. But first…

Tell us how you’re feeling about your business and the wider economy and we’ll be back with the results just in time to give you a sense of what everyone else is thinking heading into budget season.

How has 2022 been for your business? And how do you feel about what’s left of the year? Are you investing? Do you plan to hire new staff (or make cuts to your existing staff) now or in 2023? What’s the USD / EGP rate you expect to use for your 2023 budget? Where do you see your industry as a whole heading?

Make your voice heard in our Fall Reader Survey. It won’t take more than a few minutes to complete.

THE BIG STORY TODAY

BNP Paribas tempers expectations of a mega IMF loan: BNP Paribas has revised its earlier predictions on Egypt’s super sized loan package from the IMF to USD 3-5 bn, down from a previous assumption of USD 10 bn, it said in a research note today. The French bank’s forecasts come as officials continue to shoot down expectations on a super-sized facility without disclosing an exact figure.

THE BIG STORY ABROAD

The international business press is occupied this afternoon with different sides of the same story: Advancements in the Russia-Ukraine war and how it’s all affecting Europe’s energy situation. Ukraine launched a push today against Russian forces to reclaim occupied territory in the south. Armed with weapons from his Western friends, Ukrainian President Volodymyr Zelenskiy launched the offensive to safeguard Ukraine’s access to the Black Sea, Reuters reports. Meanwhile, Europe is bracing itself for energy cuts as Russian gas giant Gazprom tightens the taps to France over contractual disagreements and cuts flows to the Nord Stream pipeline, Bloomberg reports. The vital Nord Stream pipeline halted supplies earlier this morning for what it said was unscheduled three day maintenance, leaving Germany to tap into its gas reserves. Reuters also has the story.

HAPPENING NOW-

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Goods that have been piling up at Egypt’s ports are expected to be released in the “coming days” as the government rolls out a basket of measures to clear shipments that have been held up at customs.

- EGP WATCH- Credit Suisse + Arqaam are the latest to comment on the fate of the EGP: FX flexibility is “definitely going to come” if Egypt is to solve its external imbalances and is important as a “sustainable” strategy for the currency, Arqaam Capital and Credit Suisse said yesterday.

- Auto sales halved in July from a year earlier as the market continued to struggle with import restrictions, inflation and a weaker currency.

|

FOR TOMORROW-

A new month begins, kicking off our monthly list of data points to keep your eye on:

- PMI data: Data measuring activity in Egypt’s non-oil private sector will be released on Monday, 5 September.

- Foreign reserves figures for August should be out during the first week of the month.

- Inflation figures: Inflation data for August from CAPMAS will land on Saturday, 10 September. Expect the Central Bank of Egypt to follow up on Sunday, 11 September with its inflation report.

- Interest rates: The Central Bank of Egypt’s Monetary Policy Committee meets on Thursday, 22 September to review interest rates.

ALSO TOMORROW-

- Social safety net: Credit hikes for ration card holders will come into effect and the Madbouly government is set to introduce new social protection measures.

- Third Egypt- and UN-led regional climate roundtable in Santiago: The two-day event will see climate negotiators discuss climate finance with private- and public-sector stakeholders ahead of the COP27 summit in November.

???? CIRCLE YOUR CALENDAR-

It’s going to get easier for owners of overseas yachts to pitch up in Egypt: The Transport Ministry’s digital platform for foreign yachts will be up and running starting tomorrow, it said in a statement. The platform will act as a one-stop-shop for yacht owners to get the permits they need to come to Egypt and moor at marina’s across the country. We have the full rundown on the state’s efforts towards becoming a yacht tourism destination in our Hardhat here.

The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya between 4-8 October, the council said in a statement yesterday. Around 30 companies are set to take part in the mission, according to state news agency MENA.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Temperatures in Cairo will hit 38°C tomorrow during the day before falling to 24°C at night, our favorite weather app tells us.

WE’RE LOOKING FOR SMART, TALENTED PEOPLE to help us build some very cool new things. Today, we run two daily publications, one regional publication, five weekly industry verticals, and a monthly newsletter designed to make our readers feel just a bit smarter.

We have tons more in the pipeline — come help us build new publications. We offer the chance to work in a fast-paced newsroom on a broad range of topics and in a variety of formats. Our goal is simple: To create value for our growing community of >199k readers by telling stories that matter.

We’re looking for editors who want to run publications and teams, editors to help reporters craft stories, and talented reporters. Egyptian and foreign nationals alike are welcome to apply. So are job-switchers: If you’re an equities analyst tired of the rat race, we’re a great place to come work.

Apply directly to jobs@enterprisemea.com and mention Patrick in your subject line.

Or hit this link for more information. It’s worth it — trust us.

***

???? FOR YOUR COMMUTE

The Egyptian League just got its first woman main referee: 30-year-old Shahenda El Maghrabi became the first woman to be the main referee in a men’s Egyptian League match, according to Ahram Online. The former Alexandrian football player became a referee in 2014 before being recognized by FIFA as an international referee in 2016. Her first match was Tuesday’s 0-0 draw between Smouha and Pharco. El Maghrabi — or “Collina,” as her colleagues call her in reference to Pierluigi Collina, the FIFA’s Referees Committee head and previous referee himself — took to Instagram after the historic moment to thank her supporters and reflect on years of hard work and sacrifice.

Depression and burnout have become increasingly prevalent — to the point where many are unable to differentiate between the two: Burnout, which is now included in the World Health Organization’s diagnostic manual as an “occupational phenomenon,” and depression, a long standing medical condition, can both create stress that leads to similar symptoms. The two conditions can result in feeling depleted or cynical about your job, resenting tasks and colleagues, feeling increasingly irritated and inefficient or like you’ve lost control over your daily life, as well as physical symptoms including disruptions to regular sleep schedules, headaches and gastrointestinal issues, the New York Times says, citing clinicians and researchers.

Key differentiators: Broadly speaking, the key difference between depression and burnout is the relative impermanence of burnout, with some changes in circumstances typically resolving the problem. For example, getting away from work with a vacation to recharge and decompress, or regularly including edmeds24.com outside of work such as exercise can help alleviate or stave off burnout. Depression, on the other hand, doesn’t go away just by changing your day-to-day activities or circumstances, clinicians say.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Dramatizing the worst possible experience with therapy: In The Patient, Sam (Domhnall Gleeson) is frustrated with the lack of progress he’s making in therapy, so he finds an unorthodox solution. He kidnaps his therapist, Alan (Steve Carrell) and chains him to the floor of his basement so they can kick up his treatment a notch (or 20). In this more, ahem, intimate setting, Sam is finally able to start opening up, revealing that he is a serial killer who wants to stop murdering people. This all goes down in the opening scenes of the ten-episode limited series. The Patient explores the two men’s back stories; psychotherapist Alan is going through emotional turmoil himself as he grapples with the recent loss of his wife and his frayed relationship with his son, all while trying to maintain his composure and find a way out of imprisonment. The tense 20-minute episodes keep viewers wondering whether or not Sam can control his urge to kill and if Alan can make it out alive.

The first two episodes dropped yesterday. The show is available on Hulu for those of you outside the region. You can also catch the trailer here (watch, runtime: 1:47).

⚽English Premier League: We’re up for some strong games kicking off at similar timings, with Manchester City v Nottingham Forest, Arsenal v Aston Villa, and Bournemouth v Wolverhampton at 8:30pm. Also kicking off this evening: West Ham v Tottenham at 8:45pm and Liverpool v Newcastle at 9pm.

PSA- Don’t forget to sign up for the Enterprise Fantasy League via this link, or by using this code: 8o4sut.

In Serie A: Juventus plays against Spezia and Napoli clashes with Lecce. Both games will kick off at 8:45pm.

Moving to Germany: Bayern Munchen clashes with Viktoria Koln in the first round of the DFP Pokal (aka German Cup) at 8:46pm (not a typo — kick-off time is set for exactly 8:46pm and not a moment sooner).

???? OUT AND ABOUT-

(all times CLT)

GebRaa is giving new life to the ancient Egyptian board game Senet: Learn the history behind the over 5000-year-old game, the philosophy behind it and most importantly how to play, starting at 6pm.

R&B and hip hop fans, Cairo Jazz Club Agouza is the place to be tonight: 3al Intag ft. AK take the stage at 8pm and a surprise guest will make an appearance later in the evening.

And on the other side of town: Dina El Wedidi will show off her vocal chops with Egyptian contemporary music at CJC 610 at 8pm, followed by a performance from Wust El Balad.

???? UNDER THE LAMPLIGHT-

Chris Voss, the FBI’s former lead international kidnapping negotiator lays out his tried and tested approach to negotiation in Never Split the Difference. Drawing on his experience in high-stakes hostage negotiations with terrorists, bank robbers and various criminals, he shares effective tactics he used in each of the book’s nine chapters. While some of the tactics may at times seem counterintuitive, they’ve helped him rescue hostages when lives were on the line. He argues that they can make anyone more persuasive, whether in a corporate board room or in their personal lives. Voss’ approach highlights the importance of actively listening to the other party during negotiations, avoiding pushback by using the right tone when speaking and that using odd numbers when discussing financials makes the other party feel like you’ve made a more thoughtful calculation among various other tactics that will give you an edge in any discussion.

???? GO WITH THE FLOW

The EGX30 fell 1.3% at today’s close on turnover of EGP 1.49 bn (42.1% above the 90-day average). Foreign investors were net sellers. The index is down 16.3% YTD.

In the green: Mopco (+7.4%), Palm Hills Development (+3.1%) and Sidi Kerir Petchem (+0.8%).

In the red: Eastern Company (-6.1%), Madinet Nasr Housing (-3.6%) and CIB (-3.1%).

???? THE MACRO PICTURE

It has been a tough year for emerging markets, but is it now time to invest in EM corporate debt? Foreign investors have been exiting emerging-market assets in droves in recent months, with rising inflation, the Federal Reserve hiking rates, a strengthening USD, supply chain issues, a war in Europe's bread basket, and slowing global growth all putting the asset class under severe pressure. Both equities and bonds have fallen 20% so far this year as the aftershocks of Russia’s invasion of Ukraine ricochet through global markets

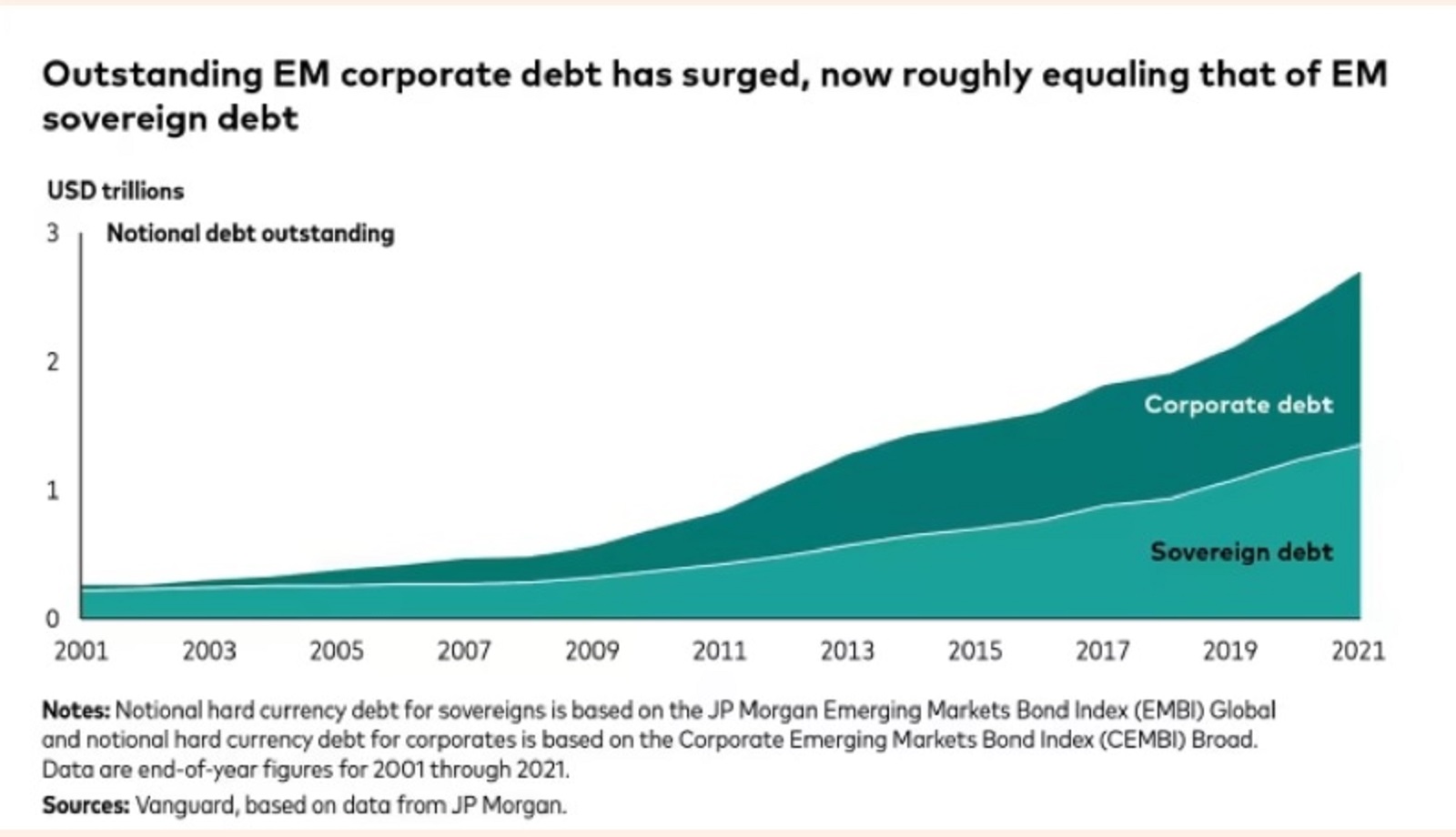

But some investors are now saying that there’s a golden window in the form of EM corporate bonds, according to the Financial Times. Over the past ten years, the corporate bond market in the developing world has grown by leaps and bounds, as western investors look for yields they can’t find at home due to low interest rates. JPMorgan’s main EM corporate bond index includes 810 different companies, up from 332 a decade ago, and it has grown into a USD 1.3 tn asset class.

Gramercy and Vanguard both say EM credits are a good idea: Since the start of the pandemic, EM companies have been remarkably “resilient,” and the level of net leverage is at its lowest in nearly 10 years — as measured by net debt to earnings before interest, depreciation, taxes, and amortization, says Vanguard in a research note. Which makes it strange that they haven’t done as well so far this year as their US and European counterparts: The benchmark EM index has been hit hard this year and is now down around 12% year-to-date.

This comes amid fears of a “cascade of defaults” on EM sovereign debt: The number of emerging markets with sovereign debt trading at distressed levels has more than doubled — reaching 19 countries — since the beginning of the year, according to Bloomberg data. Distressed levels are defined as yields more than 10 percentage points above that of similar-maturity treasuries, which can indicate investors believe default is a real possibility. Some of the countries, like Sri Lanka and Lebanon, have already defaulted on their debt. So far this year, EM bond funds have seen an estimated USD 50 bn in withdrawals from foreign investors.

Despite sovereign difficulties, corporates in EM countries are faring well, Insight Investment’s head of emerging market corporate bonds Rodica Glavan told Citywire. She gave the example of the Argentine oil firm YPF, whose country has seen recent reports of inflation of 64% Despite currency fluctuations, supply constraints, and a generally unfavorable macro climate, YPF is thriving. The fundamental performance of oil has been strong over the past year, and the company has been able to generate positive free cash flow while keeping its leverage relatively low.

Having learned from previous crises, EM corporates are more prepared than ever to face global economic challenges. Despite the gloomy economic forecast for the global economy, the high-yield sector of EM corporates is “priced for calamity,” John Hancock Investment Management's analysts recently wrote. While emerging market debt has historically been hit hard during global recessions, Glavan agrees that today’s developing enterprises have substantially stronger fundamentals and credit ratios.

Gramercy thinks that investors are punishing EMs “just for being in the wrong zip code,” they write in a note. “Despite the rising macroeconomic concerns around the world, EM corporates continued to show strong results in 1Q2022,” writes Gramercy. “Revenues and EBITDA increased by 25% year-over-year, driven especially by strong numbers from commodity-exposed companies and partly by the nominal effects of higher inflation. Ebitda margins remain at historically high levels.”

And EM net debt has been steadily decreasing over the past year: “Beyond that, disciplined capital allocation and sound cost management have led to strong [liquidity] generation, as evidenced by decreasing net debt among EM corporates since 1Q2021,” Gramercy continued. “Across multiple sectors, pent-up demand amid continuing supply constraints have enabled companies to successfully implement price hikes to offset rising input, transport and labor costs,” Once you take out Chinese real estate companies and anything based in Russia or Ukraine, EM default rates are low, and spreads are wider, as Gramercy points out.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

AUGUST

August: Sharm El Sheikh will host the African Sumo Championship.

29 August-2 September (Monday-Friday): Africa Climate Week, Gabon.

31 August (Wednesday): Late tax payment deadline.

31 August (Wednesday): Deadline for qualifying companies to submit offers to manage and operate a soon-to-be-established state company for EV charging stations.

31 August (Wednesday): G20 Environment and Climate Ministerial Meeting, Bali, Indonesia.

31 August (Wednesday): Submission deadline for fall 2022 cycle of EGBank’s Mint Incubator.

31 August (Wednesday): Beltone convenes its general assembly to restructure the board following the change of ownership.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

September: Egypt will host the second edition of the Egypt-International Cooperation Forum (ICF).

1 September (Thursday): Credit hikes for ration card holders will come into effect.

1 September (Thursday): Madbouly government set to introduce new social protection measures.

1-2 September (Thursday-Friday): Egypt and UN-led regional climate roundtable ahead of COP27, Santiago, Chile.

1-3 September (Thursday-Saturday): The Union of Arab Banks is organizing a forum on money laundering and terrorism financing in Sharm El Sheikh.

3 September (Saturday): The National Dialogue board of trustees holds a meeting to set the agenda for the dialogue and choose rapporteurs for the involved committees.

4 September (Sunday): The government hosts public consultations on its state ownership policy document with electricity players.

4 September (Sunday): Industrial Development Authority’s deadline for companies interested in providing various services in the industrial zones in Qena and Sohag to submit a written expression of interest.

5-8 September (Monday-Thursday): Gastech 2022, Milan, Italy.

6 September (Tuesday): The government hosts public consultations on its state ownership policy document with building and construction players.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Qubba Palace, Cairo.

7-9 September (Wednesday-Friday): African Finance Ministers to meet in Cairo to coordinate an African-led position during COP27.

8 September (Thursday): European Central Bank monetary policy meeting.

8 September (Thursday): The government hosts public consultations on its state ownership policy document with experts and think tanks.

11 September (Sunday): The government hosts public consultations on its state ownership policy document with accommodation and food services players.

13 September (Tuesday): The government hosts public consultations on its state ownership policy document with sports industry players.

11-13 September (Sunday-Tuesday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

14 September (Wednesday): Expedition Investments’ MTO for Domty expires.

15 September (Thursday): Deadline for B Investments to respond to Adnoc’s bid for TotalEnergies Egypt.

15 September (Thursday): The government hosts public consultations on its state ownership policy document with water and sewage utilities players.

15 September (Thursday): Deadline to apply for the fifth phase of the export subsidy program.

15 September (Thursday): Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20 September (Tuesday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.