Are EM corporates being punished for being in the wrong part of the world?

It has been a tough year for emerging markets, but is it now time to invest in EM corporate debt? Foreign investors have been exiting emerging-market assets in droves in recent months, with rising inflation, the Federal Reserve hiking rates, a strengthening USD, supply chain issues, a war in Europe's bread basket, and slowing global growth all putting the asset class under severe pressure. Both equities and bonds have fallen 20% so far this year as the aftershocks of Russia’s invasion of Ukraine ricochet through global markets

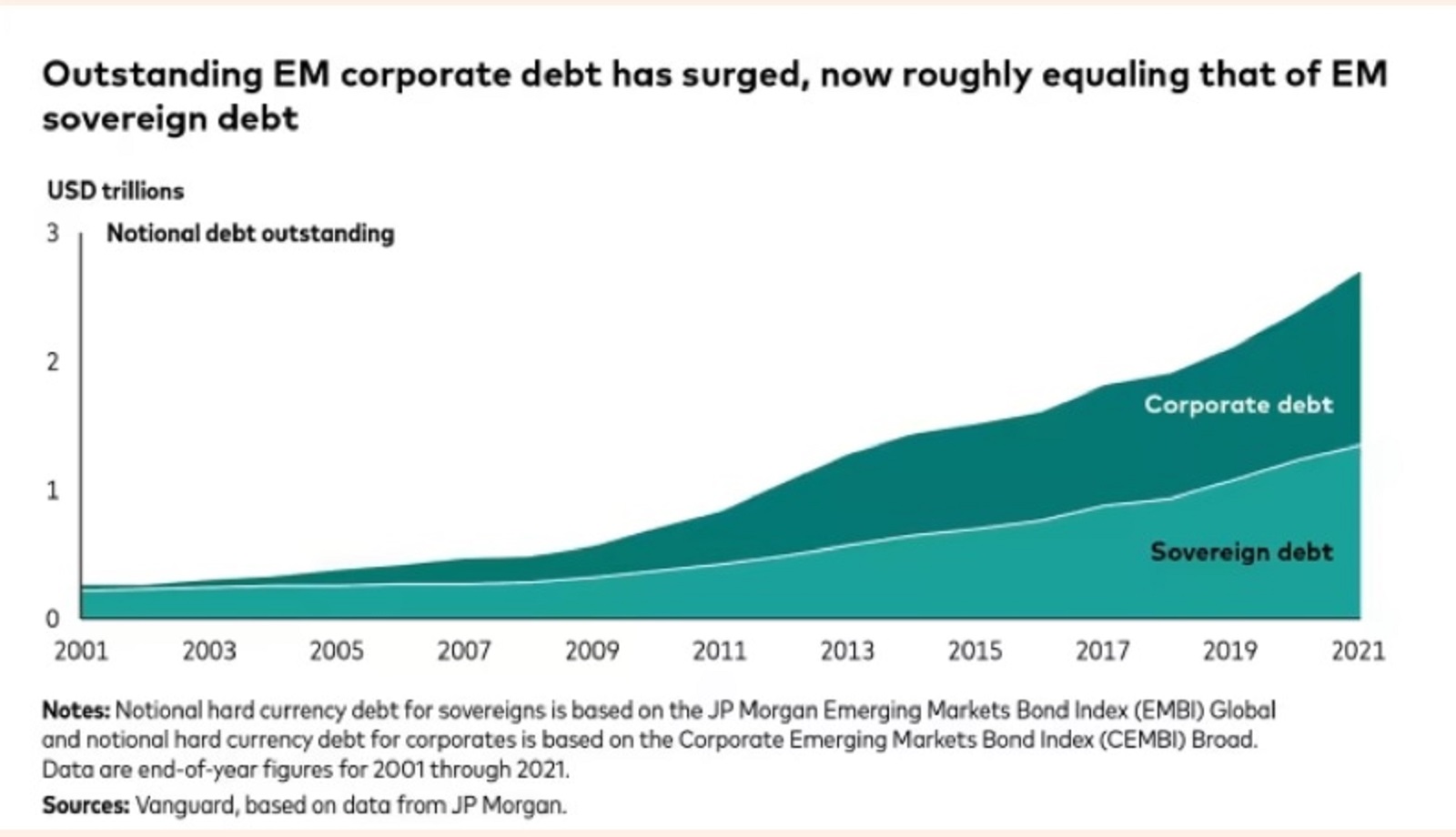

But some investors are now saying that there’s a golden window in the form of EM corporate bonds, according to the Financial Times. Over the past ten years, the corporate bond market in the developing world has grown by leaps and bounds, as western investors look for yields they can’t find at home due to low interest rates. JPMorgan’s main EM corporate bond index includes 810 different companies, up from 332 a decade ago, and it has grown into a USD 1.3 tn asset class.

Gramercy and Vanguard both say EM credits are a good idea: Since the start of the pandemic, EM companies have been remarkably “resilient,” and the level of net leverage is at its lowest in nearly 10 years — as measured by net debt to earnings before interest, depreciation, taxes, and amortization, says Vanguard in a research note. Which makes it strange that they haven’t done as well so far this year as their US and European counterparts: The benchmark EM index has been hit hard this year and is now down around 12% year-to-date.

This comes amid fears of a “cascade of defaults” on EM sovereign debt: The number of emerging markets with sovereign debt trading at distressed levels has more than doubled — reaching 19 countries — since the beginning of the year, according to Bloomberg data. Distressed levels are defined as yields more than 10 percentage points above that of similar-maturity treasuries, which can indicate investors believe default is a real possibility. Some of the countries, like Sri Lanka and Lebanon, have already defaulted on their debt. So far this year, EM bond funds have seen an estimated USD 50 bn in withdrawals from foreign investors.

Despite sovereign difficulties, corporates in EM countries are faring well, Insight Investment’s head of emerging market corporate bonds Rodica Glavan told Citywire. She gave the example of the Argentine oil firm YPF, whose country has seen recent reports of inflation of 64% Despite currency fluctuations, supply constraints, and a generally unfavorable macro climate, YPF is thriving. The fundamental performance of oil has been strong over the past year, and the company has been able to generate positive free cash flow while keeping its leverage relatively low.

Having learned from previous crises, EM corporates are more prepared than ever to face global economic challenges. Despite the gloomy economic forecast for the global economy, the high-yield sector of EM corporates is “priced for calamity,” John Hancock Investment Management's analysts recently wrote. While emerging market debt has historically been hit hard during global recessions, Glavan agrees that today’s developing enterprises have substantially stronger fundamentals and credit ratios.

Gramercy thinks that investors are punishing EMs “just for being in the wrong zip code,” they write in a note. “Despite the rising macroeconomic concerns around the world, EM corporates continued to show strong results in 1Q2022,” writes Gramercy. “Revenues and EBITDA increased by 25% year-over-year, driven especially by strong numbers from commodity-exposed companies and partly by the nominal effects of higher inflation. Ebitda margins remain at historically high levels.”

And EM net debt has been steadily decreasing over the past year: “Beyond that, disciplined capital allocation and sound cost management have led to strong [liquidity] generation, as evidenced by decreasing net debt among EM corporates since 1Q2021,” Gramercy continued. “Across multiple sectors, pent-up demand amid continuing supply constraints have enabled companies to successfully implement price hikes to offset rising input, transport and labor costs,” Once you take out Chinese real estate companies and anything based in Russia or Ukraine, EM default rates are low, and spreads are wider, as Gramercy points out.