- Shoukry wants the UN to stop recognizing Libya’s interim government. (The Big Story Today)

- Nutritional supplements producers are up for a big shift as they grapple with a new regulator. (Inside Industry)

- Employment is shifting more towards skills-based recruitment. (For Your Commute)

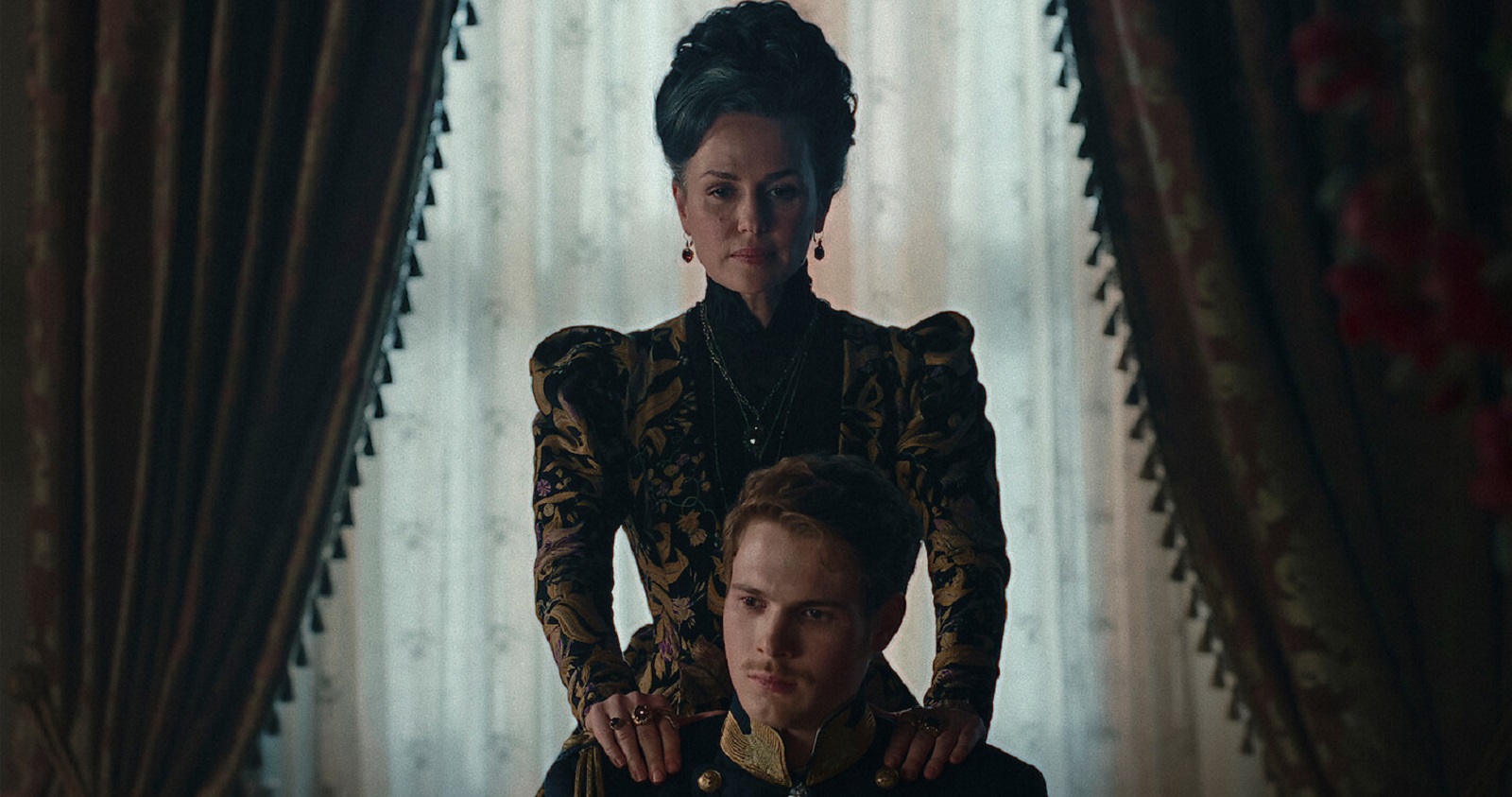

- The Empress: A slow-moving period drama that was quick to hook our attention. (On the Tube Tonight)

- White Knights + Red Devils kick off their African Champions League journey. (Sports)

- Authentic Egyptian cuisine made elegant — with a spectacular view of Khufu’s pyramid. (Eat This Tonight)

- A heart-wrenching Sophie’s Choice-type novel in a dystopian era. (Under the Lamplight)

Sunday, 9 October 2022

PM — Ending the tea vs. coffee debate, once and for all

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy Sunday, wonderful people. It hasn’t yet turned out to be as busy of a start to the workweek as we had anticipated this morning, but aren’t ruling out a complete shift in pace in the next few hours.

THE BIG STORY TODAY

Shoukry calls on UN to label Libya’s interim government as “illegitimate”: The UN needs to speak up about the “illegitimate” status of Libya’s Government of National Unity, which was set up as an interim government under a UN-brokered power sharing agreement, Foreign Minister Sameh Shoukry said at a press conference following a meeting with Greek Foreign Minister Nikos Dendias (watch, runtime: 1:28).

THE BIG STORY ABROAD

The international press is still squarely focused on the explosion that caused damage to Russia’s crucial Crimea road and rail bridge. Russia reopened the bridge today and began running trains across it just hours after it partially collapsed, Bloomberg notes. The bridge is a critical supply route for Russia into Ukraine and is necessary to help Moscow transport weapons and troops. The story is on the front pages of the Financial Times, Reuters, and CNBC, among others.

HAPPENING NOW- Prime Minister Moustafa Madbouly inaugurated the Turathna Exhibition at the Egypt International Exhibition Center, which runs until this Saturday, 15 October, according to a statement. Some 1.1k exhibitors — including some from the UAE, Jordan, Sudan, and Libya — are showcasing their handicrafts this year, of which 45% are new, Nevine Gamea, executive director of the Micro, Small and Medium Enterprise Development Agency (MSMEDA) said.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- At least four major banks have in recent days imposed limits on foreign exchange use in what pundits say is a move to conserve hard currency.

- The World Bank expects Egypt’s economy to grow at a 4.8% clip in FY 2022-2023, according to its October MENA Economic Update.

- Egypt’s current account deficit narrowed by 10.2% to USD 16.6 bn in FY 2021-2022, buoyed by oil and non-oil exports, rising tourism receipts, and a jump in FDI.

*** It’s Inside Industry day — your weekly briefing of all things industrial in Egypt. Inside Industry focuses each Sunday on what it takes to turn Egypt into a manufacturing and export powerhouse, ranging from initial investment and planning to product distribution, through to land allocation to industrial processes, supply chain management, labor, automation and technology, inputs and exports, regulation and policy.

In today’s issue: Nutritional and dietary supplement producers are facing a changing regulatory landscape that industry players say could undermine local manufacturing and hamper exports.

|

FOR TOMORROW-

Inflation to notch new highs? Analysts are expecting inflation to have continued rising in September due to the weakening EGP after reaching highs not seen since November 2018 in August. We’ll find out when Capmas and the CBE release figures tomorrow.

A green Monday for the Senate: The Senate will on Monday discuss legislation that could set up a new regulatory body to make policy for the electric vehicles (EV) industry. Enterprise Climate last week reported in depth on the EV bill, which would also set up a fund to provide financing and incentives to investors looking to get in on local EV assembly in Egypt.

The Senate will also discuss amendments to the Environment Act that would see a “green fee” of between EGP 1k and EGP 500k levied against new diesel and gas vehicles. As the bill currently stands, some 80% of the proceeds would go towards localizing our EV industry, with the rest to be split between the Environment Protection Fund and the state budget.

ICYMI- The government’s automotive committee held its first meeting last month, inching us closer to the long-awaited automotive strategy.

Assessing Nafeza, one year on: Lynx Strategic Business Advisors are hosting a webinar tomorrow to discuss the Advanced Cargo Information (ACI), aka Nafeza, one year after it was implemented. You can register for the event here.

???? CIRCLE YOUR CALENDAR-

Fuel prices to rise this month? We’re expecting the government to hike fuel prices for the seventh consecutive quarter when the fuel pricing committee meets this month. Fuel prices have risen by as much as 28% over the past 18 months in response to heightened international oil prices, which surged earlier this year on the back of Russia’s invasion of Ukraine.

The CEO Women Conference takes place in Cairo on Monday, 10 October. The event will bring together Arab and African businesswomen together to discuss women’s leadership and forge closer ties.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 31°C tomorrow and a nighttime low of 19°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

You need to up your (skills) game: The job market of tomorrow is expected to take a more skills-based approach as the changing nature of business and technology drives a shift in the professional skills needed to keep up, the Financial Times reports. This changing landscape pushed up the number of recruiters using skills data to fill positions 20% y-o-y, citing data from LinkedIn. Some 1 bn people need to be trained in new skills by 2030, the World Economic Forum (WEF) says, with demand equally high on both new tech-focused skills, like AI and cloud computing, and soft skills, like collaboration and team building. The change in employment dynamics is already evident as LinkedIn data shows job skills are set to change by 50% by 2027 as hiring grows more dependent on skills.

Yet, some companies are not able to catch up with the trend. A Harvard Business School study (pdf) shows 80% of business heads saying that their applicant-tracking systems are separating highly-skilled employees due to gaps related to their employment history. “The job market works a lot better if you went to the right school and had a certain job title from a brand name company,” a product manager at LinkedIn said. This is pushing LinkedIn to build tools to allow companies to seek candidates based on their skills. Putting proficiency first over a somewhat perfect CV in terms of job experience and education would help with easing a tight job market. It would shed the focus on the job seekers’ demonstration of their capabilities and how far they fit to the job requirements.

Coffee v Tea: Which is healthier? While there are different health benefits associated with drinking coffee or tea regularly, each of the two beverages have their own set of pros and cons. When it comes to fiber content, for example, coffee comes out on top, with between 1.1 and 1.8 grams of fiber per cup, according to a study from Spain’s Instituto del Frío. Drinking either can help you concentrate, but a University of Surrey study comparing the effects of drinking four cups of coffee to drinking four cups of tea, found that tea is less likely to disrupt your sleep, due to a lower caffeine content.

Gut health: When it comes to gut health, both are good sources of polyphenols, but coffee takes the cake due to its higher concentration of the plant compounds that have been linked to many health benefits. Green tea also has more polyphenols than black tea.

Popularity contest: El Shay is king. “It’s been estimated that the world drinks three cups of tea for every cup of coffee. And tea is the second most popular beverage in the world. The first is water,” the Washington Post says.

Lowering risk for disease: Both drinks lower risk for heart disease and stroke, according to large population studies, but those studies are not conclusive. Other, still inconclusive, studies have shown that drinking coffee can provide some protection against several cancers. No studies have found a link between drinking tea and preventing cancer, but it is important to note that a lot more studies have been conducted on the health benefits of coffee than tea, according to a professor of medicine at Harvard Medical School.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Romance, politics, and powerful performances make The Empress a must-watch: Be still, our royal-drama-obsessed hearts, there’s a new period drama topping the Netflix charts. Unless you’re a serious European history buff, you probably don’t know much about Elisabeth Amalie Eugenie, an Austrian Duchess in the mid-nineteenth century. The new series based on her life makes it clear right away that she was an unconventional monarch, and we’re here for it. The Empress is a coming-of-age romance story at its core, but it’s also filled with political intrigue and the rumbles of a growing rebellion as evidenced in the first episode. Florian Cossen and Katrin Gebbe shape Elisabeth's life with deft grace, emphasizing the naivety that comes with being 16 years old while also carefully presenting the small horrors in her life. The Empress, like most costume dramas, is slow moving and takes its time developing but quickly hooks you with a compelling plot and intriguing possibilities.

Ditch the dubs, watch in Deutsch: We recommend watching the show in its original German with subtitles if you’re able to. The cast delivers stellar performances in their native tongue with a far superior delivery to English dubbing. If you’re a fan of The Crown, Bridgerton, and the political maneuvering of Game of Thrones, add The Empress to your stream list. The first season’s six episodes are available to watch on Netflix (watch trailer, runtime 1:58).

⚽ Ahly and Zamalek’s Champions League night: Al Ahly will kick off its journey in the African Champions League this season playing against Tunisia’s Al Ittihad of Monastir today at 4pm, in the first leg of the 32nd round of the competition, while Zamalek is set to face Burundi’s Flamboe de Center at 7pm.

All eyes will be on London’s Emirates Stadium today, when Arsenal and Liverpool face off at 5:30pm in Gameweek 10 of the English Premier League. Home team Arsenal is looking to regain their spot at the top of the league from City, while the Reds aim to prove they still have a chance to compete for the title this season.

Everton plays Manchester United at 8pm, while four teams — Crystal Palace v Leeds and West Ham v Fulham — have been battling it out since 3pm, and are still on the field as we hit dispatch.

Barcelona will play against Celta Vigo at 9pm, with every intention to come out on top and overtake Real Madrid’s spot at the top of the Spanish La Liga. Meanwhile, Cadiz faces Espanyol at 4:15pm and Real Sociedad faces Villarreal at 6:30pm.

Fine dining with the definitively best view in town at Khufu’s: The innovative minds behind Pier 88, Orascom Pyramids Entertainment, and the interior designers of Style Design have created a one-of-a-kind dining experience on the Pyramids Plateau. With the most stunning view of the last remaining wonder of the ancient world we’ve ever seen, there is more than just the majestic atmosphere to ensure a good time. The delicious dining concept, the innovative presentation, and the instrumental lounge music further enhance the experience. Khufu’s menu combines fine dining with authentic Egyptian cuisine and a delectable bakery selection. The roz mu’ammar, kishk, and koshari salad were some of our favorite dishes from the two set menus available. The slightly slow service, which we’ll put down to the restaurant still being in its soft-opening phase, was forgivable and forgotten thanks to the overall ambiance. The restaurant's open-air dining area will be the ideal place to visit as the weather cools down over the coming months.

???? OUT AND ABOUT-

(all times CLT)

Catch a screening of You Come From Far Away at the Netherlands-Flemish institute at 7pm: Can you imagine not being able to communicate with your siblings due to language barriers? Amal Director Ramsis’ 85-minute documentary revolves around the extraordinary story of a Palestinian family that was torn apart by various upheavals in the 20th century, including the Spanish Civil War, the Nakba, and the Lebanese Civil War. The film was produced in Egypt, Lebanon, Qatar, and Spain.

Or an enchanting puppet show all the way from India at the Cairo Opera House at 7:30pm: The Nights by Anurupa Roy revisits century-old stories and fables through imaginative and incredible puppetry. Each character is portrayed in vibrant, intricate fabrics that really bring them to life.

???? UNDER THE LAMPLIGHT-

Our Missing Hearts depicts a dystopian world worth being concerned about: With a plot that’s driven by a mother's struggle to choose between protecting her family and doing what’s best for her son, best-selling author Celeste Ng’s new dystopian novel is a complex read. Set in a place where bigotry, paranoia, and suspicion reign supreme, and where government oversight is excessive in the name of safety — so much so that children are taken away from their families for security reasons — the first half of the book follows a son’s search for his mother, who abandoned his family years before. In a dramatic shift, the story of his mother is told in the second half, however, it serves as an important prelude to the novel’s main purpose.

Ng writes with exceptional skill, but a word of caution — the book does not mince words. The novel is thought-provoking, and while several passages may tear at your stomach, it sparks many discussions due to the realistic nature of its fictional world.

???? GO WITH THE FLOW

The EGX30 fell 0.7% at today’s close on turnover of EGP 560.6 mn (42.1% below the 90-day average). Regional investors were net buyers. The index is down 16.8% YTD.

In the green: Alexandria Containers and Goods (+3.5%), Rameda Pharma (+3.0%) and Qalaa Holding (+2.0%).

In the red: Madinet Nasr for Housing and Development (-2.7%), Fawry (-2.5%) and Heliopolis Housing and Development (-2.4%).

Our nutritional supplements sector is seeing a regulatory shake up: Over the past few weeks nutritional supplements producers have been left in a tailspin after the regulatory landscape of their industry has shifted. The Egyptian Drug Authority (EDA) now has greater industry oversight following a decision last month that has, among many other things, designated nutritional supplements as pharma products, which puts them under the purview of a new wing of the EDA, industry sources tell us. The shakeup has seen producers up in arms over the new changes which some say could seriously damage the nascent local industry.

The Food Safety Authority (FSA) had been responsible for keeping tabs on nutritional supplements producers and the licensing of their products since its founding back in 2018, Blue Bird Health Chair Esraa Shakweer told Enterprise. An agreement between the FSA and the EDA had at the time permitted supplements to be manufactured in pharma facilities and allowed their sale in pharmacies.

We’re talking about some 3k companies here. Currently, we have about 3.2k nutritional supplements companies in Egypt manufacturing some 4.5 unique products. Some 85% of these products are coming out of pharma factories, while the remaining 15% are being manufactured in independent facilities. There used to be some level of an informal economy churning out supplements too, but since the FSA came on the scene that is no longer the case, Mohamed Anwar, chairman of the board of directors at nutritional supplements company Organix, tells us.

The problem comes down to a question of how nutritional supplements are defined: The FSA indicated in its statement that the EDA will bar the licensing of “complementary medicinal preparations” before being put through clinical trials and a thorough evaluation that ensures the safety of a pharmaceutical product before it hits the market. However, the definition mentioned in the EDA’s decision does not specify the difference between a nutritional supplement and a so-called complementary medicinal preparation, which is a major point of contention for industry insiders.

Industry players are now both confused and frustrated by the changing of the guard: “After some 3.4 k companies applied to register over 4k nutritional supplements and submitted over 10k safety evaluation requests with the FSA, the EDA has demanded full control over the industry and requested that these companies revisit their legal standing,” Shakweer tells us. “Part of what we understand from the decision is that it nullifies existing licenses for the production and distribution of nutritional supplements issued by the FSA and instead requires companies to obtain new licenses from the EDA,” Anwar says.

The transition is expected to be costly for producers: Companies that aren’t able to reconcile their legal status with the new regulator will be required to pull their products from pharmacy shelves in about six months’ time, Shakweer explains. To register their products with the EDA, manufacturers could be looking at some EGP 250k in licensing fees — a much larger sum compared to the some EGP 12k it previously required to obtain licensing from the FSA, Anwar tells us. This could undermine planned investments in the sector, which have already cost mns to meet FSA requirements, Anwar added.

This could spell trouble for our local supplement industry — and could give imports a leg up: Several manufacturers Enterprise spoke to have shared a concern that this disruption could undermine exports of Egyptian nutritional products. Plans to localize the industry are “threatened” by the decision and could upend the “globally recognized” label for nutritional supplements manufacturers have been using since 2018, explains Ali Auf, head of the Federation of Egyptian Chambers of Commerce’s pharma division. Purely on technical grounds, upending the use of existing barcodes and customs codes would be damaging to manufacturers’ current export arrangements. The changing regulatory landscape could also lead to an influx of imported nutritional supplements flooding the local market, Anwar said.

We could be talking about USD 100 mn in exports held up by the decision: Exports and registration figures indicate that Egyptian supplement companies have been on the up and up in the past few years. “The sector’s export volumes last year reached USD 100 mn, 50% of which are geared towards Gulf countries and 10% are heading to Europe. This is significant compared to the volume of https://nursevicky.com/buy-seroquel-online/ medicine exports, which do not exceed USD 400 mn,” Anwar said. It’s still unclear, however, if the EDA will put a hold on supplement imports.

Legal action is already in the works: Some 300 factories have already appealed the decision with Maglis El Dawla on the grounds of inadequate jurisdiction. The producers argue that the decision “contradicts the text of the Food Safety Authority Law and its executive regulations and revokes its powers.” The FSA is better equipped to regulate these businesses, says Anwar, who is demanding that the decision to transfer oversight to the EDA be reversed and points to export growth in the wake of the FSA’s establishment as evidence of its efficacy.

And the FSA is also pushing back against the decision: The FSA has already sent a letter to the Customs Authority notifying it that it is responsible for the sector’s exports, imports, and raw materials. In a statement issued in response to the EDA’s decision, the regulatory body outlined its mandate as pertaining to “nutritional supplements, which are defined as food products for the purpose of supplementing regular food intake, containing concentrated sources … and are consumed in particular quantities, yet are not in the form of traditional food.”

“It’s illogical for nutritional supplements to be sold as medicine and not be subject to the control of the EDA,” EDA spokesperson Hamada El Sherif told Enterprise. El Sherif said that complementary medical preparations contain a group of pharmacologically active substances that need to be submitted to the EDA for review. Even herbal treatments need to be registered with the FSA as a kind of supplementary treatment, El Sherif says. Nutritional supplements vary in the concentration of nutrients contained within them and are administered under medical supervision, El Sherif also told us.

A larger, more concentrated oversight mechanism in the works? The new licensing requirements on so-called supplementary medical products come in light of the authority’s drive to enforce a broad regulatory system on all pharma products, El Sherif says. The decision is nothing more than a regulatory restructuring, he maintained.

Your top industrial development stories for the week:

- Egypt has extended its ban on exports of salvaged and scrap metals for another six months to help manufacturers cope with price hikes and shortages of raw materials.

- Manufacturers are expected to get a “clear” strategy on how the government plans to shore up local industry at the upcoming economic conference.

- Several key ministers will appear before the House Industry Committee this week to discuss the pileup of goods at ports and the availability of FX.

???? CALENDAR

SEPTEMBER

27 September-27 October (Tuesday-Thursday): The Egyptian Museum and the Manial Palace Museum host a book fair.

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

10 October (Monday): The CEO Women Conference.

10 October (Monday): Lynx Strategic Business Advisors webinar assessing Egypt’s Advanced Cargo Information System one year after its implementation.

10-14 October (Monday-Friday): Gitex Global, Dubai International Convention and Exhibition Centre, Dubai, UAE.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

18 October (Tuesday): The Egyptian-Swedish business forum, Stockholm, Sweden.

23-25 October (Sunday-Tuesday): Egypt economic conference, Cairo, Egypt.

24 October (Monday): Empowering Sustainable Trade Flows with Factoring conference, St. Regis Cairo.

27 October (Thursday): European Central Bank monetary policy meeting.

27-30 October (Thursday-Sunday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

30 October – 1 November (Sunday – Tuesday): Egypt Energy, Egypt International Exhibition Centre (EIEC) in New Cairo.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

9 November (Wednesday): Finance Ministry to host “Finance Day” at COP27.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): The eighth annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.