- We have a light rail system now + Ghazl El Mahalla’s retail subscription pushed to 14 August. (The Big Stories At Home)

- Cement companies are lobbying for an extension to last year’s production caps. But do they really need it? (Inside Industry)

- The EGX30 fell 2.4% at today’s close. The index is down 24.6% YTD. (Go With The Flow)

- House will “hopefully” be done with Competition Act amendments before recess. (Happening Now)

- Amino acids — the building blocks of life and juiced up bodybuilders — have been detected in Mars. (For Your Commute)

- And life could in theory survive on harsher surfaces such as hypothetical “Super Earths.” (For Your Commute)

- Get your nostalgia fix with Stranger Things season 4 finale. (On The Tube Tonight)

- This season’s Egyptian Cup’s semi finals kick off today. Or was it last season? No, probably this season. (On The Tube Tonight)

Sunday, 3 July 2022

PM — El Sisi inaugurates the first phase of the light rail transit system.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

With the three-day holiday behind us, the countdown to the Eid break begins, ladies and gentlemen. Friday will be Wa’fa day, with the first day of Eid falling on Saturday. It is customary for us to get three working days off, so we’re expecting a very short week next week. But before we check out…

#1- Habemus, light rail: President Abdel Fattah El Sisi inaugurated the first phase of the light rail transit system (LRT) connecting Cairo, the New Administrative capital and 10th of Ramadan in a ceremony today at the Adly Mansour station (watch, runtime: 47:00). The 103.3 km network runs primarily through East Cairo’s new desert cities connecting El Salam, by way of the Adly Mansour transit station, to Al Obour, Al Shorouk, Badr, Rubiki, 10th of Ramadan and Belbeis. Adly Mansour’s Cairo Metro Line 3 station was also inaugurated.

In attendance was European Investment Bank (EIB) Vice President Gelsomina Vigliotti who’s in Egypt for a four-day visit this week, according to a statement (pdf). Cairo Metro Line 3 received EUR 600 mn in funding from the EIB for construction — making it the largest single transport project backed by the EIB in Africa, according to the statement. Vigliotti is set to meet with government officials and private sector representatives to talk future EIB investments in Egypt’s energy and food security, as well as green projects ahead of the COP27 summit in November, according to a separate statement (pdf). This marks her first high-level visit to the country since the covid pandemic began in 2020.

#2- The deadline to subscribe to the retail portion of Ghazl El Mahalla’s IPO has been extended to 14 August, according to a notice on the bourse today. This follows reports last week that the delay was likely due to weak demand for the retail portion. The note also confirmed that the club will now allow investors to purchase up to 15 mn shares, up from 2 mn currently, in a bid to attract institutional investors

HAPPENING NOW- The House of Representatives voted to approve an agreement signed with Saudi Arabia’s Public Investment Fund (PIF) at the end of March which could see USD 10 bn of fresh Saudi investment in the economy. The PIF and the Sovereign Fund of Egypt (SFE) have already identified the companies — both private and state-owned — that the Saudi wealth fund will invest in.

Will the reforms to competition rules make it to the House before the recess? “Hopefully”: The House is still not done with committee level discussions on the proposed amendments to the Competition Act that would give the Egyptian Competition Authority sharper teeth at regulating M&As, House Economic Committee Ahmed Samir said. Somehow, he is hopeful that the debate will be out of committee and the legislation will be put up to a vote in a plenary session this week.

Plenary sessions are expected to continue tomorrow and Tuesday as the current legislative cycle draws to a close. Speculation is growing among MPs that recess could begin later this week though there’s still a chance that our elected representatives will have to postpone their annual Sahel getaways until after Eid.

On the legislative agenda this week:

- Consumer finance: Government-drafted amendments to the Consumer Finance Act will be debated tomorrow. Three articles could be added to the act to provide greater fraud protections to consumers, according to a note seen by Enterprise.

- Tax disputes: The House will also discuss government-drafted amendments to tax dispute settlements tomorrow, part of efforts to improve the investor climate and boost tax revenues.

THE BIG STORY ABROAD- Luhansk has fallen: Russian forces and Moscow-backed separatists have completed the capture of Ukraine’s eastern Luhansk region, after it took control of Lysychansk, the last city that was still under Ukrainian control, a statement by the Russian Defense Ministry read.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- GASC makes huge wheat buy: State grain buyer GASC last week made its largest wheat purchase in a decade, as it locked in 815k tons of wheat for shipment in August, September and October amid a price slump.

- More love from our Gulf neighbors: Abu Dhabi Ports (ADP) reached an agreement to acquire a 70% stake in local shipping and logistics firm International Associated Cargo Carrier (IACC) for AED 514 mn (USD 140 mn).

- Qatari Diar’s string of victories in the Egyptian court system: Qatari Diar and other related investors saw taxation and administrative court rulings go in their favor last week.

*** It’s Inside Industry day — your weekly briefing of all things industrial in Egypt. Inside Industry focuses each Sunday on what it takes to turn Egypt into a manufacturing and export powerhouse, ranging from initial investment and planning to product distribution, through to land allocation to industrial processes, supply chain management, labor, automation and technology, inputs and exports, regulation and policy.

In today’s issue: Local cement players are lobbying the government to extend a regulation which stipulates that cement production be cut by at least 10%. We explore the reasons behind their request and the status of the cement industry in Egypt as it stands today.

|

???? CIRCLE YOUR CALENDAR-

It’s the start of a brand new month — and you know what that means…

- PMI: Data measuring activity in Egypt’s non-oil private sector will drop on Wednesday, 6 July.

- Foreign reserves: Foreign reserves figures will be out sometime this week.

- Inflation: Inflation data for June will land on Sunday, 10 July.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Expect a daytime high of 39°C tomorrow and a nighttime low of 24°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

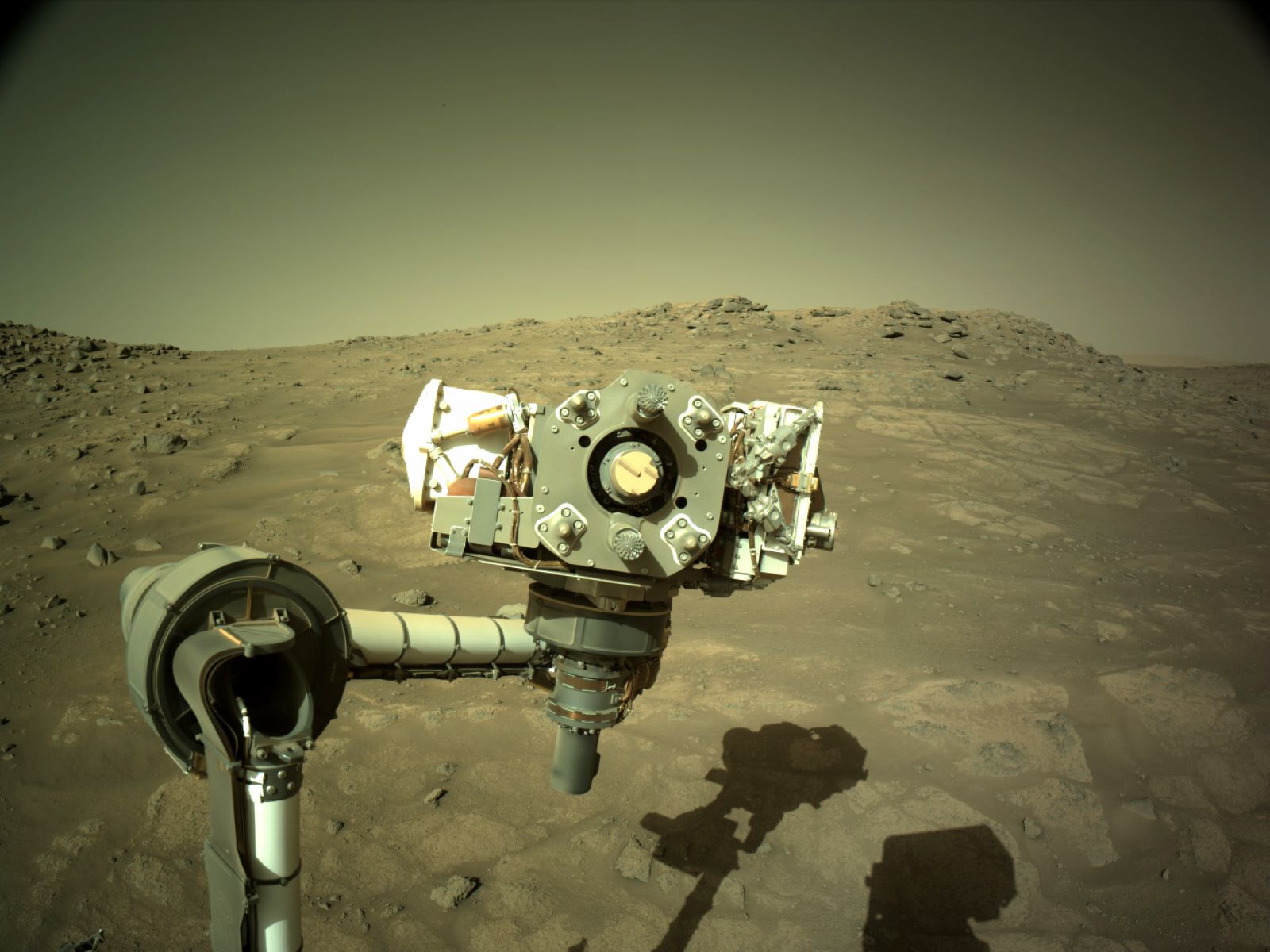

Did the evidence of life on Mars get zapped by cosmic rays? Scientific evidence is mounting that there could have been life on Mars — even if only microbial — once upon a time. That’s what the Perseverance rover, which landed last year and has been trundling over the Red Planet ever since, was sent to investigate (and you can check out some neat travel pics from the bot here.) But a new study from NASA space scientists suggests cosmic rays likely irradiate all amino acids — key markers that could have traced ancient Martian life — within two meters of Mars’ surface. That means that Perserverance’s perseverance could all be in vain, since the rover can only dig a few centimeters into the planetary surface.

Farther afield in the search for extraterrestrial life: Meet the dozens of ‘Super-Earths.’ The search for life beyond our solar system is most often concentrated on finding planets most like ours, where we assume conditions would be right to recreate life as we know it. But a team studying exoplanets at the University of Zürich is out with a new study that urges scientists to broaden their horizons. They’ve identified so-called “cold Super-Earths” that could in theory have the ability to sustain life for bns of years, despite being bigger than our planet and further away from their suns. “We argue that it should be considered that habitable planets could be very different from Earth, and that we should remain open-minded when investigating such potentially habitable planets,” the study’s lead author tells Vice. The research is based on computer modeling because these rocky exoplanets are so difficult to spot, or in some cases, may not even become potentially hospitable for bns of years to come.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

It’s finally here: the Stranger Things season 4 finale is now streaming on Netflix. The closing chapter to the penultimate season of what plenty of people argue is the best Netflix show of all time is finally available to stream (watch, runtime 2:05). We were quite impressed with the first seven episodes of Stranger Things’ long awaited fourth season when they dropped in May, but the action-packed cliffhanger left us with so many questions and we couldn’t wait to get the answers — and the finale delivers. #NoSpoilers, but we will say this: The mega-popular series may be returning for a fifth and final season, but that doesn’t mean that all of our favorite characters will come out of the final episode unscathed.

Make sure you have nothing pressing when you watch it: The season finale clocks in longer than most feature films at nearly 2.5 hours. Side note: We loved Kate Bush before y’all.

⚽ The 2021-2022 Egyptian Cup’s semi finals kick off today: Ismaili will face Ghazl El Mahalla at 6pm, then Future will play against Enppi at 9.30pm.

The time traveling in the Egyptian Cup continues: Yesterday, Al-Ahly defeated Petrojet in the semi-finals of the 2020-2021 Egypt Cup (which is being played in parallel with the current Cup). The Reds will face Zamalek in the final on 21 July.

????EAT THIS TONIGHT-

Head to Topaz at Walk of Cairo for the right balance of class and casual. With scrumptious main dishes and an exquisitely-designed new venue at Sodic West’s Walk of Cairo, Topaz has climbed up our list of favorite casual dining spots. We enjoyed just about everything we tried, but if you’re looking for specific recommendations, you can’t go wrong with their fresh Norwegian grilled salmon filet or their signature fish paupiette. Their salads are creative, fresh and highly satisfying, and their dessert options are just as yummy — the chocolate fondant and the date gratin are not to be missed.

???? OUT AND ABOUT-

(all times CLT)

It’s swing dancing night at Minglings tonight: The Heliopolis venue is hosting a swing dancing night tonight at 8pm, kicking things off with an introductory class followed by dancing games and competitions. Minglings urges attendees to dress up in their “20s or 50s outfits” to really get into the spirit. Register beforehand — it’s EGP 300 for the class and the party, and EGP 150 if you just want to rock up after the class.

???? UNDER THE LAMPLIGHT-

There’s a wealth of literature on climate change, but Supercharge Me is a refreshing addition. For starters, it takes for granted that we need to prevent the earth’s temperature from rising 1.5°C (none of us want to rehash the arguments on whether or not we’re facing a global emergency, and what the targets should be for slowing it down.) Fund manager Eric Lonergan and sustainability adviser Corinne Sawers enlighten us on how we can get to net zero faster, moving past all the target-talk to actions that they say have the power to “supercharge” change. This includes what they call EPICs or “extreme positive incentives for behavioral change.” This breezy and informative read has answers for individuals, businesses and governments on what they can do to help, in what publishers Columbia University Press are calling “one of the most accessible and practical guides to the climate crisis.”

???? GO WITH THE FLOW

Cement companies have started lobbying the Egyptian Competition Authority (ECA) to extend a regulation which stipulates that cement production be cut by at least 10%. Companies have requested that the Federation of Egyptian Industries (FEI)’s cement division begin discussions with ECA to renew supply cuts brought in last year, Shorouk News quotes division head Ahmed Shireen Korayem as saying earlier this month.

And they’re likely to get it as the Trade and Industry Ministry supports the extension, because actual supply continues to outstrip real demand in the market, several industry executives told Enterprise.

Background: Last year, The ECA heeded the request of 23 local cement companies to slash production by more than 10%. The regulation came into effect mid-July last year, and has a one year expiration date. The regulation was implemented to revive an ailing industry that had been struggling for years from a supply satiation that drove many cement companies to halt their operations and rendered others on the brink of closure.

Building materials companies staunchly opposed the ECA’s decision last year, raising the point that price hikes would put players in their sector under pressure.

How has the sector fared since the decision? Consistent rise in prices since the decision: Cement prices surged 47% reaching EGP 1250 per ton in May, according to a Housing Ministry report (pdf). Before the regulation came into effect in July, the price of cement was EGP 850 per ton.

The regulation’s goals have come to fruition, effectively reducing the losses incurred by cement factories in pre-regulation years, CEO of Beni Suef Cement Company Farouk Mustafa, told Enterprise. The regulation provided manufacturers with the stability to plan out their operations, such as production, sales movements, and inventory management, Ahmed Abdo, Lafarge's head of commercial and marketing, told Enterprise.

This improvement is reflected in their earnings: Arabian Cement returned to the black in 1Q2022, with its bottom line recording EGP 58.9 mn during the quarter compared to net losses of EGP 6.3 mn in 1Q2021, according to the company’s financials (pdf). The company’s sales rose 145% y-o-y to EGP 1.06 bn in 1Q2022. Misr Cement Group similarly saw a 161% boom in their profits y-o-y in 1Q2022.

The regulation provided a lifeline and resuscitated companies that had halted their operations: Saad El Din Group restarted the Spanish-Egyptian Cement Factory in the Port Said Freezone, after a three-year hiatus. The cement production quotas enacted last year factored in the company’s decision to revive the factory, Saad El Din CEO Mohamed Saad El-Din, told Enterprise, adding that the factory is set to operate at its full production capacity (600K tons per annum), though he did not disclose when.

So, if all is better in the sector, why should the production caps be extended? For one, capacity still outstrips demand: Demand for Egyptian cement is expected to amount to 50 mn tons by the end of the year, an increase from 2021’s 48.5 mn, according to Abdo. Local cement factories’ production capacity remains at around 83 mn tons, Abdo said. He expects demand for cement to increase by 2-3% by 2023, he said.

Demand may surge if the government is willing to increase the number of building permits in the country’s governorates, according to Mostafa. The government had previously enforced a six-month ban of construction permits in 2020 in an effort to combat building code violations, and then reopened the doors for permits on a provisional basis in 2021.

Inflation in energy costs: The price tag of coal, which is used by approximately 16 out of 18 cement companies, rose to USD 300-350 from USD 60-80 during the past year, industry players told Enterprise. Energy costs amount to approximately 70% of the expenses that go into cement production.

Cement companies aren’t out of the woods yet: While some cement companies have seen their earnings grow since the cap, some are still in the red, Korayem said. Sinai Cement’s net losses narrowed 54.6% y-o-y to EGP 67.2 mn in 1Q2022 from EGP 148.0 mn in 1Q2021, according to their financials (pdf).

Lack of financing as well as commitments to reduce carbon emissions are both drivers:

Banks remain reluctant, “with minor exceptions,” to finance cement companies due to the instability of the sector, according to Korayem. Furthermore, cement companies are under pressure to cut carbon emissions and adhere to environmental regulations ahead of COP 27, he added.

The cost of converting a single production line to run on alternative energy is at least EGP 50 mn, he adds. Capturing surplus heat from their factories and reusing it to generate electricity and further minimize emissions also comes with a hefty cost. Some factories are currently exploring the possibility of partially introducing solar energy to their operations, he added.

And ultimately, the survival of the industry is of benefit to consumers: If players leave the market, it won’t help prices in the long term, as we will see a concentration of production in the hands of fewer players, Korayem tells us.

Your top industrial development stories for the week:

- Egypt and Algeria signed 12 MoUs in the fields of industry, investment, exports, irrigation and water resources, and small and micro enterprises.

- Farewell, British American Tobacco Egypt: British American Tobacco (BAT) will discontinue operations in Egypt this month due to concerns about the market’s long-term commercial viability.

- Passenger car sales fell for the third consecutive month in May against a backdrop of continued economic headwinds and import restrictions.

- Gov’t works to get car imports flowing again: Prime Minister Moustafa Madbouly has directed his ministers, the central bank, and the banking sector to coordinate on setting up “a mechanism for the orderly release of car shipments” from ports.

- Abou Ghaly Motors is now in the final stage of negotiations with Chinese automaker Geely to begin producing their cars in Egypt under a long-term contract.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

July: Actis’ expected sale of its majority stake in Lekela to Infinity and Masdar’s Infinity Power.

First week of July: Fuel pricing committee meets to decide quarterly fuel prices.

First week of July: The national dialogue called for by President Abdel Fattah El Sisi kicks off.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July-14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

August: Sharm El Sheikh will host the African Sumo Championship.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Egypt will display its first naval exhibition, Naval Power.

September: Estate Waves Egypt real estate exhibition through metaverse technology.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

September: The sixth session of the Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

6-9 September (Tuesday-Friday): Gate Travel Expo 2022, El Kobba Palace, Cairo.

8 September (Thursday): European Central Bank monetary policy meeting.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

October: The finals of the IEEE’s Arab IoT & AI Challenge will be held during GITEX Technology Week in Dubai next October, with participants from 11 Arab countries.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings chaired by CBE Governor Tarek Amer, Washington, DC.

18-20 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

JANUARY 2023

January EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

MAY 2023

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

EVENTS WITH NO SET DATE

2Q2022: The Sovereign Fund of Egypt will invest in two companies in the financial inclusion and non-banking financial services sectors.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 2Q2022: Door for bidding for the contract to redevelop the site of the former National Democratic Party HQ to close.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.