- FRA expands proposed caps on margin trading in its latest decision. (The Big Stories Today)

- The EBRD is more optimistic about our growth outlook. (The Big Stories Today)

- Coal is getting the boot as Egypt signs int’l agreement at COP26 to phase out its use. (The Big Stories Abroad)

- We’re looking at a warm, sunny weekend. (Tomorrow’s Weather)

- The UK just became the first country to approve a covid-19 antiviral pill. (Your Mandatory Covid Story)

- How scammers made mns from a loophole in Europe’s carbon quota system. (On the Tube Tonight)

- Visit CairoComix 6 at the Mahmod Mokhtar Cultural Center. (Out and About)

- A whole lotta football this weekend: From the Egyptian and English premier league to the Europa League schedule. (Enterprise Recommends)

Thursday, 4 November 2021

PM — Coal is getting the boot as Egypt signs int’l agreement at COP26 to phase out its use.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

…and just like that, the first week of November is over. We hope the week has been kind to you — and that you’re looking forward to a relaxing weekend with family and friends.

A special shout-out this afternoon to our Hindu readers, to whom we offer our very best wishes on the occasion of Diwali. We hope, given all that’s happening in the world around us right now, that you’re celebrating the festival of lights with your loved ones. (Today is the first day of the five-day Diwali festival, which is as significant to Hindus as the Eids are to Muslims or Christmas and Easter are to Christians.)

THE BIG STORIES TODAY-

#1- FRA expands proposed caps on margin trading in its latest decision: The Financial Regulatory Authority (FRA) issued a decision today setting new caps on margin trading on shares of listed companies — and from what we’re seeing, it appears the FRA has expanded them from its previous proposals. Newly released regulations would not permit any single investor or their related group to purchase on margin more than 3% of a company’s market cap or 5% of shares on freefloat, whichever is higher. In its previous proposal the FRA had wanted to limit a single investor’s margin trading cap at 1% of the company’s market cap or 3% of its freefloat shares.

A single company would also not be permitted to have over 15% of its outstanding shares held on margin, or 30% of its publicly-traded shares, whichever is higher. In its April proposal, the FRA had suggested that it would limit freefloat shares held on margin to 25%.

#2- The EBRD is getting more optimistic about Egypt’s growth prospects, saying in its latest Regional Economic Prospects report (pdf) that it now expects the economy to grow at a 5.3% clip during the calendar year. This is an upwards revision of 1.1 percentage points from the bank’s most recent forecast in June, which the report says will be underpinned by the CIT sector and rebounding FDI flows.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Covid passports are now live: The Health Ministry has launched its covid passport app, which acts as proof of covid vaccination, and is designed to replace the paper certificates in efforts to avoid fraud.

- Private sector activity dips to five-month low: The contraction of non-oil private sector activity in Egypt deepened in October as continued supply chain disruptions abroad caused input costs to rise at their quickest pace in over three years.

- Heliopolis Housing is reviving its plans to tap the EGX with a secondary offering by mid-2022, after e-Finance’s IPO breathed new life into the state privatization program.

THE BIG STORIES ABROAD–

Countries and organizations signed on to several landmark agreements to phase out the use of coal power and end financing for new coal plants at the COP26 summit yesterday, according to a statement. One agreement — the Global Coal to Clean Power Transition Statement — sets deadlines for developed and developing countries, with “major economies” committing to the phase-out in the 2030s and the rest of the world agreeing to taper off their coal use a decade later. Banks and financial institutions also pledged to end financing for new plants, but emerging economies will have access to funding packages to support the “early retirement” of existing plants to make the move away from coal more equitable, according to the statement.

Egypt is one of the signatories of the agreement to phase out coal use — but major emitters China, the US, and India are not. However, China previously agreed to eliminate financing of overseas coal plants, and the US joined other countries in making a similar pledge at COP26. Egypt’s decision to sign on to the agreement comes days after it declined to sign two agreements to end deforestation by 2030 and reduce methane emissions by at least 30% by the end of the decade. Coal has recently been falling out of favor in Egypt, leading to the scrapping of Al Nowais’ planned USD 4 bn, 2.65 GW “clean coal” project, as well as the 6.6 GW Hamrawein coal plant.

So what does this mean for Egypt’s cement industry? The vast majority of cement producers in Egypt rely on coal for at least part of their manufacturing processes, after a number of them outfitted their facilities to run on coal in 2016 in response to the lifting of fuel subsidies. And as one of the most-polluting industries, cement manufacturing has been under pressure to decarbonize by phasing out their coal-based heating processes for biomass fuels. The switch would be extremely costly, however, and would likely drive up prices even further after rising costs of input materials already led cement prices to rise earlier this year.

ALSO FROM COP- Bezos pledges USD 2 bn to restoring nature … after flying to COP26 in a private jet: Amazon’s Jeff Bezos — the world’s second richest man — pledged USD 2 bn from selling Amazon stocks to the Bezos Earth Fund at COP26 in Glasgow earlier this week. USD 1 bn will go toward landscape restoration in Africa and the US, while the other USD 1 bn will go towards raising crop yields. That’s all good and well, but Bezos flew to the climate summit in a private jet (hardly an eco-friendly commute choice). The bn’aire’s pledge comes a few short days after Elon Musk questioned the validity of suggestions that donating from his wealth could help solve world hunger.

Higher energy is weighing on BoE as it keeps interest rates on hold: The Bank of England kept interest rates on hold on Thursday, following in the footsteps of the US Federal Reserve yesterday and the European Central Bank last week. It said that the UK’s continued recovery from the covid-19 pandemic was behind the decision.

Inflation is a big problem and rates will have to rise: “Inflation is above our 2% target…Some of the increase was caused by a rise in oil and gas prices. That put the cost of petrol and utility bills up,” the UK’s central bank said. While the BoE was accommodating this time around, it did say that interest rates will need to “rise moderately” to return inflation to its 2% target. This comes as the Fed has begun unwinding its huge stimulus program this month amid concerns that inflation will remain elevated for longer than previously thought.

And while we’re on energy, the FT is out with quite the pretty infographic explainer charting where Europe sources its gas needs.

MARKET WATCH- Keep an eye out for the OPEC vs. Biden showdown: OPEC+ will decide today whether to heed US President Joe Biden’s request to up oil production as the White House worries that “inflation caused by high energy prices could derail its economic agenda,” writes Bloomberg. (Remember, the US Federal Reserve decided yesterday to begin tapering its stimulus program, citing elevated inflation.) The Biden administration is asking the oil producing countries to hike monthly supply to between 600-800k bbl/day or else stick to the current 400k bbl/day and allow other members to pump extra to compensate, sources were quoted as saying. The cartel seems likely to shrug off the request as many members are already struggling to meet their production targets.

What does this all mean? A bout of volatility in oil markets over the next few weeks “as the conflict between the world’s largest producers and consumers plays out,” the business information service says.

YOUR MANDATORY COVID STORY- The UK became the first country in the world to approve a covid-19 antiviral pill, giving the greenlight to administer molnupiravir in mild to moderate cases, according to a government statement. Molnupiravir is jointly developed by US-based Merck and Ridgeback Biotherapeutics, but the med has yet to get regulatory approval from Washington. Britain's Medicines and Healthcare products Regulatory Agency (MHRA) said the pill was found to be safe and effective at reducing the risk of hospitalisation and death and recommended that molnupiravir be used as soon as possible following a positive covid test. The med works by interfering with the virus’ replication, keeping it from multiplying and intensifying the disease in patients.

The move is being hailed by the global press (including from Reuters) as a huge step in containing the covid-19 pandemic as most efforts until now have focused on vaccine administration.

|

???? CIRCLE YOUR CALENDAR-

The Africa Early Stage Investors Summit continues today, featuring virtual sessions featuring speakers from angel networks, VC funds, accelerators, and the public sector, among others.

Key news triggers coming up:

- Inflation: Inflation figures for October will be released next Wednesday, 10 November;

- There’s no MPC meeting this month — the central bank will next meet on 16 December to review interest rates for the final time this year. The CBE has yet to issue its MPC calendar for 2022.

Women entrepreneurs have until this Saturday, 6 November to apply to a new accelerator program launched by NGO Nahdet El Mahrousa offering up to EGP 200k in grants, mentorship, and other business support. Founders and social enterprise leaders working in ICT, creative industries, or on projects that support gender equality are eligible to apply. The program, Rabeha, was launched in partnership with UN Women Egypt, the Egyptian National Council for Women, Global Affairs Canada, and other partners. You can apply here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers

☀️ TOMORROW’S WEATHER- Expect the mercury to rise to 30-31°C during the afternoon this weekend, while nighttime lows are forecasted to fall in the 19-20°C range, our favorite weather app tells us.

???? FOR YOUR COMMUTE

Play Stranger Things on your Android: Netflix has released five new games on Android app stores as the streaming giant attempts to expand its offerings with its foray into gaming. Two of the titles out now come from the successful Netflix franchise Stranger Things which quickly amassed a cult following. The games are titled Stranger Things: 1984, Stranger Things 3: The Game, Shooting Hoops, Card Blast and Teeter Up. Netflix subscribers can play the games without any additional charges. The company has said it would also develop games for iPhones, but no timeline has been specified. Bloomberg picked up the story.

China is getting a leg up in the semiconductor race as Tencent discloses that it has developed three chips, according to CNBC. Tencent — one of the world’s biggest gaming companies and the operator of WeChat — has been expanding into the cloud computing and semiconductor spaces as it aims to diversify its offerings. The first AI chip, called Zixiao, can be used for voice assistants as it can process images, video and natural language, while the company also released a video transcoding chip and a network card designed to help cloud computing processes. This comes as the world’s superpowers race to design and manufacture chips amid a global semiconductor shortage that has wreaked havoc on multiple industries and highlighted a disadvantageous dependence on a handful of chip manufacturers.

???? ENTERPRISE RECOMMENDS

How scammers made mns from a loophole in Europe’s carbon quota system + There’s football galore this weekend + Visit CairoComix 6

???? ON THE TUBE TONIGHT-

(all times CLT)

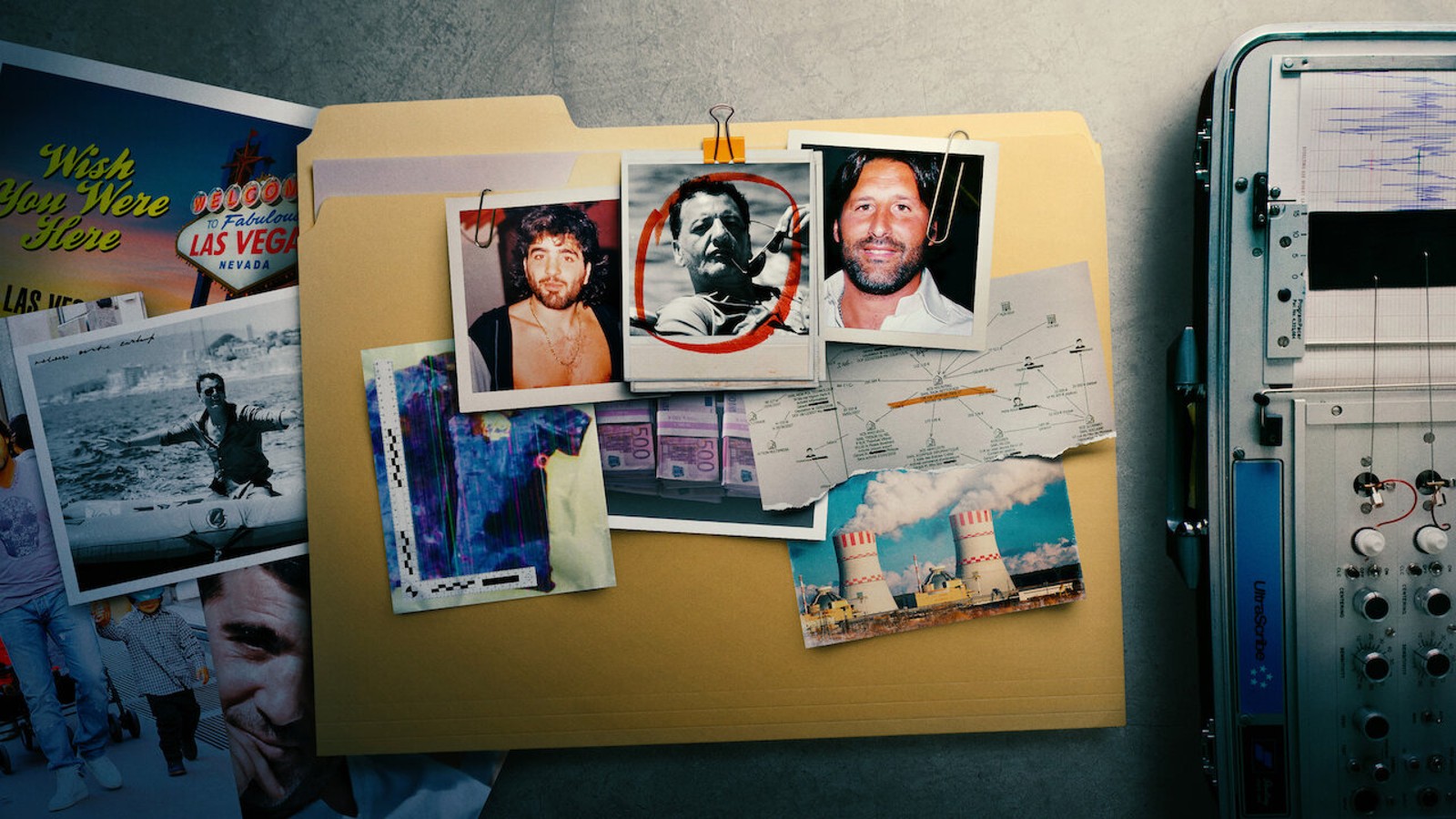

Lords of Scam looks at the scammers that managed to skim mns of EURs from financial loopholes in the EU’s Emissions Trading System. The French-language Netflix documentary traces the rise and crash of businessmen-turned-scammers who amassed a fortune through financial deception and altered carbon taxes. Europe has a carbon quota system in place that allows for companies to buy and sell offsets on carbon emissions levels, but for years the system had a series of loopholes that flew under the radar. By interviewing the front man of the operation, Tunisian Mardouche “Marco” Mouly, the true crime doc goes into the details of the scam and how it fell apart from the inside out as those involved began to turn on each other once the police came sniffing.

⚽ Pyramids will face Alexandria’s Al Ittihad in the most important matches of the Egyptian League today at 8pm, while El-Gouna will play against Pharco and Al Mokawleen against El Gaish, both at 5:30pm.

But the game all Egyptian football lovers will be waiting for is tomorrow’s Al Ahly versus El Zamalek at 8pm at the Cairo International Stadium.

Today in the Europa League:

- 7:45pm: Leon vs. Sparta Braga

- 7:45pm: Legia Warsaw vs. Napoli

- 10:00pm: Leicester City vs. Spartak Moscow

- 10:00pm: Marseille vs. Lazio

And the Europa Conference League (Serious question: does anyone actually watch it?):

- 10:00pm: Roma vs. Bodo Glimt

- 10:00pm: Tottenham vs. Fethiye Arnhem

And as usual, new gameweeks of the major European leagues are coming back on Friday: In the English Premier League, Southampton will play against Aston Villa at 10pm. In La Liga, Athletic Bilbao faces Cadiz at 10pm while Empoli plays against Genoa at 10:15pm in Serie A. In the German Bundesliga, Mainz will meet Borussia Moenchengladbach at 9:30pm.

But the Premier League will really kick off on Saturday, with the day starting with the Manchester derby between United and City at 2:30pm. At 5pm, Chelsea will play against Burnley, Brentford against Norwich City, and Crystal Palace against Wolves. Brighton and Newcastle will end the day with a game at 7:30pm.

Barcelona will face Celta Vigo at 5:15pm on Saturday in La Liga, while Real Madrid will host Rayo Vallecano at 10pm.

Bayern Munich plays against Freiburg at 4:30pm in the German League, while Borussia Dortmund has a difficult confrontation against RB Leipzig at 7:30pm.

Juventus will face Fiorentina at 7pm on Saturday in Serie A. You can stream the match without charge on YouTube.

And finally, Ligue 1 will see Paris Saint-Germain face Bordeaux at 10pm.

???? EAT THIS TONIGHT-

Some sweet treats to enjoy during the weekend: Craema Bakery infuses Egyptian flavors and spices into Western pastries and cakes, coming up with creations that are as aesthetically pleasing as they are delicious. Their specialty tarts come in all shapes and sizes, with flavors ranging from custard, molasses and tahini, pistachio and halva, and sticky pecan buns. Craema also makes a wide selection of cookies including halva and dark chocolate, pecan and cinnamon, and our personal favorite, oatmeal cookies with white chocolate and apricot. For more intense dessert lovers, check out their signature cakes which vary from lemon blueberry to 3agameya walnut. You can order the sweet treats from their page on Instagram. For now it seems only Maadi peeps are privy.

???? OUT AND ABOUT-

(all times CLT)

Don’t miss out on CairoComix 6 this weekend at the Mahmod Mokhtar Cultural Center which brings together local comic book creators and animators in a series of exhibits, workshops, talks, and book signings.

AUC’s Falaki Theatre is hosting this year’s Hakawy Festival for youth art, featuring music groups, art exhibitions, and acting performances from children across the country. You can check out the festival’s events here.

Singer and actor Mohamed Ramadan is holding a concert at Family Park tomorrow at 10pm. We’re guessing the family-friendly venue felt confident enough, now that Ramadan has vowed to keep his clothes on while on stage.

Pink Floyd cover band Paranoid Eyes are performing tomorrow at 10pm at The Room New Cairo in a set called The Dark Side Of The Room.

???? EARS TO THE GROUND-

Stuff you should know, from the Stuff You Should Know podcast: Hosted by Josh Clark and Chuck Bryant, the show has often topped charts since its debut in 2008. The podcast explores such a wide variety of topics, that you’ll find something that suits you no matter what your interests are. However, the duo always venture to explain things in a way that is interesting and comedic, tying events to both popular culture and history. The episodes have two formats: A full-length episode that nears an hour in length or the 15-minute “short stuff.” Some of their most popular releases explore tipping in restaurants, cheese, Barbie, and pinball; we’ve recently listened to an episode that poses the question “Will we find evidence of aliens by their engineering projects?” You can find the show on Apple Podcasts or Spotify.

???? UNDER THE LAMPLIGHT-

This Is How They Tell Me the World Will End: The Cyber Weapons Arms Race: In her book, New York Times reporter Nicole Perlroth explores the new kind of global warfare that comes with the threat of cyberweapons. She focuses mainly on zero day exploits where hackers exploit a vulnerability before software developers can find a fix. With zero day attacks, hackers have been able to do everything from silently spying on an iPhone, dismantling the safety controls at a chemical plant, rigging an election, or even shutting down the electric grid. For a long time, the US was planning to hoard the zero day technology for its own uses, but soon the hacker market grew out of control until the West eventually became the main targets from other nations who mastered the use of cyberweapons. Perlroth uses years of reporting and hundreds of interviews to paint a picture of what could happen if cyber criminals decide to take on the world.

???? GO WITH THE FLOW

Credit Agricole reports higher net income in 9M2021 on slightly higher net interest income

EARNINGS WATCH-

Credit Agricole Egypt reported EGP 1.18 bn in net income in 9M2021, up 13.8% y-o-y, according to its earning release (pdf). It reported a net interest income (NII) of EGP 2.2 bn, up 1.6% y-o-y.

MARKET ROUNDUP-

The EGX30 fell 0.6% at today’s close on turnover of EGP 1.05 bn (31.4% below the 90-day average). Local investors were net buyers. The index is up 7.1% YTD.

In the green: Orascom Development Egypt (+3.5%), Fawry (+2.1%) and Eastern Company (+1.6%).

In the red: Mopco (-5.1%), GB Auto (-4.2%) and Sidi Kerir Petrochem (-2.2%).

???? CALENDAR

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

31 October – 12 November (Sunday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

3-5 November (Wednesday-Friday): Africa Early Stage Investor Summit.

6 November (Saturday): Deadline to apply to Nahdet El Mahrousa’s Rabeha, a women entrepreneurship accelerator program.

7-10 November (Sunday-Wednesday): Cairo ICT 2021, Egypt International Exhibition Center, New Cairo.

8 November (Monday): Egypt CSR Forum, International Citystars, Cairo.

11 November (Thursday): Deadline for Anghami SPAC merger.

15 November (Monday): Unvaccinated public sector workers won’t be allowed into their workplaces.

15-21 November (Monday-Sunday): Intra-African Trade Fair 2021, Durban, KwaZulu-Natal, South Africa.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

18-19 November (Thursday-Friday): British royal family members Prince Charles and the Duchess of Cornwall visit Cairo.

25 November (Thursday): Rameda Pharma’s annual general meeting (pdf), at which it will decide on the sale of a 5% stake in the company from an individual shareholder to an unnamed foreign institutional investor.

25-27 November (Thursday-Saturday): RiseUp Summit, Cairo, Egypt.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

30 November (Tuesday): Launch of open call by GIZ and KfW for green project proposals in Egypt as part of their Investing for Employment facility (pdf).

1 December (Wednesday): Unvaccinated members of the public will be banned from government buildings from this date; unvaccinated students will be prevented from accessing university campuses.

1 December (Wednesday): Government departments will begin moving to offices in the new capital.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1Q2022: Launch of the Egyptian Commodities Exchange.

7 January 2022 (Friday): Coptic Christmas.

27 January 2022 (Tuesday): National holiday in observance of 25 January revolution anniversary / Police Day.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

19 February 2022 (Saturday): Public universities begin the second term of the 2021-2022 academic year.

1H2022: The World Economic Forum annual meeting, location TBD.

2 April 2022 (Saturday): First day of Ramadan (TBC).

22-24 April 2022 (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April 2022 (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April 2022 (Monday): Sham El Nessim.

25 April 2022 (Monday): Sinai Liberation Day.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

2 May 2022 (Monday): Eid El Fitr (TBC).

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

30 June 2022 (Thursday): June 30 Revolution Day, national holiday.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July (Saturday): Islamic New Year.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday.

18-20 October 2022 (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.