- Egypt attracts second most inbound M&A transactions from Middle East in 1H2021 + FinMin denies introduction of new capital gains tax. (The Big Stories Today)

- EU stocks breathe a sigh of relief over the Fed possibly delaying Taper Tantrum. (What We’re Tracking Tonight)

- Women employees feel their wellbeing is supported in the workplace following the negative impact of covid-19. (A Message From)

- Cairo ranks 57th safest city out of 60 in Economist Intelligence Unit’s The Safe Cities Index 2021. (What We’re Tracking Tonight)

- ADNOC plans to sell at least 7.5% of its drilling unit’s shares on the ADX. (What We’re Tracking Tonight)

- The GrEEk Campus is hosting a three-day PS5 FIFA Tournament and VR Gaming Experience starting today. (Enterprise Recommends)

- Egyptian-Canadian writer Mona Awad’s All’s Well is a gripping summer read. (Under The Lamplight)

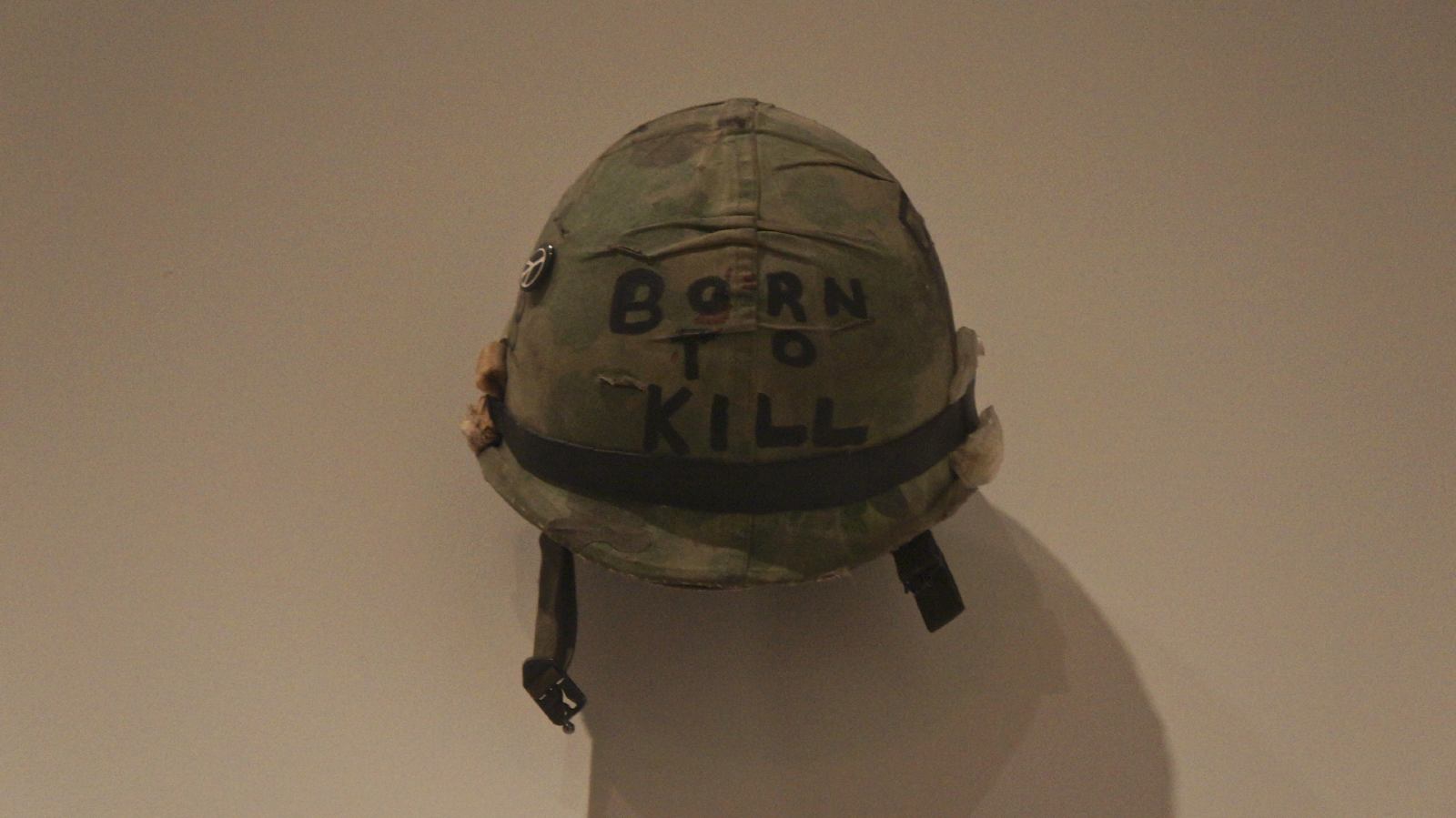

- It’s ‘80s week On The Tube Tonight and we’re starting with Stanley Kubrick’s Full Metal Jacket. (On The Tube Tonight)

Monday, 6 September 2021

EnterprisePM — Egypt attracted second most inbound M&A transactions from Middle East in 1H2021.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, ladies and gentlemen, and welcome to a stacked day of business and finance news both foreign and domestic.

#1 Egypt attracts second most inbound M&A transactions from the Middle East in 1H2021, recording 18 transactions valued at USD 1.8 bn during the first half of the year, according to a Baker McKenzie report. Global M&A activity saw a 120% increase over the six months compared to 1H2020, while activity in the Middle East increased by 59%.

#2 The Finance Ministry has issued a statement (pdf) denying that it will impose new taxes on capital gains after a document circulated by FinMin caused speculation as to whether the long-shelved capital gains tax would be making a comeback in January 2022. The FinMin did not address when the tax could be reintroduced, but explained that the circular was issued in order to clarify pre-existing regulations, and did not constitute the issuance of new tax legislation.

#3 Consumer finance provider Contact Financial and Abou Ghaly Motors will join forces to launch Abou Ghaly Finance in the coming months, offering finance solutions for car purchases through a fully digitized process, Contact Financial CEO Said Zater told us. Separately, the company is also planning to soon launch e-payment services, and is expecting to receive its license this month.

^^ We’ll have chapter and verse on all three stories in tomorrow’s edition of EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Egypt’s non-oil private sector shrinks in August: Business activity in Egypt’s non-oil private sector contracted for the ninth straight month in August. But a record surge in corporate spending and a pick-up in demand softened the decline.

- Elsewedy returns to Ghana: Elsewedy Electric for Transmission and Distribution of Energy signed a USD 16.7 mn EPC contract to build a substation for Ghana’s state-owned electricity company.

- Four Egyptian startups secure USD 125k seed funding: ShipBlu, Amenli, Pylon and Odiggo have secured USD 125k each in seed funding by US accelerator Y Combinator.

SMART POLICY- Capmas will conduct a survey on family health in Egypt, Capmas head Khairat Barakat told Youm7. The survey will focus on the health of mothers and children, in addition surveying families on fertility and family planning. Survey preparations have already kicked off in August and field work should begin by next month. Preliminary results should be out by April 2022. The survey’s data will be used in sketching out health policies and programs that tackle overpopulation. This is the first time for the agency to do such a survey.

The move is likely part of Egypt’s plans to control Egypt’s overpopulation, which include an initiative announced back in March aiming to bring the birth rate down from 3.4 to 2.4 children per woman by 2030. The government’s family planning strategy will include financial incentives for having fewer children, in addition to providing contraceptives and other family planning tools at no cost. That’s not counting the Two is Enough initiative, which aimed to get 20 mn families on board by mid-2021, while MPs are also working on the overpopulation problem by legislating new family planning rules.

This certainly isn’t going to help tourism: The Economist Intelligence Unit’s The Safe Cities Index 2021 ranked Cairo the 57th safest city out of 60 major metropolises. The countries are graded in terms of safety based on five indicators: digital security, health, infrastructure, personal security and environmental security. Cairo ranked below average in all categories, but scored particularly badly in the environmental security category — which measures sustainability and climate adaptation following the pandemic — coming in second to last, ahead of Kuwait City. Its smart city plans were also noted. This is the index’s fourth edition, with Denmark’s Copenhagen being labeled the safest city in the world in 2021. Egypt came in the 53rd place in 2019.

STARTUP WATCH- Three startups took home EGP 150k each after the conclusion of the Agri-Digital Startup Competition yesterday, held collaboratively between GIZ and Ain Shams University’s Innovation, Entrepreneurship, and Creativity Hub (IHub), according to a statement. The winning startups were farm monitoring solutions provider ReNile, agricultural community platform Croposa, and an e-commerce platform Cotton Town. Thirty six teams in the startup stage and 41 teams in the idea stage participated, with an additional three winners in the idea stage winning EGP 10k each.

HAPPENING NOW- EU stocks breathe a sigh of relief over the Fed possibly delaying Taper Tantrum 2.0: European stocks have been on the rise on the first day of trading following a poor US jobs report out last Friday. The Stoxx Europe 600 was up 0.63% (bolstered by rising tech stocks) as of dispatch time, closing in on a record high, according to Bloomberg. Analysts tell the news outlet that last week’s US jobs report, which showed the smallest gains in new jobs in seven months, has markets thinking that the US Federal Reserve will likely delay it’s expected tapering. The FTSE was up 0.59% as of dispatch time, while US markets are closed for Labor Day.

This is good news for us (for now): We could be at risk of outflows if the Federal Reserve starts to unwind its bond-buying program sooner. Statements by Fed head Jerome Powell last month signalled that the central bank could begin rolling back its program as early as this year, which would be followed by an uptick in interest rates, potentially putting some pressure on the EGP carry trade.

Taper tantrum who? That said, Egypt’s world-beating real interest rate will help it weather an uptick in global rates, S&P Global Ratings said in a report yesterday. It did warn, however, that the country faces some risk from capital outflows unless it acts to reduce its debt costs.

IN OTHER MARKET NEWS-

Abu Dhabi National Oil Company (ADNOC) is planning to sell at least 7.5% of its drilling unit’s shares on the ADX, in what could be one of the largest IPOs in the UAE, Bloomberg reports. Previous reports put the value of Adnoc Drilling at USD 10 bn, meaning this IPO could raise some USD 750 mn. This comes as Abu Dhabi tries to revive its IPO pipeline, with sovereign wealth fund Mubadala also planning to list up to 40% of its subsidiary Emirates Global Aluminum.

THE BIG STORY ABROAD- Afghanistan again: The Taliban announced that it completed its Afghanistan takeover, saying it captured the province of Panjshir, Reuters reports. The National Resistance Front of Afghanistan, which is based in the province, shared a tweet denying the Taliban’s claims.

|

FOR TOMORROW-

Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, which kicks off tomorrow and features Vice Minister of Finance Minister Ahmed Kouchouk. The conference will run until Wednesday.

???? CIRCLE YOUR CALENDAR-

It’s day two of the Arab Labor Conference, which is running through to 12 September at the InterContinental CityStars Hotel in Heliopolis. Government officials, ambassadors, trade union reps and business owners’ association delegates from 21 Arab countries are participating in the gathering.

It’s also the second day of the Arab Security Conference at the Nile Ritz-Carlton in Downtown Cairo. The cybersecurity conference will run until tomorrow.

Also taking place this week:

- The Egy Health Expo will take place on Tuesday at the Al Manara International Conference Center.

- The International Cooperation Ministry is hosting its inaugural two-day Egypt-International Cooperation Forum (ICF) this Wednesday.

☀️ TOMORROW’S WEATHER- Tomorrow will be the warmest day of the week, with highs of 37°C in the daytime and lows of 24°C at night. We’re not even sure if there’s anyone left in Sahel, but for those of you still out there, expect the mercury to max out to 31°C during the day and to drop to 23°C at night, our favorite weather app tells us.

A MESSAGE FROM BUPA EGYPT INSURANCE

Women employees feel their wellbeing is supported in the workplace following the negative impact of covid-19, our survey in association with Bupa indicated. Many women leave the workplace due to issues surrounding their health, but covid-19 has brought women’s health and wellbeing into even sharper focus. While many of our respondents believe their workplaces foster positive environments to support employee wellbeing, many of them agree that there is room for improvement.

While a few of them say that the lines between work and home are blurred, those that strive to prioritize their professional successes admit that many factors continue to impact their mental health with regards to their jobs. Businesses must listen and reshape by making reasonable adjustments that can boost efficiency and satisfaction across their work environments.

Click here to access the survey results and understand how women can bring their best to the workplace.

???? FOR YOUR COMMUTE

THE GOOD- High-risk patients with covid are less likely to be hospitalized when taking monoclonal antibody treatment, according to the results of recent studies by Mayo Clinic. Two monoclonal antibody treatments under Food and Drug Administration emergency use authorization — casirivimab and imdevimab — have been proven to reduce the risk of hospitalization by nearly 60-70% when combined according to a study that was conducted on 1.4k patients. Monoclonal antibodies are lab-manufactured proteins similar to those produced by the human body to fight infection. Those hospitalized were also less likely to be administered to the ICU and had a lower mortality rate.

THE BAD- Vaccination rates in the West are slowing to a trickle: Nine months after vaccines were rolled out in the US and Europe, 33 countries in the region have reported a more than 10% increase in infections in the two week case rate incidence, due in part to a relaxed attitude towards covid-19 in younger adults which has slowed vaccination efforts, according to CNBC. While some 69.2% of adults in the EU and 79.8% of adults in the UK are fully vaccinated, only 6% of people in lower and lower-middle-income countries in the Western Europe, Russia, and the surrounding region have been fully vaccinated.

THE UGLY- Business travel might not make its promised comeback as covid cases begin to increase again, according to the Wall Street Journal. Some companies are canceling their employees’ business trips and postponing their plans to return to the office with the spread of the delta variant. Subsequently, airports are seeing a slowdown in bookings with many trips being cancelled. Airports as well as hotels had hoped business travel — which they heavily depend on — would resume to its pre-covid levels in the coming months.

A call to ARM: The global semiconductor industry needs to rethink operations in the face of covid-induced disruptions that are likely to continue, Renesas Electronics CEO Hidetoshi Shibata told the Financial Times. The auto chip giant’s head criticized how automakers often halt production and institute quarantines each time there is a rise in new cases, but don’t offer a conclusive alternative to how the auto industry should live with covid. The semiconductor supply crunch has not been kind to automakers, with Volkswagen and Toyota among the many who cut production when they couldn’t access the needed parts. The shortage, caused by a spike in demand for electronics during the pandemic-induced lockdowns, could take years to be resolved.

The Theranos fiasco is not discouraging investors from blood testing devices, as they pour record sums into the sector, the Financial Times reports. Three startups have raised more than USD 200 mn over the past year to build blood-testing devices, while companies in the broader equipment diagnostics category raised USD 6.1 bn through the end of August this year. Startups are saying that the scandal surrounding Theranos, whose founder Elizabeth Holmes is currently on trial for fraud for claiming to have built such a device, pushed them to work harder to regain investors’ trust, and resulted in their work being held to a higher critical standard by investors, a fact that ultimately worked to their favour.

???? ENTERPRISE RECOMMENDS

Egypt draws with Gabon + It’s ‘80s week on the tube tonight

???? ON THE TUBE TONIGHT-

(all times in CLT)

It’s ‘80s week On The Tube Tonight and we decided to start with none other than Stanley Kubrick’s Full Metal Jacket — one of the greatest depictions of the Vietnam war. Kubrick directed two other great anti-war movies, Paths of Glory and Dr. Strangelove, but Full Metal Jacket lies on the other end of the spectrum, and is significantly darker than both. Structurally, the film is a two-in-one movie; the first act is an almost perverse coming of age tale following a Vietnam sergeant’s brutal initiation into army life. The second one expands onto the battlefield and hits on the dehumanizing military mindset that turns people into trained killers. You can watch it now on OSN on demand.

⚽ Libya will face off against Angola tomorrow in the world cup qualifiers, after Egypt secured a last minute draw with Gabon yesterday. Egypt currently leads the group with four points, followed by Libya, Gabon and Angola. Our next match will be with our neighbors to the west on 6 October.

???? OUT AND ABOUT-

(all times CLT)

Cairo Jazz Club 610 is hosting Salsa Night with Soul Motion Studio with Salsa instructors Rasha Sadek and Salah Eissa at 7pm, while Clay Lio / Hatem Zahran will be spinning their decks at the original Cairo Jazz Club at 8pm.

The GrEEk Campus is hosting a PS5 FIFA Tournament and VR Gaming Experience for three days in a row from 6pm to 9pm, starting today. First place winner will be rewarded with consoles and game activities sponsored by 3anqod and second place will get a PS5 for 3 days.

???? UNDER THE LAMPLIGHT-

Egyptian-Canadian writer Mona Awad releases one of the best books of the summer: All's Well is a novel that follows Miranda Fitch, a character who lost her job, husband, and sobriety after an accident that upended her life and left her with chronic back pain. When she decides to put her life back together, she sets her sights on delivering Shakespeare’s All’s Well That Ends Well at the college where she now teaches, despite obstacles standing in her way, convinced that the play’s success could offer her a vessel for redemption. The tragicomic book is a modern tale of dismissed female pain, and explores the feelings of desperation and obsession that can arise from putting all your eggs in one basket in search of validation.

???? GO WITH THE FLOW

The Market on 6 September

The EGX30 fell 0.3% at today’s close on turnover of EGP 1.7 bn (11.6% above the 90-day average). Local investors were net sellers. The index is up 2% YTD.

In the green: Fawry (+4.4%), Oriental Weavers (+2.5%) and T M G Holding (+1.2%).

In the red: Speed Medical (-13.5%), Egyptian for Tourism Resorts (-4.9%) and Raya (-4.9%).

???? CALENDAR

5-12 September (Sunday-Sunday): Arab Labor Conference, the InterContinental CityStars Hotel, Cairo, Egypt.

5-7 September (Sunday-Tuesday): The Arab Security Conference, The Nile Ritz-Carlton, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

13-21 September (Monday-Tuesday): 76th session of the general assembly, New York

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.