- You can sign up next week to be vaccinated, just as some 8.6 mn doses of the Oxford vaccine arrive in town. (Speed Round)

- Raya’s Aman to tap the country’s hot securitization market in 1Q2021. (Speed Round)

- The debt market has been good to EFG Hermes Corp Solutions. (Spotlight)

- Medical diagnostics in the spotlight. (Go with the Flow)

- Machiavelli wouldn’t make a good boss. (Office Life)

- It’s Sunday, so it’s all football, all the time. (On the Tube)

- Jack is in his grave, but the battle over who tanked GE marches on as Jeff Immelt releases his autobiography. (Under the Lamplight)

- Bank lending to SMEs isn’t just the right thing for the economy — it’s the right thing for shareholders, too. (Parting Shot)

Sunday, 21 February 2021

EnterprisePM — 8.6 mn Oxford jabs are due next week — and you’ll be able to put your name on the list online

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone — we hope the first day of the workweek has treated you well.

THE BIG STORY OF THE DAY- We’re getting mns of doses of a covid vaccine next week — and you’ll be able to sign up online to get jabbed. We have chapter and verse in this afternoon’s Speed Round, below.

HAPPENING NOW- Gulfood 2021 — the world’s largest food and beverage exhibition — kicked off today at the Dubai World Trade Center and will run all week. Some 55 Egyptian major Egyptian companies are taking part in the event, Ahram Online reports. This is apparently the first major live, in-person food and beverages industry event since the pandemic began.

*** CATCH UP QUICK on the top stories from this morning’s edition of EnterpriseAM:

- Are we closing in on a supply of Sputnik V after Russia said it would provide 300 mn doses to the African Union?

- Are direct flights from Moscow to Sharm and Hurghada back on — or not? There were conflicting reports this weekend.

- The academic year just got longer at public universities, with exams likely to run into August as the year is extended to make up for time lost to covid.

THE BIG STORIES ABROAD as we slide into day’s end: Israel has reopened large portions of its economy including malls and leisure facilities, Reuters reports, also noting that Facebook has “tentatively friended [Australia] again,” as the tech giant went back to the bargaining table. Meanwhile, Bloomberg is leading with the upcoming SPAC-enabled IPO of Lucid, an EV manufacturer backed by Saudi Arabia’s sovereign wealth fund.

Across the Atlantic, the WSJ warns that vaccination delays could see the appearance of more and more virus variants — and is running with a video suggesting Tesla’s quality problems are threatening its position in China. And last, but not least, Fortune picked up on a UK court decisions declaring that Uber drivers are workers — and so deserve minimum wage and paid leave. It’s the exact opposite of a ruling in California that suggests the “gig economy is coming for mns of jobs,” Bloomberg Businessweek writes.

Our mood right now? We’ll let the inimitable, immortal strip Calvin & Hobbes speak for us.

|

YOUR STATUTORILY REQUIRED COVID UPDATE: The Pfizer / BioNTech jab is highly effective after the first dose — and can be stored and transported in normal freezers (-25°C to-15°C) instead of the -80°C to -60°C recommended until now, Axios reports (or check out Pfizer’s statement).

That comes as G7 leaders said over the weekend that they may kick in another USD 4.3 bn to help emerging economies access vaccines.

GOOD NEWS- The US officially rejoined the 2015 Paris climate agreement on Friday as President Joe Biden reversed Agent Orange’s decision to exit the pact, writes CNN. Signatories to the accords agreed to limit the rise in global temperatures to less than 2°C and make efforts to limit it to 1.5°C. The Biden administration will announce its plans to reduce carbon emissions on 22 April, when the US will host a global climate summit to coincide with Earth Day.

Take it all as suggesting that “America is back”: Biden used the G7 summit and this weekend’s Munich Security Conference to “tick through a daunting to-do list … that he said would require close cooperation between the U.S. and its Western allies.” On the list: A nuclear Iran, the economic fallout from the pandemic and both economic and security challenges from China and Russia. The AP and NYT have more.

FOR TOMORROW-

The 2021 ISSF Shooting World Cup takes place here tomorrow, with participants loading up at 6 October’s Shooting Club. Over 300 shooters from 31 countries are participating and you can watch the competition live from ISSF’s YouTube and Facebook pages. The program includes mixed, individual and team events.

The Second Arab Land Conference kicks off tomorrow, with discussion focusing on land management, access to land for women and vulnerable groups, efficient land use, technologies and smart solutions, and private-sector participation.

???? CIRCLE YOUR CALENDAR-

The Donald will launch his political comeback a week from today when he plans to speak on the final day of the Conservative Political Action Conference in Florida, Reuters reports, citing a source who spoke on condition of anonymity. Expect plenty of the usual blah, blah, blah: “He’ll be talking about the future of the Republican Party and the conservative movement. Also look for the 45th President to take on President Biden’s disastrous amnesty and border policies,” the source tells the newswire.

Russia and Saudi Arabia are once again on opposite pages heading into next week’s Opec+ meeting. The summit, scheduled for Thursday, 4 March, sees KSA lobbying to leave output stable to support prices, while Russia is pushing for a supply increase, Bloomberg says.

???? FOR YOUR COMMUTE-

Do we have another epidemic to which to look forward? Russia has detected the world’s first cases of the H5N8 strain of bird influenza in humans, with seven people testing positive for the strain connected to a poultry farm in southern Russia, Bloomberg writes. Russia’s chief public health official is already sending a warning: “It is not transmitted from person to person. But only time will tell how soon future mutations will allow it to overcome this barrier … giving us all, the whole world, time to prepare for possible mutations and the possibility to react in a timely way and develop test systems and vaccines.”

All that’s missing is a misty bridge: Israel is (quite secretly) funding an unknown number of vaccines for Syria as part of a prisoner swap.

It’s bonus season for commercial and investment bankers around the world — and the outlook is decidedly mixed. European investment bankers are making … bank … with their 2020 bonuses, but commercial bankers? Not so much, the Financial Times reports. Credit Suisse and Barclays boosted payouts, while Italy’s Intesa Sanpaolo, Germany’s Commerzbank and the UK’s Lloyds have all slashed bonuses. HSBC is set to announce its bonus plans on Tuesday and Standard Chartered on Thursday. Corporate and consumer divisions are taking it on the chin, the salmon-colored paper writes. It’s a mixed picture across the pond, where traders and investment bankers “have flourished despite the global economic crisis,” the Wall Street Journal notes, yet most Wall Street bankers are in line for lower bonuses.

That probably means it’s prime time to go talent hunting: Pronounced disparities in how individual banks perform (and reward their staff) will set up a situation that sees “weaker franchises lose more talent to stronger ones than in the aftermath of a normal bonus season” EFC predicts.

No, damnit, your mobile will not make the benzina blow up. Don’t believe the good people at Jalopnik? Perhaps we can all agree to trust the US industry association for the folks who provide equipment to petrol stations? Or the US Federal Communications Commission? Don’t bother trying to explain this to the kids at your local filling station. They’re just doing their job. And besides, you can definitely do without your electronic pacifier for the five minutes it takes to fill up and pay. Heck, the one thing we miss the most about flying? Being able to guiltlessly disconnect from the internet for the duration of the flight.

???? ON THE TUBE TONIGHT-

⚽️ It’s Sunday, so it’s all football, all the time. Let’s start with Egypt’s Pyramids FC facing off against Cote d'Ivoire's Racing D'Abidjan Club at 6pm CLT for the CAF Confederation Cup’s second leg.

The Egyptian League is also on today with three matches: El Gouna and Al Mokawloon are already on the field, while Ismaily will play against Enppi at 5pm CLT and Al Ittihad will play against Aswan at 7:30pm CLT.

Premier League, Serie A, and La Liga each have four matches on today: In the Premier League, West Ham and Tottenham should be finishing up their match as we dispatch this issue, but you can still catch Aston Villa and Leicester City at 4:05pm CLT, Arsenal and Man City at 6:30pm CLT. Man United and Newcastle will hit the field at 9pm.

Parma and Udinese kicked off Serie A today at 1:30pm CLT, while AC Milan and Inter Milan will face off at 4pm CLT, Atalanta will play against Napoli at 7pm CLT, and Beneveto and Roma will play at 9:45pm CLT.

Barcelona and Cadiz started playing at 3pm CLT in La Liga, Real Sociedad will play against Alaves at 5:15pm CLT, Huesca will face off Granada at 7:30pm CLT, and Athletic Club and Villareal will hit the field at 10pm CLT.

KUDOS- Egypt’s national basketball team has qualified for FIBA AfroBasket 2021 after an undefeated streak in all Group E matches. Egypt is playing a final match against Morocco as we dispatch, but the score currently stands at 84-59 in favor of Omm El Donia, so we’re expecting our b-ball team’s streak to continue.

EAT THIS TONIGHT-

Don’t eat junk food. Easier said than done when you have the munchies after dark, but the very smart Anahad O’Connor at the New York Times notes that our favourite comfort foods can elicit “intense cravings, a loss of control, and an inability to cut back” — they’re not just bad for us, they’re addictive.

At the top of the list? Our favourite food groups, including pizza, chocolate, potato chips, cookies, ice cream, French fries and cheeseburgers.

Try a low-carb comfort food instead — like these ridiculously good and fantastically easy creamy scrambled eggs. The secret ingredients? A tiny bit of cornstarch and some cold butter. J. Kenji López-Alt takes a deep dive into the science of scrambled eggs, or you can just jump ahead to the recipe here.

???? OUT AND ABOUT-

An exhibition of handmade products entitled Deyarna is on at Cairo Festival City in New Cairo. The exhibit is organized by the Sawiris Foundation for Social Development and is on from 10am-10pm everyday until Thursday. A tip on how to find it: Head towards the parking lot that leads you to the back of the dancing fountain, then keep an eye out for the big white tent.

Jazz group Tonic Quartet are on at Cairo Jazz Club in Agouza tonight at 9pm CLT, promising a tranquil night to kick off your week.

???? UNDER THE LAMPLIGHT-

For true business nerds (of a certain age): The guy who had to preside over the (downfall? diminution?) of GE is out with a memoir. Jeff Immelt had a tough act to follow: 1990s / early 2000s business legend Jack Welch at GE, a guy lionized by Wall Street and the business press alike who passed away last March. Fortune’s Geoff Colvin chronicled Welch closely and spoke for many when he wrote in the man’s obit that “blaming an ex-CEO for trouble 16 years after his departure surely violates some reputational statute of limitations.”

But Immelt seems to make a decent case that his predecessor should share responsibility for what has become of GE. In a preview of the book, the Wall Street Journal notes that “Immelt says that many of GE’s problems were inherited. ‘I’d become CEO of a company where perception didn’t equal reality,’ he writes. GE’s shares were overvalued, high returns from its pension funds inflated earnings, and the company relied too heavily on its financial division, GE Capital, which contributed nearly half the firm’s earnings in 2001 by loading up on debt and becoming overleveraged in the ins. business.”

Hot Seat: What I learned leading a great American company is out on Tuesday. You can pre-order it on Amazon or read Colvin’s What the Hell Happened at GE? wherein he argues that while “few corporate meltdowns have been as swift and dramatic as General Electric’s, the problems started long before.”

???? TOMORROW’S WEATHER- The outlook for tomorrow is beautiful: Sunny skies with cloudy periods and a high of 20°C. Tonight may be chilly, with a low of 8°C

And it looks like we may be in for rain on Tuesday, with our favourite weather app calling for as much as 5mm of the wet stuff in the capital city and a daytime high of 18°C. The national weather service is calling for high winds in Cairo on Tuesday and a 70% chance of rain in Sinai (falling to 50% along the Mediterranean coast).

SPEED ROUND: COVID WATCH

We can register for our covid jab starting next week as 8.6 mn doses are set to arrive

Egyptians can register to take a covid-19 vaccine starting next week on the ministry’s website, Health Minister Hala Zayed said at a press conference today (watch, runtime: 18:44). Priority will go to the elderly and people with chronic illnesses, the minister added, saying the ministry has set up vaccination centers in 27 governorates nationwide. Zayed said folks who take the jab will be asked to contact the ministry to report any adverse reactions.

The news comes as Egypt expects to receive c. 8.6 mn doses of the Oxford-AstraZeneca vaccine by next week as part of the agreement signed with Gavi (the Vaccine Alliance) which will see Egypt receive 40 mn doses of the AstraZeneca jab during 2021, Zayed added. We’re also expecting to receive a shipment of China’s Sinopharm vaccine “as a gift” within the next few hours, she said. The ministry will announce more details when the batch lands.

SPEED ROUND: DEBT WATCH

Raya’s Aman to tap securitization market in 1Q2021

Raya subsidiary Aman is planning to take EGP 600 mn in securitized bonds to market before the end of the quarter, Raya’s CFO Hossam Hussein said. The sale will be open to qualified institutional investors, banks, and other financial institutions, and will be split into tranches with tenors ranging from six months to over five years, Hussein noted. The company plans to use the proceeds to fund its expansion plans in 1H2021, he added, without providing details on planned investments.

Advisors: CIB and the National Bank of Egypt as lead managers and promoters and Dreny and Partners Law Firm as counsel. UHY, meanwhile, will act as a financial advisor and auditor.

Raya’s debt fund isn’t part of the plan: The issuance is a traditional offering of securitized bonds that receive a credit rating and are taken to market through an SPV — the company isn’t bringing in a fund it is planning to set up as an alternative to traditional securitization, Ahmed NourEldin Hassan, Raya’s head of corporate finance and investment, told us. Sources said earlier this month that Raya is mulling setting up a “movable assets” fund that would raise money to fund non-banking financial services (NBFS) companies by investing in their portfolios, including Raya’s own subsidiaries. Chatter in the market was that Aman could sidestep a traditional offering and instead tap the fund. Hassan says while Raya is still interested in the fund, it’s still weighing “the pros and cons.”

Unclear on what securitization is? Enterprise Explains has your back.

Securitization isn’t the only thing in Aman’s pipeline: The company has plans to debut on the EGX. It’s targeting an initial public offering in the coming two years, by which time it hopes to have captured more market share.

SPOTLIGHT

The debt market has been good to EFG Hermes Corp Solutions

Talal Elayat, CEO of EFG Hermes Corp-Solutions, on the firm's plans for the debt market: The non-banking financial services (NBFS) sector has done well despite pressure from the covid-19 pandemic, including the near shutdown of the market in the early days of corona and a holiday on repayments ordered by the regulator. A stress test (pdf) conducted last year by the Financial Regulatory Authority to gauge the sector’s resilience showed that institutions’ financial positions were “robust” and remained sufficiently liquid to cope with the effects of the pandemic.

One company that didn’t suffer from covid was EFG Hermes Corp-Solutions, whose leasing and factoring services saw a surge in demand over the 12-month period. We sat down with the company’s CEO, Talal Elayat, to find out more about how it has coped with the challenging conditions, the state of the NBFS sector, and its plans for the future.

Key takeaways:

- 2020 was a strong year for Corp-Solutions;

- Its total portfolio grew 55% and its factoring portfolio more than doubled;

- It is planning to securitize EGP 500 mn of its portfolio later this year;

- It wasn’t just banks investing in EFG’s latest issuance;

- The company has kept bad loans below 1.6% of its portfolio despite the pandemic.

Edited excerpts of our conversation:

Corp-Solutions brushed off the pandemic in 2020: In mid-2020, EFG Hermes merged its leasing & factoring services under one entity, setting it up for a year in which it improved its market position despite the pandemic. EFG Hermes Corp-Solutions’ combined leasing and factoring portfolio reached EGP 6 bn by the end of 2020, jumping 55% y-o-y, with the majority (EGP 5.1 bn) coming from leasing, while factoring took EGP 800 mn.

And the company made its play for Egypt’s factoring market: The factoring business, which we launched in 2018, grew around 120% last year. The majority of the customers are with the leasing arm, but last year we started to build on our existing customer base and expand the factoring arm. (Factoring is where you sell a middleman your unpaid receivable, taking funding today but leaving some of it on the table for the middleman to make a margin. Sound complicated? We have your back in Enterprise Explains: Factoring.)

Corp-Solutions isn’t focused on a particular sector or client base: We aim to tap all sectors rather than prioritizing one over the other, but we are giving more attention to the industries driving the Egyptian economy. These include healthcare, education, construction, and fintech. As far as our client base goes, we’re pushing back our plans for increased targeting of SMEs — one of our goals since our inception — due to the pandemic and until the market stabilizes.

When life gives you lemons… The pandemic was full of uncertainties due to the partial lockdown of the economy, but it opened up potential mergers, acquisitions, and new investments. We’ve taken this time as a chance to support a large number of entities with their financing needs, resulting in more customers and an expansion of our loan book.

Central bank stimulus helped to support the NBFS sector through covid: The Central Bank of Egypt (CBE) certainly had a big hand in stabilizing the market last year with its monetary stimulus measures. Its debt relief initiative, which delayed loan repayments for individuals and businesses, and the interest rate cuts it enacted helped the market to grow.

How bad were NPLs thanks to covid? Corp-Solutions is closely monitoring its clients to align their plans and mitigate risks. As a result, the company’s non-performing loans (NPLs) did not exceed 1.6% of the overall portfolio in 2020. Looking ahead, we’re aiming to trim our NPLs by growing our portfolio, bolstering our client relationships by offering support and different solutions. All of this, however, is subject to market conditions stabilizing.

Elayat welcomes the prospect of lower rates: Further cuts would unlock capex borrowing and encourage companies in expansion. It would also improve competitiveness for local NBFS players due to the lower cost of borrowing.

Egypt’s debt securities market is booming: The securitization market saw significant growth in 2020 and will maintain this uptrend this year as players look to reduce exposure of their balance sheets and diversify their funding mix. Diversifying the investor base away from banks is also important for the development and liquidity of the debt capital market.

EFG Hermes is planning a EGP 500 mn issuance in 2H2020: Corp-Solutions is looking to tap capital markets once again following a successful first issuance a few years ago. We're looking at an issuance worth EGP 500 mn as part of a larger program in 2H2020. But it won’t be limited to the sale of receivables.

Bringing retail investors into the securitized bond market: Diversifying the investor base away from banks is important for the development and liquidity of the debt capital market. The recent securitized bond issuance led by EFG Hermes on behalf of Hermes Securities Brokerage (HSB) saw participation from a diverse base of retail investors including high net worth individuals and corporates. With the Financial Regulatory Authority (FRA) and the CBE pushing to enhance the market and the funding mix, the company hopes to see more retail investors participating in the market in the near future.

GO WITH THE FLOW

Medical diagnostics in the spotlight

The EGX30 rose 0.4% at today’s close on turnover of EGP 1.25 bn (13.5% below the 90-day average). Foreign investors were net sellers. The index is up 5.4% YTD.

In the green: Pioneers (+4.7%), Ezz Steel (+3.5%) and Ibn Sina Pharma (+3.1%).

In the red: Orascom Financial Holding (-5.3%), Cleopatra Hospital (-2.9%) and Orascom Investment Holding (-2.3%).

Medical diagnostics in the analysts’ spotlight: Buy- and sell-side folk alike have had strong interest in Speed Medical over the past year, and it’s hard not to wonder whether it’s in part because shares in market leader IDH are just so illiquid. That fact, after all, is what’s pushing the LSE-listed company to look at bringing some of its shares home to trade on the Egyptian Exchange later this year.

As we noted this morning, IDH said it would beat its FY2020 guidance as it looks to report a top line of about EGP 2.6 bn with an EBITDA margin of 40%. It had previously said it would deliver revenues in the EGP 2.3-2.4 bn range.

Speed has played a solid game creating appetite for its shares and became the first company to make the leap from the Nilex to the EGX in the process. But as Prime’s Amr El Alfy wrote in a note to clients this morning, the upstart is looking expensive, currently trading at trailing 12-month P/E of 41x. Prime estimates that “for the stock to trade at 15x 2025 P/E, earnings will have to grow at a 5-year CAGR or 23%, perhaps questionable once COVID-19-induced boon subsides.” The bottom line, El Alfy writes: “We believe the earnings boost SPMD is witnessing is only transitory and linked directly to COVID-19.”

EARNINGS WATCH- Al Tawfeek for Financial Lease (AT Lease) saw a 10.1% y-o-y hike in net profit in 2020 to EGP 74.1 mn, the company reported to the EGX (pdf). AT Lease’s revenues also rose, reaching EGP 97.9 mn in 2020 from EGP 91.8 mn in 2019.

Egyptian Media Production Company’s (EMPC) net profit fell 1.72% y-o-y in 2020 to around EGP 103 mn from EGP 105 mn in 2019, according to the company’s financials (pdf). Meanwhile, EMPC’s revenues rose 8.6% y-o-y in 2020 to EGP 468 mn from EGP 430 mn the year before.

Abu Dhabi Islamic Bank Egypt (ADIB) saw net profits in FY2020 fall to EGP 1.19 bn from EGP 1.23 bn in FY2019, the bank announced in a bourse filing.

Egyptian Transport and Commercial Services (Egytrans) saw its net profits decline 50% y-o-y in FY2020 to EGP 13.1 mn, the company said in a bourse filing (pdf). Revenues declined 13.4% y-o-y in FY2020 to EGP 316.1 mn.

OFFICE LIFE

Machiavelli wouldn’t make a good boss

Why a ruthless attitude isn’t always the best approach in management — particularly in the long run: The workplace may not be the right place to apply the “nice guys finish last” saying, and taking a constantly Machiavellian approach with employees can sometimes lead to a company coming up short, writes David Bodanis for the Financial Times.

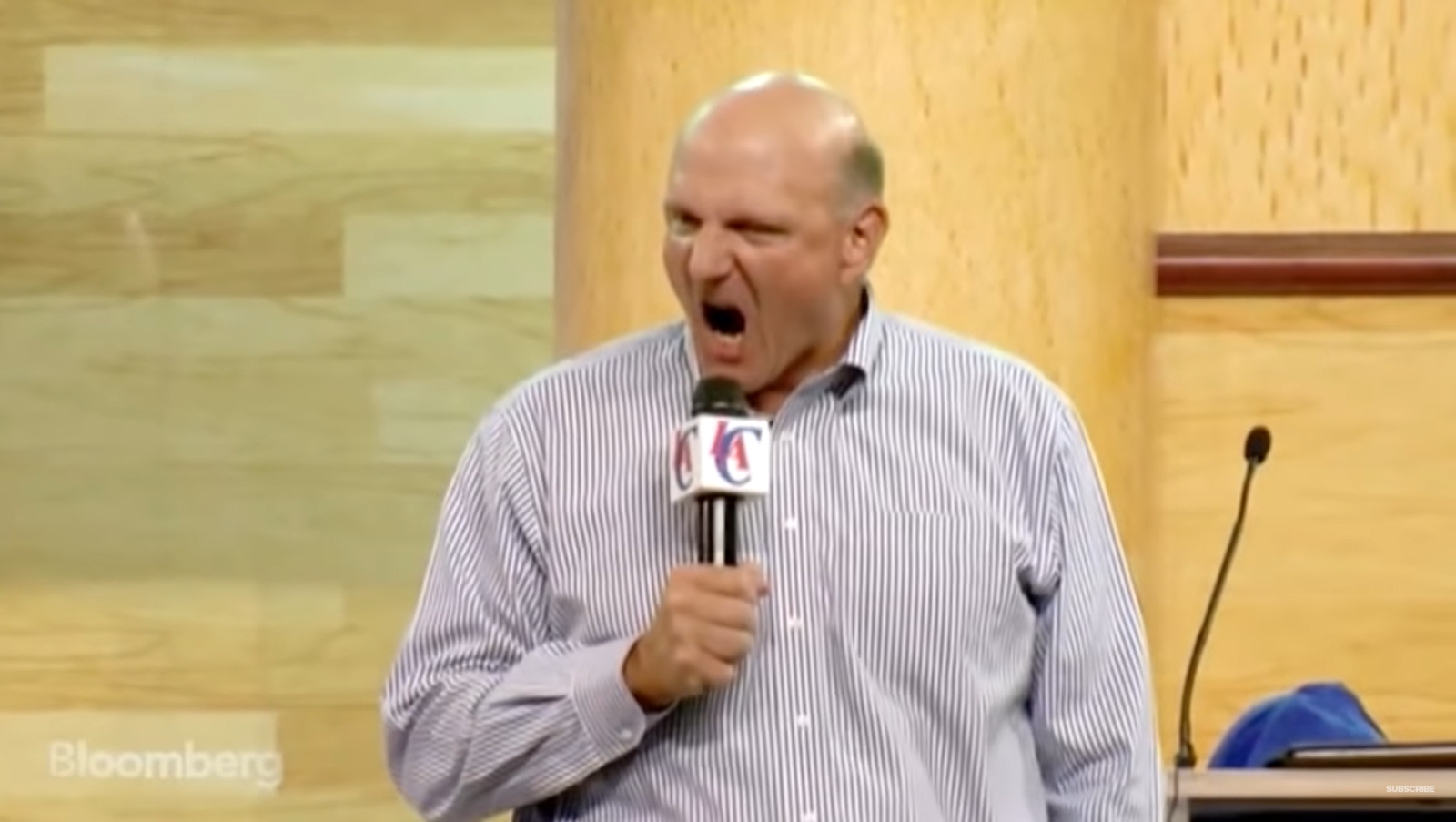

Introducing Exhibit A: We’ve seen it happen in big-name corporates like Microsoft, which was under Steve Ballmer’s helm between 2000-2014. Ballmer was quick tempered and lacked personal charm and was named “the worst CEO of a large publicly traded American company” by Forbes Magazine in 2012. With employees harboring resentment and ultimately shying away from approaching the CEO, Microsoft missed out on chnces to pursue smartphones, social media, key aspects of the cloud and other significant developments in tech during his tenure. (We dare you to watch how legendary Balmer’s yelling can get on full volume here and here.)

His successor, Satya Nadella, took a more considerate approach and has been credited with helping Microsoft rise to be one of the more profitable companies in the world. He was named the FT’s Person of the Year in 2019.

The keyword to keep in mind as a manager? Fairness: A skillfully applied fair approach is far more effective in managing a team, argues Bodanis — the author of The Art of Fairness. This style of management rests on three principles: Listening, giving, and defending. As a superior, there’s still plenty to learn from your employees and putting your ego aside could help you tap into fresh knowledge. Fostering a culture of working together, rather than working for individual benefit, helps boost company morale and team spirit.

While Bodanis makes the argument for being generous with your team, that doesn’t mean going on a bonus bonanza is a good idea. Balance is key to avoid being taken advantage of. Finally, while leaders should defend their viewpoints and decisions, Bodanis cautions against being overly defensive, encouraging managers to instead work to see and better understand other perspectives. This will help open gateways, and create alliances in the workplace.

Above all else, be a mentor. This starts by taking the time to connect with employees by possibly adding a “gratitude block” to your calendar to let workers know you appreciate them as individuals and as part of the team, Faiza Hughell writes for Entrepreneur. By understanding employees’ life outside of work, managers will become mentors by knowing how to help and advise. In small businesses particularly, every team member can have a ripple effect on the rest of the staff. When one colleague is having a bad day, everybody feels it. When someone is on vacation, everyone else needs to pick up the slack. Managers need to excel at more than delegating tasks — managing relationships and employees as people is just as important. When people feel they belong and appreciated, they tend to perform at a higher level.

That doesn’t mean you should micromanage: Too much help could be unnecessary or unwanted. How to help without being a helicopter manager? Get the timing right, clarify that you’re helping and not trying to point out bad performance on the employee’s part, and clear a path for them to get a handle on issues, The Harvard Business Review says.

PARTING SHOT

Banks need to get their acts together when it comes to SME lending — not because it’s the right thing to do for the economy (it is), but because it’s the right thing to do for their shareholders.

An AUC study we noted this morning said the solution lies (to varying degrees) in NBFS players, in teaching bank staff how to allocate credit, and in looking at the central bank-led programs that are pushing SME lending.

But that’s a mis-diagnosis of the problem, which stems not from a lack of CBE leadership or bad loanmaking skills on the part of bankers. Rather, the problem is that banks are run by people — and people naturally choose the path of least resistance.

The Central Bank of Egypt has (largely) done its part, mandating that loans to SMEs make up a set minium at every institution and providing banks with subsidized funding for onlending. Yes, non-bank financial services — factoring, leasing, merchant finance and more — could well fill the gap, as the authors of the AUC study suggested. But if banks allow it to happen, they’ll be missing out on a generational chance in our very under-served market.

SMEs are the mainstream of economies the world over — they’re also expensive to reach and expensive to bank. Globally, the pattern holds: Banks in EM chase small businesses only once they’ve cornered the market on easier, more predictable returns loaning to big business (and to governments). And they meet success only when they learn to speak the language of SMEs instead of shoe-horning them into operations originally designed to serve either large corporate clients or individual customers.

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

21-25 February (Sunday-Thursday): Gulfood 2021 — the world’s largest food and beverage exhibition — takes place at the Dubai World Trade Center.

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

26-28 February (Thursday-Saturday): The second edition of the Egypt International Art Fair will be held at Dusit Thani Lakeview Cairo.

27 February (Saturday) — Mid-year school break ends for public schools and universities.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

March: CBE / FRA fintech “innovation sprint.”

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

4 March (Thursday): OPEC+ meeting.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Union of Arab Banks holds a forum on compliance and combating financial crime, Sharm El Sheikh.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.