- The gov’t has unveiled a three-stage plan to fully reopen the economy. (Speed Round)

- Daily new covid case count falls again to 338, bringing the total cases to 10,431. (What We’re Tracking Today)

- Egypt wants another USD 9 bn in funding from IMF + other int’l lenders. (Speed Round)

- Egypt’s economy to grow 3% next fiscal year after “sharp” slowdown in 2020; growth will bottom out at 0.5% this calendar year -EBRD. (Speed Round)

- Cabinet approves bill waiving late fees on taxes. (Speed Round)

- South Africa’s Tana Capital bids for 25% stake in Mabaret Al Asafra Hospitals. (Speed Round)

- Digital lender Shahry raises USD 650k in pre-seed funding. (Speed Round)

- The impending EM debt crisis is going to be messy, the chattering class suggests. (The Macro Picture)

- The Market Yesterday

Thursday, 14 May 2020

Gov’t unveils three-stage plan to fully reopen the economy

TL;DR

What We’re Tracking Today

It’s big news morning to end the workweek week as we all prepare to (very gratefully) slide into the weekend:

- The Health Ministry has released a three-stage plan to re-open the economy at the same time as the government is lining up another USD 9 bn in foreign funding to shore up foreign reserves in the face of the pandemic.

- The Madbouly government is asking us all not to lay off staff.

- It’s interest rate day and the expectation is that rates will be left on hold.

- US Fed chairman Jay Powell spooked global markets by telling the truth: We’re looking at a long, slow, painful recovery.

- Europe and the UAE are looking to salvage something of the summer tourism season.

The plan to reopen the economy leads this morning’s Speed Round, followed by a rundown on how policymakers plan to shore up FX reserves.

Let’s get started?

The government has launched a campaign to discourage layoffs in the private sector, with our friends Ahmed El Sewedy (Elsewedy Electric) and Ahmed Heikal (Qalaa Holdings) out in front on this one, according to a statement (pdf). You can watch the campaign video here (runtime: 1:04).

It’s interest rate day: The Central Bank of Egypt’s Monetary Policy Committee meets today to review interest rates. Ten of the 12 analysts in our regular poll are predicting that rates will be left on hold.

***PLEASE LET US KNOW how covid-19 is impacting your business. We run an annual reader poll asking what you expect of business conditions and the economy in the year ahead. Covid-19 has us thinking that the results of this year’s survey need updating. Take a minute and tell us how covid-19 has impacted your business, whether it’s changed your outlook on the economy, and what you think of WFH. We’ll have the results for you immediately after the Eid.

So, when do we eat? Maghrib prayers are at 6:41pm and you’ll have until 3:22am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

COVID-19 IN EGYPT-

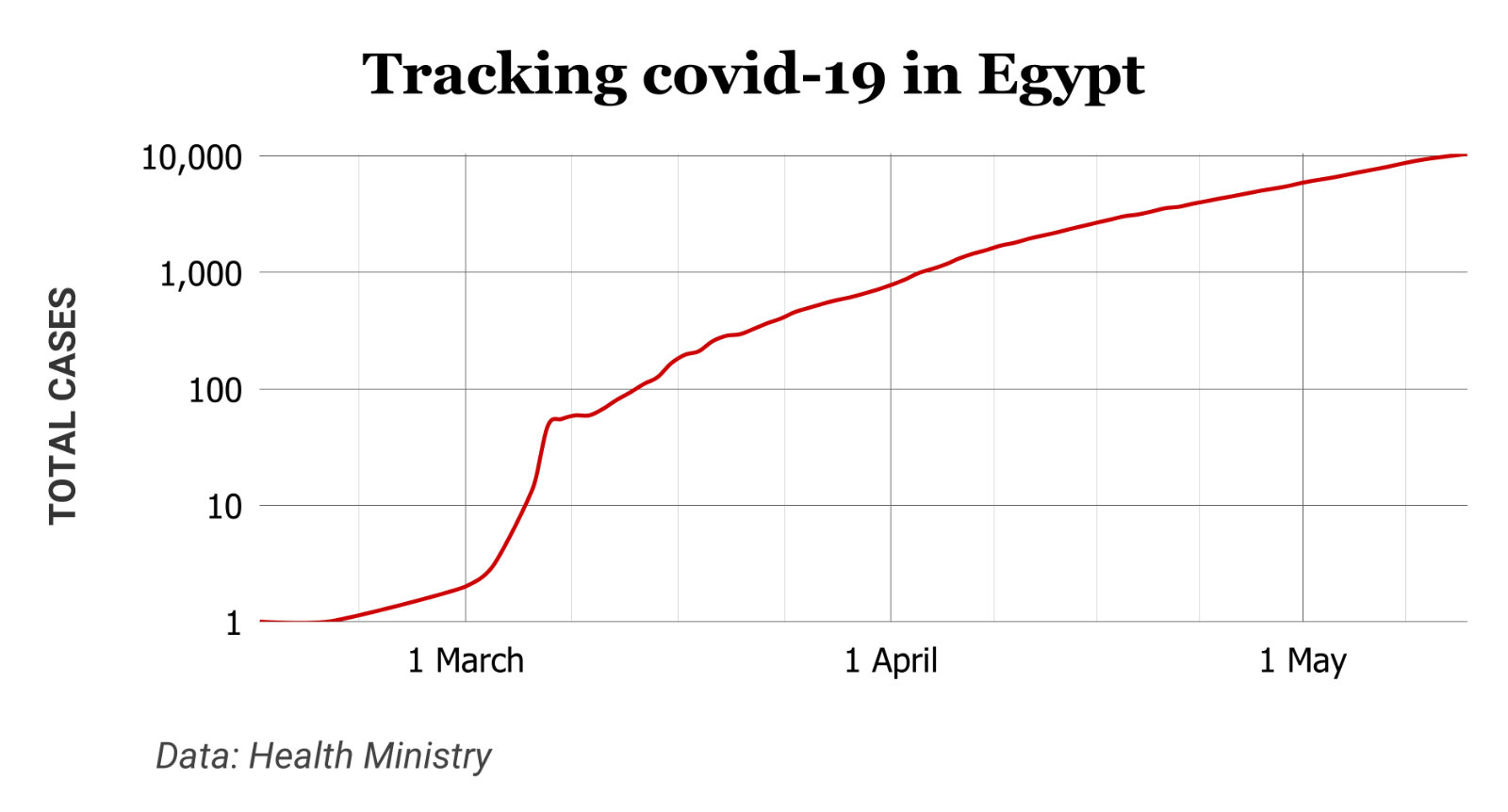

Egypt has now disclosed a total of 10,431 confirmed cases of covid-19 after the Health Ministry reported 338 new infections yesterday. The ministry also said that another 12 people had died from the virus, taking the death toll to 556. We now have a total of 2980 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 2486 have fully recovered.

Healthcare workers are feeling the stress, with the Medical Syndicate calling on authorities to repeal “dangerous” new guidelines that instruct health workers not to get tested for the virus unless they show symptoms. The call comes after reports that as many as 130 medical professionals at Al Azhar-associated hospitals are infected, Al Azhar University Vice President Mahmoud Sedik, according to Masrawy.

Separately, a university hospital in El Matareya also reported 19 new infections among its employees yesterday, Al Shorouk reports.

Hotels can choose to reopen starting tomorrow at a cap of 25% occupancy that could be raised to 50% in June if things go well. Operators face a laundry list of common sense protocols as a condition of reopening. Violators could have their licenses pulled and face a two-year closure order, Red Sea Governor Amr Hanafy told ‘Ala Mas’ouleety’s Ahmed Moussa on Tuesday (watch, runtime 6:05).

A “curfew” could be in place after Eid running from 11pm to 6am (also known as: When Normals should be sleeping, anyway) as part of the government’s package of measures to contain the spread of covid-19, says well-connected MP and former journalist Mostafa Bakry in a piece from Ahram Online’s Gamal Essam El Din that is very much worth a skim if you’re looking for insight into where parliamentarians’ heads are on the coronavirus.

The Finance Ministry is using covid-19 as cover to go after businesses selling online without charging and remitting VAT, a report in Al Mal suggests. The drive is specific to unlicensed businesses marketing themselves online, but readers should see this in the context of the state’s ongoing (and very sensible) push to ensure that ecommerce and online ad buys are subject to the same taxes as offline commerce.

Contractors will be able to apply for help under the central bank’s EGP 100 bn stimulus initiative for select industries to help them survive the fallout from covid-19, the CBE said yesterday. Companies need to have turnover of at least EGP 50 mn per year to qualify. Meanwhile, the unfortunately named FEDCOC continues to (sensibly) call for the CBE to expand its low-interest subsidized loan initiative to cover the retail and service sectors, Masrawy reports.

Meanwhile, construction at the new capital is moving forward at full steam, Reuters quoted officials as saying. Fewer workers are present on site, with work being stretched over two shifts. President Abdel Fattah El Sisi last month postponed to 2021 the inauguration of all national projects, including the new capital, due to the outbreak. Government employees were due to move in next month.

DONATIONS-

Our friends at GB Auto alongside TVD — its JV with El Ghalban Auto Market Group — have donated 20 pickup trucks to the Health Ministry, GB said yesterday.

Lafarge Egypt is contributing to repairing 460 ventilators at public hospitals, in addition to covering the expenses of 2k food boxes the Egyptian Food Bank is distributing to day laborers in Qalyubia, according to a press release (pdf).

Al Ahly Sabbour for Real Estate Developments has donated EGP 4.5 mn worth of ventilators and PPE, as well as 12k food boxes worth EGP 3 mn, to covid-19 front line workers, according to a cabinet statement.

ON THE GLOBAL FRONT-

The global tourism industry is desperate to reopen before it misses the northern hemisphere’s critical summer season.

Emirates Airlines is resuming service to Heathrow, Frankfurt, Paris, Milan, Madrid, Chicago, Toronto, Sydney and Melbourne, the company said in a statement yesterday. The news came as Dubai reopened public parks and private beaches for hotel guests while limiting gatherings to groups of five, the state news agency WAM reported.

The EU will try to reopen borders to avoid losing out on the lucrative summer season, but prospects are mixed over fears for health and safety, an EU commission deputy, Margrethe Vestager, said yesterday, according to Reuters. A proposal seen by Euractiv would ease travel restrictions in phases to reopen borders with “similar risk profiles.”

If this is nudging you to bring back the Eurotrip plans you shelved in March, here’s what you should know.

Canada and the US, meanwhile, look set to leave their border closed to all non-essential travel until 21 June, the Globe & Mail reports, citing unnamed government sources.

Air traffic won’t return to pre-covid levels until 2023 at the earliest, the International Air Transport Association (IATA) said yesterday, suggesting the 8k job cut at LSE-listed global travel operator TUI could just be the tip of the iceberg. TUI chief Fritz Joussen told reporters that the company plans to begin taking bookings for European holidays in July and that the industry might not make a full recovery until 2022.

GLOBAL MACRO-

The pages of the financial press were adorned with Jay Powell’s face for much of yesterday: In a webcast for the Peterson Institute yesterday the Fed chair had some choice words about where he sees the US economy going and what lawmakers should do to prevent the situation from getting any messier.

- Prepare for an “extended period” of weak growth: Contradicting the widespread optimism for a rapid economic recovery, Powell warned that immediate growth prospects were dire and it will take “some time” before the economy finds its feet. (Reuters)

- The US needs to get its act together and pass new fiscal measures: Congress and the White House need to agree on further fiscal support to prevent an extended recession. “Additional fiscal support could be costly but worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery,” he said. (Washington Post)

- Negative rates are a no-go: The Fed chair pushed back on growing market speculation that the central bank could cut rates below zero if push came to shove. “The committee’s view on negative rates really has not changed. This is not something we’re looking at,” he said. (MarketWatch)

None of this went down too well with the markets: US stocks dipped to a three-week low on Powell’s comments. The S&P 500 closed 2.2% in the red and the Dow lost 1.75%.

Chinese officials are considering pulling out of the trade pact with the US: President Trump has rejected the prospect of reworking the first phase of the US-China trade agreement after Chinese state media reported that officials in Beijing are considering pulling out of the pact and renegotiating terms, Reuters reports. Unnamed Chinese trade officials told the Global Times that there is growing dissatisfaction over the terms of the agreement in Beijing, with some in the government calling for a complete renegotiation of the pact. The news comes as new figures revealed the two countries are pulling investments at a startling rate, the Financial Times notes.

AND THE REST OF THE WORLD-

It’s a fire sale at NMC Health: The UAE’s troubled healthcare provider has begun selling off assets as it tries to raise money to repay its creditors, Bloomberg reports. The company is planning to sell its distribution business, its fertility unit, and even its hospital business — the largest private healthcare provider in the region. The situation at NMC, once traded on the FTSE 100 with a USD 11 bn market cap, began to unwind in recent months after an internal investigation revealed evidence of fraudulent accounting.

It’s Making It day: Episode four of the second season of our podcast on building a great business in Egypt is out today. We will be taking a short break for the Eid weekend, and resuming on May 28th.

Sahar Salama, founder and CEO of TPay: As a software engineer who worked on consumer billing solutions for telecom companies, Sahar Salama has built the infrastructure that’s helping mns with cellphones — but no bank accounts — get online. Launched in 2014 in Egypt, Saudi Arabia and the UAE TPay helps consumers and businesses transact through direct operator billing. Before 2014, online payment options were sparse. Today, TPay is one of the region’s leading fintech companies specializing in enabling digital payments through mobile phones, operating in 18 markets across MENA covering almost 51 mn transactions a day.

Salama spoke to us on the importance of anticipating a business opening and getting a technological headstart to capitalize on it. Through her experience scaling her company from three to eighteen markets, she also discussed the importance of forming strategic partnerships that are right for scaling your business.

Tap or click here to listen to the episode on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

Enterprise+: Last Night’s Talk Shows

‘Ala Mas’ouleety host Ahmed Moussa had the floor to himself last night, airing interviews with central bank deputy governor Ramy Aboul Naga and Transport Minister Kamel El Wazir.

Foreign investors have pulled USD 17 bn out of Egypt since the beginning of the covid-19 crisis in March, CBE Deputy Governor Ramy Aboul Naga told Moussa last night. Capital flight peaked in March before easing in April, he said. Aboul Naga reassured that the country has enough reserves and cash on hand to meet its import needs for the next seven months. Egypt’s foreign reserves have fallen by USD 8.5 bn over the past two months as the CBE responded to the accelerating portfolio outflows, made debt repayments and bought strategic goods. Watch the full interview here: (watch, runtime: 46:50)

Delivery of Russian railcars faces delays due to covid -El Wazir: Egypt will not receive the first batch of railcars from Russian manufacturer Transmashholding before 30 June due to disruption caused by the pandemic, Transport Minister Kamel El Wazir told Moussa last night. The government was expecting to receive 100 units before the end of next month, the minister said, before suggesting that 34 might arrive “soon.”

Transport Ministry to set up new factory in Port Said: The ministry will work with international companies to establish a new factory in Port Said that will manufacture primarily electric and monorail train cars and spare parts for the nation’s railways and metro lines. Check the full interview here: (watch, runtime: 58:18)

Speed Round

Speed Round is presented in association with

Egypt will reopen in three phases under a plan released last night by the Health Ministry. Cabinet spokesman Nader Saad suggested earlier this week that the plan would go into effect on 1 June, but the document released last night does not really make clear when phase one begins — look for an announcement on that front later today.

The highlights:

- Phase one includes a raft of measures including requirements that staff at all businesses wear face masks in the workplace. It remains in effect for at least two weeks.

- Phase two starts after we see 14 days of declining day-on-day counts of new cases in phase one. Measures for the general population and for specific industries will ease over a 28 day period provided there’s no spike in new cases.

- Phase three is probably best described as “watchful waiting” with light precautions in place until the World Health Organization gives the all-clear.

You can tap or click here to read the full plan in pdf format.

The ministry’s timetable makes no mention of what will happen to the nighttime curfew, which the Madbouly government last week extended through 26 May, when Eid El Fitr ends.

Also unclear: The plan makes no mention of when:

- Egyptian airspace will reopen to regular commercial flights;

- Public-facing government services including passport and visa issuance will resume;

- Mosques and churches will reopen.

Here’s what to expect:

The kids are not going back to school, university or nursery anytime soon. They’re closed “during the pandemic,” the plan says without detail on the phase in which they might be allowed to reopen.

You’re not going to go back to the gym, either. Gyms, sporting clubs, cafes, cinemas, theaters and other entertainment venues are also closed “during the pandemic,” the plan says. Large gatherings for weddings and funerals will remain prohibited.

The picture is less clear when it comes to restaurants: It seems they will only be allowed to open for takeout and delivery in phase one before dining rooms open with a cap at 50% occupancy in phase two.

PHASE 1: You’ll need to wear face masks in the workplace, including factories and offices, and everyone will need to wear masks in public places, including in shops and on public transportation. Businesses will need to cap headcounts at the lowest possible number per shift that’s compatible with full operations. All public establishments will be required to keep hand sanitizer at their entryways and screen people for temperatures or obvious signs of infection before admission. Seniors will be urged to stay home and anyone with an underlying health condition will be urged to work from home wherever possible. There will be specific cars on the Metro for the elderly and for vulnerable citizens.

Shops, banks, and other public spaces will be required to limit footfall by asking customers to line up outside. Authorities will promote the use of electronic payment, smart technology, and delivery services.

How do we get from phase one to phase two? Fourteen days of declining case counts.

PHASE 2 will see the measures imposed in phase one eased over a period of 28 days. We will still be required to wear face masks in public and in the workplace — and entertainment venues will remain closed.

PHASE 3 will see only light precautions in place provided we see no spikes in new cases. The measures will include limits on large gatherings and ensuring closed spaces remain clean and well-ventilated. Only vulnerable people (seniors and those with underlying health conditions) will be required to wear face masks. We’ll remain in phase three until the World Health Organization gives the all-clear.

Read the pdf carefully — the ministry’s plan lists measures designed specifically for workplaces, malls and shops, construction sites, public transport, and hotels. The measures will also follow the same pattern, beginning with a strict phase and then gradually easing out as we enter the later phases. They vary from conducting rapid covid screening tests before admitting foreign guests at hotels to deep cleaning offices, retail areas, and public transportation facilities.

When airspace reopens, tourists will need to produce the results of a PCR test completed 48 hours before they hopped on their flights.

The get out of jail [without charge] card: If the WHO approves a vaccine at any stage, the Health Ministry will immediately launch an immunization drive.

Egypt is lining up another USD 9 bn from int’l lenders to plug budget deficit, shore up reserves: The Madbouly government is in talks with international lenders for an additional USD 9 bn to help it plug its budget deficit as it spends bns to fight covid-19, Bloomberg reports, citing an unnamed official. The funding, which comes on top of the USD 2.77 bn rapid finance instrument we landed this week from the IMF, includes a USD 5 bn stand-by arrangement (SBA) from the IMF, for which talks are already underway, and a further USD 4 bn from other international lenders, the official said, without providing further details.

SBA could be closer to USD 5.5 bn, first tranche to come in June: The SBA could see us receive up to USD 5.5 bn, and the first tranche of funding could land as early as next month, Masrawy reports, quoting a source from the central bank. “There are discussions with the Egyptian government … to enable and support it in the coming stage,” IMF Middle East and Central Asia Director Jihad Azour said. “Due to the uncertainty of the situation, the program [the SBA] may be shorter in duration than regular programs, which last for four years.” The SBA would also aim to encourage other multilaterals to support Egypt, he added.

Funding needs are too much for one source to fulfill -IMF: Egypt’s “external financing need is too large to be filled by any single source. It will require joint efforts by the authorities, bilateral partners, multilateral development banks, and of course the IMF,” IMF mission chief to Egypt Uma Ramakrishnan told Bloomberg. Egypt already received a USD 2.8 bn rapid financing instrument from the IMF earlier this week. The facility will be used for “targeted and temporary spending” to prop up the economy.

Egypt will have enough funding from the IMF, other lenders, and bilateral agreements to cover its financing needs, Central Bank of Egypt Sub-Governor Rami Abulnaga told Alarabiya yesterday (watch, runtime: 8:54). Abulnaga did not confirm the USD 9 bn figure, but said it “could be close” once negotiations wrap up. Reuters also had the story.

Egypt isn’t alone in asking for help: More than 90 countries have inquired about IMF funding to help them withstand the economic fallout caused by the pandemic. The multilateral lender has also approved USD 13 bn in emergency aid to African countries, according to Bloomberg.

EBRD sees Egypt’s economy growing 3% next fiscal year after “sharp” slowdown in 2020: The European Bank for Reconstruction and Development (EBRD) expects Egypt’s GDP growth in FY2020-2021 to come in at 3% as disruptions from the pandemic weigh on growth during the first six months of the fiscal year, according to a Regional Economic Prospects report (pdf).

Egypt is expected to see 0.5% growth in the 2020 calendar year before recovering to 5.2% in 2021. Both figures outperform expectations for the rest of the Southern and Eastern Mediterranean (SEMED) region, with the exception of Lebanon, which is expected to bounce back to 6% growth next year from a stunning 11% contraction in 2020.

Tourism, FDI, global conditions weigh on growth: The lower growth projection for the next fiscal year is “due mainly to the weak outlook in the tourism sector, disruptions in global value chains, weaker demand from trading partners, and the slowdown in foreign direct investment.”

Next fiscal year’s growth will be concentrated in its second half, with economic recovery beginning in earnest at the beginning of calendar year 2021, while the remainder of 2020 is expected to be bogged down in economic disruption, Bassem Kamar, lead economist for the south and east Mediterranean, tells us.

With interest rates at a good place, private investments will lead growth next year: Private sector investments are expected to be the largest contributor to GDP growth in calendar year 2021, Kamar said in a chat yesterday. The return of private investment will be spurred largely by the Central Bank of Egypt’s (CBE) monetary easing, which has brought interest rates to a “very acceptable level” to unlock capex borrowing. “2020 was expected to be the year of high private sector investment, but then [the pandemic] happened, and now all of these investments are postponed to 2021,” he says.

What could help us unlock higher-than-expected growth: The biggest factor is to keep the spread of the virus that causes covid-19 under control and therefore allow business activity to pick up pace again, Kamar says. Once the wheels start turning again, growth will be spurred mostly by construction — including the ongoing construction of the new administrative capital and the Suez Canal Economic Zone — and renewed consumer demand for Egyptian products in domestic and international markets.

Recovering tourism from Europe, which is gradually reopening over the coming weeks, will also help drive growth. Kamar suggests that tourism inflows to Egypt could get a boost by sending a reassuring message to potential visitors that we understand the risk and are taking the necessary steps to address those risks. For example, he suggests a partnership with the World Health Organization that would see the organization certify certain destinations and hotels — akin to a TripAdvisor top-rated sticker — that tells tourists it’s safe to visit.

What could push our growth figures lower: Economic growth will take a further hit if new cases accelerate and require an intensification of the current lockdown, or if there is a second wave of infections further down the road that necessitates new restrictions.

Inflation likely to stay low, unemployment to normalize in mid-2021: As for the rest of Egypt’s fundamentals, Kamar doesn’t see much reason to expect an uptick in inflation, with deflationary pressures keeping the balance in check. The EBRD expects inflation to remain comfortably within the CBE’s target range of 9% (+/- 3%) — and could hover around the lower bound, he says. The unemployment rate will normalize in Egypt to December 2019 levels somewhere around mid-2021, Kamar expects.

CABINET WATCH- Cabinet approves bill waiving late fees on income, real estate taxes, others: The Madbouly cabinet greenlit in a meeting on Wednesday a bill that would waive a portion of interest payments and late fees on income tax, VAT, customs tax, real estate tax, social insurance fees, and other state dues, provided the taxes owed are cleared. The bill would waive 90% of the fees if the taxes are paid within 60 days after the bill passes, 70% if paid within the next 60 days, and 50% for the following 60 days.

Ministers also decided on Wednesday to:

- Approve an amendment for issuing commercial licenses to natural gas-based industry projects, especially in fertilizers and petrochemicals, to operate in no-customs zones.

- Waive purchasing fees on medicines and PPE used to combat covid-19 supplied by the Egyptian Drug Authority.

- Allocate EGP 339 mn to the Transport Ministry’s Egyptian Maintenance Company to carry out roadworks across 12 governorates.

M&A WATCH- South Africa’s Tana Capital eyes stake in Mabaret Al Asafra Hospitals: South African investment firm Tana Africa Capital has submitted an offer to purchase a 25% stake in Mabaret Al Asafra Hospital Group, sources close to the negotiations told the local press. Talks have been ongoing between the two sides for months and a preliminary agreement was signed a month-and-a-half ago, the sources said. Mabaret Al Asafra head Amr Morsi refused to confirm whether Tana had made a formal offer and denied signing an initial agreement. “We have been in negotiations with several investors for a long time and we have not signed any final or initial contracts,” he told the press, stressing that negotiations remain at an early stage. The group owns three hospitals on Egypt’s north coast: Mabaret Al Asafra West, Mabaret Al-Asafra Central and Mabaret Al Asafra Alexandria.

STARTUP WATCH- Digital lender Shahry raises USD 650k in pre-seed funding: Cairo-based digital lender Shahry has secured USD 650k in pre-seed funding from the investment arm of Egbank, the company told MenaBytes. The company’s mobile app allows users to apply for virtual credit and use it to purchase products and set-up monthly installment plans with various online stores without leaving the app. Usage has grown by 100% month-on-month since its launch in July 2019 and currently has 15k users, co-founder Sherif ElRakabawy said.

EARNINGS WATCH- ElSewedy Electric profit halve in 1Q as covid-19 hits operations: ElSewedy Electric’s quarterly profits plunged in 1Q2020 as weaknesses in the broader economy caused by the coronavirus impacted its operations, the company said in its quarterly earnings statement yesterday (pdf). The company reported profits of EGP 400 mn during the first quarter, down 58% from 1Q2019. Revenues fell 4% year-on-year to EGP 10.8 bn. The company’s top line was largely supported by growth in turnkey projects, which rose 54.2% y‐o‐y to reach EGP 4.9 bn in 1Q2020. The slowdown affected key segments and was mostly attributable to the impact the covid-19 pandemic has had on the wider economy, with which these segments’ performance “tends to be highly correlated,” said CEO Ahmed El Sewedy.

ElSewedy “fully confident” about navigating the crisis: “Thanks to a solid liquidity position, management is fully confident of ElSewedy Electric’s ability to meet any and all upcoming obligations. The strength of our balance sheet affords us room for flexibility and will be key in seeing us through these turbulent times,” El Sewedy said. “We have striven to keep our talented team fully intact recognizing that their ability will be key in allowing ElSewedy to stage as rapid a recovery as possible from the circumstances.”

MOVES- Credit Agricole Egypt has appointed Didier Reboul (bio) as a non-executive board member, replacing Mathieu Michel (bio), according to an EGX disclosure (pdf). Reboul served as head of group ALM for Credit Agricole in 2013, then as head of agriculture, agrifood, and specialist markets from 2019.

The Macro Picture

Emerging markets are facing an impending debt crisis that will be more difficult and “messier” to resolve than previous crises, as countries that tapped the bond market “at a record pace” over the past decade are now under immense economic pressure from the covid-19 pandemic, Colby Smith and Robin Wigglesworth write for the Financial Times.

The road ahead will be tough, to say the least: “The withdrawal of money [from EM funds] is greater and more sudden than in 2008, the economic shock is huge and the path to recovery more uncertain than it was after the last crisis,” says former head of EM debt at Pimco, Ramin Toloui. Compounding the problem is an increased difficulty for borrowers to reach a debt restructuring agreement with their creditors, which are now mostly “a multitude of bond funds” as opposed to banks and governments.

Complication #1- The threat of vulture funds, which threaten to sue sovereign borrowers in the middle of a debt crisis and demand that these governments repay their full debts, rather than undergoing debt restructuring. With the threat of a lengthy and costly legal battle, governments sometimes opt to pay these funds the full amount — as long as they remain a minority — and the funds come out on top. After one fund managed to eke out USD 2.4 bn from the Argentinian government 15 years after it defaulted, analysts are now concerned that we could see a wave of imitators that would worsen the looming debt crisis.

Complication #2- EM governments themselves are reluctant to ask for debt restructuring for fear of a credit rating downgrade that would make it difficult for them to tap debt markets again in the future, Jonathan Wheatley writes for the salmon-colored paper. These concerns are not baseless: Ratings agencies Moody’s, S&P and Fitch have signaled they would “have little choice but to downgrade a sovereign issuer the moment it requested a standstill and would probably regard any renegotiation of terms as a default.” The emerging consensus is also that debt restructuring wouldn’t actually be that helpful in the long run — governments won’t be any better positioned to repay their debts a few months down the line than they are today.

Enter the Paris Club, which may be about to put its weight behind an expanded debt moratorium to more than just the poorest countries and beyond the G20’s initial six-month period, Paris Club Chair Odile Renaud-Basso said, according to Bloomberg. While Renaud-Basso says the club is “confident” China will agree to pause debt repayments, he says that middle-income EMs likely also need debt relief or restructuring agreements. China has received several debt relief requests from countries that received loans from its banks under the Belt and Road Initiative, with the majority coming from African countries, where lenders doled out USD 461 bn in loans since 2013.

Egypt in the News

It’s a quiet morning in the pages of the foreign press as far as Egypt is concerned.

Diplomacy + Foreign Trade

Sudan rejects Ethiopian proposal to begin filling GERD: Sudan has refused to sign an early agreement with Ethiopia to go ahead with the first phase of filling the Grand Ethiopian Renaissance Dam’s reservoir as key sticking points on the timeline and long term operation of the dam still need to hashed out between Egypt and the two African countries, the Sudanese Irrigation Ministry said in a statement carried by Sky News Arabia. Ethiopia has repeatedly stated that it will begin filling the dam in July without committing to a formal agreement to resolve the dispute, and earlier this year walked away from US-backed talks.

El Sisi, Ramaphosa talk African covid-19 cooperation: President Abdel Fattah El Sisi discussed cooperation between African countries to curb the spread of covid-19 in a phone call with his South African counterpart and current African Union chair Cyril Ramaphosa. The two agreed to provide medical assistance to African countries through a fund recently set up by the AU to support its members as they grapple with the pandemic.

Energy

Elsewedy Electric subsidiary signs EGP 209 mn contract for Fayoum substation

Elsewedy Electric subsidiary Elsewedy Electric for Trading & Distribution has signed a EGP 209 mn EPC contract to build a 200/22/220 KV substation in Fayoum’s Al Lahun, according to a statement (pdf). The substation will take six months to complete.

Pharos Energy announces cutbacks, reduced output in Egypt on oil price collapse

Pharos Energy has reduced capital expenditures and output at its oil drilling operations in Egypt as its finances come under pressure from the collapse in global oil prices, according to Morning Star. Cost-cutting initiatives will remain the company’s top priority for the medium to long term while oil will remain “an important component of the global energy mix over many future decades” according to Pharos Energy CEO Ed Story.

Basic Materials + Commodities

Edita to add 200 trucks to distribution network, open new Morocco production facility this year

Edita will add 200 delivery trucks to its distribution network this year and expects to inaugurate a new production facility in Morocco by the year’s end, Menna Shams El Din, head of investor relations, told the local press. Edita is also looking to produce a new biscuit product and add an additional production line at its existing facility, said Shams El Din without providing further details.

On Your Way Out

Orascom’s Gemini Enterprises Africa launches new program to support startups: Naguib Sawiris’ startup investment platform Gemini Enterprises Africa has launched the “Gemini Uplift Initiative,” its latest program to connect entrepreneurs to investors and provide mentorship, it said in a statement (pdf). The program is supported by more than 45 regional and international partners including the UNDP, startupfest organizer RiseUp, accelerators Flat6Labs and Falak Startups, and the American University in Cairo. Interested startups from all sectors across Africa can apply through this link.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Wednesday): 10,396 (-1.8%)

Turnover: EGP 1.1 bn (57% above the 90-day average)

EGX 30 year-to-date: -25.5%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 1.8%. CIB, the index’s heaviest constituent, ended down 1.7%. EGX30’s top performing constituents were Ibnsina Pharma up 1.3%, Crédit Agricole up 0.9%, and Heliopolis Housing up 0.6%. Yesterday’s worst performing stocks were Elsewedy Electric down 7.7%, Ezz Steel down 6.3% and Porto Group down 4.4%. The market turnover was EGP 1.1 bn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -24.4 mn

Regional: Net Long | EGP +779.3 mn

Domestic: Net Short | EGP -755.0 mn

Retail: 26.9% of total trades | 28.2% of buyers | 25.6% of sellers

Institutions: 73.1% of total trades | 71.8% of buyers | 74.4% of sellers

WTI: USD 25.29 (-1.9%)

Brent: USD 29.19 (-2.6%)

Natural Gas (Nymex, futures prices) USD 1.616 MMBtu, (-6.1%, June 2020 contract)

Gold: USD 1,713.98 / troy ounce (-0.16%)

TASI: 6,721.24 (+0.55%) (YTD: -19.88%)

ADX: 4,058.95 (-1.82%) (YTD: -20.03%)

DFM: 1,921.15 (+1.53%) (YTD: -30.52%)

KSE Premier Market: 5,034.62 (-1.61%

QE: 8,801.70 (-1.02%) (YTD: -15.58%)

MSM: 3,446.70 (-0.12%) (YTD: -13.43%)

BB: 1,232.40 (-0.50%) (YTD: -23.46%)

Calendar

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 May (Friday): Egyptian hotels will be allowed to partially reopen to domestic tourists.

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.