Private-sector contraction deepens following EGP devaluation

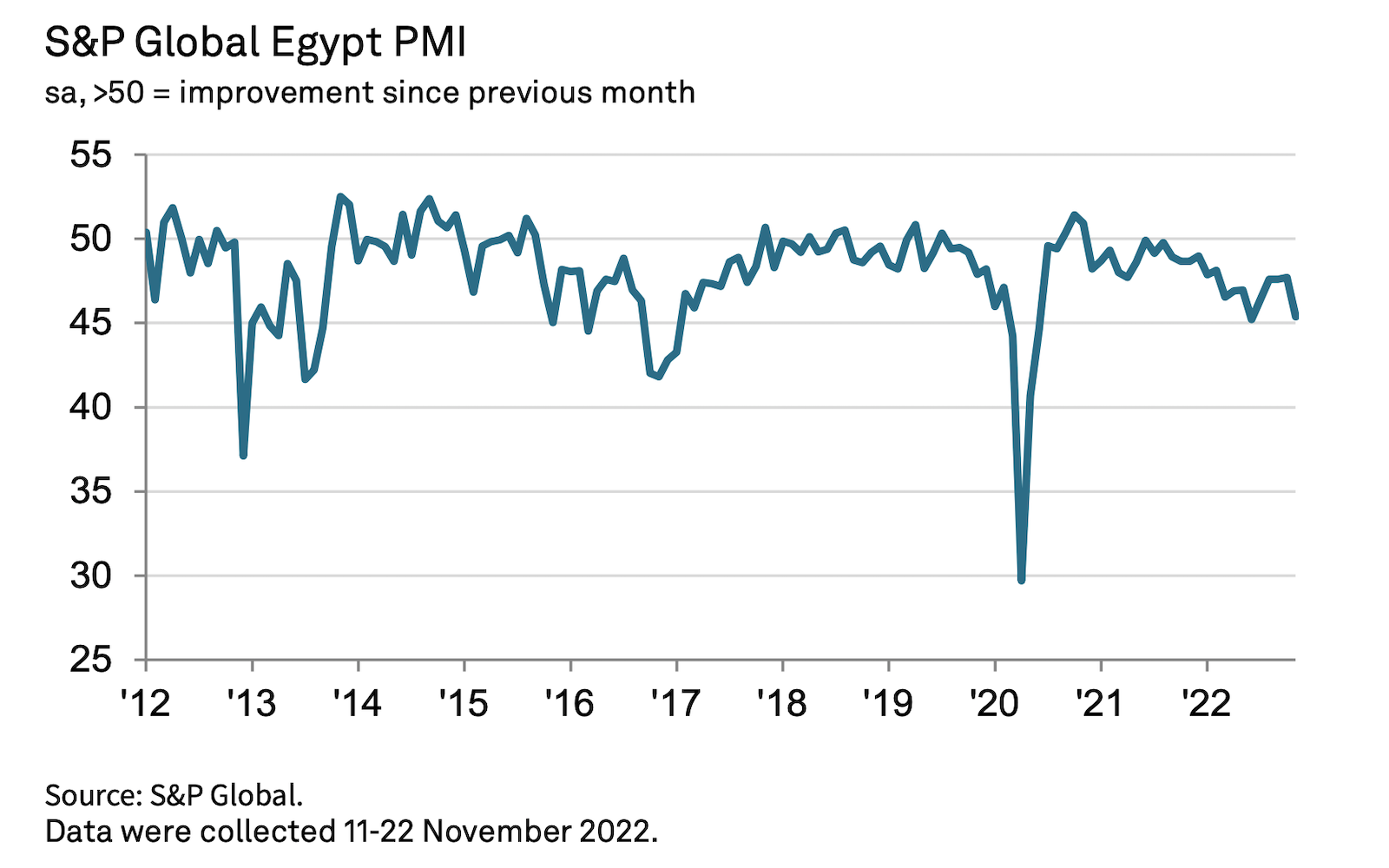

Private sector activity takes a hit following devaluation: The contraction in Egypt’s private sector deepened in November as the depreciation of the EGP triggered a surge in inflation, according to S&P Global’s purchasing managers’ index (pdf). The PMI index fell to 45.4 from 47.7 in October, falling further below the 50.0 threshold that separates growth from contraction to hit its lowest level since June.

Inflation at 4+ year high: Purchase price inflation rose at its fastest rate in more than four years, with more than 42% of businesses reporting an increase in overall costs. That is 3x higher than those who saw an increase in selling prices, suggesting that “most firms were shouldering the burden of rising costs as demand continues to worsen,” S&P Global economist David Owen said. The central bank will release November’s inflation figures on Thursday, 8 December.

Thanks, EGP: “Egyptian firms faced an immediate hit to demand from a rapid depreciation of the EGP since late October,” David Owen, economist at S&P Global, wrote. The currency has tumbled 24.6% against the USD since late October when the central bank moved to a flexible exchange rate. This “led to a marked increase in prices paid for raw materials, which have already been exacerbated by import restrictions since early-2022,” Owen wrote.

Output + demand at lowest levels since pandemic peak: Businesses suffered the worst falls in output and new orders since the height of the pandemic shock in May 2020. Outside of covid-19, this was the most severe downturn since January 2017.

Import restrictions are not letting up either: Firms also reported continuing supply disruptions amid ongoing import restrictions, which were exacerbated by the rising costs of raw materials on the back of the devaluation, the survey notes. This prompted companies to cut input buying levels and utilize existing stocks, slightly affecting inventory levels, it added. The central bank is now in the process of rolling back the import curbs it put in place earlier this year, with plans to phase them out completely by the end of the year.

On the bright side: Companies expanded their headcount at the quickest rate in more than three years, as business sentiment recovered slightly from an all-time-low in October. Owen also signaled a potential relief on price pressures in the medium- to long-term on the back of slowing demand and falling commodity prices.

Two years and counting: The last time the PMI was in the green was all the way back in November 2020.

The release got coverage internationally: Reuters | Bloomberg.