- T-minus two hours until the Enterprise Climate X Forum. (What We’re Tracking Today)

- Private-sector contraction deepens following EGP devaluation. (Economy)

- Port Said Container & Cargo Handling takes another step towards an IPO. (IPO Watch)

- Lawyers stage second protest against e-invoicing; “Register or else,” says Tax Authority. (Tax)

- Two Egyptian startups close seven-figure USD funding rounds. (Startup Watch)

- Merchants have stopped pricing gold. (What We’re Tracking Today)

- MBS eyes Credit Suisse + high food prices could be the new normal. (Planet Finance)

- Enterprise Explains: Mitigation vs. Adaptation. (Going Green)

Tuesday, 6 December 2022

AM — The Enterprise Climate X Forum is happening today

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. We’re really looking forward to seeing many of you in a couple of hours’ time at our Enterprise Climate X Forum, which gets underway this morning at 8am at the Grand Egyptian Museum.

Please join us in thanking the wonderful people who made all this possible: USAID, HSBC, Mashreq, Attijariwafa Bank, Etisalat by e&, Hassan Allam Utilities, and Infinity.

If you’re attending: Please plan to arrive on time. Our standing networking breakfast is one of the hallmarks of the event. It gets underway at 8am CLT sharp. Traffic in the area surrounding the GEM has been heavy of late, so you will likely want to leave a few minutes early.

** You will need a special QR code to gain admission to the GEM. Everyone who received and completed our online registration form got their QR code by email on Sunday.

We regret that overwhelming demand from the community meant we could not welcome everyone who expressed interest in attending.

STAY TUNED- The Enterprise Climate X Forum is our first large-scale event, but it’s not our last. We look forward to welcoming many more of you at our slate of Enterprise X Forums coming up in 2023.

** We’re taking a day off from the PM edition today. EnterprisePM will be back in your inboxes at the normal time on Wednesday.

WHAT’S HAPPENING TODAY-

It’s day two of Food Africa 2022 at the Egypt International Exhibitions Center. More than 440 exhibitors from 28 countries will be at the food expo, which runs through to tomorrow.

Samir in the hot seat: Trade and Industry Minister Ahmed Samir will face questions from MPs today on issues facing manufacturers, including on licensing and exports, as well as what the ministry is doing to solve the crisis in the automotive industry.

LATER THIS WEEK-

President Abdel Fattah El Sisi is in Riyadh later this week to attend the China-Arab summit that will coincide with Chinese President Xi Jinping’s visit to the kingdom, Ala Mas’ouleety’s Ahmed Moussa said last night (watch, runtime: 3:40). Some 12-14 Arab leaders are expected to attend the summit which will take place on Friday. The visit by Xi, who is set to arrive in the kingdom tomorrow for talks with King Salman and Crown Prince Mohamed bin Salman, comes amid fraying US-Saudi ties over energy policy and growing nerves in Washington about rising Chinese power in the region.

WATCH THIS SPACE #1- Some gold merchants have stopped pricing the precious metal amid confusion about the USD price in the wake of October’s devaluation. Local gold prices have surged to record highs this week, with 21 carat gold reaching EGP 1.8k. Demand for gold has surged in the wake of October’s EGP devaluation which has seen the currency fall almost 25% against the USD.

WATCH THIS SPACE #2- Misr Ins. Holding is in advanced talks to acquire a controlling stake in a healthcare third-party administrator (TPA), Chairman Basel El Hini told Enterprise yesterday. The company is hoping to close the acquisition within a month, he said. El Hini did not disclose the exact size or value of the stake. The news was originally reported by Al Mal.

SOUND SMART- A TPA is typically an organization that helps streamline admin processes and can help make the ins. process more efficient.

PSA- Rice hoarders have until Christmas Day to come forward: Rice producers, sellers and distributors now have until 25 December to notify the Supply Ministry of how much rice they’ve stockpiled and where they’re keeping it, the ministry said yesterday. The ministry has pushed the deadline from the previously announced 4 December.

REMEMBER- Rice has been designated as a “strategic commodity” for at least three months under efforts to deter traders who try to exploit the shortage of commodities.

WORLD CUP-

Brazil set for Croatia clash in the World Cup quarter-final: Brazil danced its way to the quarter finals of the World Cup last night, sweeping aside South Korea with an impressive 4-1 win. Richarlison bagged one of the goals of the tournament, Neymar converted a penalty, while Vinicius Jr and Lucas Paqueta also got on the scoresheet in the first half. Croatia also booked their place in the next round yesterday, beating Japan on penalties.

Up today: It’s the final batch of R16 games (all times CLT):

- The Arab world will be cheering on Morocco when they meet Spain this evening at 5pm.

- Portugal play Switzerland at 9pm.

THE BIG STORIES ABROAD-

No single story is dominating the global front pages this morning:

- The UK is readying “sweeping” crypto regulations in the wake of FTX’s collapse last month. (FT)

- Pepsico will cut hundreds of jobs in North America. (WSJ)

- Ukraine has hit air bases deep into Russian territory while a new wave of missile strikes on the Ukrainian electricity grid has Kyiv warning of emergency blackouts. (Associated Press | Reuters)

|

MARKET WATCH-

US stocks fell and bond yields rose yesterday after unexpectedly strong economic data raised concerns that the Federal Reserve will continue to raise interest rates to quell inflation, Bloomberg reported. The S&P 500 was down 1.8%, with 95% of the benchmark index’s companies in red, while the tech-heavy Nasdaq lost 1.7%. A pullback in US debt markets led 10-year yields to advance 3.6%. “Good economic news is bad news for stocks as it will keep the risk elevated that rates might have to end up higher later next year,” one analyst told the news outlet.

It’s a mixed picture in Asia this morning: Shares in China are continuing to gain as authorities ease covid-19 curbs, but bourses elsewhere are feeling the impact of yesterday’s Wall Street sell-off, with the Hang Seng falling 1.0%, the Kospi down 0.4%, the ASX losing 0.1%.

More volatility in Europe + New York today: Markets across Europe are expected to open in the red later this morning while US stock futures are currently flat.

CIRCLE YOUR CALENDAR-

Key news triggers to keep an eye on this week and beyond:

- Inflation: Inflation data for November will land on Thursday, 8 December.

- Foreign reserves figures for November should be out sometime this week.

- Interest rates: The Central Bank of Egypt’s Monetary Policy Committee meets on Thursday, 22 December to review interest rates.

The cabinet’s Information and Decision Support Center (IDSC) will kick off the first session of its new intellectual forum on Thursday, 8 December, according to a statement. The weekly forum will see experts including government officials, academics, representatives of multilateral institutions, MPs, and national dialogue members meet to discuss key policy questions and make recommendations on them to the prime minister.

Thursday’s session will cover fiscal discipline and sustainability. The remainder of the December sessions will focus on our investment environment; ways to support sustainable agriculture in line with Europe’s Green Deal; and the latest in Ukraine.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

Enjoy renting with home comfort, privacy, exclusive privileges, and tailor-made packages for an unforgettable guest experience. A signature collection of handpicked serviced villas, chalets, apartments, and studios to transform your vacation into an exceptional experience, and to discover the magic of Somabay in luxury bliss. For booking inquiries, contact us by phone at +20 155 600 5693, by email at info@stayr.somabay.com, or through our website holidays.somabay.com

ECONOMY

Private-sector contraction deepens following EGP devaluation

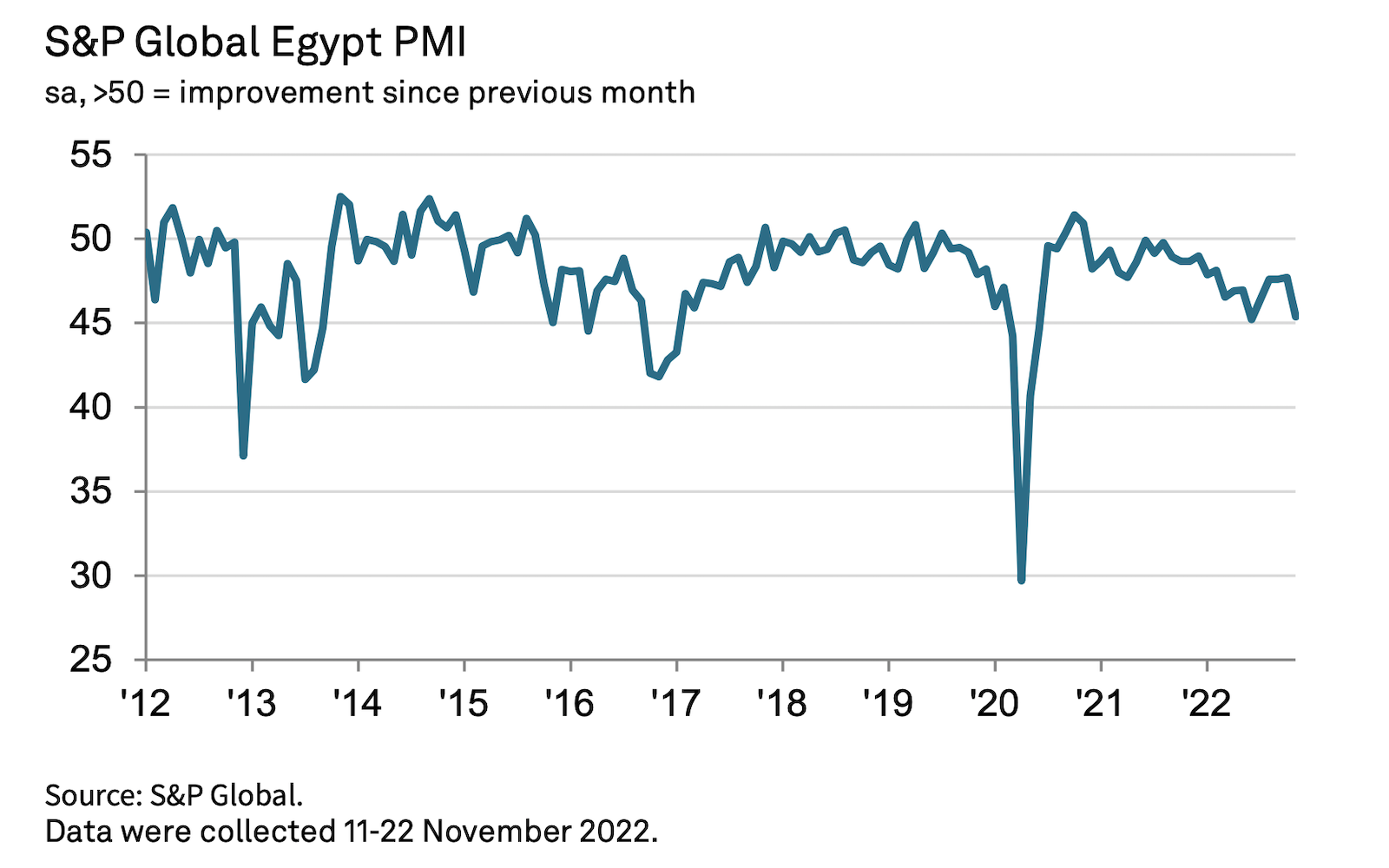

Private sector activity takes a hit following devaluation: The contraction in Egypt’s private sector deepened in November as the depreciation of the EGP triggered a surge in inflation, according to S&P Global’s purchasing managers’ index (pdf). The PMI index fell to 45.4 from 47.7 in October, falling further below the 50.0 threshold that separates growth from contraction to hit its lowest level since June.

Inflation at 4+ year high: Purchase price inflation rose at its fastest rate in more than four years, with more than 42% of businesses reporting an increase in overall costs. That is 3x higher than those who saw an increase in selling prices, suggesting that “most firms were shouldering the burden of rising costs as demand continues to worsen,” S&P Global economist David Owen said. The central bank will release November’s inflation figures on Thursday, 8 December.

Thanks, EGP: “Egyptian firms faced an immediate hit to demand from a rapid depreciation of the EGP since late October,” David Owen, economist at S&P Global, wrote. The currency has tumbled 24.6% against the USD since late October when the central bank moved to a flexible exchange rate. This “led to a marked increase in prices paid for raw materials, which have already been exacerbated by import restrictions since early-2022,” Owen wrote.

Output + demand at lowest levels since pandemic peak: Businesses suffered the worst falls in output and new orders since the height of the pandemic shock in May 2020. Outside of covid-19, this was the most severe downturn since January 2017.

Import restrictions are not letting up either: Firms also reported continuing supply disruptions amid ongoing import restrictions, which were exacerbated by the rising costs of raw materials on the back of the devaluation, the survey notes. This prompted companies to cut input buying levels and utilize existing stocks, slightly affecting inventory levels, it added. The central bank is now in the process of rolling back the import curbs it put in place earlier this year, with plans to phase them out completely by the end of the year.

On the bright side: Companies expanded their headcount at the quickest rate in more than three years, as business sentiment recovered slightly from an all-time-low in October. Owen also signaled a potential relief on price pressures in the medium- to long-term on the back of slowing demand and falling commodity prices.

Two years and counting: The last time the PMI was in the green was all the way back in November 2020.

The release got coverage internationally: Reuters | Bloomberg.

IPO WATCH

EGX greenlights listing of state-owned ports company ahead of IPO

State-owned maritime transport company to list on the EGX on Wednesday: The EGX’s listing committee has signed off on the temporary listing of the state-owned Port Said Container & Cargo Handling Company (PSCCHC) ahead of a planned IPO, the bourse said in a statement (pdf). This gives the company six months to meet listing requirements including minimum quotas for the number of listed shares and shareholders, and obtain regulatory approvals, under recent changes to listing procedures.

The details: The Holding Company for Maritime Transport subsidiary will list over 32.8 mn shares on the bourse, the statement said, without disclosing the exact stake size it plans to offer on the exchange. Local media has reported that the company is looking to sell a 25% stake in 1Q 2023. Trading on its shares will eventually take place under the ticker POCO.CA.

Will Damietta Container & Cargo Handling Company (DCHC) be next? The EGX approval comes the day after reports that the ordinary general assemblies of PSCCHC and sister company DCHC both approved IPO plans. Both subsidiaries of the Holding Company for Maritime Transport are eyeing 25% stake sales, according to the domestic press. The Madbouly government is reportedly planning to IPO the two companies in 1Q 2023, along with a Nilex listing for the Egyptian Company For Maritime Transport (Martrans) and General Egyptian Warehouse Company.

The EGX is gearing up for at least five listings “in the coming period,” Al Mal quotes EGX boss Ramy El Dokany as saying at a conference yesterday. Finance Minister Mohamed Maait also said earlier this week that the government could sell stakes in companies in the banking and oil sectors before March 2023.

In the pipeline: Banque du Caire (BdC) was planning to make its debut this year but decided in July to postpone the sale until market conditions improve; It now has until 31 March 2023 to finish the IPO procedures. The Suez Canal Authority (SCA) had also been planning to IPO the Canal Mooring & Lights Company on the EGX at the end of the year.

Market conditions have staged a recovery from an intense sell-off on the back of the crisis in Ukraine, helped by last month’s currency float and the announcement of a USD 3 bn IMF bailout package. The sell-offs had led to the postponement of at least two IPOs and forced the government to rethink its privatization plans, which at the beginning of the year envisaged as many as 10 state-owned companies selling shares on the bourse.

The bourse is currently in talks with Arab investors to help attract large firms to the EGX, El Dokany is quoted as saying at yesterday’s conference. The EGX recently kickstarted a series of roadshows across the GCC that has taken it to Oman and the UAE to help drum up investments in our bourse.

TAX

Tax Authority tells self-employed to register for e-invoicing amid growing protests

The taxman isn’t backing down on e-invoicing: Lawyers will not be granted an exemption from registering on the government’s e-invoicing system, the head of the Tax Authority said yesterday in the wake of rare protests in several parts of the country. Hundreds of lawyers gathered outside syndicates in Cairo, Alexandria, Assiut and elsewhere yesterday in opposition to the rules, which they say will hit them with huge fees.

REMEMBER- The Tax Authority is requiring self-employed professionals, including doctors, engineers, lawyers and artists to register on the e-invoicing system by 15 December.

This was the second protest in a week, with a smaller one taking place last Thursday. In statements to AFP, lawyer Tarek Al Awady claimed that “thousands” of lawyers turned out yesterday to oppose e-invoicing, which he said could impose fees exceeding what an average law firm makes in four months.

Taxman takes no [redacted]: Tawfik said that the authority will impose penalties on everyone who fails to register on the system by 15 December. Sources at the authority said that those who don’t meet the deadline could be fined between EGP 20k and EGP 100k. They will also be included in a “blacklist” of those who have not registered, and won’t be able to claim VAT and other tax rebates.

It’s not just lawyers who aren’t happy: The decision has recently sparked backlash among a number of self-employed professions, including doctors and pharmacists who are calling on the Finance Ministry to scrap or delay the 15 December deadline.

STARTUP WATCH

OneOrder closes USD 3 mn round + SideUp raises USD 1.2 mn

One Order raises USD 3 mn in Nclude-led seed round: Tech-enabled F&B logistics platform OneOrder has closed a USD 3 mn seed round led by local fintech fund Nclude, with participation from follow-on investor A15, and Delivery Hero’s VC arm, Techcrunch reports.

About OneOrder: Founded earlier this year by restaurateur Tamer Amer (LinkedIn), the company offers a one-stop shop for restaurants to source all their produce and equipment. It seeks to address inefficiencies and fragmentation in the restaurant supply chain and standardize quality, prices and delivery times. OneOrder secured a USD 1 mn funding round led by A15 in tandem with its launch in February.

Expansion on the horizon: The startup aims to use the capital to increase its network of local warehouses. It will also explore regional expansion opportunities across Africa and the GCC, including in Saudi Arabia.

Read more: Amer was our Founder of the Week earlier this year.

VOO rebrands as SideUp + closes USD 1.2 mn seed round ahead of move to Riyadh: E-commerce platform SideUp (formerly known as VOO) raised USD 1.2 mn in a seed round from Launch Africa Ventures, 500 Global, Riyadh Angel Investors, Alexandria Angels, Al Tuwaijri Fund and Saudi angel investor Faisal Al-Abdulsalam (LinkedIn), the company said in a statement yesterday.

About SideUp: The startup was founded as logistics and on-demand delivery app VOO in 2019 before rebranding as SideUp last month. SideUp connects e-commerce players with B2B services companies who provide payment gateways, API integration, warehousing, fulfillment, and advisory. The company currently works with over 2k e-commerce businesses.

Why the rebrand? “VOO was indicative of the speed with which we moved … as we grew, and expanded our services to payment gateways, API integration for shipping, warehousing, fulfillment, advisory and much more, there was a need to highlight our role in empowering e-commerce business owners,” founder and CEO Waleed Rashed (LinkedIn) told Enterprise. The SideUp name highlights the company’s ability to work side by side with entrepreneurs, he said.

SideUp is moving its HQ from Egypt to Riyadh amid regional expansion plans: With its newly secured funding, SideUp plans to launch in Saudi Arabia over the next 12 months, and relocate its HQ from Egypt to Riyadh. Despite this, the startup says it will “double down” on its Egyptian operations, as well as target one other country in the GCC or Africa. “Being in Saudi also gives us access to new markets in the GCC as well as the rest of Africa … Here in Saudi Arabia, we have access to a young population, digital infrastructure, and small business owners who want to benefit from the e-commerce industry,” Rashed told us.

LEGISLATION WATCH

A new-look Competition Act is one step closer

One step closer to a new-look Competition Act: The House of Representatives approved amendments to the Competition Act yesterday, with a final vote on the bill delayed to an upcoming session. The amendments, which got a preliminary approval by the House earlier this week, would give the Egyptian Competition Authority (ECA) sharper teeth to regulate M&As.

Also getting a nod by MPs: MPs approved three oil exploration agreements in the Western Desert signed with Energean and Croatia-based INA, Kuwait Energy Egypt, and the Egyptian National Petroleum for Exploration and Development Company (Enpedco).

MOVES

Mohamed Fahmy (LinkedIn) has been appointed assistant tourism minister for economic affairs, the ministry said yesterday. Fahmy holds over 30 years of experience in several local and global banks and companies, where he worked as a specialist in M&As. He has served as the CFO for Prince Alwaleed bin Talal’s Kingdom Holding, and was previously both the COO and the CFO at Palm Hills Developments.

LAST NIGHT’S TALK SHOWS

Government infrastructure projects are awesome: That was the main message delivered by the talking heads last night, who couldn’t stop talking about the state’s development plans. The trigger was yesterday’s inauguration of the Fouad Abu Zekry axis in Alexandria, but praise was also heaped on the revamp of the 19th century Al Montazah gardens in Alexandria (watch, runtime: 2:41), the development of Alexandria train station (watch, runtime: 2:11), and a new social housing project in the city (watch, runtime: 4:17). The axis received coverage from all quarters, including Ala Mas’ouleety (watch, runtime: 9:40), Masaa DMC (watch, runtime: 5:26), Kelma Akhira (watch, runtime: 1:53), Al Hayah Al Youm (watch, runtime: 1:47) and others.

Traders won’t be allowed to snap up BMWs: A decision by the new BMW agent Global Auto Group to have car seekers pre-order cars online to “prevent speculation” in the market got Kelma Akhira El Hadidi’s attention (watch, runtime: 10:06). The agent acknowledged that many of those standing in long queues seen earlier this week were actually speculators looking to get their hands on most pre-order forms, adding that it would have the right to call off pre-booking requests if they determine that the vehicles being used are not for personal use. Automotive expert Mahmoud Khairy reiterated earlier statements on talk shows this week that most of the line standard were actually traders looking to resell the cars at higher prices.

EGYPT IN THE NEWS

Dior’s show at the Giza pyramids is continuing to lead coverage on Egypt internationally this morning, with AFP, the Financial Times, and the National all covering Kim Jones’ spectacular event on Saturday.

MEANWHILE-

- Bloomberg’s Bobby Ghosh is out with an opinion piece on the potential for Erdogan and El Sisi to mend ties following last month’s handshake in Qatar.

- An investigation has been launched into a video showing an Egyptian air force officer and his brother attacking nurses at a hospital in Menoufia. (The National)

ALSO ON OUR RADAR

CAPITAL MARKETS-

The EGX is looking to take a majority stake in the planned futures exchange,EGX boss Ramy El Dokany said at a conference yesterday, according to Al Mal. The bourse is in talks with several financial institutions over the next steps, he said, adding that it aims to finalize the exchange’s ownership structure in 1Q 2023.

DEBT-

Benya borrows big to fund infrastructure projects: CIB and Banque Misr have agreed to lend EGP 6.35 bn to IT infrastructure contractor Benya Group, the state-owned bank said in a statement (pdf) yesterday. The financing, split 50-50 between the two banks, will be used to fund the company’s telecoms infrastructure projects.

ُEGOTH borrows EGP 393 mn from NBE for Winter Palace revamp: The National Bank of Egypt (NBE) is lending the Egyptian General Company for Tourism and Hotels (EGOTH) EGP 393 mn to renovate the Sofitel Winter Palace hotel in Luxor, it said in a statement (pdf).

ENERGY-

A new player in the power sector: Emaar Misr for Development has received regulatory approval to sell and distribute electricity, the Financial Regulatory Authority said (pdf) yesterday.

PLANET FINANCE

MBS eyes Credit Suisse: Credit Suisse’s new investment bank has garnered interest from Saudi Arabia’s Crown Prince Mohamed bin Salman, who reportedly is among a group of investors considering making a USD 1 bn investment, informed sources tell the Wall Street Journal. The Saudi royal could put up half of the money, potentially alongside former Barclays CEO Bob Diamond’s Atlas Merchant Capital, the people said.

Tough times: The scandal-hit, financially-stricken Swiss lender is spinning off its investment bank as part of efforts to raise CHF 4 bn in capital. The Saudi National Bank is participating in the capital increase, and will become its single-largest shareholder in the process.

Food prices remain unchanged in November: Global food prices measured by the UN Food Price Index were flat in November as falling grain, dairy and meat prices offset rising oil and sugar costs.

But high food prices are set to become the new normal as the war in Ukraine and climate change continue to cause supply problems, according to the Financial Times. Though global food prices have eased from record highs in recent months, economists and analysts expect costs to remain much higher than the pre-covid norm.

The high inflation-growth slowdown combo is putting emerging markets across the world in a bind: The risk of policy errors by central banks in emerging economies is growing, as the combination of slowing economic growth and soaring inflation put them in a tight spot, Bloomberg writes. Countries from Europe and Asia to Africa and Latin America are trying to balance the conflicting need to raise interest rates and crack down on inflation, and lower them to soften the economic slowdown.

ALSO WORTH NOTING-

- Jumia is relocating its senior management from Dubai to Africa: The NYSE-listed ecommerce startup is shutting down its Dubai office and moving its senior management to the African markets they oversee in a bid to cut losses, the company’s acting head Francis Dufay told Bloomberg. Jumia founders Sacha Poignonnec and Jeremy Hodara were forced to quit the firm last month.

- Turkey finally gets a break: Turkish inflation slowed for the first time since May 2021 thanks to the base effect and the stabilization of the TRY. Consumer prices rose 84.4% y-o-y in November, compared to 85.5% the month prior. (Statement (pdf) | Bloomberg)

- Vodafone boss to step down this month: Vodafone CEO Nick Read will resign this month after four years at the helm of the company. During his tenure the company’s share price has halved and concerns about growth have persisted. Vodafone cut its full-year profit forecast last month, worsening a bad year that has seen its share price fall by a fifth. The company’s CFO, Margherita Della Valle, will take over on an interim basis. Reuters | FT)

|

|

EGX30 |

14,328 |

+1.8% (YTD: +19.9%) |

|

|

USD (CBE) |

Buy 24.55 |

Sell 24.63 |

|

|

USD at CIB |

Buy 24.55 |

Sell 24.61 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

10,419 |

-2.8% (YTD: -7.7%) |

|

|

ADX |

10,465 |

-0.8% (YTD: +23.3%) |

|

|

DFM |

3,352 |

+0.8% (YTD: +4.9%) |

|

|

S&P 500 |

3,999 |

-1.8% (YTD: -16.1%) |

|

|

FTSE 100 |

7,568 |

+0.2% (YTD: +2.5%) |

|

|

Euro Stoxx 50 |

3,957 |

-0.6% (YTD: -8.0%) |

|

|

Brent crude |

USD 83.04 |

-3.0% |

|

|

Natural gas (Nymex) |

USD 5.62 |

-10.5% |

|

|

Gold |

USD 1,780.80 |

-1.6% |

|

|

BTC |

USD 16,970 |

-0.8% (YTD: 63.3%) |

THE CLOSING BELL-

The EGX30 rose 1.8% at yesterday’s close on turnover of EGP 2.9 bn (53.9% above the 90-day average). Foreign investors were net sellers. The index is up 19.9% YTD.

In the green: Housing and Development Bank (+18.4%), GB Auto (+4.8%) and CIB (+3.9%).

In the red: Rameda Pharma (-3.0%), Qalaa Holding (-2.4%) and Sidi Kerir Petrochemicals (-2.1%).

AROUND THE WORLD

The West’s price cap on Russian crude is now in effect — and a backlog of tankers is forming off the Turkish coast as Ankara demands to see proof of ins. before allowing vessels through the straits, the Financial Times reported, citing ship brokers, oil traders and satellite tracking services. Nineteen ships are now waiting to transit through the Turkish straits in a potential sign of the disruption to come as the world responds to what the FT editorial board calls “one of the most forceful interventions in the global oil market ever.”

FYI- Under the sanctions, oil tankers are prevented from buying Western maritime ins. if the oil is sold above the USD 60 price cap.

Meanwhile, on the other side of the world: Russia was selling its ESPO blend from the port of Kozmino on the Sea of Japan for USD 79 a barrel, significantly above the USD 60 cap, Reuters reported yesterday.

Breakthrough in Sudan? Sudan’s ruling military leaders have signed an agreement with the country’s main pro-democracy group that lays the foundations for a return to a civilian-led administration following last year’s military coup, according to the Associated Press. Under the framework agreement — signed by General Abdel Fattah Burhan, General Mohammed Hamdan Dagalo and the leaders of the Forces for the Declaration of Freedom and Change — the military vowed to eventually reduce its involvement in politics and allow for the creation of a new transitional government.

Yes, but: The agreement doesn’t commit the military to a timetable or specify how it would share power with civilian leaders ahead of national elections. Other anti-military protest groups and rebel leaders rejected the pact.

Egypt has voiced support for the agreement: The Foreign Ministry called it an “important and pivotal step” for addressing the political crisis in the country.

China to keep easing covid curbs: China is set to relax more of its strict covid-19 measures as early as tomorrow, as investors react positively to the recent easing of some restrictions, two sources familiar with the matter told Reuters. The CNY rose to its highest level against the greenback since mid-September and Chinese stocks rose on investor hopes that easing restrictions will boost global economic growth and increase demand for commodities. Apple was also given a boost yesterday after its main supplier Foxconn said that its covid-hit “iPhone City” in Zhengzhou could be back running at full capacity later this month.

Iran is trying to appease protesters: Iran’s attorney-general has said that the country’s morality police are being disbanded in an apparent olive branch to anti-government protests that have raged since September following the death of a woman in police custody. The religious police are responsible for enforcing the country’s strict Islamic dress code and have been blamed for the death of Mahsa Amini, who was arrested for allegedly failing to cover her head. The official’s statements have not been officially confirmed by the government.

Enterprise Explains: Mitigation vs. adaptation. Climate mitigation and adaptation are separate yet equally important issues in the battle against climate change. At the COP27 summit in Sharm El Sheikh, a narrative emerged in parts of the international press that pitted the two objectives against each other: Mitigation was seen as a greater concern among developed countries, while adaptation — and the money to finance it — was set up as the priority for developing nations. So what’s the difference between the two, and why does it matter?

First thing’s first: What are mitigation and adaptation? Mitigation consists of measures that seek to limit climate change by preventing or reducing the emission of greenhouse gases, according to the European Environment Agency. This can involve investing in renewable energy to replace traditional fuels, for example, or removing emissions from the atmosphere through methods like carbon capture and reforestation. Adaptation, on the other hand, refers to preventive measures to make our infrastructure and economy more resilient to the adverse effects of climate change. That could mean building defenses to protect against sea-level rise or securing water resources by modernizing irrigation systems.

The COP of adaptation: November’s climate summit was lauded for its achievements on pushing forward the adaptation agenda, from the landmark decision to establish a loss and damage fund — which will see developed countries pay to help vulnerable countries cope with climate disasters — to the ambitious adaptation agenda, which aims to mobilize USD 140-300 bn in public and private sector funding for adaptation and resilience by 2030. Meanwhile, some delegates — most vocally the EU — and climate experts bemoaned a lack of progress on mitigation pledges at COP, which were not strengthened beyond what was agreed last year at COP26.

Where does loss and damage fit into the conversation?: Loss and damage goes beyond adaptation to compensate countries in the global south for the climate damage they have already sustained. The idea is that wealthy nations should foot the bill because they have historically been responsible for the vast majority of harmful emissions. Despite its connection to adaptation, loss and damage is a separate issue that requires different evidence, funding, support, and technical work, Egypt’s UN high-level climate champion Mahmoud Mohieldin told Enterprise Climate recently. Loss and damage finally got the boost it needed at COP27 when it was included in the summit’s agenda this year. Countries managed to agree on a landmark fund to which developed countries can contribute to help the countries most affected by climate change.

Adaptation is pricey — but mitigation is around 20x more expensive: Annual adaptation needs for developing countries are estimated to reach USD 160-340 bn by 2030 and USD 315-565 bn by 2050, according to a United Nations Environment Program (UNEP) report (pdf). Current international adaptation finance flows to developing countries are 5-10x below estimated needs, the report tells us. On the mitigation side, McKinsey pegs the global cost of transitioning energy and other sectors to net-zero emissions by 2050 at USD 9.2 tn a year. That said, the more that climate change progresses, the higher the adaptation costs will rise — including for developed countries, whose adaptation costs aren’t included in the UNEP report.

The public sector cannot foot the bill on its own: The costs of addressing both mitigation and adaptation are much higher than can be borne by “limited public capital, whether domestic public budgets or international development cooperation finance,” concludes the Sharm El Sheikh Guidebook to Just Financing (pdf) launched by the International Cooperation Ministry at COP. The collective funds of multilateral development banks, if directed to climate action, would make up only 4% of what’s needed, the guide says.

“Private investment will be necessary” for both, according to the guidebook, which says that just 1.4% of the USD 410 tn in privately held global financial assets would be enough to bridge the current gap in global climate finance.

But not all climate projects are viewed as “investable”: The investability of climate projects depends largely on whether there is an addressable market and a supportive policy and regulatory environment, the climate finance guidebook notes. That’s the case for more mitigation projects (for example, renewables) than adaptation projects — which are mostly treated as a “public goods” and do not generate sufficient financial returns, the guidebook says.

Investors also find it difficult to measure adaptation: Another obstacle to investment is the “complexity of articulating, measuring and implementing good adaptation,” the CEO of the UK’s Environment Agency, Sir James Bevan, said in a speech during COP27. By contrast, mitigation targets for emissions are usually straightforward and can reap direct economic benefits, as well as helping to unlock access to tools and financial instruments like carbon credits.

As of this year, mitigation projects are still getting the lion’s share of international climate investments, with 94% of global investments this year going towards renewable energy and energy efficiency projects, according to an UNCTAD report (pdf).

That’s why for adaptation, debt + public finance need to come first — and private investment second: Adaptation projects — especially those in EMs — require more public investments to de-risk and to provide guarantees or first-loss capital to absorb the upfront risks associated with them, as we’ve previously noted. This should ideally come from grants, foreign direct investment, or concessional long-term financing.

Stay tuned for more details on the adaptation agreements made at COP: The Sharm El Sheikh Adaptation Agenda (pdf) will lay out a shared set of adaptation actions that are required by the end of this decade, with the goal of protecting “climate vulnerable” communities from “rising climate hazards.” The COP27 presidency will work on defining those priority actions and plans to report its progress in COP28. On the loss and damage side, a 24-member committee — with representatives from the current and incoming COP presidencies as well as both developing and advanced economies — is now working on identifying the scope of work, funding sources, and priorities for the fund, with a schedule due before the end of the year. The details of the fund should be unveiled in time for COP28 next year

Egypt is making strides on mitigation: COP27 was a huge catalyst for new renewable energy projects here, with Egypt signing initial agreements for some 29.5 GW worth of fresh wind power during the summit. Some of the financing pledged by the US and Europe for the projects was unlocked by a government pledge to speed up mitigation efforts and submit revised national emissions targets by next summer.

Your top green economy stories for the week:

- Al Nowais subsidiary AMEA Power has locked in USD 1.1 bn in funding for a 500 MW solar plant and 500 MW wind farm in Egypt.

- The country should put a long-term focus on building feeder industries related to the green economy, Actis’ Sherif El Kholy told us in our CEO poll on FDI and exports.

- Strapped for sustainable Secret Santa gift ideas? Our eco-friendly Christmas gift guide has you covered with gifts that impress without destroying the planet.

CALENDAR

NOVEMBER

20 November-18 December (Sunday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

5-8 December (Monday-Thursday): QS Reimagine Education Awards and Conference, multiple locations.

5-7 December (Monday-Wednesday): Food Africa 2022 kicks off at Egypt International Exhibitions Center.

6 December (Tuesday): Enterprise Climate X Forum, Grand Egyptian Museum.

7 December (Wednesday): Euromoney Egypt 2022 conference

10 December (Saturday): The TriFactory’s Pyramids Half Marathon.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

19-20 December (Monday-Tuesday): The Arab Administrative Development Organization’s conference on Modern Methods in Hospital Management, Cairo.

20 December (Tuesday): EGX-listed Pachin will brief shareholders on offers received to acquire the company in an ordinary general assembly.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

December: Chinese President Xi Jinping visit to Saudi Arabia

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

End of December/early January: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q 2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Arabia’s Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.