What we’re tracking on 10 February 2019

It’s interest rate week, and it is anyone’s guess whether the central bank will give us chocolate on Valentine’s Day or a bag of mulched roses. We should get our first clue later today, when we expect the release of inflation figures for January. The central bank’s monetary policy committee is set to meet on Thursday.

May we casually note that central bankers the world over are putting the brakes on interest rate hikes, according to the Financial Times?

Egypt assumes the presidency of the African Union today, with President Abdel Fattah El Sisi in Addis Ababa for a summit of heads of state. We have more in this morning’s Speed Round, below.

The window to settle with the taxman in return for a 50% break on late fees has now closed, according to a Finance Ministry statement (pdf).

Cairo’s first conference on international banking and finance disputes wraps up today. The two-day gathering was organized by the Cairo Branch of the Chartered Institute of Arbitrators and the Cairo Regional Center for International Commercial Arbitration to discuss the increased use of international arbitration in banking, project finance, PPPs, and Islamic finance disputes. Guest speakers at the conference include Zulficar & Partners founding partners Mona Zulficar and Mohamed Abdel Wahab, while the keynote address will be delivered by CBE Sub-Governor Mohamed Abou Moussa.

IMF Managing Director Christine Lagarde was again singing Egypt’s praises during a meeting with Finance Minister Mohamed Maait in Dubai on Friday, the ministry said in a statement (pdf). Egypt plans to increase spending on health and education to allow citizens to reap the fruit of the reforms, according to the ministry.

Lagarde thinks Arab oil exporters haven’t recovered from price shocks. The IMF boss said at a conference in Dubai that despite the reforms on the spending and revenue sides, fiscal deficits of oil-exporting Arab countries are slowly declining and public debt is quickly growing, Reuters reported. Lagarde also cautioned against “white elephant projects,” with Reuters drawing a line between that and the planned Saudi robot utopia known a Neom.

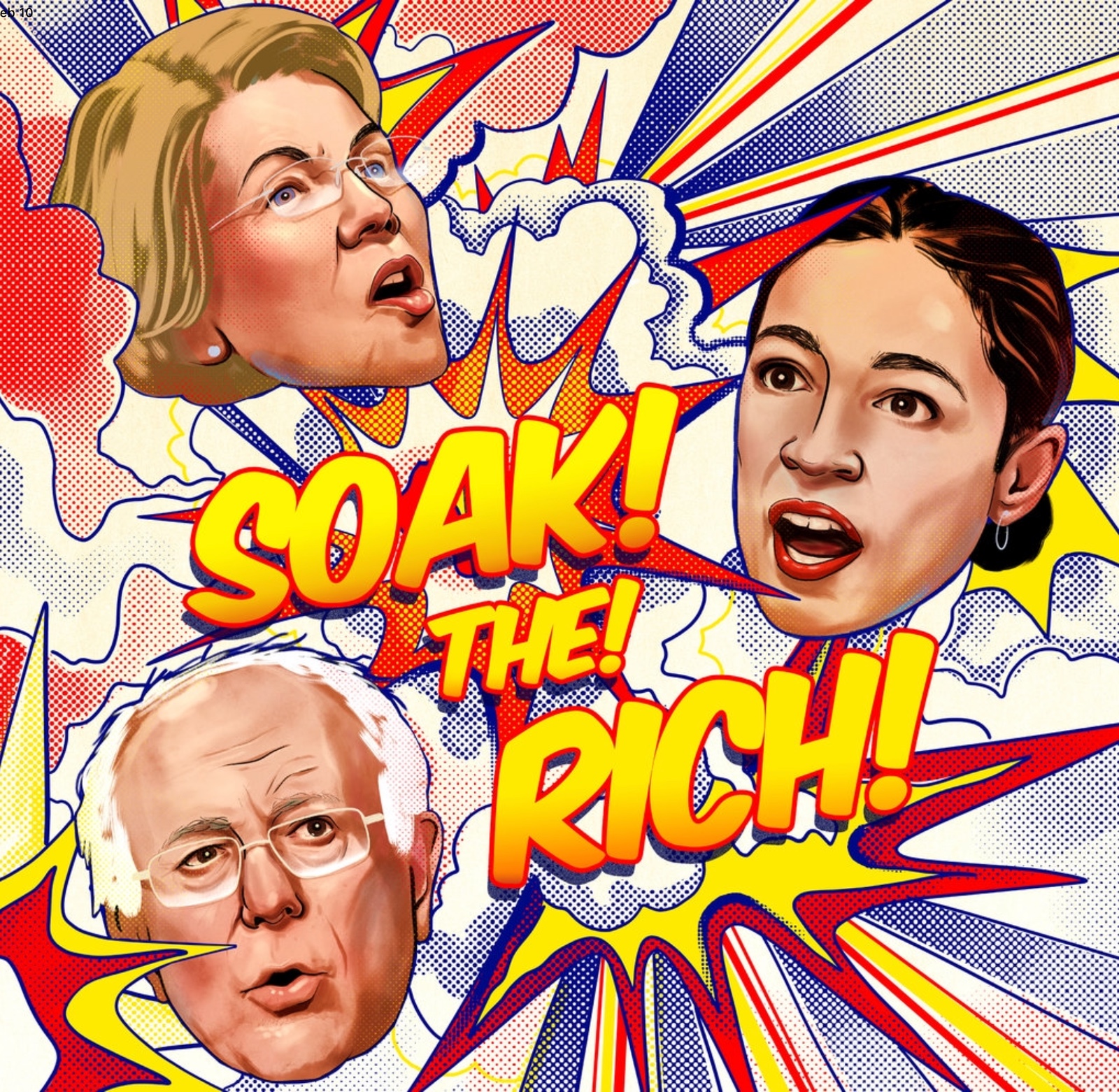

Eat the Rich: America is having something of a socialist moment, with high-profile Democrats arguing for everything from higher taxes on the wealthy to taxes on dynastic heirs and even a straight-up wealth tax, the New York Times reports, suggesting in a fantastic rundown that we may have entered a new era in which left-leaning policy proposals have legs. NYT columnist Farhad Manjoo takes it a step further, suggesting it may be time to abolish bn’aires. Expect the idea of a wealth tax to get a lot of attention in the US press the next couple of days — it’s a signature idea of Elizabeth Warren, who launched yesterday her 2020 presidential campaign. History, CNBC argues, may be on the side of the reformers.

In miscellany worth knowing about this morning:

- The US business press is preoccupied with a particular … package … from Amazon as CEO Jeff Bezos has accused the sleazemongers at the National Enquirer of trying to blackmail him with racy texts and pics from an affair with a US television personality. Bloomberg has a copy of Bezos’ public letter, which he posted to Medium (which is kinda flaky here in Egypt).

- The Donald and Kim Jong Un will meet in Hanoi on 27 and 27 February, according to a tweet from the orange-haired one.

- Blackstone is retreating from Africa. The world’s largest private equity firm is pulling back from a pledge to invest USD 2.5 bn in infrastructure just as the Pentagon warns of rising Chinese and Russian influence on the continent.

Want to add to your TBR pile? Let the Financial Times feed your sickness with its list of 15 books everyone needs to read this year. (TBR, for the uninitiated, is To Be Read.)

Just don’t expect the FT to talk about what’s trendy outside of books. Five or so years after vinyl made its comeback, the salmon-colored paper’s editorial board is just now taking notice.

Did you miss any of our 2019 Enterprise CEO Poll interviews? Links to all of last week’s interviews are below:

- Osama Bishai (CEO, Orascom Construction)

- Hend El Sherbini (CEO, IDH)

- Amr Allam (Co-CEO, Hassan Allam Holding)

- Mohamed El Kalla (CEO, CIRA)

- Riad Armanious (CEO, EvaPharma)

- Elwy Taymour (Chairman and CEO, Pharos)

- F. John Matouk (Founding partner, Matouk Bassiouny)

- Basel El Hini (Chairman and MD, Misr Insurance Holding Company)

- Tarek Assaad (Managing partner, Algebra Ventures)

- Sherif El Kholy (partner and head of MENA, Actis)

MUST READ- Why girls beat boys at school and lose to them in the office, an opinion piece in the New York Times, which suggests that “we need to ask: What if school is a confidence factory for our sons, but only a competence factory for our daughters?” Doesn’t matter whether you’re a parent or an educator, you need to read this.