- All schools and universities are closing for two weeks starting today, gov’t pledges EGP 100 bn to fund response. (What We’re Tracking Today)

- 21 dead as ‘Dragon storm’ pummels Egypt. (Speed Round)

- It was a truly mad week in the global markets — expect more of the same this week. (Speed Round)

- El Sisi reviews draft FY2020-2021 budget. (Speed Round)

- Low income earners to get larger-than-expected tax cut. (Speed Round)

- State-owned Kenyan reinsurer eyes Egypt. (Speed Round)

- EIP establishes Levant Fund targeting SMEs in Egypt, Jordan, Lebanon, and Iraq. (Speed Round)

- EBRD unveils EUR 1 bn “solidarity package” to help businesses cope with the impact of covid-19. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 15 March 2020

Schools, universities ordered closed for 2 weeks amid covid-19 outbreak

TL;DR

What We’re Tracking Today

With more than 100 confirmed cases, Egypt got serious yesterday about its response to covid-19 after cabinet last week banned large gatherings and urged citizens to practice social distancing. New measures include school closures and an EGP 100 bn response package ordered by Ittihadiya, details of which should be made clear in the days ahead. Regionally, central banks in Saudi Arabia and the UAE have announced stimulus packages.

All schools and universities in Egypt have been ordered closed for two weeks starting this morning after Ittihadiya yesterday announced emergency measures designed to help prevent the spread of the virus. The measures were put in place after Education Minister Tarek Shawky said seven schoolchildren were among the latest confirmed cases in Egypt. Shawky told his cabinet colleagues that the individual student cases were spread across a wide geographic area.

Independent schools and universities in Egypt had earlier decided to suspend in-person instruction. AUC brought its spring break forward by four weeks to run this week and will then begin two weeks of online instruction after the break. Cairo American College and other independent schools are moving to remote learning this week.

The current post-secondary term may be extended for 1-2 weeks to compensate for the closures, Higher Education Minister Khaled Abdel Ghaffar said.

Meanwhile, the EGX reopens today after sitting out Thursday following a last-minute holiday in the face of massive storm. What to watch for: The bourse missed Thursday’s sell-off in global markets and the rebound on Friday — and will be digesting Egypt’s response this weekend to covid-19.

What should businesses do right now? Social distancing is the order of the day if we want to flatten the curve and give healthcare professionals a chance to manage the caseload that epidemiologists say could be coming. If you have staff whose jobs can be done remotely, have them work from home now. For folks running retail outlets, malls and other businesses where face-to-face contact is a standard part of business: Give your staff a refresher on proper hygiene (soap kills the virus better than anything else), step up your cleaning efforts, and make certain anyone who shows any sign of illness knows to stay home from work. The CDC’s resources for employers on how to stay safe during the pandemic are a must-read.

*** JOIN US FOR A WEBINAR ON HOW TO WORK REMOTELY. Entreprise has been produced remotely for the past week and has always had half of its staff working from home at any given time. The staff at Inktank, our parent company, will follow suit tomorrow. This coming Thursday, 19 March at 2pm CLT, we’ll be hosting a call for Enterprise readers to discuss the strategies and technologies you can use to go remote. We have lines for up to 100 readers to either dial in or log in from their computer (the latter will allow you to see our screen). Use this link to sign up.

Pro tip from our staff virologist: Soap and hot water kill and wash away the virus better than alcohol-based hand sanitizer. Soap literally dissolves the virus’ lipid membrane, making it unable to infect your cells — and the hot water washes it away.

The total number of confirmed cases in Egypt now stands at 110, according to a statement last night from the Health Ministry, up from 45 a week ago.

Egypt reported its second death from covid-19 over the weekend. A 60-year-old woman from Daqahliyah died on Thursday, a day after being admitted to the hospital and testing positive for covid-19, raising Egypt’s death toll from the virus to two. She suffered from acute pneumonia from the virus, according to a Cabinet statement. The first death was that of a German national who passed away on 8 March.

Just about every event you can think of has been cancelled, in Egypt and around the world. Here at home, AmCham postponed last week its monthly luncheon, conferences are being cancelled, and furniture expo Le Marché La Casa’s summer round has been postponed, according to a statement. New dates for the expo will be announced at a later time.

Meanwhile, football matches have been suspended for 15 days starting tomorrow, according to a statement from the Egyptian Football Association, and most sporting clubs have suspended team activities for an indefinite period.

All non-immigrant visa appointments at the US embassy scheduled for 15 March through 9 April have been postponed.

The tourism industry is bracing for the hit, the most recent sign of which is Ukraine saying it has suspended international flights starting 17 March. The country is a major inbound market, particularly for Sinai and Red Sea destinations.

Sign of the times: The cost of insuring Egyptian sovereign debt has almost doubled over the past month: The price of credit default swaps — financial instruments that provide cover against default — on Egyptian government bonds has increased by almost 95% over the past month and 64% in the past week alone, the local press reported yesterday. CDS prices reflect market confidence in the bond issuer’s ability to meet its repayments: lower prices indicate low-risk debt while higher prices imply an increased likelihood of default.

Globally, it’s something of a [redacted] show this morning:

Saudi Arabia has suspended all flights into and out of the kingdom for a two-week period starting this morning.

Kuwait is effectively on lockdown, having shut down government offices, many bank branches and declared an official holiday until 26 March in a bid to limit the spread of the virus. The government has shuttered gyms and private health clubs and imposed a ban on gatherings in cafes and restaurants, while commercial flights have been suspended across the board with the exception of inbound flights for Kuwaiti citizens and their first-degree relatives, according to Bloomberg.

In Europe, Spain and France have followed Italy into nationwide lockdown. Spain has announced a 15-day nationwide lockdown starting tomorrow after 1.5k new cases were reported in just 24 hours at the weekend. People will only be allowed outside to buy food, work or for emergencies, according to the decree being finalized by the government. In France, all non-essential stores are being forced to close, leaving only food shops, pharmacies and petrol stations open to the public.

Europe now the epicenter of the pandemic, the World Health Organization says. “More cases are now being reported [in Europe] every day than were reported in China at the height of its epidemic,” said WHO Director-General Tedros Adhanom Ghebreyesus, according to CNBC.

The US has officially declared a national emergency, releasing USD 50 bn in funds to support efforts to fight the outbreak, says the Associated Press.

The UK’s science czar has a novel approach: Sit back and let everyone get infected. The UK should let around 60% of its population catch the virus for society to develop “herd immunity” from future outbreaks, the government’s top science advisor Sir Patrick Vallance told Sky News. In response, more than 200 scientists warned (pdf) that the government’s strategy could lead to mns of people being affected in the coming weeks and urged it to take stronger action at containing the outbreak.

Covid-19 is now in at least 19 African countries: Kenya, Ethiopia, Sudan and Guinea all confirmed their first cases of the virus on Friday, Reuters reports.

Work is grinding to a halt the world over: Apple is closing all of its retail stores outside Greater China until 27 March and its employees have begun working remotely and Patagonia is shutting down all of its stores and its website. Companies from Italy to Silicon Valley are moving to remote work.

Global travel is becoming increasingly difficult, with airlines suspending flights and several countries imposing new restrictions on travel and visa issuances:

- US President Donald Trump has added the UK and Ireland to a US travel ban on 26 European countries;

- The UAE has suspended issuing visas, effective 17 March, except for those holding diplomatic passports;

- Saudi Arabia has suspended all inbound and outbound flights for a two-week period;

- Jordan has suspended all incoming and outgoing flights and placed a ban on public gatherings;

- Lebanon is banning travel to and from 11 countries, including Egypt, Italy, Iran, China, and South Korea after granting a four-day grace period for Lebanese nationals to return;

- Libya will shut down all air and seaports from Monday, the Tripoli-based Government of National Accord said on Saturday;

- Morocco suspended travel from 21 countries, including Egypt, the state’s news agency reported on Saturday;

- Sudan has banned flights to Egypt and EgyptAir has stopped flying to our southern neighbor.

Reason #932 we love the EBRD: The European Bank for Reconstruction and Development (EBRD) has unveiled an emergency EUR 1 bn “solidarity package” to help mitigate the impact of covid-19 for companies in the regions in which it operates, according to a statement (pdf). The package includes emergency liquidity, working capital, and trade finance facilities for existing EBRD clients, said EBRD President Sir Suma Chakrabarti.

Stimulus is coming: Egypt as well as the central banks of Saudi Arabia and the UAE have announced packages worth a combined USD 47 bn to ease the blow to their respective economies as amid the spread of covid-19, Bloomberg reports. Egypt will allocate EGP 100 bn (USD 6.4 bn) to combat covid-19, with details expected this week. The UAE regulator will support banks and businesses with a USD 27.2 bn plan, while Saudi Arabia is preparing a USD 13.3 bn package, mainly tailored for SMEs, offering them six-month deferrals on bank payments.

In non-covid-19 news worth knowing about:

S&P has downgraded Lebanon’s foreign currency ratings to Selective Default (SD) down from extremely high risk (CC/C) after Beirut decided to not meet its USD 1.2 bn eurobond payment last week, according to a press release. The ratings agency also affirmed its local currency long- and short-term ratings at CC/C and maintained its outlook on the long-term rating at negative. Lebanon is set to hold talks with its creditors to restructure the rest of its USD 31 bn debt.

Abu Dhabi joins team Saudi in oil war, cuts price for its flagship grade: State-run Abu Dhabi National Oil Company (Adnoc) shaved USD 2.75 off its Murban grade to sell at USD 35.20 / bbl, citing “unprecedented market conditions,” while also boosting supply by 33%, Bloomberg reported. Though Adnoc remains the only major Gulf producer making price cuts, global oil prices have fallen to an average of USD 33.85 since the UAE, the third largest OPEC producer, joined Saudi Arabia in its price war with Russia.

Enterprise+: Last Night’s Talk Shows

The shutdown of Egyptian schools and universities was topic du jour on the airwaves last night: Al Hayah Al Youm’s Lobna Assal reviewed Prime Minister Moustafa Madbouly’s press conference, which included discussion of President Abdel Fattah El Sisi’s EGP 100 bn package to help prevent the spread of the virus and the decision to suspend schools and higher learning institutions for two weeks.

Egypt is in “stage two” of its response, Madbouly noted: Egypt has a “limited” number of positive cases compared with other countries, but the discovery of cases across a wider geographic spread prompted phase two measures including a ban on large gatherings and school closures. The latter is necessary because a number of new positive cases were students.

Higher Education Minister Khaled Abdel Ghaffar told Assal that students aren’t on holiday — lessons and lectures will continue online. Universities will be subject to deep cleaning while students study remotely, he said (watch, runtime: 9:34). Masaa DMC’s Eman El Hosary (watch, runtime: 8:09) and El Hekaya’s Amr Adib (watch, runtime: 6:35) had the same report.

K-12 exams are not being delayed: Adib also spoke with Education Minister Tarek Shawky, who said exams would not be delayed, but will be scheduled in coordination with the Health Ministry with necessary precautions in place. He added that he was in touch with the Communications Ministry who assured him that ISPs will not count time spent on the Education Ministry’s online lessons against families’ data caps (watch, runtime: 7:31). Min Masr’s Amr Khalil also covered the story (watch, runtime: 12:25).

Covid-19 updates: Adib also spoke with Health Minister Hala Zayed, who noted the rollout of rapid detection systems that provide results within an hour. They also discussed a Washington Post article on how an outbreak on a Nile cruise ship reportedly resulted in cases around the globe; Adib said the report maligned the ministry’s efforts. Zayed said that, out of the 171 people on board that were tested, 45 tested positive and many have since recovered and left the country (watch: runtime: 10:06).

Income tax cuts for low earners: Assal also highlighted President Abdel Fattah El Sisi’s meeting on the draft FY2020-2021 budget. During the meeting El Sisi called on ministers to raise the tax exemption limit for all workers from EGP 8k to EGP 15k annually and to lower the tax rate for those earning EGP 15-35k to 2.5%. (watch, runtime: 3:29). Khalil also had the same report (watch, runtime: 1:19). We have more on this in this morning’s Speed Round, below.

Pro-Egypt GERD efforts abroad: Assal spoke by phone with community organizer Iman Wehman, who has rallied members of the Egyptian community in New York and New Jersey, and elsewhere in the US, to stage a demonstration in front of the White House and World Bank on Sunday in support of Egypt’s position on the Grand Ethiopian Renaissance Dam negotiations (watch, runtime: 2:46).

Correction: 16/03/2020

A previous version of this story incorrectly named Higher Education Minister Khaled Abdel Ghaffar as Adel Abdel Ghaffar.

Speed Round

Speed Round is presented in association with

21 people have been reported dead after rain, wind, sand and lightning pummeled the country in what has been dubbed a ‘dragon storm.’ The downpour on Thursday and Friday caused widespread power outages, travel disruption and infrastructure damage as roads flooded and several buildings collapsed. Ten people died when a building collapsed in the Al Zarayeb suburb in Helwan and in Qena a six-year-old child was killed after a tree fell on his family’s home. Speaking at a press conference, Prime Minister Moustafa Madbouly described the level of rainfall as unprecedented in recent decades.

Businesses, government, banks and the EGX had all closed their doors in anticipation of the extreme weather and Thursday was declared a school holiday last week after the national weather service said that sandstorms and heavy rains would hit the country.

The weather was a factor in the collision of two passenger trains in Cairo on Thursday afternoon, leaving 13 injured and rail services to be suspended for the rest of the day, Ahram Online reports. Four officials at the Railway Authority have been detained for four days over the accident pending investigation, Egypt Today reports.

Apocalyptic scenes of orange skies and flooded streets circulated on social media: An eyewitness video posted to social media appeared to show a drowned man floating face down in a flooded street. New Cairo saw water running down many of its main roads and residents posted videos of sinks running in reverse, overflowing with rainwater, and of flooded basements and living rooms. Sand and dust could be seen covering much of the country’s sky Thursday morning.

The story made global headlines at outlets including the Associated Press | Reuters | The National | Gulf News.

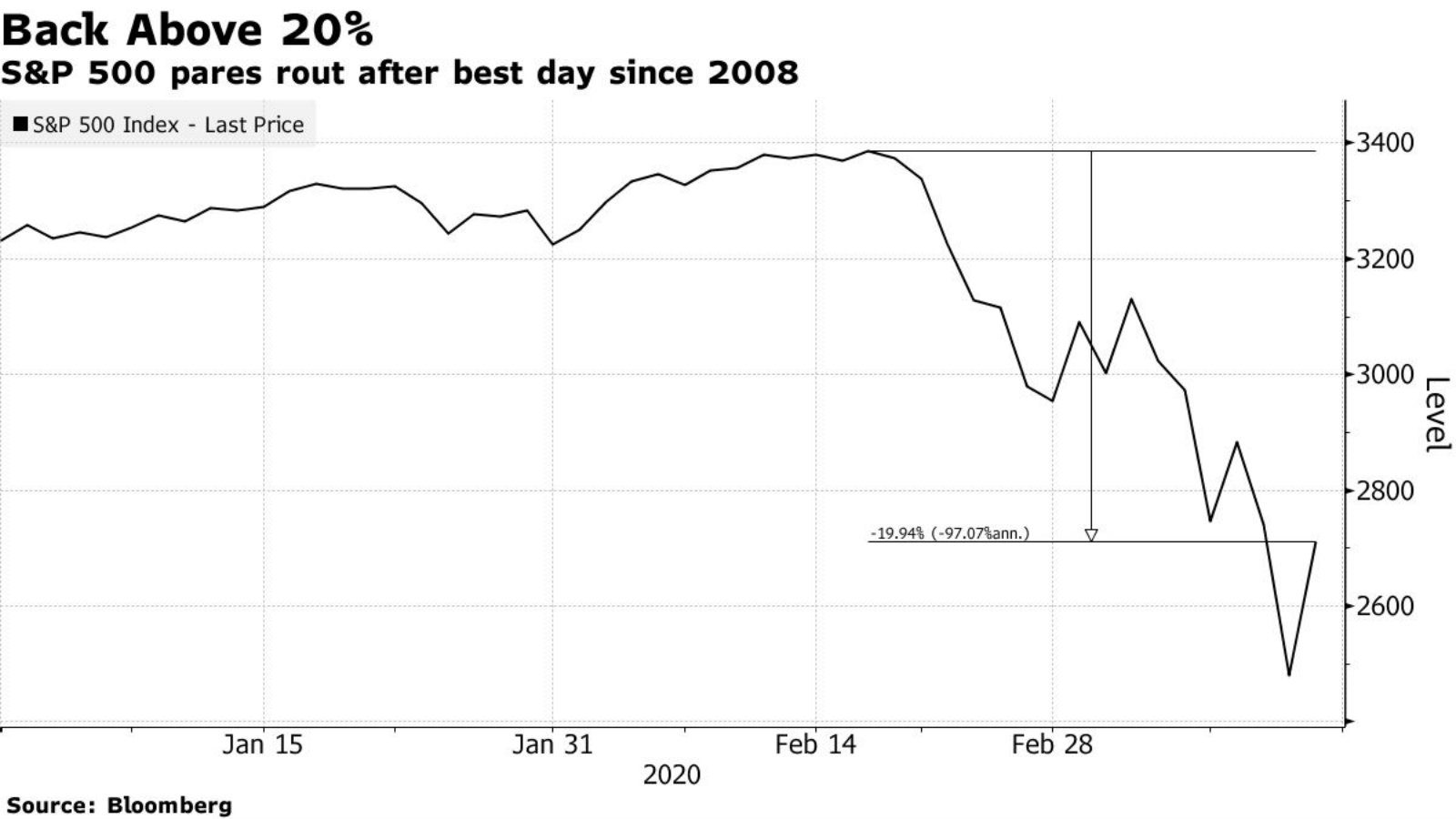

Global equities cap wild week of trading with late Friday surge on stimulus hopes: Global stocks surged on the final day of trading last week on hopes that world leaders would step in with fiscal support for businesses threatened by the covid-19 outbreak. President Donald Trump declared a national state of emergency that unlocks USD 50 bn in federal funds, helping the S&P 500 to see its best day’s trading since 2008, finishing 9.3% in the green. The other major US indices, the Dow Jones and Nasdaq, also ended the day up almost 9.4%.

Just a day before, US and European equities had posted their biggest single-day drop since Black Monday in 1987, reeling from Trump’s decision to suspend air travel between the US and Europe and ECB President Christine Lagarde’s botched press conference following the central bank’s interest rate meeting. The Federal Reserve was forced to inject USD 1.5 tn in emergency liquidity into the financial system as US markets collapsed more than 9% in response to the travel ban. And in Europe, Lagarde’s suggestion that the central bank wouldn’t provide support to the bond market caused Spanish and Italian yields to spike and helped indices across the continent to close more than 10% in the red, with the Italian exchange down almost 17%. It was a “catastrophic failure,” in the words of one European economist.

The one-day comeback is barely a relief for Wall Street, which saw its second-worst week in a decade following a manic Monday-Thursday selloff, along with many other markets around the world. “The slide into a bear market has been the fastest since World War II,” says the AP. The S&P 500 fell over 20% last week and the Dow nearly 15% before recouping some of the losses on Friday.

Oil prices also took a breather, with Brent up 5.27% on the day and US crude gaining 4.54%. Trump pledged that the US will begin filling up its strategic reserves to take advantage of historically low prices. Oil prices were battered last week after Saudi Arabia announced it would flood the market with ultra-cheap crude in response to the collapse of talks with Russia to agree new supply cuts.

This seems to at least indicate that “we’re definitely taking steps in the right direction,” Boston-based State Street Global Advisors chief investment strategist Michael Arone was quoted as saying by Reuters. However, volatility and a lack of liquidity are expected to remain high, Chicago’s Piper Sandler analyst Justin Hoogendoorn says.

China steps up stimulus with USD 79 bn plan: The People’s Bank of China’s decided late on Friday to slash the reserve requirement for commercial banks, allowing USD 79 bn in funds to flow to local companies, the Financial Times reports. This measure was announced on the same day other central banks in the Asia-Pacific “looked to shore up [their] crisis-hit markets and economies.” Meanwhile, the Bank of Japan purchased USD bns-worth of bonds and the Reserve Bank of Australia boosted financial market liquidity by USD 5.6 bn.

While global equities were hammered on Thursday, the EGX (quite literally) weathered the storm. The exchange was closed as Cairo’s streets were hit with heavy rain.

BUDGET WATCH- President Abdel Fattah El Sisi reviewed the FY2020-2021 draft budget with senior cabinet ministers yesterday, an Ittihadiya statement said. Largely in line with previous estimates, its projections include a primary budget surplus of 2%, a budget deficit of 6.2% of GDP, down from 7.2% in the current fiscal year, and reducing public debt to 80% of GDP by the end of the fiscal year.

The government sees GDP growing at a 6% clip and expects unemployment to fall to 8% during the coming fiscal year, according a 2021 investment plan presented by Planning Minister Hala El Said.

Don’t be surprised if these figures change thanks to current events: As Finance Minister Mohamed Maait and Vice Minister of Finance Ahmed Kouchouk told us last week, the government may need to rethink its economic growth and budget targets if the covid-19 crisis persists over the coming weeks and months.

The government is also planning investment in the healthcare sector as part of its "Nurseries and Families in Intensive Care” initiative, to increase nurseries by 10%, child care services by 90%, and intensive care services by 80%, the statement said, without providing additional detail.

LEGISLATION WATCH- Low income earners to get larger-than-expected tax cut on orders of President El Sisi: President Abdel Fattah El Sisi yesterday ordered the Madbouly government to provide larger income tax breaks to low-income earners under draft amendments to the Income Tax Act that will soon go up for a vote at the House of Representatives, according to a statement from Ittihadiya. The current amendments, which had been approved by the House Planning and Budgeting Committee last month, would have increased the income tax exemption threshold to EGP 14k and raised the upper limit of each tax band. The directions given by the president yesterday go a step further, raising the exemption threshold to EGP 15k, cutting the wage tax burden on those earning EGP 15-35k a year to just 2.5%, down from 10-15% currently.

It is unclear how this will affect the other tax bands, which according to the legislation that had already been reviewed by the house would have been as follows:

- Those earning between EGP 14-40k would be taxed 10%;

- Those earning between EGP 40-60k would be taxed 15%;

- Those earning between EGP 60-200k would be taxed 20%;

- Those earning more than EGP 200k would be taxed at 22.5%.

New raises: El Sisi also directed ministers to approve new annual raises amounting to 7% of the gross wage for public-sector employees whose employment is regulated by the Civil Service Act and 12% of the basic wage for state employees who are not covered by the act.

INVESTMENT WATCH- State-owned Kenyan reinsurer eyeing Egypt: Kenya Reinsurance Corporation (Kenya Re) is planning to establish a subsidiary in Egypt specialized in Sharia-compliant reinsurance, the EastAfrican reports, quoting a company statement. Kenya Re is looking to provide “re-takaful” services, which is reinsurance for mutual guarantee or sharia-compliant “takaful” companies. The state-owned reinsurer would use KES 5.25 bn (c. USD 52.5 mn) from its cash reserves to set up its Egypt arm.

INVESTMENT WATCH- Private equity outfit EIP looking at SMEs in Egypt, Jordan, Lebanon, Iraq: Private equity firm Emerging Investment Partners (EIP) has raised USD 60 mn for its EIP Levant Fund, which will target SMEs in Egypt, Lebanon, Jordan, and Iraq, according to an emailed statement (pdf). Key investors include the International Finance Corporation and the Dutch Good Growth Fund, as well as Obegi Group, Alfadel Group, and Capital PE. The fund is looking to take stakes in SMEs with turnover under USD 50 mn, writing tickets in the USD 1-6 mn range. EIP started fundraising in 2016, at which time Managing Director Karim Burhani said that 50% of the target funding will be channeled to Egypt.

Egypt in the News

Egypt’s response to the covid-19 threat continues to top coverage in the foreign press, with questions circulating as to whether we’re doing enough to counter the risk posed by the virus. Misinformation abounds on social media and it remains difficult to obtain accurate official data about the number of infections, writes Zvi Bar'el in an opinion piece for Haaretz.

Meanwhile, the US tourist held in covid-19 quarantine in a military hospital in Marsa Matrouh is attracting attention on Twitter and various media outlets, as he details his experience online. Technology journalist Matt Swider is one of 45 people on the Asara cruise ship who initially tested positive for the virus, although reports suggest his test result may have been a false positive and that he is now returning to the US. (AP | Washington Post | New York Post | Live Science)

How to solve a problem like the GERD? Use a multi-stage approach instead of trying to solve all the issues at once, the Brookings Institution’s Addisu Lashitew writes for Foreign Policy. Signing off on an agreement for the initial filling of the dam — an issue on which Egypt, Ethiopia and Sudan have made significant progress — will provide plenty of time to find common ground over how Addis Ababa operates it in the long term, which is now the main source of the dispute.

Startups are fueling alternative tourism in Egypt, with platforms being set up to help freelance tour guides and drive interest to lesser known destinations in Egypt like Cairo’s garbage city, Deutsche Welle reports.

Diplomacy + Foreign Trade

Shoukry lobbies France for GERD support: Foreign Minister Sameh Shoukry met on Friday with his French counterpart Jean-Yves Le Drian, where he handed a letter from President Abdel Fattah El Sisi to the French President Emmanuel Macron urging France to put pressure on Ethiopia to sign the agreement brokered by the US over the timetable for filling and operating the Grand Ethiopian Renaissance Dam (GERD), according to a cabinet statement.

Shoukry is currently visiting a number of European capitals to shore up support for Egypt in its dispute with Ethiopia, less than a week after he toured the Arab world. Ethiopia, on the other hand, is reportedly working on a new proposal and will present it soon to Egypt and Sudan. Tensions over access to the Nile’s water have grown in recent weeks after Ethiopia backed out of the US and World Bank-mediated talks, accusing the US of being biased in favor of Egypt. Ethiopian military officials visited the dam on Thursday and later issued a statement vowing retaliation in the case of any attacks, in what AP is terming “a veiled warning to Egypt not to try to sabotage the dam.”

Energy

Dana Gas Egypt assets see production fall 4% in 2019

Dana Gas saw production from its Egypt assets fell 4% in 2019 to 33k boe/d from 34.5k the year before, the company said in a statement last week. The company is continuing with a strategic review of its assets in Egypt and claims to have received an encouraging level of interest so far. The Emirati firm announced in July last year that it planned to offload its entire Egypt portfolio to focus on developing its operations in Iraq. It reported last month that it had received “numerous” bids for the assets in 2H2019 and that will make a final decision by the end of March.

Automotive + Transportation

Egypt launches consultancy tender for monorail project

Egypt has launched a tender for advisory services for its monorail project (pdf), with the deadline for technical and financial bids set for 17 March. The country is looking to construct two high-speed monorail lines, one spanning 53 km from the new administrative capital to Nasr City and the other 42 km between Sixth of October City and Giza.

On Your Way Out

Haitian-French actor Jimmy Jean-Louis visited the pyramids on Friday as part of his tour in Egypt after attending the 2020 Luxor African Film Festival.

The Environment Ministry is developing an application, e-Tadweer, to help citizens get rid of their electronic waste safely by providing incentives such as discount vouchers that can be used when purchasing electronic appliances, Egypt Today reports. Minister Yasmine Fouad is drafting legislation to formalize the electronic waste management sector to ensure safe disposal, in cooperation with the United Nations Development Program (UNDP). The report did not provide a value for the program, but said a joint statement by the ministries of environment and telecommunications will be issued in the coming months.

The Market Yesterday

EGP / USD CBE market average: Buy 15.66 | Sell 15.76

EGP / USD at CIB: Buy 15.66 | Sell 15.76

EGP / USD at NBE: Buy 15.65 | Sell 15.75

EGX30 (Wednesday): 11,194 (-0.1%)

Turnover: EGP 717 mn (20% above the 90-day average)

EGX 30 year-to-date: -19.8%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.1%. CIB, the index’s heaviest constituent, ended down 0.2%. EGX30’s top performing constituents were Dice up 8.5%, GB Auto up 3.2%, and Elsewedy Electric up 2.5%. Yesterday’s worst performing stocks were CIRA down 6.5%, Qalaa Holding down 2.9% and AMOC down 2.2%. The market turnover was EGP 717 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -80.2 mn

Regional: Net long | EGP +1.8 mn

Domestic: Net long | EGP +78.3 mn

Retail: 53.5% of total trades | 50.5% of buyers | 56.5% of sellers

Institutions: 46.5% of total trades | 49.5% of buyers | 43.5% of sellers

WTI: USD 31.73 (+0.73%)

Brent: USD 33.85 (+1.90%)

Natural Gas (Nymex, futures prices) USD 1.87 MMBtu, (+1.52%, April 2020 contract)

Gold: USD 1,516.70 / troy ounce (-4.63%)

TASI: 6,357 (-2.98%) (YTD: -24.22%)

ADX: 3,922 (-7.40%) (YTD: -22.73%)

DFM: 2,032 (-7.96%) (YTD: -26.50%)

KSE Premier Market: 5,246 (+1.39%)

QE: 8,230 (-4.45%) (YTD: -21.06%)

MSM: 3,733 (-2.57%) (YTD: -6.22%)

BB: 1,436 (-3.55%) (YTD: -10.79%)

Calendar

March: South Korean business delegation to visit Egypt.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

March: The French Chamber of Commerce and Industry is sending 10 French companies to Egypt to promote French tourists to visit.

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 March (Tuesday): The Annual Export Summit, Nile Ritz Carlton, Cairo, Egypt.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

26 March (Thursday): Court session for Amer Group, Porto Group lawsuit against Antaradous.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action”, new administrative capital, Egypt.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

17-19 April (Friday-Sunday): IMF, World Bank hold Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.