- FinMin is mulling a cap on the monetary value of the corporate healthcare tithe. (Speed Round)

- Swvl looking to raise over USD 100 mn in a financing round in 1Q2020. (Speed Round)

- SODIC launches “The Estates” in New Zayed. (Speed Round)

- Noble, Delek attempt to allay fears of gas export delays to Egypt. (Speed Round)

- Gov’t kicks off its EGP 6 bn export subsidy program, encouraging big companies to invest more to get faster payouts. (Speed Round)

- Say it ain’t so: Are GERD talks grinding to a halt again? (Speed Round)

- Oil prices soared yesterday as Trump accused Iran of orchestrating the Aramco facility attack. (Speed Round)

- The FRA wants to impose an insurance policy for divorced women under the Insurance Act. (Last Night’s Talk Shows)

- The Mineral Resources Act is getting more praise from economists and investors. (Egypt in the News)

- The Market Yesterday

Tuesday, 17 September 2019

Will the healthcare tithe be capped at EGP 10k for all businesses?

TL;DR

What We’re Tracking Today

Saudi Arabia and the ramifications of last week’s attack on Aramco facilities have been dominating the headlines in the foreign press, thanks to renewed accusations that Iran had a hand in the attacks.

Global stock markets also saw a dip as a result, with airline stocks and those of other fuel-intensive businesses taking the hardest knocks, while inflation expectations were pushed up, amid a climate of general uncertainty. Both S&P 500 and Dow Jones futures were down 0.4% on Monday, AP reports. We cover all the happenings from yesterday in the Speed Round below.

The story is casting a cloud over Fed day. The US Federal Reserve’s Federal Open Market Committee will meet today and tomorrow to decide on interest rates. US President Donald Trump is not done dropping hints towards Fed Chairman Jerome Powell, going so far as to use the current troubles in Saudi Arabia as reasons to urge Powell to drop rates. “Federal Reserve, is paying a MUCH higher Interest Rate than other competing countries…And now, on top of it all, the Oil hit,” he wrote. “Big Interest Rate Drop, Stimulus,” Trump said in a tweet on Monday. Markets are anticipating a rate cut will be announced on Wednesday, particularly after the European Central Bank did just that last Thursday.

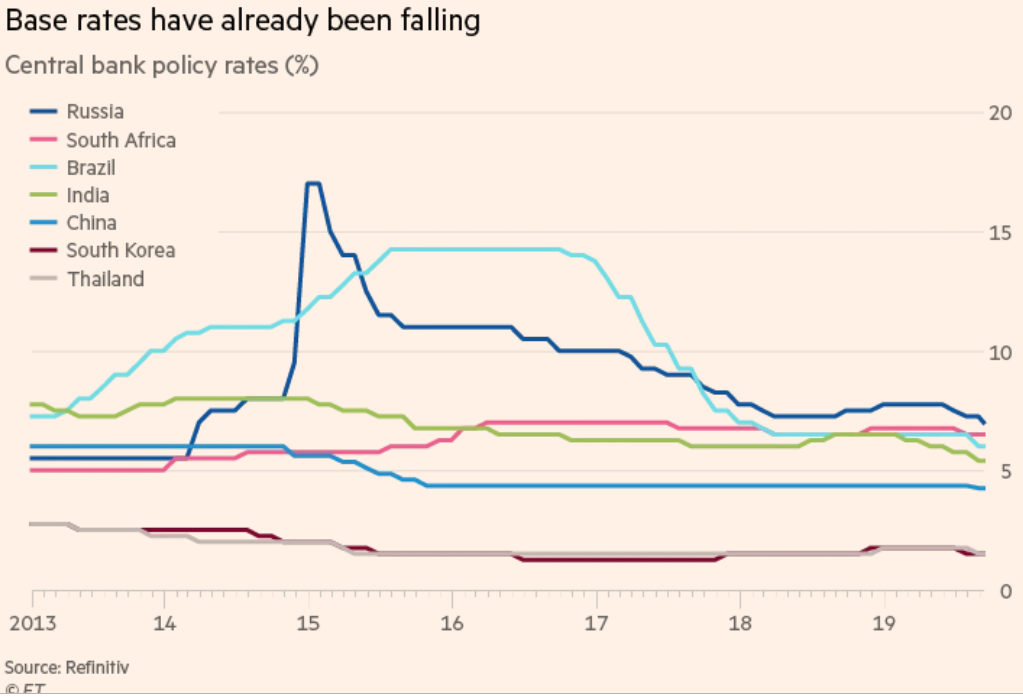

Our central bank’s Monetary Policy Committee will meet next Thursday, 26 September, to decide on interest rates. Analysts are projecting a rate cut, in light of inflation for August falling to a six-year low of 7.5% and an expectation that the Fed will join the ECB in rate cuts, followed by other countries.

This would have us rowing in the same direction as other emerging markets, whose central banks are apparently more inclined towards monetary easing than at any other time since the global financial crisis, according to the Financial Times (paywall), which cites data from Bank of America Merrill Lynch’s Emerging Monetary Mood Indicator. These EMs have in August have apparently dropped more hints that they were inclined towards monetary easing than at any moment since the DotCom crash in 2000. “There are quite a few emerging markets where we are comfortable saying we think [central banks] will cut more than the market is expecting,” said David Hauner, head of EM cross-asset strategy and economics at BofA, who cited Russia, Brazil, China and the Czech Republic as examples.

The United Nations General Assembly opens today in New York City, and will wrap on 30 September. The General Debate doesn’t kick off until next Tuesday, 24 September, which is when we expected President Abdel Fattah El Sisi to land in New York. You can check out the full schedule of high-level events set to take place over the next two weeks here.

Back in Egypt, the fall conference season’s next few days is all about tech, with a number of tech conferences, summits, and competitions kicking off across the country:

The E-Commerce Summit kicks off today at the Nile Ritz Carlton Hotel in Cairo. The summit will focus on the reshaped world of retail in light of tech innovation and how to break the barriers of moving your business online. 80 speakers from high-profile local and multinational companies will be taking part, along with government officials, including Vice Minister of Finance Ahmed Kouchouk. The sessions will explore many aspects of e-commerce, from laws and regulations to strategies on how to grow e-commerce businesses. You can catch the full agenda here.

Mediterranean Business Angels Network to launch in Techne Summit: The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria, according to VentureBurn. The angels network aims to bring together a large number of business angel networks, groups, funds as well as individual angel investors from Mediterranean countries.

Meanwhile, ITIDA and Huaweii announced the launch of the “Egypt App Cup” competition to offer university students and fresh graduates the opportunity to develop innovative mobile-based solutions and android applications that support transportation, health, and tourism sectors, according to a statement (pdf). The submitted applications will get exposure by being a part of the HUAWEI AppGallery, the official application market for HUAWEI and HONOR smartphone, with millions of users around the world. Those looking to register can sign up here.

Other events to look for this conference include the Egyptian Private Equity Association will host their venture capital event (pdf) on Wednesday, 18 September at the Conrad Hotel and the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

Deutsche Bank has joined the JPMorgan-led Interbank Information Network (IIN), financial services industry’s biggest blockchain project, in a move that will be formally announced this week, the Financial Times reports. The network comprises 320 banks that have agreed to use the medium to swap information about global payments, aiming to reduce delays by making transfer information instantly accessible to every bank in the payments chain.

Business books of the year: The short list for the Financial Times / McKinsey Business Book of the Year is out, featuring “heavyweight books on data privacy, bias against women and the rise of the politically powerful conglomerate Koch Industries.” The list includes Raghuram Rajam’s The Third Pillar (“a broad prescription for reform of capitalism), The Man Who Solved the Market (a narrative biography on the founder of Renaissance Technologies) by Gregory Zuckerman, and Invisible Women by Caroline Criado Perez, an activist.

Enterprise+: Last Night’s Talk Shows

It was another mixed bag of nuts on an eventful night on the nation’s airwaves, keeping the talking heads chattering away.

Egypt’s trade balance improved in 1H2019 as the value of exports climbed 2% y-o-y to USD 15.3 bn, up from USD 15 bn in 1H2018, Al Hayah Al Youm’s Khaled Abu Bakr reported, citing an infographic recently released by the Cabinet Information and Decision Support Center (watch, runtime: 1:53). Exports increased 32.7% y-o-y by 2018-end, the infographic shows.

Insurance Act could introduce prenup-style insurance payment: The new Insurance Act could require men to pay “insurance” when getting married alongside all the regular fees that are paid to receive a marriage license, Financial Regulatory Authority (FRA) deputy head Reda Abdel Moaty told TenTv. The exact amount that would be imposed is still under study, but would be a set fee that would not change according to the couple’s income, dowry, or any other factors. If approved, this stipulation would automatically grant women access to the sum as soon as her husband legally files for divorce, and would not require a court order. The idea is to provide freshly divorced women with financial support until the legal process of finalizing the divorce settlement — including receiving alimony — is complete (watch, runtime: 5:10).

Aramco attack hits both crude, gold prices: After causing crude indices to post unheard-of gains, the attack on Saudi Aramco’s oil plants has had a similar effect on gold prices, causing them to rebound after falling in response to the prospect of a cooling US-China trade war, deputy head of the gold division at the Federation of Egyptian Chambers of Commerce Ehab Wassef said in a phone call with Hona Al Asema’s Reham Ibrahim (watch, runtime: 6:26).

Luxor boasts third highest number of tourist air balloons: Masaa DMC’s Eman El Hosary took note of Luxor recording the third-highest number of hot air balloons in the world (watch, runtime: 3:31). We have the story in Tourism, below.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- FinMin mulls amending corporate healthcare tithe to impose across-the-board cap at EGP 10k: The Finance Ministry is considering introducing amendments to the Universal Healthcare Act that would set an across-the-board limit on the healthcare tithe paid by businesses to fund the new universal healthcare system, two government sources tell Enterprise. The amendments would see businesses pay the 0.25% levy on revenues, but the payment would be capped at EGP 10k, regardless of the size of the company or its revenues. Under the current framework, businesses will be charged the 0.25% levy on their revenues, which will not be tax deductible for this tax season. Loss-making companies will not be exempt from the payment.

The ministry had previously suggested imposing the cap at EGP 100k, but brought the figure down to EGP 10k when the proposal was met with backlash from the business community. The new ceiling is expected to reduce business’ tax burden, our source said. Businesses had previously lobbied to transform the 0.25% levy into a surtax on pre- or post-tax profits.

When is this coming into effect? According to our sources, the ministry plans to implement the changes in January, meaning they would affect the next tax collection season but would be included in the state’s tax revenues for the current fiscal year.

Background: The government began rolling out its EGP 600 bn health insurance plan in Port Said in July, and more governorates will be added gradually over the course of the next 11-13 years. The ministry started collecting taxes (including the 0.25% tithe) to fund the scheme this fiscal year. The government had said in July that it would postpone talks on setting a cap on the tithe until the House of Representatives new legislative session, which begins on 1 October.

STARTUP WATCH- Swvl is seeking to raise more than USD 100 mn in a financing round in 1Q2020, and targeting a USD 1 bn valuation in the coming five years, co-founder and CEO Mostafa Kandil told Reuters. “We were a company worth about USD 2 mn two years ago and our paid-up capital is now USD 80 mn,” he said. The company has been losing money, but expects to become profitable in two to three years, Kandil continued, Currently Swvl’s co-founders — Kandil, Mahmoud Nouh and Ahmed Sabbah — own over 30% of the company, while the rest is owned by 17 investment funds, including Sweden’s Vostok New Ventures and the UAE’s BECO Capital.

To IPO or to be acquired by Uber? That is the question: Kandil said that he hopes Swvl will eventually IPO. He also threw another shocking twist to the interview, saying that they would consider buyout offers from companies such as Uber — which now operates its own bus service in direct competition with Swvl.

Expansion plans are still in the works: Swvl will expand into two cities in Pakistan in the next two weeks, begin operations in Lagos before the end of the year, and expand into Manila in 1H2020, Kandil said. The company is also reportedly eyeing entry into some 10 or 20 new cities next year, with Dar es Salaam and Abidjan being of particular interest, as well as markets in South East Asia. In Egypt, Swvl plans to reach 1 mn trips per day in the coming five years.

Background: In June, Swvl announced its plans to launch 50 buses in Lagos by mid-July, having entered Kenya earlier this year. Later that month, it raised USD 42 mn in the largest-ever funding round for an Egyptian startup. It was recently valued at USD 157 mn, and earlier this month revealed that it was moving its headquarters from Egypt to Dubai by November this year, but that Cairo would remain a hub for operations and engineering.

SODIC has launched “The Estates,” a new project in New Zayed, the company said in a statement (pdf). The west Cairo project will have easy access to western neighborhoods, the North Coast, the newly opened Sphinx Airport and the Grand Egyptian Museum, the upscale real estate developer said. “We are very excited to bring this new community to the market and believe it will be one of the finest additions to our Signature Community series,” said Managing Director Magued Sherif. Located 5 km north of SODIC West, the 630,000 sqm (with 160,000 sqm of landscape and open spaces) all-villa compound will include a clubhouse and a spa.

M&A WATCH- Arqaam to complete three M&A transactions in 1Q2020: Investment bank Arqaam Capital has three M&A transactions worth USD 50-100 mn each in its pipeline, and expects to close them during the first quarter of next year, CEO Rady El Helw said, according to Amwal Al Ghad. El Helw provided no further details on the transactions beyond stating that the companies operate in the service sector.

Noble, Delek attempt to allay fears of gas export delays to Egypt: The USD 15 bn agreement with Egypt is “advancing as it should,” Israel’s Noble Energy and Delek Drilling said on Sunday, according to Eran Azran’s op-ed piece in Haaretz. The statements follow those made by US Deputy Energy Secretary Dan Brouillette to a group of reporters, including Enterprise, last Thursday that the implementation of the natural gas agreement between Israel and Egypt has been delayed because of security concerns and some infrastructure that still needed to be repaired. Oil Minister Tarek El Molla threw the two companies a bone last week when he said that Egypt expects to begin receiving natural gas from Israel by the end of the year. Tamar Petroleum, whose shares have dropped 50% since it went public, saw its shares rise 8% last following El Molla’s comments. However, El Molla’s estimate of 2 bcm of Israeli gas per year falls short of the 7 bcm figure that was initially mentioned in the agreement, deepening worries amongst investors, including Delek Drilling, which has stakes in the Tamar and Leviathan fields, Azran suggests.

Background: Israel’s Noble Energy and Delek Drilling agreed last year to export natural gas to Egypt through Alaa Arafa-led Dolphinus Holding, a milestone move that bodes well for our intentions to become a major energy hub in the region. Trial shipments from Israel’s Tamar and Leviathan gas fields were originally supposed to come in March of this year, but capacity restrictions posed by Israel’s domestic pipeline network meant that the imports had to be delayed. Delek later said that it would begin commercial natural gas sales to Egypt by the end of June. When it didn’t, Israeli Energy Minister Yuval Steinitz came out to say the holdup was a result of Israel’s “complex regulatory regime.” Israel’s antitrust regulator agreed last month to let partners Noble Energy and Delek Drilling buy into the EMG pipeline.

Gov’t kicks off EGP 6 bn export subsidy program, says more overdue payments on the way: The government has started implementing the EGP 6 bn new export subsidy framework and is taking more steps to settle the overdue payments promised by the Export Subsidy Fund since 2012, Finance Minister Mohamed Maait said at a presser yesterday, according to two cabinet statements (here and here). Around 1,000 small companies and exporters will be receiving their dues “immediately.”

Larger companies, meanwhile, will be encouraged to commit to new investments to speed up their payments. They will be given 10% of their arrears “on the spot,” and will be provided with several options to receive the remainder of their arrears. The options include writing off any taxes or customs owed to the government, investing in domestic manufacturing and getting in return priority treatment, and/or applying for industrial land at a discount through the government’s new online land allocation portal.

How much are we looking at? The Egyptian Businessmen’s Association estimated last year that the government could owe exporters EGP 9 bn. Others in the field have put the figure even higher. The Finance Ministry said earlier this week in the process of giving back EGP 800 mn thorough tax breaks, and added that EGP 2 bn are expected to be settled by other alternatives. This came after Minister Mohamed Maait said last week the ministry has already disbursed EGP 1.4 bn over the past few weeks.

GERD talks at a gridlock again? Ethiopia rejected last month Egypt’s proposal for the timeline of filling the Grand Ethiopian Renaissance Dam’s (GERD) reservoir, less than two weeks after Egypt handed it to the African country and neighboring Sudan, according to a note circulated by the Foreign Ministry to diplomats and seen by Reuters. Ethiopia said that the proposal “put(s) the dam filling in an impossible condition,” according to the diplomatic wire, and called for a meeting of irrigation ministers to discuss its own proposal. The meeting, which was held on Sunday and Monday in Cairo and marked a resumption in negotiations after a yearlong hiatus, saw Egypt dismissing the Ethiopian plan.

Why the bickering? Both Egypt and Ethiopia’s proposalsagree that it would take two years to complete the first phase of filling GERD’s reservoir to 595 meters and see the dam’s hydropower turbines operational. Egypt wants Ethiopia to extend this timeline if it were to coincide with extreme drought in the Blue Nile. “Without such a concession, Egypt says it would risk losing more than one mn jobs and USD 1.8 bn in economic output annually, as well as electricity valued at USD 300 mn,” says the newswire. The proposal also requires a minimum yearly release of 40 bn cbm of water, but Ethiopia is eyeing 35 bcm.

Egypt, Ethiopia, Sudan will hold another trilateral meeting of scientific experts between 30 September and 3 October in Khartoum to discuss each country’s proposal for filling the Grand Ethiopian Renaissance Dam’s (GERD) reservoirs, cabinet said in a statement. The meetings held earlier this week did not discuss “technical aspects” and were limited to procedural issues, notes the statement. A meeting of irrigation ministers on 4 and 5 October will “immediately” follow the urgent meeting with an aim to strike an agreement after assessing each proposal.

The UK will give Egypt GBP 13 mn through the World Bank to promote investment in the country, said British MENA Secretary of State Andrew Morrison, according to an Investment Ministry statement. The amount is part of a four-year, GBP 15 mn-worth technical support program to push Egypt’s economic growth. In a meeting on Monday, Investment Minister Sahar Nasr invited Morison to attend the African forum that Egypt is set to host in the New Administrative Capital on 22-23 November. The two sides discussed increasing British investment in Egypt, which now stands at USD 47.4 bn by 1,816 companies, as well as the possibility to fund development projects. They also discussed future cooperation in the transport sector as well as with SMEs.

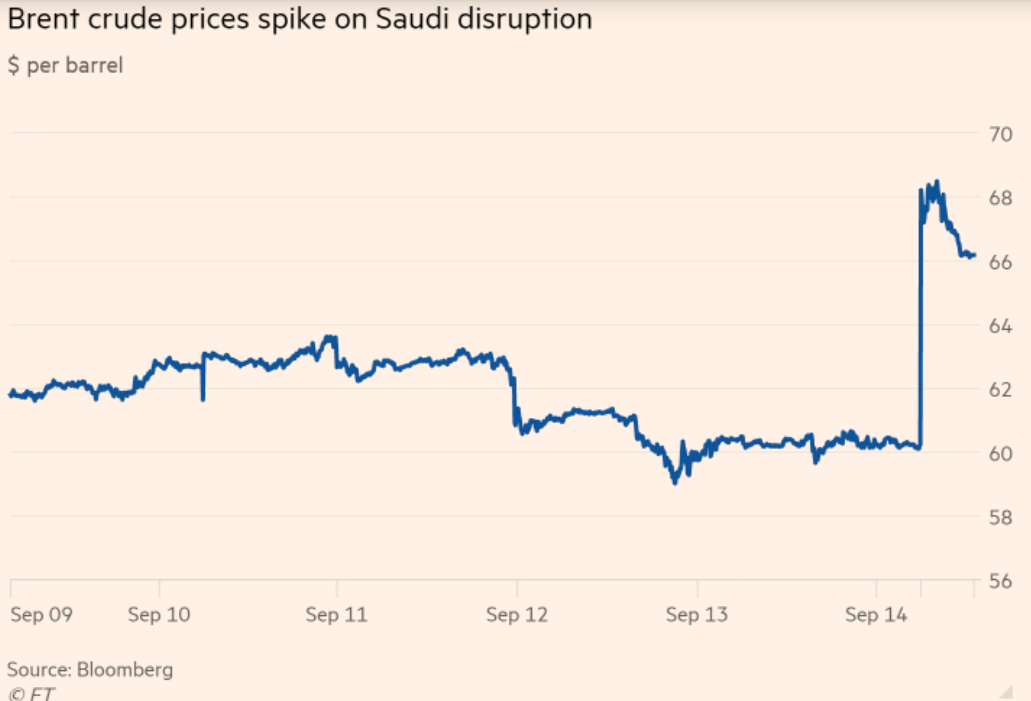

US President Donald Trump has accused Iran of Saturday’s attacks on Saudi Arabia’s Abqaiq oil facility, which have disrupted production of 5.7 mn barrels of oil a day, or roughly 5% of global supply. Accusing Iran of lying in a tweet, he reiterated his support for Saudi Arabia, and hinted that he is ready to escalate a conflict if evidence emerges to verify that Iran was behind the attack — an accusation first directly leveled by Secretary of State Mike Pompeo.

Saudi Aramco officials, meanwhile, are less optimistic about the rapid resumption of full oil production than they were on Sunday. Having initially said operations would resume within days, current estimates suggest it may be weeks or even months before the plant is operating at full production capacity again. While Aramco is using offshore oil fields to replace some of its lost production, and supplying customers using stockpiles, analysts are highlighting the infrastructure’s vulnerability to attack, driving market jitters.

In response to the turmoil, crude oil prices made their biggest jump on record, initially soaring by as much as 20% to almost USD 72/bbl when the market opened on Monday, the Financial Times reports. While they later decreased to around USD 66/bbl, this is still a gain of almost 11% on the day, which puts them on track for their biggest one-day percentage gains since 2016. “We have never seen a supply disruption and price response like this in the oil market,” says a Credit Suisse energy analyst. “Political-risk premiums are now back on the oil-market agenda.”

This isn’t good for us, as Egypt has budgeted a benchmark price of USD 68/bbl. Even the fuel hedging contracts the government has already signed with international banks have reportedly been set at USD 64-68 per bbl. A Bloomberg analysis last year showed that every USD 1 increase above a benchmark price used by the state in annual budgeting added EGP 4 bn (USD 222 mn) to annual spending.

Nonetheless, Saudi Aramco is moving forward with plans for its IPO,and has given no indication that it will delay its timeline, Bloomberg reports. However, bankers and analysts are reportedly casting doubt on the odds of the IPO happening on schedule, with some citing the climate of heightened risk as a reason for investor caution, others saying the attack is likely to reduce Aramco’s valuation — which Crown Prince Mohammed bin Salman has put at over USD 2 tn — and still others raising the specter of other potential attacks, which they say would make it virtually impossible for the IPO to proceed. The rate at which Aramco can resume full production is the crucial determinant for whether the IPO will move forward on schedule, experts say.

Lack of confidence is the prevailing sentiment in the foreign press, with an FT opinion piece that decries Saudi Arabia as “ill-equipped” to handle the disruption, having just dismissed Khalid Al Faleh as energy minister and Saudi Aramco chairman, seeming to capture the overall mood.

MOVES- President Abdel Fattah El Sisi received yesterday the credentials of 10 new ambassadors to Egypt, according to an Ittihadiya statement. The ambassadors are:

- Yevhen Mykytenko, Ukraine;

- Winfred Nii Okai Hammond, Ghana;

- Timothée Ezouan, Côte d'Ivoire;

- Liao Liqiang, China;

- Cyrill Nunn, Germany;

- Miko Haljas, Estonia;

- Lene Natasha Lind, Norway;

- Sidik Spahić, Bosnia and Herzegovina;

- Nikolas Garilidis, Greece;

- Dominic Goh Kian Swee, Singapore.

Image of the Day

The perfect snapshot of the USD 86 tn global economic landscape in 2018: We know, it’s data from last year, but this chart from HowMuch.net, shared by Visual Capitalist, is exactly what is right about infographics and visually mapping out something as complex as a USD 86 tn global GDP. Based on World Bank data (pdf), it clearly illustrates the world’s dominant economies, and the variations in size at both the regional and country levels. Egypt may be Africa’s third largest economy, but this image really puts us into perspective when we see the size of our USD 250 bn economy (0.29% of the global economy) plotted out with the rest of the world. But if you are panicking at how small we are, it helps to note that we weren't lumped in with the “other states,” with a combined 8.98% of the global economy. The good people at HowMuch brought us this stunning infographic on the hot zone of countries with the highest ratio of government debt to GDP, which ranked us 15th out of 221 countries.

Egypt in the News

Egypt’s recently-ratified Mineral Resources Act is drawing praise from investors and economists, who believe it will increase investment in mineral exploration and extraction, boosting the national economy, Al Monitor reports. The law has introduced new incentives for companies to invest in the mineral wealth sector, in the hope of attracting some USD 700 mn in investments by 2030. Some 90% of Egypt’s land is said to have untapped mineral wealth, and the government’s strategic reform to upgrade the mining sector, of which the new law is a part, is seen by investors and legislators as a bold step to up the potential of the mining sector as a source of income.

Our tuk tuk woes have made it to the foreign press, with Xinhua reporting on the threatened livelihood of tuk tuk drivers who worry they won’t be able to afford the switch to a minivan. New tuk-tuks cost around EGP 34,000, while minivans start at EGP 90,000. Drivers are being asked to take up soft loans to cover the costs from the CBE. Prime Minister Moustafa Madbouly called for the phasing out of new tuk tuks over the next three years, on the grounds that they are unsafe and unlicensed.

Other headlines to keep on your radar:

- The friendly relationship between the leaders of Egypt and the US glosses over troubling human rights violations, Haaretz argues.

- A group of women in Egypt is reportedly cutting the hair off other, non-hijab wearing women in public places like the Cairo metro, according to Vice Arabia.

- Egypt’s expansion of its extradition requests with other countries over the past five months have “brought many terrorists to justice,” according to Asharq Al Awsat.

- Ancient Egyptian mummies are being examined in a novel, and less invasive, way — by using body scanners outside of working hours at the UK’s Manchester Children’s Hospital, the BBC reports.

Worth Watching

Could the new “scramble for Africa” benefit Africans above all? The latest rush by non-African countries to find avenues for trade and investment on the continent is, the Economist argues, a chance to put Africans in the driving seat (watch, runtime: 04:10). Greater openness, fewer wars, and better macroeconomic policies have all seen Africa as a continent become two-fifths wealthier than it was in 2000, and the scale of foreign interest in setting up agreements now is unprecedented, with a record 320 new embassies built between 2010 and 2016.

But in many countries corruption is still endemic, and even well-intentioned governments sometimes need to be more strategic in securing fair agreements that will benefit them as much as their non-African counterparts.

So how can Africans leverage this foreign interest to come out on top? Voters and watchdogs need to insist on more transparency in the way that agreements are set up and projects implemented, the video says, citing the recent work of Kenyan journalists in exposing scandals connected to a Chinese railway project as a great example of holding leaders to account.

Diplomacy + Foreign Trade

Egypt, Italy sign MoU to cooperate in internal trade: Egypt and Italy have signed an MoU that will see both countries cooperate on training and investment in domestic trade, the Supply Ministry said in a statement. Several Italian companies have expressed interest in setting up retail chains and logistics centers in Egypt, Minister Ali El Moselhy said.

Egypt could be exporting garlic, grapes, and citrus fruits to Brazil soon, after Brazilian Agriculture Minister Tereza Cristina greenlit imports of Egyptian grapes and garlic, according to an Agriculture Ministry statement. Cristina was in town earlier this week to look into an Egyptian government decision to limit the acceptance of halal meat certificates from Latin America to only the Egyptian Islamic Company (IS EG).

Energy

AfDB’s investments in Egypt’s energy sector reach USD 1.7 bn

The African Development Bank (AfDB) has built a portfolio of up to USD 1.7 bn in Egypt’s energy sector since 2007, the bank’s director for energy financial solutions, policy, and regulation Wale Shonibare said, according to Al Shorouk. Speaking at a conference organized by the Egyptian Junior Business Association on the bank’s role in supporting Africa’s energy sector, Shonibare added that energy was AfDB’s focus in Egypt over the past few years.

Infrastructure

Gov’t to build seven bridges in Upper Egypt at a cost of EGP 9.4 bn

The government is currently building seven bridges on the Nile in Upper Egypt at a cost of EGP 9.4 bn, according to an announcement by Transport Minister Kamel El Wazir picked up by Zawya. El Wazir met with the board members of the European Bank for Construction and Development (EBRD) to discuss funding for infrastructure development.

Tourism

Luxor has third highest number of hot air balloons in the world

Luxor has been ranked third for the highest number of hot air balloon flights in the world, with a grand total of 11,000 hot air balloons in one Egypt’s most touristic cities, said Ahmed Aboud, a representative for the Egyptian Federation of Hot Air Ballooning Companies in Luxor, according to Ahram Online. Hot air balloons trips resumed last Tuesday in Luxor after an 80-day suspension due to safety concerns.

Dugong population threatened in Marsa Alam due to tourism

Environmental researcher Ahmed Shawky warned that tourism in the Red Sea, particularly Marsa Alam, may have serious consequences for dugongs, a marine mammal vulnerable to extinction, according to Al Masry Al Youm. Marsa Alam is one of the few areas in Egypt with a fair number of dugongs. Shawky urged that tourism companies and diving guides should focus on environmental awareness towards tourists and that boat drivers should be careful if speeding.

Telecoms + ICT

Egypt nearing the bottom of the list of global internet speeds

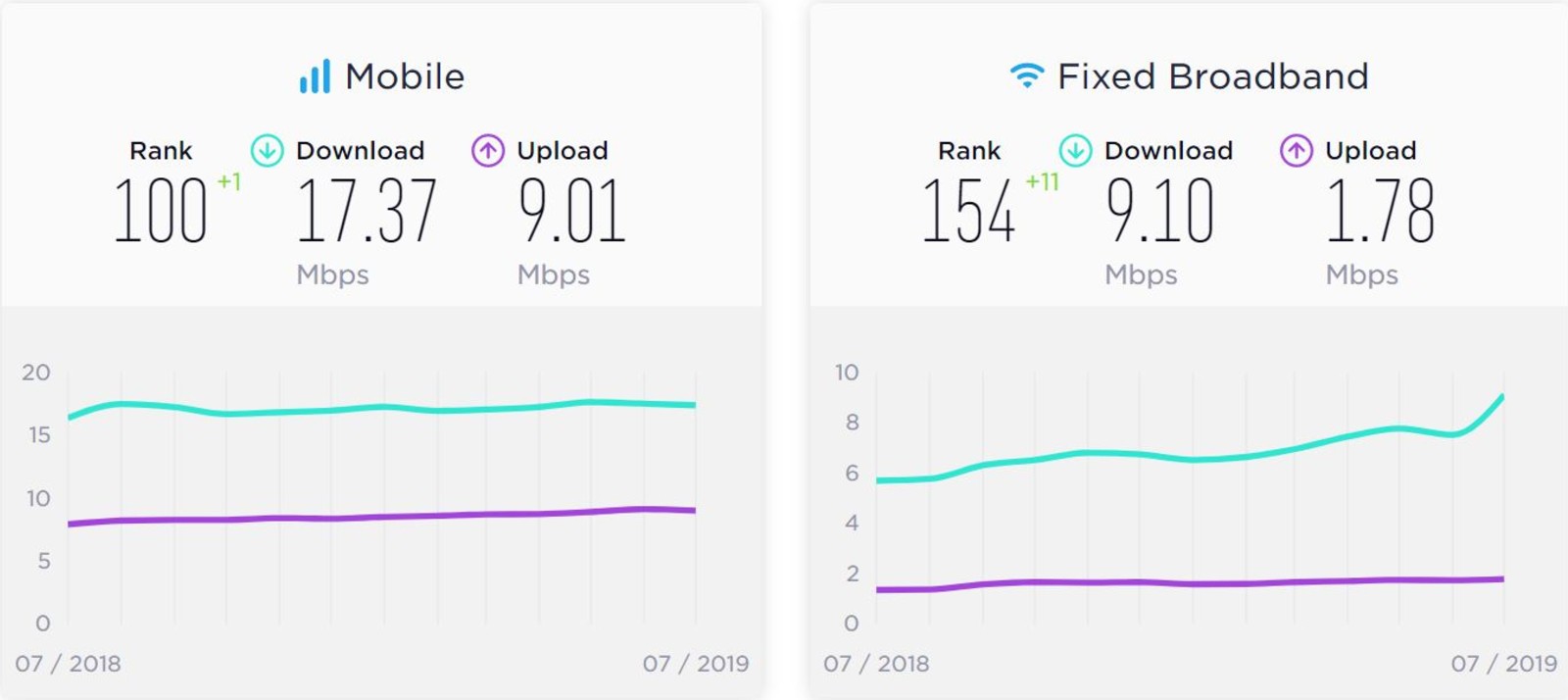

Egypt was ranked 100 out of 144 countries in the monthly global study of mobile internet speeds taken by SpeedTest for July. The only thing that could make us feel better is that Egypt was up one place from a month prior (actually, it doesn’t). Egypt’s average download speed was at 17.37 Mbps, while the global average was 26.69 Mbps. Egypt ranked 8 out of the 24 African countries in the study. Mali had the best speed for African countries at ranking 44. As for fixed broadband, Egypt did much worse, having ranked 154 out of 177 countries, up 11 places since June. The global average download speed was 63.85 Mbps, with Egypt’s speed at a meager 9.10 Mbps. Out of 39 African countries, Egypt ranked 27 for fixed broadband. While it doesn’t seem to have helped our snail-paced connections, Telecom Egypt has reportedly spent USD 3 bn since 2014 on Egypt’s internet infrastructure, CEO Adel Hamed said, according to Mubasher.

Automotive + Transportation

El Wazir talks potential investments in Egypt’s railways with Siemens, Thales

Transport Minister Kamel El Wazir met yesterday with representatives from Siemens and Thales Spain to discuss potential investments in Egypt’s railway projects, including the planned cargo and passenger line connecting Hurghada, Safaga, Qena, and Luxor, according to a ministry statement. The two companies also looked at potentially investing in the automation of the Tanta-Damietta railway line’s signaling system.

Other Business News of Note

Egypt’s Trade Ministry looks at new, lower three-year duties on steel billet imports

A Trade Ministry committee has recommended imposing anti-dumping duties on imported steel billets for three years starting mid-October, following the end of the temporary 15-25% duties on steel raw materials imposed by the ministry in mid-April, according to a statement (pdf). The ministry continued to charge manufacturers throughout the six-month period despite an administrative court ruling to suspend the temporary duties, notes the statement. The new duties will start at 7%, and then gradually fall by 2% each year to reach 3% at the end of the three-year period. This lower percentage is based on a study by the committee, but it could perhaps be in response to the controversy spurred by the original decision.

Egypt Politics + Economics

CBE announces four key pillars to its financial inclusion strategy going forward

Central bank Sub-Governor Lobna Helal laid out the pillars of the CBE’s financial inclusion strategy in a speech (pdf) at the meeting of the Council of Arab Central Banks and Monetary Agencies Governors earlier this week. The first pillar was strengthening the CBE’s regulatory and supervisory role in the banking sector, through legislative amendments (a likely reference to the Banking Act). Next, the strategy will rely on raising awareness on financial inclusion, through initiatives that target those most in need. The third pillar involves creating a business-friendly environment by helping out SMEs. Finally, the strategy will see the CBE promoting the use of fintech.

On Your Way Out

Don’t throw away your used coffee capsules: The Association for the Protection of the Environment (APE) is collecting used Nespresso capsules and turning them into unique works of art, according to Scoop Empire. APE is an NGO which works directly with Cairo’s Zabaleen (informal garbage collectors). The project is getting support from social media users.

The Market Yesterday

EGP / USD CBE market average: Buy 16.29 | Sell 16.42

EGP / USD at CIB: Buy 16.29 | Sell 16.39

EGP / USD at NBE: Buy 16.33 | Sell 16.43

EGX30 (Monday): 14,970 (-0.4%)

Turnover: EGP 1.5 bn (138% above the 90-day average)

EGX 30 year-to-date: +14.8%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.4%. CIB, the index’s heaviest constituent, ended down 0.2%. EGX30’s top performing constituents were Eastern Co up 2.5%, Juhayna up 2.4%, and Cleopatra Hospitals up 2.2%. Yesterday’s worst performing stocks were Egyptian Resorts down 4.2%, Oriental Weavers down 2.4% and Orascom Development Egypt down 2.3%. The market turnover was EGP 1.5 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -111.1 mn

Regional: Net Long | EGP +79.4 mn

Domestic: Net Long | EGP +31.7 mn

Retail: 27.9% of total trades | 28.8% of buyers | 27.0% of sellers

Institutions: 72.1% of total trades | 71.2% of buyers | 73.0% of sellers

WTI: USD 61.90 (-1.59%)

Brent: USD 69.02 (+14.61%)

Natural Gas (Nymex, futures prices) USD 2.68 MMBtu, (0.00%, Oct 2019 contract)

Gold: USD 1,505.40 / troy ounce (-0.40%)

TASI: 7,827.17 (+1.00%) (YTD: +0.01%)

ADX: 5,160.73 (+1.71%) (YTD: +5.00%)

DFM: 2,878.04 (+0.29%) (YTD: +13.77%)

KSE Premier Market: 6,100.57 (-2.15%)

QE: 10,511.58 (+1.12%) (YTD: +2.06%)

MSM: 4,008.93 (-0.30%) (YTD: -7.28%)

BB: 1,524.33 (-0.73%) (YTD: +13.99%)

Calendar

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): Egyptian Private Equity Association’s venture capital event (pdf) at the Conrad Hotel, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

23-25 September (Monday-Wednesday): Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS), Kempinski Royal Maxim, Cairo

24 September (Tuesday): A roundtable discussion titled “investing in renewable energy and sustainable development” organized by Media Avenue, Nile Ritz Carlton, Cairo.

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

27 September (Friday): The Justice Ministry’s dispute resolution committee will hear a case filed by Raya Holding against the Financial Regulatory Authority (FRA).

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

28 September (Saturday): Smart Vision Egyptian Women’s Forum, venue TBA.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.