- More holdups (or headaches) for Israel’s gas exports to Egypt? (Speed Round)

- South Africa’s Sanlam is still looking for an entry into the Egyptian market. (Speed Round)

- EBRD, Abdel Gawad and Mahgoub families sell 8.4% stake in Ibnsina Pharma. (Speed Round)

- The government has yet to settle overdue export subsidies and businesses aren’t happy. (Speed Round)

- Madbouly: Tuk-tuks are out, natgas-operated minivans are in. (Speed Round)

- Companies issued a record amount of corporate paper, and EM bonds recovered slightly. (What We’re Tracking Today)

- As expected, most re-invested the returns on Suez Canal CDs. (Banking + Finance)

- Planetary scientists are looking at meteorites that hit Egypt 100 years ago for information about life on Mars. (On Your Way Out)

- The Market Yesterday

Sunday, 8 September 2019

Should we expect another delay in Israel’s gas exports to Egypt?

TL;DR

What We’re Tracking Today

It’s a relatively quiet news morning today with no single story dominating the headlines here at home or abroad.

Inflation figures for August are out this week: The Central Bank of Egypt and Capmas will release the monthly inflation figures in the coming days. Inflation fell unexpectedly to a four-year low of 8.7% in July.

Three conferences get underway in the capital tomorrow:

- The Japan Arab Economic Forum (Nile Ritz Carlton)

- The Euromoney Egypt Conference (venue not disclosed)

- The Sahara agricultural expo (Egypt International Exhibition Center).

EFG Hermes’ four-day London conference also kicks off tomorrow at the Arsenal Emirates Stadium.

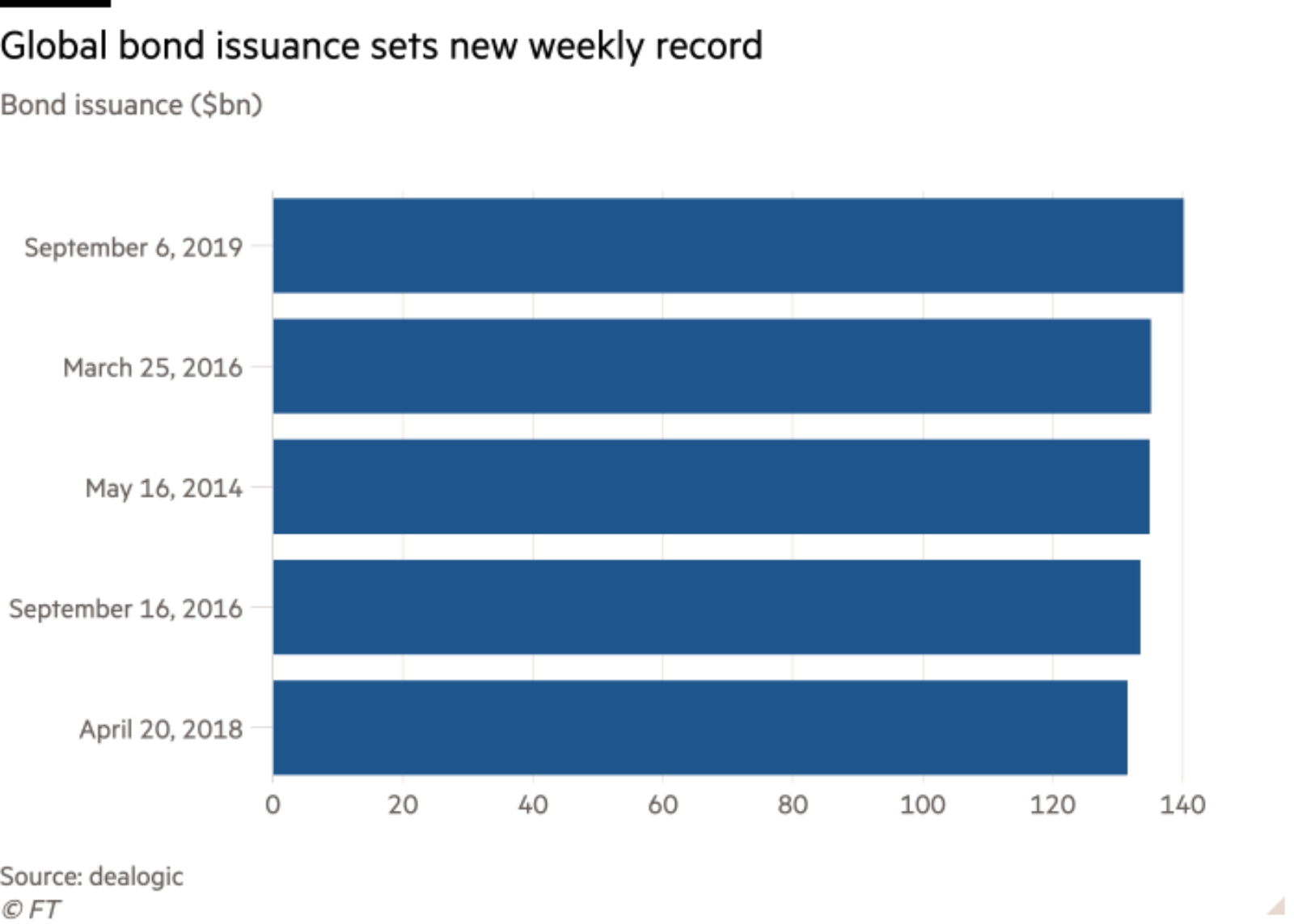

A record amount of corporate paper was issued last week. Companies across the world took advantage of historically low interest rates last week and issued a record USD 140 bn in corporate paper, the Financial Times reports, citing Dealogic data. US companies alone sold USD 72 bn-worth of bonds last week, almost equal to the total amount issued in August.

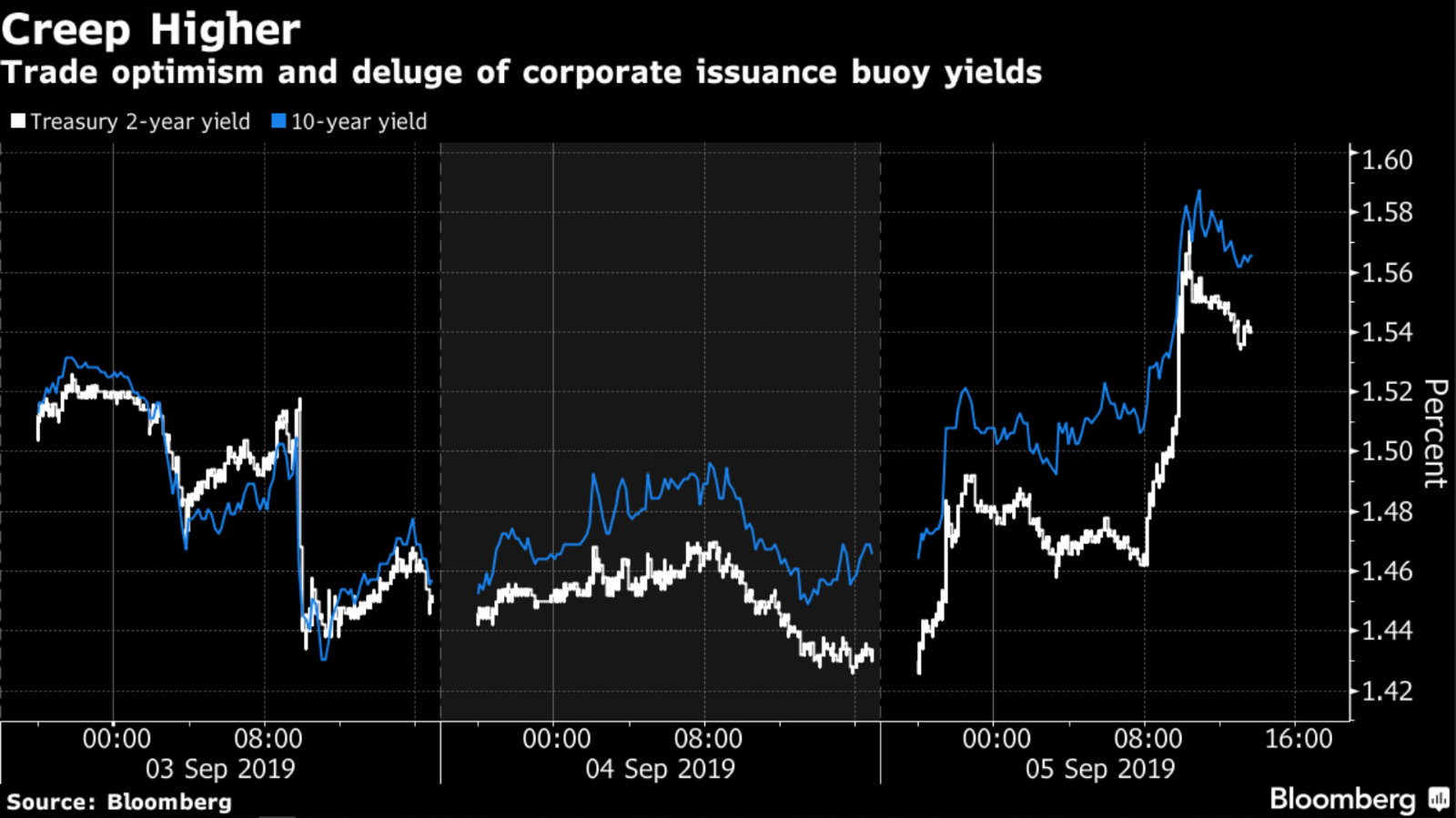

Yields responded accordingly: The deluge of corporate issuances contributed to a surge in US and German bond yields on Thursday, interrupting the rally in August that saw yields across the world sink to record lows, Bloomberg says. Rates on two-year bonds were at one point up 14 points, while the iShares ETF tracking long-term bonds suffered its biggest daily loss since the election of Donald Trump. “Treasuries are not a one-way trade, even as the trend is for lower yields,” said Scott Buchta, head of fixed income strategy at Brean Capital. “It’s a risk-on related move today given trade-talks are back on. But the backdrop of the high level of corporate issuance is also adding some volatility and putting upside pressure on Treasury yields.”

This caused investors to rush into emerging markets: Thursday’s bond sell-off coincided with a surge in high-yielding EM debt, Anders Faergemann, senior portfolio manager at Pinebridge Investments, told Bloomberg. This helped junk debt to recover slightly from August, when investors pulled USD 13.8 bn from EMs — a large part of which went into investment-grade bonds in developed markets.

Equity investors are currently faced with a situation of “eerie similarity” to last year’s near-recession when the US stock market was close to losing USD 5 tn in value, Elena Popina and Vildana Hajric write for Bloomberg. But there was no recession then, even though the two factors that are spooking investors today were at play at the time: An all-out US-China trade war and factory output woes. What’s most significantly different now is the more proactive US Fed, whose chairman Jay Powell said over the weekend it is “going to continue to watch all of these factors, and all the geopolitical things that are happening, and… act as appropriate to sustain this expansion.”

Al-Faleh “out of favor” as Salman taps his son as Saudi’s new energy minister: Saudi Arabia’s King Salman has appointed his son Prince Abdulaziz bin Salman bin Abdulaziz Al Saud as the kingdom’s new energy minister, succeeding Khalid Al-Faleh, according to a Saudi Press Agency statement. Al-Faleh was also replaced as the chairman of Saudi Aramco last week, with former royal court advisor and the head of the country’s sovereign wealth fund Yasir Al-Rumayyan assuming the position ahead of the oil giant’s imminent IPO. “In the murky world of Saudi politics, it wasn’t immediately clear why Al-Falih [sic] fell out of favor. It has been speculated that there was dissatisfaction with the low price of oil as the vital Saudi Aramco IPO nears,” says Bloomberg.

Also in global miscellany:

- Zimbabwe’s Mugabe passes away: Robert Mugabe, whose 37-year rule of Zimbabwe was instrumental in toppling white colonial occupation but also led the country to the brink of economic collapse, died last week in a Singapore hospital, aged 95. He fell from power in a bloodless coup almost two years ago. (WSJ)

- Iran is no longer abiding by uranium enrichment and centrifuge research limits agreed upon in the 2015 nuclear accord, a spokesman for the Atomic Energy Organization of Iran announced in a press conference on Saturday. (Bloomberg)

Samsung is releasing a new version of the Galaxy Note 10 that incorporates blockchain in a move that could help to demystify the technology, sources tell the WSJ. The new “KlaytnPhone” will reportedly come installed with blockchain apps, a wallet for cryptocurrencies, and a certain amount of a new digital currency, called “Klay” coins, for buyers to use. Advocates of the technology believe that offering a ready-made blockchain ecosystem will help it take off, and ultimately offer consumers more security.

And for the iSheep among us: Apple is set to unveil three new iPhone models on Tuesday at an event that gets underway at 6 pm CLT. You can get an idea of what to expect from the new models from these rundowns courtesy of Bloomberg, TechRadar, or MacRumors. Or, you know, wait and see: You can watch the event live at the appointed hour.

Egyptian nuclear scientist Abu Bakr Abdel Moniem passed away on Wednesday in Marrakech, where he was attending an energy conference, according to Youm7. Preliminary medical reports indicate he suffered from a heart attack.

Enterprise+: Last Night’s Talk Shows

There was not much of significance happening on the airwaves last night. Alongside the talking heads’ ongoing fixation on fluctuating gold prices, national projects and our ancient relics were the order of the day.

Gold futures continued to fall for two consecutive days, dropping as much as USD 50 on Friday alone, said head of the Federation of Egyptian Industries’ gold division Rafiq Abbas in a phone-in to Hona Al Asema (watch, runtime: 3:59). Abbas explained the relationship between the outlook on global economic growth and the price of gold, which is a safe haven asset. He didn’t have a concrete explanation for the drop in prices but speculated that either major investors in gold are anticipating positive news for the global economy or some sort of market manipulation to affect equity prices is at play. Either way, Abbas doesn’t expect gold prices to continue falling.

Madbouly tours more national projects: Prime Minister Mostafa Madbouly paid a visit yesterday to Minya to inspect progress on the 22 km Samalout axis currently being built over the Nile, and the soon-to-be inaugurated Samalout public hospital, which is in the final stages of renovation, Hona Al Asema’s Reham Ibrahim reported (watch, runtime: 2:30).

The Travel says our country is among the most fascinating: An article published on Friday earned valuable airtime on Al Hayah Al Youm for providing 10 numbered reasons for why “Egypt Is One Of The Most Fascinating Countries In The World” (watch, runtime: 7:18). The pyramids and Pharaonic tombs, our “overwhelming patriotism” and outwardly Egyptian pride, the people (and the camels), and our turquoise coral-reef-filled waters all made it on the list.

Speed Round

Speed Round is presented in association with

More holdups for Israel’s gas exports to Egypt? A USD 1 bn lawsuit brought against the government by Thai state-owned energy company PTT Energy for allegedly failing to meet gas deliveries to Egyptian Mediterranean Gas (EMG) after 2011 could threaten to further delay exports of Israeli gas to Egypt, Jared Malsin writes for the Wall Street Journal. Egypt had previously made any gas export agreement with Israel contingent on settling a 2012 case by EMG shareholders that led to a USD 1.76 bn international arbitration ruling against EGAS, EGPC, and EMG. PTT’s case is largely based on the same claims as the 2012 lawsuit, over which Egypt reached a final settlement in June.

This constitutes more of a headache than a legal issue: An executive at EMG tells Malsin that the suit, the trial for which is set to begin on Tuesday, would be a “headache” for the two countries’ gas partnership, but “can’t legally jeopardize the flow of gas.” Delek executives had said earlier this year that they are interested in selling even more natural gas to Egypt beyond the agreed-upon amounts, but the question has been whether Israel’s pipeline network has the capacity to deliver the volumes already contracted.

Malsin also cites one analyst as saying security concerns in the peninsula could be a potential cause for delay, but does not clarify whether the Israeli exporters have expressed concerns over Daesh in Sinai.

Background: Delek and its US-based partner Noble Energy partnered together last year with other Israeli energy companies to form the Tamar Gas Consortium. The consortium then signed a USD 15 bn agreement to supply Alaa Arafa-led Dolphinus Holding with gas from each of the Leviathan and Tamar gas fields. Commercial sales of the gas should have begun by the end of June, according to a target Delek previously announced. Trial shipments were originally supposed to come in March, but capacity restrictions posed by Israel’s domestic pipeline network meant that the imports had to be delayed.

INVESTMENT WATCH- Sanlam eyes Egypt investments in the next 12 months: South Africa’s largest insurance company Sanlam could invest an undisclosed amount in Egypt within the next 12 months as part of its continental strategy, CEO Ian Kirk told Reuters. Sanlam previously said in March it intended to take an equity stake in an Egyptian firm, but that it hadn’t found a suitable partner. Things don’t appear to have moved that much since then: Kirk said last week that the firm is looking at a number of potential companies, without providing details on which companies it is considering. “I would say [we could invest] within the next 12 months…we’re busy on it,” he said.

Shareholders sell 8.4% stake in Ibnsina: Shareholders have sold 8.4% of their shares in Ibnsina Pharma, amounting to around 69.1 mn shares, at EGP 9.7-10.22 per share, according to an emailed statement from EFG Hermes (pdf). Among the sellers was the European Bank for Reconstruction and Development (EBRD), which reduced its stake to 8.7% from 10.1%, according to the local press. The Abdel Gawad family also reduced its stake from 16.5% to 13.5% and the Mahgoub family from 16% to 13%.

Sale could help boost share value by 42% -Beltone: The sale will increase the percentage of freefloat shares to 45.7% from 37.3%, increasing Ibnsina’s weight on the EGX to 1.54% from 1.26%, Beltone Financial said. This will result in passive inflows of USD 100k equivalent to 0.3 days/trade based on the USD 500k three-month average daily trading volume. Ibnsina could see its share value go up by 42% to EGP 14.35 as a result of the sale, as well as the sector’s strong growth potential and the company’s robust sales.

The sale comes less than a week after Ibnsina announced an agreement with global pharma company Roche to import and distribute 40 Roche products in Egypt. Beltone estimates that the agreement will add around EGP 300 mn to its top line and EGP 24 mn in gross profit by the end of next year.

EFG Hermes acted as the sole sell-side bookrunner on the transaction.

LEGISLATION WATCH- The SMEs Act will include tax and non-tax incentives to support the sector and encourage small businesses to go legit, the Finance Ministry said in a statement (pdf). If passed, the incentives would include exemptions from the stamp tax as well as the fees to register contracts to set up companies and credit facilities for five years from the commercial registration date. SMEs would also be exempt from land registration fees for their projects, among other things. The draft law is expected to be discussed by the House of Representatives when it reconvenes after its summer recess. The SME tax incentives package could cost the government EGP 1.5-2 bn each year.

Could these proposals by the business community make it to the drawing board? Suggestions calling for stronger incentives for SMEs to join the formal economy and developing a “unified definition of SMEs” were presented in a meeting on Thursday between SMEs Authority head Nevine Gamea and the Egyptian Businessmen Association’s SMEs committee, EBA board member and committee head Hassan El Shafei said, according to the newspaper. Other ideas the business community has in mind for an improved SMEs sector include setting up a company to drum up interest for SME support products, prioritizing tech-intensive and manufacturing projects, and reducing red tape.

Gov’t has yet to settle overdue export subsidies: The Finance Ministry has yet to settle the overdue export subsidies owed to exporters, a number of businesses told Al Masry Al Youm. No contracts have yet been inked since officials reached an agreement in May with the companies to settle the payments — which were said to be in the range of EGP 12 bn — through deducting the overdue amounts against their taxes as an alternative to cash payments. The payments accumulated under an old, unfulfilled promise by the state-run Export Subsidy Fund to pay out 8-12% of the value of exports to companies depending on how much local content is used.

EBA boss says no clear timeline on payout framework: The government has also yet to provide a clear plan or timeline for the new EGP 6 bn framework announced in July, Egyptian Businessmen Association (EBA) boss Aly Eissa said. Authorities said in July they would begin this fiscal year doling out EGP 6 bn a year through the Export Subsidy Fund. Some EGP 2.4 bn (or 40%) of the EGP 6 bn will be disbursed as cash payments, while EGP 1.8 bn (or 30%) will be paid out as tax breaks and cuts to arrears owed to the Finance Ministry. The remaining EGP 1.8 bn will be spent by the fund to “build up Egypt’s export capacities,” the Export Subsidies Fund had said.

In related news, Egyptian exporters participated in three international expos last week, the Export Development Authority said in a statement picked up by the press. The expos included two separate ones for leather products and plastics held in Erbil, Iraqi Kurdistan and the Asia Fruit Logistica Hong Kong.

STARTUP WATCH- Doctoorum raises seed funding from Numu Capital: Emirati seed fund Numu Capital has made an undisclosed investment in Doctoorum, a Cairo-based medical tourism startup, the local press reports. The funding was agreed in July when Doctoorum graduated from the AUC Venture Lab accelerator. The company is now preparing to raise series A funding in the coming months. Doctoorum was founded by Yemeni entrepreneur Begad Nasser, and provides a platform that allows patients to locate medical providers in destinations of their choosing.

The next phase in the war on tuk-tuks: Prime Minister Moustafa Madbouly launched on Thursday a project that will replace tuk-tuks with minivans that run on natural gas — what he perceives to be a safer method of transportation, according to an official statement. The Finance Ministry will be in charge of implementing the project and discussions have already been scheduled with tuk-tuk manufacturers to switch their production lines to minivans. The plan to phase out tuk-tuks has been in the pipeline for a while, with the Industrial Development Authority ending licenses for manufacturers and assemblers back in April.

MOVES- AccorHotels’ Egypt branch has named Magdi Gamil (LinkedIn) as the country sales and marketing director, according to a release (pdf). Gamil’s new position puts him of the sales and marketing team of the French hospitality group’s 24 properties in Egypt, including the Fairmont, Sofitel and Sofitel Legend, Mövenpick, Novotel and Mercure brands, as well as 15 other planned properties.

Egypt in the News

The foreign press is still discussing the impact of the recent interest rate cuts on the Egyptian economy: Analysts tell Al Monitor that easing is good news for property, gold, and stock markets.

Other headlines worth a moment of your time:

- Platforms like Netflix are opening up new spaces within the Arab film industry, allowing more women to take on powerful lead roles, Hend Sabry tells Variety.

- Media can be an effective vehicle to counter discrimination and make positive change, Rahma Khaled, Egypt’s first TV presenter with Down syndrome, tells Deutsche Welle.

- Bellies En-Route offers food tours in Cairo with the aim of providing a new experience to visitors keen to sample our local cuisine, its founders tell Arab News.

Worth Watching

What if being human isn’t enough anymore? So asks the transhumanist movement, one that believes technology and biology should be combined to create an enhanced human being. We are flying into technologically induced change, and people are curious about digital immortality and how far technology can take us. Transhumanists are those who have used technology to give themselves special abilities or altered their state of being, to the extent that some question if transhumanists should be defined as a whole other species. This BBC short (watch, runtime; 06:24) introduces a few transhumanists who discuss what drove them to integrate technology into their bodies.

Diplomacy + Foreign Trade

Egypt, Italy sign EGP 70 mn wastewater project financing agreement: The Investment Ministry signed a EGP 70.5 mn agreement with the Italian government on Thursday to finance the third phase of a wastewater project in Minya, the ministry said in a statement. The funding comes as part of a EUR 300 mn debt swap agreement, which allows Egypt to channel its debts into development projects instead of paying back the Italian government.

Egyptian Poultry Association meets with Agriculture Ministry officials to discuss ban on poultry imports: The Egyptian Poultry Association (EPA) announced yesterday that it had met with Agriculture Ministry officials to call for a freeze on all imports of poultry to support local businesses, according to a statement picked up by the local press. Falling poultry prices and the rising cost of living are precipitating a “crisis” in the local industry that requires protectionist measures, the association said, urging all government entities to rely on local products.

Correction: 08/09/2019.

A previous version of this article incorrectly stated that the Egyptian Poultry Association had implemented a ban on poultry imports.

Egypt, South Sudan to set up working group to lead oil sector cooperation: Oil Minister Tarek El Molla and his South Sudanese counterpart Hamada Hato agreed during a meeting yesterday to form a joint working party of oil and gas experts to direct cooperation in the field in the near future, according to an Oil Ministry statement (pdf). The two also discussed providing concessions to state-owned Tharwa Petroleum Company in South Sudan, as well as exploration and production openings for other Egyptian companies.

Energy

Schlumberger, TGS to undertake 3D reimaging project in off Egypt’s Red Sea coast

Oilfield services company Schlumberger and energy information company TGS are undertaking a 3D reimaging project in the Red Sea, TGS announced in a statement. The project will involve reimaging data from three overlapping seismic surveys covering 3.6k sqkm made between 1999 and 2008. All legacy seismic and non-seismic data will be integrated and advanced imaging technologies will also be applied to better identify complex structures. The data will be made available before the closing of Egypt’s Red Sea international bid round on 15 September.

ENPEDCo, EGPC ink agreements for Western Desert oil and gas exploration

The Egyptian National Petroleum for Exploration and Development Company (ENPEDCo) and the EGPC signed two agreements to explore oil and gas in the Western Desert last week, the Oil Ministry said in a statement (pdf). The companies intend to invest at least USD 4 mn to drill four exploratory wells in the Abu Sennan and Ras Qattara concessions.

Manufacturing

Egypt’s SMEs investor associations to issue tender specifications next week

The federation of SME investor associations will issue next week the tender booklets for land to be offered in a 600-factory SMEs complex, federation managing director Yasser El Saka said. The factories will be specialized in ready-made garments, processed foods, medical supplies, and mechanical products.

Real Estate + Housing

Downtown Tanta’s first phase inaugurated on Thursday

Supply Minister Ali El Moselhy inaugurated on Thursday the first EGP 2 bn phase of the Downtown Tanta project, which includes Tanta Mall and Matrix Sporting Club, according to the local press. This is part of a bigger EGP 6 bn logistics zone project that will include a center and a commercial hub between Gharbia and Delta governorates.

Tourism

Japan could grant USD 750 mn loan for Grand Egyptian Museum

Egypt may secure a USD 750 mn loan from the Japanese government to fund technical support for the Grand Egyptian Museum after it opens next year, according to Mubasher.

Automotive + Transportation

Egypt signs MoU with China’s Geely to locally produce electric cars

The National Organization for Military Production on Friday signed an MoU with China’s Geely Company to manufacture electric cars in Egypt, an official statement said without revealing any details. Military Production Minister Mohamed El Assar had also met on Thursday with the Chairman of China’s Ankai Automobile Company to talk cooperating in the joint production of electric buses, according to MENA. The Public Enterprises Ministry last month reached an agreement with an unnamed Chinese auto company to produce electric vehicles in partnership with El Nasr automotive.

Banking + Finance

Most Suez Canal certificate holders reinvest returns, Egyptian banks say

Most holders of Suez Canal certificates of deposit (CDs) reinvested their returns into other savings products after the CDs matured on Thursday, Banque du Caire Chairman Tarek Fayed told MENA. The Suez Canal Bank began paying clients as their certificates matured but most people preferred to re-invest, said Chairman Hussein Refaai. The National Bank of Egypt also saw most of its Suez Canal investors renew their contracts or invest in similar certificates instead of withdrawing their returns last week, said retail CEO Alaa Farouk, according to Hapi Journal. The Suez Canal Authority raised more than EGP 60 bn in 2014 by offering five-year certificates to bank customers at a 12% interest rate. The proceeds were used to fund the construction of the new Suez Canal and several new tunnels. Analysts said last month that up to 80% of the 1.1 mn CD holders would likely reinvest the money into new certificates.

GTH completes delisting process from Egypt’s stock market

Global Telecom Holding (GTH) has completed its delisting from the EGX by buying all of its EGX-listed shares (32.9 mn) for a total of EGP 176.4 mn or EGP 5.08 per share, the Egyptian Exchange said, according to Dostor. Majority shareholder Veon bought 1.99 bn shares of GTH for EGP 9.7 bn in a mandatory offer (MTO) in August, bringing up its ownership to 98%.

Egypt Politics + Economics

State employees to move to Egypt’s new capital starting 1Q2020

Civil servants will gradually be transferred to the new administrative capital starting from 1Q2020, Deputy Housing Minister Khaled Abbas said, according to Mubasher. The government aims to accommodate up to 50k employees during the first phase, with plans to increase this figure to 100k by the end of 2022.

China-led project to assemble Egypt’s Misr Sat 2 kicks off

The project to assemble Egypt’s new satellite, Misr Sat 2, kicked off over the weekend during the China-Arab States Expo, Mamdouh Salman, the Egyptian embassy’s trade commissioner in Beijing said. The satellite will be used to transmit satellite imagery to aid agricultural and urban planning, meteorological forecasting, and promote more effective natural disaster aid responses. Egypt and China signed earlier this year a USD 72 mn grant agreement for the assembly equipment and staff training for the project.

Sports

EFA allows 20,000 football fans to see Egypt Cup final

The Egyptian Football Association (EFA) is allowing up to 20k fans to attend tomorrow’s Zamalek-Pyramids Egypt Cup final match at Borg El Arab stadium, and began selling tickets on Thursday, the association said in a statement.

On Your Way Out

Egypt selects ‘Poisonous Roses’ to enter 2020 Oscars foreign film category: Ahmed Fawzi Saleh’s 2018 Ward Masmoum (translated to Poisonous Roses) was chosen to represent Egypt at the 2020 Oscars for Best Foreign Language Film by the Cinematic Professions Syndicate on Thursday, according to Ahram Online. The film is based on Ahmed Zaghloul Al-Shiti’s 1990 novel Saqr’s Poisonous Roses.

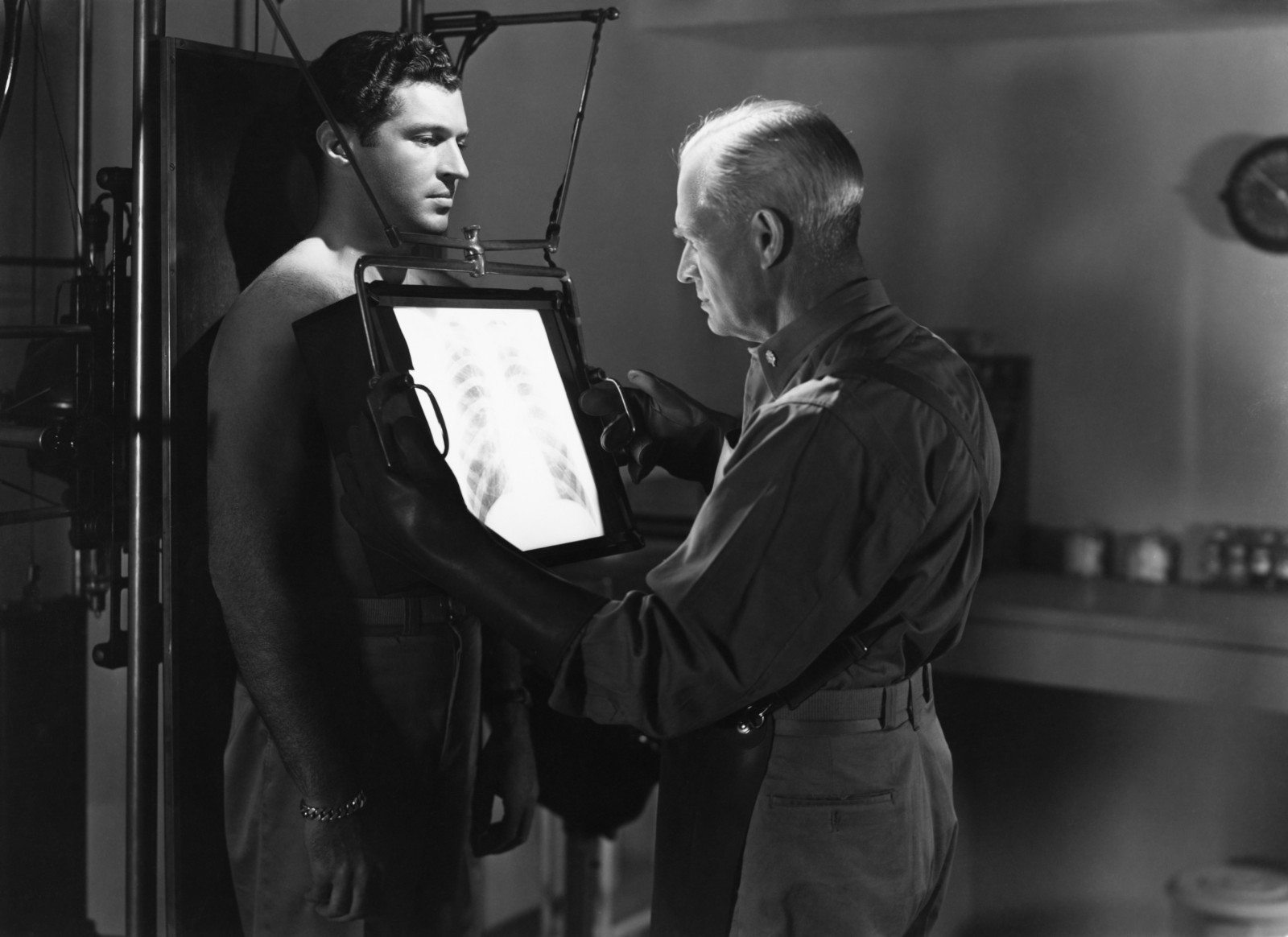

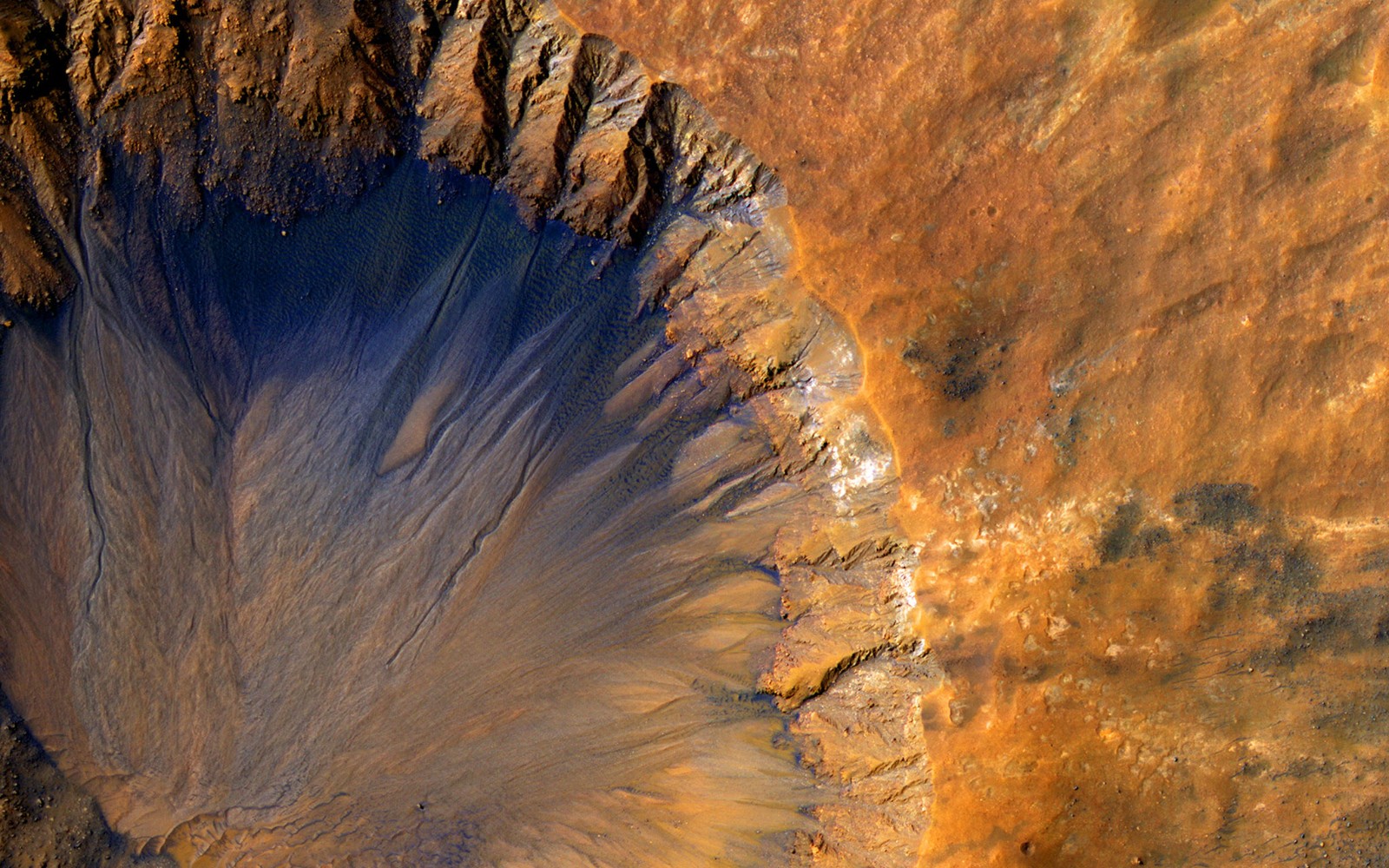

Egyptian meteorites tell the story of water on Mars: Two meteorites that hit Egypt in 1911 hold crucial information about life on Mars. A recently published study by Glasgow University describes how planetary scientists used a specialized technique to examine the meteorites (known as nakhlites, because they fell in El Nakhla). The technique provides new evidence that liquid water was formed by an asteroid hitting Mars some 633 mn years ago, with the impact of the collision melting ice under the planet’s surface. Some time later — a mere 11 mn years ago — a second impact appears to have caused the rocks to blast off and begin their long journey to Earth where they landed in Egypt.

The Market Yesterday

EGP / USD CBE market average: Buy 16.42 | Sell 16.55

EGP / USD at CIB: Buy 16.42 | Sell 16.52

EGP / USD at NBE: Buy 16.45 | Sell 16.55

EGX30 (Thursday): 14,933 (+0.6%)

Turnover: EGP 920 mn (50% above the 90-day average)

EGX 30 year-to-date: +14.6%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.6%. CIB, the index’s heaviest constituent, ended up 1.3%. EGX30’s top performing constituents were Ibnsina Pharma up 5.1%, Ezz Steel up 5.1%, and Orascom Development up 4.0%. Thursday’s worst performing stocks were Egyptian Resorts down 3.3%, Oriental Weavers down 2.1% and SODIC down 1.6%. The market turnover was EGP 920 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +59.9 mn

Regional: Net Long | EGP +225.9 mn

Domestic: Net Short | EGP -285.8 mn

Retail: 46.1% of total trades | 31.8% of buyers | 60.4% of sellers

Institutions: 53.9% of total trades | 68.2% of buyers | 39.6% of sellers

WTI: USD 56.52 (+0.39%)

Brent: USD 61.54 (+0.97%)

Natural Gas (Nymex, futures prices) USD 2.50 MMBtu, (+2.51%, Oct 2019)

Gold: USD 1,515.50 / troy ounce (-0.66%)

TASI: 8,054.75 (-0.05%) (YTD: +2.91%)

ADX: 5,114.09 (-0.21%) (YTD: +4.05%)

DFM: 2,890.92 (+0.38%) (YTD: +14.28%)

KSE Premier Market: 6,547.12 (+0.02%)

QE: 10,253.19 (-0.41%) (YTD: -0.44%)

MSM: 3,997.75 (-0.34%) (YTD: -7.54%)

BB: 1,551.08 (+0.58%) (YTD: +15.99%)

Calendar

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

8 September (Sunday): The Supreme Administrative Court has postponed appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets after two judges resigned from the panel, Mubasher reported.

9 September (Monday): Japan Arab Economic Forum, Nile Ritz Carlton, Cairo.

9 September (Monday): The Euromoney Egypt Conference 2019, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-12 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Cairo.

10 September (Monday): AmCham lunch with Transport Minister Kamel El Wazir.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): Egyptian Private Equity Association’s venture capital event (pdf) at the Conrad Hotel, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

28 September (Saturday): Smart Vision Egyptian Women’s Forum, venue TBA.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.