- Egypt is planning to issue USD 250-500 mn of Asian bonds during FY2019-2020. (Speed Round)

- Fawry’s private placement closed yesterday more than 6x oversubscribed. (Speed Round)

- The Fed cut interest rates for the first time in a decade. (What We’re Tracking Today)

- The Electricity Ministry is tweaking its project pipeline due to significant oversupply. (Speed Round)

- Americana Egypt’s minority shareholders say nay to Adeptio AD’s buyout offer. (Speed Round)

- Israel’s antitrust regulator gives its thumbs up to Delek-led EMG pipeline acquisition. (Speed Round)

- Ditch the tradition of always choosing a European leader, Mohamed El Erian tells the IMF. (What We’re Tracking Today)

- My Morning Routine: Menatalla Sadek, CEO of Hassan Allam Utilities.

- The Market Yesterday

Thursday, 1 August 2019

The Fed cut interest rates for the first time in a decade

TL;DR

What We’re Tracking Today

Don’t ask us how, but we’re two-thirds of the way through the summer. June and July seem to have whizzed by, and at this rate, August promises to do the same. With a brand new month comes a handful of news triggers coming up over the next several days:

- Foreign reserves: The CBE is due to release Egypt’s net foreign reserve figures for July sometime next week.

- PMI: The purchasing managers’ index for Egypt, the UAE, and Saudi Arabia will be released on Monday, 5 August.

- Inflation: Monthly inflation figures are due out next week. Inflation fell to a three-year low in June, coming in at 9.4%.

Fed cuts interest rates for the first time in a decade, but don’t expect more cuts soon: The US Federal Reserve cut interest rates by 25 basis points, marking the first rate cut since 2008, according to a statement out yesterday after the Open Market Committee’s two-day meeting. Two policymakers voted against the rate cut. The Gray Lady was out with an explainer for the preemptive move, which came “even as the economic expansion in the United States reaches record length, unemployment hovers a historic lows and consumers keep spending.”

When might we next see a cut? Yesterday’s rate cut, although widely expected, “disappointed investors by calling the move a ‘mid-cycle adjustment to policy’ rather than the start of a more aggressive cycle of monetary easing,” the Financial Times says. Chairman Jerome Powell suggested at a presser after the meeting that at least one more cut is likely, but that beginning a “lengthy cutting cycle” is “not our perspective now, or outlook.” Following Powell’s statements, the yield curve on US bonds became inverted again, “reflecting pessimism that the Fed will further prop up the US economy.” An inverted yield curve has preceded every US recession over the past five decades. The reaction on Wall Street was negative: The S&P 500 and Dow Jones both posted the biggest one-day drops in two months, according to Reuters.

Emerging markets also didn’t react well to Powell’s statements: “Money managers and analysts said the Fed decision is slightly negative for developing-nation assets as traders may ease [wagers] on further rate reductions in the U.S.,” according to Bloomberg. Emerging market currencies had expected to see a dovish Fed, but Powell’s commentary yesterday presented a more hawkish stance than had been priced into the market, suggesting that a correction is on the horizon, analysts say.

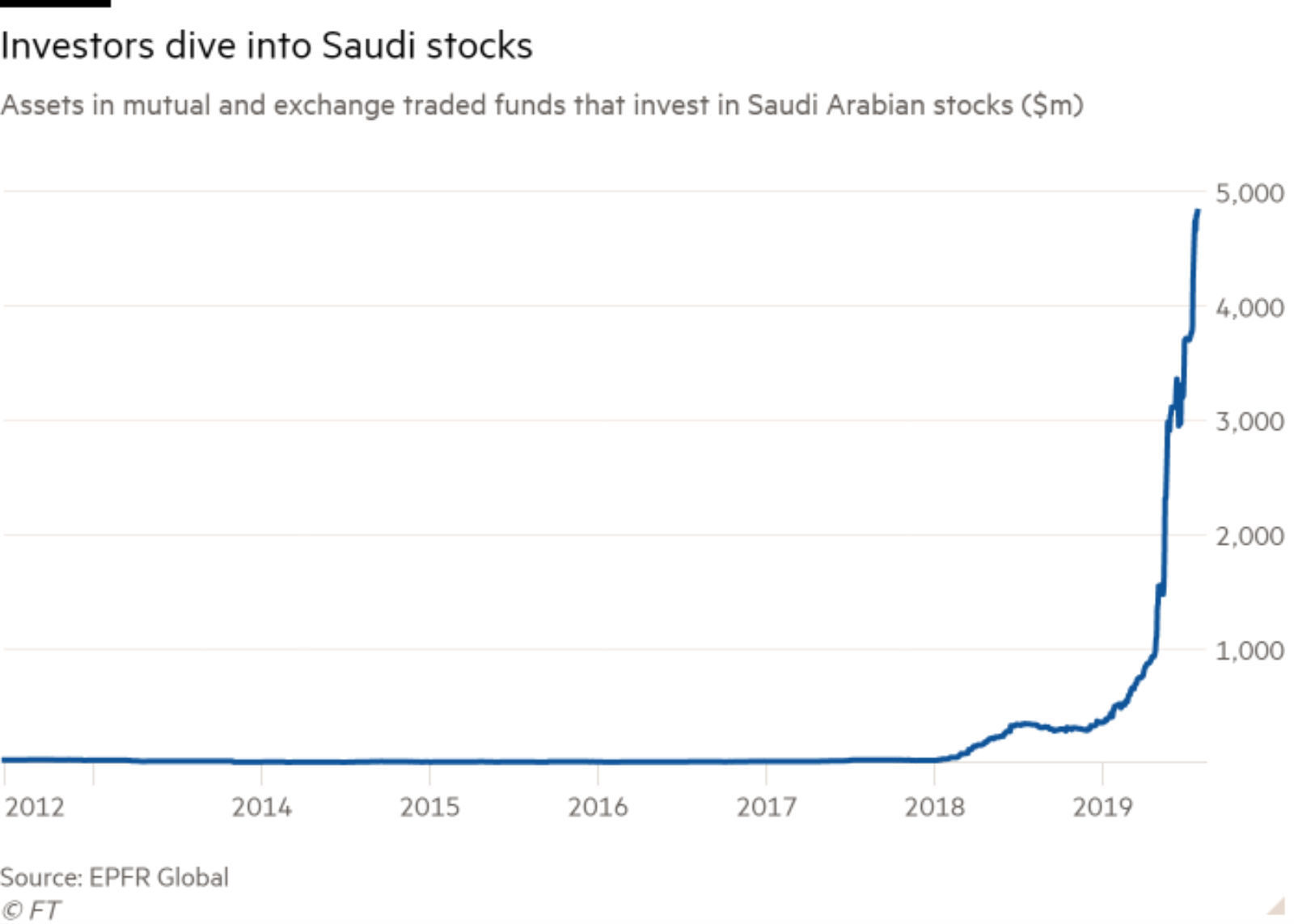

Saudi equities are booming: Mutual and exchange-traded funds have poured money into Saudi equities in 2019 after indexing groups MSCI, FTSE, Russell and S&P Dow Jones Indices included them in their emerging-market benchmarks, the FT reports. Holdings have surged to USD 4.8 bn from just USD 356 mn at the start of the year, demonstrating the influence that the index providers have in directing capital flows.

Make more noise, get paid by Abraaj. Abraaj used a color chart to decide which investor to pay based on how much “noise” they made, according to a report by Dubai’s financial regulator. The defunct private equity firm prioritized “payments in order of importance, noise makers and those that will come back” when one of its funds fell short in 2016. Dubai fined Abraaj USD 314.6 mn this week for misusing funds, misleading clients and financial manipulation.

Trump’s Middle East peace plan will be revealed in the next six weeks: US President Donald Trump’s long-awaited Middle East peace plan will apparently be revealed before the 17 September Israeli elections (in a bid, we presume, to boost Netanyahu’s chances for reelection). Israeli media are reporting that White House advisor Jared Kushner will invite Arab leaders to a Camp David summit in the US to discuss the Trump administration’s plans. Kushner will travel to Egypt, Jordan, Saudi Arabia, Qatar, and the UAE next week to drum up support for the plan.

New Greek gov’t pulls no punches on Turkey’s east Med gas adventures: The newly-elected conservative Greek government has ramped up its rhetoric against Turkey, accusing it of threatening regional security for exploring for oil and gas off the Cypriot coast, Reuters reports. “The illegal actions of Turkey, which defy international law, are placing the security of the region at risk. As such, they are absolutely condemnable,” Greek Foreign Minister Nikos Dendias said on Tuesday after meeting with Egyptian FM Sameh Shoukry.

Iran to redenominate currency to combat inflation: The Iranian government will knock four zeroes off the rial in a bid to stem inflation, according to Iran’s news agency. The currency has been under severe pressure since the US reintroduced economic sanctions last year, having fallen to IRR 120k /USD from IRR 32k /USD in 2015. The currency will also be renamed the toman, restoring a currency unit that was removed from circulation in 1925.

The historical tradition of appointing a European to head the IMF is an “outmoded and counterproductive” system in an increasingly multipolar global economy, Mohamed El Erian writes for Bloomberg. There is an unofficial tradition for the World Bank to be headed by a US national, while the top position at the fund is given to a European. El Erian, who was sidelined from the shortlist of nominees to replace Christine Lagarde as the IMF’s managing director, says that the tradition has seen European governments bypass experienced nominees with technical expertise for politicians.

While the selection process currently underway is too far along for Europe to change its ways, governments must enact changes to the next selection process, El Erian says. “It should do so not only for its own sake, but to ensure a more credible and effective multilateral response if, as seems possible, unusually loose global financial conditions and weakening growth end up proving to be the calm before an economic and market storm.”

Apple may have seen a 12% decline in iPhone sales in 2Q2019 but it has countered this with revenue growth in every other area of its business, including iPad and Mac, the Wall Street Journal reports. The company expects revenue for 3Q2019 of between USD 61 bn and 64 bn, even though reduced iPhone business continues to impact results. This has been driven by fewer iPhone sales and a slowdown in the Chinese economy, with revenue in China plummeting by over 20% in 4Q2018 and 1Q2019.

PSA- The Financial Regulatory Authority published yesterday a guide (pdf) on the rules and regulations of issuing sukuk that were issued in April.

Enterprise+: Last Night’s Talk Shows

The National Youth Conference continued to occupy the talking heads on an otherwise bland night on the airwaves. Mohamed Salah’s nomination among the world’s top 10 footballers also got some attention.

The conference’s “Decent Life” session was the highlight of the second and final day. President Abdel Fattah El Sisi said during that Egypt’s economic growth over the past decade has been “incompatible”with the population surge. He also talked about building new cities without straining the country's budget Hona Al Asema Reham Ibrahim dedicated a chunk of airtime to covering the session (watch, runtime: 39:25). El Sisi also hit on the region’s fluctuating oil prices in the context of the government’s ongoing fuel hedging contracts during the Ask the President Q&A session, the full two hours of which you can catch here.

Mohamed Salah’s nomination by football experts for the Best Fifa’s Men’s Player award also got some airtime last night. Yahduth Fi Misr’s Sherif Amer was amongst those taking note (watch, runtime: 1:26). We have the story in this morning's Speed Round, below.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- The government is planning to issue between USD 250-500 mn of Asian bonds during the current fiscal year, two government officials told Enterprise. The Finance Ministry was originally planning to issue between USD 500 mn and USD 1 bn of Asian bonds, the sources said. The government is still considering whether to issue the bonds in JPY, RMB, or KRW. Egypt will be required to insure the bonds prior to issuance and is currently in talks with Asian insurance companies, the officials said.

The government is trying to reduce its bond issuances: The government is looking to cut bond issuances this year to between USD 3-4 bn from USD 5 bn, the officials said. The Finance Ministry began earlier this year implementing a strategy to reduce debt to 80% of GDP by 2022.

IPO WATCH- Fawry private placement more than 6x oversubscribed: The private placement portion of e-payments platform Fawry’s initial public offering, which closed yesterday, was c.6.5x oversubscribed, sources close to the matter told the local press. The private placement constitutes 10% of the offering, which will see Fawry sell 36% of its shares. The retail component of the offering is now 55.1% covered, with investors requesting 19.5 mn shares from a total of 35 mn up for grabs. The offering is set to wrap up on Monday.

Background: Fawry’s IPO will be Egypt’s first since last October, testing the waters of an anemic IPO market that has seen no action since Sarwa Capital went public last year. The IPO could set the tone for the market ahead of other planned offerings, including those in the state privatization program. The company’s shares will debut on the EGX on Thursday, 8 August.

M&A WATCH- Azimut gets green light to acquire Rasmala subsidiary: The Financial Regulatory Authority (FRA) has approved Italy-based asset manager Azimut Group’s acquisition of 100% of Rasmala Egypt Asset Management (REAM) from its parent company Rasmala Group, REAM chairman and MD Ahmed Abou El-Saad told Al Mal. The transaction, the value of which remains undisclosed, is expected to be concluded next week but the name will be changed to Azimut Egypt Asset Management later, Abou El-Saad said. Azimut signed the agreement to acquire REAM back in January.

Qalaa’s ERC signs pet coke supply agreements with Suez Cement, Arabian Cement: Qalaa Holdings’ Egyptian Refining Company (ERC) has inked agreements with Suez Cement and Arabian Cement to supply 500k tonnes of petroleum coke each year. Arabian Cement has agreed (pdf) to purchase 300k tonnes a year while Suez Cement will receive 200k (pdf), according to their respective EGX filings.

Separately, Qalaa announced yesterday that its share in ERC was diluted to 13.14% following the latest funding round in May. The investment company reduced its 19% stake after co-owners Qatar Petroleum and state-owned Egyptian General Petroleum Company underwrote USD 192 mn in additional equity for the USD 4.4 bn refinery. EGPC underwrote USD 50 mn of the USD 120 mn funding round in May, which included a USD 70 mn capital increase. Qalaa is banking on ERC to boost the company's profitability and expected it to start generating income in July. Chairman Ahmed Heikal said in May that he expects the refinery to generate more than EGP 90 bn in revenues next year. Qalaa’s share price dipped following the announcement and due to concerns over low prices affecting the refinery’s profitability Radwa El Swaify, head of research at Pharos, told Reuters.

Electricity Ministry to postpone planned plants amid oversupply, slow growth: A surplus in electricity production of up to 15k MW per day and relatively slow demand growth have prompted the Electricity Ministry to tweak its project pipeline and postpone a number of planned plants, government sources told the press. The excess production could still be as high as 13k MW a day — even after the completion of interconnection projects underway that would see Egypt export electricity to Sudan, Greece, and Cyprus. Officials from the electricity, finance, and oil ministries will meet to decide which projects are suitable, given the sector’s growth rate. Power plants in Oyoun Moussa, Damanhour, and Mahmodeya are among the projects likely to be either postponed or tweaked.

The ministry is also looking at other ways to promote energy efficiency. It is mulling plans to utilize the excess electricity in water desalination projects and deploying electric car charging docks. The ministry has also received offers from investors to purchase stakes in electricity plants in the new capital, Burullus, and Beni Suef. We noted in May that the Egyptian Electricity Holding Company (EEHC) could sell stakes in its electricity production and distribution subsidiaries to the private sector under an asset management program, as part of what could be a privatization drive to overhaul the electricity sector to promote market competition and increase efficiency.

DISPUTE WATCH- Americana Egypt’s minority shareholders say nay to Adeptio AD’s buyout offer: Minority shareholders in the Egyptian International Tourism Projects Company (Americana Egypt) are skeptical of a planned buyout offer from main shareholder Adeptio AD Investments and will continue their fight with the company if it fails to submit a “suitable offer,” minority shareholder Hatem Sultan told the local press. Sultan said that after Adeptio’s acquisition of Americana Egypt’s mother company in 2016, Adeptio made internal and structural decisions that were not revealed to the EGX and that may have impacted the company’s value. Adeptio has submitted a request to the Financial Regulatory Authority (FRA) to approve the buyout through one of its subsidiaries. The company said it will “comply with all capital market regulations in Egypt including a tender offer for [Americana Egypt’s] listed shares as applicable.” Adeptio, which is led by Emirati businessman Mohamed Alabbar, is already the main shareholder in Americana Egypt.

Background: Adeptio acquired 67% in Kuwait Food Company (Americana) in June 2016 following a two-year process, giving it indirect ownership of the majority of Americana Egypt. The FRA then ordered Adeptio to submit a mandatory tender offer (MTO) to buy the remaining shares in Americana Egypt earlier this year, but Adeptio had argued that its indirect ownership in the company is less than 90% of its total capital and therefore does not require an MTO submission. Adeptio submitted an appeal against the order, which the FRA promptly rejected. The company then filed a suit with an economic court challenging the FRA’s rejection, but the court also dismissed the appeal.

Clarified on 6 August 2019

Adeptio is yet to submit the MTO for the remaining shares of Americana Egypt. A previous version of the story had suggested that the offer was submitted by the former, and that the minority shareholders are fighting for a better offer.

DISPUTE WATCH- Edita to probe ending contract with Greece’s Chipita: Edita Food Industries is probing a dispute over a “manufacturing and services contract” with Greek snack maker Chipita, the company said in a bourse disclosure (pdf). Edita’s chairman and managing director have been mandated with evaluating the situation and “specifying the necessary legal course.” The company said it had not received any technical support, despite a contract valued at EUR 150k a year that it had signed in April 2011 with Chipita. The contract was annulled under an informal agreement in 2016, but appears to still be in force. No further details were provided. Chipita co-founded Edita with the Berzi family in 1996. The Greece-based company’s Exoder Limited owned (as of August 2019) 13% of the leading Egyptian snack maker, after selling some of its shares when Edita went public in 2015.

Israeli regulator gives thumbs up to Delek-led EMG pipeline acquisition: Israel’s antitrust regulator has agreed to let partners Noble Energy and Delek Drilling buy into the East Mediterranean Gas (EMG) pipeline running between Egypt and Israel, provided they let other companies access it, Reuters reported. Delek, Noble, and East Gas hope to complete their acquisition of a 39% stake in the subsea Ashkelon-El Arish pipeline by August, paving the way for Israel to begin exporting gas to Egypt in November. The Israeli gas partners will be supplying Alaa Arafa-led Dolphinus Holding with gas from each of the Leviathan and Tamar gas fields under a USD 15 bn agreement signed last year. The regulator, which will review the situation in 10 years, has asked the two companies to be prepared to “swap” supply agreements should an Egyptian supplier later decide to sell gas to Israeli companies.

IPO WATCH- Misr Clearing looking to IPO sports subsidiary: Procedures to IPO Misr Lel Makkasa Sporting Club will be completed by November, Misr for Central Clearing, Depository, and Registry (MCDR) boss Mohamed Abdel Salam told Amwal Al Ghad. MCDR is working on increasing its subsidiary’s capital to EGP 100 mn from EGP 42 mn, Abdel Salam said. Sporting clubs were allowed in 2017 to be listed on the EGX under the Sports Act, which allows sports companies to be established for profit.

The composition of the EGX30 is a bit different this morning after the exchange swapped six companies in its regular rebalancing. The full rundown on the rebalancing is here (pdf).

Who’s out: Global Telecom, GB Auto, the Arab Company for Asset Management and Development, Sarwa Capital, Arab Cotton Ginning Company, and Arabia Investment Holdings.

Who’s in: Orascom Construction, Cleopatra Hospitals Group, Sidi Kerir Petrochemicals, Ibnsina Pharma, Abu Dhabi Islamic Bank-Egypt, and Credit Agricole-Egypt.

EARNINGS WATCH- Credit Agricole 1H2019 profits increase 20% y-o-y: Credit Agricole reported a 1H2019 net profit of EGP 1.3 bn, compared to EGP 1.1 bn a year earlier, the lender said in a bourse filing (pdf).

Eastern Co turned in a loss in FY2018-2019,reporting a net profit of EGP 3.77 bn, down from EGP 4.24 bn a year ago, the state-owned company said in its earnings release (pdf). The company said the 11% decline in net profit was due to a decrease in interest income, credit interest, and foreign exchange losses. Topline sales for the year increased slightly to EGP 13.89 bn, up from EGP 13.41 bn in FY2017-2018, a 3.61% increase.

CI Capital Holding reported a 39% increase in net profit after tax in 1H2019 to EGP 207.7 mn, up from EGP 149.7 bn during the same period last year, according to an EGX disclosure (pdf). Topline sales for the year rose 35% to EGP 1.1 bn, up from EGP 849 mn in 1H2018.

MM Group for Industry and International Trade reported a 59.2% increase in net profit of EGP 254 mn in 1H2019, up from EGP 159 mn during the same period last year, according to a bourse filing (pdf). Topline sales for the year rose 55.3% to EGP 5.3 bn, up from EGP 3.4 bn in 1H2018.

MOVES- Finance Minister Mohamed Maait has tapped Reda Abdel Kader as advisor to the finance minister on tax evasion, reports Al Mal. Abdel Kader will remain in his current executive position as the co-head of the Tax Authority until he reaches retirement age.

Mo Salah among 10 nominees for Best Fifa’s Men’s Player award: A panel of Fifa legends has nominated the Egyptian King, along with nine others, for the Best Fifa Men’s Player of the Year award. The usual suspects, Messi and Ronaldo, also made it on the list — alongside Salah’s teammates Sadio Mane and Virgil van Dijk, as well as five others. Last year’s award winner, Luka Modric, missed out on the nomination. The top ten list is based on the players’ performance between 16 July 2018 and 19 July 2019, during which time Salah was the Premier League’s top scorer, but also had a less-than-stellar showing at the African Cup last month. Football fans can now vote to place Salah on the whittled-down list of the top three contenders, which he comfortably made last year but ended up third best. The winner will be selected on 23 September at FIFA’s award ceremony in Milan.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

Visualizing the rise of Airbnb: This infographic from Adioma shows how the folks behind Airbnb went from scraping together their monthly rent to sitting atop a USD 38 bn company. You can find more engaging startup-themed infographics here.

Egypt in the News

Human rights is topping coverage of Egypt in the foreign press this morning: Amnesty International is calling on authorities to allow regular family visits at Tora’s Aqrab maximum security prison, where some 130 detainees have been on hunger strike for six weeks due to “cruel and inhumane conditions.” A separate Reuters report discusses capital punishment in Egypt, with 3k people having been sentenced to death since 2014.

Worth Watching

It’s time to acknowledge that perfectionism is toxic: Many people deeply mired in the mistaken belief that perfectionism is a good thing don’t let themselves shoot high enough to risk failure, this BBC video shows (watch, runtime: 03:06). This can endanger mental health, as well as squandering chances for learning and professional growth.

Diplomacy + Foreign Trade

Investment Minister Sahar Nasr recently met with the Japanese ambassador Masaki Noke and other representatives of Japanese trade organizations and companies to discuss preparations for the 2019 Tokyo International Conference on African Development (TICAD7), which will take place from 28-30 August, the local press reports. It is expected that several MoUs will be signed at the conference, which President Abdel Fattah El Sisi will attend.

Foreign Minister Sameh Shoukry discussed yesterday energy cooperation with Cypriot President Nicos Anastasiades and FM Nikos Christodoulides, with talks covering hydrocarbon and natural gas discoveries in the eastern Mediterranean and the potential for stronger EU-Egypt ties. Shoukry was in Greece on Tuesday before landing in Cyprus.

Energy

EETC, GE sign agreement for monitoring center for Benban solar park

The Egyptian Electricity Transmission Company (EETC) and General Electric (GE) have signed an agreement to establish an EGP 89 mn monitoring center for the Benban solar park, Al Mal reported. The agreement comes as part of the government’s strategy to develop the energy sector. Construction of the project is expected to take eight months.

Manufacturing

Egyptian cement producer Aswan Cement to launch ready-mix concrete business

Aswan Cement is planning to venture into the ready-mix concrete market to diversify its business amid saturation in the cement market, company sources said. The company will begin in September building 10 batch plants at an initial investment of EGP 200 mn. It is in talks with EU-based equipment suppliers and the Arab Organization for Industrialization for the project. Industry experts have been warning that the cement market was in oversupply, having produced some 18 mn tonnes more than the local market wanted to buy in 2016.

Real Estate + Housing

Egypt’s NUCA allocates EGP 16 bn land to new city investor

The New Urban Communities Authority (NUCA) has allocated EGP 16-bn worth of land plots under a new land tender mechanism that allocates land directly to investors, a source from the Housing Ministry told the press. A total of 170 companies made the 10% down payment specified by the new mechanism and were allocated 170 land plots in new cities. The Madbouly Cabinet outlined in June the new regulatory framework to handle requests for the allocation of land for mixed-use projects.

Tourism

Luxury Steigenberger Hotel El Lessan opens in Ras el Bar

Steigenberger has opened its 4.2k sqm Hotel El Lessan in Damietta’s Ras El Bar, the company announced in a statement. The hotel has 153 rooms, including 15 suites, all of which feature a balcony with a view of the Nile and the sea. Egypt is one of Steigenberger’s "most important and strongest growth markets,” said Thomas Willms, CEO of parent company Deutsche Hospitality.

Other Business News of Note

Union National Bank’s BoD approves voluntary delisting from Egypt’s exchange

Union National Bank’s board of directors has approved a decision to voluntarily delist the bank’s shares from the EGX and purchase the minority shareholders' shares at their fair value, according to a bourse disclosure (pdf). The board has called for an extraordinary general assembly meeting to vote on the delisting and nominated its chairman to set the date. The EGX’s delisting committee separately also greenlit the voluntary delisting of the National Company for Maize Products, according to the stock market’s session news screen.

Legislation + Policy

El Sisi ratifies law keeping stamp tax on Egypt’s stock transactions unchanged

President Abdel Fattah El Sisi has signed into law a recently-passed bill keeping the provisional stamp tax on EGX transactions unchanged at 0.15%, according to the Official Gazette (pdf). The House of Representatives gave its final nod to the bill last month. The tax was scheduled to increase to 0.175% on 1 June as part of a plan to hike it annually over a three-year period, but the Finance Ministry called off the increase in a move designed to ease the financial burden on traders.

National Security

US State Department approves potential USD 554 mn military sale to Egypt

The US State Department has approved a potential USD 554 mn military sale for Follow-On Technical Support (FOTS) for various ships to Egypt, the Defense Security Cooperation Agency (DSCA) said. “The proposed sale is essential to maintain Egypt’s national security, regional stability, and the [unobstructed] flow of worldwide commerce via the Suez Canal,” the DSCA said.

My Morning Routine

Menatalla Sadek, CEO of Hassan Allam Utilities: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Menatalla Sadek, CEO of Hassan Allam Utilities, which is an investment platform for power, renewable energy, and water companies.

My name is Menatalla Sadek. I am the proud mother of three children, and co-founder of three relatively new start-ups, which I entered into with local and foreign industry veterans.

I’m the CEO of Hassan Allam Utilities, a development and investment platform that was set up less than two years ago to lead the market in investment in the renewable energy, power, and water sectors — starting in Egypt.

The renewables sector is very different from water desalination and treatment, but our business approach is the same for both. We find the right projects and then develop them to meet the needs of our clients, offering the best pricing and quality in the contractors we bring on, and managing the building and the financing, using a mix of equity and debt financing. When we identify a prospective client — perhaps a large industrial outlet that would benefit from using solar energy, for instance — we meet them and explain our idea, to demonstrate how it will add value. This is more important than you might think, because the sectors are relatively new. Then we conduct a site visit and take our measurements, structuring our design of the project, before looking at the implementation. We’re there from the beginning until the project is fully up and running.

What’s great is that we’re able to offer our clients a product that is cost effective. So we can sell desalinated water or electricity to the offtaker (the client buying the product) at a highly competitive price for a particular period of time, enabling the offtaker to cut their costs. In the end, we will recoup our investment, but over a longer period of time than a traditional investor would. We use the Build-Own-Operate model for both sectors.

My morning routine is a very active one. I wake up at 5:30 am, and go for a 7-10 km run (increasing the length to 10-15+ km on Saturdays). I then return home, make a cup of coffee, and join my children for breakfast. After dropping the children off at school, I then head to CrossFit Training (three days a week) or to Mysore Ashtanga yoga (three days a week), before heading to work. Crazy, I know. But I wouldn’t start my day any other way, even on the weekend and during holidays, when the school part changes, the rest of the routine remains intact. Luckily I don’t need a lot of sleep; I can get by on five hours.

As I’m currently in charge of three companies, my days are often hectic and always interesting. I’m unable to dedicate a particular day of the week to each operation, though I did try this in the past (but it really didn’t work). So instead I have to put clear targets in my head and set goals to be achieved each week, and then be as flexible as possible to juggle everything. My calendar is always full, and often changes drastically from week to week. I have to support my team members as much as possible, and this often means attending different meetings when it’s needed. But I also have to ensure I’m not swamped with too many obligations that would prevent me from reaching my weekly targets.

I don’t watch a lot of TV, but I love reading. Lately I’ve been reading Sun Tzu’s The Art of War, which is a brilliant book by an ancient Chinese military strategist, for the second time. The book focuses on how warfare is applied to military strategy and tactics. But when I read the book, I look at it from the perspective that the real battle in life is often with oneself, more than with anyone else. This is important for me personally, as it’s the most difficult task I have at hand.

The idea of HA Utilities stemmed from the Hassan Allam Group deciding to diversify. The brilliant co-CEOs decided to expand their family-focused construction business to include complementary businesses, benefitting from the large value chain they had access to. I was then brought on to lead HA Utilities, explore the renewables and water-related investment sectors, and see where opportunities existed for us. Initially the plan was to penetrate the market by acquiring existing companies (what we call the non-organic approach), which is easier than building projects from scratch. But quite honestly, though there are good and successful companies working in both sectors in Egypt, none have the know-how for the larger projects that we were looking to take on. So we ended up creating our joint venture companies with international industry veterans, in the case of both sectors. Lightsource BP is Europe’s largest solar developer, with 3GW+ of solar assets either developed or under management. And Almar Water Solutions has Europe’s most experienced water desalination and water treatment team.

Renewables are such a great alternative for the Egyptian market at the moment,because electricity prices are going up and solar energy prices are becoming more competitive. Thanks to our partnerships and know-how, we can offer the best solutions for our customers. Looking at the big industries, we can cut their costs substantially and help them become more sustainable and green.

Water, meanwhile, is becoming a critical sector for the government because Egypt is facing a serious water shortage. Even without the Grand Ethiopian Renaissance Dam (GERD), we still face a shortage, but of course the GERD will exacerbate the problem. People often look at the Nile and can’t imagine we have any water shortages, but with a growing population, we are really facing a problem. So we’re offering an important service to both the public and private sectors.

In the field of development, it takes time to get long-term stable cash flows. The initial development phase of a project can take up to 24 months, but getting it fully up and running often takes longer. So, it is really a game of patience, deep pockets and more patience. But the end result should be worth it.

There are two ideas that I apply often in my professional life. My mentor and former boss Raouf Ghabbour taught me that working in an organization requires much more than just doing the tasks you’re responsible for. People skills are essential. I learned so much during my time as chief investment officer of GB Auto, and even more from directly working with Dr. Ghabbour. The second idea is the importance of an organization’s working culture in developing a business. “Culture eats strategy for breakfast,” as Henry Ford once said. I was once asked in an interview what I would seek in any future job, and my answer remains that I want to be part of a team that really embodies the qualities of teamwork. It’s important to me to be part of a place with a non-political working culture and ethics. This is something I will always pursue in my career.

The Market Yesterday

EGP / USD CBE market average: Buy 16.49 | Sell 16.62

EGP / USD at CIB: Buy 16.50 | Sell 16.60

EGP / USD at NBE: Buy 16.53 | Sell 16.63

EGX30 (Wednesday): 13,392 (+0.2%)

Turnover: EGP 626 mn (6% above the 90-day average)

EGX 30 year-to-date: +2.7%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.2%. CIB, the index heaviest constituent ended up 1.6%. EGX30’s top performing constituents were Heliopolis Housing up 3.1% and Egyptian Resorts up 2.7%. Yesterday’s worst performing stocks were Qalaa Holdings down 9.6%, Arabia Investments Holding down 4.4% and Kima down 3.7%. The market turnover was EGP 626 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +73.3 mn

Regional: Net Short | EGP -36.7 mn

Domestic: Net Short | EGP -36.6 mn

Retail: 49.1% of total trades | 48.0% of buyers | 50.3% of sellers

Institutions: 50.9% of total trades | 52.0% of buyers | 49.7% of sellers

WTI: USD 57.50 (-1.84%)

Brent: USD 65.17 (+0.70%)

Natural Gas (Nymex, futures prices) USD 2.24 MMBtu, (+0.18%,Sep 2019 contract)

Gold: USD 1,422.90 / troy ounce (-1.04%)

TASI: 8,732.62 (-0.10%) (YTD: +11.57%)

ADX: 5,317.90 (-0.25%) (YTD: +8.20%)

DFM: 2,918.38 (+0.23%) (YTD: +15.36%)

KSE Premier Market: 6,744.08 (+0.14%)

QE: 10,505.00 (-0.80%) (YTD: +2.00%)

MSM: 3,760.63 (+0.14%) (YTD: -13.02%)

BB: 1,547.68 (+0.09%) (YTD: +15.74%)

Calendar

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

3 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

3-4 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

4 August (Sunday): The High Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets.

5 August (Monday): Egypt’s Emirates NBD PMI for July released.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.