- The Finance Ministry and the EGX are looking to restore the old capital gains tax. (Speed Round)

- Your move, Russia: Germany just lifted flight restrictions on Taba. (Speed Round)

- Top investment banks are throwing their hats in the ring to advise on the sale of United Bank. (Speed Round)

- Saudi’s Andalusia plans to invest EGP 1 bn in building two new hospitals. (Speed Round)

- Emerging markets central banks are pushing ahead with rate cuts. (What We’re Tracking Today)

- Traders should finally start short selling in 3Q2019. (Speed Round)

- Is an Aramco IPO back in the cards again? (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 3 July 2019

The old capital gains tax might be restored

TL;DR

What We’re Tracking Today

It’s official: The new electricity tariffs are now in force. Electricity companies have begun to apply the new rates for the FY2019-20, which means higher utility bills for all of us starting next month. You can check the full breakdown of the new rates here.

We’re still waiting to see if the Oil Ministry will move 95-octane fuel prices under the automatic fuel pricing mechanism this month, which appears to be the general expectation in the local press. All eyes are also on other fuel grades, as the government was expected to announce last month its plan to extend the mechanism to other grades.

IMF Managing Director Christine Lagarde has been nominated to lead the European Central Bank, and will “temporarily relinquish” her responsibilities as IMF boss, Lagarde said in a statement yesterday. Lagarde’s nomination is not popular among some parts of the European Parliament, however, and many have been quick to point out her lack of direct experience in monetary policy. If her nomination is approved, the former French finance minister will officially take the helm of the ECB within a few months. The story leads the global business press this morning (Bloomberg | Reuters | WSJ | Financial Times).

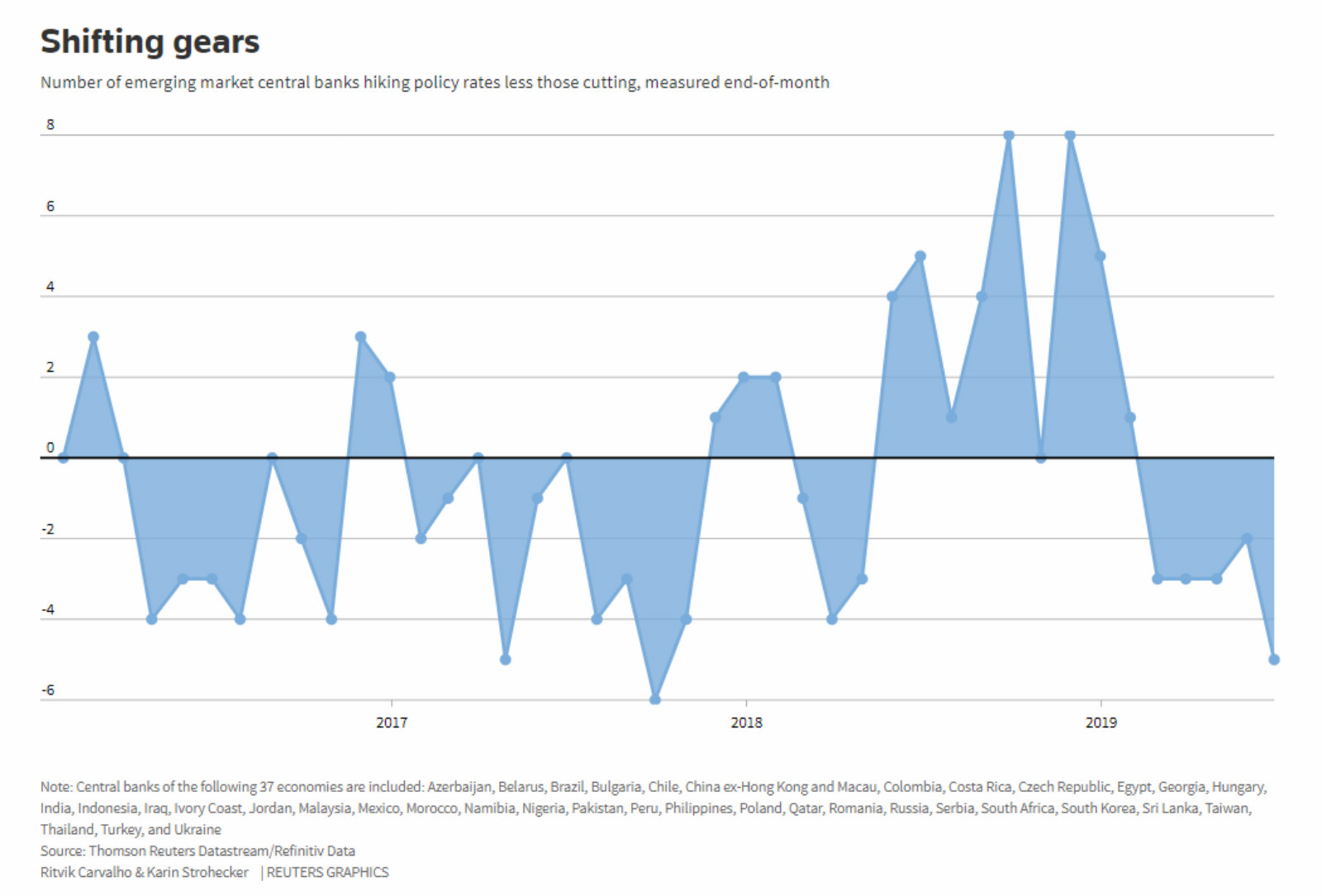

Emerging market central banks put the pedal to the metal and push ahead with rate cuts: Easing by emerging market central banks accelerated in June, as the number of rate cuts exceeded hikes for the fifth consecutive month, Reuters reports. A total of five net rate cuts were made across 37 developing economies last month, as banks reacted to signals from the US Federal Reserve and the European Central Bank that they could cut rates in the coming months. The ECB and the Fed will next meet on 25 July and 30-31 July, respectively.

We’ll find out if Egypt will be included in next month’s list of EM doves when the CBE’s Monetary Policy Committee meets a week from tomorrow to review rates.

It’s PMI day: The Emirates NBD purchasing managers’ indexes for Egypt, the UAE and Saudi Arabia are due for release today at 6:15am CLT. Non-oil business activity contracted again in May, having expanded for the first time in nine months in April. The dip was fueled in part by a decline in tourism activity. You can see the PMI here when it’s released.

Key data points coming up over the next several days:

· Foreign reserves: The CBE is due to release net foreign reserve figures for June this week.

· Inflation: Monthly inflation figures are due out next week.

The EBRD’s VP of banking Alain Pilloux wraps up his four-day visit today. More EBRD investment plans were announced yesterday, a day after Pilloux indicated during a meeting with Prime Minister Moustafa Madbouly that the bank could help to finance the government’s monorail project, along with other infrastructure initiatives. We have more in this morning’s Speed Round, below.

Pilloux’s tour included a ceremony yesterday to celebrate the EBRD’s achievement of providing advisory support to 200 small businesses in Alexandria, the bank said in a press release (pdf).

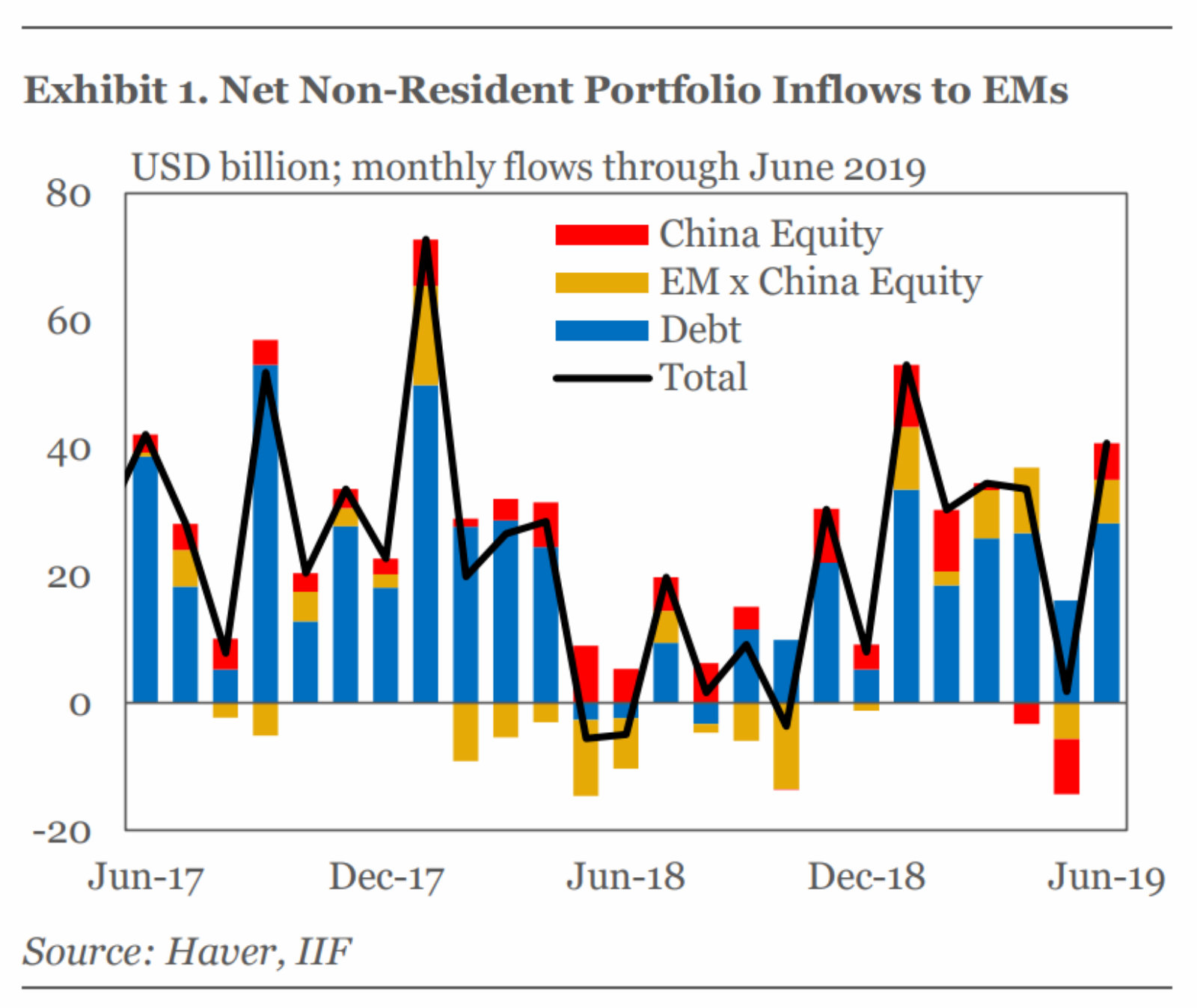

EM inflows hit five-month high in June: Emerging market inflows staged a sharp recovery in June, as investors poured USD 40.8 bn into EM stocks and bonds, according to Institute of International Finance data. Investors largely avoided emerging markets during the so-called ‘trade tantrum’ in May, with inflows amounting to just USD 1.8 bn during the month. But a recovery in Chinese stocks last month saw equity flows rise to USD 12.6 bn from USD -14.3 bn in May, while debt flows rose to five-month highs of USD 28.2 bn.

Is an Aramco IPO back in the cards (again)? Saudi Arabia is dusting off its plans to list Aramco more than a year after its IPO was put on hold. Sources told Bloomberg that company officials are in talks with investment banks over potential roles on the listing, which would be the world’s biggest ever IPO, if it comes to fruition. The company shelved its IPO plans last year in favor of purchasing Saudi chemical giant Sabic, and is reportedly waiting until the acquisition is complete before pushing ahead with the listing. Crown Prince Mohammed bin Salman has said that the IPO will go ahead in either 2020 or 2021, but sources say that no decision has been taken regarding the timing.

OPEC countries signed yesterday a long-term agreement with Russia to continue cooperating on oil production once the supply cut agreement currently in place expires in nine months, the Wall Street Journal reports. The cooperation pact will remain in place “indefinitely” as the cartel looks to prop up oil prices, particularly in the face of oil prices “nearing a bear market” as the collective hand-wringing over the global economy persists.

The UAE has stepped up efforts to entice investors: The UAE will allow foreigners to acquire 100% ownership of local businesses in a bid to attract outside investment, Prime Minister Sheikh Mohammed bin Rashid Al Maktoum wrote on social media. Full ownership will be permitted in a number of industries including e-commerce, agriculture and construction, and individual emirates will “identify relevant [foreign] ownership percentages in every activity,” he said. Foreign ownership of Emirati businesses was previously capped at 49%.

In international miscellany:

· Careem says goodbye to Sudan: Careem has exited Sudan as part of Uber’s USD 3.1 bn takeover of the company, a spokesperson said, according to Reuters.

· “Banking’s most notorious rogue” Nick Leeson is earning big bucks for giving talks about shady financial practices to an international audience, after going to prison for bringing down Barings Bank by gambling away GBP 862 mn, the Guardian reports.

EG Bank and Cairo Angels are now accepting applications for the fourth cycle of the MINT incubator, according to a statement (pdf). The incubation period will provide the 10-12 businesses selected to participate with “a series of different workshops that will address key areas to help accelerate the startups’ growth,” in addition to mentorship and access to legal support. You can apply here for the upcoming cycle, which lasts three months.

PSA- Surprise, it’s going to be a hot and humid day: Daytime highs are forecast to reach 37°C (pdf), while the nighttime will be more merciful, with lows expected at 25°C.

Enterprise+: Last Night’s Talk Shows

The airwaves gave us a mixed bag of nuts last night, with no single topic reigning supreme.

End of fiscal year report: Al Hayah Al Youm’s Lobna Assal took note of President Abdel Fattah El Sisi’s meeting with Prime Minister Moustafa Madbouly and Finance Minister Mohamed Maait to recap the country’s economic performance in FY2018-2019. The preliminary indicators “are reflective of great improvement on a number of levels,” Assal noted (watch, runtime: 4:30). We have the full story in Speed Round, below

Fresh Saudi investment: Saudi’s Andalusia Group’s plan to build two new hospitals in Cairo and Giza at a cost of EGP 1 bn also came up on Al Hayah Al Youm (watch, runtime: 2:51). We have the full story in Speed Round, below.

ITFC celebrates USD 1.13 bn trade finance agreement with Egypt: The International Islamic Trade Finance Corporation celebrated yesterday an agreement with the government to unlock USD 1.13 bn in financing for basic goods, foodstuffs, petroleum, and energy commodities, Hona Al Asema’s Lama Gebril reported. The proceeds also include funding for several projects and programs to train youth and women (watch, runtime: 4:17).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- Gov’t to restore the old capital gains tax regime under its latest proposal: A government committee looking to amend the capital gains tax (CGT) is proposing to restore the old tax rate of 10% on gains from the sale of shares in both EGX-listed and non-listed companies, a number of government officials we spoke with told us on Monday.

Stamp tax for non-residents only: The new proposal will also see the stamp tax on stock market transactions eliminated for residents in Egypt. A stamp tax will remain in place for non-residents, but will be lowered to 0.1% from 0.15%. Investors who have lived in Egypt for 182 days or more will be considered residents. Officials tell us that the proposal would abide by dual-taxation agreements signed.

Proposal is with the Madbouly Cabinet: The proposed changes to the tax will be sent to the Cabinet for review before being introduced to the House of Representatives in its next legislative cycle, which begins in October, the officials added.

Where do we stand today? Right now, anyone making a gain on the sale of shares in a privately held company is taxed at 22.5%. The levy on gains made trading in shares of EGX-listed companies stands at 10% on the books, but has been “suspended” until May 2020.

This sounds eerily familiar: Representatives in the House Economics Committee had been planning to move forward last month with a separate plan to unify capital gains tax, which could see both listed and non-listed companies face a 10% tax. The plan was proposed at a time when the government was still unclear on how it would restore the tax. The Tax Authority had said at the time that it would not back the move. The plan is currently still with the committee and is expected to be debated when the House reconvenes.

Background: After a revolt by retail investors, officials shelved the old tax proposal in 2017 for a three-year period — and replaced the measure with a provisional stamp tax. The full introduction of the tax was a recommendation of the IMF, and reports in the local press citing unnamed government sources had suggested in May that the government would not be bringing back the tax “anytime soon” despite deciding to keep the stamp tax on EGX trades unchanged at 0.15% this year.

INVESTMENT WATCH- UAE banks invested USD 11.8 bn in Egypt in 1Q2019: Investments by Emirati banks in Egyptian assets reached AED 43.4 bn (USD 11.8 bn) at the end of 1Q2019,according to UAE Central Bank data, Emirates News Agency (WAM) reports. Investments in Egypt by UAE banks grew AED 11.7 bn (USD 3.1 bn) over 1Q2018 — the highest annual increase in investment by Emirati banks in any country, according to WAM. The other countries to see substantial annual increases are Saudi Arabia, with an increase of USD 3.04 bn to USD 12.7 bn and the UK, with an increase of USD 2.06 bn to reach USD 16.6 bn.

INVESTMENT WATCH- Saudi’s Andalusia for Medical Services plans to invest EGP 1 bn in building two hospitals in Egypt, CEO Hazem Zagzoug told Prime Minister Mostafa Madbouly yesterday, according to a Cabinet statement. The company is currently working on buying two land plots from the New Urban Communities Authority (NUCA), one in 6 October and the other in New Cairo. The company is also planning to expand one of its existing hospitals, which is located in Maadi, Zagzoug said. The group, for whom the European Bank for Reconstruction and Development (EBRD) had approved a USD 24 mn loan late last year, had announced back in 2016 that it was investing USD 50 mn over three years.

M&A WATCH- EFG, Pharos, CI, HC among investment banks facing off to advise on United Bank sale: EFG Hermes, CI Capital, Pharos and HC Securities are among investment banks bidding to become the sell-side adviser on the sale of United Bank, CBE Governor Tarek Amer told Bloomberg on Tuesday. The CBE will select an adviser “in the coming weeks,” Amer said. The selected adviser will determine when the sale will take place, he added. He had said in May that the acquisition of the country’s third-biggest lender should be completed within three months’ time.

Amer encouraging foreign banks to get in on the sale? The sale has to be managed by a local investment bank, but they “can team up with international banks if they need to,” Amer said. Be on the lookout for some interesting partnerships and joint bids going forward.

So how much of the bank is the CBE looking to sell? That will depend on the investor chosen, said Amer. The size of the stake “depends on the value that the investor will bring to the market,”the CBE governor told Bloomberg in London yesterday, adding that it could either be a majority or minority stake. Amer reiterated that a US institution made an offer to acquire United Bank and is currently doing due diligence on the transaction. He did not confirm statements he made last month that the CBE has received new bids from other international institutions. The central bank owns 99.9% of the bank’s shares, having created the institution through the merger of a number of smaller institutions.

M&A WATCH- Pioneers Holding names CI Capital as adviser on Arab Dairy sale: Pioneers Holding has hired investment bank CI Capital to become its adviser on the sale of its cheese-maker subsidiary Arab Dairy, the company said in a bourse filing (pdf). The producers of the Panda cheese brand received interest from UAE-based Gulf Capital’s GC Equity Partners III fund and Netherlands-based FrieslandCampina, the company said. Both were given the go-ahead to proceed with due diligence. Pioneers holds 70% of Arab Dairy.

M&A WATCH- Global Telecom MTO progresses after tax dispute resolution: Global Telecom Holding (GTH) shareholders have offered to sell 37% of the 1.99 bn shares targeted in a mandatory tender offer launched by majority shareholder Veon to acquire 42.3% of GTH, according to Al Mal. The MTO kicked off yesterday, and is due to close on 6 August. Veon’s plans to launch the MTO were previously hampered by a tax dispute between GTH and the government which was resolved last week after GTH signed a USD 136 mn settlement agreement with the Egyptian Tax Authority. Meanwhile, GTH’s board canceled a planned general assembly to discuss an EGP 11.2 bn capital increase through a rights issue, the company said in a bourse filing (pdf). GTH had planned the increase in case the MTO had fallen through.

The government met its 8.4% budget deficit and 2% primary budget surplus targets in FY2018-2019, which ended on Sunday, according to an Ittihadiya statement out following a meeting between President Abdel Fattah El Sisi, Prime Minister Moustafa Madbouly, and Finance Minister Mohamed Maait. The economy grew at a 5.6% clip, and the debt-to-GDP ratio is expected to continue falling to reach 90%, above the fiscal year’s 93% target. The three also reviewed the state’s budget FY2019-20 (pdf), in which expenditures are expected to be EGP 150 bn higher than last fiscal year. The increase is primarily due to the recent decision to increase the national minimum wage to EGP 2,000 from EGP 1,200 and raise minimum monthly pensions for state employees. The budget took effect when El Sisi ratified it on Monday.

EARNINGS WATCH- Qalaa Holdings revenues rise 13%, losses narrow to EGP 154.6 mn: Qalaa Holdings’ revenues rose 13% y-o-y in 1Q2019 to EGP 3.4 bn “on the back of robust results posted across its subsidiaries,” the company said in its earnings release (pdf). The company singled out its energy platform, with TAQA Arabia’s revenues up 41% y-o-y and Tawazon’s revenues up by 59% y-o-y. Growth has also been strong in the agrifoods space, with revenues for ASCOM up 18% y-o-y and Nile Logistics up 86% y-o-y. The company’s losses during the period narrowed to EGP 154.6 mn from 186.1 mn in 1Q2018. “Growth has been dual-driven by both the streamlining of Qalaa’s portfolio in addition to successful growth strategies that capitalize on favorable economic policies. We began implementing a three-year growth strategy at our energy segment in late 2018 that will see us grow our distribution reach and diversify our offerings,” said chairman and founder Ahmed Heikal.

Looking ahead: Qalaa is continuing with its portfolio restructuring strategy, with a focus on balancing risk reduction with “small incremental investments to generate growth,” Heikal added. Strengthening its foothold in Egypt’s renewable energy sector is a priority, with further PV projects identified in addition to its Benban solar project. Meanwhile, Qalaa’s ERC plant is expected to start generating income in July. Unrest in Sudan has impacted cement production, and therefore, “while we remain committed to allocating the necessary resources to Al Takamol, management is actively working to exit this investment,” said co-founder and managing director Hisham El-Khazindar.

The Egyptian Transport and Commercial Services Company (Egytrans) reported a 27% y-o-y increase in 1Q2019 net profits to EGP 17.6 mn, up from EGP 13.8 mn a year earlier, the company said in an earnings statement picked up by Masrawy. Revenues for the quarter rose 42.8% to EGP 89 mn.

USD 200 mn in funding from the EBRD to Majid Al Futtaim’s City Centre Almaza: The European Bank for Reconstruction & Development (EBRD) is providing up to USD 200 mn to Majid Al Futtaim to build its USD 437 mn City Centre Almaza in East Cairo, the financial institution said on its website. The funds will be used to finance the construction, equipment, and operation of the center. City Centre Almaza will be Majid Al Futtaim’s third City Centre in Egypt.

Germany has removed flight restrictions to Taba, allowing direct flights to the Sinai city, the country’s foreign ministry said. “The decision means that all airlines are allowed again to fly directly to Taba International Airport,” Orascom Development said in a press release. Germany had banned flights to Taba in the wake of the Russian Metrojet crash in 2015.

Orascom Development welcomed the news, saying it bodes well for business in its Taba Heights, the company’s second largest hotel and largest tourist destination in south Sinai. “Now with the lifting of the restrictions, the potential upside for the destination can be achievable, noting that in 2010, Taba Heights used to generate approximately USD 20 mn of pure EBITDA,” said CEO Khaled Bichara.

Travel warnings remain: The ministry recommends that travelers avoid unaccompanied, individual trips to south Sinai and warned against travel to the north Sinai, the Egyptian-Israeli border (except Taba), and remote areas in the Sahara desert. High security levels are expected in Cairo, Alexandria, Ismailia and Suez until 19 July because of the Afcon 2019 tournament, the German foreign ministry said, advising its citizens to avoid crowds and follow the instructions of local security forces.

So what’s your excuse, Russia? The lifting of restrictions by Germany comes as Russia continues to remain cagey about restoring charter flights to Egypt. “It is difficult to say when the charter flights could resume between Egypt and Russia,” the country’s industry and trade minister, Denis Manturv, said last month.

REGULATION WATCH- Expect short selling to begin in 3Q2019: Traders should begin short selling in 3Q2019, when the new system is implemented, Financial Regulatory Authority (FRA) deputy head Khaled El Nashar told Reuters on Tuesday. “The only thing still to be finalised is the implementation mechanism, and this is under discussion between the company Misr for Central Clearing and the stock exchange,” he said. The FRA began issuing licenses for brokerages to become short sellers last month, with Arqaam, EFG Hermes, CI Capital and the Arab Arfrican International Securities all receiving licenses.

Background: The market regulator issued regulations last February for short selling on the EGX, allowing brokerage firms to act as market makers by finding lenders and borrowers of stocks. Investors looking to open a short position will need to put down 50% of the value of the securities borrowed, and brokerages will be required to park 20% in fixed-income instruments while the position is open. The EGX published last month a list of stocks approved for short selling.

World Bank approves USD 500 mn loan to support Egypt’s cash-subsidy programs: The World Bank’s board of directors has approved the USD 500 mn facility offered last year to extend for three years a program to support Egypt’s social safety net, according to an Investment Ministry statement (pdf). The proceeds will be used to expand the Takaful and Karama cash subsidy programs by offering employment and “economic empowerment” to members of families enrolled in the programs. We noted yesterday that the Finance Ministry set to wrap up the procedures of obtaining the loan by the end of the month.

MOVES- Baker McKenzie has appointed Ghada El Ehwany (LinkedIn) as an M&A partner at its Egypt office, the law firm said in a statement yesterday (pdf). The law firm has elected 81 new partners across its global offices, according to the statement.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Egypt in the News

The foreign press is blessing us with yet another slow morning for Egypt. Let’s all enjoy it while it lasts.

On The Front Pages

President Abdel Fattah El Sisi’s meeting with senior officials to discuss Egypt’s economic performance in FY2018-19 and FY2019-20 topped the front page of state-owned Al Akhbar. We recap the story above in this morning’s Speed Round. Both Al Ahram and Al Gomhuria’s websites were still down this morning.

Worth Reading

Facebook’s grandiose ambitions for financial inclusion sound great — but Libra may be destined to remain a pipe dream: The announcement of Facebook’s new Libra cryptocurrency last month was greeted by media fanfare and scepticism in equal measure. What Libra is proposing is potentially revolutionary: a global cryptocurrency capable of delivering mobile banking to the entire planet. But even if we leave aside the regulatory concerns, the limited internet infrastructure in many developing countries mean that Libra in its current form is destined to remain a pipe dream, Patrick Jenkins writes in the FT.

What is Facebook proposing? In its policy document, Facebook pitches Libra as a global cryptocurrency that allows people across the world to store and transfer money using only their Facebook accounts. The bns of people living in developing countries currently unable to open a bank account, transfer money, and secure a loan would be able to achieve all of this through a single app, effectively rendering bank accounts defunct. But what makes Libra truly unique in the crypto sphere is that it would it be backed by a basket of underlying assets, comprised mainly of bank deposits and low-risk government securities. This would help reduce volatility and stabilize the rate of exchange into local paper currencies.

How realistic is financial inclusion? If we assume that Zuckerberg’s intentions are benign, his grandiose ambitions are impressive. But as Jenkins points out, reality often turns out to be disappointing, and there remain serious obstacles to Libra ever becoming workable in developing countries. Around 75% of the 1.7 bn financially excluded people do not have access to the internet. Broadband infrastructure remains rudimentary in many developing countries, and while smartphone ownership is growing, many people are unable to afford the kinds of phones used by consumers in advanced economies. And then there’s the question of transaction fees. The company claims that any charges would be low, but convincing people living in low-income, cash-based economies to pay fees every time they want to make a transfer could prove to be a hard-sell — one that it has so far chosen to ignore.

Worth Watching

The meticulously-planned ‘war effort’ to reconstruct Notre Dame: A massive initiative to reconstruct the Notre Dame cathedral is underway, following the fire that decimated parts of it — and even with the use of cutting edge technology, it’s expected to take at least five years, this FT video shows (watch, runtime: 06:49). For the reconstruction process to begin in earnest, experts in 3D scanning are using laser scanners to create an exact digital copy of the cathedral, from which they can then create a 3D model. The whole process needs to be undertaken with meticulous care. Notre Dame’s characteristic arches are very thin, and their balance is extremely precise, meaning the whole building is at risk of disappearing forever into the annals of history if the structure is not solid enough.

Energy

Delek finishes tests on El Arish-Ashkelon pipeline setting up EMG acquisition for August

Delek Drilling has completed tests on the subsea Eastern Mediterranean Gas (EMG) pipeline linking Israel and Egypt, paving the way for Delek, Noble Energy and East Gas to complete their acquisition of a 39% stake in EMG by the end of August, the company said yesterday (pdf). The Israeli company confirmed that the pipeline is fit to transport up to 7 bcm of natural gas per year, removing doubts cast last year on its integrity. We noted local reports yesterday that the Delek consortium has postponed Egypt-bound gas shipments until the end of 2019 due to high gas demand in Israel during the summer. Shipments from Israel’s offshore fields which were originally expected to start at the end of June.

Basic Materials + Commodities

Egypt procures 3.3 mn tonnes of wheat so far into the season

The Supply Ministry has purchased nearly 3.3 mn tonnes of wheat worth EGP 15 bn from local farmers since the beginning of the harvest season in mid-April, Assistant Minister Wael Abbas said, according to Al Masry Al Youm. The purchase came at an average price of EGP 670 per ardib (EGP 4,545 per tonne). Supply Minister Ali El Moselhy had previously said his ministry plans to procure 3.6 mn tonnes of wheat from local farmers this season.

[Correction: The email edition incorrectly noted that EGP 670 was the average price per tonne. We apologize for the mix-up.]

Tourism

Egypt’s capital on list of top cities to see increased tourist arrivals over a decade

Cairo is on a list of the top cities expected to grow their number of tourist arrivals over the next decade, according to a World Travel and Tourism Council report (paywall). Delhi, Manilla, Bangkok, and Moscow were also on the list. The report urges these cities to improve their infrastructure in order to cope with the increase and prevent “overtourism.”

Telecoms + ICT

Telecom Egypt to launch IPTV services in “days”

Fixed land-line monopoly Telecom Egypt (TE) is planning to launch Internet Protocol Television (IPTV) services in a “few days,” CEO Adel Hamed said, according to Al Shorouk. The company is planning to transform into a “gateway for internet services” connecting Asia, Africa and Europe, Hamed said.

Banking + Finance

Kharafi National signs EGP 750 mn syndicated loan with four Egyptian banks

Pan-Arabian infrastructure contractor Kharafi National has signed a syndicated loan agreement with four local banks led by SAIB Bank to arrange a EGP 750 mn facility, the bank said, according to a local press report. The consortium also includes the Export Development Bank Of Egypt, the Industrial Development Bank, and Al Baraka. The loan’s proceeds will be used to finance project Kharafi’s contracting work in Egypt.

Other Business News of Note

CBE to set up by year end risk assurance company for Africa-bound exports

The Central Bank of Egypt (CBE) is planning to set up by the end of December a risk assurance company to protect exporters doing business in Africa, a CBE official told the local press. The CBE is currently finalizing the company’s organizational and shareholder structure, for which the African Export-Import Bank has offered recommendations. The company is meant to support exports into Africa as part of Egypt’s strategy to improve its trade position.

Law

Maatouk Bassiouny legal counsel to ADNOC in OCI NV fertilizer business merger

Matouk Bassiouny is acting as local counsel to Abu Dhabi National Oil Company (ADNOC) in the merger of ADNOC fertilizers business into OCI NV’s nitrogen fertilizers production platform in the Middle East and North Africa, the law firm said in a statement (pdf). OCI NV, meanwhile, hired Cleary Gottlieb Steen & Hamilton LLP.

Sports

Egypt plans to bid for hosting UEFA, Spanish, Italian super cups -EFA boss

Egypt is planning to bid for hosting the UEFA, Spanish, and Italian super cups, Egyptian Football Association (EFA) boss Hany Abo Rida said. ُEgypt’s hosting of the African Cup of Nations has been so far successful and by 2030 “we will be able to host the World Cup,” Abo Rida said.

Egyptian footballer Trezeguet could crack into the Premier League soon

Premier League football clubs Aston Villa and Watford are both showing interest in Egyptian national team player Mahmoud Trezeguet. According to the Watford Observer, Watford FC has already placed a GBP 10 mn bid on the Egyptian striker, who currently plays for Turkish club Kasımpaşa. Aston Villa’s player scouts are also reportedly impressed by his performance in Afcon so far, says King Fut. Turkey’s Galatasaray, French majors Olympique Lyonnais, La Liga giants Sevilla were all previously said to have shown interest in the 24-year-old midfielder.

On Your Way Out

Methanex Egypt has received the International Council for Small Business (ICSB) Humane Entrepreneurship Award for contributions to micro, small and medium-sized enterprises (MSME) culture in Damietta, the company said in a press release (pdf). Methanex Egypt operates a methanol production plant in Damietta, and in February it signed a two-year partnership with the ILO to extend a Canada-funded project focused on job creation for youth to the Egyptian governorate.

Three Egyptians earn Motion Picture Academy memberships: Veteran Egyptian actor Yousra, director Mohamed Hefzy, and producer Amr Salama were invited to join the roster of the Academy of Motion Picture Arts and Sciences (aka the Academy). The honorary organization is responsible for voting for the Oscar winners. The four Egyptians were selected as part of a recent push by the body to diversify its membership base following campaigns calling for inclusion such as #OscarsSoWhite.

The Market Yesterday

EGP / USD CBE market average: Buy 16.56 | Sell 16.69

EGP / USD at CIB: Buy 16.57 | Sell 16.67

EGP / USD at NBE: Buy 16.60 | Sell 16.70

EGX30 (Tuesday): 14,137 (+0.3%)

Turnover: EGP 795 mn (13% above the 90-day average)

EGX 30 year-to-date: +8.4%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.3%. CIB, the index heaviest constituent ended down 0.5%. EGX30’s top performing constituents were Orascom Investment Holding up 5.4%, EFG Hermes up 3.7%, and Kima up 3.5%. Yesterday’s worst performing stocks were Sarwa Capital down 2.6%, Arabia Investments Holding down 2.2%, and Ezz Steel down 1.4%. The market turnover was EGP 795 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +43.1 mn

Regional: Net Short | EGP -97.7 mn

Domestic: Net Long | EGP +54.6 mn

Retail: 56.4% of total trades | 55.1% of buyers | 57.7% of sellers

Institutions: 43.6% of total trades | 44.9% of buyers | 42.3% of sellers

WTI: USD 56.63 (+0.68%)

Brent: USD 62.86 (+0.74%)

Natural Gas (Nymex, futures prices) USD 2.25 MMBtu, (+0.40%, Aug 2019 contract)

Gold: USD 1,437.60 / troy ounce (+2.10%)

TASI: 8,834.26 (-0.21%) (YTD: +12.87%)

ADX: 4,978.84 (+0.01%) (YTD: +1.30%)

DFM: 2,678.92 (+0.20%) (YTD: +5.90%)

KSE Premier Market: 6,453.06 (+0.96%)

QE: 10,578.43 (+0.17%) (YTD: +2.71%)

MSM: 3,858.62 (-0.45%) (YTD: -10.76%)

BB: 1,490.42 (+1.00%) (YTD: +11.45%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

7 July (Wednesday) The FRA will hear an appeal filed by Adeptio AD Investments, the lead shareholder of Egyptian International Tourism Projects Company’s (Americana Egypt), against an order to submit an MTO for Americana

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

1 September (Sunday): A postponed Cairo Criminal Court trial of former Finance Minister Youssef Botrous Ghaly over the voluntary misuse of public funds in the pre-2011 revolution days.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.