- Manufacturers could catch a break as gov’t looks set to announce new electricity prices for industry today. (Speed Round)

- Banking Act to impose term limits on board members at state-owned banks, put all banks on a Jan-December fiscal year. (Speed Round)

- Exporters get exemption from paying VAT on shipping services. (Speed Round)

- EFG Hermes to begin operations in Vietnam through partnership with ACBS. (Speed Round)

- Good news for Egyptian cotton — from a US judge. (What We’re Tracking Today)

- A week before Saudi stocks join the MSCI EM index, foreign investors aren’t buying. (What We’re Tracking Today)

- When cryptocurrency meets the banking sector. (Worth a Listen)

- The Market Yesterday

Tuesday, 21 May 2019

Is industry about to get a break on power prices?

TL;DR

What We’re Tracking Today

A class act: Tourism Minister Rania Al Mashat visited in hospital yesterday a number of tourists injured in the roadside bombing earlier this week — then took other members of the same group on a personal tour of the Giza Pyramids. At least 14 tourists were injured in the attack, which took place near the Pyramids.

We are just about at the half-way mark in Ramadan, with 14 days left until Eid El Fitr, depending on the movement of the lunar calendar.

And we have just two days left until interest rate day. The central bank’s monetary policy committee meets on Thursday to review key interest rates; all 12 economists we polled expect the CBE to leave rates on hold.

Checking in on the EGP… Banks are buying greenbacks at about 16.97 and selling them for 17.07. The EGP is up about 90 piasters (or 5%) against the USD since the beginning of the year and approached the psychologically important EGP 17 barrier last week.

[Correction: The email edition incorrectly noted that the EGP is “down” about 90 pt — the entire point is that the pound has strengthened against the USD and is accordingly up about 90 piasters (or 5%). Too little sleep, too little coffee. We apologize.]

…and on the market: The EGX30 closed down 1.1% yesterday on an anemic 415 mn in turnover, paring the index’s total gains for 2019 to 2.6%.

Good news for Egyptian cotton — from a US court. A US district judge has ruled that top US retailers including Walmart and Bed Bath & Beyond “must face a lawsuit claiming they sold linens that were falsely labeled ‘100% Egyptian Cotton’ or ‘100% Long-Staple Egyptian cotton’ despite being suspicious of their origin.” Sounds like an opportune moment to pour some resources into the Cotton Egypt Association’s Egyptian cotton branding campaign…

A week before Saudi stocks join the MSCI EM index, foreign investors aren’t buying: Saudi equities currently make up just 0.09% of the average emerging market fund portfolio, with 90% of funds not holding any at all, according to a Copley Fund Research analysis of 189 funds, the FT writes. The article notes that the low weighting is “highly unusual” given investors tend to buy prior to index inclusion. Saudi equities have also been in the FTSE Russell and S&P Dow Jones EM indices for two months, making the lack of buying activity even more surprising.

Why the snub? Fund managers interviewed by the salmon-colored paper cite the country’s oil dependency, concerns about corporate governance and uncertainty about valuations: Saudi shares are trading at a historic price-to-earnings ratio that is 3x that of Turkey and Russia, 2x the UAE and 1.7x the MSCI EM index.

Meanwhile, smart policy in KSA: “Saudi Arabia will expand an excise tax charged on tobacco and soda to include electronic cigarettes and all drinks with added sugar,” Bloomberg reports.

SIGN OF THE TIMES #1: Credit quality is declining at big banks loaning to US businesses, with non-performing loans on a sudden upswingdespite low interest rates and strong growth. “Non-performing loans at the 10 largest commercial lenders rose 20 per cent, or US 1.6 bn, in the first quarter,” according to an analysis by the Financial Times.

SIGN OF THE TIMES #2: A Democratic presidential hopeful wants to punish companies that fail to close the gender pay gap, suggesting large companies should have to pay a fine equal to 1% of their profits for every 1% wage gap they allow. We’re generally not advocates of anything that sees government fining business, but this just makes sense.

Also worth knowing about this morning:

- Deutsche Bank shares hit an all-time low and there are now suggestions that Goldman Sachs should buy the struggling German lender, which will hold its annual meeting of shareholders on Thursday. (Note it is “should” not “could” or “is.”)

- Workplace messaging app Slack expects to raise about USD 197 mn in a direct listing on the New York Stock Exchange. It will trade under the ticker WORK. You can visit Slack’s IR page here or head straight to the SEC to read its prospectus.

- US auto maker Ford is cutting 10% of its global white-collar workforce, joining GM, Volkswagen and Jaguar Land Rover “as global carmakers hunker down to deal with falling sales.” (FT | Reuters)

- Amazon will now delivering to your car: Amazon Prime members are now able to get orders delivered straight to their cars using the online retailer’s Key app. The catch: you must live in one of 50 US cities and own a Ford.

What We’re Tracking Today, the Ramadan edition:

A pre-iftar reading list to kill time between your post-workout shower and the breaking of the fast:

- The curse of genius. “We see exceptional intelligence as a blessing. So why are so many brilliant children miserable misfits?” asks the Economist’s 1843 in a long read well worth your time.

- ‘Playing catch-up in the game of life’: Millennials approach middle age in crisis, writes the Wall Street Journal, suggesting that “new data show they’re in worse financial shape than every preceding living generation and may never recover.” It’s a very US-centric take, but many of the themes are cross-border in developed economies.

- You want your kid / younger sibling to become a data scientist — it’s the highest-paying job for fresh grads in the US, according to Bloomberg. But watch out before you steer them toward investment banking (the fourth-highest paying job). As Bloomberg’s Matt Levine regularly points out: If you’re under the age of 28 and working in investment banking, a robot can already do your job.

Stranger Things fans can take a moment this morning to check out the latest art from the show’s Twitter account, teasing that “our boys can change everything” and that “one friendship can change everything.”

Reviews are mixed on the final episode of Game of Thrones, which capped an eight-season run on Sunday / Monday (depending on your time zone). Critics were generally kind to the series finale, which we enjoyed much more than some of the more vocal fans on the lunatic fringe (or “internet,” as you prefer). The Financial Times called the series ending “both brilliant and maddening,” Rolling Stone found it “bittersweet” and the New York Times suggested it was a “mishmash of poignant moments and puzzling turns.” Either way: The final episode was HBO’s most-watched ever, the Wall Street Journal and Reuters report: About 19.3 mn people in the US tuned in.

Looking for something to watch with GoT now over? OSN’s Wavo app is trying to convince you not to cancel your subscription, offering up West World, True Detectives, Lost, The Sopranos and Veep as bingeworthy material. Business Insider, meanwhile, has a list of seven shows it thinks are worth your time, crowned by Lucifer on Netflix: “Bored with being the Lord of Hell, the devil relocates to Los Angeles, where he opens a nightclub and forms a connection with a homicide detective.” The paper-thin plots are (so far) made tolerable by the one-liners written for the Lucifer character. We already knew about Lucifer thanks to our friend Haitham A.

RAMADAN PSA- Bank hours are at 9am-2pm for employees; doors are open from 9:30am until 1:30pm for customers. The trading day at the EGX runs 10:00am until 1:30pm.

So, when do we eat? Maghrib is at 6:45 pm CLT today in Cairo. You’ll have until 3:17am tomorrow morning to caffeinate / finish your sohour.

WEATHER- Brace yourselves for a heat wave. Look for a daytime high of 40°C today rising steadily to 45°C by Thursday and settling in at 44°C on Friday. The mercury will be locked in the 38-42°C band straight through until Eid El Fitr, our favorite weather app suggests. It’s summer, folks.

Enterprise+: Last Night’s Talk Shows

Our daily roundup of last night’s talk shows will be back after Ramadan. The talking heads are on vacation this month.

Speed Round

Speed Round is presented in association with

Manufacturers could catch a break as gov’t looks set to announce new electricity prices for industry today: Industrial producers could see their electricity bills fall in the state’s new fiscal year, which starts in July, government sources told the domestic press. Businesses in the medium, high, and ultra-high consumption tiers could see prices decrease as authorities do not wish to see high energy prices affecting the sector’s competitiveness — or prompt manufacturers to raise prices, the sources said. Manufacturers in the highest consumption tiers are already paying at a rate that effectively subsidizes lower-tier customers.

Prices will rise for households and commercial clients: The government denied last week reports that households could be subject to a 30-60% price hike in the coming fiscal year. While the reports out so far have not commented on that range, the domestic press suggests households will face price hikes of EGP 5-200 price depending on consumption.

Electricity Minister Mohamed Shaker is expected to announce the new rates at a presser scheduled for today, according to Masrawy.

Background: Egypt raised its average electricity prices by an average of 26% for all tiers of industrial, residential, and commercial buyers last July as part of the Sisi administration’s plan to gradually phase out electricity subsidies. The plan began in FY2015-2016 with the launch of the IMF-sanctioned economic reform program and is now approaching its fifth and penultimate round. Electricity subsidies were originally due to be fully lifted in the coming fiscal year, but the period was extended to FY2020-2021 to avoid placing too much pressure on household budgets.

LEGISLATION WATCH- Banking Act to impose term limits on board members at state-owned banks: The new draft Banking Act would, if passed, would put a cap of three consecutive terms on board members of state-owned banks, according to Masrawy. The current version of the law imposes no term limits, but caps each term for a board member at three years.

Other features of the proposed legislation: The bill would also unify all state-owned banks’ fiscal years to begin on 1 January and would require them to publish their financial results in at least one widely circulating newspaper. Under the legislation, foreign banks in Egypt would face a minimum capital requirement of USD 150 mn or its equivalent in other foreign currencies, up from a current requirement of USD 50 mn, Masrawy reports.

Background: A first draft of the new Banking and Central Bank Act leaked in 2017 and was controversial within the sector for suggesting term limits on bank managing directors as well as a tithe on industry profits to finance an industry development fund that would be managed by the central bank. The current draft has been with the Madbouly Cabinet for review since January, and is due to be introduced to the House of Representatives for discussion by the end of the month.

EXCLUSIVE- Tax Authority exempts exporters from paying VAT on shipping services: The Tax Authority has issued a decree that will exempt shipping companies from charging and remitting VAT from exporters, Tax Authority boss Abdel Azim Hussein tells Enterprise. The decision applies to all companies providing shipping services via land, air and sea. Exporters will need to present export papers to the shipping company in order to become VAT exempt. A copy of the decree is available here (jpg).

Background: The government wants to add around 500k new VAT taxpayers by 2020 and raise VAT revenues to EGP 364.6 bn in the next fiscal year, from EGP 312 bn currently. The government will introduce a new export subsidies strategy in the coming fiscal year that aims to increase the value of exports to USD 55 bn within the coming five years, from USD 24.8 bn currently.

EFG Hermes to begin operations in Vietnam through partnership with ACBS: EFG Hermes has signed a partnership agreement with Vietnam’s Asia Commercial Bank Securities that will allow its clients to trade on the Hanoi Stock Exchange, Ho Chi Minh City Exchange and UPCOM, EFG Hermes said in a bourse filing (pdf). “The partnership will see the assembly of a Vietnam-based team over the coming 12 to 18 months to complement our award-winning roster of research and trading professionals,” said EFG Hermes Frontier CEO Ali Khalpey. “This partnership will provide our clients access to the Hanoi Stock Exchange, Ho Chi Minh City Exchange and UPCOM using ACBS’ platform, while expanding our Vietnamese research offering, under our own brand name.” EFG’s expansion into frontier markets has already seen it enter Pakistan, Bangladesh, Nigeria and Kenya.

Barrick Gold could be eyeing assets in Egypt’s Arabian-Nubian Shield, Seeking Alpha reported CEO Mark Bristow as saying. The mining company is reportedly planning to explore the area and could sell its stake in the Jabal Sayid copper mine in Saudi Arabia if it finds gold or copper deposits. “I think they will seriously look at Egypt as an area to get into,” Aton Resources CEO Mark Campbell told us, commenting on the report. “It was an area that Bristow looked at when he ran Randgold, but as with most they were put off by the unattractive terms and conditions imposed on investors here in mineral exploration, so they went elsewhere. But when those terms and conditions change to be investor friendly, then I believe they will come,” he said. Aton Resources is a Canadian-based gold exploration and development company working on the Arabian-Nubian Shield. Campbell has previously written for Enterprise on the need to change contract terms for the mining industry in Egypt.

Mubarak sees Trump’s Middle East peace plan as cause for concern: Recent developments in the Israeli-Palestinian conflict are cause for concern that US President Donald Trump’s Middle East peace plan will be tough for the Arab world to swallow, former president Hosni Mubarak tells Kuwait’s Al Anba in an interview. Mubarak points to the US deciding to recognize Jerusalem as the official Israeli capital last year as an indicator that the groundwork is currently being laid for other unilateral decisions against Palestine and the region. According to the former president, Israeli Prime Minister Benjamin Netanyahu had previously tried to float the idea of creating a new Palestine in Gaza, with a piece of Egypt’s Sinai thrown in. Mubarak says he rejected the proposal and told Netanyahu that the revival of any such proposal would cause Egypt and Israel to go to war once again. Mubarak also spoke extensively during the interview about how Egypt rekindled relations with Arab countries after the peace treaty with Israel and the behind-the-scenes details of the Iraq-Gulf War.

Seven Egyptian startups have been selected to participate in the 2019 Global Entrepreneurship Summit (GES)due to take place 3-5 June in the Netherlands, the US Embassy said yesterday (pdf). The startups, which include household names Swvl and Elves along with health providers SmartCare, Al-Mouneer, and Chitosan, and agriculture businesses Breadfast and Agrimatic Farms, will join corporate leaders, policymakers, investors, government officials and more than 1,000 entrepreneurs from around the world.

CLARIFICATION- We noted yesterday GB Auto Chairman Raouf Ghabbour’s sit-down with Al Masry Al Youm, in which he spoke of the obstacles facing the automotive sector. For the sake of accuracy, note that Ghabbour did not pin the blame on the Madbouly Cabinet’s economic group as a whole, but singled out the “responsible minister” as having failed to formulate a clear vision to develop the sector. Ghabbour lauded the authorities’ economic reform program in the interview.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions).

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Image of the Day

An Ethiopian photographer changing how we look at Africa: Aïda Muluneh’s colorful photographs mix surrealist imagery with national symbolism to subvert stereotypes engrained in “the single story” so often told about Africa. This piece in The Atlantic explores what influences this offbeat artist, who every year presents Africa’s largest photography festival, the Addis Foto Fest.

Egypt in the News

It’s a pleasantly quiet morning for Egypt in the foreign press, with no single story leading the conversation.

Among the very small handful of pieces worth noting:

- Harriet Tubman would be proud: Abanoub Elias, who went into hiding after he raised the rainbow flag at the Mashrou Leila concert in 2017, escaped Egypt via the Rainbow Railroad, an underground network that helps LGBT individuals leave countries where they’re at risk of persecution, reports CBS.

- Security forces killed 12 terrorists in Cairo yesterday, a day after an explosion near the pyramids injured at least 12 people, including South African holidaymakers, Reuters reports.

- Egyptian women are learning ancient Indonesian martial arts to improve their self-defense skills and help guard themselves against [redacted] harassment, according to Reuters.

On The Front Pages

El Sisi meets with Noble Energy boss, says Egypt is committed to strengthening ties with the US: A meeting between President Abdel Fattah El Sisi and Noble Energy CEO David Stover tops the front pages of Al Ahram, Al Akhbar and Al Gomhuria this morning. El Sisi used the occasion to reaffirm Egypt’s commitment to strengthening strategic ties with the US and said the country was following the highest standards in its gas exploration and production projects.

Other coverage of the story: Noble, which is helping lead the charge to develop Israeli gas fields and sell the offtake to Egypt, is interested in a helping build a gas pipeline between Egypt and Cyprus, an unnamed Oil Ministry source told Youm7. No further details were provided on the company’s plans. Egypt and Cyprus signed an agreement last year, which would allow natural gas from the Aphrodite gas field to be transported to Egypt’s liquefaction facilities at Idku and Damietta, and re-exported as liquefied natural gas.

Worth Reading

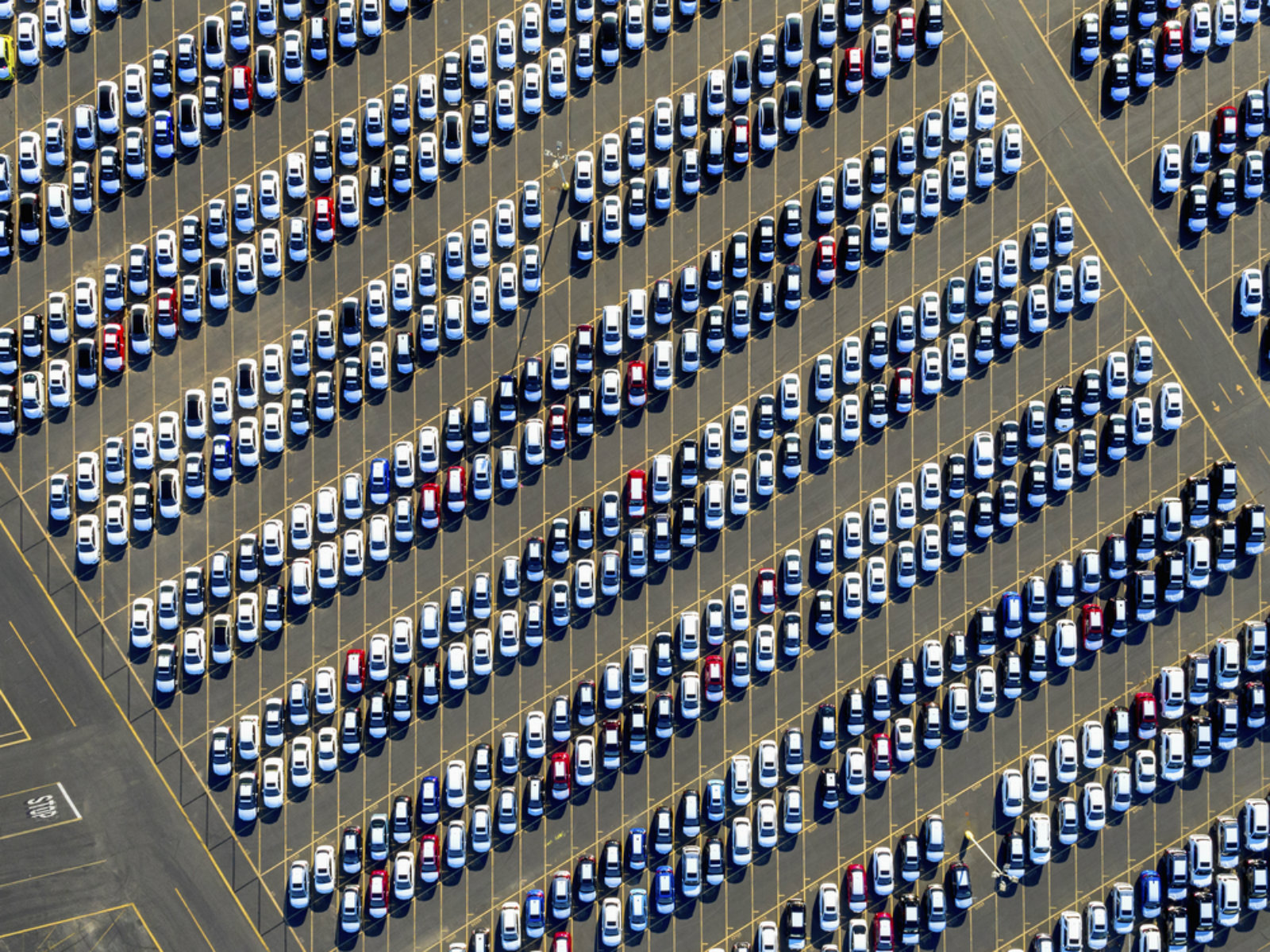

Space – the final frontier, and the latest tool in investors’ decision-making arsenal, according to this Atlantic piece. RS Metrics was founded by two brothers followed a hunch of Walmart’s founder: the number of cars in a store parking lot is an indication of how well the store is doing. Revamping this concept with real-time satellite imagery, the brothers started selling parking lot counts of major retailers to investors. They got their big break in 2010 when a UBS analyst bought 100 representative Walmart parking lot counts and used them to correctly predict that Walmart’s stock was undervalued.

A level playing field? RS Metrics today sells a variety of satellite imagery to investors trying to pick stocks. They’re not alone. The “alternative data space race” has spawned a field of companies like RS Metrics who sell everything from geolocation to online browsing activity to investment firms for hundreds of mns of USD. This begs two important questions: How valuable is alternative data? And does the everyday investor benefit, too?

Worth a Listen

When cryptocurrency meets the banking sector: Blockchain technology can be leveraged to rewire the global financial infrastructure and simplify transactions between financial institutions, argues Ripple CEO Brad Garlinghouse in this Vox podcast (listen, runtime: 61:32). Ripple sells financial institutions a cryptocurrency called the XRP ledger, which enables direct cross-border payments to be made without relying on pre-funded payments being made in the corresponding currencies (in what is known as “correspondent banking”). This, he says, benefits the population most penalized by the current system, who are liable for cross-border remittance costs averaging 6%. Perhaps surprisingly, it is also welcomed by many large financial institutions, partly because it may in time open up access to bns of unbanked people — and partly because it creates a more level playing field within a system currently controlled by a small number of global banks.

Regulation is key: Garlinghouse spends a lot of time meeting with financial regulators, dispelling myths about crypto and assuring them that Ripple-enabled technologies are regulation-compliant. He believes that banks will continue to apply an important regulatory framework for the industry, and views the ideal future scenario as being one in which the technology enables the banks to grow their businesses, and the banks help to regulate it. “We can reduce the friction of global commerce, we can allow people globally more access to the economies around the world to compete. I think that’s actually a really good thing,” he says.

Diplomacy + Foreign Trade

Canadian Senate speaker George Furey met yesterday with Foreign Minister Sameh Shoukry and discussed both foreign policy issues and how Canadian companies can capture a larger slice of Egypt’s growth story, Ahram Online reports. Furey also met yesterday with Al-Azhar Grand Imam Sheikh Ahmed El-Tayeb and sat down on Sunday with President Abdel Fattah El Sisi.

Energy

Egypt’s target for natgas production increases to 7.95 bcf/d in 2019-20

The government has raised its target for natural gas production to 7.95 bcf/d during FY2019-2020, up from 7.5 bcf/d in the current plan, an industry source told the press. Linking the second development phase of wells at the North Alexandria field, as well as an expected increase in production from the Zohr field, will offset the annual 10% fall in production due to field maturation. The ministry is also planning to complete 11 natgas projects by 2023 at a combined investment value of USD 18 bn to increase production by some 2 bcf/d.

Dana Gas to drill first pilot well in North Arish concession next week

UAE’s Dana Gas is planning to drill its pilot well in the North Arish concession in the Mediterranean next week and is expected to conclude studies on its estimated reserves within two and a half months, Shorouk reports. Dana Gas plans to invest USD 5 bn in the gas field, which seismic scans indicated has about 20 tcf of potential reserves, making it Egypt’s second biggest after Zohr.

Manufacturing

Madbouly instructs gov’t to speed up industrial land allocation to Egypt’s investors

Prime Minister Moustafa Madbouly has called on the government to speed up industrial land allocation to investors, and to offer “as many industrial land plots as possible,” according to a cabinet statement. Madbouly also stressed finalizing ongoing land allocation procedures and completing a map of designated industrial zones as priorities. This is part of a strategy to promote and develop industrial activity across the country.

Tourism

Campbell Gray Hotels plans new resort in El Gouna

Campbell Gray Hotels has announced plans to create a 160-key boutique resort in El Gouna, Trade Arabia reports. The company has partnered with developer Mangroovy Residence El Gouna and consultancy firms Ghoneimi Architects and Evolve BDS to work on the project. Construction is expected to begin later this year.

Automotive + Transportation

Egypt studying proposal from Chinese company to build Sharm monorail

An unnamed Chinese company has expressed its interest in building a monorail line in Sharm El Sheikh, the South Sinai Governor’s office said earlier this week, according to Egypt Today. A committee has been set up to study the potential project. No further information was provided.

El Wazir, World Bank talk railway cargo transport

Transport Minister Kamel El Wazir met yesterday with a delegation from the World Bank to discuss developing the country’s railways to encourage more cargo transport via rail, and agreed to conduct feasibility studies on developing the Alexandria-6 October cargo line, according to a ministry statement.

Banking + Finance

QNB Alahli in talks with EBRD for USD 70 mn loan

QNB Alahli is in talks with the European Bank for Reconstruction and Development (EBRD) over a USD 70 mn loan, the local press reports. The loan will be used to finance renewable energy projects, SMEs and value chains.

FRA approves Marseilia Group’s EGP 12 mn capital increase

The Financial Regulatory Authority (FRA) has approved the EGP 12 mn capital increase of real estate company Marseilia Group, according to an EGX disclosure (pdf). The company will raise its capital to EGP 72 mn by issuing 1-for-5 shares. The increase will be financed by retained earnings and profits from FY2018.

TE to roll out money transfer service through WE in partnership with Banque Misr

Telecom Egypt has signed an agreement with Banque Misr to launch a new money transfer service through the state-owned fixed-line monopoly's We network, CEO Adel Hamed said, according to Al Mal. The launch is part of a number of other services TE is planning to roll out in the coming weeks, including an internet protocol television (IPTV) service. The move goes hand-in-hand with government efforts to push for digitization and financial inclusion.

Egypt Politics + Economics

Prosecutor General orders release of seven detainees

Prosecutor General Nabil Sadek decided yesterday to release seven defendants who had been charged with joining an illegal organization, compromising peace and national security, and publishing false news, Reuters reports. The decision included former ambassador Maasoum Marzouk as well as Abdel Fattah Al Banna, Raed Salama, Yehia Al Qazaz and activist Nermine Hussein. The case remains under investigation, the newswire noted.

On Your Way Out

The African Cup of Nations’ organizing committee has unveiled an incredibly original official mascot for the championship kicking off next month. Meet Tut: A cross between Mohamed Salah, Dora the Explorer, and a generic pharaoh. The tournament will run from 21 June to 19 July and tickets are available on the Tazkarti platform.

Egyptian short film Fakh (Trap) was screened at the Cannes International Film Festival’s Critics Week, the local press reported. Directed by Nada Riyadh, the film follows the story of a couple whose relationship is ending amid difficult circumstances. Fakh is Riyadh’s second short film.

Also making the rounds: Anas Tolba’s Between Two Seas, which will make its US debut at this year’s Brooklyn Film Festival. Tolba will be on hand for screenings on 4 and 6 June. The film picked up two nods at the Aswan International Women’s Festival, Ahram Online reports.

The Market Yesterday

EGP / USD CBE market average: Buy 16.96 | Sell 17.08

EGP / USD at CIB: Buy 16.97 | Sell 17.07

EGP / USD at NBE: Buy 16.97 | Sell 17.07

EGX30 (Monday): 13,379 (-1.1%)

Turnover: EGP 415 mn (48% below the 90-day average)

EGX 30 year-to-date: +2.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.1%. CIB, the index heaviest constituent ended down 1%. EGX30’s top performing constituents were TMG up 2.7%, Juhayna up 2.1%, and Egyptian Resorts up 0.6%. Yesterday’s worst performing stocks were Heliopolis Housing down 6.3%, CIRA down 5.5%, and Pioneers Holding down 5.1%. The market turnover was EGP 415 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +16.2 mn

Regional: Net Long | EGP +10.1 mn

Domestic: Net Short | EGP -26.4 mn

Retail: 42.4% of total trades | 41.6% of buyers | 43.2% of sellers

Institutions: 57.6% of total trades | 58.4% of buyers | 56.8% of sellers

WTI: USD 63.28 (0.29%)

Brent: USD 71.97 (-0.33%)

Natural Gas (Nymex, futures prices) USD 2.66 MMBtu, (-0.41%, JUNE 2019 contract)

Gold: USD 1,277.40 / troy ounce (0.01%)

TASI: 8,468.93 (-0.66%) (YTD: +8.21%)

ADX: 4,732.94 (0.00%) (YTD: -3.7%)

DFM: 2,513.22 (-0.25%) (YTD: -0.65%)

KSE Premier Market: 6,007.31 (+0.04%)

QE: 9,898.58 (+0.25%) (YTD: -3.89%)

MSM: 3,844.63 (-42%) (YTD: -11.08%)

BB: 1,396.46 (-0.16%) (YTD: +4.43%)

Calendar

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

23 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

27-28 May (Monday-Tuesday): UK International Trade Secretary Liam Fox will visit Egypt for meetings with senior officials on boosting bilateral trade and investments.

28 May (Tuesday): 30 Saudi stocks join the MSCI Emerging Markets Index at the end of the day’s trading session.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.