- Gov’t may offer 30% Banque du Caire stake in an IPO by the end of the year. (Speed Round)

- A final package of incentives for automotive assemblers and manufacturers is in the works. (Speed Round)

- Why is inbound FDI to Egypt declining — and should we be worried? We asked Sahar Nasr. (Speed Round)

- No further IMF loans needed, says YBG. (Speed Round)

- CI Capital-led consortium reaches agreement to buy 60% stake in Taaleem. (Speed Round)

- National Bank of Kuwait looks to grow its operations in Egypt. (Speed Round)

- Big tech expansion is keeping CEOs up at night. (Worth Watching)

- Egyptian team from AP wins Pulitzer Prize. (What We’re Tracking Today)

- House to vote today on constitutional amendments, clearing way for a referendum. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 16 April 2019

House to vote on constitutional change today.

Plus: Gov’t to offer 20-30% of BdC in IPO before end of year.

TL;DR

What We’re Tracking Today

Today’s the big day: After weeks of deliberation, the House of Representatives will today vote on the proposed constitutional amendments that would extend presidential terms, restore the office of the vice president, create an upper house of parliament and set a 25% quota for women’s representation in the House, among other things. Successful passage of the measure would set up a national referendum. The National Election Commission, the body responsible for holding the poll, poured cold water earlier this week on reports that we could be voting as early as next week.

Will we need another constitution in a decade’s time? That’s the contention of House Speaker Ali Abdel Aal, who is quoted by Al Ahram as having said earlier this week that the move will be made necessary by “changing political and economic conditions.” Abdel Aal also said that the House Constitutional and Legislative Affairs committee had nixed a suggestion that measures be included in the package that would have allowed President Abdel-Fattah El-Sisi to remain in office until 2034. “We chose a middle-ground option that will allow the sitting president to remain in office until 2024, and then he will be allowed to run for another six years,” said Abdel-Aal. “This way, I can say that the amended constitution still does not lead to any kind of inheritance of power or perpetuation of rule.”

This angle on the story is getting major play in the media, with El Watan, Youm7 and Shorouk, among others, giving it column inches.

Also on our radar today:

Egypt is taking part in the Atom Expo 2019 nuclear power conference in Sochi, which finishes today. We could well see more Dabaa action today: Rosatom subsidiary TVEL signed yesterday an agreement with Egypt’s Atomic Energy Authority to provide uranium for the Dabaa nuclear plant. Amjad Al Wakeel, head of the Nuclear Power Plants Authority, is representing Egypt at the conference, the local press report.

A delegation of 21 Hungarian companies arrives in Cairo today to explore investment options.

The two-day North Africa Iron and Steel Conference also gets underway today at the Four Seasons Nile Plaza.

Coming up later this week:

- OPEC+ oil ministers will meetin Vienna on 17-18 April to discuss an extension to the oil supply cuts.

- Keep a close eye on US and European corporate earnings this week. The pundits expect an “earnings recession,” CNBC writes, but Blackstone says it is still bullish on stocks.

- The Mueller report on Russian interference in US elections is due to be released to the public on Thursday.

An Egyptian team from the Associated Press has won a Pulitzer Prize for international reporting for “a revelatory yearlong series detailing the atrocities of the war in Yemen, including theft of food aid, deployment of child soldiers and torture of prisoners.” The AP said yesterday that the work “documented civilian casualties of a U.S. drone campaign, drew attention to the presence of child soldiers on the front lines and showed evidence of torture by both Houthi rebels and U.S.-backed forces.” The winners are longtime Cairo reporter Maggie Michael, Egyptian-Canadian photographer Nariman El-Mofty and video journalist Maad al-Zekri. You can read the team’s work here or catch the full list of 2019 Pulitzer winners here.

Another boon for Egypt’s gas hub ambitions: Greek oil and gas explorer Energean discovered yesterday 1-1.5 tcf of natural gas in one of its wells off the coast of Israel on Monday, the FT reports. Hopefully this will mean more gas flowing in our direction: we of course signed a USD 15 bn gas deal with Israel last year which could see them export up to 10 bcm each year to our LNG facilities. Now if they could just sort out their pipelines…

The robots are coming for us all, part XLVII:

Robots may be able to recognize when an employee is likely to quit — even before the staff member herself knows it, reports the Washington Post. So claims IBM, which is selling (and making use of) a “proactive retention” tool it claims has a 95% accuracy rate in identifying employees likely to leave within a six-month period. We get it: replacing staff is a pain — and expensive, with one estimate pegging the cost of employee turnover at over 200% of salary at the senior executive level. But we’re as weirded-out about this as we were yesterday about traders facing their own Minority Report moment as AI tries to predict when they’re going to go rogue before they themselves know it. But that’s not all:

Robots are already telling you how to be a better manager as “more companies are turning to AI-driven apps that aim to help newer bosses with reminders and tips on how to maintain a well-run office,” the Wall Street Journal tells us. Among them: Coach Amanda, Butterfly and

The quants want to use robots to “disrupt” private equity, the Financial Times adds. “Maths-savvy, computer-toting investors have already disrupted traditional tactics in asset management. Next in their sights is the red-hot private equity world,” says former Mideast hand Robin Wigglesworth.

Notre Dame Cathedral in Paris is in ruins after a fire broke out at around 7 pm CLT yesterday, taking down both the roof and a part of its gorgeous spire (watch the early moments, runtime: 0:29). The only reported casualty was one firefighter who was seriously injured, according to Euronews. Authorities have launched an investigation, and early speculation is that the blaze was linked to recently-started renovation work. The core structure and two main towers survived, a fire chief told reporters. French President Emmanuel Macron vowed in a later public address to rebuild the world-famous landmark. ABC News, and the New York Times have more.

FACTOID OF THE MORNING: >13 mn. That’s the number of tourists who visit Notre Dame every year. Egypt in its entirety attracted just over 11 mn last year.

PSA- The weather could be decidedly “meh” today. Look for morning fog and a chance of blowing sand in the capital city with a daytime high of 25°C, according to the Meteorological Authority. Heading north this morning? The Mediterranean coast is looking at a high of 21°C and a chance of rain.

Enterprise+: Last Night’s Talk Shows

Topic #1 on the airwaves last night- Gov’t launches plan to promote spinning and weaving: President Abdel Fattah El Sisi summoned Prime Minister Moustafa Madbouly, Public Enterprise Minister Hisham Tawfik, and other senior officials to discuss a plan to improve efficiency in state-owned spinning and weaving factories (watch, runtime: 1:07). Heads of holding companies and seven EU-based textile majors were also in attendance.

State-owned spinning and weaving factories will soon be getting north of EGP 10 bn-worth of machinery, Tawfik told Al Hayah Al Youm’s Khaled Abu Bakr in a phone-in (watch, runtime 6:24). “We are in the process, and have installed the first [modern] cotton mill,” Tawfik added, noting that there’s a parallel move to sell unused state-owned land for funding. The overall plan is expected to cost some EGP 20 bn as it will involve civil, renovation, and utility works in factories. The government will receive the first shipment of machinery in early 2020, with the plan slated for completion in 2.5 years. The plan will also see 23 companies merged into 10.

Another popular topic was agricultural exports. El Hekaya’s Amr Adib presented a recent government infographic showing a boom in Egyptian agricultural exports (watch, runtime: 3:18). We have the key figures in Diplomacy + Foreign Trade, below.

Speed Round

Speed Round is presented in association with

Expect up to 30% of Banque du Caire to be offered via IPO this year: The government is planning to sell 20-30% of Banque du Caire’s shares in an initial public offering on the EGX by the end of this year, central bank Governor Tarek Amer told Bloomberg in Washington. “It’s not about money. We have a plan to support the stock exchange with new issues. There is a lot of demand,” Amer said.

Background: Public Enterprises Minister Hisham Tawfik told us in March that the next wave of offerings under the state privatization program would include new listings. The ministry had plans to IPO four or five state companies at a rate of about one per month starting from September. The government was also expected to announce an updated list of the companies on the roster, Tawfik said, after the state kick-started the program with the sale of an additional 4.5% stake in Eastern Company last month. Proceeds from the privatization of state companies will be divided between the state treasury, shareholders, and debt repayment, a senior official told us last month.

EXCLUSIVE- It looks like the government’s strategy for the automotive sector could soon see the light of day: The finance and trade ministries are finishing work their (not-the-automotive-directive) incentive program to encourage automotive manufacturing in Egypt, a senior government official told us. The program will grant customs discounts for auto manufacturers based on the percentage of domestic content in the vehicles they produce. According to our source, the customs breaks look like this:

- Assemblers will get a 10% break on their customs bill;

- Those sourcing 20-30% of their components locally will receive a 30% customs break;

- Manufacturers sourcing 31-40% of their components locally will get a 44% break;

- Manufacturers sourcing 41-50% of their components locally will receive a 50% break;

- Manufacturers sourcing 60% or more of their components locally will get an 80% break.

Auto players that begin manufacturing cars locally will be eligible for an additional 110% tax cut, provided they also invest in the manufacturing of auto components.

The incentives will cost the government up to EGP 2 bn per year but will boost economic growth and job creation, the source said. The finance and trade ministries are also reportedly looking to change customs duties on cars (but will leave the 45% VAT unchanged).

What’s next? Cabinet will review the package of incentives and possible tax changes before it putting it out for public consultations.

Background: We reported last summer that the government was scrapping the so-called automotive directive in favor of a more limited policy, which Trade and Industry Minister Amr Nassar all but confirmed with later statements. The directive had been in the works for over four years due to wrangling in the House of Representatives and opposition from auto importers. The package of incentives was designed to allow local manufacturers, who industry backers argue support tens of thousands of skilled direct and indirect jobs, to better compete with EU, Moroccan and Turkish imports that receive customs breaks here in Egypt. That strategy was sharply opposed by our EU trade partners — particularly Germany, whose chancellor, Angela Merkel is said to have addressed the issue directly at the highest levels of government in Egypt.

EXCLUSIVE- Why is inbound foreign direct investment to Egypt declining — and should we be worried? Official figures released earlier this month showed that fresh foreign direct investment (FDI) had fallen to USD 2.84 bn in 1H2018-19 from USD 3.76 bn in the same period a year before, putting us on track for another year in which we fall short of the state’s target of a minimum of USD 10 bn in FDI per year. We spoke with Investment Minister Sahar Nasr as well as EFG Hermes’ Mohamed Abu Basha and Naeem Brokerage’s Allen Sandeep to look at what’s behind the dip and where FDI goes from here.

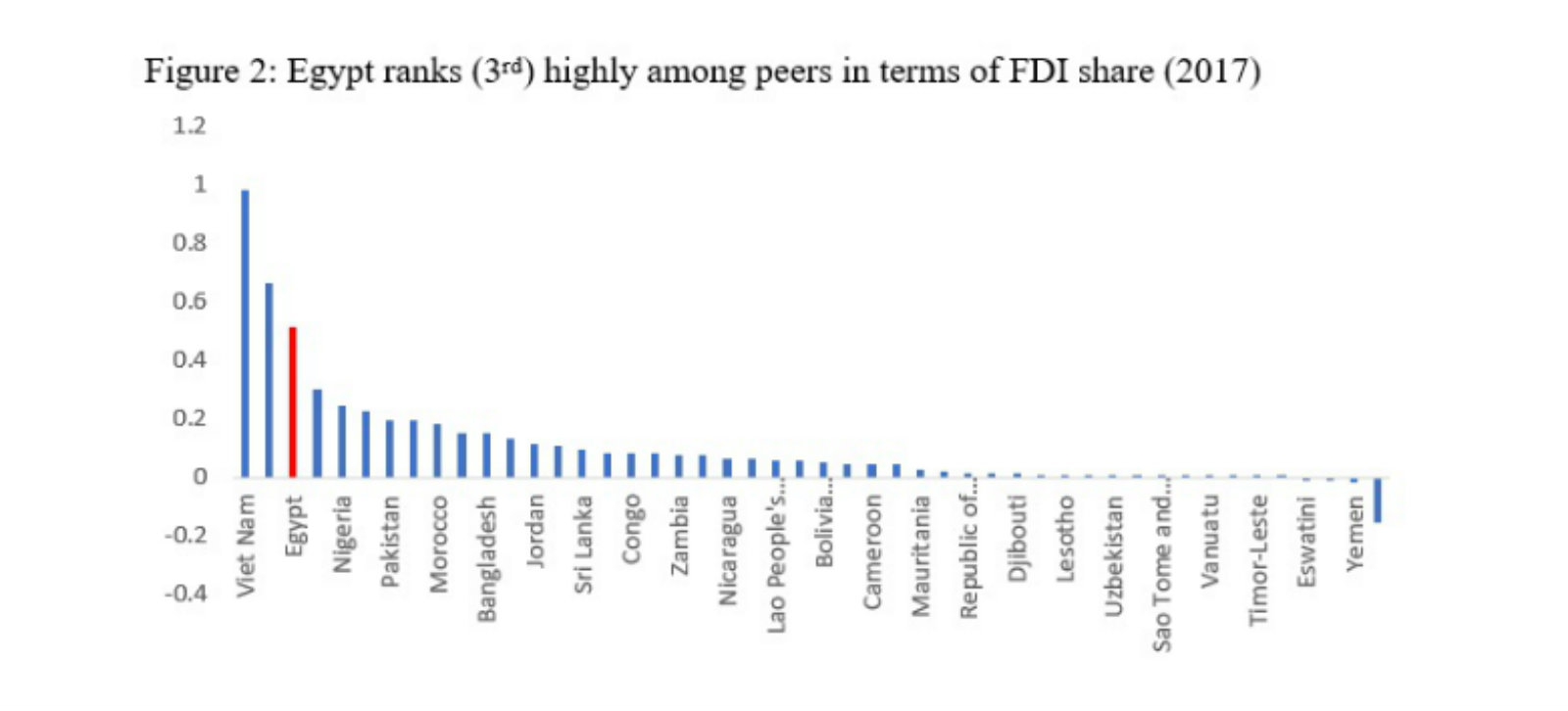

In a declining international market, it’s not about FDI in absolute terms, but Egypt’s share of global FDI, says Nasr: Egypt’s share of global FDI has continued to increase despite a global slowdown in foreign investment, Investment Minister Sahar Nasr told us. According to figures from the Investment Ministry, 2017 saw Egypt’s share of global FDI rise to 0.4% in 2017 from around 0.35% the year before. This came as net FDI inflows in FY2017-18 dipped to USD 7.7 bn, down from USD 7.9 bn the previous year. “Compared to peer countries with similar income levels, Egypt was ranked third worldwide in terms of share of FDI in 2017,” the minister said, adding that Egypt had the second-highest share of FDI in the MENA region in 2017, behind only the UAE.

More companies are setting up shop in Egypt: Nasr also pointed out that the number of new firms entering the market has increased alongside the expansion in Egypt’s share of global FDI. The results demonstrate confidence among international investors, she said — they’re setting up shop as a prelude to doing business here.

Expectations of a post-float spike in FDI were overly optimistic: The notion that FDI would spike immediately after the float of the EGP in 2016 were unfeasible, said Mohamed Abu Basha, EFG Hermes’ head of macroeconomic analysis. “It was somewhat unrealistic to expect FDI to recover immediately after the devaluation given the tough times the economy had to first go through and, equally importantly, given the nature of FDI that Egypt attracts, which mainly plays on domestic demand.” 2017 was a turbulent year which businesses spent evaluating the post-floatation economic environment. 2018 meanwhile brought more stability, but the private sector remained hesitant, preferring to assess demand before making new investments and looking for avenues for expansion, Abu Basha said.

And there’s no way the domestic private sector was going to borrow to back expansion when they’re paying credit-card levels of interest, we would add.

Comparing current FDI figures to reference points from before the float will naturally seem smaller in USD terms because the value of the EGP was slashed by half, Abu Basha pointed out.

Depressed local demand and consumption on the back of high inflation over the past two years have also been key in slowing down FDI, said Abu Basha. The devaluation was also not the only component weighing on demand, Abu Basha said, explaining that subsidy cuts and interest rates were also at play. “The nature of industries in Egypt is mostly domestic-based. Outside of oil and gas, foreign companies entering Egypt are mainly catering to domestic demand — if companies’ capacity utilization is at 40-50%, why would they be considering investing more?”

When will we see year-on-year growth in FDI? Probably in 2020 as market conditions normalize, interest rates fall and inflation continues to decline, Abu Basha said. Naeem Brokerage’s Allen Sandeep, however, predicted that non-oil FDI would not recover until the economic reform program is 5-10 years old. “I wouldn’t use the word ‘disappointed’ because if you look at other countries, you’ll see it took them 5-10 years to see FDI recover. The figures are below expectations, but I wouldn’t use the word ‘disappointed’.” Sandeep expects 2H2019 to see a pick up in non-oil FDI, especially in the agriculture and services sectors, due to seasonal factors. He also sees FDI in the upstream petroleum and minerals sectors to begin increasing by around 2021.

Egypt is expecting FDI to reach around USD 8-8.5 bn in 2019-2020, Nasr said. “[This] is because of risks facing the global economy, namely the potential slowdown and trade tensions, and allowing time for internal factors as inflation to be more conducive,” the minister added.

What are the government’s priority sectors for FDI? The government is committed to policies that cater to value-added and technology-oriented sectors that contribute to both economic growth and job creation, Nasr told us. “Also, the Investment Act and other related policies are designed to promote investments in lagging regions to raise the living standards in them,” Nasr added.

Have politics been a barrier to FDI growth? Not at all, Nasr said yesterday in a separate interview with Bloomberg TV (watch, runtime: 06:28). “The politics in the country has helped a lot to improve the business environment and has opened ground for more business to come to Egypt.”

YBG says another IMF facility is unnecessary: Egypt does not need another IMF loan, but the government needs to appoint experienced leaders, former Finance Minister Youssef Boutros Ghali told the local press. “The IMF's procedures are difficult but necessary, and the Egyptians absorbed the shock, but we have to concentrate on other important issues now,” Ghali said. The IMF reform program has squeezed poor Egyptians and bureaucracy is still an issue affecting FDI inflows, Ghali said. Egypt may not see another currency depreciation in the future, but the government must ensure incomes match the high inflation the country has been witnessing, the former minister said. He sees tourism, real estate and energy as the sectors with the most growth potential.

M&A WATCH- CI Capital-led consortium reaches agreement to buy 60% stake in Taaleem: CI Capital and a group of co-investors has entered into an agreement to acquire a 60% stake in Taaleem Management Services Company, the owner and operator of Nahda University in Beni Suef, from EDU MENA Holdings Coöperatief U.A, CI Capital said in a bourse filing (pdf). The company did not disclose the transaction value. CI Capital, which is acting as the transaction’s sponsor, will pay 15%-20% of the acquisition value, and expects the sale to be concluded in 3Q2019, pending the satisfaction of conditions precedent and regulatory approval. The acquiring parties will back Taaleem’s current management, led by Mohamed El Rashidi, to “continue to lead and scale up the business.”

Egypt and Saudi are among the markets the National Bank of Kuwait sees growth in, Group Deputy CEO Shaikha Khaled Al Bahar told Bloomberg TV (watch, runtime: 06:56). NBK is the latest foreign bank to see Egypt as a source of growth for its operations. HSBC and Lebanon’s Blom Bank had previously said Egypt is part of their positive outlook for the region. Kuwait’s biggest lender reported a 15.1% increase in its 1Q2019 profits earlier this week, Reuters reported.

Gov’t, CBE mulling changes to rules on clearing companies: The Central Bank of Egypt, the Finance Ministry, and Misr for Central Clearing, Depository and Registry (MCDR) are considering raising the ceiling for shareholders’ stakes in a clearing and depository company above the current 5% maximum, unnamed sources said, according to Al Mal. The move would require the introduction of amendments to the law regulating the establishment of these companies. The three parties, which are in talks to establish a new clearing company that will handle all government debt issuances, are reviewing all regulations to get the company up and starting in 2H1019.

LEGISLATION WATCH- Military pensions to rise 15% in FY2019-20: The House Defence and National Security Committee approved yesterday draft legislation that will raise military pensions by 15%, AMAY reports. Members of the military will see a minimum raise of EGP 150 while the minimum pension will increase to EGP 900 — the same as the pension increases for civil servants announced by President Abdel Fattah El Sisi last month. Committee head Kamal Amer said that the raises would take effect at the beginning of FY2019-20 on 1 July.

EFG Hermes’ mobile app valU has been recognized as the “Fintech Innovation of the Year” at Terrapin’s 2019 Seamless Awards, the company said in a press release (pdf). ValU, which offers payment-on-instalment services via a mobile app, launched about a year ago. “We are particularly proud that we were recognized as an innovative state-of-the-art solution that benefits users, retailers and industry partners,” said EFG Hermes Group Chief Executive Officer Karim Awad.

CORRECTION- We incorrectly said in yesterday’s issue that the USD 5.4 bn Carbon Holdings raised for its USD 10.9 bn Tahrir Petrochemicals Complex (TPC) included USD 1.25 bn from the Lagos-based African Finance Corporation and USD 3.1 bn in standby funding from Chinese lenders. A Carbon Holdings official clarified to us that the company signed a USD 1.25 bn equity subscription framework agreement with AFC during the Africa 2018 Forum, and that the equity raising for the project is still ongoing.

** OUR PARENT COMPANY IS HIRING: Do you have a passion for Arabic writing? Make it your day job. We are looking for talented copywriters who love to write in their native language and want to join a dynamic and friendly environment that we believe is simply awesome. You’ll develop content for marketing and corporate communications material for both online and offline audiences, and since all our content is bilingual, you will need a decent command of the English language to be able to work here. If you think you are our next Arabic copywriter, please send us your CV and writing sample on jobs@inktankcommunications.com.

Image of the Day

The Color Run, an international 5k “fun run” in which participants are sprayed with colored powder, was held in Egypt for the first time last weekend, Africanews reports. The privately owned event originated in the US and now takes place on multiple continents.

Egypt in the News

The constitutional amendments are getting more digital ink in foreign news outlets: Receiving widespread coverage in the foreign press this morning is today’s final general assembly vote on the package of constitutional amendments which could see El Sisi stay in office until 2030. In keeping with tradition, the press doesn’t have many positive things to say (WSJ | The Guardian | Arutz Shiva).

Other topics circulating in the foreign press this morning include:

- Arab NATO: Egypt’s decision to back out of the so-called ‘Arab NATO’ have not totally killed off plans for a regional anti-Iran alliance, says The National.

- A ‘sudden rise’ in executions is taking a toll on prisoners and their families, writes the AFP.

- History: Russian archaeologists have unearthed a 1,500-year-old tomb at Fayoum with “funerary traditions” from both ancient Egypt and Rome, reports Sputnik News.

- Art: CNN Style and Artsy collaborated to publish a collection of“ancient Egypt's spellbinding mummy portraits.”

- Queens of Egypt exhibition: The WaPo has also highlighted the ongoing “Queens of Egypt” exhibition at the National Geographic Museum in Washington. We took note of the exhibition earlier this month.

On The Front Pages

Gov’t launches plan to develop textile manufacturing, El Sisi talks Sudan, Libya with Merkel: The launch of a government plan to develop textile manufacturing and discussions between President Abdel Fattah El Sisi and German Chancellor Angela Merkel on developments in Libya and Sudan topped the front pages of the government-owned dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Watching

What does it take to scare the CEO of a big company? Big tech investment is enough to keep CEOs up at night, as legacy companies struggle to compete with the huge financial clout of the likes of Amazon, Google and Apple. This is tempting companies to make increasingly risky acquisitions in a bid to stay relevant in their respective sectors, James Fontanella-Khan says in this FT video (watch, runtime: 02:19).

The numbers clearly show who’s leading and who’s playing catch up, and the trend spans multiple sectors. After Amazon acquired online pharmacy Pill Pack for less than USD 1 bn last year, rivals Walgreens and CVS immediately lost USD 11 bn in market value, prompting CVS to buy health insurance firm Aetna for USD 69 bn. The threat posed by Netflix resulted in AT&T’s massive USD 108 bn acquisition of Time Warner (owner of HBO and CNN), as well as a bidding war between Disney and Comcast for a majority stake in 21st Century Fox. Such big-name, big-money alliances will become the new normal as the threat posed by tech companies increases, Fontanella-Khan tells us.

Diplomacy + Foreign Trade

Egypt supports the choices of the Sudanese people, President Abdel Fattah El Sisi told German Chancellor Angela Merkel in a phone call discussing the resignation of Sudanese President Omar Al Bashir, according to an Ittihadiya statement. While Egypt is keen to help, it will not interfere in domestic Sudanese affairs, El Sisi stressed. The two also discussed the situation in Libya.

Egypt’s cotton, dates, citrus exports jump in 2018: Egypt’s dates exports rose 254% y-o-y in 2017, marking the highest y-o-y increase in agricultural exports during the year, according to a cabinet statement. Other crops and produce that Egypt exported more of last year included cotton (18.9%), mandarin oranges (38.4%), tomatoes (28.5%), oranges (22.1%), and lemons (11.1%).

Infrastructure

Egypt, World Bank discuss boosting support for African infrastructure projects

Investment Minister Sahar Nasr discussed with World Bank Vice President for Infrastructure Makhtar Diop boosting support for infrastructure projects in Africa, the ministry said in a statement. Egypt also asked the World Bank to support Nile transportation infrastructure to boost integration between African countries.

Real Estate + Housing

Heliopolis Housing postpones auction to sell Sheraton land

Heliopolis Company for Housing and Development has postponed an auction to sell a land plot in Sheraton, Heliopolis in light of recent government amendments to the building regulations, the company said in a press release (pdf). The amendments include allowing the company to build up to six floors, build two basements instead of one, and use the land plot for commercial or administrative activities (as opposed to only religious). Managing director for financial affairs Sahar El Damaty said last month the company was planning to offer a 32.25% stake on the EGX by mid-2019. She said earlier this week that the stake sale would follow planned land plot sales.

Egyptian real estate player El Attal to reportedly invest USD 600 mn in Dubai residential project

Egypt-based real estate developer El Attal Holding is reportedly planning to launch a residential project in Dubai at a cost of USD 600 mn, Chairman Ahmed El Attal said, according to Hapi Journal. El Attal provided no further details, saying they will be made public soon. The company launched earlier this year its three-phase EGP 4 bn Park Lane New Capital residential compound. It is also mulling an EGX listing sometime next year, and is planning to launch an EGP 5 bn project in New Alamein and an EGP 3 bn project in Ain Sokhna.

Tourism

Russian security team begins safety inspections at Hurghada and Sharm airports

A team of Russian security experts have begun safety inspections at Hurghada and Sharm El Sheikh airports, a spokesman for the Russian Federal Air Transport Agency told Sputnik. President Abdel Fattah El Sisi discussed resuming direct Russian flights to Red Sea destinations with Russia’s Foreign Minister Sergey Lavrov during his visit earlier this month. The return of the flights, still banned since the downing of a Russian passenger jet in 2015, has been in limbo for a while due to Russia’s reluctance to agree to a deadline.

Other Business News of Note

SODIC shareholders approve EGP 0.5/share 2018 dividend payout

SODIC shareholders approved the board’s recommendation to proceed with a dividend payment of EGP 0.5 per share 2018, the company said in a bourse filing (pdf).

Egypt Politics + Economics

Egyptian receives death sentence for 2013 Milan killing

An Egyptian man was sentenced to death yesterday for killing an Italian shop owner in Milan in 2013, Ahram Online reports. The man claimed that he had been assaulted by the shop owner, who was his employer. The man will be able to appeal his sentence before the Court of Cassation.

National Security

Egypt, Cyprus, Greece hold joint military drills

Egypt, Greece and Cyprus began yesterday a multi-day joint naval and air force exercise off Egypt’s Mediterranean coast, according to an armed forces statement. The Medusa 8 drill includes the Egyptian Navy helicopter carrier ENS Anwar El-Sadat, a Type 209 submarine, and several F-16 jets.

Sports

Egypt to host PSA World Tour Finals on 8-13 June

Egypt will for the first time hold the PSA World Tour Finals at the Wadi Degla club on 8-13 June, PSA World Tour has announced. The finals will close out the 2018/19 season and will feature the world’s top eight male and female players. Egyptian world no.1’s Raneem El Welily and Ali Farag were crowned champions of the DPD Open on Saturday, overcoming fellow Egyptians Nour El Sherbini and Mohamed ElShorbagy respectively.

On Your Way Out

The Environment Ministry is looking to recycle 80% of municipal solid waste within seven years, minister Yasmine Fouad told House Reps, according to Al Ahram Al Zeraee. The rate today: No more than 20%, Fouad added, saying the country needs to focus on improving waste infrastructure and cracking down on informal landfill sites. The ministry has recently set up an authority tasked with waste disposal and has since laid down plans for 27 governorates.

The Market Yesterday

EGP / USD CBE market average: Buy 17.27 | Sell 17.37

EGP / USD at CIB: Buy 17.26 | Sell 17.36

EGP / USD at NBE: Buy 17.25 | Sell 17.35

EGX30 (Monday): 15,055 (-0.1%)

Turnover: EGP 581 mn (34% below the 90-day average)

EGX 30 year-to-date: +15.5%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.1%. CIB, the index heaviest constituent ended down 0.2%. EGX30’s top performing constituents were Ezz Steel up 2.8%, Eastern Co up 1.3%, and TMG Holding up 0.8%. Yesterday’s worst performing stocks were Kima down 0.8%, Oriental Weavers down 0.3% and GB Auto down 0.2%. The market turnover was EGP 581 mn, and domestic investors were the sole net sellers.

Foreigners: Net Long | EGP +12.1 mn

Regional: Net Long | EGP +0.4 mn

Domestic: Net Short | EGP -12.5 mn

Retail: 48.2% of total trades | 44.1% of buyers | 52.4% of sellers

Institutions: 51.8% of total trades | 55.9% of buyers | 47.6% of sellers

WTI: USD 63.57 (-0.50%)

Brent: USD 71.26 (-0.41%)

Natural Gas (Nymex, futures prices) USD 2.59 MMBtu, (-2.71%, May 2019 contract)

Gold: USD 1,290.80 / troy ounce (-0.34%)

TASI: 9,088.13 (+0.36%) (YTD: +16.12%)

ADX: 5,222.23 (+0.93%) (YTD: +6.25%)

DFM: 2,805.04 (-0.14%) (YTD: -0.75%)

KSE Premier Market: 6,135.92 (+0.21%)

QE: 10,221.52 (-0.14%) (YTD: -0.75%)

MSM: 4,011.58 (+0.52%) (YTD: -7.22%)

BB: 1,441.27 (-0.26%) (YTD: +7.78%)

Calendar

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

15- 16 April (Monday-Tuesday): Atom Expo 2019, Main Media Center, Sochi, Russia.

16 April (Tuesday): The House of Representatives votes on the proposed constitutional amendments.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

23-24 April (Tuesday-Wednesday): SME Corporate Governance Workshop, Fairmont Nile City Hotel, Cairo, Egypt.

25 April (Thursday): Sinai Liberation Day, national holiday.

25 April (Thursday): Belt and Road Forum for International Cooperation, Beijing, China.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program.ahead of the disbursement of the fifth and final tranche of Egypt’s USD 12 bn IMF loan.

1 May (Wednesday): Labor Day, national holiday.

4 May (Saturday) An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

6 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Meditteranean (UfM) countries to promote trade and investment in the 43 member states.

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.

)