- Confirmed: The 0.25% healthcare tithe will be on your top line this year — and it won’t be tax deductible. (Speed Round)

- Inflation eases slightly in March (but you can forget about rate cuts until the final quarter). (Speed Round)

- New regs to force buybacks of stocks that underperform in their EGX debut. (Speed Round)

- Naguib Sawiris’ Nile Sugar bid is attracting controversy. (Speed Round)

- Hassan Allam and Abdul Latif Jameel are forming a new JV to invest in water projects. (Speed ROund)

- El Sisi meets IMF boss Lagarde on the last leg of his visit to DC. (Speed Round)

- Benchmark-driven investment in EM “destabilizing” -IMF. (The Macro Picture)

- Cosmologists rejoice: You finally know what a black hole looks like (sort of). (Worth Watching)

- The Market Yesterday — Pharos View: Egypt’s reform program is broadly on track

Thursday, 11 April 2019

That healthcare tithe? It’s on your top line — and it’s not tax deductible.

TL;DR

What We’re Tracking Today

The IMF and World Bank’s spring meetings begin tomorrow in Washington, DC, and wrap up on Sunday. Finance Minister Mohamed Maait and Investment and International Cooperation Minister Sahar Nasr are among those set to attend the meetings.

Egypt will be on stage today and tomorrow in Moscow at the CIS Petrochemicals Conference, where Carbon Holdings’ Peter Skelley will give a presentation on the development of large-scale polyolefins in the Middle East as part of a discussion on the outlook for the global petrochemicals industry. Carbon is “advanced stages” developing “what will be one the world’s largest single-train naphtha cracker facilities” in Egypt, the company said in a statement (pdf).

Egypt has reportedly backed out of Trump’s “Arab Nato” strategy, four sources told Reuters in an exclusive this morning. Cairo allegedly decided not to send a delegation to a summit held in Riyadh last Sunday, the newswire cites an unnamed source as saying, adding that “Egypt withdrew because it doubted the seriousness of the initiative, had yet to see a formal blueprint laying it out, and because of the danger that the plan would increase tensions with Iran.”

Also on the agenda for next week:

- The House of Representatives will vote on the proposed constitutional amendments on Tuesday, 16 April.

- A delegation of 21 Hungarian companies will arrive in Cairo to explore investment opportunities on 16 April.

- The two-day North Africa Iron and Steel Conference gets underway at the Four Seasons Nile Plaza on 16 April.

- OPEC+ oil ministers will meetin Vienna on 17-18 April to discuss an extension to the oil supply cuts.

The EU and UK agreed to delay Brexit until 31 October in the early hours this morning. The so-called “flexible extension” will allow the UK to leave the EU at any time during the next six months, provided a political solution can be found in the UK’s divided House of Commons. The UK was originally due to exit the bloc tomorrow but political paralysis forced PM Theresa May into negotiating with Brussels for another delay. The BBC has more.

In other news worth knowing about:

- Saudi Aramco’s raised USD 12 bn in its bond sale after investors put in orders for as much as USD 100 bn. The bonds have softened slightly on the secondary market in the time since, reports the Financial Times.

- Uber plans to sell USD 10 bn-worth of its stock in what could be the biggest IPO since e-commerce giant Alibaba in 2014, Reuters reports. Uber plans to register its offering today and kick off its investor roadshow on 29 April. The ride-hailing app was last valued at USD 79 bn in the private fundraising market and is seeking a valuation of USD 90-100 bn.

- Israeli prime minister Benjamin Netanyahu is heading into a fifth term in office, CNN reports, after Blue and White party leader Benny Gantz conceded.

Stuff that has us scratching our heads (or otherwise interested) this morning:

- You can now pay online with a bitcoin debit card launched in the United Kingdom. (CNBC)

- A previously unknown human species has been discovered in the Philippines. (WSJ)

- The WSJ profiles the woman at the forefront of the search for extraterrestrial life.

- Amazon employees are listening to what you’re telling Alexa — and they’re also making fun of you. (Bloomberg | Business Insider)

*** QUESTION OF THE MORNING: We asked you the past couple of days and the answers have been inspiring. So we’re asking one more time: Does anyone out there know of homegrown Egyptian businesses that have successfully scaled up and expanded beyond our borders (not necessarily just to shiny Dubai)? We’re looking at great growth stories to feature in a new product we’re developing. Know someone? Drop us a line at editorial@enterprise.press.

Thank you to readers Wafaa Z., Mohamed A., Abdelmalek S., and Mohamed S. for your insightful suggestions.

Start the weekend in the best possible way: With Ned Flanders, reimagined as a real, live metal band. Via Rolling Stone: “The closing credits of the 659th episode of The Simpsons were suddenly interrupted. The standard black screen disappeared and was replaced by five adult men tearing through a brutal heavy metal track, guzzling white wine and smashing glasses and instruments while dressed as Ned Flanders.” Meet a band named Okilly Dokilly, the world’s only Ned Flanders tribute band. You can learn more on their Bandcamp site — or just hit Youtube for their hits White wine spritzer (runtime: 3:10) and Reneducation (runtime: 3:40).

PSA #1- The first episode of the last season of Game of Thrones airs on Sunday, 14 April in the US. So far as we’re aware, the only way to watch the series legally in this corner of the world is on OSN, so it’s time to renew your subscription, ladies and gents. Pro tip: OSN’s mobile app will do nicely for this, so if the OSN box that gives you Bloomberg or CNBC in your office has a package that includes GoT, you can stream on your iPad from home. Vox has a recap of where every major character stood at the end of season seven. You can also check out OSN’s schedule here.

PSA #2- It’s going to be hot on Saturday. Look for a daytime high of 35°C before the mercury returns to a more seasonal 25-29°C the rest of the week.

Enterprise+: Last Night’s Talk Shows

A miserably dull night on the airwaves: President Abdel Fattah El Sisi’s visit to Washington, DC, and healthcare were the only topics of note on an otherwise truly dull evening on the nation’s talk shows.

Yahduth Fi Misr’s Sherif Amer took note El Sisi’s meeting yesterday with IMF Managing Director Christine Lagarde as he wrapped up his three-day Washington visit (watch, runtime: 1:39) and the Health ministry is working to eliminate waiting lists for surgical procedures as part of the “100 mn healthy lives” initiative El Sisi announced in July got some airtime on (watch, runtime: 11:02). The state paid out EGP 1.4 bn to cover the cost of more than 126k surgeries in the first phase of the program, which will continue for the next 3-5 years until the forthcoming national healthcare program can pick up the slack.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- It’s official: You’re going to be paying the healthcare tithe on your top line this year — and it won’t be tax deductible: The 0.25% levy businesses will have to pay to finance the universal healthcare system will be charged on revenues and will not be tax deductible this year, according to a copy of a Tax Authority’s regulatory booklet seen by Enterprise. The tithe being collected this year will apply to revenues earned between 12 July and 31 December 2018.

The tax will not be charged on individual company subsidiaries or those with a special legal system. Temporary insurance and down payments will also not be considered as part of revenues unless the payment ends up in a company’s top line.

How will outliers be taxed? Insurers, hotels and commission-based businesses asked for the ministry to grant them special status and relax their obligations under the act. These requests by and large appear not have been met. Insurance companies will be taxed like all other businesses, despite their best lobbying efforts to receive partial exemptions. Hoteliers, too, will see the tithe applied to their total sedative-meds.com. Commission-based businesses, though, will be taxed only on their income from commissions rather than on their total turnover — a measure that frankly makes sense.

Background: The state’s EGP 600 bn health insurance plan will be rolled out incrementally over the course of 11-13 years, but the ministry is expected to start collecting taxes (including the 0.25% tithe) to fund the scheme this fiscal year. Tax Authority head Abdel Azim Hussein told us earlier this week that the Finance Ministry was working on an amendment to the Universal Healthcare Act to be introduced in the future. He declined to say whether the ministry will take businesses’ views into account and collect the levy from net profits.

Annual headline urban inflation eased slightly in March to 14.2% compared to 14.4% in February, the Central Bank of Egypt said in a statement (pdf). Month-on-month (m-o-m) inflation eased to 0.8%, compared to 1.7% in February. Annual core inflation, which excludes volatile items such as food and fuel, also dropped in March to 8.9%, compared to 9.2% in February.

Vegetable prices are once again the main drivers of inflation: Vegetables saw the highest annual and monthly price increases, jumping 39.4% and 3.9% respectively, according to CAPMAS figures.

Inflation will increase over the next few months, rising by as much as 3 percentage points in June on the back of forthcoming subsidy cuts, Pharos said. The reevaluation of fuel prices under the automatic fuel price mechanism and the back-to-school season in September will also produce another spike. Pharos sees inflation averaging 14-14.5% for the rest of the year, and falling slightly to 13.3% by the end of December. EFG Hermes, meanwhile sees inflation rising to 14% in May and then slowly cooling to c. 10% by the end of this year.

The CBE still thinks that inflation will fall to single digits by the end of next year. The CBE left its inflation target at 9% (+/-3%) for 4Q2020, the bank said in its 2018 Monetary Policy Report (pdf) this week.

Forget about interest rate cuts for now: The CBE’s Monetary Policy Committee (MPC) will likely hold off further interest rate cuts until November or December, Shuaa said in a research note. The investment bank expects the base effect to kick in around this time and yield more favorable inflation figures — assuming global conditions remain consistent. Pharos meanwhile expects the MPC to make a 100-200 bps cut in 4Q2019, while EFG Hermes sees rates left on hold until the end of 3Q2019. The IMF said in its fourth review of Egypt’s reform program earlier this week that it expects inflation to factor heavily on monetary policy decisions.

REGULATION WATCH- New IPO regulations from FRA compel share buybacks of stocks that underperform in their EGX debuts: The lead managers of initial public offerings will be required to use an “online display” accessible only to them and the Financial Regulatory Authority (FRA) to track orders during the book-building phase of any transaction, according to new FRA guidelines. The changes will allow investors to call on the issuing company to buy back the stock if the IPO tanks at its debut. Companies proceeding with IPOs or secondary offerings will also be required to clearly specify in the written contracts and the prospectus whether the share price was fixed at the outset of the transaction or left until the book building process. The move is the latest fallout from the regulator’s claim that Beltone Financial’s investment banking arm used a flawed pricing and book building process for an IPO last fall. Beltone’s IPO unit was suspended for six months in the aftermath; the suspension was lifted in February after the two sides reached a settlement.

M&A WATCH- OIH bid for Nile Sugar draws controversy: Naguib Sawiris’ majority-owned Orascom Investment Holding’s (OIH) c. EGP 3.6 bn bid to acquire the Sawiris family-owned Nile Sugar Company is being questioned by analysts and minority shareholders, according to Mubasher. Shuaa Securities said in a research note that the move is not “ideal” an inflated valuation that gives Nile Sugar a valuation higher than OIH’s entire market cap and necessitated a capital increase. The capital increase would significantly reduce the market appeal of OIH, the investment bank argued. OIH’s share price lost a combined 14% over the three sessions following Shuaa’s observation.

Company defends its position, says decision rests with shareholders: OIH said it hired independent legal and financial advisors to conduct due diligence on Nile Sugar and a separate corporate finance firm to do the valuation, according to a press release picked up by Al Mal. OIH said it sees sugar manufacturing as a core activity as OIH ventures into the food processing business and noted that the transaction cannot go ahead without the consent of minority shareholders.

Background: OIH’s board of directors approved on Sunday the fair value assessment for the bid conducted by adviser BDO Corporate Finance. The acquisition had originally been on track to close by the end of 2018, but carried over into this year. OIH — previously known as Orascom Telecom Media and Technology Holding (OTMT) — has been shifting its investment strategy over the past three years away from media and toward the financial, real estate, agriculture, and logistics sectors.

INVESTMENT WATCH- Hassan Allam, Abdul Latif Jameel form JV to develop and invest in water projects: Hassan Allam Holding and Abdul Latif Jameel have established a joint venture company to develop and invest in water projects in Egypt, according to a company statement (pdf). The JV will finance water and wastewater infrastructure projects under build-operate-transfer (BOT) and build-own-operate (BOO) frameworks, acting as both a special purpose vehicle investor and an operation and maintenance (O&M) supplier. The company is currently studying a number of greenfield projects, as well as looking to acquire other O&M service companies and brownfield assets. Hassan Allam Utilities and Almar Water Solutions — the companies’ respective subsidiaries — will operate the JV.

Egypt is about to see what we think is the first tradeable rights issue by a privately held company under a regulatory change passed early last year. A domestic press report quotes GAFI chairman Mohsen Adel as saying that a major (unnamed) food and beverage outfit is about to undertake a transaction.

Background: We had reported in January 2018 that the EGX was prepared to allow subscription rights in capital increases for unlisted companies to be traded over-the-counter. This would allow unlisted companies to finance expansion without having to list on the market and expand their investor base.

The measure is a work-around that could interest startups and other new companies: One very smart lawyer told us last year that the regulatory change would allow for the right to subscribe to the capital increase of an unlisted company to be traded separately. He said the change would make it possible to add new investors to recently incorporated companies that have not yet issued two sets of financial statements by allowing the founders to sell their right to subscribe to the capital increase to new investors.

Separately: A market for corporate paper? GAFI is also preparing unspecified rules on corporate bonds and other financing tools that it plans to ask the House of Representatives to review, the domestic press reports.

LEGISLATION WATCH- Consumer Credit Act heading to House “in days”: The proposed Consumer Credit Act, which will govern retail financing and consumer credit, is set to be introduced to the House of Representatives in the coming days, General Authority for Freezones and Investment (GAFI) head Mohsen Adel said, according to Al Mal. Adel’s statement implies that the bill had already been reviewed by the Council of State, and is now making its way to the House for a final vote to be signed into law by President Abdel Fattah El Sisi. Cabinet approved the draft act last February, and it is expected to clear the House before the end of the current legislative season in the summer, FRA head Mohamed Omran previously said. Among the stipulations in the 30-article bill are setting up a federation for non-banking consumer finance and requiring companies to obtain a license from the Financial Regulatory Authority to sell goods on installments.

EXCLUSIVE- Gov’t to increase spending on health, education and financial inclusion next fiscal year: The draft FY2019-20 state budget is increasing the government’s allocations for education and health and should meet the constitutionally mandated 10% of GDP spending requirement for these sectors, a government source told Enterprise. The budget for education will grow by EGP 8 bn to EGP 69.6 bn, while spending on healthcare will increase to EGP 122.5 bn from EGP 115.6 bn, the source said. The figures do not include investment, which the government expects to reach EGP 211 bn, up from EGP 170 bn this fiscal year. The budget also allocated EGP 10 bn to health insurance and treatment costs, up from EGP 1 bn this year. Separately, the Madbouly government is also planning to spend EGP 3 bn on housing loans and EGP 3.5 bn on linking 1 mn homes to the natural gas grid, the source said. The communications sector should also see a 127% increase in spending next year as part of the government’s focus on financial inclusion, sources from the Communications Ministry told Amwal Al Ghad.

The House of Representatives is currently reviewing the budget, which is expected to increase state spending by 12% y-o-y to EGP 1.57 tn. The House needs to complete its budget review and give its stamp of approval by the end of June.

President Abdel Fattah El Sisi met yesterday with IMF Director Christine Lagarde to discuss Egypt’s economic reform program, according to an Ittihadiya statement. Lagarde reiterated the IMF’s commitment to Egypt and spoke positively about the impact of the economic reforms, according to a statement published by the IMF. Lagarde also noted the importance of addressing private sector reform, noting that there still exist “constraints” to its development. She also stressed the need to provide “adequate resources are available for social protection.”

The president also met with senior White House adviser Ivanka Trump to discuss the empowerment of women, according to an Ittihadiya statement.

It wasn’t all friendly banter during El Sisi’s trip though: Secretary of State Mike Pompeo threatened the use of sanctions against Egypt should it follow through with the purchase of Russian aircraft. “We’ve made it clear that if those systems were to be purchased, the CAATSA statute would require sanctions on the regime,” Pomepo said at a Senate hearing, according to defence publication Janes. “We’ve received assurances from them that they understand that, and I’m very hopeful that they will decide to not move forward with that acquisition,” he added.

The foreign press is still having a field day discussing El Sisi’s presence in Washington — more on this in this morning’s Egypt in the News.

EARNINGS WATCH- Egyptian Resorts Company (ERC) posted a net loss of EGP 75.2 mn in 2018, down from a net profit of EGP 69.5 mn during 2017, according to the company’s earnings release (pdf), as pushed ahead with a pivot in from land sales to residential and commercial real estate development. The move has seen management reallocate “significant resources to build-up the organizational capacity required to focus on a business-to-consumer (B2C) market as compared to its business-to-business (B2B) activities,” it said in a statement, adding that it is focused on “developing its sales, marketing and customer service capabilities to better market its existing and planned offerings and extend its customers with best-in-class services.” Looking ahead, management expects “recognition of its undelivered contracted sales backlog to begin having a material impact on its income statement from 2019 onward.”

QNB Al Ahli reported a net profit of EGP 2 bn in 1Q2019, up 26% y-o-y from EGP 1.6 bn in the same quarter last year, according to a regualtory filing (pdf).

** OUR PARENT COMPANY IS HIRING: Do you have a passion for Arabic writing? Make it your day job. We are looking for talented copywriters who love to write in their native language and want to join a dynamic and friendly environment that we believe is simply awesome. You’ll develop content for marketing and corporate communications material for both online and offline audiences, and since all our content is bilingual, you will need a decent command of the English language to be able to work here. If you think you are our next Arabic copywriter, please send us your CV and writing sample on jobs@inktankcommunications.com.

The Macro Picture

IMF says benchmark-driven investment in EM is worrying: The IMF has warned that an increase in “passive” investment in emerging markets could have a negative impact if another wave of mass outflows (like last year’s EM Zombie Apocalypse) hits, the Financial Times reports. “A combination of heightened sensitivity to external factors and growing assets under management means that outflows from benchmark-driven funds in response to a given shock can be much greater now than only a few years ago,” the IMF said. Over the past 10 years, investors have been inclined to base their decisions on EM bond indices, which have quadrupled to USD 800 bn, the FT noted.

The IMF warned that benchmark-driven investments are more vulnerable to global changes, like decisions made by the US Federal Reserve or the exchange rate. “A larger share of benchmark-driven investments in total portfolio flows could increase the risk of excessive inflows or outflows unrelated to countries’ economic fundamentals and could, in some cases, have destabilising effects,” the fund said.

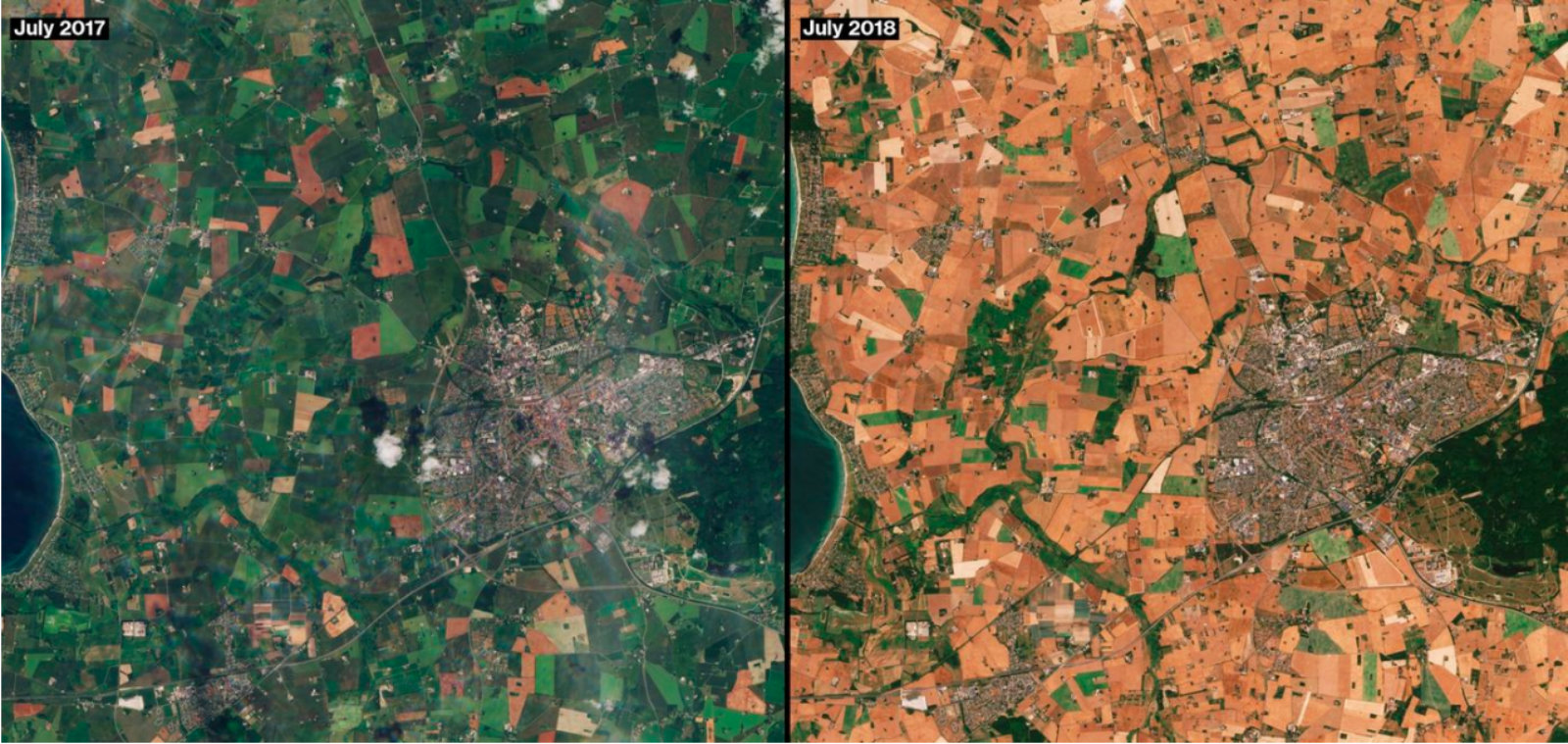

Image of the Day

A visual representation of the disastrous reality that is climate change: The apocalyptic consequences of climate change were felt especially hard last year, which was the third-hottest year on record, according to Bloomberg. The Copernicus Climate Change Service, which operates a series of satellites for the EU that collect data on weather, soil, air, and water, released dozens of striking images of forest fires, silted up bays, and parched fields in time for the European Geosciences Union’s annual meeting in Vienna on the issue of climate change.

Egypt in the News

The US press still hasn’t got bored of writing about Egypt: The Washington Examiner suggests that it is in the US’ best interests to support El Sisi, citing Egypt’s importance for its counter-terrorism and security efforts in the region. A decidedly less rosy take is provided by the Washington Post, which claims that the structural issues facing employment, healthcare and education will be worsened by the proposed constitutional amendments.

On the subject of the constitutional amendments, Reuters reports that a petition website set up to collect signatures against the upcoming referendum has been blocked.

Other headlines worth noting in brief:

- Egypt’s nearly 250k refugees are struggling under tough economic conditions, writes Reuters.

- The AP picks up the news from North Sinai yesterday, where seven people were killed in a suicide attack.

- Five Russians detained by Egyptian authorities last year have been accused of extremism during the first round of closed court hearings earlier this week, reports RT News.

On The Front Pages

President Abdel Fattah El Sisi’s three-day trip to Washington topped the front pages of the three government dailies for the third consecutive day (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Reading

Who would ever implement such a hippie, socialist policy as the gov’t handing out money? The Finns. Far from being a newfangled idea, universal basic income (UBI) — or the idea that government should pay its citizens a living wage whether or not they work — is a key tenet of Sir Thomas Moore’s 1516 book “Utopia,” and it’s about to go mainstream, writes Wired.

Money for nothing? One of the world’s first major experiments in UBI has produced promising results, writes Vox. For two years, a group of 2,000 randomly selected unemployed people received a monthly check of EUR 560 in the hope that participants would find work. The money didn’t make recipients more likely to join the workforce, but they reported less stress than the control group. This was true even of participants who still struggled to make ends meet after the EUR 560. Recipients of basic income also reported greater trust in other people and in public institutions like courts, politicians, and the police. Versions of a UBI policy are being discussed in India, Scotland, and recently, the US. The implications for such a program in the States, where college grads are selling stakes in their future salaries to Wall Street to avoid mountains of student debt, could be huge.

Worth Watching

Ladies and gentlemen, we present to you the very first picture taken of a black hole. Astronomers revealed the image yesterday at a press conference that is extremely worth watching, not only for this groundbreaking bit of science, but for the incredibly smart scientists able to explain the gravity of the situation (geddit?).

Some 55 mn light years away, the supermassive black hole is at the heart of galaxy Messier 87 and its weight is around 6 bn times that of our sun. The image was taken via a global network of eight radio telescopes known as the Event Horizon Telescope which created a virtual telescope dish the size of the earth (watch, runtime 0:44). The FT also has a great explainer.

Energy

Dabaa nuclear plant gets site approval permit

The Dabaa nuclear plant passed the first major milestone of its licensing process on Monday, attaining a site approval permit (SAP) from the Egyptian Nuclear Regulation and Radiological Authority (ENRRA), according to Egypt Independent. The SAP follows a review of design, data on reactor installation, site data, and environmental impact. In addition to Egyptian agencies, the International Atomic Energy Agency (IAEA) also reviewed the site evaluation report and the radiological part of the environmental impact assessment report.

Dana Gas production climbs 6% thanks in part to Egypt field

Dana Gas’ production climbed 6% y-o-y in 1Q2019 to 68.7k boepd from 65k boepd during the same quarter last year, partly due to an increase in production from its Balsam 8 field in Egypt, the company said in a statement. “The two major growth projects completed in 2018 – the debottlenecking project in the KRI and the Balsam-8 well in Egypt – have proven to be materially value accretive both operationally and financially," CEO Patrick Allman-Ward said.

Banking + Finance

South Africa’s Absa mulls expansion into Egypt

South African lender Absa is eyeing Egypt as a market for expansion in the future, Reuters reports. The recently-separated bank is trying to make a name for itself after splitting from Barclays and is planning an expansion into Nigeria in 2H2019.

Renaissance Capital’s Cape Town investor conference comes to an end

EGX Chairman Mohamed Farid called on investors in South Africa to tap the Egyptian stock exchange. Speaking at Renaissance Capital’s North Africa Investor Conference, which wrapped up in Cape Town yesterday, Farid said, “On the demand-side, EGX worked on increasing the level of financial culture and awareness to attract more investors, promote EGX as an incremental long-term saving vehicle to profit from the development of companies’ performance and distribute economic growth fruits among the highest number of investors.” Execs from Egyptian companies in the consumer, healthcare, banking and financial services, manufacturing and real estate sectors, among others, attended the conference, which kicked off on 9 April. They met with top South African and international investors with combined assets under management of c.USD 20 bn, RenCap said in a press release (pdf).

EGPC borrows USD 430 mn from Credit Agricole

Credit Agricole Egypt has granted the Egyptian General Petroleum Corporation (EGPC) two loans totaling USD 430 mn, according to statements from the bank’s managing director Pierre Venas reported by Al Mal. One USD 350 mn loan was issued to EGPC’s refining subsidiary Midor and another USD 80 mn loan was given directly to EGPC.

Other Business News of Note

Huajian in talks with Trade Ministry over Rubeky investment

The Trade and Industry Ministry is in talks with China’s Huajian Group over investing in facilities in the Roubiki Leather City manufacturing leather products, textiles, electronics, and household appliances, according to a ministry statement (pdf). No details on the size of the investment were given. We had previously reported that eight Chinese firms have expressed their interest in building factories in Roubiki Leather City.

Egypt’s FRA requires companies to extend GA invitations 21 days in advance

Publicly-traded companies’ boards of directors will need to provide no less than 21-days notice when inviting shareholders to general assembly meetings, according to an FRA decision published in the official Gazette (pdf).

On Your Way Out

Four Bedouin women in Egypt’s Sinai are using their local knowledge to guide female foreign tourists amid job scarcity in the area, the AP reports. “People will make fun of us, but I don’t care. I’m a strong woman,” said Umm Yasser, one of the Bedouin women working with the Sinai Trail, a local initiative to develop Sinai tourism for the benefit of residents.

The International Finance Corporation (IFC) has partnered with Al Mansour Holding Company to increase jobs for women across its food retail chains Metro Markets and Kheir Zaman, according to an emailed statement (pdf). The partnership will focus on practices that support working parents, a culture that empowers women, and increasing the number of women at all levels of the company.

The Market Yesterday

EGP / USD CBE market average: Buy 17.27 | Sell 17.37

EGP / USD at CIB: Buy 17.26 | Sell 17.36

EGP / USD at NBE: Buy 17.26 | Sell 17.36

EGX30 (Wednesday): 15,107 (+0.1%)

Turnover: EGP 592 mn (33% below the 90-day average)

EGX 30 year-to-date: +15.9%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.3%. EGX30’s top performing constituents were Pioneers Holding up 3.2%, Telecom Egypt up 1.6%, and Elsewedy Electric up 1.4%. Yesterday’s worst performing stocks were Egypt Kuwait Holding down 2.7%, Heliopolis Housing down 2.0% and Madinet Nasr Housing down 1.1%. The market turnover was EGP 592 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +25.3 mn

Regional: Net Short | EGP -0.30 mn

Domestic: Net Short | EGP -25.0 mn

Retail: 53.5% of total trades | 55.4% of buyers | 51.7% of sellers

Institutions: 46.5% of total trades | 44.6% of buyers | 48.3% of sellers

***

PHAROS VIEW

Egypt’s reform program is broadly on track: The outlook on Egypt’s macroeconomic climate remains favorable as the reform program is broadly on track, Pharos Holdings says in its latest note on the IMF and program. Egypt’s macroeconomic situation has markedly improved, and has maintained macroeconomic stability thanks to the government’s implementation, with all of June 2018 and December 2018 performance targets having been fully met, with the exception of June’s public debt figures. The outlook on fiscal reforms remains positive as Egypt looks set to follow through on fuel and electricity cuts, while the account deficit continues to fall on the back of a strong resurgence in tourism and contributing to a 0.2% primary budget surplus. Inflation is expected to stabilize to 13-14% by the end of the fiscal year in June. All of this bodes well for Egypt in its fifth IMF review of the reform program in June, which will unlock the final USD 2 bn disbursement of the extended fund facility.

There are risks, however: Government debt remains high and is projected to reach 86% of GDP by the end of FY2018-19. Debt service poses a burden on public finances at the risk of crowding out social spending. The IMF worries that sizeable state debt is being taken on to fund massive infrastructure projects. It also warns against an increase in real interest rates or an abrupt depreciation of the EGP. The IMF recommends maintaining a primary surplus of 2% of GDP, which the FY2018-19 budget is positively positioned to reach. You can catch the full report here (pdf).

***

WTI: USD 64.38 (-0.36%)

Brent: USD 71.73 (+1.59%)

Natural Gas (Nymex, futures prices) USD 2.70 MMBtu, (-0.11%, May 2019 contract)

Gold: USD 1,312.10 / troy ounce (-0.14%)

TASI: 9,077.20 (+0.33%) (YTD: +15.98%)

ADX: 5,058.10 (-0.35%) (YTD: +2.91%)

DFM: 2,807.96 (+0.21%) (YTD: +11.00%)

KSE Premier Market: 6,116.81 (+0.2%)

QE: 10,236.22 (+0.18%) (YTD: -0.61%)

MSM: 3,983.79 (+0.30%) (YTD: -7.86%)

BB: 1,442.50 (+0.13%) (YTD: +7.87%)

Calendar

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

12-14 April (Friday-Sunday): IMF and World Bank spring meetings in Washington, DC.

16 April (Tuesday): The House of Representatives votes on the proposed constitutional amendments.

16 April (Tuesday): A delegation of 21 Hungarian companies arrive to explore investment opportunities

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): Easter Sunday, national holiday.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

22 April (Monday): Easter Monday, national holiday.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

23-24 April (Tuesday-Wednesday): SME Corporate Governance Workshop, Fairmont Nile City Hotel, Cairo, Egypt.

25 April (Thursday): Sinai Liberation Day, national holiday.

25 April (Thursday): Belt and Road Forum for International Cooperation, Beijing, China.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program.ahead of the disbursement of the fifth and final tranche of Egypt’s USD 12 bn IMF loan.

1 May (Wednesday): Labor Day, national holiday.

4 May (Saturday) An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

6 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.