- Uber will acquire Careem for USD 3.1 bn. (Speed Round)

- Expect the CBE to cut rates this week. (What We’re Tracking Today)

- Is there another major Egypt-Israel gas pact in the making? (Speed Round)

- IOCs can sell gas from new Red Sea concessions at home or abroad. (Speed Round)

- What does an inverted US yield curve mean for emerging markets? (The Macro Picture)

- Is the first Egyptian corporate bond issuance in nearly a decade now in the cards? (Speed Round)

- Egypt looks to export electricity to Syria and Iraq. (Speed Round)

- Regs signal new protections coming for minority shareholders. (Speed Round)

- The Market Yesterday

Wednesday, 27 March 2019

The consensus is now for an interest rate cut tomorrow

TL;DR

What We’re Tracking Today

Tomorrow is interest rate day, and we think it safe to now say the consensus is for a rate cut. Here’s our logic:

- Adding new predictions from leading research houses to our poll of analysts, we now count seven of 11 houses as calling a rate cut of up to 100 bps (one percentage point).

- Reuters’ poll earlier this week had eight out of 12 economists expecting the central bank to keep rates unchanged.

- Bloomberg said overnight that “most economists” it surveyed predict a 100 bps rate cut.

Needless to say, a rate cut would be good for businesses that have delayed much-needed capex because borrowing costs are simply insane — credit-card level interest rates to finance an investment in your business makes no sense.

What’s the logic:

- First, we import inflation — and the 3.6% appreciation of the EGP since the start of the year is keeping that in check;

- Second, the US Fed handed us a gift by foreshadowing zero rate cuts this year, meaning Egypt will remain comparatively attractive to the carry trade after a rate cut (a good thing when it comes to keeping the EGP in balance);

- Third, it’s now or … late 3Q, because the coming months are going to see inflation tick up. Ramadan (May), subsidy cuts (around 1 July), the summer months in general (coupled with Eid vacations) and back-to-school season (starting in September) are all inflationary and promote demand for greenbacks at the expense of the EGP.

Inflation could keep rates on hold in most other major African economies: The central banks of Africa’s other largest economies are also deciding on rates these days, and nearly all of them are expected to keep rates on hold due to “upside risks in inflation,” Bloomberg says in a separate piece.

There’s no consensus in global markets about which way is up: European shares were okay and US futures up yesterday, but Asian shares are slipping this morning as “investors tried to come to terms with a sharp shift in US bond markets and the implications for the world’s top economy,” Reuters reports.

Bonds continue to be a concern though: The yield on 10-year US Treasuries is still in an inverted status against short-term paper. This is concerning investors who see it as a sign of recession (more on this in this morning’s Macro Picture, below).

And you may not want to look at the latest trade data… Global trade fell 1.8% in the first quarter of 2019 — the biggest drop since May 2009, according to World Trade Monitor stats seen by Bloomberg. This is also the first quarterly drop on a year-on-year basis in nine years.

…or at the looming “earnings recession” in the US, where profit margins “are on track to suffer their first fall since 2015 as companies increasingly struggle to pass on costs of rising labour, transportation and raw materials to customers,” the FT writes.

Two stories about tech / tech-driven businesses worth reading if you, like us, are nerds for that kind of thing:

- Be cautious before buying into the upcoming wave of tech IPOs, argues James Mackintosh in the Wall Street Journal. “When all these supersmart backers of the best startups want to sell out, do you want to be on the other side of the trade?”

- Why is Silicon Valley so obsessed with the virtue of suffering? The New York Times looks at the popularity of Stoicism in the tech elite and wannabes.

And in regional news worth knowing:

- Curtains for Bouteflika? Algeria’s army chief called for the constitutional removal of President Abdelaziz Bouteflikaon medical grounds. (CNN Arabic).

- A UK hedge fund has turned its back on USD 300 mn in Saudi AUM, “highlighting disquiet about Saudi Arabia’s human rights record.” (Bloomberg)

- So much for the ceasefire: There was renewed violence on the Gaza border last night as Hamas fired rockets into Israel, provoking retaliatory strikes and breaking the ceasefire reportedly brokered by Egypt on Monday. (Reuters)

Making us smile this morning: Ahmed Heikal’s ERC has delivered 51k tons of fuel products (including 38k tons of Euro V-spec diesel) to EGPC, putting it on track to compete trial operations by 2Q, according to Al Mal.

Enterprise+: Last Night’s Talk Shows

Uber’s acquisition of regional rival Careem was (unsurprisingly) all over the airwaves last night. Our friend Khaled Ismail, chairman of HIMAngel, the high-profile angel investment fund, told Hona Al Asema the transaction has its benefits, but may hurt competitiveness in the domestic market (watch, runtime: 07:47). We have everything you need to know about the acquisition in this morning’s Speed Round, below.

Egypt will fully eliminate subsidies on power bills in FY 2021-2022, Electricity Minister Mohamed Shaker told Yahduth Fi Misr’s Sherif Amer (watch, runtime: 08:14). The coming fiscal year and the one that follows will see partial subsidy cuts until the full elimination takes place.

Speed Round

Speed Round is presented in association with

M&A WATCH- Uber is acquiring Careem in a USD 3.1 bn transaction, making Careem the MENA region’s most valuable ‘unicorn’ ever: Ride-hailing companies Uber and Careem have reached an agreement that will see Uber acquire its regional rival for USD 3.1 bn, a joint statement said (pdf). The transaction is expected to close in 1Q2020, subject to regulatory approvals. If it goes through, the acquisition would consist of USD 1.7 bn of convertible notes and USD 1.4 bn in cash. Uber is poised to acquire Careem’s core mobility, delivery (Careem Now) and payment (Careem Pay) businesses in all countries where Careem operates.

So, what does the ride-sharing landscape look like post-transaction? Uber and Careem will operate as separate brands (for now) even as Careem becomes a wholly-owned subsidiary of Uber. The Dubai-based firm will continue to be led by co-founder and CEO Mudassir Sheikha. Careem will report to its own board, which will consist of three Uber representatives and two from Careem.

You can check out the transaction fact sheet here (pdf).

What Uber and Careem’s leadership had to say: Careem’s Sheikha sees the acquisition as a “milestone moment for us and the region [that] will serve as a catalyst for the region’s technology ecosystem.” The two companies joining forces will also help Uber “expand the strength” of its platform with Careem’s local know-how, Uber CEO Dara Khosrowshahi said.

Read Khosrowshahi’s email to Uber staff here (pdf).

The story is all the business press could talk about yesterday: Reuters, Bloomberg, the Wall Street Journal, the Financial Times (paywall), and the New York Times had the story, as does every tech-focused outlet under the sun. “For Uber, the prize is the proof that it still can secure a dominant position in an emerging market following a series of [transactions] that have seen it retreat to the role of junior partner,” Bloomberg highlighted.

For Uber, the move is a shot in the arm ahead of its upcoming IPO, Reuters Breakingviews notes. It also comes as Uber’s US rival Lyft looks set to price its IPO shares above guidance, the WSJ adds.

The Egyptian Competition Authority (ECA) is not happy with the merger, saying in a statement that the combination of the two businesses “may lead to a significant impediment on effective competition in the markets” by restricting choice for riders and drivers alike. The regulator will undertake an investigation once it has received formal confirmation from the companies and is due to announce its decision within 60 working days.

The ECA previously threatened both companies with fines of up to EGP 500 mn apiece if they went through with a merger.

Saudi companies are cashing in: Kingdom Holding Company said in a disclosure to Tadawul yesterday that it completed the sale of SR 1.25 bn-worth of Careem shares to Uber in the transaction. The Tadawul climbed yesterday as Careem shareholder Al Tayyar Group’s shares rose 10% following the agreement, Reuters reports.

So, how did Careem do it? The Dubai-based company built a moat around its operations that Uber had to pay to penetrate, Business Insider argues, citing a recent interview with Sheikha, who pointed to the service’s deep on-the-ground knowledge, including understanding that cash is king and having mapped “every building, every villa, every shopping mall” because of local limitations of Google Maps.

Delek and its partners want to export even more gas to Egypt: Executives from Israel’s Delek Drilling is in talks to sell even more natural gas to Egypt beyond the USD 15 bn agreement signed last year with Alaa Arafa-led Dolphinus Holding, according to Bloomberg. Under the agreement, Delek and its partner Noble Energy should deliver 3.5 bcm from each of the Leviathan and Tamar gas fields for a combined total of 7 bcm. Delek, Noble, and Ratio Oil Exploration are now looking to supply up to 3 bcm per year above that to satisfy “an expected increase” in Egypt’s demand for gas. “The potential in the Egyptian market is endless. We’re going to clear up a lot of question marks in the coming months, once we start flowing gas through the [East Mediterranean Gas] pipeline,” CEO Yossi Abu said yesterday.

Biting off more than they can chew? Delek and its partners are still “scrambling” to sort out how they’re actually going to get all this gas into Egypt, Bloomberg notes. Their biggest current obstacle is “finding enough spare gas from the Tamar reservoir to test the pipe’s condition.” Earlier reports had suggested that the southern Israeli gas pipeline that is meant to carry gas from Tamar and Leviathan does not have the capacity for the contracted volumes. The status of the pipelines has pushed the timeline for Egypt to begin receiving the first shipments of Israeli gas to mid-2019, instead of this month. Egypt and Israel had begun talks in January over the construction of a new subsea pipeline that would enable Israeli gas to flow directly to Egypt’s Idku liquefaction plant, eliminating the need to expand Israel’s onshore infrastructure.

Companies awarded concessions in Red Sea bid round can sell at home or abroad: The South Valley Egyptian Petroleum Holding Company (Ganope) will allow companies awarded concessions in the ongoing Red Sea bid round to decide what to do with their share of output, Al Shorouk reports. Companies looking to sell natural gas to third parties inside Egypt will be required to get approvals from Ganope, EGAS, and EGPC, as well as further approvals from the oil minister on the quantities, price, and sales contract. Any exports of natural gas or liquefied petroleum gas (LPG) from these concessions will also require ministerial sign-off on the quantities and price.

Background: Egypt launched a tender earlier this month for 10 oil and gas exploration blocks off the Red Sea coast under a new production sharing contract, according to a Ganope statement (pdf). The Oil Ministry has been reportedly planning to roll out new production sharing contracts with friendlier terms for international oil companies this quarter.

Egypt to export power to Syria, Iraq in the near future: The Electricity Ministry has confirmed plans to export electricity to Syria through Jordan and is also looking at growing electricity sales to Iraq, unnamed government sources told the local press. The plans will proceed after the government extends the capacity of our existing link with the Jordanian capital to 1 GW this year from a current 450 MW. The new capacity will then feed into Syria and Iraq. The extension would see the price of power exchanged with Jordan fall by c. 15%, but increase our receipts from the link to USD 50 mn a year, up from a current USD 20 mn, the report suggests. A later phase would double the capacity to 2 GW.

Background: The Egypt-Jordan electricity link is part of a larger project to link Egypt’s grid to Libya, Palestine, Syria, Lebanon, Iraq, and Turkey. Together, the links were referred to at some point by the Jordanian government as the “Eight Countries Electric Interconnection Project.” The project has been in the works for years, with major parts of it already completed. It is partly funded by the Arab Fund, and its completion is one of the keys to our bid to become a regional energy hub.

Is Egypt about to see its first corporate bond issuance in nearly a decade? Mansour Amer’s Porto Group has appointed consumer- and structured-finance player Sarwa Capital to study a potential bond or other debt issuance, Porto Group said in a disclosure to the EGX (pdf). The disclosure does not offer further details on the issuance or the company’s financing plans. A source confirmed to Enterprise that a corporate bond issuance is an option on the table, which would make it Egypt’s first significant issuance of corporate paper (other than securitized offerings, where Sarwa is a market leader) in years.

INVESTMENT WATCH- Gaming startup GBarena raises seed investment: Cairo-based e-sports and gaming startup GBarena has raised seed investment from angel investment fund HIMAngel, the company said in a statement, without saying how much it raised or revealing size of the ongoing round. GBarena provides a platform that allows tournament organizers to create, publish and manage tournaments. The service enables organizers to register players, schedule matches, generate brackets and send notifications to players, as well as moderate and manage the tournaments. The transaction is GBarena’s second round with HIMangel.

REGULATION WATCH- FRA to require periodical appraisals for real estate funds under Capital Markets Act: The Financial Regulatory Authority (FRA) has finalized potential changes to how real estate funds are regulated by the Capital Markets Act that would require fund managers to periodically appraise their portfolios, according to a statement (pdf). The amendments would, if enacted, mandate at least one FRA-licensed consultant per fund to appraise portfolios on a quarterly basis if listed or every six months at a minimum if privately held. The changes would also scrap a 2014 decision requiring 70% of the assets held by funds have regular returns, as well as introduce precautions to avoid conflicts of interest among shareholders.

Background: Real estate funds invest up to 80% of their proceeds in easy-to-value, specific real estate properties — whether directly or via buying shares in listed or private firms. The remaining 20% are typically invested in more liquid bonds or other instruments. They gain their appeal from price appreciation and so provide long-term income. The funds may also list on exchanges and make public offerings to grow their size. The FRA (called the Egyptian Financial Supervisory Authority at the time) amended the Capital Markets Act in 2014 to allow for the establishment of sector-specific mutual funds, one of which is the real-estate focused fund. As far as we know, the Egyptians Real Estate Fund is the country’s first, and is due to be up and running this month.

Market regulator to be in charge of issuing licenses for futures exchange: The Financial Regulatory Authority’s (FRA) board gave the market regulator the authority to issue licenses for futures exchanges, according to a statement (pdf). Companies that want to operate futures exchanges will need at least EGP 20 mn or equivalent of paid-in capital. At least 75% of these companies’ shareholders must also be financial institutions, bourses, or companies licensed to operate in financial markets. The stipulations also require that companies have in place the necessary infrastructure to meet the technical requirements specified by the regulator to operate as a futures exchange.

The FRA board also granted the EGX the green light to operate in futures after completing certain adjustments to delineate regular stock trading and futures trading.

FRA signals new protections coming for minority shareholders: The Financial Regulatory Authority (FRA) has reportedly signed off on a regulatory change that aims to protect the rights of minority shareholders when companies list and delist shares on the EGX, Al Masry Al Youm reports. The changes zero in on conflicts of interest and allow the FRA to exclude majority shareholders from voting on decisions of voluntary delisting during extraordinary general assemblies. Only minority shareholders would be permitted to vote in such circumstances. The amendment would also allow the authority to compel the buyout of minority investors at a value set by an independent financial advisor. The story does not make clear when the changes go into effect.

Message to folks speculating on the EGP: The Administrative Control Authority and Interior Ministry have arrested 23 people accused of illegal trade in foreign currencies, Ahram Online reports.

** WE’RE HIRING: Inktank Communications is the region’s leading investor relations and financial communications firm. We’re growing and we’re looking for executives to join our client relations and strategy team. Our ideal candidate is:

- Energetic and eager to learn;

- Passionate about corporate communications and dealing with high-profile clients;

- A strong believer in the power of the written word and visual concepts;

- A people’s person; comfortable with working in an informal environment while managing clients coming from formal industries;

- A team player who can comfortably work with several parties, internally and externally;

- Fluent in English and Arabic.

Interested? Send your CV along and a solid cover letter to ssultan@inktankcommunications.com.

The Macro Picture

Why the inverted US yield curve could spell trouble for emerging markets: An inverted US yield curve could be the harbinger of hard times for emerging markets, Shuli Ren writes for Bloomberg. The yield spread between US three-month and 10-year Treasuries turned negative for the first time in over a decade on Friday, something that has presaged each of the past seven recessions in the US.

“But what is an inverted yield curve?” we hear you ask: The yield curve measures the differences in interest rates paid on bonds of all maturities. A conventional curve will feature low rates attached to short-term bonds, with the yield increasing as the maturity increases. This is because short-term bonds are generally seen as being lower risk (there’s less time in which something can go wrong), while long-term bonds are more likely to be affected by interest rate changes, defaults and economic slowdowns. The inverted curve flips this on its head, with short-term bonds carrying higher yields than long-term bonds. In this case, the yield on three-month US Treasurys rose to 2.46% on Monday, higher than the 2.42% rate on 10-years.

And how does this affect emerging markets? One school of thought tells us that this might be a positive development for EM. Increasing chances of a US recession makes it more likely that the Federal Reserve will lower rates. And the last time US curves inverted in 2006, EM high-yield bonds were unaffected — at least initially. But the threat of a US recession — one that is indirectly driven by China’s underlying economic problems and increasingly wild stimulus measures — is real. “The last time this happened, EM debt happily churned along for a few months, until one day the music stopped,” Ren says. “That party ended in tears.”

Image of the Day

Vintage car lovers were able to feast their eyes on 250 classic vehicles of all shapes and sizes at the 7th Cairo Classic Meet, held in Cairo’s Smart Village Club on Saturday. For all those who could happily spend hours arguing why a 1967 Ford Mustang is better than a Chevrolet Camaro, Xinhua has a selection of pictures.

Egypt in the News

Egypt is getting some flack in the US press this morning, with the Washington Post arguing that Congress should review the USD 1.3 bn aid it gives to Egypt — or at least use it as leverage to address human rights issues, a group of academics, policymakers and activists told a recent event in the US about the proposed constitutional amendments.

China’s planned textile complex could spell doom for Egypt’s local industry: The USD 2.1 bn textile industrial complex being developed by Chinese firm Mankai Investment in Sadat City may cripple Egypt’s already-squeezed local textile industry, Hagar Mohamed writes for Al Monitor. The government could have capitalized on the company’s interest in the sector to develop existing facilities with the “decades of experience” under Mankai’s belt — and help local firms build an international presence, the head of the Federation of Egyptian Industries’ textiles division says. On the flipside, however, some say the Chinese complex will actually be a boon for Egypt’s economy without harming local industry, since its output will be earmarked for export and therefore will not eat into the domestic market.

Other stories worth a skim this morning:

- Egyptian hero earns Italian citizenship: Italian deputy PM Matteo Salvini has approved granting citizenship toRamy Shehata, the Egyptian boy living in Italy who saved his school bus from a hijack attempt last week, reports The BBC.

- Terrorism list updates: The decision to put 145 people, including senior Muslim Brotherhood figures and supporters, on Egypt’s “terrorism list” was upheld by a court on Tuesday, a judicial source revealed, according to AFP.

- Forty years of peace: The WSJ looks back at the 40-year peace between Egypt and Israel.

- But is it really peace? What we have is strategic cooperation, rather than a “warm peace” consisting of vibrant relations between the two societies, RFI argues.

- Putting an end to harassment: Two young Egyptian men have launched Fyonka, a female driver and passenger only ride-hailing app designed to curb harassment, EFE reports.

On The Front Pages

President Abdel Fattah El Sisi’s meeting with Bulgarian President Rumen Radev yesterday topped the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar). The two sides discussed regional affairs and efforts to strengthen economic and military ties, Al Ahram reported. Fighting terrorism was also a main point of discussion during the summit, Al Gomhuria and Al Akhbar highlighted.

Worth Watching

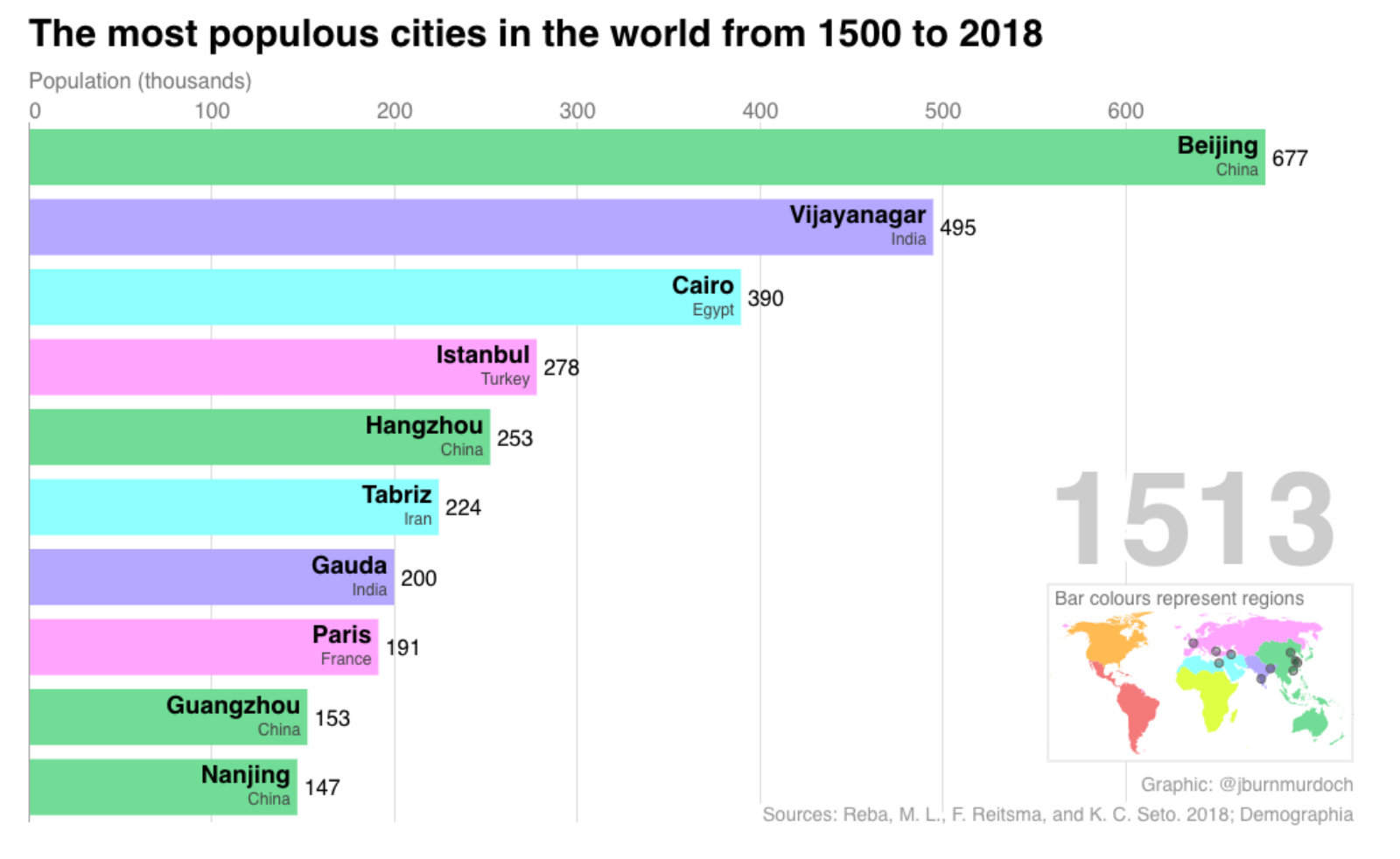

Cairo was one of the most populous cities in the world in 1500 (it’s nowhere near the top now). Making the rounds of the internet these days is one of the better marriages of spare time, data, and graphics: This bar chart race of the world’s most populous cities since 1500. Cairo comes in third fresh out of the gate at 400k inhabitants and stays around the top until about 1600, when East Asian cities (Kyoto, Agra, Beijing) start taking the population density cake. London, Paris, and New York make a comeback in the mid-1850s but Tokyo wins the day with a greater metropolitan population of 38 mn (watch, runtime: 1:00).

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry met with Democratic and Republican senators in Washington yesterday for discussions about combating terrorism, Egypt’s economic development, and several regional issues, Ahram Online reports. Shoukry emphasized the importance of the strategic relationship between Egypt and the US, as well as the need for continued US support to address the threat of terrorism and ensure regional stability. It is expected that he will meet US Secretary of State Mike Pompeo in the coming days.

Energy

Finance Ministry issues financial guarantee for Oyoun Moussa plant

The Finance Ministry issued a financial guarantee for Al Nowais’ USD 4 bn 2.65 GW Oyoun Moussa coal plant, a source from the Electricity Ministry tells Al Mal. Al Nowais had previously said it is putting up 70% of the capital for the project, and was in talks with backers in Singapore, South Korea, China, and Egypt to fund the remaining 30%. The Emirati investment group is expected to sign a power purchase agreement with the Egyptian Electricity Transmission Company (EETC) by 1Q2019.

Electricity Ministry looks for partners on geothermal energy map

The Electricity Ministry is seeking international partners and funding to create a geothermal energy map of Egypt as part of its goal of increasing the country’s reliance on renewable energy sources, according to a report picked up by Think Geoenergy. The last time we heard about geothermal energy was in 2016, when oil and electricity ministries agreed to team up, conduct feasibility studies, and select an unrevealed pilot location.

Basic Materials + Commodities

Supply Ministry fixes sugar price at EGP 7,500

The Supply Ministry reached an agreement with sugar beet producers to set the price of beet sugar for the current season at EGP 7,500 per tonne, according to Al Mal.

Emisal Salts to build EGP 150 mn medical salt factory

Emisal Salts is establishing a medical salts factory at a cost of EGP 150 mn, Chairman Atef El Kordy tells Al Mal. The factory’s expected output is 15k tonnes per year, which will be earmarked for local consumption. Egypt currently imports 25k tonnes of medical salts per year.

GASC agrees to purchase 60k tonnes of wheat at USD 221 per tonne

State grain purchaser GASC concluded its wheat tender yesterday, receiving the lowest offer from Cargill of USD 221 per tonne for 60k tonnes of US soft red wheat, reports Reuters. GASC had announced it would be reverting to a delayed payment schedule, which led to an increase of USD 4 – 4.5 per tonne for the current tender. Wheat productivity saw a 20% increase this season compared to the previous year, Sherif Bassily, head of the Holding Company for Silos, told VetoGate. Bassily said the increase is due to weather-related factors and 3.7-4 mn tonnes are expected to be harvested this year.

Real Estate + Housing

MNHD approves Minka Real Estate Investment offer for land plot in Taj City

Madinet Nasr Housing and Development’s (MNHD) board of directors approved on Monday an offer from Minka Real Estate Investment to purchase a 3,360 sqm piece of non-residential land in MNHD’s Taj City project for a total of EGP 184.8 mn, MNHD said in a statement (pdf). The plot is in the first phase of Taj City’s office park, will be used to develop a hotel apartments project.

Talaat Moustafa Group Holding in talks with Saudi Arabia over residential project

Talaat Moustafa Group (TMG) is in talks with the Saudi Housing Ministry over developing a residential project in the kingdom, CEO Hisham Talaat Mostafa said on Monday, according to Mubasher. No further details about the project were revealed. TMG had signed a number of cooperation agreements with the kingdom back in 2016 to build housing projects on Saudi government-owned land in exchange for ownership of a number of units it constructs.

Telecoms + ICT

Balances in e-wallets to become interest bearing?

The Central Bank of Egypt (CBE) is mulling whether interest should be paid on funds left in e-wallets to give users incentives to activate dormant accounts as part of the country’s financial inclusion drive, sources tell Al Mal. The CBE is also almost done with new regulations for the e-wallets, which will allow mobile lending and raise the ceiling of payments, the sources added.

Banking + Finance

GTH board approves rescheduling of USD 100 mn loan from majority shareholder

Global Telecom Holding’s (GTH) board of directors has approved a three-month extension on the maturity of a USD 100 mn revolving credit facility from majority shareholder Veon Holdings, according to an EGX disclosure (pdf). The debt was originally due to be settled on 31 May. GTH said earlier this week it had postponed to 26 June a general assembly meeting to vote for a capital increase of EGP 11.2 bn after Veon rescheduled the repayment of this debt and another also due in May.

Other Business News of Note

House approves gov’t budget account for 2017-18

The House of Representatives has given its final nod to a government-proposed draft bill that finalizes the results of its FY 2017-18 budget, Al Ahram reported. The legislation puts expenses at EGP 1.244 tn, revenues at EGP 821 bn and loans at EGP 700 bn. Final results also show the government spent EGP 240 on salary and benefits for civil servants, EGP 53.88 bn on commodities and EGP 437 bn on debt service. It also spent EGP 329 bn on subsidies, grants and other social programs.

E-finance to increase capital ahead of planned IPO

State-run electronic payments company e-finance will increase its capital to EGP 1.5 bn ahead of its planned IPO this year, according to Chairman Ibrahim Sarhan, Al Mal reports.

Egypt Politics + Economics

Parliament wants to survey state-owned companies’ assets

The House of Representatives’ economic and industry committees have submitted a formal request to the Public Enterprises Ministry to set up a specialized committee to survey and value state-owned companies’ assets, according to the local press. House reps are looking to have these assets dealt with in a similar way to those under the planned EGP 200 bn sovereign wealth fund, and without private sector involvement. The committees have also requested that the companies present their detailed development and restructuring plans to parliament within one month.

On Your Way Out

Egypt lost to Nigeria in yesterday’s football friendly as both sides kicked off preparations for the upcoming African Nations Cup tournament, reports Ahram Online. The Egyptian side was more concerned with setting records though: Nigeria scored the second fastest goal in the history of international football, taking them less than 8 seconds to seal the affair.

The Market Yesterday

EGP / USD CBE market average: Buy 17.24 | Sell 17.34

EGP / USD at CIB: Buy 17.23 | Sell 17.33

EGP / USD at NBE: Buy 17.24 | Sell 17.34

EGX30 (Tuesday): 14,637 (-0.2%)

Turnover: EGP 832 mn (11% below the 90-day average)

EGX 30 year-to-date: +12.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.2%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were Orascom Development Egypt up 3.6%, Global Telecom up 2.2%, and Orascom Investment Holdings up 2.0%. Yesterday’s worst performing stocks were SODIC down 2.8%, Qalaa Holdings down 2.2% and Pioneers Holding down 1.7%. The market turnover was EGP 832 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -102.3 mn

Regional: Net Short | EGP -7.2 mn

Domestic: Net Long | EGP +109.5 mn

Retail: 57.8% of total trades | 61.0% of buyers | 54.7% of sellers

Institutions: 42.2% of total trades | 39.0% of buyers | 45.3% of sellers

WTI: USD 60.04 (+0.17%)

Brent: USD 68.09 (+0.18%)

Natural Gas (Nymex, futures prices) USD 2.72 MMBtu, (-0.62%, Apr 2019)

Gold: USD 1,323.60 / troy ounce (+0.18%)

TASI: 8,678.88 (+0.14%) (YTD: +10.89%)

ADX: 5,126.86 (+0.17%) (YTD: +4.31%)

DFM: 2,615.17 (-0.73%) (YTD: +3.38%)

KSE Premier Market: 5,900.14 (-0.73%)

QE: 9,935.47 (-0.14%) (YTD: -3.53%)

MSM: 4,049.40 (-1.90%) (YTD: -6.34%)

BB: 1,408.04 (-0.56%) (YTD: +5.29%)

Calendar

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30 March (Saturday): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: A World Bank delegation will be in town to review current investment legislation, economic policies and administrative for next year’s Ease of Doing Business Report.

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

10 April: Egyptian Retail Summit (ERS 2019), Nile Ritz Carlton, Garden City, Cairo, Egypt.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.