- The government is set to double SMEs’ minimum VAT registration requirement to EGP 1 mn. (Speed Round)

- Alabbar and Saudi investors are hungry for Eastern Company shares. (Speed Round)

- We might be getting a USD 1.2 bn loan from the African Development Bank. (Speed Round)

- Foreign holdings in Egyptian treasuries rise to USD 15.6 bn in February. (Speed Round)

- Borrowing by emerging market businesses is skyrocketing. (The Macro Picture)

- Amendments to the Investment Act have cabinet approval. (Speed Round)

- Is this the end of stamp duty as we know it? (Speed Round)

- Behold Hollywood in all its Orientalist glory. (Image of the Day)

- The Market Yesterday

Thursday, 7 March 2019

Gov’t wants to exempt more SMEs from paying VAT

TL;DR

What We’re Tracking Today

Good morning, friends, and happy Thursday from Enterprise Global Headquarters, where we are all looking forward to a warm and sunny weekend.

Egypt won’t go back to the IMF, cap in hand for more: Our future cooperation with the IMF on the reform program will not involve another loan, Madbouly Cabinet spokesperson Nader Saad told Extra News in a call-in on Wednesday (watch, runtime: 6:09). As the country presses ahead with the reform program, we will need to cooperate further with the IMF, but that would take the form of consultations and technical assistance, he added. Egypt will draw out the last tranche of the USD 12 bn extended fund facility it got from the IMF this year.

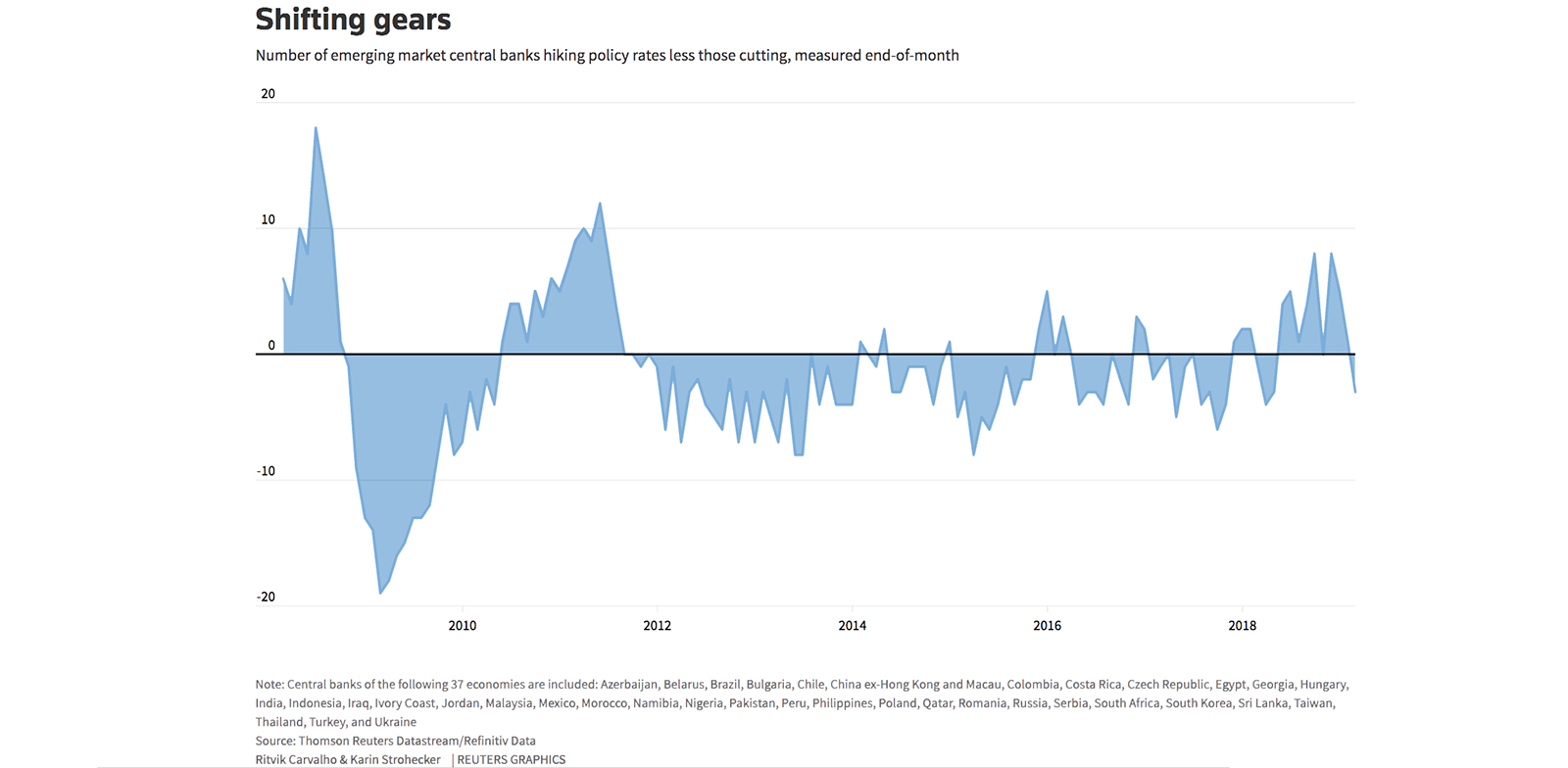

The CBE was one of several emerging market central banks to cut interest rates in February, according to Reuters. “Taking their cue from a dovish turn at the U.S. Federal Reserve and a USD rally that has run out of steam for now,” seven central banks in 37 emerging markets cut interest rates, while another four have raised rates, bringing the net rate cuts in February to three. EMs have seen net rate hikes every month since May 2018.

The job markets of both the UAE and Saudi Arabia are showing signs of faltering, the Emirates NBD Purchasing Managers’ Index indicates, with the index’s employment tracker in both countries at its lowest in ten and five years, respectively, Bloomberg reports. Although the UAE remains a strong economy (with growth anticipated to rise to 3.1% this year from 2.9% in 2018), the impact of lower crude prices and a weak real estate sector is being felt, especially in the non-oil private sector.

How’s that trade war working for you, Donald? Despite US President Donald Trump’s moaning about the “politician-made disaster” that is the trade deficit, on his watch, it rose to USD 891 bn — the largest it has ever been in US history— the Washington Post writes. A report from the Commerce Department underscores what numerous economic studies have been showing: that despite an increase in tariffs imposed on assorted foreign-made goods, imports have been pouring in and that, moreover, in many cases “it is the domestic consumers and purchasers of imports that bear the full cost of the tariffs.”

Enterprise+: Last Night’s Talk Shows

Foreign holdings in Egyptian treasuries climbed to USD 15.8 bn by end-February amid a surge in appetite and positive sentiment (watch, runtime: 01:44). We have more on this in our Speed Round, below.

New amendments to the Investment Act were not issued to resolve obstacles, but to offer incentives to investors to expand, General Authority for Freezones and Investment (GAFI) boss Mohsen Adel told Al Hayah Al Youm (watch, runtime: 06:51). The Cabinet approved the amendments yesterday. We also have more on this in the Speed Round.

Thomas Cook is looking to expand tourism cooperation with Egypt, CEO Peter Fankhauser told Tourism Minister Rania Al Mashat on the sidelines of the Tourism forum ITB Berlin, (watch, runtime: 03:50).

Speaking of tourism, Egypt’s tourism industry grew by 94.9% from 2013 to 2018, according to German tourism portal FVW, Masaa DMC’s Osama Kamal had the story (watch, runtime: 01:44).

The 1.5 mn feddan project got significant attention on the airwaves last night (watch, runtime: 02:41). West Minya is leading the project with 20k feddans that have been reclaimed (watch, runtime: 02:25) and (watch, runtime: 03:02). Also (watch, runtime: 03:30) and (watch, runtime: 03:12).

The Dutch embassy in Cairo launched earlier this week Start Egypt Up, an event aimed at supporting entrepreneurs, Yahduth fi Masr’s Sherif Amer highlighted (watch, runtime: 03:06).

Speed Round

Speed Round is presented in association with

Alabbar, Saudis gobble up 25% of shares on offer from Eastern Company stake sale: Emirati businessman and chairman of Emaar Properties Mohamed Alabbar, along with a number of unamed Saudi Arabian investors, have bought 25% of shares in the institutional offering of Eastern Company’s stake sale that took place last weekend, according to a statement from Sarie-Eldin & Partners picked up by Arabic Reuters. The investors paid EGP 400 mn to acquire the shares in the institutional offering, which was 1.8x oversubscribed, the law firm, which advised the investors on the transactions said. “Alabbar is keen to work with all of Eastern Company’s shareholders to boost shareholder value,” the statement said. The statement is another sign at the success of the share sale, and the ability of the state privatization program to draw in investors.

Eastern share sale rakes in EGP 1.7 bn: Both the institutional and public offerings of the company’s share sale raked in a total of EGP 1.7 bn, the EGX said on Wednesday. The public offering of the stake sale, which piloted the long-awaited state privatization program, was 4.27x oversubscribed, the EGX said on Tuesday.

Potential regional expansion on the horizon for Eastern Company? Alabbar is looking to obtain licenses to manufacture cigarettes and other tobacco products in the GCC and in Iraq, said the statement. This could hint at a regional expansion for the company down the road.

EXCLUSIVE- AfDB plans USD 1.2 bn of financing to Egypt in 2019 and 2020: The African Development Bank (AfDB) is planning to provide USD 1.2 bn in new funding to Egypt in 2019 and 2020, focusing on energy and development sectors, AfDB Egypt Country Manager Malinne Blomberg told Enterprise. The pan-African bank is currently in talks with the Egyptian government over a USD 500 mn loan that will go towards electricity spending to help “continue reforms and support the transformation of the electricity sector.” The bank’s board will decide on the loan this year. AfDB is also working on financing a rural sanitation project in Upper Egypt, as well as funding programs that provide technological training to university students, Blomberg said.

The lender praised Egypt’s economic reforms: Being the biggest recipient of FDI in Africa in 2018 shows how much progress Egypt has made with its reform program, Vice President for Regional Development, Integration and Business Delivery Khaled Sherif told us. “The reforms that have been undertaken were very difficult but were well-executed. We have been waiting for these reforms for decades and this speaks volumes to this government’s commitment to reforms.”

So what still needs to be done? Unlike the now resurgent tourism sector, exports didn’t flourish as much as needed, because most manufacturers’ supply chains and intermediate inputs still rely heavily on imported goods, Sherif said. That said, the government is doing a good job in starting a structural reform process by looking at each sector and identifying ways to help manufacture these inputs locally. Also, as the government gets fiscal reform out of the way, it needs to focus on increasing income to boost economy growth, Sherif said. This needs investments to grow, and increasing employment and consequently disposable income.

Is the AfDB backing our bid to count the informal economy as part of GDP? “We have been arguing that the GDP figure is too small and doesn’t reflect the size of the economy and obviously the reason for this is the very large informal sector that doesn’t register on the surveys of how much goods and services Egypt produce every year. We are trying to help the government to come up with a more correct number which will be significantly large,” Sherif said. When Nigeria did this in 2014, its GDP doubled. Sherif expects that we would see a significant change in GDP data in the coming two years, which would change how we view figures like the debt to GDP ratio, for example.

A delegation from the bank met with Prime Minister Moustafa Madbouly to discuss increasing cooperation and boosting intra-African trade, according to a Cabinet statement.

Foreign holdings in Egyptian treasuries up to USD 15.8 bn: Foreign investors held USD 15.8 bn of Egyptian treasury bills and bonds at the end of February, Finance Minister Mohamed Maait revealed on Wednesday, in a leap from January’s figures of USD 13.36 bn, Reuters reports. “That’s great news,” said Allen Sandeep, head of research at Naeem Brokerage, adding it signals foreign investors’ rebounding appetite for Egyptian debt. “That could mean that net foreign currency liabilities of banks have narrowed even more since January.” The CBE revealed that the average yield on 91-day Egyptian T-bills was 17.78%, with 17.85% for 182-day bills, 17.79% for 273-day bills, and 17.72% for 364-day bills. Meanwhile, the average yield on three-year bonds was 16.46% and 16.99% on seven-year bonds. All figures relate to T-bills and bonds issued on Tuesday.

EXCLUSIVE- VAT minimum registration requirements to be amended as an incentive to SMEs: The government is set to amend the minimum revenue required to register for VAT to spare SMEs from the burden of paying a VAT, a government official told Enterprise yesterday. The government plans to raise the minimum revenue requirement to EGP 1 mn, from a EGP 500,000 in the current version of the VAT Act. The move, which is part of a series of incentives for SMEs to join the formal economy, will require both an amendment to the VAT Act and will be enshrined in the upcoming SMEs Act, the source added. The Finance Ministry has concluded drafting the act and will review it before putting it up for a national dialogue ahead of introducing it to the House of Representatives. The source did not reveal the timeline for pushing through the SMEs Act or when the ministry plans to introduce the amendments to the VAT Act.

So how are SMEs to be taxed under this final draft of the act? SMEs whose topline is EGP 250,000 or less, will pay a flat tax of EGP 2,000. Those earning between EGP 251,000 and EGP 500,000 in revenues will pay an income tax of EGP 5,000. SMEs with revenues of EGP 501,000 and EGP 1 mn will have to pay a flat tax of EGP 10,000. These flat taxes will be reviewed and possibly revised every five years, the source noted. The ministry is also going to tax SMEs that own trucks with a haulage capacity of over 5 tonnes, the source added. They will have to pay 1% of the average annual haulage value per truck.

All back taxes before the law are forgiven, if you go formal: Other key features of the law, include exempting SMEs from any back taxes if they are registered and licensed within a year after the act becomes the law of the land, the source noted.

CABINET WATCH- Madbouly Cabinet approves amendments to the Investment Act: The Madbouly Cabinet approved on Wednesday amendments to the Investment Act that expand the application of the law. Under amendments to Article 12, any expansion to an already existing investment project is eligible for the incentives granted under the law, Investment Minister Sahar Nasr said. Amendments to Article 48 of the law seek to cap notary fees on contracts to EGP 10,000 in a bid to lower costs to investors, Nasr added.

Resurrecting the Ras Sudr airport? The cabinet also approved appropriating land for the development of an airport in Ras Sudr, according to a statement following the meeting. The EGP 2 bn zombie project had seen two tenders come and fail. Last we heard, there were discussions last October to issue a third tender for the project. Land will also be privatized and tendered in Ras Sudr to build resorts and tourism projects there.

INVESTMENT WATCH- MoneyFellows announces series A investment round: Fintech startup MoneyFellows is looking to raise EGP 50 mn in its series A investment round to finance expansion in Egypt and other MENA countries, according to an emailed statement. The company plans to rapidly expand its operations in Egypt this year and is looking to enter several other MENA markets in 2020. MoneyFellows is a secure online ‘money circle’ (gameya) platform which enables users to easily connect with each other and collectively save money.

M&A WATCH- FRA agrees to MTO announcement for Raya: The Financial Regulatory Authority (FRA) has agreed to publish El Pharonia for Real Estate Investment’s mandatory tender offer (MTO) announcement for Raya Holding for Financial Investments, it said in a statement (pdf). El Pharonia, owned by Raya Holding Chairman and CEO Medhat Khalil, aims to buy 36.7% (78.6 mn shares) of the company. The FRA ordered Khalil last year to submit an MTO for Raya, saying he and related parties control a combined 42% stake in the company, a percentage that requires an MTO under securities regulations.

M&A WATCH- FRA agrees to MTO announcement for Electric Cable: The Financial Regulatory Authority (FRA) has agreed to publish the MTO announcement for Electric Cable Egypt that was submitted by a consortium led by Pioneers Holding subsidiary Summu Investment, it said in a statement (pdf). The consortium, which includes Wadi Investment (which is 99.98% owned by Pioneers) and Flourish Investment, aims to acquire 41.46% (294.9 shares) of Electric Cable Egypt at EGP 1.35 per share. The consortium had submitted the MTO last month. Pioneers already owns 48.5% of Electric Cable through Summu, and would raise its stake in the company to 90% if the transaction goes through.

ECMA wants to scrap (or at least amend) the stamp tax: The Egyptian Capital Markets Association (ECMA) has submitted a request to the Finance Ministry to cancel the stamp tax, saying the levy imposes an extra burden on stocks traders and generates unsatisfactory tax revenue, ECMA head Mohamed Maher tells Al Mal. The association is also open to introducing amendments to the tax instead, and has presented a proposal for the potential amendments to the ministry before a scheduled increase in May.

Background: The stamp tax came into effect in 2017 with a 0.125% levy, which will rise to 0.175% this year. The levy earned the government EGP 700 mn in revenues from main market transactions excluding OTC trades in its first year. Sources told Al Mal that the total revenues from the tax reached EGP 1.5 bn since it was instated.

Up Next

AmCham is putting on a one-day entrepreneurship event on 11 March, “The Egyptian Dream,” in collaboration with the AUC School of Business, Mindsalike Network, the Entrepreneurs’ Organization and Endeavor Egypt.

A delegation of 50 Japanese companies is expected in Egypt between 10-12 March to sign several investment agreements and explore areas of cooperation for the development of technical industries, reports Egypt Today.

A consortium of Russian companies is expected to visit Egypt this month to explore investment and operational logistics in the Russian Industrial Zone area of the Suez Canal Economic Zone, reports the local press.

The gov’t will begin rolling out its debt control strategy this month. The four-year strategy aims to bring down Egypt’s public debt to 80-85% of GDP by the end of FY2021-22.

The Macro Picture

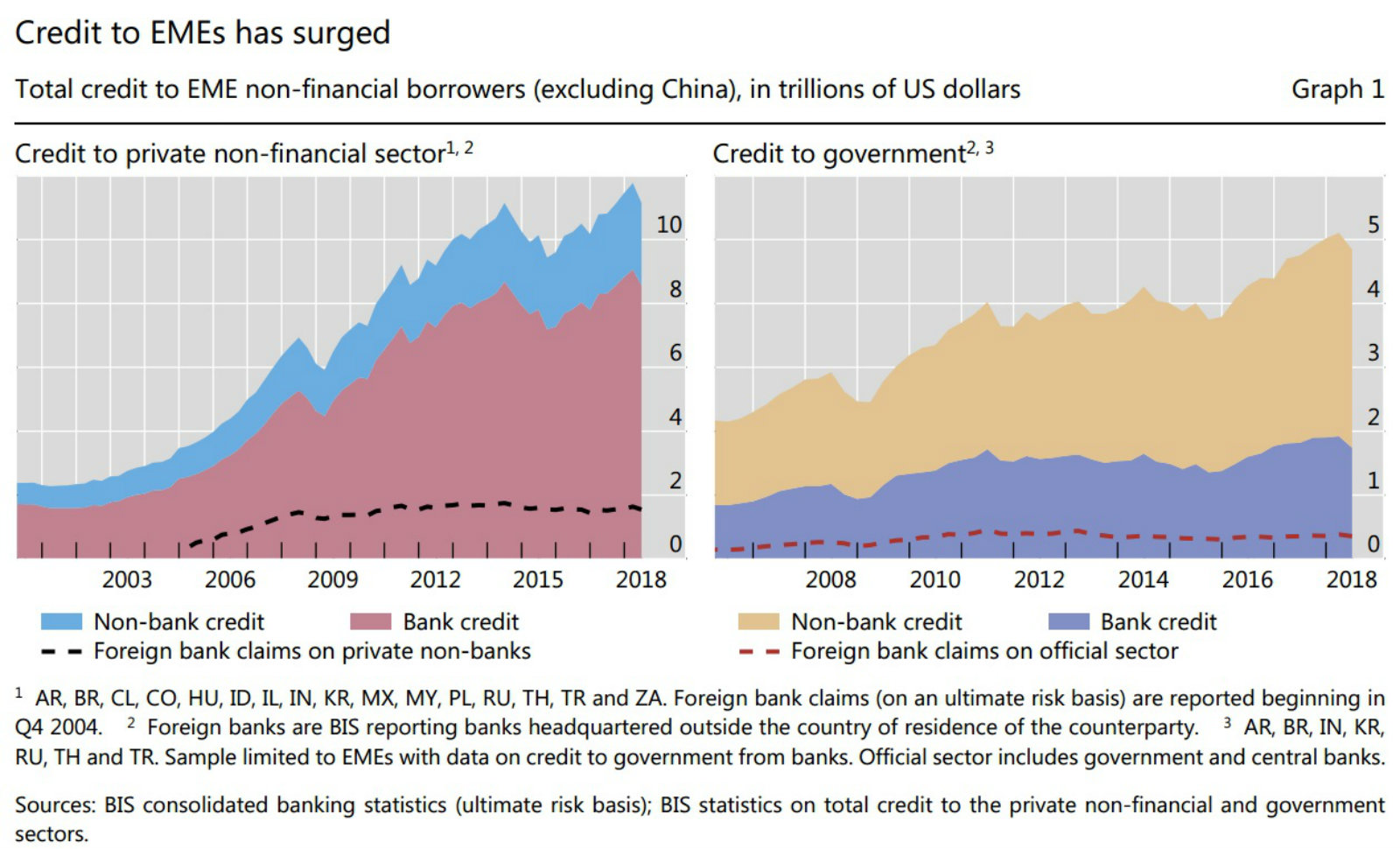

Credit to non-financial EM businesses is going through the roof: Borrowing by non-financial emerging market businesses has rapidly increased since 2008, according to research by the Bank of International Settlements (BIS). The bank’s quarterly review says that the banking sector continues to be the main source of credit — supplying 77% of the total in 2Q2018 — but non-banking lenders are expanding their role, increasing credit by an average 4.5% each year.

Non-financial businesses in EMs are becoming less reliant on foreign lenders for credit: Foreign bank credit to EM businesses has fallen to 19% in 2Q2018, from 28% of the total in 3Q2008. BIS says that stagnation in the aftermath of the 2008 financial crisis and increasing credit from local banks and non-banking lenders have contributed to the decline.

And this may be a good thing: “Excessive reliance [on foreign credit] can make EMEs vulnerable to foreign developments, with negative events leading to a contraction in credit and positive events fuelling a domestic credit boom that could potentially result in financial stress as it turns to bust,” the BIS says.

Having said that… The concentration of foreign entities lending to EM businesses has increased since the financial crisis, which has raised EM exposure to individual banking systems. Non-financial EM businesses source 70-80% of their overseas credit from just three foreign banking systems, while top ranked creditors provide 40% of the total foreign credit.

Image of the Day

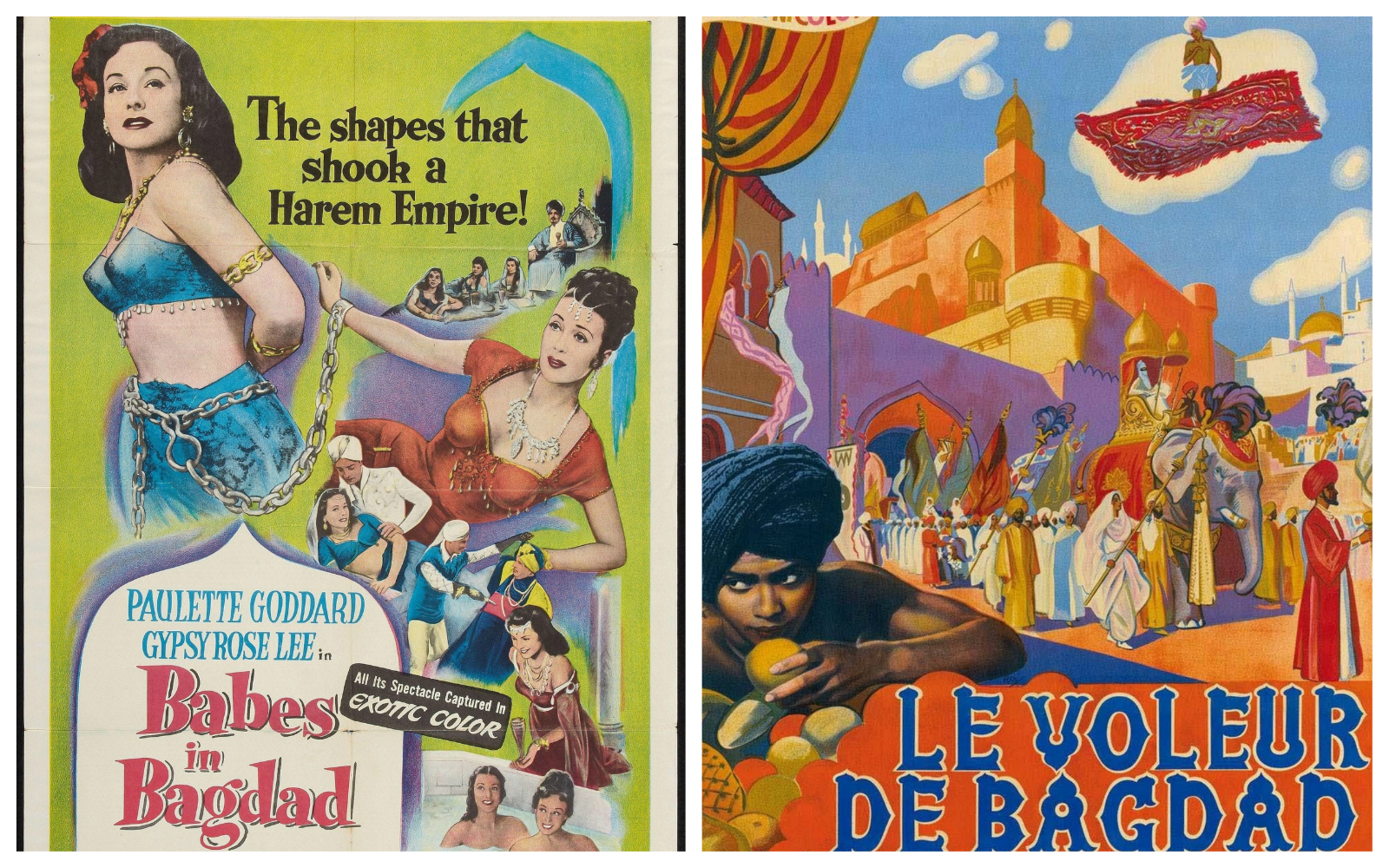

Beirut exhibit showcases Western films set in the Middle East in all their Orientalist glory: A Beirut exhibition of 10 movie posters set in the Arab world (most often Baghdad) is a visual representation of the stereotypes Hollywood holds near and dear, according to the National. “Thanks to the Orientalist fascination with One Thousand and One Nights, the Baghdad of these films is a place of total fantasy, filled with camels and elephants, flying carpets and genies, as well as heroes, villains and damsels waiting to be rescued or wooed.” We’re guessing the people who designed these movie posters are of the same variety who believe Agrabah is a real place.

Egypt in the News

Topping coverage of Egypt in the foreign press on was Amnesty International’s investigation into phishing attacks reportedly targeting dozens of activists. Amnesty alleges that the authorities are behind this phishing. The story was picked up by the Washington Post and France 24, among others.

On The Front Pages

Investment Act, wheat prices and a narcotics crackdown top front pages of the three state-run newspapers: The Cabinet’s approval of amendments to the Investment Act, new purchasing prices for local wheat, and stricter punishments for civil servants using narcotics topped the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Worth Reading

Is there a “destabilizing rift” between the Saudi king and crown prince? Rumors are circulating of a rift between King Salman bin Abdulaziz Al Saud and his volatile, reformist son Mohammed bin Salman (MbS), which reportedly started after the murder of journalist Jamal Khashoggi and then escalated dramatically during the king’s visit to Egypt in February, write Stephanie Kirchgaessner and Nick Hopkins in the Guardian.

Signs of trouble contradict claims that rumors are “baseless”: While the king and crown prince have reportedly disagreed before on matters of foreign policy, sources say that indications of a potential power struggle were in particular evidence during King Salman’s Egypt visit. Two “major personnel changes,” though planned, were signed off by MbS while the king was away and announced without his knowledge. So concerned was the king’s entourage about a potential threat to his authority, that a team of 30 loyalists was flown to Egypt to replace his existing security detail. Although a spokesman for the Saudi embassy in Washington has dismissed the rumors as “baseless” insinuations, at least one experienced analyst has said that they speak to “subtle but important signs of something amiss in the royal palace.”

MbS eager to forge his own path: Even those who believe MBS is seriously undermining his father’s rule agree on his push ahead with reform and to assert his authority where necessary. His recent visit to India, Pakistan, and China shows a “domestic political agenda in play,” Jonathan Fulton writes in the Washington Post. The traditional US role in the region has allowed a status quo to remain in place that prioritizes Saudi interests. Now, with US influence waning and the global economy becoming ever more focused on China and India, MbS’ trip suggests that, just as he is pushing for domestic economic diversification, so is he pushing for diversification in Saudi Arabia’s “diplomatic relationships.

Diplomacy + Foreign Trade

Inaugural meeting of the East Med seven took place yesterday: Representatives from the seven East Mediterranean countries held the inaugural meeting to form a regional gas market in Cairo on Wednesday, according to an Oil Ministry statement. The meeting, which included representatives from Egypt, Israel, Cyprus, Greece, Italy, Jordan, and Palestine, looked at the initial steps needed to bring about the market. The seven nations had reached an agreement back in January at the East Med Gas Forum to create a regional organization to help establish the market. It remains to be clear what the organization and alliance hopes to achieve, but its establishment and base in Cairo is yet another sign of Egypt’s emerging role as a regional gas hub.

Egypt criticizes “inaccurate” UN report on housing rights: A UN report on housing rights presented on Monday, with a special focus on findings in Egypt, has been heavily criticized and deemed “inaccurate” by the Egyptian Permanent Representative Ambassador at the UN in Geneva, Alaa Youssef, according to Ahram Gate. The report, issued by UN Special Rapporteur Leilani Farha, is the second such document to provoke condemnation from the Egyptian government after Farha’s visit to Egypt in October last year.

Foreign Minister Sameh Shoukry met with his Somalian counterpart Ahmed Eissa Awad in Cairo on Tuesday to discuss bilateral economic relations as well as security, with emphasis on boosting counter-terrorism efforts, reports Egypt Today.

Energy

FinMin mulling issuing letter of guarantee for Hamrawein coal plant

The Finance Ministry is set to meet next month with the China Development Bank (CDB) to discuss the latter’s offer to finance the USD 4.4 bn, 6 GW Hamrawein “clean coal” power plant ahead of issuing a letter of guarantee for the project, according to unnamed government sources. CDB is reportedly offering USD 3.7 bn in financing to the Egyptian Electricity Holding Company for the construction while the remainder is expected to come from local banks. The Egyptian government was said in October to have been seeking better terms from the CDB on the financing package. The construction of the plant was awarded to a consortium of Chinese companies including Shanghai Dongwei Electric Appliance Co. and Hassan Allam Holding.

Egyptian Electricity Transmission signs EGP 590 mn contracts

The Egyptian Electricity Transmission Co. (EETC) has signed two contracts worth EGP 590 mn to overhaul overhead electricity lines north of Cairo, local press reported. One contract was signed with Energya Power & Telecom Solutions and Energya Cables worth EGP 295 mn. The second contract was signed with the Egyptian Chinese Company for ultra high voltage transmission networks worth EGP 294 mn.

Egypt to offer three oil & gas exploration bid rounds this year

Egypt is planning to offer three oil & gas exploration bid rounds this year, Energy Minister Tarek El Molla told local press. EGAS will offer a bid round in the Mediterranean and EGPC will offer two bid rounds in the Western Desert, the Red Sea, and the Eastern Desert.

Infrastructure

Aqua Swiss to take part in desalination projects in Egypt

Military Productions Minister Mohamed Al Assar signed an MoU with Swiss desalination company Aqua Swiss, which would see the latter cooperate on the development of desalination plants across the country, according to a Cabinet statement. The statement implies that Aqua Swiss will be consulting on several of the ministry's desalination projects.

Basic Materials + Commodities

Government sets local wheat purchasing prices and procurement targets

The Supply Ministry announced the local wheat purchasing prices for this year ranging from EGP 655 per ardeb of purity 22.5 to EGP 685 per ardeb of purity 23.5, Supply Minister Ali El Moselhy said at a presser, according to Al Masry Al Youm The minister added that Egypt expects to procure 3.6 mn tonnes of wheat for the upcoming season starting in April, up from the 3.15 mn tonnes procured last year, reports Reuters.

Tourism

EgyptAir to run Cairo-Washington DC direct flights, starting June

EgyptAir will start running three weekly non-stop flights between Cairo and Washington DC from June 3, Ahram Online reports. The airline will use its newest fleet of Dreamliner B787-9 aircraft.

Banking + Finance

Sarwa Capital concludes EGP 760 mn PHD securitization

Sarwa Capital announced that it has concluded the EGP 760 mn securitization of Palm Hills Development’s receivables portfolio, which was made up of 670 delivered homes in the Golf View, Golf Extensions, Palm Hills Katameya Extension (1&2), Hacienda Bay and Hacienda White 2 projects. The receivables portfolio is currently valued at EGP 609 mn, Sarwa said in a press release on Wednesday (pdf). “In total to date, we have issued bonds for gross receivables of EGP 1.6 bn out of the c.EGP 5 bn program,” said Ayman El Sawy, managing director of Sarwa Promotion & Underwriting.

EGX committee asks UNB to speed up delisting procedures

The EGX listing committee has asked Union National Bank Egypt to expedite efforts to complete procedures for its delisting from the stock market by 30 June at the latest, it said in a statement (pdf). The committee urged the bank to purchase shares from affected shareholders at a fair value determined by an independent financial advisor. UNB agreed to a voluntary delisting last year.

Other Business News of Note

Madbouly meets with reps from 40 US companies

Prime Minister Moustafa Madbouly met yesterday with representatives from 40 US-based companies operating in Egypt to discuss expanding their investments and address hurdles they are currently facing, according to a cabinet statement. Some companies, including IBM, vowed to increase investments in Egypt, the statement says. No further details were provided.

Egypt Politics + Economics

Egyptian activists urge investigation into Qatar-backed terrorism in Libya

A cohort of Egyptian human rights advocates have urged the United Nations Human Rights Council (UNHRC) to investigate Qatar’s role in funding terrorism in Libya, Ahram Online reports. The group claims that Qatar stands in violation of UN global counter-terrorism strategy by backing armed terrorist groups such as the Ikhwan. The call for investigation came on the sidelines of the ongoing UNHCR session in Geneva. Qatar continues to face hostility from the GCC and Egypt over similar allegations levied back in 2017.

Government committee approves legalization of 156 churches

A government committee has approved the status legalization requests of 156 churches and their affiliated buildings, the cabinet said in a statement. The committee has now approved 783 churches since it was formed in 2016.

My Morning Routine

Emad Barsoum, founder and Managing Director of Ezdehar Management: My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions just for fun. Speaking to us this week is Emad Barsoum, founder and Managing Director of Ezdehar Management, a private equity fund manager investing in high growth businesses in Egypt.

My name is Emad Barsoum. If it weren’t for my lower back reminding me every once and a while that I’m in my mid-fifties, I would believe I was in my early thirties. As I’ve lived in so many places and held so many different roles, I now find it difficult to define myself in terms of the functions I perform or my citizenship. The thing that defines me the most now is being the father of two crazy kids.

I work with Ezdehar, a private equity firm focused on investing in Egyptian companies.

I’m an early riser, so I’m up by 5:00 am most days, and I haven’t used an alarm clock for decades. I start by going immediately to my iPad, checking the major news, international affairs, business and technology news, on Enterprise and my other favorite publications. Then it’s a look at my emails, to see if there are any important messages waiting that need my attention and a quick response. It’s good to get that out of the way early, without any distractions. Then I look at my schedule, to make sure I am ready for the meetings and events of the day, and to prepare myself for what’s happening over the next couple of days. It’s very important that I do this before going to the office, as it helps me focus on the objectives I’ve set for the days ahead and not get lost in distractions. I’m usually in the office by 8:00 am.

Most of my days are full of meetings, either with the management teams of the companies we’ve invested in, or with the new companies we’re considering to partner with. It’s a people-centered business, and I need to spend a lot of time with our existing and potential partners to be able to determine if and how we can help them, and whether we’re aligned in terms of our objectives. I also spend a lot of time with my team, discussing and debating what we have in the pipeline. We argue a lot, but it’s a blessing to work with such an amazing group of smart, humble, hardworking individuals.

I don’t watch TV at all — just the occasional movie from a streaming service — but I do read a lot of short articles about technology and industry.

Ezdehar started when I was given the opportunity to manage a holding company, with several operations and lines of business within the Orascom Telecom group. The lines of business weren’t all that arresting, and the countries of operation weren’t the easiest to operate in. But in a few years, we were able to grow the group to about 10 times its original size. In addition to having a supportive macro environment, the major factor behind this success was the teams who led these operations. Many of the developing markets we were operating in have a lot of potential, and the key to unlocking that potential was selecting the right leadership teams and giving them the institutional culture and work environment that would allow them to thrive. In turn, these teams had an amazing impact on the companies they were managing. Private equity (PE), I realized, was the best setup to have deep impact at scale, ideally leveraging your experience to contribute to the growth of many Egyptian companies. This is the ultimate goal that brought the team together to start Ezdehar.

I’m very optimistic about the developments taking place in Egypt’s legislative and economic climate. Having lived through several cycles and attempts at reform here, this one seems more serious and courageous than those of the past. From my perspective, given the circumstances and the challenges, the steps that have been taken on all fronts (whether related to currency, rates, infrastructure, or energy) are real moves in the right direction. In addition to this, the potential of the market in terms of its size and its growth is amazing. Overall, I think Egypt is a great investment destination for the medium term.

PE as a sector is not well understood in our region, especially because the scope of it varies considerably. It can range from investing 5% in a publicly traded company and having a totally passive role to owning 100% of a distressed asset and managing it completely. And then there’s everything in between. So it’s understandable that people not familiar with the sector can have a hard time figuring out what exactly our impact, role and responsibility is and where we fit in. We spend a lot of time trying to explain the benefits of having institutional investors and the positive impact this can have on strengthening a business and making it sustainable.

So the PE industry in our part of the world is not easy, and not many native fund managers have succeeded. This was unfortunately evidenced by the collapse of one of the major players: Abraaj. I feel that what sets Ezdehar apart is the quality of our team. Our place in PE is quite clear: we partner with companies to support them to grow. We’ll neither manage the company for them, nor will we be passive. We seek to achieve a fine balance and we spend a lot of time with our sponsors before undertaking any investment, to make sure that we’re aligned and have the same vision, and that both parties will be able to help each other to reach our targets. We’re very proud of the companies we’ve invested in so far, and are looking forward to being even more active in the coming period.

As investors, we’re impacted by the disruptions that occur in the industries we invest in, and this adds to the complexities that fund managers face. I’m particularly concerned by rapid technological changes and how they will impact us here.

The purpose of free time is that it’s really free time, which for me means that you don’t do much. Sometimes I just sit in the garden in the sun, and watch the trees, the birds and the stray cats. I also sometimes watch absorbing movies, which acts like meditation, transporting one’s attention to a totally different world. And of course the kids are a huge focus. I’m often trying to spend some quality time with them, while driving them from one activity to the other.

The best piece of business advice I’ve ever been given? Speak from experience or keep learning.

Besides using the old-fashioned paper and pen on my desk, which is constantly updated with my to-do list, I use Microsoft tools that allow me to write my to-dos anywhere in my quest to stay organized. Of course, this means that I then find the to-dos appearing on my phone, my computer and my iPad at all hours. It also seems that I have implanted in my brain a version of the to-do list, and I’m not sure if this is a curse or a blessing. Sometimes it’s both.

The Market Yesterday

EGP / USD CBE market average: Buy 17.43 | Sell 17.53

EGP / USD at CIB: Buy 17.43 | Sell 17.53

EGP / USD at NBE: Buy 17.43 | Sell 17.53

EGX30 (Wednesday): 14,643 (-0.6%)

Turnover: EGP 845 mn (8% below the 90-day average)

EGX 30 year-to-date: +12.3%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.6%. CIB, the index heaviest constituent ended down 0.8%. EGX30’s top performing constituents were Palm Hills up 2.2%, Pioneers Holding up 2.1%, and Egyptian Resorts up 2.1%. Yesterday’s worst performing stocks were Ezz Steel down 3.0%, Heliopolis Housing down 1.9% and Egypt Kuwait Holding down 1.8%. The market turnover was EGP 845 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +99.2 mn

Regional: Net Long | EGP +466.0 mn

Domestic: Net Short | EGP -565.3 mn

Retail: 18.5% of total trades | 20.6% of buyers | 16.4% of sellers

Institutions: 81.5% of total trades | 79.4% of buyers | 83.6% of sellers

WTI: USD 56.16 (-0.11%)

Brent: USD 65.99 (+0.20%)

Natural Gas (Nymex, futures prices) USD 2.85 MMBtu, (+0.18%, Apr 2019)

Gold: USD 1,287.50 / troy ounce (-0.01%)

TASI: 8,534.16 (-0.32%) (YTD: +9.04%)

ADX: 4,977.19 (-2.17%) (YTD: +1.26%)

DFM: 2,626.13 (-0.40%) (YTD: +3.81%)

KSE Premier Market: 5,596.45 (+0.44%)

QE: 9,884.21 (-1.26%) (YTD: -4.03%)

MSM: 4,153.42 (-0.30%) (YTD: -3.94%)

BB: 1,410.83 (-0.25%) (YTD: +5.50%)

Calendar

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.