Borrowing by emerging market businesses is going through the roof

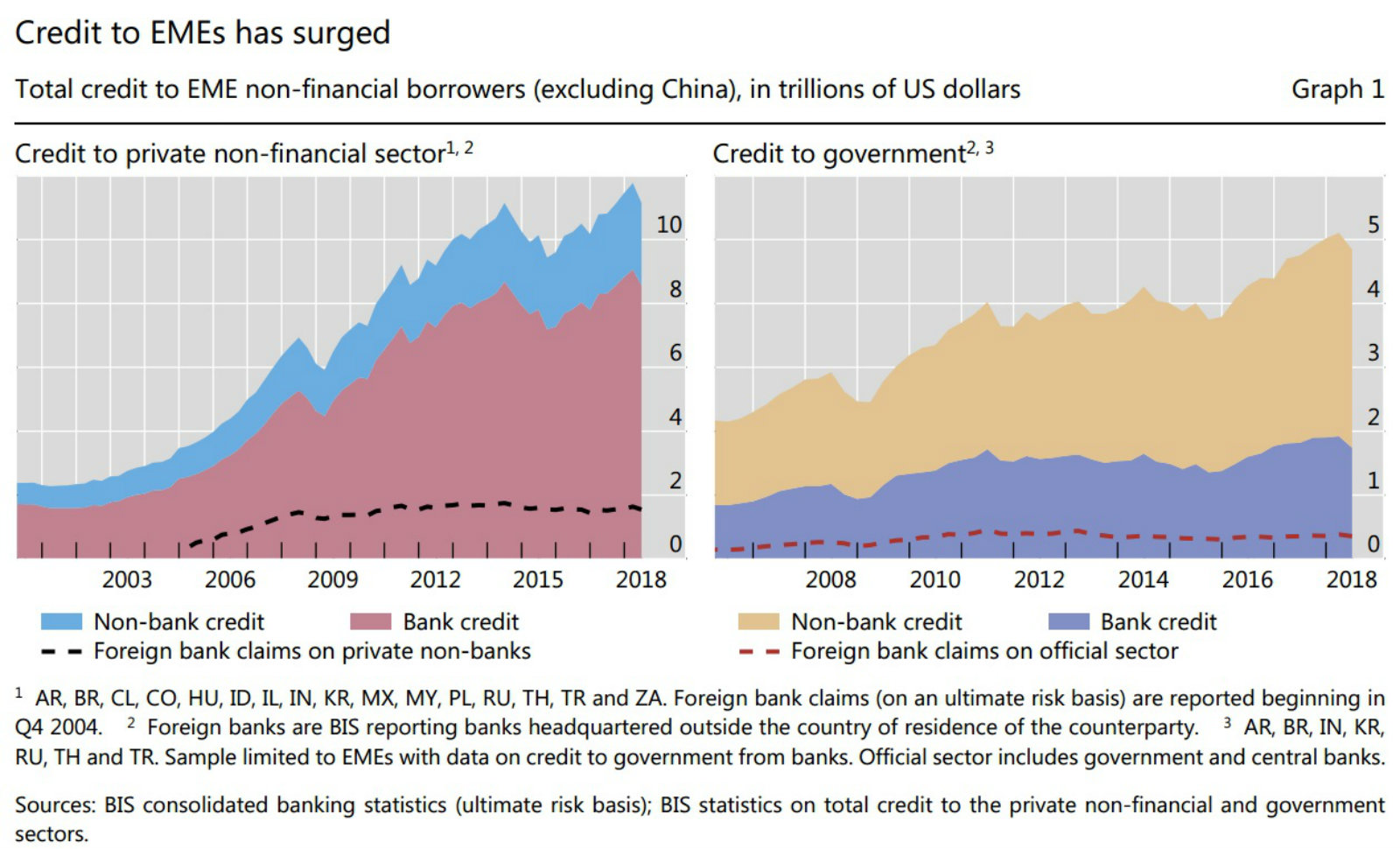

Credit to non-financial EM businesses is going through the roof: Borrowing by non-financial emerging market businesses has rapidly increased since 2008, according to research by the Bank of International Settlements (BIS). The bank’s quarterly review says that the banking sector continues to be the main source of credit — supplying 77% of the total in 2Q2018 — but non-banking lenders are expanding their role, increasing credit by an average 4.5% each year.

Non-financial businesses in EMs are becoming less reliant on foreign lenders for credit: Foreign bank credit to EM businesses has fallen to 19% in 2Q2018, from 28% of the total in 3Q2008. BIS says that stagnation in the aftermath of the 2008 financial crisis and increasing credit from local banks and non-banking lenders have contributed to the decline.

And this may be a good thing: “Excessive reliance [on foreign credit] can make EMEs vulnerable to foreign developments, with negative events leading to a contraction in credit and positive events fuelling a domestic credit boom that could potentially result in financial stress as it turns to bust,” the BIS says.

Having said that… The concentration of foreign entities lending to EM businesses has increased since the financial crisis, which has raised EM exposure to individual banking systems. Non-financial EM businesses source 70-80% of their overseas credit from just three foreign banking systems, while top ranked creditors provide 40% of the total foreign credit.