- Income Tax Act amendments to impose 10% capital gains tax on all corporates. (Speed Round)

- FX reserves fall for first time since the EGP float. (Speed Round)

- 95 octane fuel could move up or down 10% thanks to the IMF-imposed new price mechanism. (Speed Round)

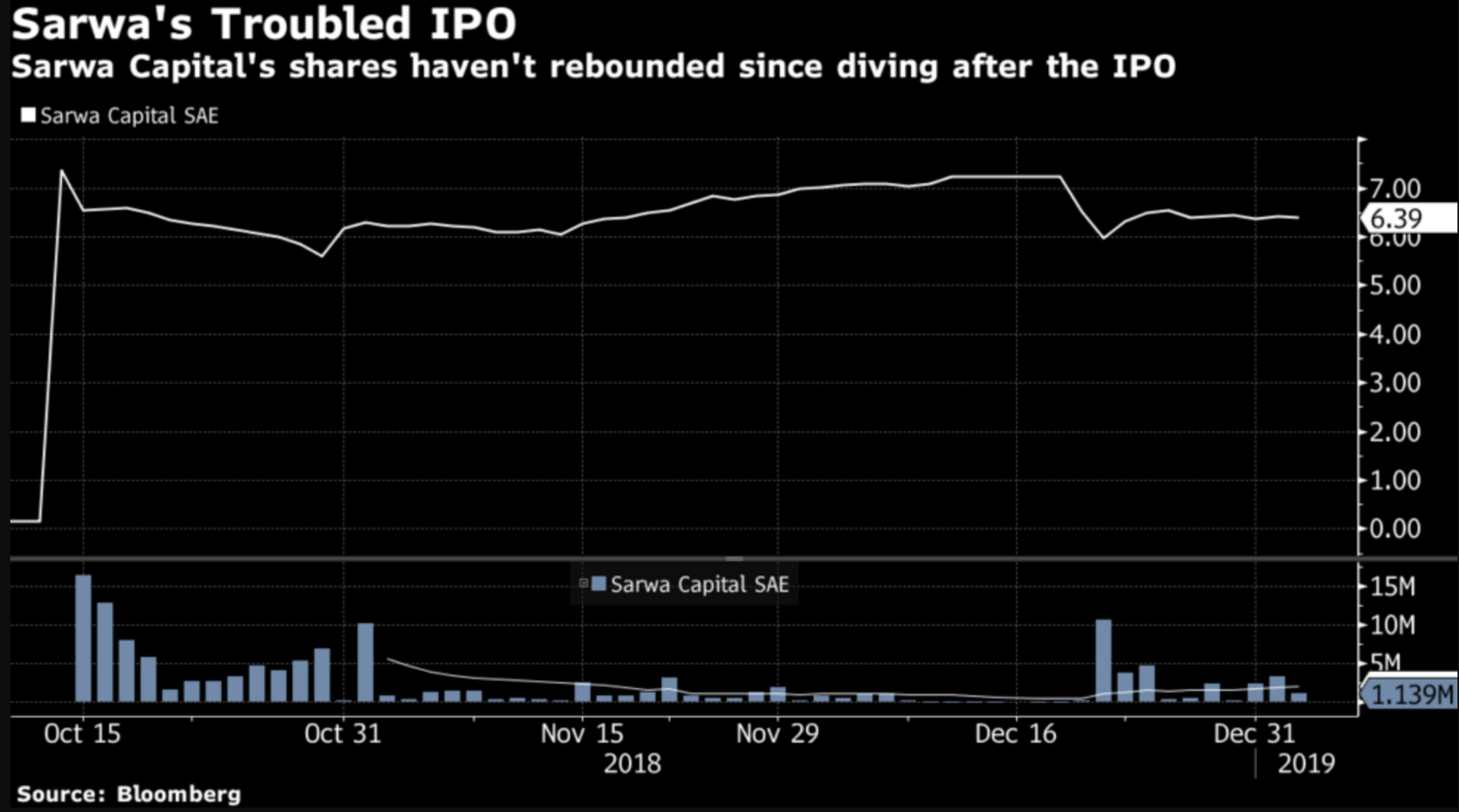

- FRA looking to file criminal case against Beltone officials over Sarwa IPO. (Speed Round)

- AMOC have decided to hold off on the sale of a 20% stake on the EGX until the company’s profitability rebounds. (Speed Round)

- Insurance Act to substantially increase minimum capital requirement for insurance companies. (Speed Round)

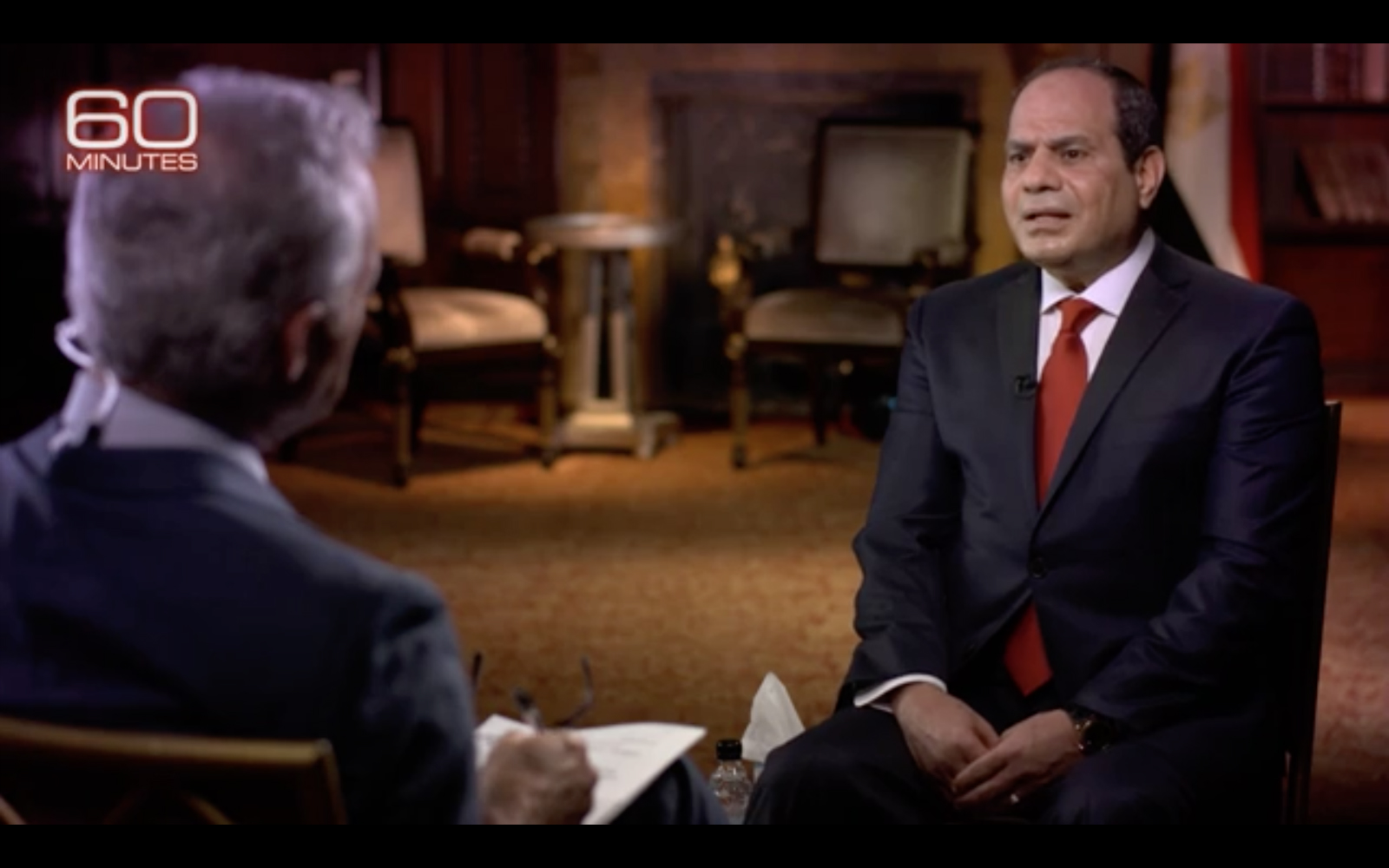

- President El Sisi talks terrorism, Ikhwan, political prisoners in CBS 60 Minutes interview. (Speed Round)

- Emerging markets off to an amazing start in 2019. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 8 January 2019

10% capital gains tax for all.

TL;DR

What We’re Tracking Today

The New Year holiday lull is over, with major announcements and key important news covering business, politics, legislation and regulation and international politics coming in over the past two days. Some of the the key highlights include, FX reserves have fallen, A new capital gains tax on corporations is upon us, the EGX approving market makers regs, AMOC postponing its share sale, and the Financial Regulatory Authority pursuing criminal charges against Beltone Financial. We have all these stories and more in the Speed Round below. Welcome back, everyone and it looks to be an exciting 2019.

The year is already off to an exquisite start for emerging markets. The MSCI currency index rose to its highest level since July 2018, according to Bloomberg. Furthermore, investors last week pumped USD 1.4 bn into emerging-market stocks and bonds ETFs. Stocks across the board are seeing gains.

That includes Middle East stocks, with Sunday seeing all of the region’s indices closing on a positive. The EGX30 rose 0.6% on Sunday after falling 13.2% in 2018. But the big winners in this jump has to be Saudi Arabia and Israel. Israeli stocks were on track for their biggest gain since August 2015 as all companies of its main index advanced, according to Bloomberg. Saudi’s main index scored their steepest gains in a month to become the second best performing index at the start of the week.

This comes as leading banks are expecting EM debt sales, including from Egypt, to ratchet up 15%. Morgan Stanley’s EM sovereign credit outlook for 2019 expected international bond issuance to rise 15% to USD 158 bn from the previous year, remaining below the USD 674 bn it raised in 2017. Saudi Arabia and Indonesia are expected to be the top issuers, with each raising USD 10 bn in 2019, followed by Abu Dhabi and Kuwait. Egypt will issue international treasury bonds “sooner than later,” Morgan Stanley strategist Simon Waever predicted, according to Reuters. “The Philippines has already announced a benchmark 10y bond deal, and we think that Egypt, Oman and Mexico are likely to issue sooner rather than later,” Waever said, pointing out that historically 17% of total issuance happen in the first month of the year. Finance Minister Mohamed Maait said last month that the government would unveil its international bond issuance plans for 1Q2019 in January.

And you can thank Jerome Powell for this renewed interest in EMs following a hard 2018, which we have (only slightly) described as apocalyptic. The US Federal Reserve Chairman said last week that the Fed would take a “patient” approach to monetary policy tightening after “US data seem to be on track to sustain good momentum into the new year.” He added that policy makers are “listening carefully” to markets, denting the dollar and boosting the allure of riskier investments.

We shouldn’t pop the champagne bottles just yet, according to the ever-present and gloomy naysayers. “The bears will point to how quickly the gains at the start of last year evaporated,” writes Bloomberg’s Justin Carrigan. The FT’s Han Trang, meanwhile, is telling us that EMs are ageing faster than initially hoped. This “premature ageing” is reflected both literally, with the labor force outside of Africa and India declining, and figuratively, as the trend for slower productivity in EMs shows signs of resuming. Nonetheless, in the short and medium term, the fundamentals of EMs appear sound.

On the global front, a figure who contributed to the financial crisis has reared his unpleasant head to warn of a recession in the offing. Former US Secretary of the Treasury Lawrence Summers — whose fight to keep the US derivatives market unregulated helped bring about the crisis — is saying in an oped in the FT that indicators in the US, China and others are making it to that “the overall judgment of financial markets is that recession is significantly more likely than not in the next two years.”

Rami Malek wins big in Golden Globes: Egyptian-American Actor Rami Malek has won Best Performance by an Actor in a Motion Picture — Drama for his role as Freddie Mercury in Bohemian Rhapsody in this year’s Golden Globes. Malek made a special reference to Queen band members Brian May and Roger Taylor — who were present during the ceremony — and dedicated the award to the late Mercury himself (watch his acceptance speech here, runtime: 06:23). The biopic was also selected Best Drama Motion Picture. Malek was among six other actors “of color” to snatch Globes this year, said the New York Times, who called the event one with “a diverse slate of winners.”

Others who took home trophies: Glenn Close, meanwhile, won Best Performance by an Actress in a Motion Picture — Drama, for her role in The Wife. Christian Bale and Olivia Colman were hailed as best performers in the Musical/Comedy Movie category. Other notable winners include Michael Douglas and Rachel Brosnahan.

Other global headlines worth noting include:

- World Bank president Jim Yong Kim abruptly resigned after three years at the helm. His last day is 1 February (FT).

- US national security adviser John Bolton is suggesting that the Trump Administration may pull an about face on its Syria withdrawal (FT).

- Another Brexit vote is expected next week Tuesday, after UK Prime Minister Theresa May signalled some concessions from the EU are coming (FT).

Enterprise+: Last Night’s Talk Shows

Dominating the airwaves was the new fuel pricing mechanism that the government will impose on 95 octane gasoline come April (scroll down for the full story in this morning’s Speed Round). There was not much else from the airwaves last night.

Masaa DMC also hosted the family of Mohamed Abeed, the officer who was killed during an attempt to defuse a bomb in Nasr City on Saturday (watch, runtime: 09:59). Adib said Abeed’s friend died grieving him (watch, runtime: 02:35).

Speed Round

LEGISLATION WATCH- Income Tax Act amendments to impose 10% capital gains tax on all corporates: Proposed amendments to the Income Tax Act would impose an across-the-board 10% capital gains tax on listed and privately held companies alike, House Planning and Budgeting Committee Chair Yasser Omar said. As it currently stands, the law imposes a 22.5% capital gains tax on unlisted companies, while listed corporations are subjected to a 10% tax. However, the levy for listed companies is currently on hold until 2020, after the Mehleb government backtracked in 2015 on plans to impose the tax from retail investors. The amendments to the Income Tax Act — which the committee is expected to begin discussing sometime this week with Finance Ministry officials — would essentially level the playing field between listed and privately held companies.

Amendments could be well-received: The move would likely spur M&A activity by reducing the cost of these transactions for privately held companies, Shalakany Law Office Senior Partner Emad El Shalakany said. The Egyptian Capital Markets Association (ECMA) had also said back in June that it may be receptive to scrapping the current stamp tax on EGX trades and instead implementing the capital gains tax. The lobby group said at the time it would push for a new framework for the tax that would address the issues which made the initial implementation of the tax “unbearable” to investors.

Background: The proposed amendments to the Income Tax Act, which were approved in principle in November, would also affect how corporations’ income from holdings of government debt is taxed, Finance Minister Mohamed Maait said last month. The amendments could also see some banks looking at a double-digit increase in effective tax rate. Banks would be required to split their books, separately accounting for income earned from holdings of government debt. The new, higher effective tax rate will be a result of the aforementioned splits — which will widen the bank’s taxable income — despite no change in income tax rates.

Foreign reserves have fallen for the first time in two years: Egypt’s net foreign reserves fell in December for the first time since the currency float, coming at USD 42.551 bn fromUSD 44.513 bn at the end of November, the CBE said yesterday. The fall is attributed to year-end interest payments made to foreign treasury bill investors, as well as other interest payments and arrears owed to other countries, CBE Sub Governor Rami Aboul Naga told Youm7.

Could the delayed disbursal of the IMF loan have something to do with this? Naeem Brokerage head of research Allen Sandeep told Reuters that receiving the fifth tranche of the USD 12 bn IMF fund facility will be reflected in the January figure, sending foreign reserves back to their end-November levels. Agreeing with Sandeep, Alia Mamdouh, director of macro and strategy at Beltone Financial, said “I don’t think it’s alarming because we are expecting the tranche to be disbursed in January, and 5 bn EUR bonds are expected to be issued in the first half of this year.” Backing the sub governor’s comments, Mamdouh also pointed out that the CBE had to pay USD 3 bn in liabilities in December.

95 octane fuel could move up or down 10% thanks to new price mechanism: The price of 95 octane gas may fluctuate up or down by 10% when the a new pricing mechanism that pegs it to the global market comes into effect in April, according to a government decree establishing the committee that will manage mechanism published in the Official Gazette. That grade of gasoline is no longer subsidized. The new pricing committee, which will include representatives from the oil and finance ministries, will be in charge of issuing quarterly recommendations based on Brent crude and the exchange rate. The Oil Ministry will proceed based on the recommendations, which will aim to ensure the efficiency of the pricing mechanism and tie up any loose ends.

New pricing mechanism to be applied to other fuel grades, an unnamed official had told Bloomberg. The government plans to extend the pricing mechanism for other grades in June after it lifts subsidies, effective in September.

Price won’t necessarily change in April: The price could just stabilize, Oil Minister Tarek El Molla told Reuters. “This does not mean an increase in price during the second quarter of this year,” he said. “The price may fall or rise or stabilise at its current rate.” The price of 95 octane gasoline will remain the same until 2Q2019 and potential cuts or raises will not exceed 10%.

Not if Saudi has anything to say on the matter: Meanwhile, Saudi Arabia is showing us again that what is good for some EMs is not good for others, as it plans reduce crude exports by up to 800,000 bbl/d from November levels. The oil exporter is hoping to see prices reach USD 80/bbl, according to the Wall Street Journal. The spike in all prices to USD 80/bbl last year had contributed to a strain in Egypt’s budget. Brent crude had gained 2% last Friday to 57.06/bbl, they’re highest since 19 December, following OPEC cuts.

Background: Disbursal of a USD 2 bn tranche of the IMF extended fund facility to Egypt had reportedly been delayed from December to January because the multinational organization was waiting for Egypt to announce plans to implement the mechanism.

The Oil Ministry is in full damage mode, as the story has been the biggest thing on the airwaves. Oil Ministry Spokesman Hamdy Abdel Aziz told Al Hayah Al Youm’s Khaled Abu Bakr that the mechanism will mean that 95 octane, a gasoline grade only used by 4% of the population, will be pegged to international prices (watch, runtime: 06:06). Abdel Aziz also told Hona Al Asema that the 10 percent average is meant to protect the people’s interest (watch, runtime: 05:47). The spokesman also phoned Masaa DMC's Eman El Hosary (watch, runtime: 02:56) to discuss the same ordeal.

FRA looking to file criminal case against Beltone officials over Sarwa IPO: The Financial Regulatory Authority (FRA) is looking to file a criminal case against officials at Beltone Financial’s brokerage and investment banking arms over alleged irregularities in the IPO of Sarwa Capital, according to statements from the FRA presented to the Administrative Court last week, according to Youm7. The FRA has requested that the Financial Affairs Prosecution to look into the alleged wrongdoing and determine which individuals would be brought to trial.

Background: Beltone and the FRA have been butting heads over Beltone’s management of Sarwa’s IPO, which saw the structured- and consumer-finance player’s shares plunge on the first day of trading, prompting an investigation into the transaction. Beltone has denied the allegations with some backup coming from Misr for Central Clearing, Depository & Registry and the Egyptian Capital Markets Association. Sarwa’s shares have yet to recover “to anywhere close to the IPO price … even after Beltone’s parent company Orascom Investment Holding bought a 30 percent stake in the company,” Bloomberg notes.

Did FinMin really blame the Sarwa IPO for the delay in the state privatization program? The FRA also claims that it received a written statement from the Finance Ministry suggesting that the downslide in the Sarwa IPO was motivator behind the delay in the state IPO program.

AMOC shareholders decide to postpone stake sale until profitability restored: Shareholders in the Alexandria Mineral Oils Company (AMOC) have decided to hold off on the sale of a 20% stake on the EGX as part of the state privatization program until the company’s profitability rebounds, an unnamed government source tells Al Shorouk. According to the source, AMOC’s profits dropped 37.1% y-o-y during the first quarter of the current fiscal year. The government committee overseeing the privatization program is currently looking into whether to push AMOC’s sale to the second wave of companies or eliminate it from the program altogether if shareholders continue to object.

Background: The government had initially planned for AMOC to pilot phase one of the state’s privatization program in October alongside Eastern Company. AMOC’s stake sale had been expected at the time to raise EGP 2.8 bn in proceeds, the Finance Ministry said in September. The sale of an additional 4.5% share of Eastern Company on the EGX had been put on ice in October after its share price took a nosedive amid the emerging markets selloff. Public Enterprise Minister Hisham Tawfik said last month that a revised timeline for the first phase of the program has yet to be determined and will depend on the performance of both the EGX and of emerging markets generally in the coming period.

LEGISLATION WATCH- Insurance Act to substantially increase minimum capital requirement for insurance companies: The new Insurance Act would raise the minimum requirement for the issued and paid-in capital of life and property insurance companies by 150% to EGP 150 mn, according to details of the law that leaked on Sunday, courtesy of Al Mal. Property insurance companies would have to tack on an additional EGP 300 mn to that figure if it plans on providing insurance in the aviation industry or fuel hedging services. Reinsurance companies, meanwhile, would see their minimum capital requirements jump 733% to EGP 500 mn, from a current EGP 60 mn.

Other elements of the draft: If passed, the bill would also double the ceiling for life insurance payouts to EGP 80,000, from EGP 40,000 currently. The draft also confirms earlier reports that the insurance cover for public gatherings and venues (such as malls and concerts) would be made mandatory under the bill. The draft law would also require individuals with liability-prone professions (such as doctors and architects) to obtain liability insurance.

Background: The Financial Regulatory Authority (FRA) had announced last year that it was drafting a new Insurance Act that would make it the primary regulator for the sector, governing everything from the establishment and licensing of insurance companies, to setting best practices and industry standards, and regulating transactions, contracts, and policies. FRA deputy head Reda Abdel Moaty had said last month that the authority would submit the bill to its board for approval and present a final draft to the Madbouly Cabinet by the end of the month.

LEGISLATION WATCH- Regs for granting IDA independence from Trade Ministry ready by month-end: The Industrial Development Authority is planning to finalize by the end of this month the draft executive regulations for recently passed legislation granting the authority operational autonomy, a source from the IDA told Amwal Al Ghad. The legislation will make the IDA independent from the ministry, able to allocate land to industrial investors and award industrial permits and licenses. It will also establish a fund to promote industrial activity, for which the IDA will be responsible.

INVESTMENT WATCH- The authority targets EGP 30-40 bn of new investments: This comes as the IDA targets between EGP 30-40 bn in fresh investments throughout 2019. “We are looking to tender 15 mn sqm of land to willing investors,” a source told the local newspaper, adding that 3 mn sqm will be offered under the industrial development framework. The tender pipeline includes 6 mn sqm in Sadat City, 4 mn in Borg El Arab and 5 mn across Upper Egypt. The authority is also planning to complete 13 industrial complexes for small and medium textile, food, chemicals and engineering projects in 2019. Tenders for four of the complexes — located in Alexandria, the Red Sea, Aswan and Beni Suef — will be launched in 1H2019.

MOVES- Emaar Misr has tapped Moustafa Mounir Moustafa El Kadi (LinkedIn) as the company’s new CEO, according to a company disclosure (pdf). Former CEO Mohamed El Dahan’s resignation, which he had submitted over the weekend, was approved by the company’s board of directors.

El Sisi talks terrorism, Ikhwan, political prisoners in CBS 60 Minutes interview: Egypt has been cooperating with Israel in the sweeping anti-terrorism campaign in Sinai, which is necessary to allow Egypt’s Air Force to cross into Israeli airspace, President Abdel Fattah El Sisi said in an interview on CBS’ 60 Minutes.

El Sisi defended Egypt’s efforts to wipe out terrorism in the peninsula — and the US providing some USD 1.3 bn per year in military aid to support these efforts, saying that the US is “investing in security and stability in the region.” Alluding to the difficulty in completely quashing a militant insurgency, the president said that the US failed to defeat terrorism in Afghanistan “after 17 years and spending USD 1 tn.” The statement comes amid reports that the US House of Representatives wants to maintain a USD 300 mn freeze on military aid to Egypt.

The president also denied that Egypt has political prisoners or prisoners of opinion, saying that those who organizations such as Human Rights Watch count as such are a minority trying to impose their extremist thoughts on the rest of the country. Referencing the Ikhwan, El Sisi said that Egypt would “welcome them to live among the people” if they were not violent or trying to “destroy the Egyptian economy.” Host Scott Pelley also spoke to US citizen and former Islamist prisoner Mohamed Soltan about his arrest during the Raba’a sit-in and his time in prison, where he alleges he was “systematically” subjected to inhumane conditions.

You can watch the full interview here (runtime: 13:41) or read a transcript here.

The interview is guiding the conversation on Egypt in the foreign press, with the discussions being largely focused on the cooperation between Egypt and Israel and reports that Egypt tried to prevent the interview from being aired. Reuters says El Sisi’s confirmation that Egypt’s military is cooperating with Israel is a “rare acknowledgement” of what “can be a sensitive topic in Egypt.” The FT’s Heba Saleh is noting CBS’ allegations that the government attempted to have the interview pulled.

Israel to seek USD 250 bn from Egypt, other Arab countries, for Jewish assets: Cooperation on Sinai, however, does not mean that Israel won’t try to reign in the worst impulses of hardliners in the Israeli government. Israel is trying to reclaim back USD 250 bn-worth of assets left behind by Jewswho fledor were forced out of Egypt and other Middle Eastern countries during the rise of the Israeli state, Bloomberg reported. The Israeli government has hired an international accounting firm to put a number on the lost assets amid expected US backing, the newswire cited a report by Israel’s Hahadashot TV as saying. Israel will reportedly seek USD 50 bn from Tunisia and Libya and USD 200 bn from Egypt, Morocco, Iraq, Syria, Iran and Yemen. No further details were provided.

Two German-Egyptians have gone missing while visiting the country last month, German Foreign Ministry Spokesman Christofer Burger said yesterday, according to the AP. One case involves an 18-year-old who hasn’t been heard of since 17 December and another a 23-year-old who was detained at Cairo International Airport on 27 December. The former was due to board a Luxor-Cairo flight to visit his grandfather. The German government has launched an investigation into the cases.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

LEGISLATION WATCH- The Social Solidarity Ministry will present a draft of the new Social Welfare Act to the House of Representatives “within days,” Minister Ghada Wali said on Sunday, according to Al Mal. The bill, if passed, would require the government to provide families eliminated from the Takaful or Karama social welfare programs. It would also see the introduction two new cash subsidy programs — Igatha and Forsa — in addition to amending the overall framework governing social welfare and pensions programs, Deputy Social Solidarity Minister Nevine El Kabbag had said in October. Kabbag said at the time that the ministry would present the draft act to the Madbouly Cabinet as soon as ministry officials complete their final review of the bill.

Supply Minister Ali El Moselhy will present his ministry’s food security strategy to the Madbouly Cabinet “soon,” the minister said at a press conference on Sunday, according to a local source. The new strategy will track the country’s commodity production and consumption rates to able crop production forecasts and better anticipate shortages. The ministry expects the new strategy to reduce the country’s EGP 50 bn wheat subsidy bill by 10-15%, according to El Moselhy.

Are we hosting the African Cup of Nations? The football supremos at CAF will reveal tomorrow whether Egypt or South Africa will host this year’s African Cup of Nation.

Egypt, Sudan begin trial runs on electricity grid connection project in three weeks: Egypt and Sudan will begin trial runs for the first phase of a USD 60-70 mn electricity interconnection project in two weeks at a capacity of 100 MW, local news reported. A government source said 95% of the project has been completed.

A government committee mandated with defining Egypt’s informal economy is set to meet for the first time this month. The committee’s work comes in light of the Madbouly government’s bid to convince the World Bank and the IMF to agree to include the informal economy in calculations of Egypt’s GDP.

Bond issuance plans to be made clear this month: Finance Minister Mohamed Maait said last month that the government would unveil its international bond issuance plans for 1Q2019 in January.

Egypt in the News

Attempted church bombing, house of worship inauguration tops coverage: Topping coverage of Egypt is the death of a policeman who was killed last Saturday while trying to defuse a bomb that was found near a church in the district of Nasr City. The story was picked up by the BBC, the Associated Press, and the UK’s Express. The attack came two days before Coptic Christians celebrated their Christmas yesterday, and a day before President Abdel Fattah El Sisi inaugurated a massive church in the new capital. A number of leading international media outlets took note of the inauguration the day after the attack, including France’s AFP, the BBC, Bloomberg and Euronews.

On The Front Pages

President Abdel Fattah El Sisi wishing Coptic Christians a Merry Christmas is dominating the front pages of the country’s three main state-owned dailies (Al Ahram | Al Akhbar | Al Gomhuria). The inauguration of a massive mosque and church in the new capital city also got some attention on Al Gomhuria.

Diplomacy + Foreign Trade

PA pulls staff from Rafah border crossing: The Palestinian Authority has reportedly withdrawn its staff from their posts on the Ratah border crossing into Egypt, the BBC reported, citing a statement blaming Hamas for aggression towards PA employees. Following the move, reports came out that Hamas has actually regained control of the crossing. The PA took control of the crossing in 2017, after an Egypt-brokered reconciliation agreement. Egypt has closed the Rafah border crossing as a result. France24 also has the story.

Energy

Companies looking to invest USD 500 mn in wind power in Egypt

Three unnamed Arab energy companies are looking to invest USD 500 mn to build 400 MW-worth of wind power plants on a combined land area of 80 sqm in unspecified locations, sources from the New and Renewable Energy Authority said. The companies, which submitted formal requests for land, are currently operating in Aswan’s Benban solar complex.

Infrastructure

El Araby to develop logistics zones across four Egyptian cities

El Araby Group subsidiary El Araby Company for Trading and Manufacturing is developing logistics zones in four different cities, New Urban Communities Authority (NUCA) Co-Head Tarek El Sebai said. The zones appear to be large storage facilities with a combined area of 208.5 sqm. The largest is located in Sadat City, with an area of 40 feddans (or 168k sqm). Other, smaller zones, are located in Katameya-Ain Sokhna road, Borg El Arab, and New Qena. NUCA has already allocated the land plots to the company for purchase.

Tourism

Turkish Airlines to begin in Jan-end daily Moscow-Red Sea flights through Istanbul

Russians will be able to fly to Sharm El Sheikh and Hurghada through Istanbul aboard two daily Turkish Airlines flights from Moscow launching by month-end, Global Travel International (GTI) Chairman Ali Okda said. “This indicates that as soon as the Russian government lifts its ban on [direct flights to] Sharm El Sheikh, Russian arrivals will soar,” Okda added. He is expecting Russia to lift its ban this April. Some Russian tour operators, meanwhile, expect their government to lift the ban in March.

Other Business News of Note

NACCUD to hire foreign companies to manage new capital services

The New Administrative Capital Company for Urban Development (NACCUD) is expected to sign soon contracts with Dutch, Chinese, and French companies to manage essential services, including transportation and sanitation, in the new capital, NACCUD Chairman Ahmed Zaki Abdeen told Egypt Today. Abdeen did not disclose company names or the expected cost of these services.

Egypt Politics + Economics

Egypt drafting framework for establishment of Africa investment risk insurance fund

The Investment Ministry has completed a preliminary draft of the framework to establish a risk insurance fund to encourage Egyptians to invest in Africa, Minister Sahar Nasr said during a Sunday meeting with Prime Minister Moustafa Madbouly, according to a Cabinet statement. The ministry is currently in talks with other ministries to incorporate their feedback on the framework, Nasr said, without clarifying when a final draft will be ready. President Abdel Fattah El Sisi had announced the fund’s launch at the Africa 2018 Forum last month.

Egyptian Pharmacists Syndicate Head detained on assault charges

Cairo’s Central Prosecution has ordered the detention of Pharmacists’ Syndicate head Mohie Ebeid for four days pending an investigation into the assault of four journalists at the syndicate headquarters last month, according to Masrawy. Ebeid has been suspended from carrying out his duties since the incident.

Court sentences former Egypt judge, Islamist to nine years for profiteering

Cairo Criminal Court sentenced on Sunday former Judge Waleed Sharaby to seven years in prison, and handed him an EGP 688k fine on charges of illicit gains, reports Masrawy. An investigation proved Sharaby made EGP 688,827 in illegal gains during his career as a judge. He was removed from his judiciary position in 2013 for taking part in the Rabaa sit-in.

On Your Way Out

Unique sculptor stands against mockery: Mai Abdullah, the Minya-based sculptor mocked and ridiculed for her “less-than-optimal” statue depicting Mohamed Salah last year, has recently displayed some breathtaking work, declaring that she will not abandon her style despite being subjected to wide criticism. Her recent work includes statues of prominent Egyptian actor Yehia El Fakharany and the late comedy legend Alaa Waley El Deen.

The Market Yesterday

EGP / USD CBE market average: Buy 17.87 | Sell 17.96

GP / USD at CIB: Buy 17.89 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 13,343 (+0.6%)

Turnover: EGP 571 mn (28% below the 90-day average)

EGX 30 year-to-date: +2.4%

THE MARKET ON SUNDAY: The EGX30 ended Monday’s session up 0.6%. CIB, the index heaviest constituent ended up 0.3%. EGX30’s top performing constituents were Egypt Aluminum up 4.4%, Orascom Construction up 3.2%, and Sidi Kerir Petrochemicals up 2.4%. Monday’s worst performing stocks were Egyptian Iron & Steel down 0.5%, Arab Cotton Ginning down 0.1% and TMG Holding down 0.1%. The market turnover was EGP 571 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -11.9 mn

Regional: Net Short | EGP -17.4 mn

Domestic: Net Long | EGP +29.3 mn

Retail: 70.9% of total trades | 73.1% of buyers | 68.7% of sellers

Institutions: 29.1% of total trades | 26.9% of buyers | 31.3% of sellers

WTI: USD 48.70 (+0.37%)

Brent: USD 57.33 (+0.47%)

Natural Gas (Nymex, futures prices) USD 2.97 MMBtu, (+0.92%, Feb 2019 contract)

Gold: USD 1,289.20 / troy ounce (-0.05%)

TASI: 8,047.58 (+1.45%) (YTD: +2.82%)

ADX: 4,934.29 (+0.62%) (YTD: +0.39%)

DFM: 2,534.80 (+0.14%) (YTD: +0.20%)

KSE Premier Market: 5,402.64 (+0.47%)

QE: 10,494.22 (+1.37%) (YTD: +1.90%)

MSM: 4,312.25 (+0.23%) (YTD: -0.27%)

BB: 1,330.85 (+0.01%) (YTD: -0.48%)

Calendar

10-13 January (Thursday-Sunday): International Property Show (IPS), Egypt International Exhibition Center.

17 January (Thursday): Talent in the Digital Era, Galleria40, Cairo, Egypt.

19 January (Saturday): Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case.

20 January (Sunday): Cairo Court of Urgent Matters to hear an amendment to the constitutional to extend the presidential term limits.

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

3 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

7 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

10-12 February (Sunday-Tuesday): Third African Forum: “Building on Science, Technology and Innovation to Boost Private Sector and Socio-Economic Transformation in Africa”, Venue TBD, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.