- Court rules Uber, Careem have to shutter Egyptian operations; both companies to continue operating; Uber plans appeal. (Speed Round)

- On the surprising resilience of Egyptian consumers. (What We’re Tracking Today)

- More detail on state IPO program: El Garhy says 4-6 companies could sell stakes on EGX this year. (Speed Round)

- ECA denies targeting steel manufacturers with price-fixing probe. (Speed Round)

- SME taxation framework could codify lower interest rates for SMEs; how it gets implemented remains open question. (Speed Round)

- BMI Research sees a second term for El Sisi as good for reform, business sentiment; El Sisi in wide-ranging hour-long interview. (Speed Round)

- Egypt to sign pan-African trade pact today. (What We’re Tracking Today)

- Widening growth premium between EM and developed markets is an attractive backdrop for both equity and credit investors –Goldman Sachs. (Worth Watching)

- The Market Yesterday

Wednesday, 21 March 2018

Court orders Uber, Careem to suspend service

TL;DR

What We’re Tracking Today

Random thought of the morning: Don’t underestimate the amount of cash Egyptians have squirrelled away under mattresses. From a Reuters piece on Al Futtaim saying it will be committing additional investment to Egypt (details in Speed Round, below): “The company is expecting sales [in Egypt] this year to reach EGP 4.5 bn compared with EGP 2.9 bn the previous year.” It’s just the latest sign we’re picking up that wage catch-up and the sheer size of the informal economy are seeing consumer sentiment improve significantly faster this year than many had expected. Consumer and consumer-related companies with we’re speaking are all guiding for good first quarters (even accounting for the low base effect) and are substantially more optimistic in their FY2018 outlooks than they were at the start of the year.

Trade and Industry Minister Tarek Kabil heads to Kigali today to sign a pan-African trade liberalization agreement, according to a ministry statement. The Continental Free-Trade Area (CFTA), whose main objective is “to create a single continental market for goods and services,” was set to include all 55 member states of the African Union, but Nigeria backed out at the last minute, saying it needs more time to review the terms, according to a statement picked up by BBC. Uganda also pulled out at the last moment.

The agreement would create a market of 1.2 bn consumers with an aggregate GDP of USD 2.5 tn, CNBC says, quoting AU chair and Rwandan President Paul Kagame as reminding us all that “less than 20% of Africa’s trade is internal.”

Moody’s sees Egypt, Kenya, and South Africa as the countries most likely to benefit from the CFTZ, according to Reuters. The ratings agency says the pact is a step toward capitalizing on the “significant potential for further trade integration in Africa.”

In related news, a delegation from the Federation of Egyptian Industries (FEI) in Kigali met with over 150 Rwandan companies specialized in energy, construction materials, engineering industries, printing, leather, and clothes to discuss doing business with Egypt, Al Masry Al Youm reports.

Investment Minister Sahar Nasr and Housing Minister Mostafa Madbouly are in Saudi Arabia to discuss projects that could fall under the SAR 60 bn joint Egyptian-Saudi investment fund, unnamed sources tell Al Mal. The two ministers will also be talking about projects on offer in New Alamein.

Foreign Minister Sameh Shoukry heads to New Delhi today for the joint Egyptian-Indian committee and a meeting with Indian Prime Minister Narendra Modi, according to a ministry statement.

It’s Fed day: The US Federal Reserve’s Federal Open Market Committee will wrap its two-day meeting today. It’s the first FOMC meeting under new Fed boss Jerome Powell. Look for a quarter-point rate hike, analysts suggest. The Fed will unveil its interest rate decision at 2pm Eastern and Powell will speak at a press conference 30 minutes later. MarketWatch has a nice rundown of five things to watch for when the Fed speaks this afternoon.

It looks like the Donald might be hitting up the Saudis for some spare change: In his opening remarks at a press conference in Washington, DC, with Saudi Arabia’s Crown Prince Mohamed Bin Salman, US President Donald Trump immediately referenced an apparent Saudi pledge of investment worth as much as USD 400 bn. Bin Salman replied that the Saudis were considering it, according to a White House statement. Trump welcomed MbS as a friend of the US and “big purchaser” of American arms. He reportedly pushed bin Salman in private to resolve the regional standoff with Qatar, according to the Financial Times (paywall).

Alwaleed says there was no “settlement” in corruption crackdown, might split Kingdom Holdings in two: Kingdom Holding’s Alwaleed bin Talal said he was not arrested and did not reach a settlement agreement with Saudi authorities in Crown Prince Mohammed bin Salman’s corruption crackdown. “We signed something, yes, a confirmed understanding. Some others may call it a settlement. I don’t call it a settlement, because settlement to me is an acknowledgment you’ve done something wrong.” Bin Talal added that he’s working with advisers including Goldman Sachs to line up as much as USD 3 bn worth of investments for Kingdom Holding, adding that he’s likely to split the company’s USD 13 bn of assets through a spinoff of its domestic property and other holdings. Watch the full interview here (runtime: 1:03:05).

In miscellany this morning:

BlackRock’s bet on algorithms to beat human fund managers is the subject of the Financial Times’ Big Read, by former Middle East correspondent Robin Widdlesworth.

Blackstone co-founder Pete Peterson has died at age 91. The son of Greek immigrants, Peterson built Blackstone into the world’s largest private equity group. (Bloomberg | WSJ |FT)

The co-founder of WhatsApp has tweeted “It is time. #deletefacebook.”Facebook bought the now-encrypted messaging service for USD 19 bn back in 2014.

What We’re Tracking This Week

Workshop on blockchain in capital markets tomorrow: Egypt’s first fintech-focused accelerator, the Pharos-affiliated Pride Capital, is hosting a workshop on Thursday titled “A Bright Future for Blockchain in Capital Markets” at the Greek Campus. The workshop will feature a discussion with EGX Chairman Mohamed Farid and Henerby Blockchain Consulting CEO Bobby Henerby. To register for a spot in the workshop, tap here if you’re on your mobile and click here if you’re on a computer. You can check out the workshop’s Facebook page for more information on the event or Pride Capital’s LinkedIn page for more on the accelerator.

On The Horizon

The Arts-Mart Gallery is bringing together visual and performing arts through its second ‘Orchestra In Art’ event, The Three Egyptian Tenors this coming Friday.The show features a full orchestra performing amidst a specially curated exhibition of Egyptian contemporary art. World-renowned conductor Nader Abassi and award-winning Egyptian tenors Hany Abdelzaher, Ragaa Eldin, and Amr Medhat will perform their Italian opera masterpieces at the Arts-Mart Gallery on Friday. The event is sponsored by our good friends SODIC as part of their drive to promote new cultural and artistic concepts.

Arab leaders will gather in Riyadh on 15 April for a summit, Arab League Secretary General Ahmed Abul Gheit announced yesterday. Saudi Crown Prince Mohammed bin Salman had said that Qatar would be allowed to attend.

The Creative Industry Summit will take place in Cairo from 17-18 April at the Four Seasons Nile Plaza. Some of the issues on the agenda include sports marketing and “how to ride the world cup wave,” and engagement through content marketing.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s interview with director Sandra Nashaat — titled “President and People 2018” — consumed the talking heads last night. Without exception, the hosts commended the format of the interview, which we cover in the detail in the Speed Round, and El Sisi’s demeanor. They offered little in the way of analysis.

Before we dive into that, the talking heads took note of the biggest business story of the day: The Administrative Court’s order to suspend Uber and Careem’s licenses. Amr Adib maxed-out his vocal cords in expressing his frustration at the Administrative Court’s ruling yesterday to suspend Uber and Careem’s licenses. The host listed all the drawbacks of the court ruling and urged the government to find a way to intervene (watch, runtime: 7:15). We gently urge Adib to take a look at the Ride-hailing Apps Act, which is expected to pass the House soon-ish. We have more in depth coverage of the issue in the Speed Round.

Consumer Protection Agency (CPA) head Atef Yacoub phoned into Yahduth fi Masr to wag his finger at iron and steel manufacturers for raising the prices of their products, saying that the move is detrimental to the state as it is undertaking infrastructure projects. The CPA had warned manufacturers against price hikes, and referred them to the Egyptian Competition Authority when they did not heed warnings, according to Yacoub (watch, runtime: 4:06). Head of the Federation of Egyptian Chambers of Commerce’s Building Materials Division Ahmed El Zeini commended Yacoub’s decision, saying the price increases are “unjustified” (watch, runtime: 3:16).

With all the grandstanding and back slapping, no one appeared to mention the fact that the Egyptian Competition Authority has denied it is probing the steel sector and noted that only it has the jurisdiction to conduct such an investigation (we have more in the Speed Round). Nice try though, Smiley Face.

The interview with El Sisi was more “cinematic” than journalistic, said Hona Al Asema’s Lamees Al Hadidi as she aired several snippets of the president’s sit-down (watch, runtime: 1:00:00). Kol Youm’s Amr Adib echoed his better half, and pointed out that the format of the interview did not leave space for any follow-up questions (watch, runtime: 3:18). Lamees also took note of a portion of the interview in which El Sisi watched a pop vox compilation from Egyptians, which the host hailed as a “true reflection” of the people’s voice (watch, runtime: 7:22).

Lamees noted that some of the citizens interviewed seemed fearful of speaking their mind in front of a camera (watch, runtime: 3:21), while Adib blamed the issue on a longstanding culture of being scared of criticizing authorities. Both hosts pointed out the generational gap among interviewees’ points of view and that the younger subjects were much more critical (watch, runtime: 1:15).

Speed Round

Taxi drivers have won an initial court victory over Uber and Careem: The Administrative Court ordered yesterday the suspension of licenses for ride-hailing apps Uber and Careem,judicial sources told Reuters. The case was filed by 42 taxi drivers seeking to shut down the operations of both platforms, claiming the ride-hailing services were illegally using private cars as taxis. Lawyer Khaled al-Gammal, who represents the plaintiffs, “said the court suspended the two companies’ licenses, banned their apps and suspended the use of private cars by the two ride-hailing services.” A spokesperson for the taxi drivers is claiming that the order goes into immediate effect, Al Mal reports.

Both companies say they will continue operating; Uber plans appeal: Uber plans to appeal the decision within the permitted 60-day window and “remain available in Egypt in the meantime,” as the company is “fully committed to working with the entire sector – including taxis – to improve mobility in Egypt together,” a spokesperson told the newswire. It also appears to be business as usual for Careem, which is also widely expected to appeal, but has said it had not received any official notice to cease its Egypt operations. Al Mal claims to have obtained a message the company sent its drivers stating unless it receives an official cease and desist, the company will continue operations.

Just like with the ergot ruling and Tiran and Sanafir, the Administrative Court appears to have gotten ahead of itself. New legislation to govern the activities of ride-hailing apps such as Uber and Careem is in the works. Last we heard, the law had been pending sign-off from the Ismail Cabinet before it goes to the House of Representatives; the Council of State concluded its review of the bill in January. With political support in both the government and parliament for the sector, look for reasonable odds of the verdict being overturned on appeal.

The story is dominating international coverage of Egypt this morning, with The Associated Press, Xinhua, and Al Arabiya all picking up the story.

The silver lining: It’s being portrayed as part of a global “Uber vs. Taxi drivers” and not “Egypt vs. Business” story. “The case builds on a long-festering dispute between taxi drivers and their ride-sharing counterparts. The taxi drivers have repeatedly complained that they are forced to shoulder licensing costs not borne by Uber and Careem,” writes Tarek El Tablawy for Bloomberg, which is the general consensus of the coverage. Nearly all are noting the importance of Egypt to the companies and plans to expand there.

IPO WATCH- The government plans to offer shares of 4-6 companies on the EGX in 2018 under its IPO program, including a chunk of Bank of Alexandria and 24% of oil services outfit Enppi, Finance Minister Amr El Garhy tells Al Mal. The issuances are expected to raise EGP 12-15 bn, according to the minister, who also said that the IPO program’s schedule and lineup is “flexible” and “could be amended” depending on how ready some companies are compared to others. El Garhy had said on Monday that the government intends to to select the first four or five companies that will list under phase one of the IPO program by September or October. The ministry had announced on Sunday a lineup of 23 state-owned companies that will IPO or list additional shares on the EGX over 24-30 months. Enppi is largely expected to be the pilot IPO of the program, while Banque du Caire should be the first of the banks to list, but not before 4Q2018.

The program will see listed at least 20% of the Middle East Oil Refinery (MIDOR) on offer, an unnamed EGPC official also tells the newspaper. The Finance Ministry’s Sunday announcement — which included around 11 companies from the oil and gas and petrochemicals sectors — had said that most companies would float between 15-30% of their shares on the EGX, raising some EGP 80 bn in additional capital. The EGPC official said the success of the IPO program will determine whether the government decides to add more companies from the sector to its list, noting that a number of them would qualify.

In related news, the Land and Maritime Transport Company is days away from setting a timeline for its exit from stakes it holds in companies on the state’s roster, Al Mal also says. Executives are expected to sit down with Public Enterprises Minister Khaled Badawy this week to discuss the schedule for listing shares from the Alex, Port Said, and Damietta container and cargo handling companies, a well as the Alexandria Oils and Minerals Company.

ECA denies targeting steel manufacturers in price-fixing probe: The Egyptian Competition Authority (ECA) denied on Tuesday reports published in Al Borsa that it is investigating steel manufacturers on antitrust allegations. “The authority has received no complaints against the sector, but has conducted a standard periodical review of the steel and cement industries,” the ECA said in a statement. It notes that it will announce the results of the review in the coming days. The story, which ran on Monday, heavily quotes Consumer Protection Authority (CPA) head Atef Yacoub’s objections to the steel industries operations. He had raised concerns over the drop in their output, suggesting an attempt to raise prices. It is perhaps for the this reason the ECA concluded its statement by noting that it is the only government body with exclusive jurisdiction to investigate antitrust issues.

That’s not stopping Yakoub, who is now wagging his finger at the cement industry. The ECA head said that recent spikes in cement prices were “unjustified,” in a statement to Al Mal which echoes his tone on the steel industry. He then criticizes companies justifying the price increases on inflation and a lack of supply after the temporary shuttering of Al Arish Cement, calling them “excuses.”

SME taxation framework could codify lower interest rates for SMEs: And speaking of taxes, the SME taxation framework currently being worked on by the Finance Ministry could codify lower interest rates on SME loans, SME Development Authority Chairperson Niveen Gamea said, according to Al Mal. How that would work in practice, when interest rates are set by banks regulated by the Central Bank of Egypt, is very much an open question. The move is being presented as part of a series of incentives for SMEs to join the formal economy. Earlier this month, now-former Vice Minister of Finance Amr El Monayer suggested that the ministry would be willing to grant SMEs of a certain size partial or full tax exemptions or holidays if they meet certain conditions criteria. These could include pegging the tax breaks to how far the business has come towards registration and entering the tax system.

INVESTMENT WATCH- Al-Futtaim Real Estate plans to invest EGP 30 bn (USD 1.7 bn) in its Egypt project Cairo Festival City by 2023, nearly double what it had originally planned, Managing Director Ashraf Ezzeldin told the press yesterday, Reuters reports. The company, which had set an initial investment budget of EGP 15-17 bn for Egypt, will break ground on four new projects worth EGP 7.5 bn this year that will be complete in three-years’ time, Ezzeldin said.

The National Authority for Tunnels (NAT) will sign next month a USD 1.2 bn loan agreement with the Export-Import Bank of China to build an electric rail line linking Salam City with Tenth of Ramadan City and the new administrative capital, the authority’s planning chief Tarek Abul Wafa tells Al Borsa. The bank was initially set to cover USD 739 mn of the cost, with the Egyptian state picking up the rest. However, China Exim recently agreed to NAT’s request to cover the full cost of the project by adding another USD 500 mn tranche, according to Abul Wafa. NAT signed an agreement with China’s AVIC in August last year to deliver the rail line’s communication and signaling system, as well as to manufacture and supply 20 locomotives. A consortium of Egyptian construction firms, including Petrojet, Arab Contractors, and Orascom Construction, will carry out infrastructure works for the project.

Benban keeps rolling on, with three foreign companies looking to begin construction: Spain’s Acciona and Saudi Arabia’s Swicorp have begun construction on three large-scale PV power plants with a combined capacity of 186 MW in Aswan’s USD 2.8 bn Benban solar park, according to PV Magazine. With USD 180 mn investments, the two companies will own 50% of the projects, which are being developed under phase II of Egypt’s feed-in tariff program.

Meanwhile, Enerray SpA is also constructing three ground-mounted photovoltaic solar power plants in Benban with a combined production capacity of 116 MW, the company announced. Construction on the plants is scheduled to begin next month. The company did not disclose the expected cost of the plants, which will be co-financed through the International Finance Corporation, the Asian Infrastructure Investment Bank, the Europe Arab Bank, and the Green for Growth Fund. Enerray has reached a 25-year PPA with the Egyptian Electricity Transmission Company “at an effective feed in tariff of USD 71/MHw.” The first solar facility in Benban was inaugurated last week with a capacity of 50 MW. Upon completion next year.

LEGISLATION WATCH- The House of Representatives will discuss the Tenders and Auctions Act in a plenary session when it reconvenes in April, Planning and Budgeting Committee chair Hussein Issa tells Al Mal. The committee will put its “final touches” on the bill after the March presidential elections before it moves it to the general assembly’s agenda, according to Issa.

Amendments to the Income Tax Code that would push the deadline for submitting supplementary documentation to tax returns will also be up for discussion next month, he added, without elaborating. Both pieces of legislation had been expected to go to a plenary session this month.

Trend Micro sees Egypt as one of the most vulnerable to cyber attacks in Africa: Cybersecurity firm Trend Micro is warning that Egypt may be one of the most vulnerable countries on the continent to cyber attacks. The company logged over 242k malware attacks in the country in 4Q2017, up 25% from 3Q2017, the firm said in a press release. This is the third highest rate of cybersecurity attacks in Africa after South Africa and Morocco. A worrying concern is the rise in the number of online banking malwares, which grew to 301 in 4Q2017, up 37% from the previous quarter. The report revealed that the state’s manufacturing sector was the one most affected by malware, followed by education, government, real estate and technology. We had noted last month reports that Orascom Telecom Media and Technology (OTMT) had been hacked by an elite North Korean cyber warfare unit.

The good news is that the awareness is there. In a survey Trend Micro conducted in partnership with Enterprise last October, 81% of our readers believed that Ransomware was a problem, with a majority believing their businesses were inadequately prepared for further attacks.

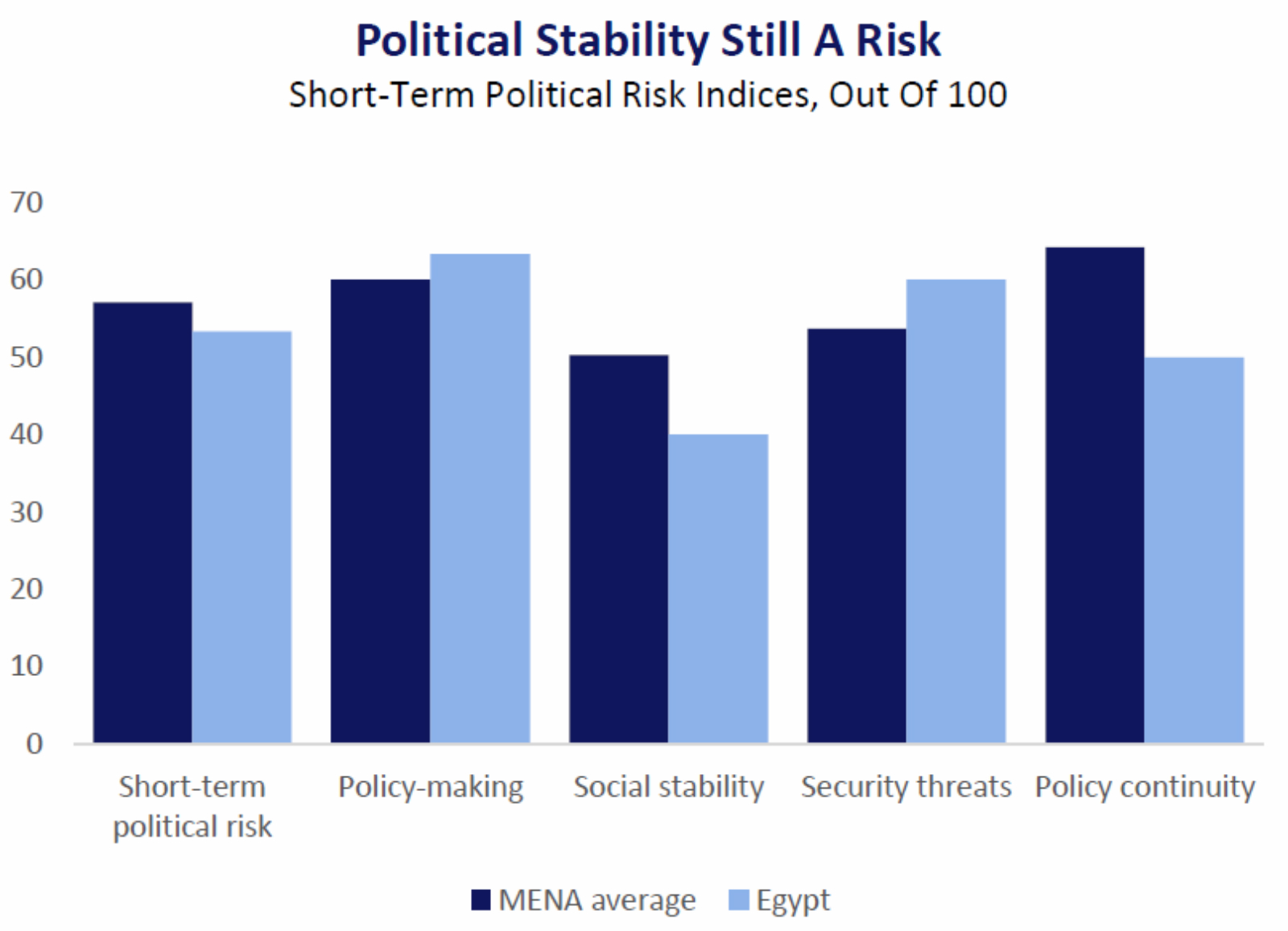

Fitch Group’s BMI Research sees another term for President Abdel Fattah El Sisi as boding well for reform and business sentiment, the firm said in its monthly political risk analysis note (pdf). “While many of the most painful (and important) reforms have already been completed, El Sisi’s re-election will likely open the door for modest fiscal consolidation, including cuts to fuel subsidies. Egypt will be an economic outperformer in the Middle East region in 2018. Private consumption is set to benefit from cooling inflation and gradual improvements in job creation, and investment will be buoyant on the back of continued reform progress,” the statement reads.

Any political instability arising from El Sisi’s reelection will be a more long term issue, with BMI seeing no political instability following the March elections. The firm notes that the circumstances behind the aported campaigns of former senior military officers Samy Anan and Ahmed Shafik “suggests some level of tension which could bubble to the surface if perceptions of El Sisi’s ability to serve military interests weakens.” It also warns that “popular discontent with the relatively limited political freedoms” could fuel discontent, especially if growth disappoints.

On a regional level, the firm identified six key risks in MENA in 2018: A renewed slump in oil prices and a breakdown of the GCC as a result of the Qatar beef had been named first of the list of major risks. Other potential flare ups identified include a large scale terrorist attack on a safe haven such as the UAE and the collapse of the Iran nuclear agreement. At the bottom of the list were any hiccups in the succession of Oman in the event Sultan Qaboos dies and a return of Nouri Al Maliki in Iraq.

Egypt’s political scene was “not ready” to put forth serious presidential candidates, President Abdel Fattah El Sisi said in a documentary-style interview with director Sandra Nashaat that aired yesterday. The president said he had wished several contestants had tossed their hats into the ring and that he should not be held responsible for candidates dropping out. He laid the blame instead on unprepared political parties. The president als stressed that he is “not against people speaking their minds” but said that the media highlights issues that “are not fitting” for Egyptian values or that should not be discussed. On terrorism, El Sisi said that the country will never be able to completely weed it out, as is evidenced by many countries’ inability to do so, but bringing stability “after the past seven years” continues to be a priority.

El Sisi announced that he will launch a 14-year program this year to overhaul the country’s educational system and encouraged universities to establish partnerships with international institutions to improve the rankings of Egyptian schools. The president also touched on economic challenges including the booming population growth, and praised the Egyptian populace for enduring tough reforms.

El Sisi also downplayed the military’s involvement in the economy, repeating his previous claim that the military’s activities account for 2-3% of the country’s GDP.

You can watch the full interview here (runtime: 59:38).

** No fake news here: We’re not typically in the mood to apologize for our occasional sarcasm or insertion of opinion into your morning read. This daily briefing is offered without charge, and we invite those born without a sense of humor to exercise their democratic right to unsubscribe if they do not appreciate our (admittedly sometimes sophomoric) commentary. That said, we are dogmatic about factual accuracy. If ever you think we have misspoken on the facts, email us at editorial@enterprise.press — we’ll look into it right away and set it right.

In that spirit, we offer you:

CLARIFICATION #1- From the good Mr. Ahmed Marwan, founder and chairman of Sigma Capital, whose firm has been in the news of late thanks its contemplated IPO, commentary from its analysts and its role quarterbacking the IPO of B Investments: “I write with reference to your news item related to MBC networks in today’s issue. We at Sigma Capital would much appreciate if you would kindly issue a clarification tomorrow that the Sigma referred to in the news piece is not Sigma Capital and you are referring another specific company.” Ahmed is entirely correct: The vehicle to which we had referred in the MBC vs. Al Hayat TV case has absolutely nothing to do with Sigma Capital.

CLARIFICATION #2- Sigma Capital chief economist Aya Abdullah tells us she was misquoted by Al Shorouk in her phone interview on whether the government was able to meet its budget deficit targets of 8.4%. The newspaper had mistakenly written that she attributed the possibility of the government reaching that target to the state IPO program. What she had said was that the target was feasible in light of further fiscal consolidation the government is planning and that the target is not far off from the IMF’s projections. The state IPO program was another sign that the government is committed to the reform agenda.

*** SMART PEOPLE WANTED. We’re hiring at both Enterprise and at our parent company, Inktank. We’re looking for critical thinkers who have outstanding English-language writing skills. Don’t apply if you are not (at an absolute minimum) unafraid of numbers. We offer a great, casual work environment, the opportunity to work with smart people who care about what they do, and plenty of intellectual challenge. You’ll do your best work here, whatever your profession is. Check out the open positions, from creative director to reporter, from Enterprise editor to senior investor relations advisor at Inktank.

Image of the Day

World’s last male northern white rhino passes away: The last male northern white rhinoceros, Sudan, passed away on Monday at age 45, the OI Pejeta Conservancy announced yesterday. The rhino had been suffering from several age-related health complications, which led veterinarians at the conservancy to euthanize him. Sudan’s species is dangerously close to extinction as there remain only two females in the world, but scientists managed to collect Sudan’s genetic material in hopes of artificially inseminating the females to prevent their extinction. Rhinos are often poached for their horns, which some believe can be used to treat illnesses and others display as a symbol of wealth.

Egypt in the News

President Abdel Fattah El Sisi insisted that “stability must take priority over freedoms,” Hamza Hendawi writes for the Associated Press. Hendawi suggests that El Sisi “seems convinced that a genuinely contested election could destabilize the country, allow his Islamist foes a backdoor into politics or interfere with his high-octane, single-handed drive to revive the battered economy.” Reuters also notes that El Sisi has promised to “safeguard Egypt’s security.”

…Speaking of the elections, El Sisi’s rival Moussa Moustafa Moussa says he is “no puppet” and tells the Guardian’s Ruth Michaelson he is cautiously optimistic about his chances. Michaelson says the impression that Moussa does not intend to challenge El Sisi on the campaign trail “is buoyed by his bland policy platform, which carefully avoids anything that could be interpreted as a criticism of the president’s previous term.” Reuters has a similar story.

Meanwhile, The Week says Egypt is preparing for “Putinesque” elections, while RFI offers a guide to “understanding Egypt’s presidential election.”

Egyptian Cotton is the most recognized cotton brand in the US, according to a recent consumer research by marketing agency PBM, Fibre2Fashion reports. Egyptian Cotton “was also the name most people associated with quality and were prepared to pay a premium for, ahead of Pima cotton, Turkish cotton, and Supima.” Chairman of Cotton Egypt Association Wael Olama says “this survey underlines the strength of the Egyptian Cotton brand in the mind of the consumer.” The Association’s executive director noted that they are “extremely proud of the thorough accreditation programme we have created in association with Bureau Veritas. The success of this is mirrored in the increase in retailer confidence we have experienced in the UK.”

Worth a quick skim this morning:

- State censors have allowed the performance of “Before the Revolution,” a socially critical play they had prohibited on the day of its Cairo premiere, the Associated Press reports.

- Egyptian sisters Mariam and Yasmine Yeya are blending the aesthetics of their respective fashion design brands, Maison Yeya and Mrs Keepa, “to create a capsule collection which Yasmine describes as ‘schizophrenically beautiful,’” according to Harper’s Bazaar Arabia.

- China’s Global Times reviews the Pharaonic Village park in Cairo, where actors simulate daily activities and arts of the ancient Egyptians.

Worth Watching

The widening growth premium between emerging and developed markets is providing an attractive backdrop for both equity and credit investors, Katie Koch of Goldman Sachs Asset Management says. EMs are set to expand at double the pace of their developed peers and GS is paying attention to India in particular. Koch says she expects EM equities to show double-digit earnings growth. She is also looking at the growth in consumption, noting that 86% of the world’s millenials live in emerging countries. “The drivers behind EM’s growth include both macro and micro factors. Not only are EM countries in stronger fiscal shape — many countries are running current account surpluses —but investors also have access to deeper and more diversified financial markets” (watch, runtime 02:47).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi and Foreign Minister Sameh Shoukry met with Greek Foreign Affairs Minister Nikos Kotzias in Cairo yesterday, according to an Ittihadiya statement. Talks extended to trilateral relations between Egypt, Greece, and Cyprus on East-Mediterranean gas, increased cooperation on economy, trade, and investment, as well as counter-terror and the peaceful resolution to regional disputes. Last month, Oil Minister Tarek El Molla had said that Egypt was in talks with Greece to establish a framework for further energy cooperation, after announcing that it was closing in on an LNG import agreement with Cyprus. The three countries also said last week they would be working on a USD 4 bn 2,000 MW subsea electricity interconnection project that is expected to become part of a larger network linking Europe and Africa.

Libyan military officials representing General Khalifa Haftar’s army and Fayez Al Serraj’s government concluded cooperation talks in Cairo yesterday, Ahram Online reports. The rivals reportedly agreed to end the current polarization within the Libyan military to ensure its efficacy as a national force. The talks were mediated by the government’s committee on Libyan affairs, which has previously hosted four rounds of meetings.

Kabil talks cooperation, investment with the EU at UfM meeting in Brussels: Trade and Industry Minister Tarek Kabil joined 43 trade ministers from member countries at the 10th edition of the Union for the Mediterranean (UfM) meeting in Brussels yesterday, during which he looked into cooperation and investment openings with the European Union, according to the ministry.

Infrastructure

Schneider Electric, Seven Seas in talks with gov’t over new desalination plant

The Ismail Cabinet is in talks with France’s Schneider Electric and the US’ Seven Seas Water over the construction of new desalination plants, Al Borsa reports. Seven Seas will be responsible for arranging financing and selling processed water back to the government under a 20-year agreement, said Schneider Electric’s Energy Director for North East Africa and the Levant Khaled Kamel. He added that the stations will be constructed over several phases, the first of which will process 300 cbm of water per day. Negotiations are ongoing to settle on a price per cbm. Details on the investment value and project timeline were not disclosed.

Health + Education

Ibnsina signs distribution agreement with Novo Nordisk

Ibnsina Pharma announced it signed two contracts with Novo Nordisk to distribute over 20 stock-keeping units of its diabetes care, haemophilia, and growth disorders products in Egypt. Ibnsina says it invested EGP 2 mn in additional warehousing facilities to deliver Novo Nordisk’s cold-chain products and that the investment is the first execution in our plan to invest EGP 700 mn over the next five years in new sites and expansions.

Gov’t suspends school meals in Menoufia after suspected food poisoning

The Education Ministry has suspended government-issued school meals across the Menoufia governorate after 43 students in one school suffered symptoms of food poisoning, Al Masry Al Youm reports. The Health Ministry has retrieved samples of the meals for testing and ensured that all students received medical attention, ministry official Alaa Eid tells Youm7. The government had halted school meals last year after hundreds of school children suffered from food poisoning from the meals, which were produced by the state-owned Al Nasr for Services and Maintenance.

Real Estate + Housing

Two real estate companies to invest a combined EGP 3.4 bn this year

Mena Group for Constructions and Trading is planning to invest EGP 3 bn in residential and touristism projects this year, Sales Manager Wael Salah El Din tells Al Borsa. Those include an EGP 2 bn residential and commercial project in Dokki — to be completed by 2022 — as well as a tourist beach compound in the North Coast and a residential project in Alexandria. The company is also planning to purchase 50 feddans for a residential compound in the new capital. Meanwhile, Smart House Real Estate is planning to double its investments this year to EGP 400 mn, CEO Wael El Ott tells the newspaper. The projects include the EGP 100 mn Oriana Compound in Mokattam, as well as others in the new capital and Al Galala.

Tourism

Egypt shifts UK tourists focus Hurghada instead of Sharm El Sheikh

Egypt has “thrown its full marketing weight behind Hurghada and aims to double UK visitor numbers to the resort” as the flight ban to Sharm El Sheikh remains, Travel Weekly reports. “The British market used to have a preference for Sharm rather than Hurghada. But this year our strategy is focussed on Hurghada,” says Amr El Ezaby the UK and Ireland director at the Tourism Promotion Authority. The UK market can double its capacity in Hurghada, El Ezaby believes. He said they would be using the name of resorts including Hurghada, as well as Luxor and Marsa Alam, in a marketing campaign due to launch in April.

Hilton signs management contracts for two hotels in New Alamein City

Hilton signed yesterday contracts with the New Urban Communities Authority (NUCA) to manage two hotels that will be constructed in New Alamein City, Al Masry Al Youm reports. The hotels will have a combined total of 550 rooms. Hilton Worldwide has plans to add 1,000 hotel rooms in Egypt throughout the year and targets expanding in the country with seven new hotels by 2021.

TUI to launch Cardiff-Hurghada flights in November

German airline TUI fly has announced it would launch a new direct route connecting Cardiff to Hurghada as of November 2018, according to Wales Online.

Banking + Finance

Auerback Grayson to partner with Switzerland’s Mirabaud Securities

Beltone Financial’s New York-based brokerage subsidiary Auerbach Grayson & Company announced that it has partnered with the brokerage business line of Swiss investment bank Mirabaud Group to provide US investors with greater access to Swiss equities, the firm said in a statement on Tuesday (pdf).

Egypt Politics + Economics

Prosecutor refers Roads and Bridges Co. chief to trial over corruption charges

Prosecutor General Nabil Sadek has referred the Chairman of the General Nile Company For Roads and Bridges, Ashraf Attiya, and another company official to trial on corruption charges, Al Shorouk reports. The two officials are accused of allegedly accepting EGP 250k-worth of bribes from a contractor in exchange for priority contracts.

On Your Way Out

Attack on Mariam Moustafa not racially motivated, say police: Nottingham police said that the death of the 18 year-old Egyptian-Italian student was not racially motivated as they originally thought, according to the Guardian. A delegation from Egypt’s House of Representatives is scheduled to arrive in London on Thursday to follow up on British police’s investigation into the death of of Egyptian student Mariam Moustafa in Nottingham, Al Shorouk reports.

Here we go again with Abla Fahita: The entire archive of CBC’s satirical puppet show Abla Fahita (El Duplex) has been taken off the show’s YouTube channel, Youm 7 reports. The show’s official Facebook page has also been deleted (We checked ourselves and were unable to access). This comes as a surprise to many as CBC recently denied reports that the Supreme Council for Media Regulation had ordered the indefinite suspension of the show.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5739 | Sell 17.6717

EGP / USD at CIB: Buy 17.55 | Sell 17.65

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Tuesday): 17,114 (-0.3%)

Turnover: EGP 1.6 bn (39% ABOVE the 90-day average)

EGX 30 year-to-date: +13.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.3%. CIB, the index heaviest constituent ended down 0.7%. EGX30’s top performing constituents were Qalaa Holdings up 7.2%, AMOC up 5.1%, and Egyptian Resorts up 3.4%. Yesterday’s worst performing stocks Emaar Misr down 3.7%, Heliopolis Housing down 3.3%, and Madinet Nasr Housing down 2.2%. The market turnover was EGP 1.6 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +42.3 mn

Regional: Net Long | EGP +56.1 mn

Domestic: Net Short | EGP -98.3 mn

Retail: 63.9% of total trades | 64.3% of buyers | 63.5% of sellers

Institutions: 36.1% of total trades | 35.7% of buyers | 36.5% of sellers

Foreign: 16.1% of total | 17.5% of buyers | 14.8% of sellers

Regional: 15.0% of total | 16.8% of buyers | 13.2% of sellers

Domestic: 68.8% of total | 65.7% of buyers | 72.0% of sellers

WTI: USD 63.77 (+0.36%)

Brent: USD 67.65 (+0.34%)

Natural Gas (Nymex, futures prices) USD 2.68 MMBtu, (+0.07%, April 2018 contract)

Gold: USD 1,311.40 / troy ounce (-0.04%)

TASI: 7,724.79 (+0.18%) (YTD: +6.90%)

ADX: 4,525.42 (-0.38%) (YTD: +2.89%)

DFM: 3,182.80 (-0.02%) (YTD: -5.56%)

KSE Weighted Index: 409.92 (-0.50%) (YTD: +2.12%)

QE: 8,977.85 (+0.99%) (YTD: +5.33%)

MSM: 4,781.92 (-1.05%) (YTD: -6.22%)

BB: 1,341.05 (-0.53%) (YTD: +0.70%)

Calendar

23 March (Friday): Orchestra In Art gala concert “The Three Egyptian Tenors,” Arts-Mart Gallery, 9:00pm.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

02-03 April (Monday-Tuesday): Pharos Holding’s investor conference: In Search for Egypt Alpha, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

11 April (Wednesday): The Game Sports Industry Conference, Nile Ritz-Carlton Hotel, Cairo.

17-18 April (Tuesday-Wednesday): Creative Industry Summit, Four Seasons Nile Plaza Hotel, Cairo.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.