- Automotive sales tumble again in September. (The Big Story Today)

- AI-developed meds go into human trials. (For Your Commute)

- Ambient computing pits convenience against privacy. (What’s Next)

- China’s one-child policy was so successful, it needs to be reversed. (For Your Commute)

- Unsettling discoveries are found on the hunt for a killer in The Little Things. (On the Tube Tonight)

- Halloween celebrations + A week of jazz. (Out and About)

- Ghosts, strange connections, and a mystery unsolved in The Therapist. (Under the Lamplight)

Monday, 31 October 2022

PM — Happy Halloween ????

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, wonderful people. It’s a reasonably busy Monday here in Omm El Donia, with a little bit of everything coming out of the news cycle. But first…

We wanted to thank our friends at CIRA Education (formerly just CIRA), who join us today as a pillar sponsor of EnterprisePM alongside Palm Hills Developments and Etisalat Misr. It is through their generous support that we are able to continue to provide your afternoon reads without charge.

CIRA Education’s CEO Mohamed El Kalla joined us in the podcast studio to discuss the company’s recent rebranding and its evolution into a multifaceted education platform, with services covering the entire value chain of education. You can listen our discussion is on our website (listen, runtime: 44:43) or on: Apple Podcasts | Spotify | Omny | and Google Podcasts. Or you can read edited excerpts of our conversation here.

THE BIG STORY TODAY

Auto sales fell 49.8% y-o-y in September 2022 to around 11.4k units sold as the market continued to struggle with import restrictions. Passenger car sales dropped nearly 58.9% y-o-y last month to just 6.8k vehicles, according to figures provided by the Automotive Information Council (AMIC).

THE BIG STORY ABROAD

There are three big stories vying for attention in the international business press: Picking up where we left off this morning, left-wing former president Luiz Inácio Lula da Silva’s victory in Brazil’s presidential elections is still on the front pages of the Financial Times and Reuters. Meanwhile, Eurozone inflation jumped to a fresh record high of 10.7% in October (CNBC) and a grain shipment sailed out of a Ukrainian port today despite Russia pulling out of the UN-brokered agreement that allowed Ukraine to resume grain exports (Bloomberg | Reuters).

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- MoneyFellows closes bumper series B round: Egyptian fintech startup MoneyFellows has raised USD 31 mn in a series B funding round.

- House committee approves public-sector, pensioner bonuses: The House Manpower Committee approved yesterday disbursing a EGP 300 bonus in November to public-sector employees and pensioners.

- Coffee With Mohamed El Kalla, CEO of CIRA Education: Egypt’s largest listed private-sector education company, CIRA (Cairo for Investment and Real Estate Development) has officially rebranded itself as CIRA Education.

|

???? CIRCLE YOUR CALENDAR-

We’re starting a new month- The key news triggers as we slide towards November:

- PMI: We’ll know how Egypt’s private sector fared in October on Wednesday when S&P Global releases the purchasing managers’ index. A 22-month contraction in private sector activity didn’t show signs of abating in September as high inflation continued to weigh on demand and output.

- Foreign reserves figures for October will be released next week.

- Inflation: Capmas and the central bank will release October’s inflation figures on Thursday, 10 November.

The Sovereign Fund of Egypt (SFE) will begin the roadshow for its pre-IPO fund at the end of November, Planning Minister Hala El Said told Bloomberg Asharq yesterday (watch, runtime: 2:10). The fund plans to market several state companies — including the military-owned firms Safi and Wataniya — to strategic investors ahead of IPOing them on the EGX at a later date. Several Arab sovereign wealth funds have expressed interest in purchasing stakes in the companies, the minister said.

The Nebu Expo for Gold and Jewelry will be held on 10-12 December, bringing together 50 local companies and 35 international exhibitors from Italy, Turkey, India and the UAE, Supply Minister Ali El Moselhy said.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- We’re in store for another sunny day in the capital city, with a daytime high of 26°C and a nighttime low of 18°C.

???? FOR YOUR COMMUTE

Biotech company begins first human trials on AI-created drugs: Verge, biotech firm backed by Merck, Eli Lilly, and private equity group BlackRock is running one of the first clinical trials in humans of a drug discovered by AI to analyze a vast database of brain tissue, according to a company statement. A patient was dosed with a novel therapy targeting ALS, a neurodegenerative disease with no known cure, Verge founder Alice Zhang told the Financial Times.

How AI discovers potential treatments: AI can process mass amounts of data to quickly identify the therapeutic targets of protein in the body linked to various diseases and which molecules can be turned into medicine. It also helps reduce typically high failure rates, development costs, and the time required for the medication to attain its approvals.

A growing sector worth potential bns: Verge raised USD 98 mn last year from investors to fund its ALS clinical trial and finance its expansions. It also signed an agreement with Eli Lilly to develop ALS treatments earning an additional USD 25 mn and potential milestone and royalty payments worth an extra USD 694 mn if certain targets are met. Pharma and investors see AI being worth USD 50 bn over the next decade, according to forecasts from Morgan Stanley, which forecasts an increase in early-stage drug development and the potential for up to 50 therapies over the next 10 years.

As a result of China’s one-child policy, the country is now facing a dangerous decline in births, Reuters reports. The controversial population control policy was in effect from 1980 to 2015, and now the number of new births is predicted to fall to less than 10 mn this year after seeing an 11.5% dip in 2020. A newlywed said in an online post (that has since been removed) she received a call from her local government asking if she was pregnant, leading many users to add their voices to the chorus, claiming to have received similar pressuring calls regarding pregnancy planning and when they were planning to have children. President Xi Jinping has previously announced that China would implement a policy to increase birth rates and enhance the nation's population growth plan.

Is investing an old man’s game? The ever-increasing cost of living and inflation paired with unfavorable market conditions has made investing a “tough sell” for young people, the Financial Times writes, citing investment service AJ Bell. The platform recently launched its user-friendly investing app Dodl targeting a younger customer base as the company aims to shift its focus from those investing in pensions to those saving up for retirement.

Egypt has jumped on the same bandwagon: Trading app Thndr, which accounted for 80% of all new brokerage accounts opened by those under 21 years old last year, is also working to harness younger investors with an easy-to-use method of investing.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The Little Things will give you Halloween thrills: This American neo-noir psychological crime thriller, starring Denzel Washington and Rami Malek, revolves around a serial killer investigation that unearths echoes from the past. Joe Deke is dispatched to Los Angeles for a quick evidence-gathering job but is sucked into an investigation by Jim Baxter, an LA Sheriff Department sergeant. Disturbing secrets are discovered as they search for the killer together.

⚽ Today in the Egyptian Premier League: Al-Ittihad will face Tala’e El-Gaish at 5pm, and the Arab Contractors will play Pharco at 7pm.

In La Liga: Elche will host Getafe at 10 pm.

???? OUT AND ABOUT-

(all times CLT)

Celebrate Halloween at the Goganian Armenian Club party tonight at 7:30pm.

Kick off the night at Cairo Jazz Club in Agouza with tunes spun by DJ Momo, Sebzz and A. Salah.

Catch Dabet Namla and Hardcase perform at Room Art Space in New Cairo at 9pm.

Cairo Jazz Festival 2022 is running until this Friday, 4 November at AUC Tahrir Cultural Center featuring a variety of events including live concerts, film screenings, jam sessions, jazz talks, and photo exhibitions from 14 countries.

???? UNDER THE LAMPLIGHT-

Delve into psychological suspense with The Therapist: BA Paris’ novel follows Alice and Leo, a married couple, who relocate to a luxury gated neighborhood called The Circle — but quickly find out why the house was such a steal. As strange things begin to unfold, Alice becomes infatuated with the home’s former owner, Nina, developing a strong connection with her, and begins to suspect the neighbors who seem to be hiding things from her about the night Nina was murdered

???? GO WITH THE FLOW

The EGX30 rose 2.5% at today’s close on turnover of EGP 1.5 bn (29.6% above the 90-day average). Local investors were net sellers. The index is down 4.8% YTD.

In the green: Oriental Weavers (+7.5%), GB Auto (+6.6%) and Ezz Steel (+5.3%).

In the red: Rameda (-2.2%), Credit Agricole Egypt (-1.8%) and Egypt Kuwait Holding-EGP (-1.2%).

???? WHAT’S NEXT

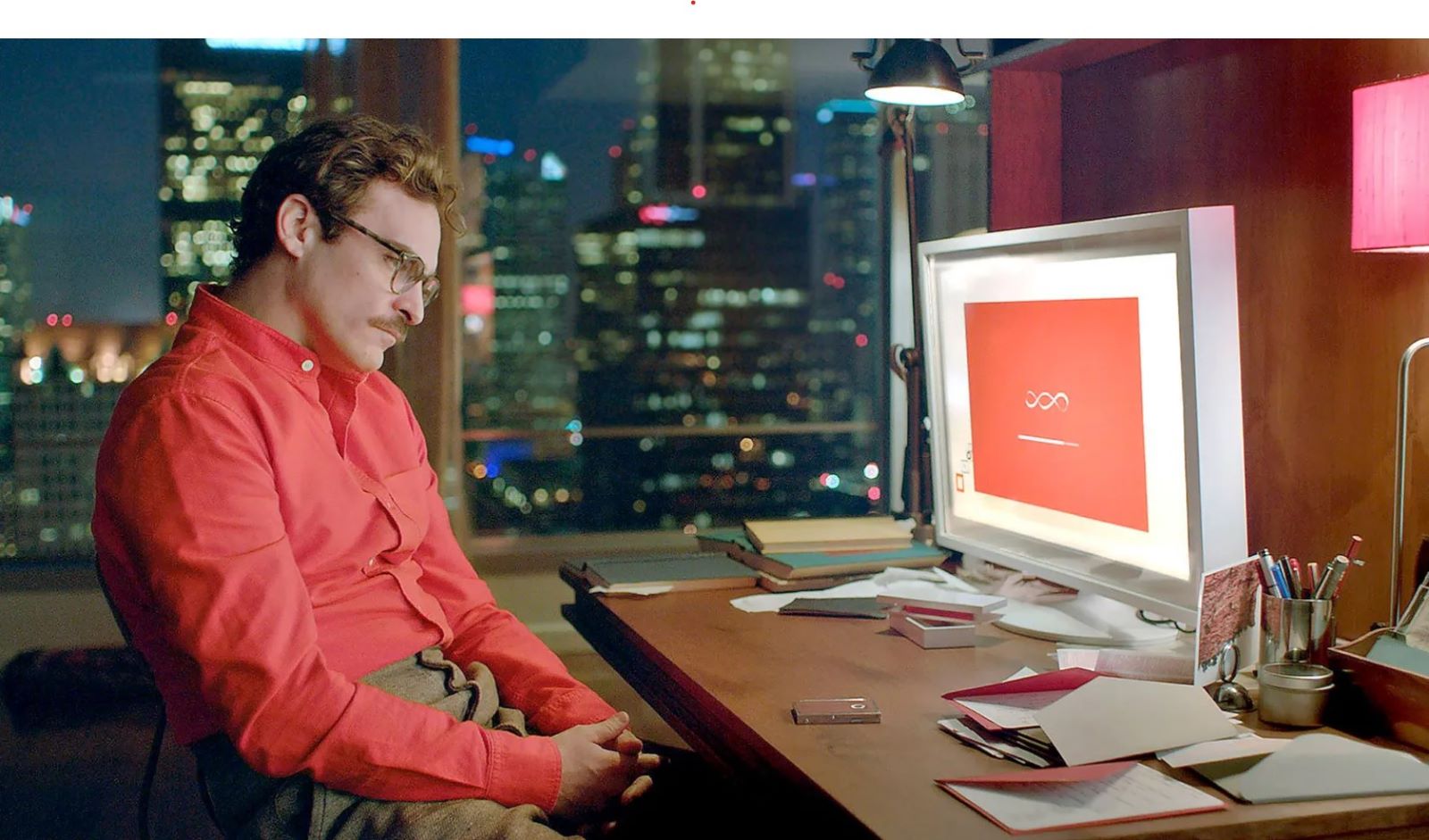

The future of smart devices: Imagine living or working in a space embedded with sensors that are equipped with mics and cams. The sensors are connected to one another through a central computing system, which picks up on your patterns and performs tasks on your behalf without any kind of prompting. From opening your curtains in the morning to placing an order from your favorite restaurant, or even gathering and analyzing research from online sources, this invisible butler would be by your side 24/7, anticipating your every need. This is called ambient computing — and some of the world’s biggest tech companies are working to make it a reality.

It’s not hard to imagine the benefits: Ambient computing would put the Internet of Things (IoT) to work for individuals, upping efficiency and leaving us to channel our time and energy to the things that we consider of most value, according to the Wall Street Journal.

But for computers to be ‘ambient,’ they need eyes and ears everywhere: We’d have to allow the technology to watch and track our every move, and listen to our conversations, in order for it to predict and perform tasks unprompted. The more features ambient computing masters, the more personal information and footage we’ll have to feed into the technology, leaving the question of how much privacy we are willing to give up in return for luxury and convenience. There’s already evidence that plenty of consumers aren’t comfortable with feeding personal information and footage to devices knowing that they could be hacked into at any time.

Ambient computing could also pose a safety risk: If your smart system misinterprets a situation or experiences a glitch, it could pose a real threat to users. Imagine your car putting itself into drive mode when you are parked, or misidentifying a face and opening your house door to a stranger.

Alexa fans won’t find this too groundbreaking: Smart speakers like the Amazon Echo or Google Nest are the closest thing we have to ambient computing for now, according to ZDNET. These voice assistants are integrated into the home — meaning they can “talk” to other smart devices you have installed — and can be activated handsfree, through voice alone. What they don’t yet do is collect data in order to anticipate what you want and do it for you before you think to ask.

Big Tech wants to corner the market: Amazon and Google have each released a stream of devices recently that they hope could one day form the hardware backbone of the ambient computing system in every home, the Wall Street Journal reports. These include smartphones, smart watches, tablets, headphones and TVs that can interact with each other and with the surrounding environment, creating a kind of personal computing bubble that follows us wherever we go.

Making ambient computing infrastructure universally compatible is key: Amazon, Apple, and Google parent Alphabet have all signed up to a new smart home standard dubbed the Matter. All devices that support the Matter protocol will be compatible with each other, opening up the possibility to mix and match smart home tech from different companies to build a seamless ambient computing environment. The Matter is getting an official launch this Thursday, 3 November.

But the next level of ambient computing will require way more powerful wireless: To reach the full potential of ambient computing, devices would need to receive continuous data from hundreds or even thousands of distinct communication points. That would overwhelm current wireless technologies. (Tiny but powerful microelectronic sensors known as “smart dust” could present part of the solution.)

???? CALENDAR

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

30 October-1 November (Sunday-Tuesday): Egypt Energy, Egypt International Exhibition Center (EIEC), New Cairo.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1 November (Tuesday): Deadline for importers, exporters and customs brokers to join Nafeza.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

5-8 November (Sunday-Tuesday): Techne Summit for Investment and Entrepreneurship, Alexandria, Egypt

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): Middle East Green Initiative, Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

9 November (Wednesday): Finance Ministry to host “Finance Day” at COP27.

11-12 November (Friday-Saturday): Saudi Green Initiative, Sharm El Sheikh.

7-13 November (Monday-Sunday): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

15-16 November (Tuesday-Wednesday): G20 summit, Bali, Indonesia.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

22 November- 23 November (Tuesday-Wednesday): The Fingerprint Summit will be held at the Nile Ritz Carlton Hotel.

27 – 28 November (Thursday-Friday): The first edition of the Egypt Media Forum.

27-30 November (Sunday-Wednesday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of November: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.