- State plans to sell 25% of EgyptAlum + ADQ to invest USD 10 bn in UAE-Egypt-Jordan industrial partnership. (The Big Story Today)

- It’s looking like that EU ban on Russian oil could be materializing soon. (The Big Story Abroad)

- Egypt’s exports were up in 1Q2022. Which sectors and markets have seen the biggest increases? (Inside Industry)

- The Russia-Ukraine war could push mns into hunger or famine, triggering a “messier” refugee crisis. (For Your Commute)

- Trust No One documents the conspiracies surrounding a crypto exchange founder’s sudden death. (On the Tube Tonight)

- Start your week on a healthy note with a delicious salad from Bar N’ Jar. (Eat This Tonight)

- Spring conference season is in full swing this week. (Circle Your Calendar)

- The recipe for a great work culture. (Under the Lamplight)

Sunday, 29 May 2022

PM — Where our exports stood in 1Q2022

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, folks. As we anticipated this morning, it’s shaping up to be a rather busy week for business news — and it’s only Sunday. A busy news day is just what the doctor ordered to help us get over our collective heartbreak over Liverpool (read: Mo Salah) didn’t walk away with the Champions League title last night.

THE BIG STORY TODAY

The state plans to sell a 25% stake in EGX-listed Egypt Aluminum (Egyptalum) to an Arab sovereign fund, Public Enterprises Minister Hisham Tawfik said at an Al Mal conference, according to a press release (pdf) from the conference organizer. The transaction will take place through a capital increase, Tawfik added, without providing a timeframe for the sale.

ADQ to invest USD 10 bn in UAE-Egypt-Jordan industrial partnership: Abu Dhabi sovereign wealth fund ADQ will set up a USD 10 bn investment fund for projects linked to the new industrial partnership between the UAE, Egypt, and Jordan, state news agency WAM reports, citing a speech by UAE Industry and Advanced Technology Minister Sultan Al Jaber during the partnership’s launch event. It’s still unclear how much Egypt and Jordan will be investing into the partnership. The announcement comes as Prime Minister Moustafa Madbouly is in Abu Dhabi to launch an “industrial partnership” with Jordan and the UAE, with the aim of attracting fresh FDI into the country, bolstering “industrial integration, and [serving] development objectives.”

THE BIG STORY ABROAD

It’s looking like that EU ban on Russian oil could be materializing soon: The EU is looking to ban imports of Russian oil via sea, while continuing imports from the Druzhba pipeline — Hungary’s main source of crude imports — in efforts to cater to the country’s objections, Bloomberg reports, citing people it says have knowledge of the matter.. Hungary has so far refused to budge on its opposition to a Russian oil embargo, leading the EU to draft a revised plan which would see nations phase out their imports of seaborne crude in six months and refined petroleum products in eight months, according to Bloomberg’s sources.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Siemens Mobility, Orascom Construction and Arab Contractors have signed a contract with the government for the second phase of the planned 2k-km high-speed rail line.

- Moody’s has cut its outlook on Egypt’s credit rating to negative as tightening financing conditions puts pressure on the country’s ability to make external debt repayments.

- The EU is working on an agreement to import more Israeli gas through Egypt as the bloc tries to secure new supplies and cut imports from Russia

*** It’s Inside Industry day — your weekly briefing of all things industrial in Egypt. Inside Industry focuses each Sunday on what it takes to turn Egypt into a manufacturing and export powerhouse, ranging from initial investment and planning to product distribution, through to land allocation to industrial processes, supply chain management, labor, automation and technology, inputs and exports, regulation and policy.

In today’s issue: The government has been targeting substantial increases of our non-oil exports, with last year’s launch of a new structural reform program indicating a heightened focus on exports, as we noted previously. And recent data suggests that their efforts may have started to bear fruit, with our non-oil exports seeing a 20% y-o-y increase in 1Q2022, rising to USD 9.18 bn up from USD 7.67 bn in 1Q2021. Today, we look at which sectors and markets have seen the biggest increases, and give a run-down of the government’s plans for boosting exports in areas including textiles, metals and construction materials between 2022 and 2025.

|

FOR TOMORROW-

Public consultations on non-bank financial services: Public consultations on the second phase of the Financial Regulatory Authority’s (FRA) strategy to develop the non-banking financial services sector will begin tomorrow, the regulator said in a statement (pdf) yesterday. The FRA has identified six key priorities for the four-year strategy including boosting use of fintech, accelerating digital transformation, achieving financial inclusion, and improving risk management.

???? CIRCLE YOUR CALENDAR-

Tuesday is the last day for EGX-listed companies to file their earnings for 1Q2022, after the Financial Regulatory Authority granted listed companies a two-week deadline extension.

Tuesday is also the application deadline for ITIDA’s annual Export IT program. The program is designed to encourage local IT companies to boost exports while reducing related costs.

Central Bank of Egypt Governor Tarek Amer is set to chair the World Bank and International Monetary Fund’s Annual Meetings, which will be held in person in Washington, DC. The meetings have been held virtually since the start of the pandemic. Amer will give the opening speeches at both meetings alongside the head of each of the two lenders and will chair the board meetings of the World Bank, the IMF, and the European Bank for Reconstruction and Development, the central bank said in a statement. The meetings will be held on 10-16 October.

Spring conference season is in full swing this week. Among the events taking place over the next few days:

- Egypt Can with Industry begins tomorrow and wraps on Tuesday, 31 May.

- The Islamic Development Bank’s 2022 annual meetings are scheduled for this Wednesday-Saturday, 1-4 June in Sharm El Sheikh. Enterprise will be attending the annual meetings and bringing you updates from there.

- The Islamic Corporation for the Ins. of Investment and Export Credit will hold two high-level parallel meetings on climate action and digital transformation during IsDB’s annual meetings.

It’s official: We’re hosting next year’s African Development Bank (AfDB) annual meeting. The meeting will be held in Sharm El Sheikh from 22-26 May, 2023, the bank said yesterday.

☀️ TOMORROW’S WEATHER- Wear a hat and stay hydrated tomorrow, because the mercury is going to hit a high of 41°C in the capital city. The evening should be a bit cooler with a low of 24°C.

???? FOR YOUR COMMUTE

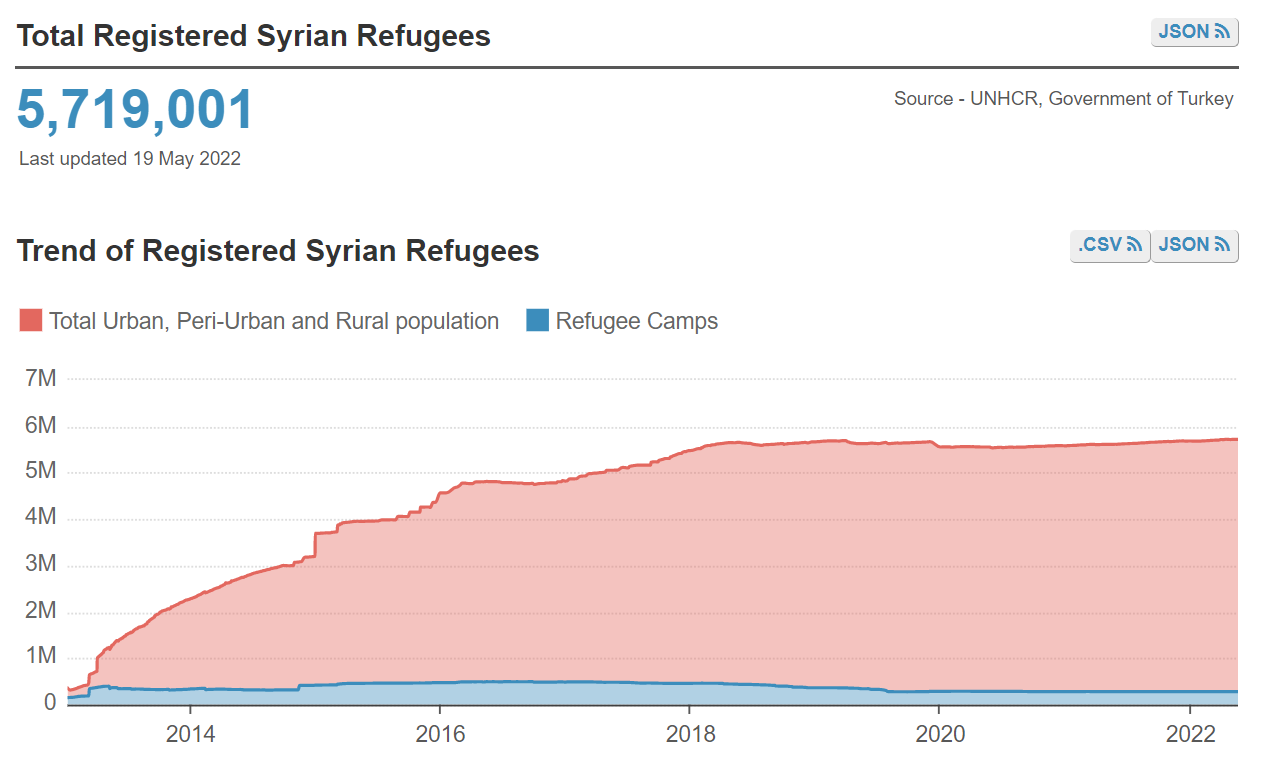

The war in Ukraine could trigger a “more messy” refugee crisis — particularly as food shortages push mns into hunger or famine. Mns of people could be forcibly displaced in an imminent refugee crisis that would be more reminiscent of the 2015-2016 immigration wave from Syria, Margaritis Schinas, the European Union’s commissioner in charge of migration, told Bloomberg.

His comments come as, for the first time on record, the number of people forcibly displaced globally has topped 100 mn, according to the UN’s refugee agency, on the back of conflicts and violence worldwide. These include Ukraine, with 6.7 mn refugees so far, and Syria with at least 5.7 mn registered refugees, according to UN figures. This also includes refugees from Ethiopia, Afghanistan and others. This record-high figure must “serve as a wake-up call” for more action to promote peace, said Filippo Grandi, the UN High Commissioner for Refugees, Andreas Kluth writes for Bloomberg.

Regional shuttle flights for World Cup attendees: Over 180 daily regional shuttle flights will be operated by Gulf airliners for the FIFA World Cup 2022 hosted by Qatar in November, Reuters quotes Qatar Airways CEO Akbar Al Baker as saying. Flights are set to be operated by Oman Air, Kuwait Airways, Saudia, and UAE budget airline Fly Dubai, he said, adding that the UAE’s Etihad and Air Arabia might possibly join the plan.

But what about us? Al Baker did not mention shuttle flights picking up Egyptian travel goers. We’ve also yet to hear of any offers and packages by Egyptair for the World Cup. Our local airline had a similar package for Russia 2018, but Egypt had been playing at the time.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The conspiracy theory surrounding a cryptocurrency exchange’s founder and his sudden death: Trust No One is a documentary that follows the story of Gerald Cotten — the founder of crypto exchange QuadrigaCX — who died without warning while in India. His death blocked users of the exchange from accessing the USD mns that were invested through the platform, creating havoc for all those involved — especially since they haven’t gotten back their money until today. The way Cotten’s demise played out gave rise to several conspiracy theories, including some that postulated he stole the money and faked his own death.

Seriously, Netflix, stop wasting our time with these “mystery / not really a mystery,” clickbait documentaries: While Trust No One has garnered great reviews, including from the likes of the Guardian, it definitely falls under the category of a bait and switch Netflix documentary. While the documentary is suspenseful — delving into these theories and unveiling a web of intrigue and deception — it falls flat on its face when you get to the ending, which is something that Netflix has increasingly been guilty of. If Netflix wants to stay competitive in the era of the streaming wars and stem the decline of its share price, we recommend they produce documentaries with actual mysteries that have a payout in the end. Still, not a bad way to kill a few hours.

⚽ Just two matches today in Om El Donya: Future will face Eastern Company at 4pm, and Pyramids v Al Masry will kick off at 6:30pm.

????EAT THIS TONIGHT-

Start your week off with a healthy delicious salad from Bar N’ Jar in West Cairo: The salad station at Galleria 40’s Zaitona food hall has a wide range of salads to suit just about every taste, or you can even build your own salad by mixing and choosing between more than 36 items. Our only complaint was how difficult it is to pick among the salad bar’s tasty-looking, colorful options. If you want to avoid the paradox of choice, you can’t go wrong with their Fully Loaded salad — a yummy mix of grilled chicken, beets, quinoa, sweet corn, oakleaf lettuce, kidney beans, and thousand island dressing. Finish off your meal with their signature berry yogurt parfait or a low-calorie vanilla ice cream, and voila — a totally no-guilt dessert to satisfy your sweet tooth.

???? OUT AND ABOUT-

(all times CLT)

A tribute night with familiar tunes is happening tonight at Cairo Jazz Club: The evening kicks off at 9 pm with some of the best Foo Fighters hits from musician Shady Ahmed rocking out alongside grunge cover band Seattle. Stick around for some of the best 21 Pilots tunes from tribute band Skeleton Clique, who will be making their debut on CJC's stage.

???? UNDER THE LAMPLIGHT-

If you’re a leader keen on creating the best work environment, you should really pick up Daniel Coyle’s Culture Playbook, a handbook for fostering a strong team with trust, safety and a sense of purpose. Where does great work culture come from? And how can you create it? The New York Times bestselling author is back with a follow-up to the Culture Code, which was named the best Business Book of the Year by Bloomberg. Having advised organizations such as Microsoft and Google, Coyle believes that a good culture at the workplace is a skill that “doesn’t depend on who you are but on what you do,” he writes. The big takeaway: It takes work to create that thriving work culture, but the three most important pillars are safety, vulnerability, and purpose. This book is an easy to read crash course into 60 important steps to get great culture, including one important tip: “Zero tolerance of brilliant jerks.”

???? GO WITH THE FLOW

EARNINGS WATCH-

MM Group reported a 60.1% y-o-y drop in its 1Q2022 bottom line, recording EGP 51 mn, according to an earnings release (pdf). The company’s consolidated revenues also fell 22.9% y-o-y during the quarter to hit EGP 1.94 bn.

Oriental Weavers recorded EGP 260.06 mn in net income in 1Q2022, down 24.2% y-o-y, according to its financial statements (pdf). The company’s sales rose 18.2% y-o-y to reach EGP 3.26 bn.

Emaar Misr’s bottom line rose 199% y-o-y in 1Q2022 to record EGP 1.58 bn, according to the company’s financial statements (pdf). Revenues for the quarter rose 66.6% y-o-y, coming in at EGP 2.57 bn.

The EGX30 fell 1.1% at today’s close on turnover of EGP 298 mn (64.6% below the 90-day average). Local investors were net buyers. The index is up/down 15.6% YTD.

In the green: GB Auto (+7.3%), AMOC (+0.9%) and Fawry (+0.8%).

In the red: Oriental Weavers (-5.4%), Heliopolis Housing (-4.6%) and EFG-Hermes (-3.5%).

BY THE NUMBERS- Egypt’s exports were up in 1Q2022. Which sectors and markets have seen the biggest increases? Egypt’s non-oil exports increased 20% y-o-y in 1Q2022, recent data from the Trade and Industry Ministry shows. Exports rose to USD 9.18 bn, up from USD 7.67 bn in 1Q2021, according to the late-April statement. With the government targeting substantial increases of our non-oil exports — specifically ramping up exports in manufacturing, telecoms and IT, and agriculture — this most recent data could indicate the activity is starting to bear fruit.

A variety of sectors saw export increases in 1Q2022: Printing and packaging saw a 59% y-o-y increase, with 1Q2022 export revenues standing at USD 312 mn, the most recent Trade and Industry Ministry data shows. This was followed by readymade garments, which were up 44% y-o-y, standing at USD 625 mn. Building materials stood at USD 1.9 bn (up 35% y-o-y), and textiles at USD 279 mn (up 32% y-o-y). Egypt’s top engineering export sectors saw 1Q2022 revenues totalling USD 983 mn (up 32% y-o-y), with a recent report (pdf) from the Engineering Export Council of Egypt giving a breakdown of the different industries. Next up were chemical products and fertilizers which stood at USD 935 mn (up 23% y-o-y), according to ministry data.

Other rising export goods: Footwear and leather exports reached USD 26 mn (up 22% y-o-y); furniture at USD 183 mn (up 20% y-o-y); medicine at USD 210 mn (up 19% y-o-y); agriculture at USD 1.3 bn (up 10% y-o-y); and food at USD 1.9 bn (up 5% y-o-y).

It continues a trend that saw non-oil exports rise 26% y-o-y in 2021: Egypt’s non-oil exports hit a record USD 32 bn in 2021, up from USD 25.4 bn in 2020, we reported in January. Egypt’s largest non-oil exports are in the chemicals and fertilizers sector, which brought in USD 6.7 bn in 2021 (up 45% y-o-y), engineering and electronics which brought in USD 3.4 bn (up 46% y-o-y), and readymade garments which brought in USD 2 bn (up 39% y-o-y).

Our exports to African markets saw the most growth in 1Q2022, according to ministry data. Exports to non-Arab countries in Africa saw a 35% y-o-y increase, standing at USD 515 mn in 1Q2022. Meanwhile, exports to Arab League countries are up 28% y-o-y.

But the USA, Saudi Arabia, Turkey and Italy were our largest export markets overall in 1Q2022, GOEIC head Essam El Nagar was quoted as saying in the April statement. Exports to the US increased 21% y-o-y, rising to USD 623 mn in 1Q2022, ministry data shows. Meanwhile, exports to the EU increased 14% y-o-y, rising to USD 2.5 bn in 1Q2022. And exports to other markets increased 13% y-o-y, rising to USD 2.5 bn in 1Q2022.

Looking ahead, the government is focused on boosting exports in areas including textiles, metals, and construction materials between 2022 and 2025, President Abdel Fattah El Sisi said in late April during a televised speech introducing his plans to boost private sector investment (pdf). As we noted last week, the government has identified nine sectors to boost exports in: Wood and furniture, engineering, food and agriculture, chemicals, textiles, pharma and medical, printing and packaging, building materials, and metallurgical industries.

The plan indicates that we’re set to see increased manufacturing of specific products within these sectors, including metals (like magnesium or calcium), non-alkaline metals (like steel), plastics and rubber, food products, tractors and trucks, paper, computers, construction equipment (like drills), cosmetics and meds, and finished metallic goods.

Altogether, the government is targeting the replacement of imports valued at around USD 20 bn in the coming three years. This includes roughly USD 4.3 bn in chemical products, USD 4 bn in engineering services, USD 2.5 bn worth of meds, USD 2.4 bn in textiles, USD 1.9 bn in food and agricultural products, and USD 1.5 bn in construction and mining, the Ittihadiya plan notes.

The plan also involves building 300 large factories geared towards exports, in partnership with the private sector, and targeting the creation of 700k jobs.

The Finance Ministry is also increasing allocations for its export subsidy program in the FY2022-23 budget to EGP 6 bn, up from EGP 4.2 bn in the FY2021-22 budget, advisor to the Vice Minister of Finance Nevine Mansour tells Enterprise. “This is part of a concerted effort to support and increase exports,” she adds.

All subsidies owed as part of the government’s subsidy repayment program have now been paid to companies who have applied for the program, Finance Minister Mohamed Maait tells Enterprise. A total of EGP 34 bn has now been paid out to exporters by the government since 2012 with EGP 23 bn of this coming from the repayment program, Maait notes. The repayment program has seen exporters collect one-time cash payments in return for a haircut of 15%, which was then lowered to 8% in later phases of the program.

Your top industrial development stories for the week:

- Unified system to locally produce prosthetics: The government is developing a unified system for the manufacture of prosthetic limbs and prosthetic devices to increase local production and reduce imports, Trade Minister Nevine Gamea said, according to a statement.

- Lots of fresh investment in food, pharma and aluminum: Egypt Otsuka is planning a USD 30 mn factory, a consortium of Egypt’s Octa International and Saudi Olayan Group’s Aluminum Products Company is building a EGP 500 mn aluminum factory, German snackmaker Lorenz is investing EGP 200 mn in Egypt, and dairy producer Milkys will spend EGP 400 mn on a new factory.

- Orascom Construction and Al Ahly Capital are building an industrial park in West Cairo that will be home to companies in logistics, light industries, and MSMEs.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

MAY

27 May-3 June (Friday-Friday): El Gouna International Squash Open 2022.

30-31 May (Monday-Tuesday): Egypt Can with Industry, Cairo, Egypt.

31 May (Tuesday): Last day for EGX-listed companies to file 1Q2022 earnings

31 May (Tuesday): The application deadline for ITIDA’s annual Export IT program.

May: Investment in Logistics Conference, Cairo, Egypt.

May: General Authority for Land and Dry Ports to issue the conditions booklet for the tender to establish and operate the Tenth of Ramadan dry port.

May: Egypt to sign contracts for second and third high-speed rail lines with Siemens by the end of the month.

May: Government to announce its automotive strategy by the end of the month.

JUNE

1-4 June (Wednesday-Saturday): The Islamic Development Bank will hold its 2022 annual meetings in Sharm El Sheikh.

2-3 June (Thursday-Friday): Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) will hold two high-level parallel meetings on climate action and digital transformation during IsDB’s 2022 annual meetings in Sharm.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, new administrative capital.

5 June (Sunday): GB Auto is hosting an extraordinary general assembly meeting (pdf).

7 June (Tuesday): Technology conference Tech Invest 4 will take place at the Grand Nile Hotel in Cairo.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): EU-Egypt Sustainable Food Value Chain conference, Grand Nile Tower Hotel, Cairo.

16 June (Thursday): End of 2021-2022 academic year for public schools.

21-22 June (Tuesday-Wednesday): Aswan Forum for Sustainable Peace and Development, Cairo.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 June (Sunday): The deadline for private companies to pre-register ahead of bidding for the second phase of the PPP national project to establish and operate 1k language schools.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

30 June (Thursday): Deadline for bids for National Democratic Party HQ redevelopment contract.

June: Egypt will launch a unified ticketing system for all means of transport at the Adly Mansour Interchange Station.

June: Polish President Andrzej Duda will visit Egypt to coordinate ways to ship Ukrainian wheat to Egypt amid the war in Ukraine.

JULY

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

1 July (Friday): Official rollout of e-receipt system begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

AUGUST

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 600 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

OCTOBER

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC, chaired by CBE Governor Tarek Amer

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

NOVEMBER

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP 27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

DECEMBER

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

JANUARY 2023

January EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

MAY 2023

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

EVENTS WITH NO SET DATE

2Q2022: The Sovereign Fund of Egypt will invest in two companies in the financial inclusion and non-banking financial services sectors.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 2Q2022: Door for bidding for the contract to redevelop the site of the former National Democratic Party HQ to close.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.