- Corplease issues EGP 2.4 bn in securitized bonds in the first issuance of the year. (The Big Stories Today)

- The Suez Canal had its best year on record with USD 6.3 bn in revenues. (The Big Stories Today)

- Civil servants are getting this Thursday off in celebration of Coptic Christmas. (What We’re Tracking Tonight)

- Egypt to ride the recovery wave as world economy set to surpass USD 100 tn in 2022. (Macro Picture)

- You only have a few days left to take our annual reader poll — and join us for breakfast. (What We’re Tracking Tonight)

- It’s raining, it’s pouring… (Happening Now)

- Would you like fries with your 3D-printed burger? (For Your Commute)

- Why is the Jetsons era taking so long to get here? (Under the Lamplight)

- Elon Musk is getting slapped with one of the largest tax bills in US history. (For Your Commute)

Sunday, 2 January 2022

PM — Corplease issues EGP 2.4 bn in securitized bonds in the first issuance of the year.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

It’s the first EnterprisePM of the year, ladies and gentlemen. Work on this edition was one of the highlights of 2021 for us, and we’re very grateful to you, dear reader, for allowing us to continue doing it. We hope you had as much fun reading it as we’ve had making it.

We also wanted to thank our friends at Etisalat Misr, who join us today as a pillar sponsor of EnterprisePM alongside CIB. It is through their generous support that we are able to continue to provide your afternoon reads without charge.

PSA #1- Civil servants are getting this Thursday off, with a cabinet statement today announcing that 6 January will be off in observance of Coptic Christmas which falls on Friday. We’re still waiting on announcements from the Central Bank of Egypt and the EGX on whether banks and the stock market will be closed on that.

PSA #2- The Taxman would very much like it if you were to soon file your 2021 tax returns: The deadline for submission for individuals is 31 March, while the deadline for companies with January-December fiscal years is 30 April.

A reminder that the EGX capital gains tax is now being implemented: As of today’s trading session, resident investors will face a 10% capital gains tax on EGX transactions. The tax will be imposed on net portfolio earnings at the end of the tax year after deducting brokerage fees. Foreign investors are not subject to the tax.

PSA #3- You only have a few days left to take our annual reader poll — and join us for breakfast. Every year, we ask our readers to weigh in on what you expect for the year ahead in our Enterprise Reader Poll. Take a few minutes to give us your take on the outlook for your business and industry, whether you’re planning fresh investments and new hires, and how your business fared in the year past. We’ll share the results with the entire community next week to help shape your view of the year — and will invite eight of you to break bread with us. Another dozen of you who complete the poll will also get special Enterprise mugs to enjoy your morning beverage of choice.

THE BIG STORY TODAY-

#1- We have our first securitization of the year: CI Capital’s Corplease closed a four-tranche EGP 2.4 bn securitized bond issuance, lead manager and underwriter Misr Capital said in a statement today (pdf). Corplease’s issuance comes as the Financial Regulatory Authority signed off (pdf) on two more sales from Cairo Housing and Development and its sister companies.

#2- It’s official — the Suez Canal had its best year on record: The Suez Canal ended 2021 with a record USD 6.3 bn in revenues, up 12.2% y-o-y, Ever Given and all, Suez Canal Authority boss Osama Rabie said.

^^We’ll have more on these stories and others in tomorrow’s EnterpriseAM.

HAPPENING NOW- It’s pouring out there: We’re already seeing the beginning of a downpour here at the Enterprise global HQ in Maadi, with rain starting and stopping every few minutes. Our weather app is expecting rain from 6pm to 10pm tonight so you may want to take that into consideration when heading home from work today.

☀️ TOMORROW’S WEATHER- There’s more wind and rain expected tomorrow, with the mercury set to reach 20°C during the day and 11°C at night, according to our favorite weather app.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Four or five companies could offer shares on the EGX in 2022, EGX boss Mohamed Farid said, with Nahr Elkhair Development and Investment likely to be first in the chute.

- Also in the pipeline is Ghazl El Mahalla FC, whose shares are set to begin trading on the EGX in February.

- Israel-UAE’s answer to the Suez Canal just got blocked: A proposed oil transport corridor between the UAE and Israel that could have undermined the Suez Canal’s role as a major trade artery has been blocked by Israel’s justice ministry.

THE BIG STORY ABROAD-

There’s no one single story driving the conversation in the foreign press, which is somewhat expected since it’s the first Sunday after New Year’s. There’s a smattering of stories looking at how schools are coping with omicron closures (here and here), as well as tick-tock coverage of the Russia-Ukraine-Nato story, including Finland pushing to join the alliance.

A handful of OPEC+ countries — including Russia — are struggling to meet their production quotas after the oil cartel ramped up its output targets, suggesting that they’ve maxed out their capacity, Bloomberg says. Oil output from Angola, Nigeria, and Kuwait is also falling below target, after OPEC+ agreed in December to continue ramping up oil production despite concerns that the spread of the omicron variant could hit energy demand, according to the business information service. The oil cartel is set to meet on Tuesday, with experts expecting it to stick to its planned production increases.

|

???? CIRCLE YOUR CALENDAR-

It’s the start of a new month. The key news triggers to keep your eye on:

- PMI: Purchasing managers’ index figures for December for Egypt, Saudi Arabia, and Qatar will be released on Tuesday, 4 January. Figures for the UAE will be released on Wednesday, 5 January.

- Foreign reserves: December’s foreign reserves figures will be announced before the week is out.

- Inflation: Inflation figures for December will be released on Monday, 10 January.

- Interest rates: The Central Bank of Egypt (CBE) will hold its first policy meeting of 2022 later this month. The CBE hasn’t yet published its meeting schedule for the year so we’re still waiting on an exact date.

Expect progress in El Nasr Auto’s EV talks this month, with the company set to announce updates on its talks with seven foreign auto firms to begin assembling electric vehicles in Egypt, CEO Hani El Khouly said over the weekend.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

???? FOR YOUR COMMUTE

How would you like your burger printed? The launch of Israeli foodtech firm SavorEat’s plant-based burger system makes it one of the first restaurants to use 3D printing technology, according to Reuters. Their on-site printer has three cartridges filled with oils and other ingredients (including potato, chickpea, and pea protein), allowing customers to choose the amount of fat and protein in their burger for a personalized meal. SavorEats’ 3D-printing “robot chefs” will initially only be rolled out in some branches of a local burger chain, but the company is inking an agreement to serve the burgers at US universities. It’s now working on similar technology to create a vegan alternative for breakfast sausages to further penetrate the US market.

Elon Musk is getting slapped with one of the largest tax bills in US history after going on a selling spree of his Tesla shares last year, according to CNN. In November, Musk set up a Twitter poll asking his followers whether or not he should sell USD 21 bn (10%) of his shares in the automaker, claiming that it was “the only way” for him to pay taxes personally. During the second week of November, he sold USD 6.9 bn worth of his Tesla shares, and has continued to sell shares in the company through last week, bringing his federal tax bill to USD 10.7 bn, at a tax rate of 40.8%.

Blanket booster programs are likely to prolong the pandemic, rather than end it, warns WHO: World Health Organization (WHO) chief Tedros Ghebreyesus has criticized blanket vaccine booster programs that divert supply to wealthier countries as poor countries struggle to obtain initial doses. Unequal access to immunizations could lead to more mutated variants that drag out the global health emergency, Ghebreyesus told reporters in Geneva last month. The WHO has repeatedly discouraged booster programs amid rampant vaccine inequality, but has been widely ignored by developed countries, many of which have rolled out nationwide booster programs as they struggle to get a grip on the omicron variant.

???? ENTERPRISE RECOMMENDS

Check out legendary graphic designer Paul Rand’s exhibit + say ‘farewell’ to the past year with Netflix’s Death to 2021

???? ON THE TUBE TONIGHT-

(all times CLT)

Netflix sums it all up with mockumentary Death to 2021: Think Enterprise’s Year in Reviews, only with celebrities, dirty jokes, and a ton of weird interview questions, and you get Death to 2021. The mockumentary looks at the events, trends, and experiences of the past year and explores them through hilarious skits and interviews, delving into topics such as modern-day dating, influencers and cancel culture as well as more political events such as the raid on Capitol Hill and the scuffles within the British royal family. If you’re a fan of dark and audacious humor, you’ll appreciate the mockumentary’s brand of comedy, according to First Post. The one-hour recap of the year is a therapeutic way to laugh at all the chaos 2021 threw at us… and finally say good riddance, they write.

⚽ Liverpool will play against Chelsea in gameweek 21 of the English Premier League today at 6:30pm. The two teams — who occupy the second and third places — have been facing some difficulties in their last matches, as Chelsea, who led the league for several rounds, tied three times in the last five games and expanded the point difference with league leaders Manchester City to 11 points. Meanwhile, Liverpool suffered a sudden defeat at the hands of Leicester City in the last round to widen the difference with City to 12 points. Today we also have three matches that will start soon at 4pm: Brentford vs. Aston Villa, Everton vs. Brighton, Leeds vs. Burnley.

Spanish League: Getafe will play against Real Madrid at 3pm while at 5:15pm, Atlético Madrid will host Rayo Vallecano and Elche will compete against Granada. At 7:30pm, Deportivo Alavés will face Real Sociedad and Real Betis will face Celta Vigo, before we conclude the day with Mallorca and Barcelona at 10pm.

???? EAT THIS TONIGHT-

Kaya Restobar brings good food and good music to the table: If you’re hungry or just bored while in Sheraton, check out Kaya Restobar which is an amazing place to hear some live music or just get together with friends. The menu is full of great dishes which vary from yummy snacks to a fancy meal. We love their cheesy spinach dip, their seafood appetizer platter, and their chicken wings as starters. Main dishes include a variety of steaks, a flavorful mushroom risotto, lamb sausages, and seafood flambé which comes with flames rising from the plate. For a sweet treat, try out their creamy tiramisu.

???? OUT AND ABOUT-

(all times CLT)

AUC’s Tahrir Culture Center has an exhibition showing works by the late legendary graphic designer Paul Rand: The exhibit, titled The Idealist/Realist, touches on the origins of branding design, visual identity design, editorial design, and advertising, with the event expected to run until 20 January. Rand is best known for his corporate logo designs, including the logos for IBM, UPS, Enron, Morningstar, and ABC.

Ubuntu Art Gallery has two new exhibitions on: Middle of Nowhere, Center of Everywhere by Hakim AbouKila features a number of surreal and colorful paintings while Let's Ride a Bike by Sayda Khalil showcases mixed-material sculptures that have all been formed to look like bikes.

It’s sure to be a great night at Sheikh Zayed’s Cairo Jazz Club this Wednesday as Dina El Wedidi and underground band Wust El Balad take the stage at 9pm.

???? UNDER THE LAMPLIGHT-

J. Storrs Hall wonders where the Jetsons era is in his book, Where Is My Flying Car? Flying cars have been expected to arrive any minute now since the 1962 release of the famous animated sitcom The Jetsons, but we’ve remained relegated to a life without the luxuries of George Jetson. Hall — who is a research fellow at the Institute for Molecular Manufacturing and an associate editor of the International Journal of Nanotechnology and Molecular Computation — poses a few explanations for why the world’s cars are still grounded. The first is what he calls the “Machiavelli effect”: Innovators have no room to explore new ideas and technologies as institutions and funding systems continue to reward cadres or those who are politically skilled, writes the WSJ. Otherwise, scientists often suffer from “failures of nerve” or “failures of the imagination” which limits their creativity by making them assume that they already know everything that can be known and results that oppose these “facts” are wrong.

???? GO WITH THE FLOW

Market roundup on 2 January

MARKET ROUNDUP-

The EGX30 fell 0.3% at today’s close on turnover of EGP 617 mn (52.6% below the 90-day average). Local investors were net buyers. The index is down 0.3% YTD.

In the green: Cleopatra Hospital (+2.0%), Rameda (+1.7%) and AMOC (+1.1%).

In the red: Mopco (-4.3%), Abu Qir Fertilizers (-3.2%) and Orascom Development Egypt (-2.7%).

???? MACRO PICTURE

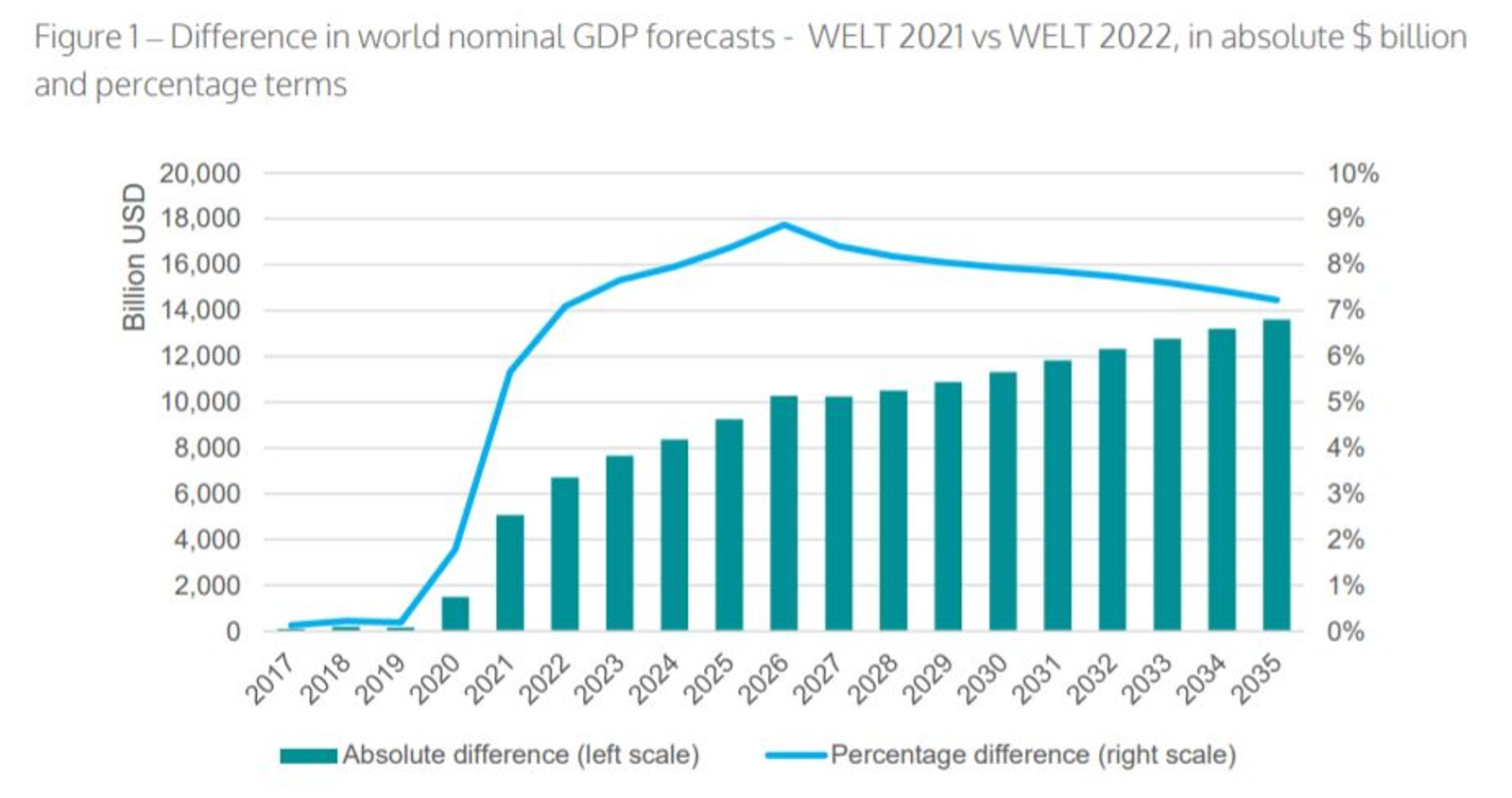

Global GDP is set to surpass a record USD 100 tn in 2022, with growth expected to hit 4.2% this year, according to the World Economic League Table (WELT) from the Centre for Economics and Business Research (CEBR). That’s two years earlier than the UK-based think tank previously expected the global economy to reach the USD 100 tn milestone and the GDP growth rate is a significant upward revision from its prior estimate of 3.4%.

What’s driving the momentum? In a word, vaccines, which are helping to drive a faster than expected recovery from the pandemic. CEBR had previously projected that global GDP would contract 4.4% in 2021, but the year ended with GDP falling a less severe 3.2%. Since December 2020, when the first vaccine was administered to a 90-year-old British woman, over 58% of the global population has received at least one dose of the inoculation, according to Our World in Data. The rapid rollout of jabs has allowed several countries to enter a post-pandemic recovery phase, CEBR says.

How does this stack up against other forecasts? The IMF is slightly more bullish than CEBR, penciling in 4.9% growth this year in its latest World Economic Outlook report. The lender expects global growth will taper down beyond next year to average at 3.3% in the medium term. The World Bank’s June global growth outlook (pdf) was almost identical to CEBR, with 4.3% forecasted growth.

But inflation remains a thorn in our side: It is essential that nations find ways to cope with inflation or else the world will need to “brace itself for a recession in 2023 or 2024,” the report warns. If conditions continue as they are, GDP growth will clock in at less than 1% in 2023 before recovering slightly in 2024 to 2%. Inflation skyrocketed this year due to shortages of commodities, finished goods, shipping space and fossil fuels, leading to what analysts now call “persistent inflation.” Wage inflation has also contributed to the problem amid the so-called “Great Resignation” which occurred during labor shortages.

Fiscal consolidation will ease inflation, but monetary austerity is also necessary, especially as the CEBR estimates that there is a monetary overhang of 15-20% around the world. Central banks need to reduce monetary expansion and raise interest rates, among other counter inflationary monetary actions in the coming period. The CEBR expects asset prices to fall by around 10-15% this year, which could also help avoid an inflation-fueled slowdown in the global economy without nations needing to resort to extreme austerity measures. The US has already led this movement — scheduling three interest rate hikes in 2022 — with China expected to soon follow and the European Central Bank signaling it will do the same next year. Emerging markets are likely to get burnt along the way, the report believes, echoing warnings from several institutions such as S&P Ratings.

Where does Egypt fall in all of this? In terms of GDP growth, Egypt is expected to rank #33 out of 191 nations in 2022, with a GDP of EGP 4.34 tn, according to WELT. The rankings take into account everything from the availability of tech and energy to environmental risks. In 2026, Egypt will inch up to #32 before falling to #36 in 2031 and #38 in 2036. “CEBR forecasts that the annual rate of GDP growth will accelerate to an average of 5.4% between 2022 and 2026, before slowing to an average of 4.2% per year between 2027 and 2036,” the report added.

Unemployment and public sector debt are seen as our biggest challenges: Egypt’s high unemployment rate could deter consumer spending-driven economic growth, while confidence, investment, and fiscal headroom in the country have been negatively impacted by the level of public sector debt, according to WELT. Egypt’s unemployment rate rose to 7.5% in 3Q2021 as the job market failed to absorb fresh grads. Meanwhile, the country’s fiscal deficit currently stands at 7.3% of GDP. These factors “paint a worrying picture for the country’s fiscal stability in the coming years,” the report added.

Who’s #1? No surprises there — the US will likely lead world GDP in 2022 and 2026 with a GDP of USD 20 tn and USD 21 tn respectively. China comes in second place in 2022, followed by Japan, UK, Germany, France, and India.

But China might soon eclipse the US in 2031 and retain the top spot through to 2036. The think tank had previously forecasted that Beijing would overtake Washington in 2028 in the previous edition of WELT, but pushed back the outlook by two years to take into account the US’s faster than anticipated growth this year. China’s GDP is expected to reach RMB 158 tn in 2031 (equivalent to USD 27 tn) and RMB 190 tn in 2036 (or USD 36 tn).

BONUS- You might want to thank Mama and Baba for pushing you to get an engineering degree after all, with the report suggesting that in 10 years, the world will need double the number of engineers and technologists to meet the demand of rapid technological development.

???? CALENDAR

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

January: Tenth of Ramadan dry port tender to be launched.

January: NilePreneurs is launching a training program that aims to increase the industrial capacity of SMEs in the automobile manufacturing, home appliances and engineering industries.

1-15 January (Saturday-Saturday): Qualified Industrial Zones (QIZ) Joint Committee.

4 January (Tuesday): OPEC+ ministerial meeting.

6 January (Thursday): National Holiday in observance of Coptic Christmas.

7 January (Friday): Coptic Christmas.

9 January – 6 February (Sunday-Sunday): 2021 Africa Cup of Nations, Cameroon.

10-13 January (Monday-Thursday): World Youth Forum, Sharm El Sheikh.

15 January (Saturday): Target date for the finalization of snackfood giant Edita’s acquisition of the Egyptian Belgian Company, owner of the Ole brand.

Second half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

Second half of January: Regulations for installing EV charging stations will be published.

16 January (Sunday): SODIC shareholders will vote on the company’s new board of directors at an extraordinary general meeting.

17-19 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi.

20 January (Thursday): Kadmar Shipping’s new line transporting agricultural crops between Alexandria and Russia begins its operations.

23 January (Sunday): Deadline for Macro Pharma to IPO on the EGX.

25 January (Tuesday): 25 January revolution anniversary / Police Day.

27 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

End of January: The Egyptian-Romanian business forum will take place with the aim of strengthening joint investment relations.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX this month.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

11 February (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: The World Economic Forum annual meeting, location TBD.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

15-18 June: St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

July: A law governing ins. for seasonal contractors will come into effect.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

September: Egypt will display its first naval exhibition with the title Naval Power.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November: 3Q2022 earnings season.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.