- STC is once again playing footsie with Vodafone Egypt as it attempts to secure funding for a possible acquisition. (The Big Stories Today)

- How are Egypt and global business leaders coping with the stresses of 2021? Not well, according to this Bupa poll. (Poll)

- China Evergrande’s negotiated agreement with its bondholders brings relief to global markets. (The Big Story Abroad)

- We’ll find out tonight if the Fed will give us an indicator on when it will begin its tapering. (Happening Now)

- Batteries and cameras. That’s the extent of innovation at Apple these days, apparently. (For Your Commute)

- It’s Mobster Wednesday here at Enterprise, as HBO releases The Sopranos prequel. (On The Tube Tonight)

- German auto giants BMW and Audi are increasing their investments in hydrogen. (For Your Commute)

Wednesday, 22 September 2021

EnterprisePM — Saudi’s STC is seeking funding to restart its M&A dance with Vodafone Egypt.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Egypt’s appeal to Gulf investors appears on the upswing once again. Just one week ago, Aldar and ADQ announced they were launching a mandatory tender offer to for up to 90% of upmarket real estate developer SODIC. Today, we have news that Saudi Telecom is back in the hunt for control of Vodafone Egypt. Not a bad way to slide into the next-to-last workday of the week, huh?

THE BIG STORIES so far today:

#1- Vodafone and Saudi Telecom’s (STC) will they-won’t they dance is back on again after nine months of silence. Citing unnamed sources, CNBC Arabia claims the Saudi company is looking a secure a USD 1.1 bn soft loan to finance part of the USD 2.4 bn it needs to acquire 55% of the mobile network operator’s Egyptian arm, an acquisition which has been in the works since early last year before it appeared to fall through in December.

#2- CIRA’s board has given the green light to an EGP 260 mn loan from an Egyptian bank with proceeds earmarked to fund the education outfit’s upcoming projects, the company announced in a regulatory filing (pdf). CIRA and its subsidiary Eduhive are eyeing major expansion, aiming to have over 25k seats in Upper Egypt alone at K-12 schools and higher education establishments by 2023.

#3- Egypt has infrastructure ready to store up to 4 mn doses of Pfizer’s covid-19 jab, according to Health Minister Hala Zayed, who noted that the country is prepared to receive a batch of Pfizer over the weekend. The ministry has purchased and positioned nationwide some 600 fridges with a combined capacity to store over 4 mn vaccine doses. Egypt has so far received or produced some 33.7 mn doses of covid vaccines, including some 2 mn locally produced Sinovac doses, she said.

THE BIG STORY ABROAD- Global markets are sighing in (muted?) relief after China Evergrande negotiated an agreement with its bondholders and settled an interest payment on its domestic bonds due tomorrow “via negotiations off the clearing house,” the company said in a statement picked up by the global financial press. The announcement lacked detail, “leaving analysts guessing” about the when and the how of the payment, according to Bloomberg, suggesting the company has struck an agreement to push an interest payment while avoiding the label “default.” Evergrande is expected to pay USD 36 mn in bond interest tomorrow. Evergrande’s statement said nothing about two separate coupon payments totaling USD 131 mn due tomorrow and next week.

Most global media outlets are covering the story from a “this is good for US stocks” point of view as they cast their gaze to the US Federal Reserve, where the FOMC is meeting now. But dig deeper and there’s some worthwhile commentary. Reuters writes that what appears to have been a restructuring — accompanied by an injection of liquidity into the banking system by China’s central bank — has “calmed immediate contagion concerns.” The WSJ, meanwhile, writes that “Evergrande is China’s economy in a nutshell,” suggesting that the country’s “economic model has run out of road” and that more “Evergrande-like mistakes” are waiting in the wings. The Financial Times takes a similar tack, suggesting the Evergrande flap could mark the end of “China’s ‘build, build, build’ model.”

Lehman? Who said anything about Lehman? The news of what may be a restructuring now has pundits proclaiming that it was clear all along that Evergrande was not going to be China’s “Lehman moment.” Not that you’d have gotten that from the headlines yesterday…

Lack of clarity or not, traders have welcomed the news, with CNBC writing that “European stocks have shed Evergrande tensions to trade higher ahead of Fed update.” The Stoxx600 is up more than 0.7% at dispatch time. Shares in London, Frankfurt and Paris are all happily in the green, and futures suggest both Wall Street and Bay Street will follow suit later this afternoon.

Here at home, the benchmark EGX30 finally snapped a five-session losing streak, closing the day up more than 0.9%. The index is now down 2.3% year-to-date.

HAPPENING NOW- The US Federal Reserve’s open markets committee will wrap later today a two-day meeting. Look for word from Jay Powell this evening (CLT) on a timetable for the Fed to taper its stimulus as officials try to “forge consensus on how and when to reduce their asset purchases.” You’ll be able to find the meeting minutes and press conference (link + transcript) here.

ALSO- The Spanish island of La Palma is still struggling with an erupting volcano that has been spewing lava and debris for the past four days, incinerating houses, schools, and fields, reports Reuters. About 6k people of the 80k people living on the island have been evacuated and no fatalities or injuries have been reported. The volcano shows no sign of slowing down, with experts now worried that when the lava reaches the sea, it could trigger more explosions and clouds of toxic gases.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Real estate firms could face heightened scrutiny. A proposal now being floated could see auditors assigned to each real estate developer and a requirement to produce quarterly reports on their projects and activities.

- Contact Cars acquires Sa3ar: Egyptian auto marketplace Contact Cars has acquired car valuation and auction platform Sa3ar for an undisclosed sum.

- Cartona raises USD 4.5 mn in pre-series A funding. The B2B e-commerce platform raised the funds in a round led by the Dubai-based VC firm Global Ventures.

|

???? CIRCLE YOUR CALENDAR-

Cityscape real estate investment conference kicks off today at 12pm and runs until 25 September at the Egypt International Exhibition Center.

Conference season continues next week with ITIDA’s DevOpsDays Cairo 2021, which is being organized together with Software Engineering Competence Center, DXC Technology, IBM Egypt and Orange Labs. The event will take place on Wednesday, 29 September.

The Cairo International Fair, which will take place on 30 September-8 October at the Cairo International Conference Center.

Egypt Projects 2021 construction expo, which will take place at the Egypt International Exhibition Center on 30 September-2 October.

ALSO NEXT WEEK- The deadline to register for the American University in Cairo Business School’s Private Equity Diploma is coming up on 28 September.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- Autumn seems to be knocking on our doors tomorrow with the mercury maxing out at just 34°C during the day and dropping to 22°C overnight, our favorite weather app tells us. Expect a high of just 30°C on Friday to kick off the weekend.

PSA- Speaking of weather, has anybody else noticed the excellent redesign of the Weather app in iOS 15? We’ll keep an eye on it over the coming weeks to see if it mounts a challenge to our favourite weather app in the accuracy department.

???? FOR YOUR COMMUTE

Reviewers are out with first looks at the new iPhone 13 lineup, including the mini, 13, 13 Pro and 13 Pro Max. Daring Fireball’s John Gruber nails it on the head when he writes: “The two ways that Apple could best improve the day-to-day utility of using an iPhone are improving the camera system and improving battery life. And those are exactly where Apple focused its attention for this year’s new iPhones.” Also worth a read: Dieter Bohn’s take for The Verge and Joanna Stern writing for the Wall Street Journal.

Apple is working on tech to help diagnose depression and cognitive decline using sensor data that includes mobility, physical activity, sleep patterns, typing behavior and more, reports the Wall Street Journal in an exclusive. It’s the device maker’s latest foray into the “potential gold mine” that is healthcare. Apple has teamed up with UCLA researchers studying stress, anxiety and depression and with pharma giant Biogen, which is studying mild cognitive impairment. No timeline has been set for a roll out, with the tech still in “early phases.”

Oh, and while you’re reading the Journal: Go check out its 2022 US college rankings. The newspaper says Harvard, Stanford and MIT top the list. Shocking, no?

Ice hockey is coming to a desert near you: Canadian national and owner of Performance Edge Hockey Development, Justin Scott, is planning to set up a hockey academy for Egyptian kids ages 6-14 — and to help build the men’s program with the Egyptian Ice Hockey Federation, according to Med Hat News. The hockey coach is coming to Egypt for two weeks on 28 September to lead training sessions for young and adult players. Most of the lessons will be off the ice due to the small ice rink available and Scott will bring hockey gear with him from Canada. You can follow his trip and larger project on Instagram @hockey_sporttest.

German auto giants BMW and Audi are increasing their investments in hydrogen: BMW is building a fleet of around 100 cars to be tested on the roads by 2022, BMW vice president Jürgen Guldner told Reuters. Meanwhile, Audi also told the newswire that it launched a research team developing hydrogen fuel cells and had already built a few prototype cars. This comes just after BMW was sued by climate activists and NGO Deutsche Umwelthilfe (DUH) for refusing to curb carbon emissions. “Whether [hydrogen] is driven by politics or demand, we will be ready with a product,” Guldner said, adding that BMW sees hydrogen fuel-cell cars complementing electric vehicles in the future. “When the future is zero emissions, we believe having two answers is better than one,” he says.

???? ENTERPRISE RECOMMENDS

The return of the ???? of television

???? ON THE TUBE TONIGHT-

(all times CLT)

We interrupt our Emmy winner review week to bring you … drum roll … the GOAT of all Emmy winners: That’s right, ladies and gentlemen. 14 years after that controversial cut to black finale of the Sopranos — the 21 Emmy award recipient and top contender for the greatest show ever made — and 8 years after the death of its charismatic lead James Gandolfini, HBO is out with the long-awaited prequel movie The Many Saints of Newark. Set around the Newark riots of the 1960s, the film looks at the early life and influences of a young crime boss to be Tony Soprano (played by Gandolfini’s real-life son Michael).

A nostalgia ????grab, fan service or a fresh take? That’s been the perennial question surrounding this project. While the movie promises be one heck of a nostalgia trip for fans of the show, series creator David Chase points out in this Rolling Stone interview (watch, runtime: 34:41) that this is a wholly original story that also shines a light on new characters (namely Christopher’s father Dicky) and the racial tension and social upheaval of the ‘60s that made Tony the boss he was. So far the movie holds a score of 77% from critics on Rotten Tomatoes.

Fans in Egypt will have to wait though: While the movie is seeing a simultaneous release on the Warner Bros. theaters and HBO Max today, El Cinema reports that the movie is due to land in theaters in Egypt on 1 October. In the meantime, you’ll have to make do with the trailer (watch, runtime: 2:22).

⚽ Four matches in La Liga this afternoon: Sevilla vs Valencia and Espanyol against Alaves will kick off at 7:30 pm. At 10 pm, Real Madrid will play against Mallorca and Villarreal will face Elche.

Serie A also has four matches, two of which will be played at 6:30 pm: Spezia against Juventus and Salernitana vs Verona. The other two will hit the field at 8:45 pm: Milan vs Venezia and Cagliari playing against Empoli.

In Ligue 1: Monaco will face St. Etienne and PSG will take on Metz at 7:00 pm and 9:00 pm, respectively.

The third round of the Carabao Cup continues with a slew of matches at 8:45 pm and we recommend you watch: Chelsea vs Aston Villa, Man Utd against West Ham, Wolves opposing Tottenham, and Arsenal facing AFC Wimbledon.

???? OUT AND ABOUT-

(all times CLT)

It's a musical poetry night at El Sawy Culturewheel with Ali Hassan and Mariam Aziz taking the stage in Zamalek from 5-7 pm.

This week’s electro night at The Tap Maadi will feature DJ Nakhla’s Boogie Tech Baby, while The Tap West will host Cairo’s favorite Coldplay cover band Strawberry Swing at Galleria 40 at 9 pm.

???? UNDER THE LAMPLIGHT-

We guess it’s Mobster Wednesdays here at Enterprise: The Man Who Died Twice by Richard Osman is the sequel of The Thursday Murder Club, where the gang of four elderly sleuths reunite again to take on their next case. This time their case involves a New York crime family, EUR 20 mn of stolen diamonds, and a hunt for a ruthless mobster. For all Thursday Murder Club fans, it’s very exciting to see Osman’s well-established characters back with their smartly-written investigative skills, humor and camaraderie. Published on 16 September, the book quickly became one of the fastest selling novels, according to the Guardian.

???? GO WITH THE FLOW

The market roundup on 22 September

The EGX30 rose 0.8% at today’s close on turnover of EGP 1.2 bn (23.9% below the 90-day average). Regional investors were net buyers. The index is down 2.4% YTD.

In the green: Pioneers Holding (+7.6%), Raya (+6.5%) and Cleopatra Hospitals (+4.7%).

In the red: Credit Agricole (-0.9%), Fawry (-0.5%) and CIRA (-0.2%).

???? POLL

BUPA surveys Egyptian and global business leaders on how well they coped with 2021

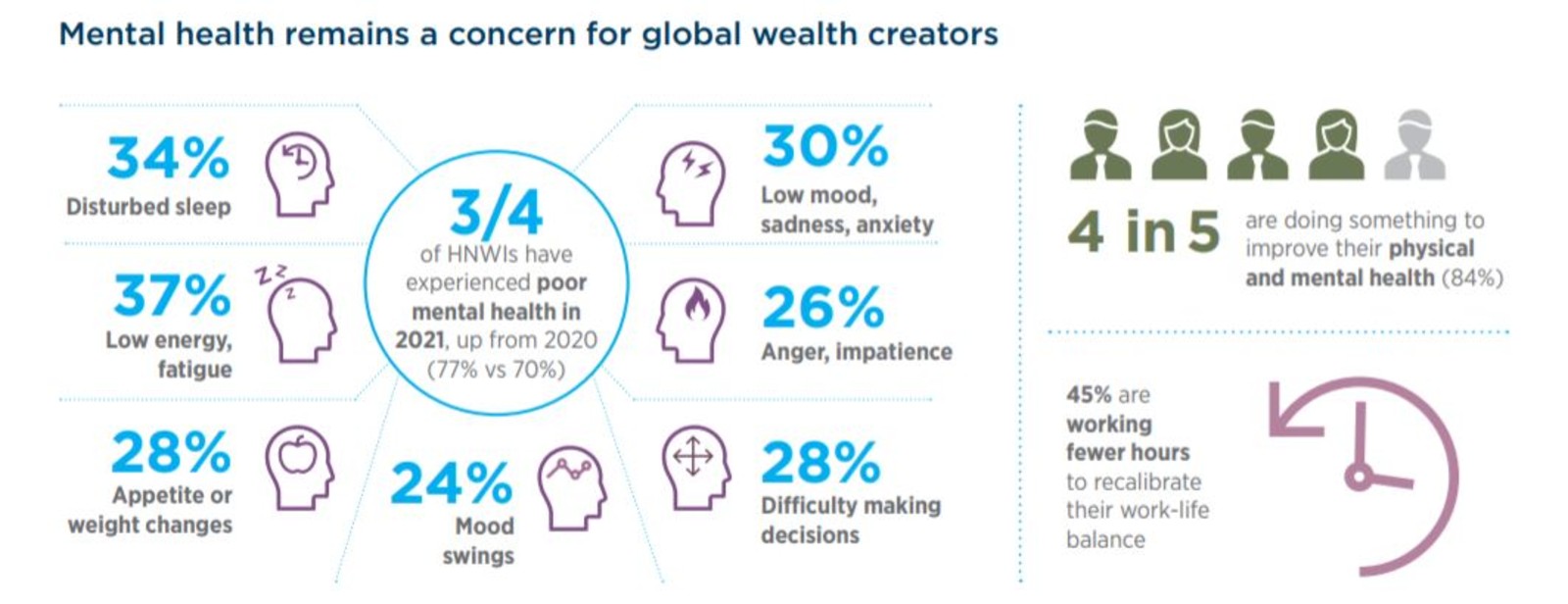

POLL- How are Egypt and global business leaders coping with the stresses of 2021? Let’s just say that it’s not as well as we’d like, according to the BUPA Global Executive Wellbeing Index 2021. The survey explores how business executives worldwide are coping with mental health in 2021 by questioning over 1k high-net-worth individuals and senior executives from Egypt, France, Hong Kong, mainland China, the UAE, the US and the UK, and Singapore about their work, home and health. The consensus: It’s been a gruelling year with the majority of execs struggling to cope with the strain of managing organizations. The silver lining: Managers have become much more empathetic to the mental health needs of employees.

Execs globally aren’t as optimistic about an economic recovery in 2021, compared to 2020, with 19% of those polled expecting a recovery in the global economy in 2021 compared to 32% the previous year.

In Egypt, the disparity is even wider as only 10% of polled executives expect a global recovery in 2021 as opposed to 34% last year.

Egypt business leaders are more optimistic about local recovery, however, with 20% believing the economy will bounce back. This comes as Egypt execs reported a low concern around covid-19, with only 27% feeling anxiety from the threat of the ongoing pandemic.

77% of polled execs globally reported experiencing at least one symptom of poor mental health, up from 70% in 2021. More than a third experienced insomnia or disturbed sleep, 28% have struggled to make decisions, 30% reported low moods and anxiety, and 24% have been angry. Other symptoms experienced include low energy or fatigue (37%) and appetite and weight changes (28%).

Egypt’s leaders are doing worse, with 82% experiencing poor mental health this year. The most commonly reported challenges are low mood, sadness or anxiety (41%), feeling angry or impatient (31%) mood swings (29%), and obsessive or compulsive thoughts (22%). Anxiety doubled compared to last year and anger and impatience rose by 55%, signifying that these symptoms are becoming more prevalent in the Egyptian business community.

However, 92% of them have taken positive steps to help manage or prevent their symptoms, with most adopting self-help strategies such as using mindfulness or meditation (39%), confiding in family and friends (39%) and making improvements to their diet (35%). They are also the most likely to spend some time every day enjoying the natural environment, with 35% embracing their inner hippie compared to 26% of global execs.

Work-life balance is at the center of it all: A third of Egypt’s execs are working from home more often and 32% are encouraging more flexible work practices. 41% cut down their working hours while 29% are reducing work efforts during their downtime.

Of all the regions spotlighted in the Index, Egyptians are the most likely to support a four-day workweek, with 39% convinced this would boost productivity — almost twice the global average of 20%.

Another silver lining: 61% of Egypt’s business leaders have sought professional help to mitigate their mental health issues. Women were more likely than men to reach out.

The emphasis on wellbeing is also trickling down to employees: Some 39% of business leaders said they would increase focus on employee wellbeing and firms are expected to increase spending on mental health support by 30% this year. Half of the companies surveyed offer mental health coverage in their insurance plans while 27% are planning to implement it in the future. The most widely used initiative was flexible work patterns (66%) to accommodate employees' non-work life.

CEOs are taking on the new role of Chief Empathy Officer or CEmO, which entails them showing more empathy and understanding to individual circumstances. Some 40% of firms now have a CEmO position in their ranks, with many bringing in people from outside the organisation to fill the new role. Meanwhile, 24% are planning to introduce it next year. The main attributes for the ideal CEO in Egypt were understanding (41%), humility (39%) and cultural intelligence (32%).

Inclusion and diversity are also big priorities: A shift towards inclusion in the workplace could take place locally, with 98% of Egyptian leaders planning to increase the number of women and people from different socio-economic groups at board-level.

What are business priorities going forward? A review of office space and facilities is in order for 37% of global respondents, while 35% want to balance the bottomline with a greater sense of purpose. 35% want more online sales and marketing, 35% will invest in more tech, and 37% believe a green agenda will be a part of their firms’ strategy.

You can check out the full report (pdf) or browse through the infographic (pdf).

???? CALENDAR

14-30 September (Tuesday-Thursday): 76th session of the UN General Assembly, New York.

19-22 September (Sunday-Wednesday): Insurance Federation of Egypt’s Rendezvous conference, Sharm El Sheikh.

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22 September (Wednesday): IMF + EBRD “State-owned enterprises in the Middle East, North Africa and Central Asia” webinar.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

30 September (Thursday): First tranche of overdue subsidy payouts will be handed to eligible exporters.

30 September (Thursday): Direct flights between Egypt and three Libyan airports resume.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): Deadline for state-owned companies and government agencies to sign up to e-invoicing platform.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28 October (Thursday): Second tranche of overdue subsidy payouts will be handed to eligible exporters.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.