- Tuk-tuk owners should be able to swap their vehicles for natgas microbuses next month (Speed Round: Energy)

- EFG, TMG, GB Capital mortgage arm Bedaya plans securitization before 2021 is out (Speed Round: Debt Watch)

- Digital trucking platform Trella closes USD 42 mn funding round co-led by Maersk VC arm

- Abu Dhabi could see its first IPO in four years next month. (What We’re Tracking Tonight)

- Gasco gets USD 200 mn syndicated loan from 8 local banks for facility expansion (Speed Round: Debt Watch)

- Green SPACs are starting to lose out, here’s why (Green Finance)

- Your sentient fridge could be shopping for you in the not so distant future (Science & Tech)

- TONIGHT’S EURO GAMES: Austria v. Ukraine, The Netherlands v. North Macedonia, Denmark v. Russia, Finland v. Belgium (On the Tube Tonight)

Monday, 21 June 2021

EnterprisePM — Natural gas transition will now include tuk-tuks.

TL;DR

WHAT WE’RE TRACKING TONIGHT

It’s an action-packed Monday news cycle today, ladies and gentlemen, with our energy diversification and transition plans guiding the conversation. This was followed by a number of key securitization, debt and VC funding news, so we hope you’re strapped in.

THE BIG STORY TODAY- Bringing tuk-tuks to the fold: The government is planning to bring tuk-tuks into the natural gas transition program, with the Finance Ministry likely to extend financial incentives to licensed tuk-tuks to join in the transition.

HAPPENING NOW- President Abdel Fattah El Sisi held a joint press conference with Greek Prime Minister Kyriakos Mitsotakis in Cairo today (watch, runtime: 20:30) Both sides stressed the importance of the East Med Gas Forum, with Mitsotakis saying that he hopes the agreement will be a unifying factor for the region. El Sisi also stressed the importance of pushing ahead with projects including linking our electricity grid to that of Greece and Cyprus.

Greece shows us love on GERD: Mitsotakis also called for a quick and peaceful resolution to the GERD impasse, saying the dispute has become a matter of life and death for Egyptians.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- USD 20 bn Saudi investment drive + more from China: Saudi Arabia could invest as much as USD 20 bn in Egypt over the next five years, Egyptian-Saudi Joint Business Council Chairman Bandar Al Ameri said.

- Vacsera’s new facility set to be biggest in MENA/Africa as vaccine rollout gains speed: State-owned vaccine maker Vacsera’s second manufacturing facility in Sixth of October City is set to become the largest in the Middle East and Africa, churning out 3 mn doses of Sinovac a day.

- The EGP will hold up better than most other emerging-market currencies in the event of the Fed’s monetary tightening, given their attractive real interest rates, analysts are saying.

THE BIG FOREIGN BUSINESS STORY- Abu Dhabi could see its first IPO in four years next month: The emirate’s sovereign wealth fund Mubadala is planning to list up to 40% of one of its subsidiaries, satellite operator Yahsat, Bloomberg reports. The company is expected to be listed on 14 July, with the price and size of the offering to be finalized on 9 July. This comes as UAE state companies aim to advance the domestic equity market and diversify the economy away from oil, with local listings of stakes in Mubadala subsidiary Emirates Global Aluminum, as well as an Abu Dhabi National Oil Company drilling business and a fertilizer joint venture expected to soon follow.

CORRECTION- HSBC has helped facilitate financing to Chinese companies working on USD 20 bn-worth of projects in Egypt, as well as provided support to the companies in other areas. The global lender didn’t provide the amount in direct funding, and the projects it supported weren’t just limited to infrastructure as a story we picked up yesterday from Asharq Business and featured in EnterpriseAM incorrectly suggested. The story has since been corrected on our website.

|

FOR TOMORROW-

The CIB PSA World Tour Finals 2020-2021 are kicking off tomorrow at The Park in Mall of Arabia and will run until 27 June. Tickets are currently on sale for the final two days on TicketsMarche.

???? CIRCLE YOUR CALENDAR-

The Clean Energy Business Council (CEBC) MENA are holding a webinar titled Energy Efficiency in the MENA region: Status and Outlook on 6 July at 3:30pm. The session will focus on energy efficiency developments and provide recommendations for businesses and policymakers. Later on next month, CEBC will also host the webinar Women Entrepreneurs in Clean Energy on 21 July at 3pm in cooperation with the initiative, Women in Clean Energy MENA and WiRE.

The British Egyptian Business Association (BEBA) is organizing a virtual education week from 5-6 July with three seminars planned. The first, taking place at 10am on 5 July, will discuss skills-based learning while the future of investment in education will be the topic on the table at 12:30pm the same day. On 6 July, a talk on the digitalization of education in Egypt will be held at 12pm.

???? FOR YOUR COMMUTE-

China has apparently been taking credit for global commodities prices tapering off, Bloomberg reports. The country has been testing several schemes to tone down price growth, from releasing its metals stockpiles to implementing trading curbs. So far, commodities are giving in, but it’s too early for China to declare victory. Though prices of commodities such as steel have fallen from highs in May, China’s markets are still fluctuating, with Shanghai copper at a two-month low and coal hitting a five-week high. But the US Federal Reserve’s announcement that it may hike interest rates sooner than expected may also have played a factor in the global cool-down of commodities, with the global nature of this boom curbing China’s ability to significantly influence prices.

The ethical use of facial recognition tech is the latest concern for conscientious ESG investors, with over 50 global asset managers pledging earlier this month to push for the technology’s ethical use by the companies they invest in, Bloomberg reports. Though governments and corporations alike have utilized facial recognition for everything from law enforcement to marketing, the rapid utilization of the technology has outpaced the issuance of privacy rules that ensure data collection does not overstep civil liberties.

This new dilemma could soon be the next ESG factor that investors need to keep in mind before pouring funding into firms or governments. Companies such as Facebook, Amazon, Alphabet, and Tencent have flourished due to the lack of data laws, but the clock might be ticking on their free reign, with high level officials in the UK and elsewhere wagging fingers at the unregulated use of facial recognition software.

Meanwhile, shares of EV startups remain unaffected in the face of market challenges, the Wall Street Journal reports. Lordstown Motors, Nikola and Canoo are among the EV startups that have maintained their share prices, despite missing production targets and failing to actually begin production of any vehicles. Amateur investors who remain keen on an EV-powered future could be fuelling the continued upwards trajectory of these companies, despite the obvious setbacks, market experts say.

Qatar will only allow vaccinated fans to attend the World Cup 2022 in November next year, Qatari Prime Minister Sheikh Khalid bin Khalifa bin Abdulaziz Al Thani told state news agency QNA, according to Reuters. Doha is hosting the 2021 Arab Cup in December and will use the tournament to evaluate their preparedness for the World Cup, Sheikh Khalid added. The Gulf country is in talks to obtain 1 mn doses of an unspecified covid vaccine to immunize some of the people coming to Qatar in case global rollouts lag, the PM said, though he did not specify how the vaccines would be administered.

???? ON THE TUBE TONIGHT-

One of our guilty pleasures is out with a new season: Season four of Elite is currently on Netflix. The highschool TV show set in Madrid has a touch of murder mystery, classism, and of course heaping scoops of drama that never fail to shock. The TV show started off with a number of scholarship students joining an elite private school with some of Spain’s richest children and followed them through their struggles of fitting in and eventually joining forces with those who were at first their enemies. Three seasons in — and the debauchery, deception, and revenge plots have been elevated to new levels, yet we can’t seem to look away.

⚽ Today in Euro 2020: Two Group C matches are taking place at 6pm, with Austria playing against Ukraine and the Netherlands playing against North Macedonia. Meanwhile, Group B has taken over the 9pm slot with Denmark going up against Russia and Finland competing with Belgium.

Last night’s fixtures: Italy continued its victory streak, beating Wales 1-0, while Switzerland won against Turkey 3-1.

???? OUT AND ABOUT-

Zar ensemble Mazaher is performing at Darb 1718 on Friday at 8pm. Mazaher features some of the last remaining Zar practitioners in Egypt.

Horendi, a documentary film by cinéma vérité pioneer Jean Roche is being shown at The French Institute in Downtown Cairo on Wednesday at 6pm. The film documents a ritual week-long dance put on by West African women to exorcise spirits.

A Go Padel tournament is taking place in Mall of Egypt from Thursday, 24 June to Saturday, 26 June, with prize-money of EGP 40k.

Still shying away from going out? Art Cafe Maadi is holding an online city sketching workshop on Wednesday at 7pm.

???? UNDER THE LAMPLIGHT-

A celebration of flavours from the Southern Mediterranean, Bilhana: Wholefood Recipes From Egypt, Lebanon, And Morocco is due out this week. Published by AUC Press, written by Yasmine and Shewekar Elgharably, and photographed by Yehia El Alaily. The book brings together recipes from all over the region with a contemporary twist and healthy cooking methods. From simple mezze to elaborate stews and seafood dishes, Bilhana showcases the color and variety of Middle Eastern cuisine, coupled with gorgeous images that will make your mouth water. Among the recipes featured are roasted eggplant with tahini, Alexandrian grilled shrimp, shakshuka, Moroccan lamb stew, and pomegranate and guava salad.

☀️ TOMORROW’S WEATHER- Expect daytime highs of 38°C in the capital city tomorrow, falling to 22°C at night, our favorite weather app tells us.

SPEED ROUND: ENERGY

Tuk-tuk owners should be able to swap their vehicles for natgas microbuses next month + we have a price tag for EVs infrastructure

Tuk-tuk owners will soon be able to apply to the natgas transition scheme: The cabinet yesterday decided to expand the Finance Ministry’s natgas transition scheme to include tuk-tuk owners, who should be able to apply to swap out their vehicles for natgas-powered microbuses as of next month, the Finance Ministry’s Automobile Financing Fund spokesperson Tarek Awad told Masaa DMC (watch, runtime: 6:39).

The Finance Ministry will provide financial support to help cover down payments for the new buses, Cabinet spokesperson Nader Saad told Ten TV (watch, runtime: 7:26). The remaining amount will be paid at reduced interest rates of as little as 3% under a financing program backed by the Central Bank of Egypt, in addition to life and auto ins. coverage which will be included in the payment plan, he added. Speaking to Enterprise, the initiative’s spokesperson Ahmed Abdel Razek said the size of the subsidies on offer is yet to be determined.

The government also plans on reducing the cost of tuk tuk licensing: A cabinet committee is expected to recommend a significant reduction of the fees required to obtain a tuk tuk license, in an attempt to legalise the status of as many of the 2.5-3 mn tuk-tuks in Egypt as possible, Saad said. Tuk tuk owners who do not register their vehicles before the deadline — which Saad posited could be set a year from the date registration for the program opens — could have their vehicles confiscated. Al Hayah Al Youm (watch, runtime: 8:01) and Ala Mas’ouleety also had coverage (watch, runtime: 4:52).

Only owners who have licensed their tuk-tuks will be able to benefit from the swap initiative, spokesperson Ahmed Abdel Razek told Enterprise. Currently only around 10% of the country’s tuk-tuks are properly licensed, he said.

This plan has been in the works for a while: The government had previously announced plans to phase out tuk tuks in favor of natgas buses, and had discussed halting the issuing of tuk tuk licenses altogether. The Public Enterprises Ministry later shelved plans to work with GB Auto on manufacturing the nat gas minivans that would replace the tuk tuks. The new announcement did not include details on where the natgas vehicles to replace the tuk tuks would be sourced.

On another front, the government has delivered over 1.7k dual-fuel passenger cars so far, and expects to bring the total to over 2k by the end of June, Abdel Razek told us, with EGP 46.5 mn in incentives having been paid out. The program had delivered some 340 dual-fuel cars in April, including a first batch of around 30 vehicles. The government plans to extend additional incentives worth EGP 2 bn in FY2021-2022 to encourage car owners to take part in the state’s natgas transition plan.

IN OTHER ENERGY NEWS-

EGP 450 mn will be invested in setting up charging stations: The government’s project to set up a nationwide network for charging electric vehicles is expected to cost some EGP 450 mn, the Public Enterprises Ministry’s office told us, confirming statements attributed to minister Hisham Tawfik by Al Mal. The project — which is being led by industry leader Infinity and would see it set up 6k electric vehicle charging points across 3k stations nationwide — will be in partnership with an unnamed government entity, Tawfik told the newspaper. We reached out to Infinity, but they declined to comment, noting only that the plan is still in early stages.

Background: The government recently announced it’s tapping Infinity to lead Egypt’s largest EVs infrastructure push to date. The project aims to deploy some 2k charging points in 1k stations in Greater Cairo, Alexandria, and parts of Qalyubia during its first phase, before eventually rolling out 6k points across the country, Infinity told Enterprise in an emailed statement last week. It comes just in time for a state-led plan to begin testing imported Chinese E70 EV cars on Egypt’s roads as a prelude to local assembly.

SPEED ROUND: DEBT WATCH

EFG, TMG, GB Capital mortgage arm Bedaya plans securitization before 2021 is out

Mortgage provider Bedaya is planning to sell securitized bonds backed by its receivables before the end of the year, EFG Hermes Finance CEO Waleed Hassouna, whose company is a partner in Bedaya, told Al Mal. The sale would come as Bedaya is looking to set up more branches across the country from a current three branches, and widen its customer base to include potential homeowners as well as companies, Hassouna said without revealing how much Bedaya is looking to raise from the planned securitized bonds sale. Bedaya’s loan portfolio currently stands at EGP 300 mn, he reportedly said. We reached out to EFG Hermes for comments on the story, but have yet to hear back as of dispatch time.

What is Bedaya: Bedaya was set up in 2019 as a joint venture between EFG Hermes, Talaat Moustafa Group and GB Capital. It then started operations in August last year. Bedaya announced this week it has just rolled out a new mortgage finance mobile application and online platform.

The securitization market has been lukewarm in 2021: Real estate developer Palm Hills Development and Arabia Investments Holding’s consumer finance subsidiary Rawaj were the only two companies to close an issuance of asset-backed securities so far into the year.

But the pipeline is deep: Everyone from Sodic, Misr Italia and Edge Holding to EFG Hermes, Sarwa Capital and Raya have announced plans to securitize parts of their portfolios, but all of them are yet to see the light of day.

IN OTHER DEBT-RELATED NEWS-

Gasco gets USD 200 mn syndicated loan for facility expansion: A group of eight local banks led by the National Bank of Egypt have arranged a USD 200 mn (c. EGP 3.1 bn) syndicated loan for state-owned natural gas company Gasco, which plans to use the proceeds to finance expansions at its Western Desert Gas Complex in Amriya, banking sources told us, confirming a report by Al Mal that quoted sources it said are in the know. The lenders include Banque Misr, Banque du Caire, CIB, QNB Al Ahli, the Arab African International Bank, Bank Audi. Each bank will provide USD 25 mn of the total amount.

STARTUP WATCH

Trella closes USD 42 mn series A round co-led by Maersk VC arm

Egyptian digital trucking platform Trella closed a USD 42 mn series A round co-led by Maersk Growth, the venture capital arm of container shipping giant Maersk, according to a statement (pdf). The financing includes USD 30 mn new equity and USD 12 mn debt facilities, which likely go towards the company plans to scale its operations in the MENAP region (Middle East, North Africa, Afghanistan and Pakistan), CEO and co-founder Omar Hagrass said in the statement. The financing will also be used to invest in the startup’s “tech capacity and product development,” the statement read.

Who are the participants? The equity portion of the funding was led by Maersk Growth and Saudi Arabian investor Raed Ventures. Other investors include Algebra Ventures, Vision Ventures, Next Billion Ventures, Venture Souq, Foundation Ventures and Flexport. The debt portion was led by Lendable and other financial institutions.

One step closer to unicorn status? Hagrass has not been shy in expressing his ambition for the company to become an Egyptian unicorn. And with the vast scope of this financing, there’s an argument to be made that it is on its way there. In 2019, Trella raised USD 600k pre-seed round led by Algebra Ventures, before it acquired rival Trukto. The freight marketplace already operates in Egypt, Saudi Arabia and recently launched in Pakistan.

Want to know how Hagrass plans to take Trella there? Hagrass tells us why he thinks Trella could be a unicorn and how he plans to take Trella there in season 2 of our podcast series Making It (listen, runtime: 42:32).

GO WITH THE FLOW

Go with the flow on 21 June

The EGX30 rose 2.7% at today’s close on turnover of EGP 1.78 bn (29% above the 90-day average). Regional investors were net buyers. The index is down 7.2% YTD.

In the green: Ezz Steel (+5.8%), ElSewedy Electric (+5.6%) and GB Auto (+4.6%).

In the red: Orascom Investment Holding (-1.6%), Credit Agricole (-1.5%) and Export Development Bank Egypt (-1.3%).

GREEN FINANCE

Green SPACs are starting to lose out, here’s why

The short-lived success of green SPACs is starting to fade, with shares of the ESG-minded blank-check companies that take too long to close acquisitions found to be losing quicker than those of their non-green counterparts, according to a piece in the Wall Street Journal citing data from SPAC Research. Over the past five years, special purpose acquisition companies with a sustainability mandate have typically outperformed those without, but that’s only if they manage to close acquisitions shortly after announcing targets.

SPACs looking to merge with ESG-focussed companies won big at the start of the year, with the value of such transactions totalling USD 117 bn for the best part of the first quarter. This was over 2.5 times more than what they raised in FY2020 and accounted for 38% of all SPAC mergers, according to data by New York-based Nomura Greentech cited by Reuters in March.

Where green SPACs outperform: On average, successful green SPACs that find a target and close an acquisition see a 10% increase in their share price within the 90 days after they close an agreement. This is better than their traditional counterparts, whose share price typically drops an average 3% despite making transactions.

… And where they lag: If circumstances change and we look at the 90 days after a SPAC has announced a target, but is yet to close a transaction — green SPACs typically lost 24% on average in share prices. By contrast, average share prices of normal SPACs fell only 9% under the same conditions.

Why are green SPACs performing worse? With their focus on renewables, electric vehicles, or other sustainable investments, Green SPACs have fewer options and a lot of funds already raised. Accordingly, their investor terms require them to return this capital if they take too long to close an acquisition target. Many of the targets suitable for green SPACs are also often building ambitious, somewhat futuristic businesses that are not currently generating much revenue.

SPACs also aren’t necessarily the best vehicle for ESG investing, sustainable financing firm PathStone’s chief impact officer and long-time green SPAC skeptic Erika Karp says. Inherently, SPACs in general aim for profit, which runs counter to investing with the goals that define environmental, social and governance principles, Karp adds.

The contrarian view: Green SPACs open up startups building green businesses to a new type of investor, as the blank-check companies are typically backed by strong institutions and funds who can also make informed decisions and invest in the right company, said Nomura GreenTech Managing Partner Jeff McDermott. Those companies previously only had access to VC funds and other risk-taking investors, but many of those investors became less risk-friendly in the aftermath of the 2008 financial crisis, according to McDermott.

Here at home, green startups actually face a similar situation: Green startups in the country are often seen as less enticing for backers, compared to other tech-focused companies, VCs and angel investors we spoke to for Going Green told us. That’s likely due to the perception that most of them are plagued by negative cash-flow cycles that can take up to 6-8 months to recover, and they can also be very asset-heavy. Those startups often have no recourse but to look for alternative sources of funding including crowdfunding, philanthropy, and revenue-sharing.

So are green SPACs actually a viable, useful option for startup funding? Maybe not now: Lets not forget that SPACs, both green and regular, haven’t been doing great anyway. According to data from SPAC Research, they raised over USD 190 bn between the start of 2020 until now, but the bulk of those proceeds came in early 2021 — when a SPAC craze that drew enormous interest from retail investors, institutional powerhouses and celebrities alike was at its height. Before the first quarter of the year drew to a close, SPACs suddenly came under increasing regulatory scrutiny in the US — where most of the transactions had taken place.

They’re expected to face even more headwinds going forward after the US’ Securities and Exchange Commission appointed a new hardliner head, Gary Gensler, who built a reputation for being tough on Wall Street in the aftermath of the financial crisis, and has promised to introduce further regulations to protect retail investors from SPACs going flop.

SCIENCE & TECH

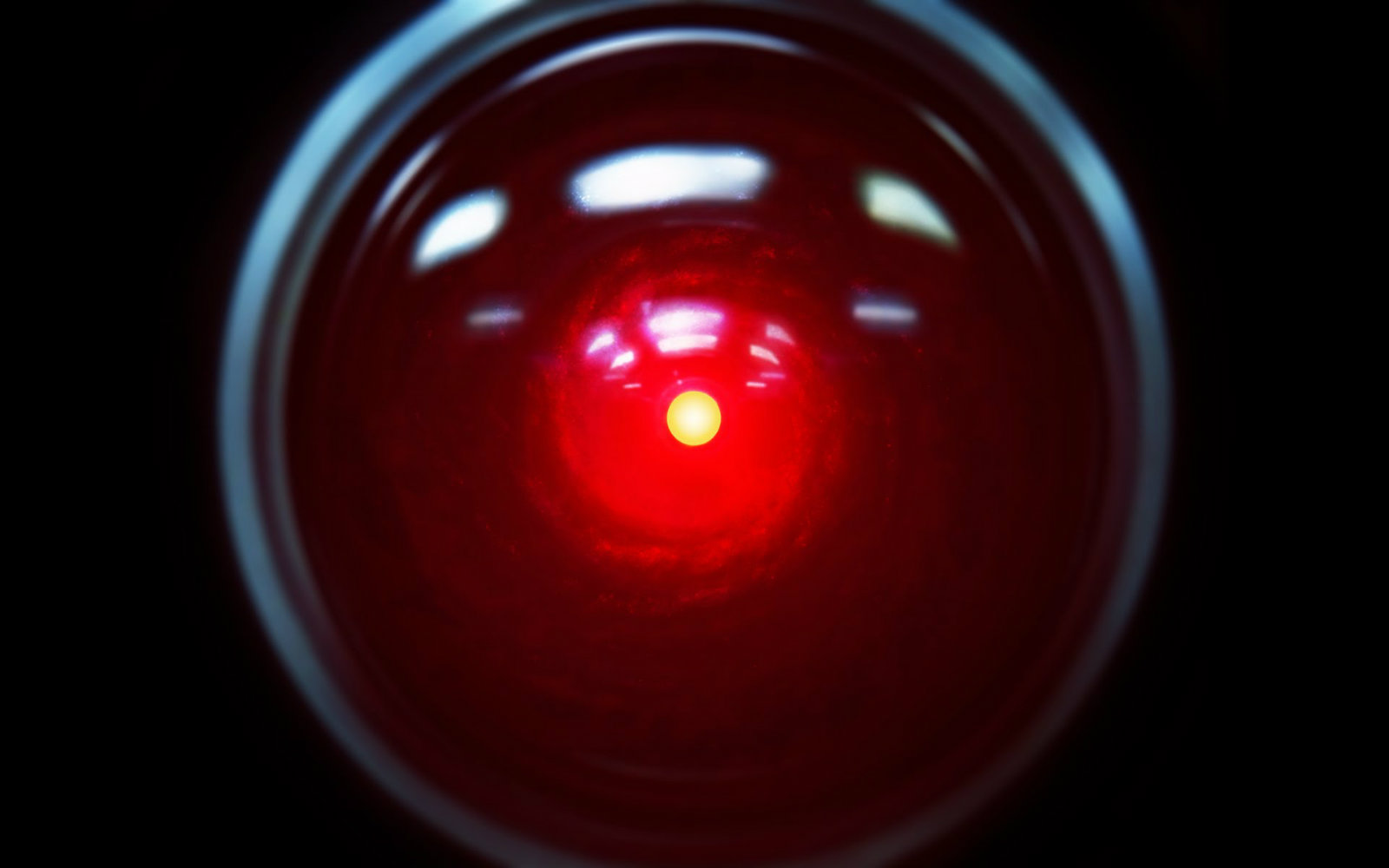

Would you like me to restock your fridge, Dave?

We could have sentient machine shoppers soon: The rise of connected devices and decentralized payment systems could soon allow our devices to shop for us, experts tell the Wall Street Journal.

Skeptical about letting your devices make your purchase decisions on your behalf? Picture this. A smart fridge that knows you’re about to run out of milk, and puts in an order. The ink in your printer is about to run dry but your machine knows how to purchase a new one — and where to get the best price. Or a car that automatically pays your parking ticket for you.

Welcome to the Internet of Things: The tns of interconnected devices that will soon be monitoring, collecting and storing data about our world, and the increasing sophistication of digital payment systems, will enable us to delegate our purchasing decisions to the machines.

Machines talking to machines: The current explosion of IoT technology was put into perspective last year by Cisco, which predicted that by 2023 some 50% of all connections in the world will be between two machines. By the same time, the number of connected devices will be three times larger than the global population, roughly equal to 3.6 devices per person.

Data monetization will increasingly work both ways: As more devices go online and communicate with one another, tech companies may look to outsource data collection to the masses in return for income. Jaguar Land Rover has already tried this in a pilot program two years ago, handing out parking credits to drivers who shared traffic updates and data about the roads.

The infrastructure to support this is currently being tested: A value transfer protocol called IOTA was developed to facilitate micropayments between IoT devices. The protocol is currently being tested in Norway as part of a project funded by the EU.

It’s unlikely existing networks can handle this influx of mns of IoT payments, according to analysts. But decentralized payment systems using blockchain technology could provide an alternative. JPMorgan Chase blockchain unit Onyx recently tested blockchain payments between two orbiting satellites, opening the door to data-for-money transactions in space.

CALENDAR

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt. The Big 5 Egypt Impact Awards will also be taking place at the event on 27 June.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: The Cairo International Book Fair, Egypt International Exhibition Center.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 July (Thursday): Deadline for 17 EGX-listed companies to file their 1Q2021 earnings.

4 July (Sunday): Ismailia Economic Court to hold hearing on Ever Given compensation case.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.