- Tarek Amer gets second term as CBE governor, but no word yet on cabinet shuffle. (What We’re Tracking Today)

- Fitch keeps Egypt’s long-term FX issuer default rating at B+ with a stable outlook. (Speed Round)

- Egypt must cut rates by another 200-400 bps to stimulate private investment -Goldman. (Speed Round)

- EDF acquires “strategic” stake in KarmSolar. (Speed Round)

- Al Madar, SEII consortium to decide on Emisal bid this week. (Speed Round)

- FRA issues new regs that look a lot like chaperone agreements for new investment funds. (Speed Round)

- EBRD earmarks USD 100-200 mn for acquisition, development of hotels in Egypt. (Tourism)

- The battle for Nile water is intensifying — and wealthy states are the beneficiaries. (Worth Reading)

- Yesterday was Mega Monday for global M&A. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 26 November 2019

Tarek Amer just got a second term as second bank governor

TL;DR

What We’re Tracking Today

Some good news with which to start the morning: Tarek Amer will remain in office as central bank governor for a second four-year term. After months of quiet speculation, state media reported overnight that President Abdel Fattah El Sisi will give Amer a second term. Ittihadiya has yet to make an announcement on the subject, but eyewitness videos now making the rounds (watch, runtime: 0:50 and watch, runtime: 1:38) show a very happy Amer confirming the news and being loudly celebrated by happy central bank staff.

The move will be widely welcomed by both international investors and the domestic business community. Amer won plaudits for floating the EGP early in his first term and for building reserves while deftly managing monetary policy in the period since the float to ensure Egyptian debt remained ‘appropriately’ attractive to the carry trade.

What does this mean? In a word: continuity. For starters, it suggests interest rates will keep coming down (if not in December, then during the course of 2020) in line with market expectations. Amer’s reappointment also signals that his amended Central Bank and Banking Act is set to move through the House of Representatives largely in its current form. More interestingly, it means we can expect a burst of activity out of the CBE on other policy fronts from the man who considers himself the chief economic advisor to the president and who now has four years of runway ahead of him.

This will be Amer’s final term: The central bank governor may serve no more two four-year terms under the Banking and Central Bank Act, meaning Amer will leave office in November 2023.

House Speaker Ali Abdel Aal has called for an “extraordinary session” on Thursday to discuss Amer’s reappointment, sparking speculation that Thursday could also see MPs discussing a cabinet shuffle.

Speaking of which: Any news of the cabinet shuffle? Nothing new yesterday or overnight, folks. The House is widely expected to vote on the cabinet change in an urgent assembly as early as tomorrow. State-owned Akhbar Al Youm Chairman Yasser Rizk, who presents himself as being close to El Sisi, was the first to publicly suggest last week that a change-up in cabinet is on its way. Since then, the rumor mill has been in overdrive with speculation on which ministers are exiting stage right.

We know for certain at this point that the Social Solidarity Ministry will get a new minister, as current minister Ghada Waly is leaving for a new post as the executive director of the UNODC. Deputy Minister Nevine El Kabbag and SME Authority head Nevine Gamea are reportedly both in the running to succeed Waly, according to Al Shorouk. Other cabinet seats that could see new chiefs include trade and industry, health, environment, supply, and agriculture ministries.

In related news: Tax Authority boss Abdel Azim Hussein will be sticking around for another year, after Finance Minister Mohamed Maait issued a decree extending his appointment. Abdel Azim’s new term will begin on 13 December. He was tapped for the role on the same day last year.

Yesterday was a big day for M&A, with more than USD 70 bn in agreements signed heading into what will be a quiet end-of-week for markets as America marks Thanksgiving.

Charles Schwab’s USD 26 bn blockbuster buyout of rival TD Ameritrade hogged the headlines: US brokerage firm Charles Schwab yesterday announced plans for a USD 26 bn all-stock acquisition of rival TD Ameritrade, creating a giant brokerage with USD 5 tn in assets under management and 24 mn client accounts. Schwab would acquire USD 1.3 tn in client assets across 12 mn accounts, and around USD 5 bn in annual revenue. The acquisition is slated to close in 2H2020. (CNBC│Associated Press)

The merger is likely to attract the attention of antitrust regulators. Charles Schwab CEO Walt Bettinger moved to quell analysts’ concerns, pointing out that the new company would control around 11% of AUM in the US retail wealth management industry and account for just 6% of its revenues, the Financial Times reports.

This comes amid troubled times for brokerage firms, which have seen their profits squeezed by a new generation of companies offering zero-fee trading. Charles Schwab bowed to pressure earlier this year and scrapped commissions on all online stock, ETF and options trades, triggering a new phase in an intensifying price war.

Lots and lots of other M&A:

- LVMH sets record for biggest ever acquisition in the luxury sector: The world’s biggest luxury goods company agreed to buy jeweler Tiffany & Company for USD 16.2 bn. (New York Times)

- Novartis buys innovative cholesterol drug company Medicines Co.: Swiss pharma giant Novartis finalized a USD 9.7 bn agreement to acquire Medicines Co, an experimental biopharma company whose marquee offering is a new technology to combat cholesterol. (Wall Street Journal)

- Viagogo bags ticketing rival StubHub: Ebay yesterday agreed to sell ticketing marketplace StubHub to Viagogo for USD 4.05 bn. (TechCrunch)

- Mitsubishi acquires Dutch energy company Eneco: A consortium led by Mitsubishi will pay EUR 4.1 bn for the state-owned gas and electricity supplier, beating out Royal Dutch Shell and investment firm KKR. (Financial Times)

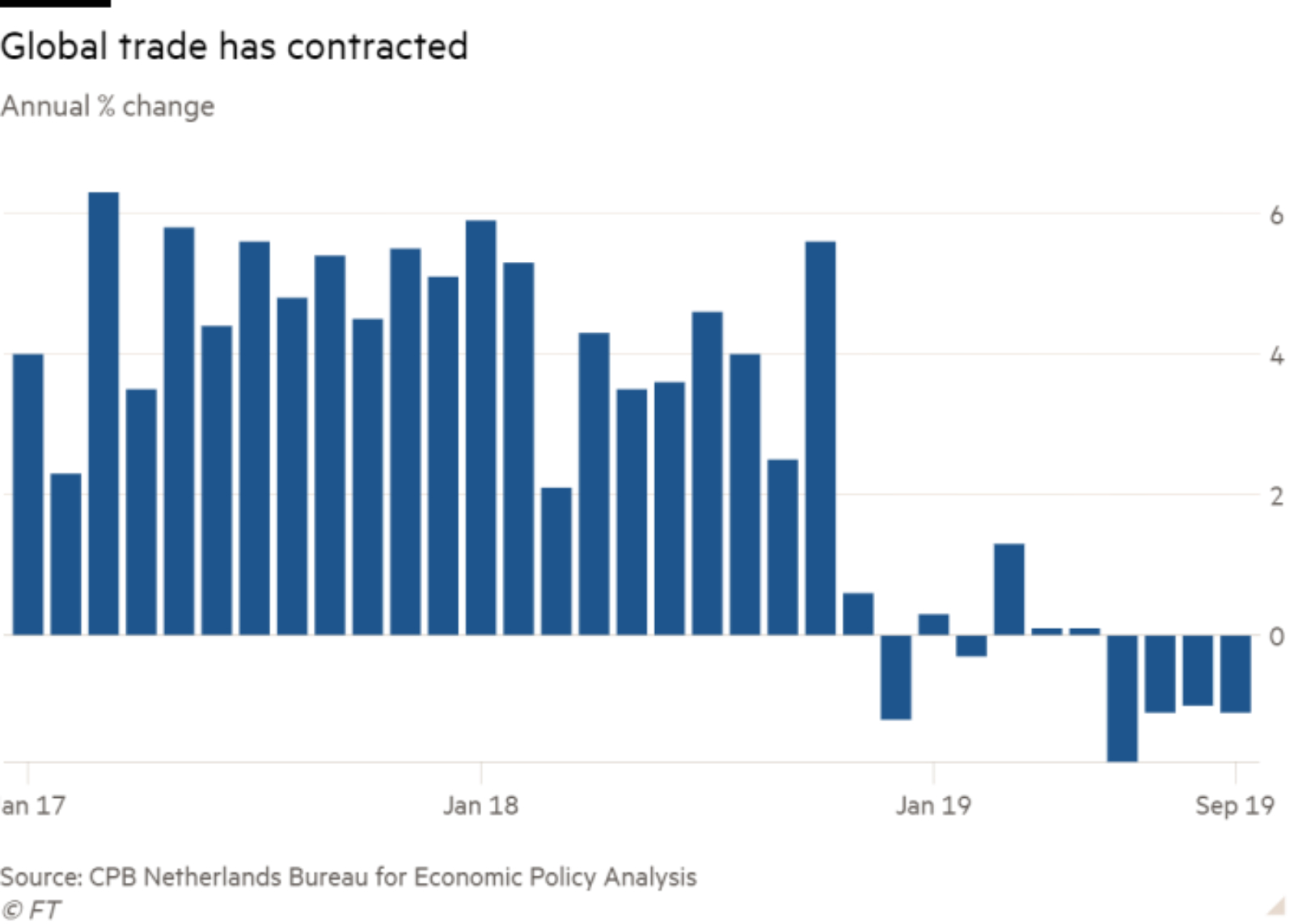

Global trade falls in September after two months of growth: Monthly global trade volumes fell 1.3% in September, raising fresh doubts about whether the world economy will stage a recovery next year, the Financial Times says. CPB World Trade Monitor data shows a reversal in fortunes for global trade, which until yesterday was fuelling hopes for a 2020 recovery following two consecutive months of growth in July and August. Unsurprisingly, the US and China were the biggest contributors to the declining volumes, with Chinese imports falling 6.9% in September and US imports down 2.1%.

On that note: Global stocks rallied yesterday amid optimism that there is a light at the end of the US-China trade war tunnel in the form of the long-awaited “phase one” trade agreement, according to the Financial Times. The rally comes after China began implementing changes to its policies against intellectual property theft, which has been one of the many sticking points with the US in resolving the trade war.

Concerns about the US fiscal position are giving gold an extra gleam, writes Rana Faroohar in the Financial Times. The cumulative costs of unfunded US pension and healthcare entitlements, defense spending, and interest on federal debt will soon necessitate financially engineered growth from the Fed, eroding confidence in the USD, she argues.

Other business news of note:

- South Korean pharma manufacturer SK Biopharma is expected to raise more than USD 850 mn from its upcoming IPO, which is planned to go to market in January, according to the Financial Times.

- Uber is down and out in London (again): Uber has been stripped of its London license for the second time after the city’s transport regulator found that 14k rides had been taken with drivers using fake identities, CNBC reports.

- And Bitcoin got hammered yesterday amid an ongoing Chinese crypto crackdown: The cryptocurrency shed more than 10% of its value yesterday, hitting its lowest value in six months, a few days after the Chinese central bank warned that it would step up actions against exchanges, Bloomberg reports.

Arab League slams US on Israeli settlements: Arab foreign ministers yesterday said that a recent US decision to recognize illegal Israeli settlements in Palestine showed “unprecedented disdain for the international system, Reuters reported citing MENA. Egyptian Foreign Minister Sameh Shoukry said that expanding the settlements would result in violence and threatens the two state solution.

In other global miscellany:

- Hong Kongers swap molotovs for ballot papers: Pro-democracy candidates swept Hong Kong’s local election on Sunday, winning 90% of the city’s 452 seats. Embattled leader Carrie Lam promised to “seriously reflect” on the result. (The Associated Press)

- Netanyahu to remain interim PM during corruption trial: Israel’s attorney general said yesterday that interim PM Benjamin Netanyahu will not be forced to resign from his position while he fights corruption charges. (The Associated Press)

- Leaked documents lift veil on Chinese internment camps: Classified documents have revealed that the Chinese government is using AI-based surveillance to preemptively detain ethnic Uighurs and forcibly re-educate them. (The Associated Press)

- The troubled relationship between the US and Turkey is likely to come under further strain as Erdogan tests his brand new Russian S-400 air defense system. (Bloomberg)

PSA- We’re looking at warmer temps and maybe some rain or dust: The Egyptian Meteorological Authority has forecasted a rise in temperature for the next three days, possibly accompanied by rain, dust, and wind.

Enterprise+: Last Night’s Talk Shows

The two biggest stories in Egypt’s print media yesterday also made it to the airwaves. Tarek Amer’s reappointment as central bank governor and Fitch’s latest FX rating both earned screen time, as did the government’s financial inclusion strategy and the president’s meeting with Eni chief Claudio Descalzi.

Story du jour #1: Tarek Amer earns himself another four-year stint at the helm of the Central Bank of Egypt. President Abdel Fattah El Sisi was reported yesterday to have handed Central Bank Governor Tarek Amer a second four-year term, Al Hayah Al Youm’s Khaled Abu Bakr noted (watch, runtime: 8:58). We have more in this morning’s What We’re Tracking Today, above.

Story du jour #2: Fitch affirms Egypt’s credit rating: El Hekaya’s Amr Adib had a lengthy segment discussing Fitch Ratings’ decision to leave Egypt’s B+ long-term foreign-currency credit rating on hold (watch, runtime: 16:26). Hona Al Asema’s Reham Ibrahim spoke to economist Abdel Monein El Sayed, who implied that the rating doesn’t do justice to recent economic indicators (watch, runtime: 5:06). Again, we have the full story in Speed Round, below.

Financial inclusion 101: Al Hayah Al Youm’s Khaled Abu Bakr sat down with ICT expert Waleed Abdel Maksoud and economist Karim El Omda for a primer on the paperless, cashless economy (watch, runtime: 4:30). El Omda simplified the buzzword ‘digital transformation’ as the gradual process of doing away with paper documents and banknotes, in favor of using computers. He also discussed the government’s push for ‘financial inclusion’, noting that the proportion of Egyptians with bank accounts rose from 14% to 38% between 2014 and 2018 as a result of a government-backed plan.

El Sisi, Eni CEO Descalzi discuss oil and gas work in Egypt: President Abdel Fattah El Sisi sat down yesterday with Eni CEO Claudio Descalzi for a periodic review of the company’s oil and gas exploration and production work in Egypt, Ibrahim noted (watch, runtime: 1:27). The president called on Descalzi to step up the company’s activities, and asked that he commit to specific time frames.

The Grand Mufti isn’t a fan of crypto: Al Kahera Alaan’s Lamees El Hadidi sat down with Grand Mufti Shawki Allam for a discussion on Ikhwani culture — and Islamic fatwas (non-binding legal opinion) on birth control, egg freezing, and cryptocurrency (watch, runtime: 22:28). Sheikh Allam said the clergy spoke to experts about cryptocurrency and concluded it leads to “ignorance, trickery, and fraud.” This is exacerbated by the fact that there is currently no legal framework or regulations to turn to in case of disputes, he added.

Also earning screen time last night:

- Egypt’s Smart Guy barred from science lectures at Cairo University: Egypt’s latest prodigal son, a 13-year-old whom the press refers to by his initials A.A.A, has been denied entry to science lectures at Cairo University by “high level security authorities” after a year-and-a-half of attendance, math professor Hani El Husseini tells El Hekaya (watch, runtime: 7:16).

- Football also got plenty of airtime: El Hadidi sat down with former veteran defender Moustafa Younis and coach Reda Abdel Aal to break down the current state of Egyptian football after the senior team national team flopped in two Afcon qualifiers and the U-23 team secured a place at the 2020 Tokyo Olympics (watch, runtime: 32:54). El Hadidi’s other half and ardent Zamalek supporter Adib also took some time to mourn his team’s recent defeat on live TV (watch, runtime: 1:24).

Speed Round

Speed Round is presented in association with

Fitch Ratings has affirmed Egypt’s long-term foreign-currency issuer default rating at ‘B+’ with a ‘stable’ outlook. The agency said that Egypt’s rating affirmation is supported by “a recent track record of economic and fiscal reforms, and improvements to macroeconomic stability and external finances.” On the flipside, Egypt’s “still large fiscal deficits, high general government debt / GDP and weak governance scores (as measured by the World Bank governance indicators” weighed on ratings. Egypt is expected to stay the course on reforms, particularly if we secure a non-loan agreement with the IMF to “help anchor structural and fiscal reforms,” Fitch says. Tap or click here for the full report.

Egypt’s GDP is expected to grow at a 5.5% clip, “with balanced risks to this forecast,” the ratings agency says. Inflation is expected to average 9.5% this year and continue cooling in 2020-2021 to average 8%, while the CBE is expected to maintain positive real interest rates. Fitch sees Egypt’s budget deficit narrowing to 7.6% of GDP during the current fiscal year, and the primary budget surplus recording 2.0%. The government is targeting a deficit of 7.2% this fiscal year. The ratings agency notes that these projections are supported by lower interest payments, but there remains a “contained risk” that a portion of government-guaranteed debt could crystalize on the state’s balance sheet.

Egypt’s current account deficit is expected to widen in 2021 to 3.2% of GDP, from 2.3% in 2018, “placing modest downward pressure on foreign reserves and the exchange rate.” The ratings agency still expects the country’s FX reserves to remain sufficient to cover 4.5 months of external payments. Fitch notes that, while Egypt’s net external debt has “risen sharply,” it remains below the median of its B-rated peers.

Egypt must push on with easing cycle to stimulate private investment -Goldman: The Central Bank of Egypt (CBE) will need to bring rates down by 200-400 basis points in 2020 to stimulate private investment, Goldman Sachs said in a recent report cited by the press. This will also be key increasing non-oil exports, which have continued to underperform since the EGP float, the bank writes.

Growth prospects mixed: Despite the economy growing at a near-6% clip, it is too reliant on government investment in infrastructure projects, Goldman says. The tourism and oil and gas industries will continue to play crucial roles in maintaining solid levels of growth, but they are only short-run substitutes to weak consumption and private investment spending patterns.

Don’t get accustomed to low inflation: Goldman sees the base effect pushing inflation up to 9% by the end of next year. The government could limit inflationary pressure if it succeeds in its ongoing efforts to eliminate commodity supply shortages, especially in food. Inflation has fallen for the past five months, reaching new multi-year lows of 2.4% in October.

Rolling back the state: The bank also warned of the potential of the growing role of the state in the economy to crowd out the private sector, and pointed to the state privatization program as a step in the right direction to correcting this.

M&A WATCH- EDF acquires undisclosed stake in Egypt’s KarmSolar: French energy company EDF Renewables has acquired a “strategic stake” in Egyptian renewable energy player KarmSolar through a capital increase, according to an emailed statement (pdf). The size and value of the stake were not disclosed.

Background: Previous local press reports had suggested that EDF was in advanced talks to invest as much as USD 25 mn in KarmSolar. An earlier version of the story had indicated that EDF would acquire a 45% stake in the Egyptian renewables company, with KarmSolar’s current shareholders retaining 55% of the company’s equity.

M&A WATCH- Al Madar, SEII consortium to decide on Emisal bid this week: A consortium of Kuwait’s Al Madar Finance & Investment Company and the Saudi Egyptian Industrial Investment Company (SEII) will decide whether to bid once more for a stake in state-owned Emisal Salts by the end of the week, sources told the local press. The consortium will gauge whether major shareholders — other than the National Bank of Egypt (NBE), which is reportedly the only one willing to offload its 49.8% stake — are still planning to exit. It would submit a starting offer of EGP 700 mn, lower than the recent EGP 1 bn valuation but negotiable upwards. The consortium announced last week that it is considering making another move for the company after Egypt Kuwait Holding dropped its bid.

REGULATION WATCH- FRA issues new regs that sound like a chaperone agreement for investment funds: The Financial Regulatory Authority (FRA) issued yesterday new regulations that would allow companies (as legal persons) to set up and manage investment funds by piggybacking on licensed banks, insurance companies, investment banks, or micro-lenders, according to a statement. The licensed entity would be required to set up a committee comprised of one representative from the fund and up to four independent members to oversee the fund’s activities. This sounds to us a lot like chaperone agreements from the securities brokerage industry, as in the US, where a US broker-dealer can provide cover that allows a foreign broker to speak with investors without registering in the US itself.

STARTUP WATCH- Pet care startup Vetwork in six-figure USD seed round: Cairo-based pet care startup Vetwork has raised six-figures of USD seed investment from Cairo Angel, Misk 500 Startups and a number of Saudi-based investors, Cairo Angels told MenaBytes. Vetwork is a mobile app that connects customers to providers of pet healthcare, vaccination, and insecticide services. The company will use the new funds to increase its range of services, and expand into new Egyptian cities and Saudi Arabia, CEO Fady Azzouny said.

Egypt in the News

International reaction to yesterday’s raid on news outlet Mada Masr continues to trickle in: EU Observer picked up a statement from an EU foreign relations spokesperson who said the arrests were “causes for concern.” Meanwhile, former FT Cairo correspondent Borzou Daraghi writes in the Independent that the move marks “another dreadful milestone” for the Egyptian press.

Other stories getting international attention:

- Challenge to inheritance laws: Coptic woman Huda Nasrallah has won her legal battle for an equal share of her family’s inheritance (BBC)

- Court hands death sentences to 2016 attackers: Seven people have been sentenced to death by a Cairo court after being found guilty of orchestrating an attack in 2016 that killed 11 policemen. (Associated Press)

Worth Listening

Gourmet and Led Zeppelin have something in common — A Whole Lotta Love: Jalal Abu Gazaleh built a business by putting love ahead of everything else: A business that customers, employees, and shareholders alike would love. Ten years down the line, it’s clear Abu Gazaleh was onto something: He built Gourmet into a retail powerhouse that survived the EGP by pivoting into food manufacturing. Episode one of Making It, our new weekly podcast on how to build a great business in Egypt, dives deep into Abu Gazaleh’s story.

You can listen to the full episode on our website or find it on Apple Podcast or Google Podcast. You can also listen on Spotify if you are not in the MENA region. The local edition of the streamer doesn’t presently offer podcasts.

Worth Reading

The battle for Nile water is intensifying: Egypt and Sudan may have access to the Nile and plenty of land for farming, but we’re not the greater beneficiaries of these resources, Justin Scheck and Scott Patterson write in the Wall Street Journal. While Egypt and Sudan both face potentially catastrophic water shortages, exacerbated by soaring population growth (which in Egypt is forecast to grow 20% to 120 mn by 2030, and to 150 mn by 2050), countries including Saudi Arabia and the UAE have made substantial investments in their arable land, where they grow crops for export. In Egypt, these countries hold some 383,000 acres of land, the article states, used to grow a variety of crops, which are then exported back to the Gulf. Both Egypt and Sudan, meanwhile, are big food importers.

In a resource-hungry world, food and water are power: Egypt is now looking for new places to grow food, with a program having been launched in 2015 to expand arable land by over 1.5 mn acres, in which companies from Saudi and the UAE have reportedly bid for land. The owner of one Saudi agricultural company, who is looking at buying farms in Egypt and Sudan says, “When you talk about buying land, you’re not really buying land. You’re buying water.” This is important both to ensure food supplies, and as a means of building regional influence during a time of increasingly scarce resources.

And the pressure keeps growing: Both the availability and quality of Nile water are impacted by developments that include pollution, droughts, industrial farming, the Aswan High Dam, and now the construction of the USD 4.2 bn Grand Ethiopian Renaissance Dam (GERD), which has been heavily financed by China. Egypt uses some 85% of its fresh water for agriculture, with 90% of that water coming from the Nile, but access is increasingly restricted. In the Delta, many small farmers complain that the water is either too scarce or too polluted for them to grow their crops.

Worth Watching

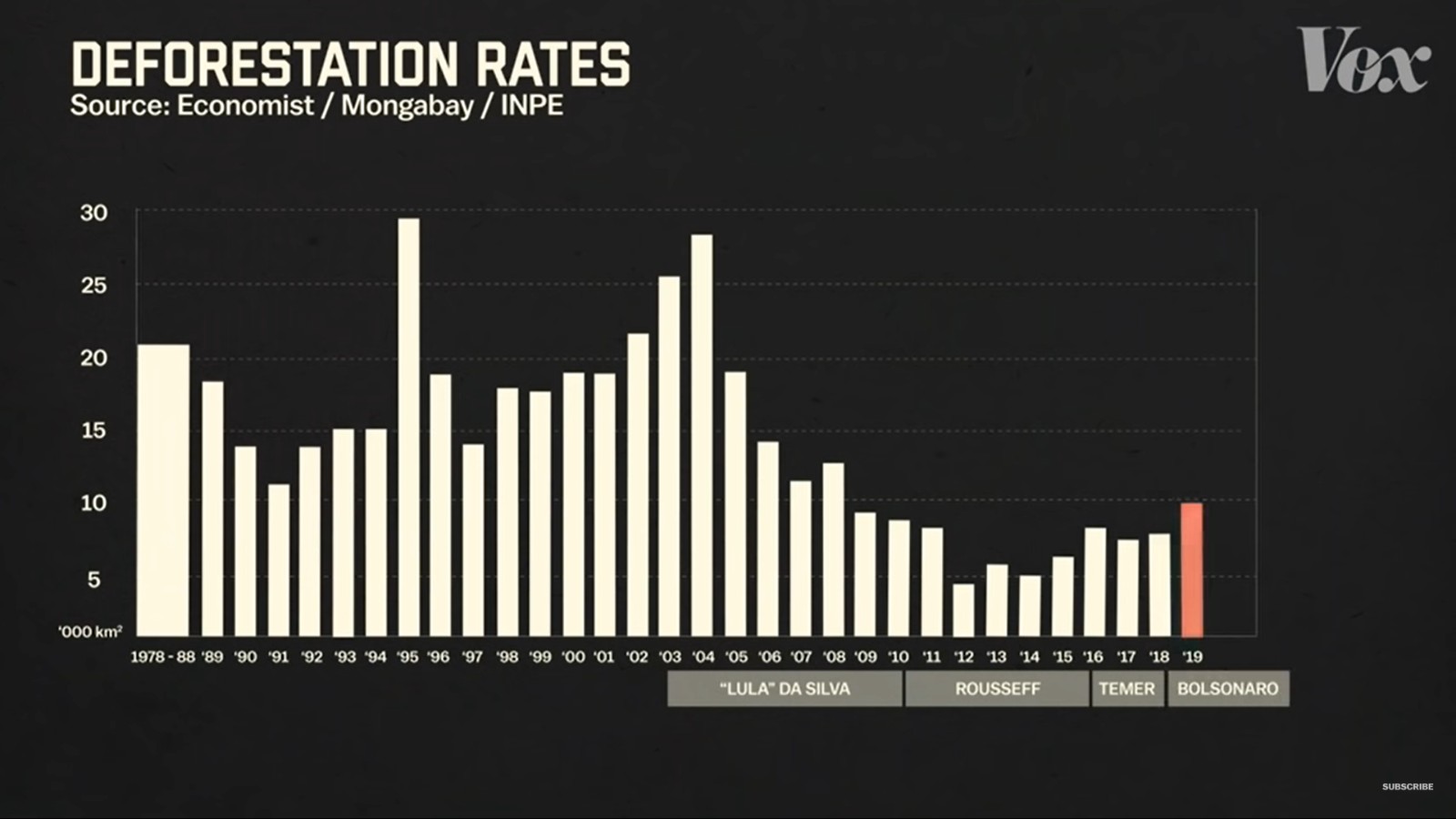

Deforestation in the Amazon underwent a massive reduction in the early 2000s. The deforestation of the Amazon rainforest, which started in the 1970s, was driven by ranchers who used the land to rear cattle and grow soybeans, fueling rapid economic growth, this Vox video shows (watch, runtime: 11:44). Environmental measures put in place by the Brazilian government in the early 2000s included the expansion of protected rainforest from about 28% in 2003 to 47% in 2012. Land not under protection was subject to the forest code, a law that said landowners could only clear 20% of their private land. This was enforced by Ibama, a police agency that could track and fine people for illegal deforestation. At the same time, a global activist movement pressed for greater accountability within the agricultural industry, and countries gave Brazil money to help protect the Amazon. With these measures in place, deforestation rates plunged to a historic low in 2012.

But with key environmental reforms now being rolled back, can it happen again? Starting in the early 2010s, many of these measures have been reversed in a movement driven by the increasingly influential conservative Ruralistas political group, and greatly exacerbated by Jair Bolsonaro, elected president in 2018. Bolsonaro weakened the forest service (which monitors the forest code) by putting it under the jurisdiction of the Agriculture Ministry. He also slashed funding to Ibama, passed a law making it easier for people who illegally seize land to keep it, and has been systematically undermining the environmental ministry. In August 2019, over 30,000 fires were burning in the Amazon — three times as many as in August 2018.

Diplomacy + Foreign Trade

Banque Misr has signed an agreement to double its SMEs financing credit line at the European Investment Bank (EIB) to EUR 1 bn, Al Mal reports. The EIB has just recently extended the credit line, saying it would support SMEs and midcaps across Egypt. In related news, the EIB is expected to provide EUR 620 mn in financing closer to the end of the year for a wastewater treatment project in Alexandria’s western district, according to the newspaper.

Libyan restrictions on ceramics imports could halve Egyptian exports: A recent decision from Libya’s cabinet banning ceramics imports from land crossings is threatening to cause a 50% drop in Egyptian ceramics and marble exports, according to Al Shorouk. Egypt exports the products to Libya — Egypt’s biggest export market for the goods — via land crossings. The decision is expected to push up prices and could lead to a slowdown in output at local factories.

Energy

Elsewedy, EETC ink EGP 687 mn contract to expand Toshka 2, Benban 3 substations

Elsewedy Electric subsidiary Elsewedy Electric for Trading and Distribution has signed a EGP 687 mn contract with the Egyptian Electricity Transmission Company (EETC) to expand the Toshka 2 and Benban 3 substations, Elsewedy said in a statement (pdf). The project, which will be completed in 12 months, is a precursor to implementing a 500 kV transmission line to link the Toshka substation to the Benban solar park in Aswan, which Elsewedy Electric is also working on.

Empower plans to scrap PPA for its biogas plant in Egypt’s Kafr El Sheikh

Renewable energy group Empower is planning to scrap its power purchase agreement with the North Delta Electricity Distribution Company for its 350-920 kWh biogas power plant in Kafr El Sheikh, CEO Hatem El Gamal tells Al Mal. According to El Gamal, the tariff the company had agreed upon back in June 2018 — EGP 1.03 per kWh — is too low. The government had set last month the official waste-to-energy (WtE) tariff at EGP 1.40 per kWh, which El Gamal says is an ideal price range.

Infrastructure

Construction of New Suez City, West Port Said to start in 2020

Egypt will begin construction works in New Suez City and West Port Said at the beginning of next year, Deputy Housing Minister Khaled Abbas said, according to Hapi Journal.

Egypt talks cooperation with African Development Bank on Cairo-Cape Town road

Transport Minister Kamal El Wazir discussed with an African Development Bank delegation a potential joint investment in the planned Cairo-Cape Town road, according to a cabinet statement. No details were provided on the size of the potential investment.

Manufacturing

UBF to establish EGP 40 mn factory to produce for Cinnabon

The United Beverage and Food Company (UBF), Cinnabon’s local agent, is planning to set up a EGP 40 mn factory in 1Q2020 to provide Cinnabon Egypt select production inputs, UBF General Manager Mohamed Nagy tells the local press. The facility, which will be self-financed, is meant to wean Cinnabon Egypt off importing raw materials for its food products and rely instead on locally sourced goods.

Health + Education

Companies to build 900 classrooms by 2020-2021 academic year under PPP program

Private companies working with the government on the public-private partnership program to build 1,000 new schools will complete phase one — approximately 900 classrooms — by the start of the next academic year, sources said, according to the local press. It’s not clear how many schools will be finished in this period, but sources say that the companies have started to receive land plots for 50 schools. The contracts — worth EGP 500 mn — were awarded in January.

Tourism

EBRD earmarks USD 100-200 mn for acquisition, development of Egyptian hotels

The European Bank for Reconstruction and Development earmarked USD 100-200 mn to fund hotel acquisitions and development projects in Egypt, Al Mal quotes Deputy Regional Director Khaled Hamza as having said. Hamza did not disclose whether the bank has its eyes on any hotels or locations in particular or what the timeline for the deployment might look like.

Orascom Development Egypt begins phase two of Makadi Heights

Orascom Development Egypt has started work on a new phase in its Red Sea development Makadi Heights, the company announced in a statement picked up by Al Mal. The 3.7 mn sqm development is a fully-integrated resort town that is a 20-minute drive from Hurghada Airport. The first phase of the project launched last April.

Automotive + Transportation

Shippers entering Egypt will begin using Canada’s ACI cargo screening system

Shipping companies will soon be required to supply more detailed cargo data to customs officials prior to arriving in Egyptian ports, Finance Minister Mohamed Maait said during a meeting with Prime Minister Moustafa Madbouly yesterday to review the ministry’s proposed customs procedures. Shippers will begin using a system known as Advance Commercial Information (ACI), a risk management tool introduced by the Canada Border Service Agency in 2004. The system is designed to identify potential health, safety, and security threats posed by inbound shipments.

Banking + Finance

Dubai-based Mubasher Holding to seek custodian license in Egypt

Dubai-based Mubasher Holding plans to apply for a custodian license in Egypt after it last year obtained approvals from the Financial Regulatory Authority to launch a holding company, Mubasher Capital Holding for Financial Services Vice Chairman Ehab Rashad said. The new branch will be up set up by the end of the year with EGP 300 mn in capital.

Evergrow in talks with Egyptian banks to restructure EGP 8 bn in loans, facilities

Evergrow Specialty Fertilizers is in talks with a local banking consortium to restructure EGP 8 bn in loans and credit facilities, and is looking to get better terms and a lower interest margin on the loans, unnamed sources tell Al Mal. The consortium includes the National Bank of Egypt, Banque Misr, the Arab African International Bank, and Abu Dhabi Islamic Bank.

Other Business News of Note

Egypt to launch EGP 70 mn solid waste recycling facility in Minya next year

Egypt is set to launch a EGP 70 mn solid waste recycling facility in Minya next January, Environment Minister Yasmine Fouad said, according to Al Mal, The facility is being set up in cooperation with Italy, according to Fouad.

Egypt Politics + Economics

Egypt creates guide for internal government auditing process

The Finance Ministry has created issued criteria for government auditors to assess during internal audits of government bodies to help ensure state funds are being used efficiently, according to a cabinet statement.

84 students, teachers hospitalized following Aswan nitrogen leak

An incident yesterday at a Kima chemical plant in Aswan left as many as 84 students and teachers hospitalized, according to Masrawy. A nitrogen machine reportedly failed at the factory, releasing gas that blew into a girls’ school. Aswan Governor Ahmed Ibrahim announced later in the day that all those affected had recovered. The company has suspended operations at at least one unit in its complex following the incident.

Sports

CAF nominates Mo Salah, Trezeguet for 2019 African Player of the Year

The Confederation of African Football (CAF) has nominated Egyptian football players Mo Salah and Mahmoud Trezeguet, along with 28 other footballers, for the 2019 African Player of the Year Award, according to CAF’s website. The awards ceremony is set to take place on 7 January in Hurghada.

On Your Way Out

Giza Zoo to open its doors on Tuesdays, but tickets will be 13x the regular price: The Giza Zoo administration has decided to open its doors to select groups of visitors from schools or companies on Tuesdays — the only day each week the zoo is usually closed, Al Mal reports. The zoo will offer tickets at EGP 65 apiece, which is 13 times the regular price, and will only admit groups who schedule their visits in advance.

The Market Yesterday

EGP / USD CBE market average: Buy 16.07 | Sell 16.17

EGP / USD at CIB: Buy 16.06 | Sell 16.16

EGP / USD at NBE: Buy 16.05 | Sell 16.15

EGX30 (Monday): 13,974 (-0.5%)

Turnover: EGP 549 mn (23% below the 90-day average)

EGX 30 year-to-date: +7.2%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.5%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were Credit Agricole up 1.8%, Orascom Construction up 1.7%, and SODIC up 0.8%. Yesterday’s worst performing stocks were Juhayna down 2.5%, TMG Holding down 2.3% and Egyptian Resorts down 1.9%. The market turnover was EGP 549 mn, and regional investors were the sole net sellers.

Foreigners: Net long | EGP +16.3 mn

Regional: Net short | EGP -58.1 mn

Domestic: Net long | EGP +41.8 mn

Retail: 42.2% of total trades | 43.5% of buyers | 40.8% of sellers

Institutions: 57.8% of total trades | 56.5% of buyers | 59.2% of sellers

WTI: USD 57.94 (-0.1%)

Brent: USD 63.65 (+0.4%)

Natural Gas (Nymex, futures prices) USD 2.52 MMBtu, (-0.4%, December 2019 contract)

Gold: USD 1,460.20 / troy ounce (-0.3%)

TASI: 8,013 (+0.2%) (YTD: +2.4%)

ADX: 5,091 (+1.0%) (YTD: +3.6%)

DFM: 2,705 (+0.7%) (YTD: +7.0%)

KSE Premier Market: 6,421 (+1.3%)

QE: 10,310 (+0.6%) (YTD: +0.1%)

MSM: 4,083 (+0.0%) (YTD: -5.6%)

BB: 1,520 (+1.0%) (YTD: +13.7%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

25-28 November (Monday-Thursday): Intergovernmental Committee of Senior Officials and Experts (ICSOE) for North Africa, Aswan.

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company

December: Indian automotive delegation to visit Egypt

1-6 December: Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

2-3 December (Monday-Tuesday): The irrigation ministers of Egypt, Sudan, and Ethiopia the second round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

8-9 December (Sunday-Monday): The 6 th CEOs THOUGHTS 2019.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.