- The amended NGOs Act is getting House approval. Here’s what’s new. (Speed Round)

- UAE-based investor Najjad Zeenni is acquiring a USD 37 mn stake in Maridive. (Speed Round)

- Your smoking habit could get more expensive as of October. (Speed Round)

- Wells Fargo thinks the Fed is going to “disappoint” markets with smaller-than-expected rate cuts. (What We’re Tracking Today)

- The EastMed drama over Turkey’s gas exploration is still simmering. (Speed Round)

- Currency devaluation increases exports, right? Not always. (Macro Picture)

- How Egypt’s new cities program underwent a total transformation. (Worth Reading)

- The Market Yesterday

Monday, 15 July 2019

An amended NGOs Act could soon see the light

TL;DR

What We’re Tracking Today

Al Mashat in the US, talks tourism reform, promotion: Tourism Minister Rania Al Mashat met this week with International Monetary Fund (IMF) executives in the US to discuss structural reforms currently being implemented in Egypt’s tourism sector, the ministry said in a statement (pdf) without providing further details. Al Mashat also separately discussed the preparation of videos and photos for the ministry’s tourism promotion campaign with well-known social media influencer and founder of Beautiful Destinations, Jeremy Johnson, reports Ahram Online. The ministry signed a protocol with Johnson’s company last March on the sidelines of the ITB Berlin tourism expo.

Will the Export Subsidy Fund decide on the new export subsidies framework this week? The board of the Export Subsidy Fund will meet today to discuss the new framework through which it will disburse some EGP 6 bn annually in export subsidies, Youm7 reports. The meeting comes as the government looks to transition export subsidies payments from a cash-based program to an incentive-based program. The finance and trade ministries held meetings last month to discuss allowing exporters to net overdue subsidies off against their taxes. The move comes as part of the government’s effort to make good on what is claimed to be some EGP 12 bn owed to Egyptian exporters by the Export Subsidy Fund since last year. Government sources tell the newspaper that the meeting will see a decision on the framework.

The government is planning to send the Social Welfare Act to the House of Representatives this week so that it can be voted on during the current parliamentary session, sources from the Social Solidarity Ministry told the local press.

SWF boss to be announced by September: We could find out who will be helming our EGP 200 bn sovereign wealth fund by September, by which time the fund’s board of directors will have interviewed the four candidates on the final shortlist, Planning Minister Hala El Said tells Hapi Journal. The minister gave no details on who made the short list.

Fed easing to “disappoint” markets -Wells Fargo: The US Federal Reserve will not meet market expectations for 65-70 bps-worth of rate cuts this year, Michael Schumacher, global head of rate strategy at Wells Fargo Securities, told CNBC (watch, runtime: 06:46). Wells Fargo is predicting that the central bank will make two cuts totaling 50bps before the end of the year.

Central banks are running out of ammo: Whether it cuts rates by 50 bps or 75 bps, the Fed along with the world’s other systemic central banks are running low on policy tools with which to fight the next economic downturn, Enda Curran writes in Bloomberg. Economic expansion and inflation remain muted, despite the negative rates at the Bank of Japan and the European Central Bank, and the 2.5% Fed rate, which is historically low for this stage of the economic cycle. And what leeway central banks do have to cut rates further will not necessarily help to counter the damaging effects of the trade war or boost inflation. “There are limits on what further monetary easing can achieve,” Australian central bank Governor Philip Lowe said last month. “You still get benefit from it, but there are limits.”

Is Deutsche Bank’s substantial downsizing a sign of what’s to come? An “automation revolution” is squeezing out inefficient or underperforming institutions, says the Financial Times, with investment banks the world over now fighting for their market share of dwindling revenues. Machine-reliant high-speed traders like XTX Markets are taking up an increasing share (currently 12%) of the European stock-trading market. And where equities are heading, other markets are following: Electronic trading handled 28% of the total volume in the US corporate bond market in May this year, compared to just under a fifth in 1Q2018.

The Trump administration is preparing to slap Turkey with fresh sanctions after Ankara began receiving parts of a Russian missile system, people familiar with the matter said, according to Bloomberg. The sanctions could be announced in the coming days, but the US administration wants to wait until after Monday’s third anniversary of the 2016 attempted coup against Erdogan to avoid feeding into conspiracy theories that the US was responsible.

Aramco raises fuel prices for the second time in three months: Saudi Aramco raised domestic prices of 95 and 91 octane for the second time in three months on Sunday as it attempts to improve the country’s energy efficiency and lessen its dependence on oil, Reuters reports. 91 octane prices rose to SAR 1.53 per liter from SAR 1.44 and 95 octane increased to SAR 2.18 from SAR 2.10.

In international miscellany:

- An IMF-sanctioned sales taxes increase in Pakistan prompted strikes at “hundreds of thousands” of Pakistani businesses in Karachi, reports the AP. The fund approved earlier this month a USD 6 bn facility to support reform in the South Asian country.

- Trump’s exit of Iran nuclear agreement was “to spite” Obama: More leaked diplomatic cables from British Ambassador Kim Darroch included a memo indicating that US President Donald Trump exited the 2015 Iran nuclear pact as “an act of diplomatic vandalism” against predecessor Barack Obama, reports the Associated Press.

Enterprise+: Last Night’s Talk Shows

Another humdrum night on the airwaves: President Abdel Fattah El Sisi’s meeting with the cabinet economic committee, the state’s new health insurance scheme, and a military-owned greenhouse project all got attention on last night’s talk shows.

Recapping socioeconomic indicators: Hona Al Asema’s Reham Ibrahim highlighted El Sisi’s meeting with the group, which gave a rundown on key FY2018-2019 social and economic indicators (watch, runtime: 2:31).

Gov’t to fully cover the cost of tumor, chronic disease meds under universal healthcare scheme: Al Hayah Al Youm’s Lobna Assal also took note of statements by health insurance director Ahmed El Sobky that the government will cover 90% of the cost of daily medications and 100% of meds used for the treatment of tumors and chronic diseases of 67k families registered in Port Said under the new healthcare system (watch, runtime: 0:48).

Assal also went on a tour of a greenhouse recently inaugurated at Mohamed Naguib military base on the Cairo-Alamein road and interviewed the chairman of the army-owned company that runs the project. Much of the project’s produce is exported, and we are seeing high demand from importers, but the priority remains for the local market, he said (watch, runtime: 1:08).

Speed Round

Speed Round is presented in association with

LEGISLATION WATCH- New NGOs Act receives preliminary House approval: The House of Representatives has approved “in principle” the proposed NGOs Act that would replace the controversial 2017 legislation, reports Al Masry Al Youm. The new legislation, the full draft of which is available here courtesy of Youm7, would scrap prison sentences imposed on violators of the law. It would also allow up to 25% of organizations’ board of directors to be foreign residents, up from 10% under the old law. Foreign NGOs would still be allowed to operate in the country following approval by the relevant minister. Local organizations would also still able to open offices in other countries and receive donor money. Other new stipulations under the law include:

ًA central authority under the relevant ministry (which we take is the Social Solidarity Ministry) would be set up to supervise civil society groups. The authority would also be mandated with conducting studies and compiling statistics on Egyptian civil society. It would be financed through state’s coffers, as well as through service fees collected from the organizations under its auspices.

Civil society organizations would be able to set up companies and investment funds to support their activities after obtaining approval from the minister. Any profits made from those ventures would have to be directed to charity or other social cause.

Organizations that were previously placed on a terror list and/or convicted in terrorism-related crimes would no longer be allowed to operate, and all funds under their name would be channeled into a fund to support civil society organizations.

NGOs still can’t partake in politics: The original law forbids NGOs from participating in political activities whether through funding, endorsement, or otherwise. According to the leaked draft, this stipulation remains unchanged.

What’s next? The law is expected to receive a final vote at the House general assembly before being signed into law by President Abdel Fattah El Sisi, who had directed his government late last year to amend the controversial law.

Why was the original law contentious? The NGO law passed in 2017 placed sharp restrictions on civil society and was roundly criticized by NGOs and the global press. The act has come under fire several times, including from Republican senators and the US Congress’ human rights commission. Domestic NGOs and international rights groups uniformly said it could lead to the shutdown of many groups, since taking up donations required advance approval from the state.

INVESTMENT WATCH- UAE-based investor acquires USD 37 mn stake in Maridive: Maridive & Oil Services’ board of directors has approved an offer by UAE-based investor Najjad Zeenni to acquire a USD 37 mn stake in the company, the company announced in a statement (pdf). Zeenni, who is chairman, CEO and a 25% shareholder in Maridive subsidiary Valentine, will acquire a 12.8% stake in the company’s share capital. The transaction will see the company’s paid-in capital increase to USD 188.1 mn from 163.8 mn.

Zeenni has agreed to pay a subscription price of USD 0.61 per share, which is significantly higher than the USD 0.37 share price as of 11 July. He justified paying the premium price back in May by saying that he wants to give the company more exposure at a time when research is suggesting a global uptick in spending on offshore exploration and production.

Maridive will obtain full ownership of Valentine: Maridive, currently a 75% shareholder of Valentine, will use the proceeds to increase the subsidiary’s share capital before purchasing Zeenni’s 25% stake in the company for USD 1. Zeenni will own 60,665,000 shares in Maridive, while Valentine would become 100% owned by the parent company.

“A vote of confidence”: “A major step forward has been taken toward concluding a mutually beneficial transaction with Mr Najjad Zeenni,” Maridive Chairman Tarek Nadim said. “His acquisition of this stake is a major vote of confidence in Maridive’s continued ability to leverage its team and its modern asset base to create lasting value for stakeholders.”

The transaction is still pending regulatory and shareholder approval. If the agreement is greenlit, Zeenni’s shares would be subject to a three-month lock-up period during which he has agreed not to sell any of his shares in Maridive.

Grant Thornton carried out the fair value study (pdf) for the transaction, which valued the company at USD 0.60 per share.

EXCLUSIVE- Cigarette prices could rise in October on the back of a sin tax increase: The prices of cigarettes may climb in October after a Finance Ministry committee finalized a draft proposal which would raise the ceiling on the taxable price brackets and tack on an additional EGP 0.5 to the tax rate on the top two brackets, two government sources told Enterprise. The raised ceiling will allow tobacco companies to increase prices without their brands moving into a higher bracket, thereby allowing more room to raise prices before being subjected to a higher tax rate. The cabinet economic group has approved the amendments, the sources told us. Changes to the ceilings will be as follows:

- The first bracket will be widened to include all cigarette packs sold in shops at less than EGP 20, up from a previous ceiling of EGP 18. It would still be subject to the old fixed tax rate of EGP 3.5;

- The second bracket will include all packs sold at EGP 20-34, up from EGP 18-30. The tax for this bracket will rise to EGP 6 from EGP 5.5;

- The third bracket will include all packs sold at more than EGP 34, up from EGP 30. The tax for the uppermost bracket will also rise to EGP 7 from EGP 6.5

What to expect: After the new ceilings are introduced, the companies are expected to announce price hikes over and above the EGP 0.5 tax increase on the two higher brackets. The added revenue from the new prices will contribute evenly to the revenues of both the company and the Tax Authority. The latter is expecting to net EGP 10-11 bn in additional revenues.

Eastern Mediterranean drama over gas exploration continues: Turkey will continue its gas drilling in waters off Cyprus until the Greek Cypriots accept a cooperation proposal from Turkish Cypriots, Turkish Foreign Minister Mevlut Cavusoglu has been quoted as saying. Turkish Cypriots had proposed that the two sides work together to explore gas, arguing cooperation would help calm tensions in the region. Turkey began drilling off western Cyprus in May, and sent a second drilling ship into Cypriot waters last week. The EU is threatening to restrict funding and contracts to Turkey in response to the drilling, according to a draft statement seen by Reuters last week.

Why do we care? Turkey, Cyprus and Greece aren’t the only players caught up in the great EastMed gas game. Egypt signed an agreement with Cyprus to build a natural gas pipeline last year. The pipeline will allow natural gas from the Aphrodite gas field to be transported to Egypt’s liquefaction facilities at Idku and Damietta, and re-exported as liquefied natural gas. The Foreign Ministry issued a statement last week expressing concern about Turkey’s plans to explore for gas in Cypriot waters.

STARTUP WATCH- Education solutions startup COLNN secures USD 100k seed round: Egyptian education solutions startup COLNN has secured USD 100k in seed funding from education-focused venture capital firm EdVentures, according to an emailed statement (pdf). COLNN provides services such as an “integrated mobile app” that connects students, teachers, and parents through one interface. “COLNN helps schools manage their internal processes, departments and activities in addition to optimizing the usage of their available resources through school management system (SMS). Upon analyzing the needs and requirements of each school, COLNN customizes their solutions/software to perfectly fit the nature and requirements of each school.”

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Currency devaluation increases exports, right? Not always. The depreciation of emerging-market currencies may actually result in falling exports, research by the Bank of International Settlements (BIS) and the FT suggests. Conventional wisdom tells us that a weakening currency makes exporters more competitive in the international market, causing an increase in orders and boosting economic output. But as the above chart illustrates, some emerging markets saw only a meager rise in exports last year, even though local currencies depreciated against the USD in 2016. Colombia even saw exports shrink, despite the COP losing around 10% of its value. Classical economic theorists may pat themselves on the back when looking at Egypt’s impressive export volumes, but only manage a shrug when it comes to explaining the fates of South Africa, Taiwan and Peru.

What’s going on? The BIS pinpoints five factors that can depress export growth in EMs during currency devaluation:

- Export prices don’t always change in response to the exchange rate, especially in EMs where almost all of the trade is denominated in USD. In these cases, a weakening currency would increase the cost of imports but would do little to increase the competitiveness of exporters.

- The greenback often rises and falls against other currencies in unison, leading to falling demand for USD-denominated exports in other countries.

- Trade finance is usually denominated in USD, and becomes more expensive to access when the currency is weakening.

- Modern value chains are complex, increasing the input costs for businesses and raising dependency on trade finance. This problem is only magnified by devaluation.

- Increasing capital flows into EMs has meant that many EM businesses have become increasingly reliant on foreign currency-denominated borrowing. This results in rising debt servicing costs and tighter financial conditions when the currency weakens against the USD.

Egypt in the News

It is a blessedly slow morning for Egypt in the foreign press. The reopening of two of the country’s oldest pyramids after more than 50 years, which we took note of yesterday, is by and large the only story getting digital ink: AP | AFP | Daily Mail | ITV.

On The Front Pages

President Abdel Fattah El Sisi’s meeting with the cabinet economic group to review last fiscal year’s social and economic indicators topped the front page of Al Akhbar. We recap the story above in Last Night’s Talk Shows.

Worth Reading

How Egypt’s new cities program underwent a total transformation: Egypt’s new cities program has undergone a radical shift from what was first envisaged (pdf) in the 1950s and 60s: The development of satellite cities to absorb the strain of a rapidly growing population. When the New Urban Communities Authority (NUCA) started selling increasing amounts of land to luxury developers in the 1990s, places like Sheikh Zayed — originally intended to be a mixed-income city — were transformed into “enclaves for wealthy Cairenes eager to escape the chaos of the capital,” Rachel Keeton and Michelle Provoost argue in this excerpt from their book ”To Build a City in Africa.” With 22 built or partially-built new cities, inhabited by 7 mn, and plans by NUCA to build 19 more, they ask to what extent the program is succeeding, and where it can go from here.

Satellite cities have not solved ‘population pressures’: 10th Ramadan is home to 650k inhabitants, mainly industrial workers and their families, although NUCA’s target is 2.1 mn by 2023. The economic incentives that led people to settle there in the 1970s and 80s have waned, and while low-income housing development perseveres, infrastructure is poor. Meanwhile, Sheikh Zayed’s 330k inhabitants are less than half the number targeted, in large part because it is outside the price bracket of all but the very wealthy: 71% live in luxury accommodation, while only 15% live in low-income housing.

The question of where to go from here remains unanswered: The investment pouring into Egypt’s 700 sqkm new capital, which is intended to house as many as 6.5 mn people, shows that the building boom is far from letting up. Land prices continue to increase (NUCA is expected to raise prices by 15-20% in 2019 alone) and developers themselves are quick to point out that land is a scarce resource. NUCA has recently issued a new regulatory framework to handle requests for the allocation of land for mixed-use projects. But securing investment while meeting the housing needs of a rapidly growing population remains somewhat of a balancing act. Urban development expert David Sims expresses surprise at “how little public land actually directly benefits the masses, and how much of it ends up enriching a few investors.” He believes the push to continue building exists partly because the new cities program “may be too big to fail.”

Worth Watching

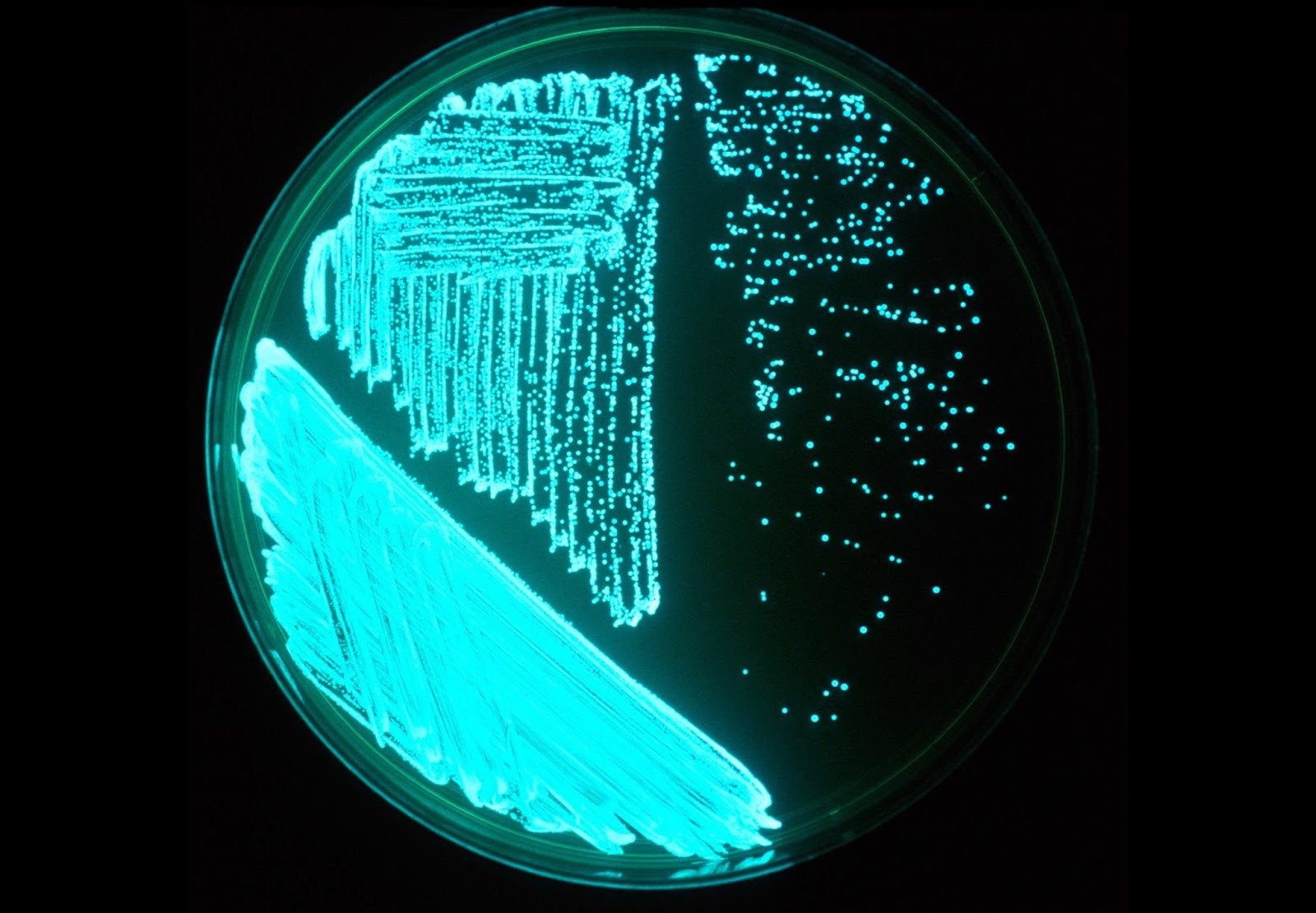

Could bacteria from the sea reduce light pollution and energy consumption? This French startup is banking on it. Fireflies, glow-worms, and 80% of marine organisms all have the ability to produce light. Now, French startup Glowee seeks to harness this bioluminescence to change the way we light our environment, as shown in this Bloomberg video (watch, runtime: 05:44). The process involves experimenting with different variables — including temperature, feeding, how oxygen is administered, and the type of water the bacteria is kept in — to find a sustainable and cost-effective way to breed the bacteria in large quantities.

The ultimate goal? To completely transform our urban lighting systems, replacing harsh LED light with an unlimited and natural source that will help us reduce environmental waste and, they say, enhance our own feelings of well-being.

Energy

Companies submit offers to construct 2.15 GW new wind farms in Egypt

Several independent power producers (IPPs) have reportedly made offers to the Electricity Ministry to construct new wind farms with a combined capacity of 2,150 MW, ministry officials told the local press. The companies are based in China, Germany, the US, and Saudi Arabia, and have proposed projects under engineering, procurement, and construction (EPC) + finance or build-own-operate (BOO) frameworks. The offers will be studied by a committee comprising representatives from the Egyptian Electricity Transmission Company, the New and Renewable Energy Authority, and the Egyptian Electricity Holding Company.

NREA to receive offers for 50 MW Zaafarana solar plant on 25 July

The New and Renewables Energy Authority (NREA) will receive on 25 July financial offers from three international bidders in its tender to construct a 50 MW solar plant in Zaafarana, sources from the authority told the press. The bidders are India’s Vikram Solar, Germany’s B Electric, and China’s NARI Group. NREA is expected to announce the winning bid before the end of the year. Australia-based TCK Solar and Spain-based Elecnor were among those qualified for the tender. Both have since been excluded, one for walking away and the other for “technical reasons,” the sources added.

Infrastructure

Egypt begins talks with Chinese-European consortium to build new capital control center

The Electricity Ministry has begun talks with China’s State Grid Corporation (SGCC), Siemens, and ABB to build an interactive control center for the new administrative capital, ministry sources told the local press. The Egyptian Electricity Holding Company will use loans it has already secured to finance the project, which the sources estimated will cost between EGP 1-1.3 bn. Egypt already owns six national and regional control centers.

Manufacturing

Edita to launch new products, construction on Morocco facility to begin next month

Edita Food Industries aims to launch a number of new products as part of expansion plans, Chairman Hani Berzi said, without providing further details or specifying a timeframe. The company also plans to begin the construction of its snack food production facility in Morocco in August, rather than in July as we reported earlier this month. The food producer last week finalized a USD 20 mn loan agreement from the International Finance Corporation (IFC), which it will use for expansion at home and abroad.

Real Estate + Housing

SODIC signs agreement with NUCA to convert land plot function

SODIC has signed an agreement with the New Urban Communities Authority (NUCA) to convert the function of a Western Cairo land plot from agricultural to housing, the company said in an EGX disclosure (pdf). The company expects the new project to be on sale in 4Q2019, it said.

Telecoms + ICT

TE, Egypt’s Etisalat cooperate on virtual fixed line, bit-stream services

State-owned Telecom Egypt has signed four agreements with Etisalat Misr to allow the latter to provide virtual fixed line and bit-stream services to its customers through TE’s infrastructure, TE said in a press release (pdf). Under the terms of the bit-stream agreements, “Etisalat Misr will be able to provide its fixed broadband customers with the new VDSL [or very high speed digital subscriber line] technology.” No details were provided on the value of the agreements.

Automotive + Transportation

Alamal auto group suspends production of BYD S5 amid low demand

Auto assembler Alamal Group is suspending its production of BYD S5 cars due to declining demand, board member Gamal Amin said, Al Mal reports. The company originally intended to assemble 50 units per month and sell 600 in 2019, but poor market conditions caused in part by the decision to scrap customs on imported European cars have forced it to shelve its plans. The company will continue to assemble the model if it receives bespoke requests. Boudy Group, the local distributor for Chinese companies Changhe Automobile and Kenbo, also said last week it is considering freezing plans to assemble Changhe cars in Egypt due to weak demand. The Egyptian automotive sector has come under pressure this year, with the latest AMIC report showing that car sales fell 10% y-o-y to 41,154 units in the first five months of 2019.

Banking + Finance

Egypt’s Baraka Bank to launch sharia-compliant daily return mutual fund

Al Baraka Bank is planning to launch a sharia-compliant investment fund that pays out dividends on a daily basis, Al Mal reports. The EGP 100 mn fund will screen potential investments for compatibility with sharia law. It will invest in EGP-denominated debt and CDs and will be managed by EFG Hermes Asset Management.

HC Securities’ brokerage arm receives short-seller license

HC Securities’ brokerage arm became the latest investment bank to receive a license approval from the Financial Regulatory Authority to become a short seller, HC said in a statement (pdf), joining the brokerage arms of Arqaam, EFG Hermes, CI Capital, the Arab African International Securities and Prime Holdings.

Other Business News of Note

Capmas: 9.7% y-o-y rise in non-Egyptians working in private sector, investment

The number of non-Egyptians working in the private sector and investment in Egypt increase 9.7% y-o-y in 2018, according to Capmas statistics. The total figures (recorded as 14,777 in 2018 and 13,469 in 2017) included 45.2% from non-Arab Asian countries, 23.9% from European countries, 21.4% from Arab countries, 7.5% from the Americas and Australasia, and only 1% from non-Arab African countries.

Pharos was exclusive sell-side advisor to Spinney’s in Investec acquisition

Pharos Investment Banking served as exclusive sell-side advisor to Spinney’s in the sale of a controlling stake in the supermarket chain to Investec Asset Management, according to an emailed statement (pdf). The transaction “solidifies Pharos Investment Banking’s capabilities and growing presence in the M&A market in Egypt,” said Pharos Holding CEO Elwy Taymour. The transaction marks Investec’s maiden investment in Egypt.

Law

White & Case acts as legal counsel for Energean in its acquisition of Edison’s Egypt assets

US-based law firm White & Case has acted as buy-side legal counsel for Energean in its acquisition of Edison’s Egypt oil and gas assets, partner and co-head of the EMEA corporate practice Allan Taylor said. The USD 750 mn transaction, which saw the Greek energy company acquire the target’s entire oil and gas portfolio in countries other than Egypt, will set up one of the largest independent exploration & production (E&P) companies listed on the exchanges of both London and Tel Aviv, Taylor added.

Egypt Politics + Economics

PM sets up board of trustees to oversee reformation of business environment

Prime Minister Moustafa Madbouly issued a decree to set up a board of trustees to handle the logistics for the Initiative for the Reform of the Business Environment (Irada), the cabinet said in a statement. The board will be headed by Madbouly, and include the investment, planning, finance and trade ministers, among other senior officials. Irada aims to streamline the regulatory environment to make it easier for businesses to operate.

On Your Way Out

Keeping Pharaonic musical traditions alive: A craftsman in Port Said is one of very few people working to keep the cultural heritage of the semsemia, a harp used during the Pharaonic era, AFP reports. Mohamed Ghaly, whose folk arts museum dedicated to the semsemia was demolished in February, has founded a new cultural museum, Canal 20. The organization aims to teach a new generation how to craft the instrument and continue the ancient musical tradition.

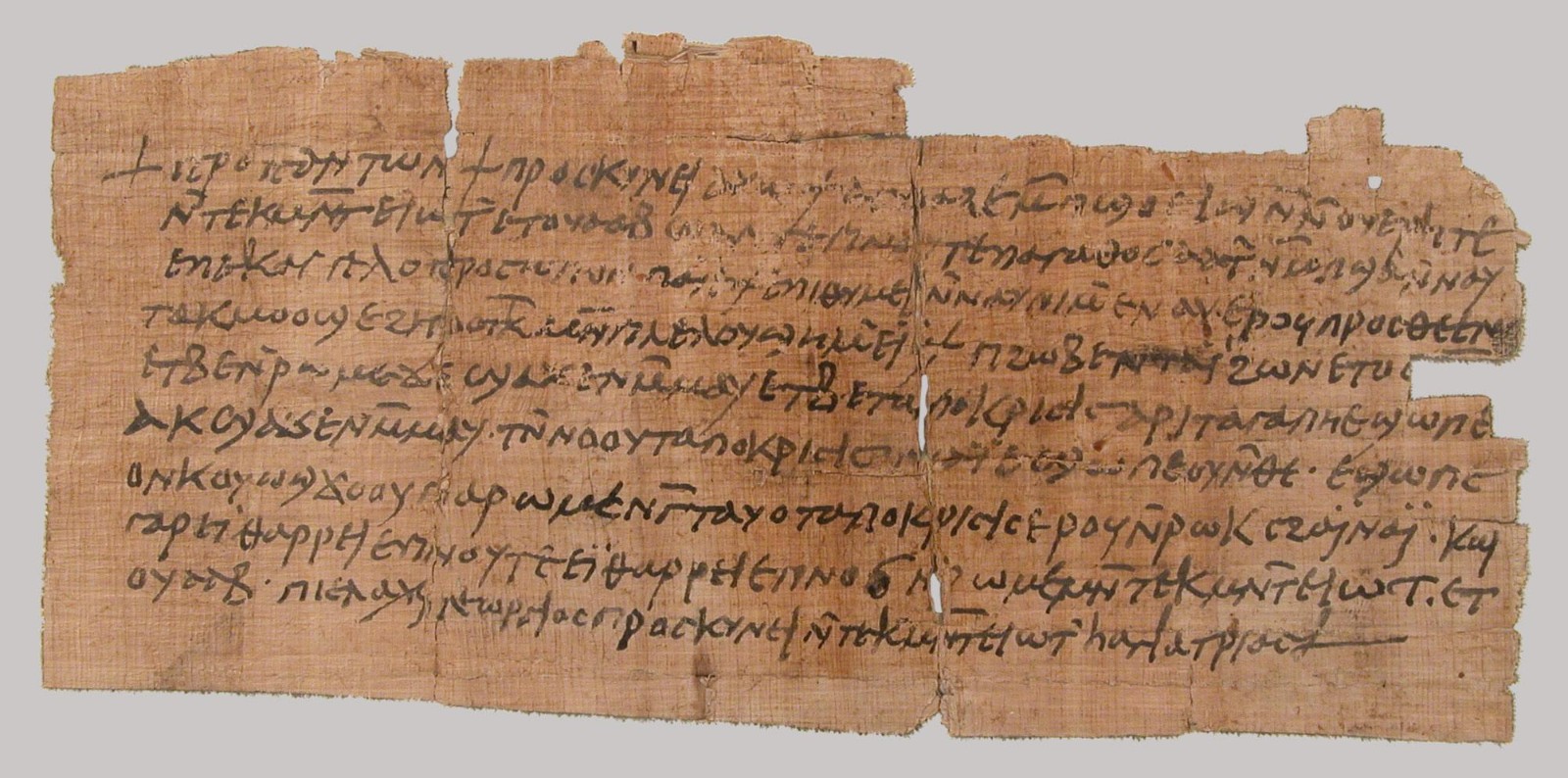

A letter written on ancient Egyptian papyrus in the 230s A.D. could be the oldest Christian letter in existence, and offers insights into the lives of the earliest Christians in the Roman Empire, International Business Times reports. The letter, which is now part of the University of Basel’s papyrus collection, has been traced back to the village of Theadelphia in central Egypt. It is believed by researchers to be 40-50 years older than any other Christian letter previously discovered.

The Market Yesterday

EGP / USD CBE market average: Buy 16.54 | Sell 16.66

EGP / USD at CIB: Buy 16.54 | Sell 16.64

EGP / USD at NBE: Buy 16.56 | Sell 16.66

EGX30 (Sunday): 13,672 (-1.0%)

Turnover: EGP 396 mn (40% below the 90-day average)

EGX 30 year-to-date: +4.9%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.0%. CIB, the index heaviest constituent ended down 0.7%. EGX30’s top performing constituent was Eastern Company up 0.3%. Yesterday’s worst performing stocks were GB Auto down 4.2%, Ezz Steel down 4.1% and Heliopolis Housing down 3.9%. The market turnover was EGP 396 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +6.8 mn

Regional: Net Short | EGP -3.9 mn

Domestic: Net Short | EGP -2.9 mn

Retail: 67.7% of total trades | 69.0% of buyers | 66.4% of sellers

Institutions: 32.3% of total trades | 31.0% of buyers | 33.6% of sellers

WTI: USD 60.17 (-0.07%)

Brent: USD 66.68 (-0.06%)

Natural Gas (Nymex, futures prices) USD 2.44 MMBtu, (-0.61%, Aug 2019 contract)

Gold: USD 1,416.13 / troy ounce (+0.03%)

TASI: 9,015.16 (+0.52%) (YTD: +15.18%)

ADX: 5,056.26 (+0.08%) (YTD: +2.87%)

DFM: 2,704.78 (+0.71%) (YTD: +6.92%)

KSE Premier Market: 6,775.05 (-0.03%)

QE: 10,600.20 (-0.12%) (YTD: +2.92%)

MSM: 3,793.90 (-0.38%) (YTD: -12.25%)

BB: 1,537.08 (+0.00%) (YTD: +14.94%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

14-18 July (Sunday-Thursday: The government is expected to announce the details of the new export subsidies framework.

17 July (Wednesday): Harvard Business School alumni reception and admissions presentation, Falak Startups-The Greek Campus, Cairo.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

29 July (Monday): An administrative court will look into charges brought by the Financial Regulatory Authority (FRA) against Raya Holding founder Medhat Khalil in connection to a mandatory tender offer forced on him by the FRA.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03 August (Saturday): A Cairo Criminal Court postponed “stock market manipulation” trial of Gamal and Alaa Mubarak, along with seven others.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.